Repligen Corporation (NASDAQ:RGEN), a life sciences company focused

on bioprocessing technology leadership, today reported financial

results for its fourth quarter of 2024, covering the three- and

twelve-month periods ended December 31, 2024. The company is also

providing financial guidance for the full year 2025.

Olivier Loeillot, President and Chief Executive

Officer of Repligen said, “During the fourth quarter, we were very

encouraged by the continued momentum across our portfolio. Total

revenue in the fourth quarter grew 13% excluding COVID, overcoming

two points of currency headwind. Total orders outpaced sales by 6%,

driven by our Filtration and Analytics franchises. The strength we

saw in the third quarter for CDMOs and capital equipment continued

during the fourth quarter, with sequential revenues increasing

approximately 20% and 30% respectively. While we continue to

monitor China and emerging biotech, the overall bioprocessing

market is returning to growth. Our order momentum during the second

half gives us confidence that we can achieve our 2025

guidance.”

Q4 2024 BUSINESS HIGHLIGHTS

- CDMO and capital equipment. Orders accelerated

sequentially in the quarter, increasing ~15% and ~30% respectively,

confirming both markets are fundamentally improving

- M&A. Closed acquisition of chromatography

innovator Tantti Laboratory Inc, strengthening and expanding our

Protein and Chromatography offering in new modalities

- New products. Launched AVIPure® dsRNA resin,

the industry’s first affinity resin for the removal of

double-stranded RNA (dsRNA); a groundbreaking solution targeting

mRNA-based therapeutics and vaccines

- Sustainability. Published our 2023

Sustainability report “Advancing Impacts”, highlighting the

company’s progress across numerous environmental, social and

governance (ESG) initiatives

FINANCIAL PERFORMANCE

Q4 and Full Year 2024 financial performance (compared to prior

year periods except as noted).All adjusted figures are non-GAAP

and, except for earnings per share, are rounded to the nearest

million, and are reconciled in the tables included later in this

press release.

- Q4 reported

revenue was $168 million compared to $167 million, bringing our

full year 2024 revenue to $634 million compared to $632

million.

- Q4 GAAP gross

profit was $39 million compared to $78 million. Adjusted gross

profit was $85 million compared to $87 million. For the full year

2024, GAAP gross profit was $275 million compared to $278 million.

Adjusted gross profit was $320 million compared to $310 million. Q4

and full year 2024 gross profit includes $45 million and $44

million in non-recurring restructuring and other inventory charges

(3), including, severance, and costs associated with manufacturing

rationalization.

- Q4 GAAP (loss)

income from operations was $(37) million, compared to $10 million.

Adjusted income from operations was $25 million, compared to $30

million. For the full year 2024, GAAP (loss) income from operations

was $(35) million, compared to $48 million. Adjusted income from

operations was $82 million compared to $88 million. Q4 and full

year 2024 (loss) income from operations includes $45 million and

$47 million in non-recurring restructuring and other inventory

charges (3), including, severance, and costs associated with

manufacturing rationalization.

- Q4 GAAP net

(loss) income was $(34) million, compared to $(16) million.

Adjusted net income was $25 million compared to $27 million. For

the full year 2024, GAAP net (loss) income was $(26) million

compared to $36 million. Adjusted net income was $89 million

compared to $93 million.

- Q4 GAAP (loss) earnings per share

was $(0.60) on a basic and fully diluted basis, compared to

$(0.29). Adjusted earnings per share was $0.44 on a fully diluted

basis, compared to $0.48. For the full year 2024, GAAP (loss)

earnings per share was $(0.46) compared to $0.63. Adjusted earnings

per share was $1.58 compared to $1.65.

MARGIN SUMMARY

|

GAAP Margins |

Q4 2024 |

Q4 2023 |

2024 |

2023 |

|

Gross Margin |

23.2% |

47.1% |

43.3% |

44.0% |

|

Operating (EBIT) Margin |

(21.8)% |

5.9% |

(5.5)% |

7.5% |

|

Adjusted (non-GAAP) Margins |

Q4 2024 |

Q4 2023 |

2024 |

2023 |

|

Gross Margin |

50.7% |

52.5% |

50.4% |

49.0% |

|

Operating (EBIT) Margin |

14.9% |

17.8% |

12.9% |

13.9% |

|

EBITDA Margin |

20.9% |

22.2% |

18.5% |

19.8% |

| |

|

|

|

|

Cash and cash equivalents at December 31, 2024,

were $757 million, compared to $751 million at December 31,

2023.

Amounts herein pertaining to December 31, 2024

represent a preliminary estimate as of the date of this earnings

release and may be revised upon filing our Annual Report on Form

10-K with the Securities and Exchange Commission (the “SEC”). More

information on our results of operations for the year ended

December 31, 2024 will be provided upon filing our Annual Report on

Form 10-K with the SEC.

FINANCIAL GUIDANCE FOR FISCAL YEAR 2025

Our financial guidance for the fiscal year 2025

is based on expectations for our existing business. Our GAAP and

Adjusted (non-GAAP) guidance excludes the impact of any potential

business acquisitions in 2025, and future fluctuations in foreign

currency exchange rates.

|

|

CURRENT GUIDANCE(at February 20, 2025) |

|

FY 2025 |

GAAP |

Adjusted (non-GAAP) |

|

Total Reported Revenue |

$685M - $710M |

$685M - $710M |

|

Reported Growth |

8% - 12% |

8% - 12% |

|

Organic Growth |

- |

9.5% - 13.5% |

|

Non-COVID Revenue Growth |

- |

10% - 14% |

|

Gross Margin |

51% - 52% |

51% - 52% |

|

Income from Operations |

$59M - $66M |

$99M - $106M |

|

Operating Margin |

8% - 9% |

14% - 15% |

|

Other Income (Expense) |

$15M - $16M |

$23M - $24M |

|

Adjusted EBITDA Margin |

- |

20% - 21% |

|

Tax Rate on Pre-Tax Income |

23% - 24% |

22% - 23% |

|

Net Income |

$51M - $56M |

$95M - $100M |

|

Earnings Per Share - Diluted |

$0.90 - $0.99 |

$1.67 - $1.76 |

| |

|

|

Conference Call and Webcast

Access

Repligen will host a conference call and webcast

today, February 20, 2025, at 8:30 a.m. ET, to discuss fourth

quarter 2024 financial results, corporate developments and

financial guidance for the year 2025. The conference call will be

accessible by dialing toll-free (844) 274-3999 for domestic callers

or (412) 317-5607 for international callers. No passcode is

required for the live call. In addition, a webcast will be

accessible via the Investor Relations section of the Company’s

website. Both the conference call and webcast will be archived for

a period of time following the live event. The replay dial-in

numbers are (877) 344-7529 from the U.S., (855) 669-9658 from

Canada and (412) 317-0088 for international callers. Replay

listeners must provide the passcode 6188777.

About Repligen Corporation

Repligen Corporation is a global life sciences

company that develops and commercializes highly innovative

bioprocessing technologies and systems that enable efficiencies in

the process of manufacturing biological drugs. We are “inspiring

advances in bioprocessing” for the customers we serve; primarily

biopharmaceutical drug developers and contract development and

manufacturing organizations (CDMOs) worldwide. Our focus areas are

Filtration and Fluid Management, Chromatography, Process Analytics

and Proteins. Our corporate headquarters are located in Waltham,

Massachusetts, and the majority of our manufacturing sites are in

the U.S., with additional key sites in Estonia, France, Germany,

Ireland, the Netherlands and Sweden. For more information about the

company see our website at www.repligen.com, and follow us on

LinkedIn.

Non-GAAP Measures of Financial

Performance

To supplement our financial statements, which

are presented on the basis of U.S. generally accepted accounting

principles (GAAP), the following Adjusted (non-GAAP) measures of

financial performance are included in this release: non-COVID

revenue and non-COVID revenue growth; organic revenue and organic

revenue growth; adjusted cost of goods sold, adjusted gross profit

and adjusted gross margin; adjusted R&D expense and adjusted

SG&A expense; adjusted income from operations and adjusted

operating margin; adjusted pre-tax income; adjusted net income;

adjusted earnings per share (diluted); adjusted earnings before

interest, taxes, depreciation and amortization (EBITDA), and

adjusted EBITDA margin. The Company provides base revenue and base

revenue growth rates, which exclude COVID-related revenue, and the

impact of acquisition revenue for current year periods that have no

prior year comparables, to facilitate a comparison of its current

revenue performance to its past performance. The Company provides

the impact of foreign currency translation, to enable determination

of revenue growth rates at constant currency. To calculate the

impact of foreign currency translation, the Company converts actual

net sales from local currency to U.S. dollars using constant

foreign currency exchange rates in the current and prior year

periods.

The Company’s non-GAAP financial results and/or

non-GAAP guidance exclude the impact of: acquisition and

integration costs; restructuring charges including the costs of

severance and accelerated depreciation among other charges;

incremental costs attributed to CEO transition; contingent

consideration related to the Company’s acquisitions; intangible

amortization costs; non-cash interest expense related to the

accretion of the debt discount; amortization of debt issuance costs

related to Company’s convertible debt; foreign currency impact of

certain intercompany loans; and, the related impact on tax of

non-GAAP charges. These costs are excluded because management

believes that such expenses do not have a direct correlation to

future business operations, nor do the resulting charges recorded

accurately reflect the performance of our ongoing operations for

the period in which such charges are recorded.

NOTE:All reconciliations of above GAAP figures

(reported or guidance) to adjusted (non-GAAP) figures are detailed

in the tables included later in this press release. When analyzing

the Company’s operating performance and guidance, investors should

not consider non-GAAP measures as a substitute for the comparable

financial measures prepared in accordance with GAAP.

Forward-Looking Statements This

release contains forward-looking statements, which are made

pursuant to and in reliance upon the safe harbor provisions of

federal securities laws, including the Private Securities

Litigation Reform Act of 1995, Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. Any statements contained herein which do not

describe historical facts, including, among others, any express or

implied statements or guidance regarding current or future

financial performance and position, including our 2025 financial

guidance and related assumptions; expected demand in the markets in

which we operate; our beliefs that the bioprocessing market is

returning to growth and that the CDMO and capital equipment markets

are fundamentally improving; expectations regarding the Tantti

acquisition; the expected performance of our business and momentum

across our portfolio, including that AVIPure is a groundbreaking

solution, are based on management’s current expectations and

beliefs and are forward-looking statements which involve risks and

uncertainties that could cause actual results to differ materially

from those discussed in such forward-looking statements. .

Such risks and uncertainties include, among

others, our ability to successfully grow our bioprocessing

business; our ability to manage through and predict headwinds; the

risk that we have assumed that markets and franchises will improve

and grow more than expected; our ability to achieve our 2025

financial guidance; our ability to develop and commercialize

products and the market acceptance of our products; our ability to

successfully integrate any acquired businesses in a timely manner

or at all, and to achieve the expected benefits of such

acquisitions; that demand for our products could decline, which

could adversely impact our future revenues, cash flows, results of

operations and financial condition; our ability to compete with

larger, better financed bioprocessing companies; risks around the

Company’s effectiveness of disclosure controls and procedures and

the effectiveness of our internal control over financial reporting;

our compliance with all U.S. Food and Drug Administration and

European Medicines Evaluation Agency regulations; our volatile

stock price; and other risks and uncertainties detailed in

Repligen’s filings with the U.S. Securities and Exchange Commission

(the Commission), including our Annual Report on Form 10-K for the

year ended December 31, 2023 and in subsequently filed reports with

the Commission, including our Quarterly Reports on Form 10-Q and

current reports on Form 8-K, as well as our upcoming Annual Report

on form 10-K for the year ended December 31, 2024 and any

subsequent filings with the Commission, which are available at the

Commission’s website at www.sec.gov. Actual results may differ

materially from those Repligen contemplated by these

forward-looking statements, which reflect management’s current

views, expectations, and assumptions regarding the future of our

business, future plans and strategies, projections, anticipated

events and trends, the economy and other future conditions, and are

based only on information currently available to us. Repligen

cautions you not to place undue reliance on any forward-looking

statements, which speak only as of the date they are made. Repligen

disclaims any obligation to update or revise any such statements to

reflect any change in expectations or in events, conditions or

circumstances on which any such statements may be based, or that

may affect the likelihood that actual results will differ from

those set forth in the forward-looking statements.

Repligen Contact: Sondra S. Newman, Global Head

of Investor Relations(781) 419-1881investors@repligen.com

|

|

|

|

|

|

|

|

|

|

REPLIGEN CORPORATION |

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

|

|

|

|

|

|

(Unaudited, amounts in thousands, except share and per

share data) |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

. |

|

|

|

Revenue: |

|

|

|

|

|

|

|

|

Product revenue |

$ |

167,394 |

|

|

$ |

166,349 |

|

|

$ |

634,178 |

|

|

$ |

631,979 |

|

|

Royalty and other revenue |

|

153 |

|

|

|

272 |

|

|

|

261 |

|

|

|

383 |

|

|

Total revenue |

|

167,547 |

|

|

|

166,621 |

|

|

|

634,439 |

|

|

|

632,362 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

Cost of goods sold |

|

128,706 |

|

|

|

88,136 |

|

|

|

359,794 |

|

|

|

353,922 |

|

|

Research and development |

|

11,677 |

|

|

|

10,285 |

|

|

|

43,200 |

|

|

|

42,722 |

|

|

Selling, general and administrative |

|

60,474 |

|

|

|

57,630 |

|

|

|

263,368 |

|

|

|

218,584 |

|

|

Contingent consideration |

|

3,191 |

|

|

|

697 |

|

|

|

3,191 |

|

|

|

(30,569 |

) |

|

Total costs and operating expenses |

|

204,048 |

|

|

|

156,748 |

|

|

|

669,553 |

|

|

|

584,659 |

|

|

(Loss) income from operations |

|

(36,501 |

) |

|

|

9,873 |

|

|

|

(35,114 |

) |

|

|

47,703 |

|

|

Other income (expenses): |

|

|

|

|

|

|

|

|

Investment income |

|

8,293 |

|

|

|

6,023 |

|

|

|

35,827 |

|

|

|

24,135 |

|

|

Interest expense |

|

(5,462 |

) |

|

|

(1,276 |

) |

|

|

(20,731 |

) |

|

|

(2,503 |

) |

|

Loss on extinguishment of debt |

|

- |

|

|

|

(12,676 |

) |

|

|

- |

|

|

|

(12,676 |

) |

|

Amortization of debt issuance costs |

|

(411 |

) |

|

|

(6,702 |

) |

|

|

(1,843 |

) |

|

|

(8,075 |

) |

|

Other income (expenses) |

|

(4,527 |

) |

|

|

6,623 |

|

|

|

(5,174 |

) |

|

|

8,123 |

|

|

Other income (expenses), net |

|

(2,107 |

) |

|

|

(8,008 |

) |

|

|

8,079 |

|

|

|

9,004 |

|

|

(Loss) income before income taxes |

|

(38,608 |

) |

|

|

1,865 |

|

|

|

(27,035 |

) |

|

|

56,707 |

|

|

Income tax (benefit) provision |

|

(4,739 |

) |

|

|

18,315 |

|

|

|

(1,521 |

) |

|

|

21,111 |

|

|

Net (loss) income |

$ |

(33,869 |

) |

|

$ |

(16,450 |

) |

|

$ |

(25,514 |

) |

|

$ |

35,596 |

|

|

(Loss) earnings per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.60 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.46 |

) |

|

$ |

0.64 |

|

|

Diluted |

$ |

(0.60 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.46 |

) |

|

$ |

0.63 |

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

56,056,993 |

|

|

|

55,815,666 |

|

|

|

55,936,751 |

|

|

|

55,719,860 |

|

|

Diluted |

|

56,056,993 |

|

|

|

55,815,666 |

|

|

|

55,936,751 |

|

|

|

56,377,319 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data: |

December 31, 2024 |

|

December 31, 2023 |

|

|

|

|

|

Cash, cash equivalents and marketable securities |

$ |

757,355 |

|

|

$ |

751,323 |

|

|

|

|

|

|

Working capital |

|

939,254 |

|

|

|

946,404 |

|

|

|

|

|

|

Total assets |

|

2,829,666 |

|

|

|

2,831,185 |

|

|

|

|

|

|

Long-term obligations |

|

730,161 |

|

|

|

701,398 |

|

|

|

|

|

|

Accumulated earnings |

|

407,354 |

|

|

|

432,868 |

|

|

|

|

|

|

Stockholders' equity |

|

1,972,718 |

|

|

|

1,964,845 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REPLIGEN CORPORATION |

|

RECONCILIATIONS OF GAAP to NON-GAAP FINANCIAL

MEASURES |

|

(Unaudited, amounts in thousands, except percentage and

earnings per share

data) |

|

In all tables below, totals may not add due to

rounding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Total Revenue (GAAP) Growth to Organic

Revenue Growth

(Non-GAAP) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

|

|

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL REPORTED REVENUE (GAAP) GROWTH |

|

1 |

% |

|

|

(11 |

%) |

|

0 |

% |

|

|

(21 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition revenue |

|

0 |

% |

|

|

(3 |

%) |

|

(2 |

%) |

|

|

(1 |

%) |

|

|

|

|

|

|

Currency exchange |

|

|

2 |

% |

|

|

(1 |

%) |

|

1 |

% |

|

|

0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORGANIC REVENUE GROWTH (NON-GAAP) |

|

3 |

% |

|

|

(15 |

%) |

|

(1 |

%) |

|

|

(22 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Total Revenue (GAAP) to Base Revenue

(Non-GAAP) |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

% Change |

|

Year Ended December 31, |

|

% Change |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

2024 v 2023 |

|

|

2024 |

|

|

|

2023 |

|

|

2024 v 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL REPORTED REVENUE (GAAP) |

$ |

167,547 |

|

|

$ |

166,621 |

|

|

1 |

% |

|

$ |

634,439 |

|

|

$ |

632,362 |

|

|

0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COVID-related revenue |

|

|

- |

|

|

|

(18,885 |

) |

|

(100 |

%) |

|

|

(11,462 |

) |

|

|

(25,814 |

) |

|

(56 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NON-COVID REVENUE (NON-GAAP) (1) |

$ |

167,547 |

|

|

$ |

147,736 |

|

|

13 |

% |

|

$ |

622,977 |

|

|

$ |

606,548 |

|

|

3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition revenue |

|

|

- |

|

|

|

- |

|

|

n/a |

|

|

(14,849 |

) |

|

|

- |

|

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASE REVENUE (NON-GAAP) (1) |

$ |

- |

|

|

$ |

147,736 |

|

|

13 |

% |

|

$ |

608,128 |

|

|

$ |

606,548 |

|

|

0 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Income from Operations (GAAP) to Adjusted

Income from Operations (Non-GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(LOSS) INCOME FROM OPERATIONS (GAAP) |

$ |

(36,501 |

) |

|

$ |

9,873 |

|

|

|

$ |

(35,114 |

) |

|

$ |

47,703 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS TO (LOSS) INCOME FROM OPERATIONS (GAAP): |

|

|

|

|

|

|

|

|

|

|

|

Inventory step-up charges |

|

- |

|

|

|

1,238 |

|

|

|

|

- |

|

|

|

1,238 |

|

|

|

|

Acquisition and integration costs |

|

2,450 |

|

|

|

934 |

|

|

|

|

7,347 |

|

|

|

5,861 |

|

|

|

|

Restructuring activities and other related charges(3) |

|

45,232 |

|

|

|

8,188 |

|

|

|

|

47,171 |

|

|

|

32,200 |

|

|

|

|

Incremental costs attributed to CEO transition(4) |

|

16 |

|

|

|

- |

|

|

|

|

22,362 |

|

|

|

- |

|

|

|

|

Contingent consideration |

|

3,191 |

|

|

|

697 |

|

|

|

|

3,191 |

|

|

|

(30,569 |

) |

|

|

|

Intangible amortization |

|

8,689 |

|

|

|

8,769 |

|

|

|

|

34,615 |

|

|

|

31,452 |

|

|

|

|

Other(5) |

|

1,922 |

|

|

|

- |

|

|

|

|

2,508 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED INCOME FROM OPERATIONS (NON-GAAP) |

$ |

24,999 |

|

|

$ |

29,699 |

|

|

|

$ |

82,080 |

|

|

$ |

87,885 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING (EBIT) MARGIN |

|

-21.8 |

% |

|

|

5.9 |

% |

|

|

|

-5.5 |

% |

|

|

7.5 |

% |

|

|

ADJUSTED OPERATING (EBIT) MARGIN |

|

14.9 |

% |

|

|

17.8 |

% |

|

|

|

12.9 |

% |

|

|

13.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Net (Loss) Income (GAAP) to Adjusted Net

Income (Non-GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET (LOSS) INCOME (GAAP) |

$ |

(33,869 |

) |

|

$ |

(16,450 |

) |

|

|

$ |

(25,514 |

) |

|

$ |

35,596 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS TO NET (LOSS) INCOME (GAAP): |

|

|

|

|

|

|

|

|

|

|

|

Inventory step-up charges |

|

- |

|

|

|

1,238 |

|

|

|

|

- |

|

|

|

1,238 |

|

|

|

|

Acquisition and integration costs |

|

2,450 |

|

|

|

934 |

|

|

|

|

7,347 |

|

|

|

5,861 |

|

|

|

|

Restructuring activities and other related charges(3) |

|

45,232 |

|

|

|

8,188 |

|

|

|

|

46,937 |

|

|

|

32,200 |

|

|

|

|

Incremental costs attributed to CEO transition(4) |

|

16 |

|

|

|

- |

|

|

|

|

22,362 |

|

|

|

- |

|

|

|

|

Contingent consideration |

|

3,191 |

|

|

|

697 |

|

|

|

|

3,191 |

|

|

|

(30,569 |

) |

|

|

|

Intangible amortization |

|

8,689 |

|

|

|

8,769 |

|

|

|

|

34,615 |

|

|

|

31,452 |

|

|

|

|

Loss on extinguishment of debt |

|

- |

|

|

|

12,676 |

|

|

|

|

- |

|

|

|

12,676 |

|

|

|

|

Non-cash interest expense |

|

3,681 |

|

|

|

758 |

|

|

|

|

14,291 |

|

|

|

1,172 |

|

|

|

|

Amortization of debt issuance costs |

|

411 |

|

|

|

6,702 |

|

|

|

|

1,843 |

|

|

|

8,075 |

|

|

|

|

Foreign currency impact of certain intercompany loans (6) |

|

4,883 |

|

|

|

(7,743 |

) |

|

|

|

5,509 |

|

|

|

(7,743 |

) |

|

|

|

Other(5) |

|

1,922 |

|

|

|

- |

|

|

|

|

2,508 |

|

|

|

- |

|

|

|

|

Tax effect of non-GAAP charges |

|

(11,479 |

) |

|

|

11,428 |

|

|

|

|

(24,288 |

) |

|

|

3,266 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED NET INCOME (NON-GAAP) |

$ |

25,127 |

|

|

$ |

27,197 |

|

|

|

$ |

88,801 |

|

|

$ |

93,224 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of (Loss) Earnings Per Share (GAAP) to

Adjusted Earnings Per Share (Non-GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(LOSS) EARNINGS PER SHARE (GAAP) - DILUTED |

|

(0.60 |

) |

|

$ |

(0.29 |

) |

|

|

|

(0.46 |

) |

|

$ |

0.63 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS TO (LOSS) EARNINGS PER SHARE (GAAP) - DILUTED: |

|

|

|

|

|

|

|

|

|

|

|

Inventory step-up charges |

|

- |

|

|

|

0.02 |

|

|

|

|

- |

|

|

$ |

0.02 |

|

|

|

|

Acquisition and integration costs |

|

0.04 |

|

|

|

0.02 |

|

|

|

|

0.13 |

|

|

$ |

0.10 |

|

|

|

|

Restructuring activities and other related charges(3) |

|

0.80 |

|

|

|

0.15 |

|

|

|

|

0.83 |

|

|

$ |

0.57 |

|

|

|

|

Incremental costs attributed to CEO transition(4) |

|

0.00 |

|

|

|

- |

|

|

|

|

0.40 |

|

|

$ |

- |

|

|

|

|

Contingent consideration |

|

0.06 |

|

|

|

0.01 |

|

|

|

|

0.06 |

|

|

$ |

(0.54 |

) |

|

|

|

Intangible amortization |

|

0.15 |

|

|

|

0.16 |

|

|

|

|

0.61 |

|

|

$ |

0.56 |

|

|

|

|

Loss on extinguishment of debt |

|

- |

|

|

|

0.22 |

|

|

|

|

- |

|

|

$ |

0.22 |

|

|

|

|

Non-cash interest expense |

|

0.07 |

|

|

|

0.01 |

|

|

|

|

0.25 |

|

|

$ |

0.02 |

|

|

|

|

Amortization of debt issuance costs |

|

0.01 |

|

|

|

0.12 |

|

|

|

|

0.03 |

|

|

$ |

0.14 |

|

|

|

|

Foreign currency impact of certain intercompany loans (6) |

|

0.09 |

|

|

|

(0.14 |

) |

|

|

|

0.10 |

|

|

$ |

(0.14 |

) |

|

|

|

Other(5) |

|

0.03 |

|

|

|

- |

|

|

|

|

0.04 |

|

|

$ |

- |

|

|

|

|

Tax effect of non-GAAP charges |

|

(0.21 |

) |

|

|

0.20 |

|

|

|

|

(0.41 |

) |

|

$ |

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED EARNINGS PER SHARE (NON-GAAP) - DILUTED(7) |

$ |

0.44 |

|

|

$ |

0.48 |

|

|

|

$ |

1.58 |

|

|

$ |

1.65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Net Income (GAAP) to Adjusted EBITDA

(Non-GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET (LOSS) INCOME (GAAP) |

$ |

(33,869 |

) |

|

$ |

(16,450 |

) |

|

|

$ |

(25,514 |

) |

|

$ |

35,596 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS: |

|

|

|

|

|

|

|

|

|

|

|

Investment income |

|

(8,293 |

) |

|

|

(6,023 |

) |

|

|

|

(35,827 |

) |

|

|

(24,135 |

) |

|

|

|

Interest expense |

|

5,462 |

|

|

|

1,276 |

|

|

|

|

20,731 |

|

|

|

2,503 |

|

|

|

|

Amortization of debt issuance costs |

|

411 |

|

|

|

6,702 |

|

|

|

|

1,843 |

|

|

|

8,075 |

|

|

|

|

Income tax provision |

|

(4,739 |

) |

|

|

18,315 |

|

|

|

|

(1,521 |

) |

|

|

21,111 |

|

|

|

|

Depreciation |

|

9,670 |

|

|

|

8,464 |

|

|

|

|

34,967 |

|

|

|

36,994 |

|

|

|

|

Intangible amortization(8) |

|

8,717 |

|

|

|

8,769 |

|

|

|

|

34,726 |

|

|

|

31,452 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

(22,641 |

) |

|

|

21,053 |

|

|

|

|

29,405 |

|

|

|

111,596 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER ADJUSTMENTS: |

|

|

|

|

|

|

|

|

|

|

|

Inventory step-up charges |

|

- |

|

|

|

1,238 |

|

|

|

|

- |

|

|

|

1,238 |

|

|

|

|

Acquisition and integration costs |

|

2,450 |

|

|

|

934 |

|

|

|

|

7,347 |

|

|

|

5,861 |

|

|

|

|

Restructuring activities and other related charges(3)(9) |

|

45,232 |

|

|

|

8,188 |

|

|

|

|

46,937 |

|

|

|

32,200 |

|

|

|

|

Incremental costs attributed to CEO transition(4) |

|

16 |

|

|

|

- |

|

|

|

|

22,362 |

|

|

|

- |

|

|

|

|

Contingent consideration |

|

3,191 |

|

|

|

697 |

|

|

|

|

3,191 |

|

|

|

(30,569 |

) |

|

|

|

Loss on extinguishment of debt |

|

- |

|

|

|

12,676 |

|

|

|

|

- |

|

|

|

12,676 |

|

|

|

|

Foreign currency impact of certain intercompany loans (6) |

|

4,883 |

|

|

|

(7,743 |

) |

|

|

|

5,509 |

|

|

|

(7,743 |

) |

|

|

|

Other(5) |

|

1,922 |

|

|

|

- |

|

|

|

|

2,508 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED EBITDA (NON-GAAP) |

$ |

35,053 |

|

|

$ |

37,043 |

|

|

|

$ |

117,259 |

|

|

$ |

125,259 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED EBITDA MARGIN |

|

20.9 |

% |

|

|

22.2 |

% |

|

|

|

18.5 |

% |

|

|

19.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Cost of Goods Sold (GAAP) to Adjusted

Cost Goods Sold (Non-GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF GOODS SOLD (GAAP) |

$ |

128,706 |

|

|

$ |

88,136 |

|

|

|

$ |

359,794 |

|

|

$ |

353,922 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS TO COST OF GOODS SOLD (GAAP): |

|

|

|

|

|

|

|

|

|

|

|

Inventory step-up charges |

|

- |

|

|

|

(1,238 |

) |

|

|

|

- |

|

|

|

(1,238 |

) |

|

|

|

Acquisition and integration costs |

|

(533 |

) |

|

|

(6 |

) |

|

|

|

(822 |

) |

|

|

(39 |

) |

|

|

|

Restructuring activities and other related charges(3) |

|

(45,079 |

) |

|

|

(7,675 |

) |

|

|

|

(44,029 |

) |

|

|

(30,386 |

) |

|

|

|

Intangible amortization |

|

(471 |

) |

|

|

- |

|

|

|

|

(471 |

) |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED COST OF GOODS SOLD (NON-GAAP) |

$ |

82,623 |

|

|

$ |

79,217 |

|

|

|

$ |

314,472 |

|

|

$ |

322,259 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS MARGIN (GAAP) |

|

23.2 |

% |

|

|

47.1 |

% |

|

|

|

43.3 |

% |

|

|

44.0 |

% |

|

|

ADJUSTED GROSS MARGIN (NON-GAAP) |

|

50.7 |

% |

|

|

52.5 |

% |

|

|

|

50.4 |

% |

|

|

49.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of R&D Expense (GAAP) to Adjusted

R&D Expense (Non-GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R&D EXPENSE (GAAP) |

$ |

11,677 |

|

|

$ |

10,285 |

|

|

|

$ |

43,200 |

|

|

$ |

42,722 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS TO R&D EXPENSE (GAAP): |

|

|

|

|

|

|

|

|

|

|

|

Acquisition and integration costs |

|

(164 |

) |

|

|

(2 |

) |

|

|

|

(364 |

) |

|

|

5 |

|

|

|

|

Restructuring activities and other related charges(3) |

|

- |

|

|

|

(81 |

) |

|

|

|

(449 |

) |

|

|

(116 |

) |

|

|

|

Intangible amortization |

|

(121 |

) |

|

|

- |

|

|

|

|

(121 |

) |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED R&D EXPENSE (NON-GAAP) |

$ |

11,392 |

|

|

$ |

10,202 |

|

|

|

$ |

42,266 |

|

|

$ |

42,611 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of SG&A Expense (GAAP) to Adjusted

SG&A Expense (Non-GAAP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SG&A EXPENSE (GAAP) |

$ |

60,474 |

|

|

$ |

57,630 |

|

|

|

$ |

263,368 |

|

|

$ |

218,584 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS TO SG&A EXPENSE (GAAP): |

|

|

|

|

|

|

|

|

|

|

|

Acquisition and integration costs |

|

(1,753 |

) |

|

|

(926 |

) |

|

|

|

(6,161 |

) |

|

|

(5,827 |

) |

|

|

|

Restructuring activities and other related charges(3) |

|

(153 |

) |

|

|

(432 |

) |

|

|

|

(2,693 |

) |

|

|

(1,698 |

) |

|

|

|

Incremental costs attributed to CEO transition(4) |

|

(16 |

) |

|

|

- |

|

|

|

|

(22,362 |

) |

|

|

- |

|

|

|

|

Intangible amortization |

|

(8,097 |

) |

|

|

(8,769 |

) |

|

|

|

(34,023 |

) |

|

|

(31,452 |

) |

|

|

|

Other(5) |

|

(1,922 |

) |

|

|

- |

|

|

|

|

(2,508 |

) |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED SG&A EXPENSE (NON-GAAP) |

$ |

48,533 |

|

|

$ |

47,503 |

|

|

|

$ |

195,621 |

|

|

$ |

179,607 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Net Income (GAAP) Guidance to Adjusted

Net Income (Non-GAAP) Guidance |

|

|

|

|

|

|

|

Year ending December 31, 2025 |

|

|

|

|

|

|

|

|

|

Low End |

|

High End |

|

|

|

|

|

|

|

GUIDANCE ON NET INCOME (GAAP) |

$ |

51,000 |

|

|

$ |

56,000 |

|

|

|

|

|

|

|

|

ADJUSTMENTS TO GUIDANCE ON NET INCOME (GAAP): |

|

|

|

|

|

|

|

|

|

|

|

Acquisition and integration costs |

|

2,575 |

|

|

|

2,575 |

|

|

|

|

|

|

|

|

|

Restructuring activities and other related charges |

|

2,248 |

|

|

|

2,248 |

|

|

|

|

|

|

|

|

|

Anticipated pre-tax amortization of acquisition-related intangible

assets |

|

34,898 |

|

|

|

34,898 |

|

|

|

|

|

|

|

|

|

Non-cash interest expense |

|

14,194 |

|

|

|

14,194 |

|

|

|

|

|

|

|

|

|

Amortization of debt issuance costs |

|

1,645 |

|

|

|

1,645 |

|

|

|

|

|

|

|

|

|

Tax effect of non-GAAP charges |

|

(11,694 |

) |

|

|

(11,694 |

) |

|

|

|

|

|

|

|

|

Guidance rounding adjustment |

|

134 |

|

|

|

134 |

|

|

|

|

|

|

|

|

GUIDANCE ON ADJUSTED NET INCOME (NON-GAAP) |

$ |

95,000 |

|

|

$ |

100,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Earnings Per Share (GAAP) Guidance to

Adjusted Earnings Per Share (Non-GAAP) Guidance |

|

|

|

|

|

Year ending December 31, 2025 |

|

|

|

|

|

|

|

|

|

Low End |

|

High End |

|

|

|

|

|

|

|

GUIDANCE ON EARNINGS PER SHARE (GAAP) - DILUTED |

$ |

0.90 |

|

|

$ |

0.99 |

|

|

|

|

|

|

|

|

ADJUSTMENTS TO GUIDANCE ON EARNINGS PER SHARE (GAAP) -

DILUTED: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition and integration costs |

|

0.05 |

|

|

|

0.05 |

|

|

|

|

|

|

|

|

|

Restructuring activities and other related charges |

|

0.04 |

|

|

|

0.04 |

|

|

|

|

|

|

|

|

|

Anticipated pre-tax amortization of acquisition-related intangible

assets |

|

0.62 |

|

|

|

0.62 |

|

|

|

|

|

|

|

|

|

Non-cash interest expense |

|

0.25 |

|

|

|

0.25 |

|

|

|

|

|

|

|

|

|

Amortization of debt issuance costs |

|

0.03 |

|

|

|

0.03 |

|

|

|

|

|

|

|

|

|

Tax effect of non-GAAP charges |

|

(0.21 |

) |

|

|

(0.21 |

) |

|

|

|

|

|

|

|

|

Guidance rounding adjustment |

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

GUIDANCE ON ADJUSTED EARNINGS PER SHARE (NON-GAAP) - DILUTED |

$ |

1.67 |

|

|

$ |

1.76 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOOTNOTES FOR ALL TABLES ABOVE (amounts in

thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Base revenue (Non-GAAP) excludes COVID-related revenue and

acquisition-related revenue contribution in current period for

which there was no prior year comparable. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

For the three- and twelve-month reporting periods ended December

31, 2023, there was $5,670 and $7,433 respectively in acquisition

revenue that has been added to Base Revenue (Non-GAAP) for

comparative purposes, as this revenue is now appropriately included

in our year-over-year Base Revenue growth percentage of 13% and 0%

respectively. At one year post-acquisition, those associated

revenues are considered part of ongoing Base business. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) |

In July 2023, the Board of Directors authorized the Company's

management team to undertake restructuring activities to simplify

and streamline our organization and strengthen the overall

effectiveness of our operations. Since the initial streamlining and

rebalancing efforts contemplated in July 2023, and with the

introduction of new management in the second half of 2024, the

Company continues to undertake further restructuring activities

(collectively, the “Restructuring Plan”) which has included

consolidating a portion of our manufacturing operations between

certain U.S. locations, writing-off abandoned equipment with the

rationalization of excess production line capacity and

discontinuing the sale of certain product SKUs. In addition, the

Company continues to evaluate the net realizable value of finished

goods and raw materials to meet rapidly changing demand during a

challenging supply chain environment in the industry. The Company

recorded pre-tax costs of $46.9 million and $32.2 million in the

years ended December 31, 2024 and 2023, respectively, related to

the Restructuring Plan and other inventory-related charges. The

Company believes the Restructuring Plan is now primarily complete

as of December 31, 2024. Severance and employee-related costs are

primarily associated with headcount reductions. Costs incurred

include cash severance and non-cash severance, including other

termination benefits. Severance and other termination benefit

packages are based on established benefit arrangements or local

statutory requirements and we recognized the contractual component

of these benefits when payment was probable and could be reasonably

estimated. Non-cash charges for the inventory write-off in 2023

included the impact of the Company discontinuing the sale of

certain product SKUs, the impact of having proactively secured

materials during the 2020-2022 pandemic period to meet accelerated

demand during a challenging supply chain environment in the

industry, and the impact of closing manufacturing facilities and

production lines which include inventory that could not be

repurposed. Where demand has reduced, finished goods and raw

materials, the value of which exceeded the projected requirements

to be used before reaching their expiration date, were written off.

The non-cash inventory write-off in 2024 includes the impact of the

Company discontinuing the sale of certain product SKUs and is also

the result of the further evaluation of inventory positions in

unusually turbulent market supply conditions. This further

evaluation took into consideration the market reset that continued

into 2024 and resulted in new senior product management leadership

updating product strategies. With these updated strategies, future

demand and product mix projections were revised as a part of the

Company’s annual strategic planning and budget sessions in 2024.

Where the value of finished goods and raw materials exceeded the

projected requirements to be used before reaching their expiration

date, or in a reasonable time horizon, they were written off.In the

fourth quarter of 2024, non-cash charges were recognized for the

write-off of abandoned equipment in connection with unneeded

capacity related to a specific product line that was also included

in the 2024 inventory adjustment. The Company’s manufacturing

strategy and footprint were also reviewed as a part of our 2024

annual strategic planning and budget session. For this product

line, capacity was expanded during the pandemic period, and current

projections indicate it will not be needed in a usable time-period.

The factory space will be reallocated for the production of other

product lines. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) |

Incremental stock compensation expense recorded during the three

and twelve months ended December 31, 2024 of $16 and $22,362

respectively, attributable to the transition of the Company’s Chief

Executive Officer (“CEO”) to Executive Chair of the Board announced

by the Company on June 12, 2024. The incremental stock compensation

expense was the result of the modification of the unvested equity

awards held by the CEO immediately prior to the modification. This

resulted in the revalue of his unvested awards and a change in his

remaining requisite service period due to his change in duties upon

transitioning to Executive Chair of the Board. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5) |

Includes a one time events relating to a cybersecurity incident,

net of insurance, and costs associated with the restatement of

previously issued financial statements. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6) |

During the three and twelve months ended December 31, 2024 we

recorded foreign currency adjustments on certain intercompany loans

of ($4,883) and ($5,509) respectively. The impact was recorded to

the Other income (expenses), net line item within the Condensed

Consolidated Statements of Operations. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(7) |

GAAP loss per share - diluted for the three and twelve months ended

December 31, 2024, was determined excluding the effect of dilutive

shares as the impact of such shares would have been antidilutive

due to the net loss for the period, while the adjusted earnings per

share - diluted for the same period was determined based upon

diluted shares. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(8) |

Includes amortization of milestone payments in accordance with GAAP

of $28 for the three months ended December 31, 2024 and 2023 and

$112 for the twelve months ended December 31, 2024 and 2023. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(9) |

Excludes $19 of accelerated depreciation related to the

restructuring plan for the twelve months ended December 31, 2024.

This amount is included in the depreciation line item of this table

for that period. |

|

|

|

|

|

|

|

|

|

|

|

|

|

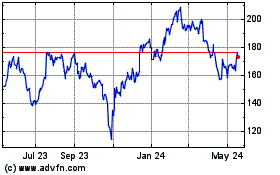

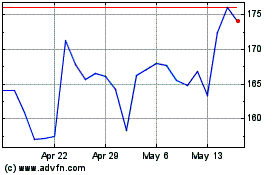

Repligen (NASDAQ:RGEN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Repligen (NASDAQ:RGEN)

Historical Stock Chart

From Feb 2024 to Feb 2025