Reading International, Inc. (NASDAQ: RDI) (“Reading” or our

“Company”), an internationally diversified cinema and real estate

company with operations and assets in the United States, Australia,

and New Zealand, today announced its results for the Second Quarter

ended June 30, 2024.

Second Quarter 2024 Summary

Results

The anticipated lingering effects of the 2023

Hollywood Strikes negatively impacted our second quarter 2024

global box office as the movie line-up featured not only fewer

blockbuster films due to changes in studio release dates, but also

a number of underperforming films. The expected hit to the box

office, which was most pronounced in April and May 2024, permeated

our key financial results leading to an overall weaker quarter

compared to Q2 2023. The 2023 Hollywood Strike impacts began to

dissipate in June 2024 with the release of the record setting

Inside Out 2, which has now become the highest grossing animated

film of all time, and the overperforming Bad Boys: Ride or Die.

Reflecting the June 2024 momentum, compared to the first quarter

2024, during the second quarter 2024 each of the Company’s cinema

divisions reported (i) increases in total segment revenue and (ii)

improvements in the total operating loss.

During Q2 2024 and for the first half of 2024,

our global real estate division reported a slight decrease in

revenues and a decrease in operating income compared to the same

periods in 2023 due to lower results from our U.S. and NZ Real

Estate divisions, which were balanced by stronger results from our

Australian real estate division.

Key Financial Results – Second Quarter

2024

- Total Revenues were $46.8 million

compared to $65.1 million in Q2 2023.

- Operating Loss was $4.4 million

compared to Operating Income of $1.8 million in Q2 2023.

- Adjusted EBITDA loss was $0.2

million compared to Adjusted EBITDA of $6.7 million in Q2

2023.

- Basic loss per share was $0.42

compared to a loss of $0.12 in Q2 2023.

- Net loss attributable to Reading

was $9.3 million compared to a loss of $2.8 million in Q2

2023.

Key Financial Results – Six Months of

2024

- Total Revenues were $91.9 million

compared to $110.9 million for the first six months of 2023.

- Operating Loss was $11.9 million

compared to a loss of $6.1 million for the same period in

2023.

- Adjusted EBITDA loss was $4.2

million compared to Adjusted EBITDA of $3.8 million for the same

period in 2023.

- Basic loss per share was $1.01

compared to a loss of $0.63 for the first six months of 2023.

- Net loss attributable to Reading

was $22.6 million compared to a loss of $13.9 million for the same

period in 2023.

During the second quarter 2024, our revenues

were impacted by foreign exchange in that both the Australian and

New Zealand dollar average exchange rates weakened against the U.S.

dollar by 1.3% and 2.1%, respectively, compared to Q2 2023.

President and Chief Executive Officer, Ellen

Cotter said, “While the 2023 Hollywood Strikes have had an

appreciable financial impact on each of our cinema divisions to

date in 2024, we look to recent results for confidence in our

ability to withstand this latest disruption. Inside Out 2, which

opened in our U.S. and Australian cinemas on June 14/13, 2024, has

been a resounding success. Then, Deadpool & Wolverine, which

recently ranked the second $1 billion 2024 movie at the global box

office after Inside Out 2, drove our global cinema cash flow in

July 2024 to be in the top five highest months since the pandemic

began. And, just this past weekend, It Ends with Us, a female

driven movie based on a bestselling novel which appears to have

become an event movie, has now exceeded all box office expectations

by delivering a global debut of $80 million. With highly

anticipated releases such as Beetlejuice Beetlejuice, Joker: Folie

à Deux, Moana 2, Wicked and Mufasa: The Lion King, we look forward

to the last half of 2024. Looking ahead to 2025, we’re encouraged

by the box office potential for James Cameron’s Avatar 3, a new

Jurassic World film from Universal, Tom Cruise in Mission:

Impossible 8, The Fantastic Four, and James Gunn’s Superman from DC

Studios for Warner Bros.”

Ms. Cotter added, “As our global cinema business

continues its recovery over the balance of 2024 and beyond, we are

proactively taking steps to improve our liquidity to address

upcoming debt maturities and our interest expense which has spiked

due to the fastest rate hike cycle in history (up 525 basis points

since March 2022). Over the past six months, we sold our Culver

City office building for $10 million (using the proceeds to retire

$8.4 million of debt and reduce ongoing G&A expense). In

addition, we have taken steps to market our Cannon Park property in

Townsville Australia. Despite this initiative, we do not anticipate

any adverse impact on our cinema operations, as we will continue to

operate our cinema at this location. In Wellington, New Zealand, we

are marketing a unique opportunity to acquire our five contiguous

parcels assembled in the entertainment core of New Zealand’s

capital city. We believe this once-in-a-lifetime opportunity offers

significant development options. We intend to reserve the right to

operate any cinema constructed on these Wellington properties

ensuring the future continuity of our cinema business.

“We believe that, with the expected closing of

these asset monetizations, together with improving box office

trends that are reinforcing the power of the theatrical release

window, our Company and our stockholders are well positioned for a

better 2025 and beyond.”

Key Points

Cinema Business

- The disruption caused by the 2023

Hollywood Strikes and the weaker performance of the Australian and

New Zealand dollars drove our Q2 2024 financial results to decrease

compared to the same period in 2023: (i) global cinema revenue

decreased 30% to $42.9 million and (ii) global operating income

dropped to a loss of $1.3 million from operating income of $4.5

million. Our global cinema financial results for the six months

ended June 30, 2024, were likewise impacted compared to the first

six months of 2023: (i) global cinema revenue decreased by 18% to

$84.2 million and (ii) global cinema segment operating loss

increased to $5.4 million from a loss of $0.1 million.

- Despite the serious headwinds

imposed by the 2023 Hollywood Strikes and the pandemic, (i) the Q2

2024 operating loss of $1.1 million of our U.S. Cinema division

represented a financially stronger result than all but three

calendar quarters since Q4 2019 (despite a 13% reduction in screen

count due to the closure of underperforming cinemas), (ii) the Q2

2024 operating loss of $87K of our Australian Cinema division

represented a financially stronger result than all but eight

calendar quarters since Q4 2019 and (iii) the Q2 2024 operating

loss of $95K of our New Zealand Cinema division represented a

financially stronger result than all but seven calendar quarters

since Q4 2019. While we are disappointed with our industry’s

macro-operating conditions, the improvements in various operational

strategies across each of our cinema divisions should position them

to benefit from the much-improved movie slate expected over the

next few years.

- From an operational perspective,

with respect to our food and beverage (“F&B”) efforts: (i) the

Q2 2024 sales per person (“SPP”) of our Australian cinema division

ranked the highest second quarter ever and (ii) despite Q2 2024

roll out of additional F&B discounts to drive revenues, the Q2

2024 F&B SPP of our U.S. cinema division ranked the highest

second quarter ever for periods when our U.S. circuit was fully

operating (i.e. excluding pandemic closure periods).

- To further improve the overall

profitability of our U.S. Cinema division, we closed an

underperforming cinema in Texas whose lease expired in Q2 2024.

This closure follows the closure of two theatres in Hawaii in Q3

2023 and one in Northern California in the Q4 2023.

- Demonstrating our long-term belief

in the cinema industry, our Board authorized management to proceed

with the negotiation of a lease for a new Reading Cinema in Noosa

(Queensland) in Australia.

Real Estate Business

- With respect to our global real

estate business, our Q2 2024 financial results compared to the same

period in 2023 experienced declines: (i) our global real estate

revenue decreased slightly by 4% to $5.0 million and (ii) global

operating income dropped 26% to $0.9 million. Our global real

estate business financial results for the six months ended

June 30, 2024, compared to the first six months of 2023

followed a similar trajectory: (i) our global real estate revenue

decreased by 3% to $9.9 million and (ii) operating income of $1.8

million decreased by 20%.

- Our U.S. real estate business

(which includes Live Theatres) posted its second-highest

second-quarter revenue in our Company’s history.

- The 2024 declines in performance

compared to 2023 were primarily attributable to (i) the

monetization of our Culver City office building and our Maitland

property (NSW), in the first quarter of 2024 and the fourth quarter

of 2023, respectively, and the related elimination of rental

revenue associated with those assets, (ii) an increase in our legal

expenses related to our Pennsylvania assets, and (iii) our Orpheum

Theatre in New York City being “dark” for the months of May and

June 2024.

- Reflective of a 95% occupancy rate

for our 74 third party tenant Australian portfolio, in Q2 2024 our

Australian real estate division delivered (i) the highest second

quarter revenues since the second quarter ended June 30, 2019 and

(ii) the highest second quarter operating income since the second

quarter ended June 30, 2018. These achievements come despite the

June 2021 sale of our Auburn/RedYard (NSW) property, which had 17

third party tenants.

- In April 2024, we extended our

license agreement with an affiliate of Audible for the Minetta Lane

Theatre by two years.

- In September 2024 and for an

open-ended run, the Orpheum Theatre debuts The Big Gay Jamboree,

co-produced by the producers of Barbie and the creator of

Titanique.

Balance Sheet and Liquidity

As of June 30, 2024,

- Our cash and cash equivalents were

$9.2 million.

- Our total gross debt was $210.4 million representing a slight

$0.1 million increase since December 31, 2023.

- Our assets had a total book value

of $494.9 million, compared to a book value of $533.1 million as of

December 31, 2023.

Through Q2 2024, we worked closely with certain lenders to amend

our existing debt facilities and extend upcoming maturity

dates.

- On April 4, 2024, we extended our

loan with National Australia Bank (NAB) to July 31, 2026, and

negotiated a Bridge Facility of A$20 million due March 31, 2025 (to

be prepaid upon the sale of certain assets).

- On April 23, 2024, we closed a

1-year extension on our 44 Union Square loan extending the maturity

date to May 6, 2025. We have one remaining 1-year extension

option.

- On June 28, 2024, we entered into

an Interest Rate Collar hedging agreement with NAB for A$50 million

where the cap rate is 4.78% and floor rate is 4.18%. The

termination date of the agreement is July 31, 2026.

- On August 13, 2024, we executed a Variation of our Westpac loan

in New Zealand which, among other things, increased our credit line

by NZ$5.0 million.

- We are currently working on a one-year extension of our loan

from Santander Bank, which matured June 1, 2024.

Conference Call and Webcast

We plan to post our pre-recorded conference call

and audio webcast on our corporate website on Friday, August 16,

2024, which will feature prepared remarks from Ellen Cotter,

President and Chief Executive Officer; Gilbert Avanes, Executive

Vice President, Chief Financial Officer and Treasurer; and Andrzej

Matyczynski, Executive Vice President - Global Operations.

A pre-recorded question and answer session will

follow our formal remarks. Questions and topics for consideration

should be submitted to InvestorRelations@readingrdi.com on August

15, 2024 by 5:00 p.m. Eastern Time. The audio webcast can be

accessed by visiting

https://investor.readingrdi.com/financial-information/quarterly-results.

About Reading International,

Inc.

Reading International, Inc. (NASDAQ: RDI), an

internationally diversified cinema and real estate company

operating through various domestic and international subsidiaries,

is a leading entertainment and real estate company, engaging in the

development, ownership, and operation of cinemas and retail and

commercial real estate in the United States, Australia, and New

Zealand.

Reading’s cinema subsidiaries operate under

multiple cinema brands: Reading Cinemas, Consolidated Theatres and

the Angelika brand. Its live theatres are owned and operated by its

Liberty Theaters subsidiary, under the Orpheum and Minetta Lane

names. Its signature property developments, including Newmarket

Village in Brisbane, Australia, and 44 Union Square in New York

City, are maintained in special purpose entities.

Additional information about Reading can be

obtained from our Company’s website: http://www.readingrdi.com.

Cautionary Note Regarding Forward-Looking

Statements

This earnings release contains a variety of

forward-looking statements as defined by the Securities Litigation

Reform Act of 1995, including those related to our expected

operated results; our belief regarding our business structure and

diversification strategy; our belief regarding the quality, the

quantity and the appeal of upcoming movie releases in the remainder

of 2024 and 2025 and our revenue expectations relating to such

movie releases; our expectations regarding our monetization of our

fee interests under our cinemas and our other real estate assets;

our beliefs regarding the upcoming movie slates, the refocus of

film distributors and its impact on our business; and our

expectations of our liquidity and capital requirements and the

allocation of funds. You can recognize these statements by our use

of words, such as “may,” “will,” “expect,” “believe,” and

“anticipate” or other similar terminology.

Given the variety and unpredictability of the

factors that will ultimately influence our businesses and our

results of operation, no guarantees can be given that any of our

forward-looking statements will ultimately prove to be correct.

Actual results will undoubtedly vary and there is no guarantee as

to how our securities will perform either when considered in

isolation or when compared to other securities or investment

opportunities.

Forward-looking statements made by us in this

earnings release are based only on information currently available

to us and speak only as of the date on which they are made. We

undertake no obligation to publicly update or to revise any of our

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable law. Accordingly, you should always note the date to

which our forward-looking statements speak.

Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of our control. Therefore, you should not rely on

any of these forward-looking statements. Important factors that

could cause our actual results and financial condition to differ

materially from those indicated in the forward-looking statements

include, among others, those factors discussed throughout Part I,

Item 1A – Risk Factors – and Part II Item 7 – Management’s

Discussion and Analysis of Financial Condition and Results of

Operations – of our Annual Report on Form 10-K for the most

recently ended fiscal year, as well as the risk factors set forth

in any other filings made under the Securities Act of 1934, as

amended, including any of our Quarterly Reports on Form 10-Q, for

more information.

Reading International, Inc. and

SubsidiariesUnaudited Consolidated Statements of

Operations(Unaudited; U.S. dollars in thousands, except

per share data)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Six Months Ended |

| |

|

June 30, |

|

June 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cinema |

|

$ |

42,942 |

|

|

$ |

61,056 |

|

|

$ |

84,213 |

|

|

$ |

103,042 |

|

| Real

estate |

|

|

3,867 |

|

|

|

3,999 |

|

|

|

7,648 |

|

|

|

7,819 |

|

|

Total revenue |

|

|

46,809 |

|

|

|

65,055 |

|

|

|

91,861 |

|

|

|

110,861 |

|

|

Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Cinema |

|

|

(39,418 |

) |

|

|

(51,364 |

) |

|

|

(80,138 |

) |

|

|

(93,019 |

) |

| Real estate |

|

|

(2,461 |

) |

|

|

(2,104 |

) |

|

|

(4,696 |

) |

|

|

(4,319 |

) |

| Depreciation and

amortization |

|

|

(4,011 |

) |

|

|

(4,689 |

) |

|

|

(8,216 |

) |

|

|

(9,329 |

) |

| General and

administrative |

|

|

(5,271 |

) |

|

|

(5,109 |

) |

|

|

(10,693 |

) |

|

|

(10,288 |

) |

|

Total costs and expenses |

|

|

(51,161 |

) |

|

|

(63,266 |

) |

|

|

(103,743 |

) |

|

|

(116,955 |

) |

|

Operating income (loss) |

|

|

(4,352 |

) |

|

|

1,789 |

|

|

|

(11,882 |

) |

|

|

(6,094 |

) |

| Interest expense, net |

|

|

(5,252 |

) |

|

|

(4,874 |

) |

|

|

(10,537 |

) |

|

|

(8,991 |

) |

| Gain (loss) on sale of

assets |

|

|

9 |

|

|

|

— |

|

|

|

(1,116 |

) |

|

|

— |

|

| Other

income (expense) |

|

|

(216 |

) |

|

|

(86 |

) |

|

|

123 |

|

|

|

91 |

|

|

Income (loss) before income tax expense and equity earnings

of unconsolidated joint ventures |

|

|

(9,811 |

) |

|

|

(3,171 |

) |

|

|

(23,412 |

) |

|

|

(14,994 |

) |

| Equity

earnings of unconsolidated joint ventures |

|

|

119 |

|

|

|

207 |

|

|

|

94 |

|

|

|

226 |

|

|

Income (loss) before income taxes |

|

|

(9,692 |

) |

|

|

(2,964 |

) |

|

|

(23,318 |

) |

|

|

(14,768 |

) |

| Income

tax benefit (expense) |

|

|

156 |

|

|

|

103 |

|

|

|

379 |

|

|

|

583 |

|

|

Net income (loss) |

|

$ |

(9,536 |

) |

|

$ |

(2,861 |

) |

|

$ |

(22,939 |

) |

|

$ |

(14,185 |

) |

| Less:

net income (loss) attributable to noncontrolling interests |

|

|

(195 |

) |

|

|

(83 |

) |

|

|

(370 |

) |

|

|

(296 |

) |

|

Net income (loss) attributable to Reading International,

Inc. |

|

$ |

(9,341 |

) |

|

$ |

(2,778 |

) |

|

$ |

(22,569 |

) |

|

$ |

(13,889 |

) |

|

Basic earnings (loss) per share |

|

$ |

(0.42 |

) |

|

$ |

(0.12 |

) |

|

$ |

(1.01 |

) |

|

$ |

(0.63 |

) |

|

Diluted earnings (loss) per share |

|

$ |

(0.42 |

) |

|

$ |

(0.12 |

) |

|

$ |

(1.01 |

) |

|

$ |

(0.63 |

) |

|

Weighted average number of shares outstanding–basic |

|

|

22,413,617 |

|

|

|

22,262,214 |

|

|

|

22,379,881 |

|

|

|

22,183,618 |

|

|

Weighted average number of shares outstanding–diluted |

|

|

23,246,591 |

|

|

|

23,502,506 |

|

|

|

23,294,887 |

|

|

|

23,423,910 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reading International, Inc. and

SubsidiariesConsolidated Balance

Sheets(U.S. dollars in thousands, except share

information)

| |

|

|

|

|

|

|

| |

|

June 30, |

|

December 31, |

|

|

|

2024 |

|

2023 |

|

ASSETS |

|

(unaudited) |

|

|

|

| Current

Assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

9,242 |

|

|

$ |

12,906 |

|

| Restricted cash |

|

|

1,485 |

|

|

|

2,535 |

|

| Receivables |

|

|

7,647 |

|

|

|

7,561 |

|

| Inventories |

|

|

1,347 |

|

|

|

1,648 |

|

| Prepaid and other current

assets |

|

|

2,485 |

|

|

|

2,881 |

|

| Land

and property held for sale |

|

|

36,446 |

|

|

|

11,179 |

|

|

Total current assets |

|

|

58,652 |

|

|

|

38,710 |

|

| Operating property, net |

|

|

225,473 |

|

|

|

262,417 |

|

| Operating lease right-of-use

assets |

|

|

168,546 |

|

|

|

181,542 |

|

| Investment and development

property, net |

|

|

— |

|

|

|

8,789 |

|

| Investment in unconsolidated

joint ventures |

|

|

4,428 |

|

|

|

4,756 |

|

| Goodwill |

|

|

25,023 |

|

|

|

25,535 |

|

| Intangible assets, net |

|

|

1,899 |

|

|

|

2,038 |

|

| Deferred tax asset, net |

|

|

2,109 |

|

|

|

299 |

|

| Other

assets |

|

|

8,725 |

|

|

|

8,965 |

|

|

Total assets |

|

$ |

494,855 |

|

|

$ |

533,051 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

|

| Accounts payable and accrued

liabilities |

|

$ |

44,392 |

|

|

$ |

43,828 |

|

| Film rent payable |

|

|

4,911 |

|

|

|

6,038 |

|

| Debt - current portion |

|

|

58,401 |

|

|

|

34,484 |

|

| Subordinated debt - current

portion |

|

|

198 |

|

|

|

586 |

|

| Taxes payable - current |

|

|

2,088 |

|

|

|

1,376 |

|

| Deferred revenue |

|

|

10,027 |

|

|

|

10,993 |

|

| Operating lease liabilities -

current portion |

|

|

21,797 |

|

|

|

23,047 |

|

| Other

current liabilities |

|

|

6,625 |

|

|

|

6,731 |

|

|

Total current liabilities |

|

|

148,439 |

|

|

|

127,083 |

|

| Debt - long-term portion |

|

|

123,347 |

|

|

|

146,605 |

|

| Derivative financial

instruments - non-current portion |

|

|

98 |

|

|

|

— |

|

| Subordinated debt, net |

|

|

27,283 |

|

|

|

27,172 |

|

| Noncurrent tax

liabilities |

|

|

6,418 |

|

|

|

6,586 |

|

| Operating lease liabilities -

non-current portion |

|

|

168,246 |

|

|

|

180,898 |

|

| Other

liabilities |

|

|

11,493 |

|

|

|

11,711 |

|

|

Total liabilities |

|

$ |

485,324 |

|

|

$ |

500,055 |

|

|

Commitments and contingencies (Note 15) |

|

|

|

|

|

|

| Stockholders’

equity: |

|

|

|

|

|

|

| Class A non-voting common

shares, par value $0.01, 100,000,000 shares authorized, |

|

|

|

|

|

|

|

33,681,705 issued and 20,745,594 outstanding at June 30, 2024

and |

|

|

|

|

|

|

|

33,602,627 issued and 20,666,516 outstanding at December 31,

2023 |

|

|

238 |

|

|

|

237 |

|

| Class B voting common shares,

par value $0.01, 20,000,000 shares authorized and |

|

|

|

|

|

|

|

1,680,590 issued and outstanding at June 30, 2024 and December 31,

2023 |

|

|

17 |

|

|

|

17 |

|

| Nonvoting preferred shares,

par value $0.01, 12,000 shares authorized and no issued |

|

|

|

|

|

|

|

or outstanding shares at June 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

| Additional paid-in

capital |

|

|

156,529 |

|

|

|

155,402 |

|

| Retained

earnings/(deficits) |

|

|

(102,058 |

) |

|

|

(79,489 |

) |

| Treasury shares |

|

|

(40,407 |

) |

|

|

(40,407 |

) |

|

Accumulated other comprehensive income |

|

|

(4,325 |

) |

|

|

(2,673 |

) |

|

Total Reading International, Inc. stockholders’

equity |

|

|

9,994 |

|

|

|

33,087 |

|

|

Noncontrolling interests |

|

|

(463 |

) |

|

|

(91 |

) |

|

Total stockholders’ equity |

|

|

9,531 |

|

|

|

32,996 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

494,855 |

|

|

$ |

533,051 |

|

|

|

|

|

|

|

|

|

|

|

Reading International, Inc. and

SubsidiariesSegment Results(Unaudited;

U.S. dollars in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Six Months Ended |

| |

|

June 30, |

|

% ChangeFavorable/ |

|

June 30, |

|

% ChangeFavorable/ |

|

(Dollars in thousands) |

|

2024 |

|

2023 |

|

(Unfavorable) |

|

2024 |

|

2023 |

|

(Unfavorable) |

|

Segment revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cinema |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

21,480 |

|

|

$ |

34,017 |

|

|

(37)% |

|

$ |

42,785 |

|

|

$ |

55,826 |

|

|

(23)% |

|

Australia |

|

|

18,543 |

|

|

|

22,940 |

|

|

(19)% |

|

|

35,867 |

|

|

|

40,151 |

|

|

(11)% |

|

New Zealand |

|

|

2,918 |

|

|

|

4,101 |

|

|

(29)% |

|

|

5,561 |

|

|

|

7,065 |

|

|

(21)% |

|

Total |

|

$ |

42,941 |

|

|

$ |

61,058 |

|

|

(30)% |

|

$ |

84,213 |

|

|

$ |

103,042 |

|

|

(18)% |

|

Real estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

1,483 |

|

|

$ |

1,834 |

|

|

(19)% |

|

$ |

2,967 |

|

|

$ |

3,389 |

|

|

(12)% |

|

Australia |

|

|

3,177 |

|

|

|

2,991 |

|

|

6% |

|

|

6,261 |

|

|

|

6,128 |

|

|

2% |

|

New Zealand |

|

|

353 |

|

|

|

392 |

|

|

(10)% |

|

|

718 |

|

|

|

765 |

|

|

(6)% |

|

Total |

|

$ |

5,013 |

|

|

$ |

5,217 |

|

|

(4)% |

|

$ |

9,946 |

|

|

$ |

10,282 |

|

|

(3)% |

|

Inter-segment elimination |

|

|

(1,146 |

) |

|

|

(1,218 |

) |

|

6% |

|

|

(2,298 |

) |

|

|

(2,463 |

) |

|

7% |

| Total segment

revenue |

|

$ |

46,808 |

|

|

$ |

65,057 |

|

|

(28)% |

|

$ |

91,861 |

|

|

$ |

110,861 |

|

|

(17)% |

| Segment operating

income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cinema |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

(1,088 |

) |

|

$ |

814 |

|

|

(>100)% |

|

$ |

(4,527 |

) |

|

$ |

(3,514 |

) |

|

(29)% |

|

Australia |

|

|

(87 |

) |

|

|

2,984 |

|

|

(>100)% |

|

|

(582 |

) |

|

|

2,858 |

|

|

(>100)% |

|

New Zealand |

|

|

(95 |

) |

|

|

676 |

|

|

(>100)% |

|

|

(326 |

) |

|

|

515 |

|

|

(>100)% |

|

Total |

|

$ |

(1,270 |

) |

|

$ |

4,474 |

|

|

(>100)% |

|

$ |

(5,435 |

) |

|

$ |

(141 |

) |

|

(>100)% |

|

Real estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

$ |

(204 |

) |

|

$ |

233 |

|

|

(>100)% |

|

$ |

(573 |

) |

|

$ |

16 |

|

|

(>100)% |

|

Australia |

|

|

1,461 |

|

|

|

1,225 |

|

|

19% |

|

|

2,921 |

|

|

|

2,639 |

|

|

11% |

|

New Zealand |

|

|

(311 |

) |

|

|

(172 |

) |

|

(81)% |

|

|

(511 |

) |

|

|

(364 |

) |

|

(40)% |

|

Total |

|

$ |

946 |

|

|

$ |

1,286 |

|

|

(26)% |

|

$ |

1,837 |

|

|

$ |

2,291 |

|

|

(20)% |

| Total segment

operating income(loss) (1) |

|

$ |

(324 |

) |

|

$ |

5,760 |

|

|

(>100)% |

|

$ |

(3,598 |

) |

|

$ |

2,150 |

|

|

(>100)% |

| |

(1) Total segment operating income is a non-GAAP

financial measure. See the discussion of non-GAAP financial

measures that follows.

Reading International, Inc. and

SubsidiariesReconciliation of EBITDA and Adjusted

EBITDA to Net Income (Loss)(Unaudited; U.S. dollars in

thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Six Months Ended |

| |

|

June 30, |

|

June 30, |

|

(Dollars in thousands) |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net Income (loss) attributable to Reading International, Inc. |

|

$ |

(9,341 |

) |

|

$ |

(2,778 |

) |

|

$ |

(22,569 |

) |

|

$ |

(13,889 |

) |

|

Add: Interest expense, net |

|

|

5,252 |

|

|

|

4,874 |

|

|

|

10,537 |

|

|

|

8,991 |

|

|

Add: Income tax expense (benefit) |

|

|

(156 |

) |

|

|

(103 |

) |

|

|

(379 |

) |

|

|

(583 |

) |

|

Add: Depreciation and amortization |

|

|

4,011 |

|

|

|

4,689 |

|

|

|

8,216 |

|

|

|

9,329 |

|

|

Adjustment for infrequent events anddiscontinued operations |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| EBITDA |

|

$ |

(234 |

) |

|

$ |

6,682 |

|

|

$ |

(4,195 |

) |

|

$ |

3,848 |

|

| Adjustments for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

None |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Adjusted

EBITDA |

|

$ |

(234 |

) |

|

$ |

6,682 |

|

|

$ |

(4,195 |

) |

|

$ |

3,848 |

|

| |

Reading International, Inc. and

SubsidiariesReconciliation of Total Segment

Operating Income (Loss) to Income (Loss) before Income

Taxes(Unaudited; U.S. dollars in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Six Months Ended |

| |

|

June 30, |

|

June 30, |

|

(Dollars in thousands) |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Segment operating income (loss) |

|

$ |

(324 |

) |

|

$ |

5,760 |

|

|

$ |

(3,598 |

) |

|

$ |

2,150 |

|

| Unallocated corporate

expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization expense |

|

|

(99 |

) |

|

|

(176 |

) |

|

|

(201 |

) |

|

|

(355 |

) |

|

General and administrative expense |

|

|

(3,929 |

) |

|

|

(3,794 |

) |

|

|

(8,083 |

) |

|

|

(7,889 |

) |

|

Interest expense, net |

|

|

(5,252 |

) |

|

|

(4,875 |

) |

|

|

(10,537 |

) |

|

|

(8,991 |

) |

| Equity earnings of

unconsolidated joint ventures |

|

|

119 |

|

|

|

207 |

|

|

|

94 |

|

|

|

226 |

|

| Gain (loss) on sale of

assets |

|

|

9 |

|

|

|

— |

|

|

|

(1,116 |

) |

|

|

— |

|

| Other income (expense) |

|

|

(216 |

) |

|

|

(86 |

) |

|

|

123 |

|

|

|

91 |

|

| Income (loss) before

income tax expense |

|

$ |

(9,692 |

) |

|

$ |

(2,964 |

) |

|

$ |

(23,318 |

) |

|

$ |

(14,768 |

) |

| |

Non-GAAP Financial Measures

This Earnings Release presents total segment

operating income (loss), EBITDA, and Adjusted EBITDA, which are

important financial measures for our Company, but are not financial

measures defined by U.S. GAAP.

These measures should be reviewed in conjunction

with the relevant U.S. GAAP financial measures and are not

presented as alternative measures of earnings (loss) per share,

cash flows or net income (loss) as determined in accordance with

U.S. GAAP. Total segment operating income (loss) and EBITDA, as we

have calculated them, may not be comparable to similarly titled

measures reported by other companies.

Total segment

operating income (loss) – We evaluate the performance of

our business segments based on segment operating income (loss), and

management uses total segment operating income (loss) as a measure

of the performance of operating businesses separate from

non-operating factors. We believe that information about total

segment operating income (loss) assists investors by allowing them

to evaluate changes in the operating results of our Company’s

business separate from non-operational factors that affect net

income (loss), thus providing separate insight into both operations

and the other factors that affect reported results.

EBITDA – We use EBITDA in the evaluation of our

Company’s performance since we believe that EBITDA provides a

useful measure of financial performance and value. We believe this

principally for the following reasons:

We believe that

EBITDA is an accepted industry-wide comparative measure of

financial performance. It is, in our experience, a measure commonly

adopted by analysts and financial commentators who report upon the

cinema exhibition and real estate industries, and it is also a

measure used by financial institutions in underwriting the

creditworthiness of companies in these industries. Accordingly, our

management monitors this calculation as a method of judging our

performance against our peers, market expectations, and our

creditworthiness. It is widely accepted that analysts, financial

commentators, and persons active in the cinema exhibition and real

estate industries typically value enterprises engaged in these

businesses at various multiples of EBITDA. Accordingly, we find

EBITDA valuable as an indicator of the underlying value of our

businesses. We expect that investors may use EBITDA to judge our

ability to generate cash, as a basis of comparison to other

companies engaged in the cinema exhibition and real estate

businesses and as a basis to value our company against such other

companies.

EBITDA is not a

measurement of financial performance under generally accepted

accounting principles in the United States of America and it should

not be considered in isolation or construed as a substitute for net

income (loss) or other operations data or cash flow data prepared

in accordance with generally accepted accounting principles in the

United States for purposes of analyzing our profitability. The

exclusion of various components, such as interest, taxes,

depreciation, and amortization, limits the usefulness of these

measures when assessing our financial performance, as not all funds

depicted by EBITDA are available for management’s discretionary

use. For example, a substantial portion of such funds may be

subject to contractual restrictions and functional requirements to

service debt, to fund necessary capital expenditures, and to meet

other commitments from time to time.

EBITDA also fails to

take into account the cost of interest and taxes. Interest is

clearly a real cost that for us is paid periodically as accrued.

Taxes may or may not be a current cash item but are nevertheless

real costs that, in most situations, must eventually be paid. A

company that realizes taxable earnings in high tax jurisdictions

may, ultimately, be less valuable than a company that realizes the

same amount of taxable earnings in a low tax jurisdiction. EBITDA

fails to take into account the cost of depreciation and

amortization and the fact that assets will eventually wear out and

have to be replaced.

Adjusted

EBITDA – using the principles we consistently apply to

determine our EBITDA, we further adjusted the EBITDA for certain

items we believe to be external to our core business and not

reflective of our costs of doing business or results of operation.

Specifically, we have adjusted for (i) legal expenses relating to

extraordinary litigation, and (ii) any other items that can be

considered non-recurring in accordance with the two-year SEC

requirement for determining an item is non-recurring, infrequent or

unusual in nature.

For more information, contact:

Gilbert Avanes – EVP, CFO, and Treasurer

Andrzej Matyczynski – EVP Global Operations

(213) 235-2240

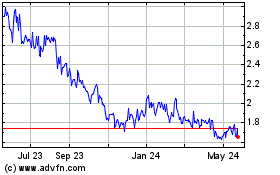

Reading (NASDAQ:RDI)

Historical Stock Chart

From Dec 2024 to Jan 2025

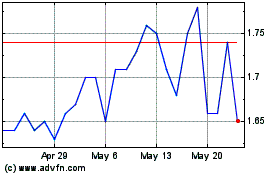

Reading (NASDAQ:RDI)

Historical Stock Chart

From Jan 2024 to Jan 2025