Redfin Reports 17% of Homeowners With Mortgages Have an Interest Rate of at Least 6%, the Highest Share in Nearly a Decade

07 February 2025 - 12:30AM

Business Wire

The lock-in effect is starting to ease because

Americans are growing accustomed to elevated rates, and for many,

it’s not realistic to stay put forever. That’s boosting listings

and easing the housing shortage.

(NASDAQ: RDFN) — Nationwide, 17.2% of U.S. homeowners with

mortgages have an interest rate greater than or equal to 6%, the

highest share since 2016, according to a new report from Redfin

(redfin.com), the technology-powered real estate brokerage. That’s

up nearly five percentage points from 12.3% in the third quarter of

2023. If this growth rate were to continue, which is feasible, the

share of homeowners with a rate of at least 6% would nearly double

in the next three years.

Meanwhile, 82.8% of homeowners with mortgages have an interest

rate below 6%. That means even more have a rate below the current

(Jan. 30) weekly average of 6.95%, prompting many to stay put

instead of selling and buying another home at a higher rate—a

phenomenon called the “lock-in effect.”

But this lock-in effect has been easing; in the third quarter of

2023, for example, 87.7% of mortgaged homeowners had a rate below

6%. And in mid-2022, the share sat at a record 92.7%.

America has been grappling with a severe housing shortage, in

part because the lock-in effect has disincentivized people from

putting their homes up for sale. Mortgage rates are now more than

double the 2.65% record low hit during the pandemic. But for most

people, it’s not realistic to stay put forever, which is why the

lock-in effect is easing. This is slowly alleviating the housing

shortage; new listings and active listings are both higher than

they were a year ago. Though it’s worth noting that one reason

supply is on the rise is that many homes are sitting on the market,

so stale listings are piling up.

Redfin agents report that many people are moving because a major

life event like a job change or divorce has given them no other

choice. There are a few other reasons the lock-in effect is easing.

One, many Americans are growing accustomed to the idea that rates

are unlikely to fall to pandemic lows anytime soon. Two, the

pandemic surge in home values means many homeowners have enough

equity to justify selling and taking on a higher rate—especially if

they’re downsizing or moving somewhere more affordable. And

finally, a rising share of Americans are mortgage-free, which means

they’re not locked into any rate at all.

Everyone who bought a home in the last two years did so at a

time when the average weekly mortgage rate was above 6%, which is

why the share of homeowners with rates below 6% has declined.

“The rate-lock effect is letting up a bit here in Seattle,” said

local Redfin Premier real estate agent David Palmer. “Homeowners

hate to give up their 2-3% mortgage rate, but life happens and

people have to move.”

Here’s a breakdown of where today’s homeowners fall on the

mortgage-rate spectrum:

- Below 6%: 82.8% of mortgaged U.S. homeowners have a rate

below 6%, down from a record 92.7% in Q2 2022 and the lowest share

since the Q4 2016.

- Below 5%: 73.3% have a rate below 5%, down from a record

85.6% in Q1 2022 and the lowest share since Q3 2017.

- Below 4%: 55.2% have a rate below 4%, down from a record

65.1% in Q1 2022 and the lowest share since Q4 2020.

- Below 3%: 21.3% have a rate below 3%, down from a record

24.6% in Q1 2022 and the lowest share since Q2 2021.

This is according to a Redfin analysis of data from the Federal

Housing Finance Agency’s National Mortgage Database through the

third quarter of 2024, the most recent period for which data is

available.

Click here to read our economists’ latest outlook for mortgage

rates.

To view the full report, including a chart, additional data and

methodology, please visit:

https://www.redfin.com/news/mortgage-rate-lock-in-effect-eases/

About Redfin

Redfin (www.redfin.com) is a technology-powered real estate

company. We help people find a place to live with brokerage,

rentals, lending, and title insurance services. We run the

country's #1 real estate brokerage site. Our customers can save

thousands in fees while working with a top agent. Our home-buying

customers see homes first with on-demand tours, and our lending and

title services help them close quickly. Our rentals business

empowers millions nationwide to find apartments and houses for

rent. Since launching in 2006, we've saved customers more than $1.6

billion in commissions. We serve approximately 100 markets across

the U.S. and Canada and employ over 4,000 people.

Redfin’s subsidiaries and affiliated brands include: Bay Equity

Home Loans®, Rent.™, Apartment Guide®, Title Forward® and

WalkScore®.

For more information or to contact a local Redfin real estate

agent, visit www.redfin.com. To learn about housing market trends

and download data, visit the Redfin Data Center. To be added to

Redfin's press release distribution list, email press@redfin.com.

To view Redfin's press center, click here.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206442392/en/

Contact Redfin Redfin Journalist Services: Isabelle Novak

press@redfin.com

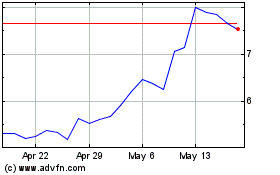

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Feb 2024 to Feb 2025