false000172820500017282052025-02-042025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 4, 2025

___________________________________

Piedmont Lithium Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware | 001-38427 | 36-4996461 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

42 E Catawba Street Belmont, North Carolina 28012 |

(Address of principal executive offices and zip code) |

(704) 461-8000 |

(Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock $0.0001 par value per share | PLL | Nasdaq |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 - Results of Operations and Financial Condition

On February 4, 2025, Piedmont Lithium Inc. issued a press release announcing North American Lithium’s Q4 2024 operating results. A copy of the press release is attached as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference herein.

The information in this current report on Form 8-K and the exhibits attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 - Exhibits

(d): Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 4th day of February, 2025.

| | | | | |

Piedmont Lithium Inc. (Registrant) |

| |

By: | /s/ Keith Phillips |

Name: | Keith Phillips |

Title: | President and Chief Executive Officer |

PRESS RELEASE | February 4, 2025 | NASDAQ: PLL

PIEDMONT LITHIUM ANNOUNCES Q4’24 NORTH AMERICAN LITHIUM OPERATIONAL RESULTS

•Piedmont had record quarterly shipments of ~55,700 dmt of spodumene concentrate in Q4’24, modestly exceeding guidance

•NAL achieved its second consecutive quarter of production greater than 50,000 dmt

•Piedmont recorded $87.8 million in cash and cash equivalents as of December 31, 2024

Belmont, North Carolina, February 4, 2025 – Piedmont Lithium Inc. (“Piedmont,” the “Company,” “we,” “our,” or “us”) (Nasdaq: PLL; ASX: PLL), a leading North American supplier of lithium products critical to the U.S. electric vehicle supply chain, announced that it shipped approximately 55,700 dry metric tons (“dmt”) of spodumene concentrate in Q4’24. NAL, North America’s largest producing spodumene mine, is jointly owned by Piedmont (25%) and Sayona Mining Limited (75%) (ASX: SYA).

Q4’24 Operational Results Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Piedmont Lithium | | Units | | Q4’24 | | Q3’24 | | QoQ Variance | | FY 2024 | | FY 2023 | | YoY Variance | | |

| Concentrate Shipped | | kt dmt | | 55.7 | | | | 31.5 | | | | 77 | % | | | 116.7 | | | | 43.3 | | | | 170 | % | | | | |

| Average Grade | | % Li2O | | ~5.4 | | | ~5.4 | | | — | | | | ~5.4 | | | ~5.5 | | | (0.1%) | | | | |

NAL(1) | | Units | | Q4’24 | | Q3’24 | | QoQ Variance | | FY 2024 | | FY 2023 | | YoY Variance | | | |

| Ore Mined | | kt wmt | | 370.4 | | | | 240.3 | | | | 54 | % | | | 1,195.5 | | | | 885.2 | | | | 35 | % | | | | |

| Concentrate Produced | | kt dmt | | 50.9 | | | | 52.1 | | | | (2) | % | | | 193.2 | | | | 98.8 | | | | 96 | % | | | | |

| Plant (Mill) Utilization | | % | | 90 | | | | 91 | | | | (1) | % | | | 84 | | | | 70 | | | | 14 | % | | | | |

| Lithium Recovery | | % | | 68 | | | | 67 | | | | 1 | % | | | 68 | | | | 59 | | | | 9 | % | | | | |

| Concentrate Sold | | kt dmt | | 66.0 | | | | 49.0 | | | | 35 | % | | | 200.8 | | | | 72.2 | | | | 178 | % | | | | |

In Q4’24, NAL produced 50,922 dmt and shipped 66,035 dmt. Approximately 55,700 dmt of spodumene concentrate were sold to Piedmont and then shipped to its customers.

Although quarterly production at NAL declined by 2% in Q4’24 compared to the prior quarter, production remains on track to achieve Sayona Mining’s fiscal year 2025 production guidance of 190,000 – 210,000 dmt2. Mill utilization of 90% in Q4’24 declined modestly from the record high of 91% in the prior quarter and was negatively impacted by a planned shutdown in October and other weather-related impacts in the crushing circuit. The Crushed Ore Dome mitigated the impact of the shutdown by enabling consistent feed and operations during the quarter. Recoveries improved to 68% for the quarter and were in-line with the life-of-mine target outlined in the 2023 Definitive Feasibility Study.

Piedmont Lithium and Sayona Mining signed a definitive agreement to merge in an all-stock transaction on November 18, 20243. The merged entity will create a leading North American hard rock lithium producer and simplify the ownership structure of North American Lithium.

“NAL continues to operate at an impressive level,” said Keith Phillips, President and CEO of Piedmont Lithium. “NAL is North America’s largest lithium operation and holds considerable strategic value to Piedmont Lithium, our customers, and the ongoing energy transition. While the lithium market remains challenging, we were pleased with the consistent performance achieved during the December-end quarter. We look forward to finalizing the merger with Sayona to consolidate the economics of NAL and create value for shareholders.”

___________________________________________________________

(1) All references to information about or related to NAL are from the December 2024 Quarterly Activities Report filed with the ASX by Sayona Mining Limited on 31 January 2025.

(2) See Sayona Mining announcement “FY2024 Results Announcement” filed with the ASX by Sayona Mining Limited on 30 August 2024.

(3) See Piedmont Lithium announcement “Piedmont Lithium and Sayona Mining to Merge” filed with the SEC on 19 November 2024.

NAL Concentrate Production

Figure 1: NAL Concentrate Production

| | | | | |

| For further information, contact: |

| |

| Michael White | |

| Chief Financial Officer | |

| T: +1 713 878 9049 | |

E: mwhite@piedmontlithium.com | |

| |

| John Koslow | |

| Investor Relations | |

| T: +1 980 701 9928 | |

E: jkoslow@piedmontlithium.com | |

About Piedmont

Piedmont Lithium Inc. (Nasdaq: PLL; ASX: PLL) is developing a world-class, multi-asset, integrated lithium business focused on enabling the transition to a net zero world and the creation of a clean energy economy in North America. Our goal is to become one of the largest lithium hydroxide producers in North America by processing spodumene concentrate produced from assets where we hold an economic interest. Our projects include our Carolina Lithium project in the United States and partnerships in Quebec with Sayona Mining (ASX: SYA) and in Ghana with Atlantic Lithium (AIM: ALL; ASX: A11). We believe these geographically diversified operations will enable us to play a pivotal role in supporting America’s move toward energy independence and the electrification of transportation and energy storage.

Cautionary Note to U.S. Investors

Piedmont’s public disclosures are governed by the U.S. Exchange Act of 1934, as amended, including Regulation S-K 1300 thereunder, whereas NAL discloses estimates of “measured,” “indicated,” and “inferred” mineral resources as such terms are used in the JORC Code and Canada’s National Instrument 43-101. Although S-K 1300, the JORC Code, and NI 43-101 have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, they at times embody different approaches or definitions. Consequently, investors are cautioned that public disclosures by NAL prepared in accordance with the JORC Code or NI 43-101 may not be comparable to similar information made public by companies, including Piedmont, subject to S-K 1300 and the other reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder.

The statements in the link below were prepared by, and made by, NAL. The following disclosures are not statements of Piedmont and have not been independently verified by Piedmont. NAL is not subject to U.S. reporting requirements or obligations, and investors are cautioned not to put undue reliance on these statements. NAL’s original announcements can be found here: https://www.asx.com.au/markets/company/sya

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of or as described in securities legislation in the United States and Australia, including statements regarding exploration, development, construction, and production activities of Sayona Mining, Atlantic Lithium, and Piedmont; current plans for Piedmont’s mineral and chemical processing projects; Piedmont’s potential acquisition of an ownership interest in Ewoyaa; and strategy. Such forward-looking statements involve substantial and known and unknown risks, uncertainties, and other risk factors, many of which are beyond our control, and which may cause actual timing of events, results, performance, or achievements and other factors to be materially different from the future timing of events, results, performance, or achievements expressed or implied by the forward-looking statements. Such risk factors include, among others: (i) that Piedmont, Sayona Mining, or Atlantic Lithium may be unable to commercially extract mineral deposits, (ii) that Piedmont’s, Sayona Mining’s, or Atlantic Lithium’s properties may not contain expected reserves, (iii) risks and hazards inherent in the mining business (including risks inherent in exploring, developing, constructing, and operating mining projects, environmental hazards, industrial accidents, weather, or geologically related conditions), (iv) uncertainty about Piedmont’s ability to obtain required capital to execute its business plan, (v) Piedmont’s ability to hire and retain required personnel, (vi) changes in the market prices of lithium and lithium products, (vii) changes in technology or the development of substitute products, (viii) the uncertainties inherent in exploratory, developmental, and production activities, including risks relating to permitting, zoning, and regulatory delays related to our projects as well as the projects of our partners in Quebec and Ghana, (ix) uncertainties inherent in the estimation of lithium resources, (x) risks related to competition, (xi) risks related to the information, data, and projections related to Sayona Mining or Atlantic Lithium, (xii) occurrences and outcomes of claims, litigation, and regulatory actions, investigations, and proceedings, (xiii) risks regarding our ability to achieve profitability, enter into and deliver product under supply agreements on favorable terms, our ability to obtain sufficient financing to develop and construct our projects, our ability to comply with governmental regulations, and our ability to obtain necessary permits, and (xiv) other uncertainties and risk factors set out in filings made from time to time with the U.S. Securities and Exchange Commission (“SEC”) and the Australian Securities Exchange, including Piedmont’s most recent filings with the SEC. The forward-looking statements, projections, and estimates are given only as of the date of this press release and actual events, results, performance, and achievements could vary significantly from the forward-looking statements, projections, and estimates presented in this press release. Readers are cautioned not to put undue reliance on forward-looking statements. Piedmont disclaims any intent or obligation to update publicly such forward-looking statements, projections, and estimates, whether as a result of new information, future events or otherwise. Additionally, Piedmont, except as required by applicable law, undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Piedmont, its financial or operating results or its securities.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

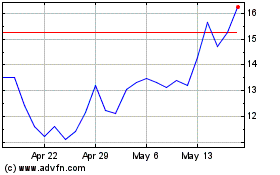

Piedmont Lithium (NASDAQ:PLL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Piedmont Lithium (NASDAQ:PLL)

Historical Stock Chart

From Feb 2024 to Feb 2025