Form 8-K - Current report

02 March 2024 - 8:45AM

Edgar (US Regulatory)

0000350894FALSE00003508942024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________

FORM 8-K

________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

February 29, 2024

Date of report (Date of earliest event reported)

________________________________________

________________________________________

SEI INVESTMENTS COMPANY

(Exact name of registrant as specified in its charter)

________________________________________

| | | | | | | | | | | | | | |

| Pennsylvania | | 0-10200 | | 23-1707341 |

(State or Other Jurisdiction of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

1 Freedom Valley Drive

Oaks, Pennsylvania 19456

(Address of Principal Executive Offices and Zip Code)

(610) 676-1000

(Registrant's Telephone Number, Including Area Code)

________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | SEIC | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 5, 2024, SEI Investments Company (the “Company”) announced in a Current Report on Form 8-K, that the Company had entered into an agreement with Sean Denham, 51, to begin employment with the Company on March 18, 2024 and serve as the Company’s Chief Financial Officer effective on or about April 30, 2024 upon (i) the Company’s filing of a Quarterly Report on Form 10-Q for first quarter of 2024 and (ii) current Chief Financial Officer Dennis McGonigle’s resignation resulting from his previously announced retirement.

Mr. McGonigle’s employment with the Company will end on April 30, 2024. On February 29, 2024, Mr. McGonigle entered into an independent consulting agreement with the Company (the “Consulting Agreement”), which becomes effective on May 1, 2024. Pursuant to the Consulting Agreement, Mr. McGonigle agreed to be available during normal business hours, provide all reasonable assistance to the Company with respect to the transition of the role of the Company’s Chief Financial Officer, serve on the boards of directors of the Company’s subsidiaries and funds as mutually agreed upon and participate in other special projects or advisory roles as the Company’s Chief Executive Officer or board of directors may designate. The Consulting Agreement has an initial term of one year and automatic one-year renewal terms thereafter until terminated.

Pursuant to the Consulting Agreement, Mr. McGonigle will receive consulting fees, payable in cash, equal to $25,000 per month. Mr. McGonigle will also receive certain benefits including among others full healthcare coverage on the same basis as made available to the Company’s employees generally or payment of comparable benefits through COBRA or gross up to the monthly fee for the cost of obtaining substantially similar personal insurance and the pro-rated 2024 Incentive Compensation that he would have been awarded for 2024 based on time spent as an employee, to be paid as and when such awards are paid to the Company’s US-based employees.

The foregoing description of the Consulting Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the Consulting Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 10.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| SEI INVESTMENTS COMPANY |

| |

| Date: | March 1, 2024 | By: | /s/ Dennis J. McGonigle |

| | Dennis J. McGonigle

Chief Financial Officer |

1 February 28, 2024 Dennis McGonigle [RESIDENCE ADDRESS OMITTED] Dear Dennis: As we have discussed, your long tenure with and significant contributions to SEI Investments Company and its affiliates (“SEI”) are greatly appreciated. You have deep and valued, long- standing relationships with colleagues, clients and board members. Notwithstanding the fact that you are ending your role as CFO effective the day upon which SEI files its Form 10-Q with the Securities & Exchange Commission for the first quarter of fiscal 2024 and your employment on April 30, 2024, we would like to retain your services as an independent Consultant: 1. to be available during normal business hours and as reasonably requested to support the transition of your former role; 2. to serve on such Boards of Directors of SEI’s subsidiaries and its Funds as you and SEI may mutually agree; and 3. participate in such other special projects or advisory roles as the SEI’s Chief Executive Officer or its Board of Directors may designate (collectively, the “Services”); for an initial term of one year and automatic renewal terms of one-year thereafter until terminated (the “Term”). In order to memorialize our agreement, please review the terms of this letter agreement (this “Agreement”) and return a counter-signed copy to our General Counsel. Pursuant to the terms of this Agreement, effective on May 1, 2024, SEI Global Services, Inc. (“SGS”) hereby engages Dennis J. McGonigle (“Consultant”) during the Term to perform the Services. In consideration of Consultant’s availability for, and performance of, the Services, SGS shall pay Consultant the total amount of $25,000/month in consulting fees during the Term (the “Fee”), which amount shall be subject to change as may be mutually agreed if the scope of the Services materially changes. Such amount shall be payable on the day that the last payroll of the month is paid to employees in general (in each case, a “Payment Date”). Such payments will be conditioned upon Consultant continuing to provide Services during the Term and not being in breach of any obligations under this Agreement. In addition to the Fee, SGS shall:

2 1. provide Consultant with full healthcare coverage on the same basis as made available to SEI employees generally (or payment of comparable benefits through COBRA or gross up to the monthly fee for the cost of obtaining substantially similar personal insurance); 2. pay Consultant the amount of his 2024 Incentive Compensation that he would have been awarded for 2024 pro-rated based on time spent as an employee, such amount to be paid as and when 2024 Incentive Compensation awards are paid to US-based employees generally; and 3. ensure that Consultant’s current membership at Stonewall Country Club is either: a. to be permanently assigned to Consultant, who will be responsible for all dues and payments associated with membership; or b. maintained in Consultant’s name; in either event (3.a or b), Consultant shall assume and be responsible for all costs associated with such membership. SGS shall be responsible for any travel or other costs or expenses incurred in connection with the performance of the Services under this Agreement; provided, that any such costs or expenses are incurred properly at the direction or on behalf of SEI and approved. During the Term, all options to purchase and restricted stock units convertible into common shares of SEI Investments Company held by Consultant (“Consultant Equity”) will continue to exist and vest under the same terms and conditions at the time of grant. If the Agreement is terminated while any Consultant Equity is outstanding, then the term, vesting and exercise period, as applicable, of any then outstanding Consultant Equity will be extend for the shorter of (a) three years, and (b) the then remaining term of the relevant grant. The following terms and conditions shall apply to the parties’ relationship: Consultant shall perform the Services in a professional manner and consistent with industry standards. Consultant shall be available during normal business hours to perform the Services as reasonably requested by SEI from time to time with reasonable notice; provided that such Services (excluding service on any board) shall not be more than 40 hours per month, in the aggregate, unless otherwise agreed. Consultant will abide by all compliance policies and procedures applicable to the Services, as specified by SEI from time to time. While at SEI’s facilities and/or in performing the Services, Consultant shall observe and follow all applicable policies of SEI relating to business and office conduct, health and safety, and use of SEI’s facilities, supplies, information technology, equipment, networks, and other resources. Consultant shall be supplied with a Company issued laptop, on which Consultant will perform work related to company compliant with Company use policies. The parties agree that Consultant is performing the Services as an independent contractor and shall not be deemed an employee, agent, joint venturer, partner or representative of SEI. Neither party is authorized to bind the other to any obligation, affirmation or commitment with respect

3 to any other person or entity. This Agreement is personal to Consultant, and Consultant may not contract or assign any part of the Services to any other person or entity. Because Consultant is an independent contractor, Consultant is solely responsible for all taxes, withholdings, and other similar statutory obligations for himself and the Services. Except as specifically set forth in this Agreement, Consultant shall not be entitled to participate in or receive any benefit or rights as an employee of any SEI entity under any of the SEI employee benefit and welfare plans, including, without limitation, employee insurance, pension, savings, vacation, health, dental, fringe, severance or security plans (“Benefits”), as a result of or in connection with the Agreement. To the extent that Consultant may become eligible for any of SEI’s employee benefits (regardless of timing or reason for eligibility), Consultant hereby waives the right to participate in or receive such Benefits not specifically provided for herein. Consultant also agrees that he shall not apply for any government-sponsored benefits (including, but not limited to, social security or state unemployment, or disability benefits), claiming to be a current employee of SEI, or a former employee following the Term, as a result of this Agreement or any Services provided hereunder. During the Term, any options to purchase SEI common stock awarded to Consultant as an employee of SEI will continue to vest and be exercisable in accordance with the terms of the relevant documents governing the terms of such options. All work product, inventions, ideas, discoveries, data, documents and materials produced or developed by Consultant in connection with performing the Services (collectively, “Work Product”) shall be considered “works made for hire”, and such Work Product and all copyrights, patents, trade secrets, industrial design rights, trademarks, trade dress, and other worldwide proprietary rights therein, together with all renewals and extensions thereof, shall be owned by SEI. Consultant hereby irrevocably assigns, conveys, and transfers to SEI, effective as of the day such Work Product is or was created, the whole and entire right, title and interest in and to the Work Product. In the performance of the Services, Consultant will have access to SEI’s proprietary materials and confidential information, including, without limitation, trade secrets, marketing and business plans, customer lists and customer information, and software and/or technical information (“Confidential Information”). Both parties agree that the terms of this Agreement and the Work Product shall be deemed Confidential Information owned by SEI. Consultant agrees not to use (except in connection with providing the Services) or disclose SEI’s Confidential Information to any third party. Consultant may only disclose Confidential Information: (i) as permitted by law if disclosure is made in confidence to a government official or attorney, either directly or indirectly, solely for the purpose of reporting or investigating a suspected violation of law or in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal and not disclosed, except pursuant to court order; or (ii) as necessary to comply with or respond to any subpoena issued by a Federal or State Agency or court or to any valid court order by a court of competent jurisdiction. If Consultant receives any such subpoena, Consultant shall notify SEI as promptly as practicable and, where possible, prior to any such disclosure, provide SEI with a reasonable opportunity to object to or limit such disclosure as permitted by applicable law. Consultant’s obligations under this paragraph shall survive any termination of this Agreement. Consultant will also promptly notify SEI in writing upon learning of any unauthorized disclosure or use of any Confidential Information. Upon SEI’s request, at any time, Consultant will return all Confidential Information to SEI. The following covenants shall apply during the longer of (a) the Term of this Agreement, and (b) the “Restricted Period” as defined in the Separation Agreement:

4 1. No Solicitation or Interference with Clients. Consultant shall not in any way, for himself, or for or on behalf of any other person, company, or other entity, directly or indirectly through others: (a) sell to, solicit, or contact for business purposes (or attempt to do any of the foregoing) any SEI Client, as defined below, for the purpose or which has the effect of competing with or harming SEI’s business; or (b) entice, induce, persuade, attempt to persuade or otherwise cause (or attempt to do any of the foregoing) any SEI Client, as defined, to terminate his, her or its relationship with SEI, to refrain from doing business with or rendering services to SEI, or to do any act that may interfere with or result in the impairment of the relationship between SEI and any SEI Clients. For purposes of this Agreement, “SEI Client” shall include any person, company, or other entity (including their directors, officers, executives, managers, employees, agents, and representatives) that Consultant had contact with, responsibility for or Confidential Information about and to which or to whom SEI provides technologies, products, or services or is an active prospect that SEI has developed or targeted in the business. The Restricted Period, which Consultant acknowledges is a reasonable period of time, shall be enforced by a court from the date of the last breach or violation of the applicable restrictions. 2. No Solicitation or Interference with Business Relationships. Consultant shall not in any way, for himself, or for or on behalf of any other person, company, or other entity, directly or indirectly through others: (a) contact for business purposes, solicit, entice, induce, persuade, attempt to persuade or otherwise cause (or attempt to do any of the foregoing) any SEI Business Relationship, as defined, to terminate his, her or its relationship with SEI, to refrain from doing business with or rendering services to SEI, or to do any act that may interfere with or result in the impairment of the relationship between SEI and any SEI Client or Business Relationship; or (b) solicit, retain, hire or employ (or attempt to do any of the foregoing) any SEI Business Relationship for the purpose or which has the effect of competing with or harming SEI’s business. For purposes of this Agreement, “Business Relationship” shall include any person, company, or other entity (including their directors, officers, executives, managers, employees, agents, and representatives) that Consultant had contact with, responsibility for or Confidential Information about and (1) from which or from whom SEI obtained or received (or currently obtains or receives) technologies, products or services; or (2) with whom SEI has a business partnership or alliance in any way. 3. No Solicitation of SEI Employees and Contractors. Consultant shall not in any way, for himself, or for or on behalf of any other person, company, or other entity, directly or indirectly through others engage in any activity that involves the solicitation or hiring of an employee, independent contractor or consultant, or any employee of any vendor that worked with or otherwise provided services to SEI within the two years prior to any such solicitation. 4. No Competition. Consultant shall not in any way, for or on behalf of himself, or for or on behalf of any other person, company, or other entity, directly or indirectly through others, perform (or assist others to perform) work for a competitor in any position or in any geographic location in which Consultant could disadvantage SEI or advantage the

5 competitor through: (i) use or disclosure of Confidential Information; (ii) use of specialized training or education provided by or paid for by SEI; and/or (iii) use of SEI’s goodwill and/or any SEI Client or Business Relationship. Consultant understands and acknowledges that, based on the position of trust and confidence Consultant held with SEI and Consultant’s Services that the geographic scope of this restriction may be global. Either party may terminate this Agreement after the initial one-year term for any reason whatsoever upon 90 days' prior written notice to the other. In the event of any termination of this Agreement, SEI shall be responsible for any pro-rated portion of the fees owned to Consultant for any Services rendered prior to the effective date of such termination and shall have no additional liability or obligation to make payments to Consultant under this Agreement. Within five days after any termination of this Agreement, Consultant shall deliver to SEI all Work Products resulting from the performance of the Services and all Confidential Information in his possession or control. This Agreement, and all disputes between the parties concerning its subject matter, shall be governed by and interpreted in accordance with the laws of the Commonwealth of Pennsylvania, without giving effect to its principles governing conflicts of law. With respect to any dispute arising out of or related to this Agreement, the venue for resolution shall be exclusively in federal Court in the Eastern District of Pennsylvania or state court in Montgomery County, Pennsylvania. Each of the parties irrevocably waives any objection that they may now or hereafter have based on personal jurisdiction or venue, including but not limited to any objection based on forum non conveniens. Consultant acknowledges that a breach of the obligations described in the covenants above will cause irreparable harm to SEI and that damages arising out of such breach would be difficult to determine. Therefore, in addition to any other remedies, SEI shall be entitled to specific performance and injunctive relief, without the posting of any bond or similar instrument, and without proving actual damage. If either party hereto prevails in enforcing its rights hereunder, in whole or in part, in any suit, the non-prevailing party will reimburse the prevailing party for its attorneys’ fees and expenses. If any of the restrictions set forth above are held invalid or unenforceable by a court, then such restrictions shall be reduced only to the extent necessary to cure such invalidity. SEI may assign the rights in this Agreement to any related company, entity or purchaser, and Consultant has no such right to assignment. This Agreement may be executed in two or more counterparts, all of which shall constitute one and the same instrument. Each such counterpart shall be deemed an original. Each such document shall be deemed executed by both parties when any one or more counterparts hereof or thereof, individually or taken together, bears the original, facsimile or electronic scanned signatures of each of the parties. Sincerely, /s/ Ryan P. Hicke Ryan P. Hicke Chief Executive Officer

6 Accepted and Agreed: By: /s/ Dennis J. McGonigle Dennis J. McGonigle Dated: February 29, 2024

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

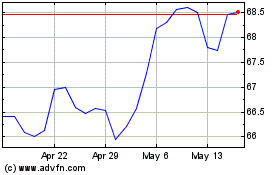

SEI Investments (NASDAQ:SEIC)

Historical Stock Chart

From Apr 2024 to May 2024

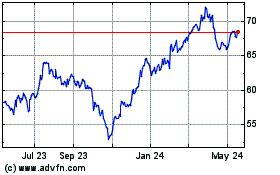

SEI Investments (NASDAQ:SEIC)

Historical Stock Chart

From May 2023 to May 2024