false

0001879726

0001879726

2025-01-14

2025-01-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 14, 2025

SIDUS

SPACE, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41154 |

|

46-0628183 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

150

N. Sykes Creek Parkway, Suite 200

Merritt

Island, FL |

|

|

|

32953 |

| (Address

of principal executive offices) |

|

|

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (321) 613-5620

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instructions A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A Common Stock, $0.0001 par value per share |

|

SIDU |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal

Officers.

On

January 14, 2025, Adarsh Parekh was appointed as Chief Financial Officer of the Company, effective January 27, 2025. Mr. Parekh has

entered into an employment agreement with the Company for a

one year term which will automatically renew for successive one year terms unless either party provides written notice of non-renewal

(the “Agreement”).

Under

the terms of the Agreement, Mr. Parekh is entitled to receive an annual base salary of $325,000 with an annual performance bonus with

a target amount equal to up to 40% of his annual base salary based upon the Board’s assessment of Mr. Parekh’s and the Company’s

attainment of goals as set by the Board in its sole discretion. In accordance with the Agreement, Mr. Parekh will also be granted a restricted

stock unit of 25,000 shares of the Company’s Class A common stock which will vest over three years. In addition, the Agreement

contains non-competition and non-solicitation provisions.

Pursuant

to the Agreement, in the event Mr. Parekh’s employment is terminated without cause, due to a non-renewal by the Company, or if

he resigns for “good reason” (in each case, other than within twelve (12) months following a change in control), Mr. Parekh

is entitled to (i) a cash payment equal to 50% of his annual base salary in effect on his last day of employment; (ii) a lump sum payment

equal to the amount of any annual bonus earned with respect to a prior fiscal year, but unpaid as of the date of termination; (iv) a

lump sum payment equal to the amount of annual bonus that was accrued through the date of termination for the year in which employment

ends; and (v) subject to Mr. Parekh’s compliance with his restrictive covenants, the outstanding and unvested portion of any time-vesting

equity award that would have vested during the one (1) year period following Mr. Parekh’s termination had he remained an employee

shall automatically vest upon his termination date.

In

the event that Mr. Parekh’s employment is terminated due to his death or disability, he will be entitled to receive (i) any accrued

but unpaid base salary, (ii) a lump sum payment equal to the amount of any annual bonus earned with respect to a prior fiscal year, but

unpaid as of the date of termination; and (iii) a lump sum payment equal to the amount of annual bonus that was accrued for the year

in which employment ends.

In

the event that Mr. Parekh’s employment is terminated due to his non-renewal or resignation without “good reason,” he

will be entitled to receive (i) any accrued but unpaid base salary; (ii) a lump sum payment equal to the amount of any annual bonus earned

with respect to a prior fiscal year, but unpaid as of the date of termination and (iii) a lump sum payment equal to the amount of annual

bonus that was accrued for the year in which employment ends.

There

are no arrangements or understandings between Mr. Parekh and any other person pursuant to which he was selected as an officer of the

Company, and there is no family relationship between Mr. Parekh and any of the Company’s other directors or executive officers.

The

foregoing description of the Agreement is not complete and is qualified in its entirety by reference to the Agreement, which is filed

as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

A

press release announcing these matters is filed as Exhibit 99.1 to this Form 8-K.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SIDUS

SPACE, INC. |

| Dated:

January 21, 2025 |

|

| |

By: |

/s/

Carol Craig |

| |

Name: |

Carol

Craig |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.1

EMPLOYMENT

AGREEMENT

This

Employment Agreement (this “Agreement”), dated January 13, 2025, is by and among Sidus Space, Inc., a Delaware corporation

(the “Company”), and Adarsh Parekh (the “Executive”).

WHEREAS,

the Company desires to employ Executive, and Executive desires to be employed by, the Company, in each case effective as of the date

of this Agreement (the “Effective Date”);

WHEREAS,

in connection with the foregoing, Executive shall be required to perform Executive’s duties and obligations hereunder on behalf

of the Company, as appropriate, and such duties and obligations shall be enforceable by the Company;

WHEREAS,

this Agreement supersedes any and all prior employment agreements or similar agreements by and between Executive and the Company;

NOW,

THEREFORE, in consideration of such employment and the mutual covenants and promises herein contained, and for other good and valuable

consideration, the receipt and sufficiency of which are hereby acknowledged, the Company and Executive agree that the above recitals

are hereby incorporated by reference into this Agreement and are binding upon the parties hereto and agree as follows:

1.

Employment. The Company hereby agrees to employ Executive, and Executive hereby agrees to be employed with the Company, upon

the terms and conditions contained in this Agreement. Unless earlier terminated by either party in accordance with Section 5,

Executive’s employment with the Company shall continue for an initial term commencing on the Effective Date and continuing until

the first anniversary of the Effective Date (the “Initial Term”) and thereafter shall automatically renew for successive

one year terms (each a “Renewal Term”) unless either party provides written notice of non-renewal to the other party

at least sixty (60) days prior to the last day of the then-current term (such Initial Term and subsequent Renewal Term(s) or portions

thereof occurring prior to termination, collectively the “Employment Period”).

2.

Duties.

2.1

During the Employment Period, Executive shall serve the Company on a full-time basis and perform services in a capacity and in a manner

consistent with Executive’s position for the Company. Executive shall have the title of Chief Financial Officer of the Company

and shall have such duties, authorities and responsibilities as are consistent with such position, as the Chief Executive Officer (the

“CEO”) may designate from time to time. Executive will report directly to the CEO. Notwithstanding the foregoing,

during the Employment Period, Executive may (i) serve as a director, officer and/or advisor of two (2) for-profit companies without the

prior approval of the Company Board; provided that such companies are not in a Competitive Business with the Company; (ii) perform and

participate in charitable, civic, educational, professional, community and industry affairs and other related activities; and (iii) manage

Executive’s personal investments, provided, however, that such activities do not materially interfere, individually or in the aggregate

with the performance of Executive’s duties hereunder.

3.

Location Of Employment. Executive shall work remotely from his home office in El Segundo, California, and shall be a California

employee.

4.

Compensation.

4.1

Base Salary. In consideration of all services rendered by Executive under this Agreement, the Company shall pay Executive a base

salary at an annual rate of $325,000 (the “Base Salary”) during the Employment Period. The Base Salary shall be paid in such

installments and at such times as the Company pays its regularly salaried employees, but no less often than once per month on or before

the 26th day of the calendar month during which services were performed, and subject to applicable taxes and withholdings.

4.2

Annual Discretionary Bonus. During each fiscal year of the Executive’s employment with the Company (commencing with the

2025 fiscal year), Executive will be eligible to receive an annual discretionary bonus (“Cash Bonus”). Executive’s

target Cash Bonus shall be up to 40% of Base Salary (the “Target Bonus”). The Cash Bonus amount will be based, in

part, upon achievement of Company and individual performance targets established by the Compensation Committee, and other factors considered

by the Compensation Committee in its sole and absolute discretion, for the fiscal year to which the bonus relates. The payment of any

Cash Bonus described herein will be made at the same time annual bonuses are generally paid to other senior executives of the Company

(generally the first regular payroll date following the Company Board’s certification of achievement of applicable performance

targets). If Executive is eligible to receive a Cash Bonus, such bonus will not be deemed to be fully “earned” unless Executive

is (i) employed by the Company and in good standing on the last day of the fiscal year to which the Cash Bonus relates, and (ii) has

not given notice of Executive’s intention to resign Executive’s employment as of, or prior to, the date the Company pays

the applicable Cash Bonus. The Cash Bonus shall be paid to Executive no later than 75 days following the period for which the bonus is

payable.

4.3

Time-Vesting Equity Award. Executive will receive a Restricted Stock Unit (“RSU”) grant of 25,000 unvested shares

of Sidus Space Class A common stock (“Unvested Shares”) during the fiscal Quarter immediately following hire (the “Grant

Date”), subject to executing the Company standard written RSU agreement containing specific terms and conditions of the RSU grant,

for which shall also govern the vesting of Executive’s Unvested Shares. Vesting shall be a three year cliff vest for all 25,000

shares. Additionally, you will be eligible to participate in the Company’s Equity Incentive Plan. The type and number of shares

as well as the vesting schedule will be recommended to the Compensation Committee by the CEO, as appropriate. Upon Board approval, and

subject to executing the Company standard written equity agreement containing specific terms and conditions of the equity award, shares

subject to that equity agreement will be granted.

4.4

Paid Leave Benefits. During the Employment Period, Executive shall be entitled to 160 hours (4 weeks) annual vacation (which shall

accrue proportionately each pay period and carry over in the following calendar year, but subject to a maximum accrual cap of 240 hours

(6 weeks)), 40 hours annual paid sick leave (which shall be granted at the time of hire and at the beginning of the calendar year thereafter,

but which shall not carryover into the following calendar year), and 10 paid holidays annually (which may be used for time off within

seven days of a Company-recognized holiday or federal- or state-recognized holiday) consistent with applicable laws and Company policy,

as may be in effect from time to time, except to the extent such policy is inconsistent with this Agreement.

4.5

Benefits. During the Employment Period, Executive shall be entitled to participate in any benefit plans offered by the Company

as in effect from time to time (collectively, “Benefit Plans”) on the same basis as those generally made available

to other employees of the Company, to the extent Executive may be eligible to do so under the terms of any such Benefit Plan. Executive

acknowledges and agrees that any such Benefit Plans may be terminated or amended from time to time by the Company in its sole discretion,

and subject to the terms of such Benefit Plans. The Company will cover Executive under directors’ and officers’ liability

insurance, with Executive as a named insured, during Executive’s employment (and for a period of six (6) years following the termination

thereof), to the same general extent as other executive officers of the Company.

5.

Termination. Executive’s employment hereunder may be terminated as follows:

5.1

Automatically in the event of the death of Executive;

5.2

At the option of the Company, by written notice to Executive or Executive’s personal representative in the event of the Disability

of Executive. As used herein, the term “Disability” shall mean a determination by an independent competent medical authority

(mutually agreed upon by Executive and the Company) that Executive is unable to perform Executive’s duties under this Agreement

with or without reasonable accommodation, for a period of 120 consecutive days or 180 days in any 365 day period. If there is a question

as to the existence of Executive’s Disability as to which Executive and the Company cannot agree, same shall be determined in writing

by a qualified independent medical authority mutually acceptable to Executive and the Company. If the parties hereto cannot agree as

to a qualified independent physician, each of the Executive, on the one hand, and the Company, on the other, shall appoint such a physician

and those two physicians shall select a third who shall make such determination in writing. The determination of Disability made in writing

to the Company and Executive shall be final and conclusive for all purposes of this Agreement. Executive shall fully cooperate

in connection with the determination of whether Disability exists.

5.3

At the option of the Company for Cause (as defined in Section 6.6), on prior written notice to Executive (subject to any cure

period described in Section 6.6);

5.4

At the option of the Company without Cause, on thirty (30) days’ prior written notice to Executive;

5.5

At the option of Executive (a) for Good Reason (in accordance with the definition in Section 6.5) or (b) for any or no reason

other than Good Reason on thirty (30) days’ prior written notice to the Company (which the Company may, in its sole discretion,

make effective as a resignation earlier than the termination date provided in such notice and further provided that if Executive unilaterally

resigns Executive’s employment before the end of such requisite notice period then such resignation shall be treated for purposes

of this Agreement as a termination under Section 5.4); or

5.6

As of the last day of the Initial Term or the then-current Renewal Term if either Executive or

the Company elects not to renew the Agreement in accordance with and subject to the notice provisions set forth in Section 1.

6.

Severance Payments.

6.1

Non-Renewal by the Company, Termination by the Company Without Cause or Termination by Executive for Good Reason. If Executive’s

employment is terminated by the Company without Cause (and not due to death or Disability), by Executive for Good Reason or as

the result of the Company’s decision not to renew the Agreement in accordance with Section 1, subject to Section

6.7 hereof, Executive shall be entitled to:

(a)

within thirty (30) days following such termination, payment of Executive’s accrued and unpaid Base Salary and reimbursement of

expenses under Section 7 hereof in each case accrued through the date of termination;

(b)

subject to Section 13.7(b) hereof, an amount in cash equal to the product of 1/2 times the sum of (i) Executive’s Base Salary

as in effect as of Executive’s last day of employment), which shall be payable in substantially equal installments (the “Severance

Amount”) at the same time Base Salary would be paid over the six (6) month period (the “Severance Period”)

following termination; provided, however, if the Executive’s review and revocation period for the release of claims

required pursuant to Section 6.7 hereof spans two of Executive’s taxable years, the first payment shall be made on the first

regularly scheduled payroll date of the later taxable year following the effective date of such release of claims and shall include all

amounts accrued prior thereto;

(c)

if Executive is eligible for and elects to enroll in “COBRA” type continuation coverage of Executive’s health benefits

under the Company’s group health plan, for the Severance Period (“COBRA Payment Period”) the Company will pay

Executive on a monthly basis a taxable amount equal to the COBRA premium costs for that month, less applicable taxes and withholdings;

provided, that the Company’s obligation to make these monthly taxable COBRA premium payments to Executive hereunder shall cease

on the earlier of: (i) the date on which Executive first becomes eligible for coverage under any group health plan made available by

another employer (and Executive shall notify the Company in writing promptly, but within 10 days, after becoming eligible for any such

benefits); and (ii) the date on which Executive’s COBRA continuation coverage under the Company’s group health plan ends

on account of Executive’s election to terminate such coverage;

(d)

a lump sum payment equal to the amount of any Cash Bonus earned with respect to a fiscal year ending prior to the date of such termination

but unpaid as of such date, payable at the same time in the year of termination as such payment would be made if Executive continued

to be employed by the Company, but in no event later than 73 days following the end of the fiscal

year in which the termination occurs;

(e)

a lump sum payment equal to the amount of Cash Bonus that was accrued for the year in which Executive’s

employment ends based upon the good faith determination of the Company Board in accordance with the Company’s normal practices

as of the last day of the calendar month during which Executive’s termination became effective (it being understood that the Company

will accrue the Cash Bonus on a monthly basis), payable no later than 73 days after the termination date;

(f)

all other accrued or vested amounts or benefits due to Executive in accordance with this Agreement, the Company’s benefit plans,

programs or policies (other than severance), and the treatment of Executive’s Award in accordance with the Award Agreement; and

(g)

subject to Executive’s compliance with the restrictive covenants set forth in Section 8 hereof, the outstanding and unvested portion

of any time-vesting equity award(s) granted to Executive by the Company shall automatically accelerate and vest in full upon Executive’s

termination date.

6.2

Termination due to Executive’s Death or Disability. Upon the termination of Executive’s employment due to Executive’s

death or Disability pursuant to Section 5.1 and Section 5.2 respectively, Executive

or Executive’s legal representatives shall be entitled to receive (i) the acceleration and vesting in full of any then outstanding

and unvested portion of any time-vesting equity award granted to Executive by the Company; and (ii) the payments and benefits described

under Sections 6.1(a), (d), (e) and (f).

6.3

Termination due to Non-Renewal by Executive or Termination by Executive without Good Reason. Upon the termination of Executive’s

employment due to the non-renewal by Executive or termination by Executive without Good Reason, Executive shall be entitled to receive

only the payments and benefits described in Sections 6.1(a), (d), (e), and (f), and the treatment of Executive’s Award in

accordance with the Award Agreement.

6.4

Termination by the Company for Cause. Upon the termination of Executive’s employment by the Company for Cause pursuant to

Section 5.3, Executive shall be entitled to receive only the payments and benefits described in Sections 6.1(a) and (f), and the

treatment of Executive’s Award in accordance with the Award Agreement.

6.5

Termination Following Change in Control. If Executive’s employment is terminated by the Company without Cause or by Executive

for Good Reason within twelve (12) months following a Change in Control, Executive shall be entitled to receive the following: (i) the

acceleration and vesting in full of any then outstanding and unvested portion of any time-vesting equity award(s) granted to Executive

by the Company; (ii) the benefits described in Section 6.1(b) and (c), provided, however, that the Severance Amount shall

equal 1/2 times the sum of Base Salary and Target Bonus and the Severance Period shall be 6 months; and (iii) the benefits described

in Section 6.1(a), (d), (e) and (f).

6.6

Definitions.

(a)

Cause. For purposes of this Agreement, “Cause” shall mean:

(i)

Executive’s continued failure or refusal to follow the lawful directives of the Company Board after being given written notice

and thirty (30) days to remedy such failures or refusals;

(ii)

Executive’s willful misconduct, gross negligence, act of material dishonesty in connection with Executive’s employment;

(iii)

Executive’s indictment for, or a plea of guilty or no contest to, any felony or any other criminal offence involving serious moral

turpitude;

(iv)

Executive’s violation of any material written policies of the Company or its affiliates of which Executive has received written

notice and which violation is, in each case, if curable, is not cured within thirty (30) days of written notice from the Company;

(v)

Executive’s breach of any non-solicitation or non-competition obligations to the Company or its affiliates, including, without

limitation, those set forth in Sections 8.1 and 8.2 of this Agreement or Executive’s willful, grossly negligent,

or reckless breach of any confidentiality obligations to the Company or its affiliates, including, without limitation, those set forth

in Section 8.3 of this Agreement;

(vi)

material breach by Executive of any of the provisions of this Agreement or any other agreement between the Company and its affiliates

on the one hand and Executive on the other hand, which (if curable) is not cured within thirty (30) days of written notice; or

(vii)

as provided in Section 13.1 hereof.

(b)

“Change in Control” shall have the meaning given that term in the Company’s 2021 Omnibus Equity Incentive Plan, and

as amended.

(c)

“Good Reason” shall mean, without Executive’s prior written consent, (i) a material diminution in Executive’s

title, authority, duties or responsibilities; (ii) a material reduction in Base Salary; (iii) a material reduction in the target percentage

of the Executive’s Cash Bonus; (iv) the relocation of Executive’s principal place of employment more than fifty (50) miles

from its then current location; or (v) a breach by the Company of any material provision of this Agreement (the parties agreeing that

Section 4.1 is one such material provision). Any Good Reason termination will require thirty (30) days’ advanced written

notice by Executive of the event giving rise to Good Reason within sixty (60) days after Executive first learns of the applicable event,

and will not be effective unless the Company has not cured the Good Reason event within such thirty (30) day notice period. In order

for Executive to resign for Good Reason, Executive must resign from Executive’s employment within sixty (60) days after the failure

of the Company to cure a Good Reason event.

(d)

“Person” means any natural person, sole proprietorship, general partnership, limited partnership, limited liability

company, joint venture, trust, unincorporated organization, association, corporation, governmental authority or any other organization,

irrespective of whether it is a legal entity and includes any successor (by merger or otherwise) of such entity.

6.7

Conditions to Payment. All payments and benefits due to Executive under this Section 6, other than the payments due to

Executive under Sections 6.1(a), (d), and (f) or which are otherwise required by law (all other payments under Section 6, “Severance”),

shall only be payable if Executive (or Executive’s beneficiary or estate) delivers to the Company and does not revoke (under the

terms of applicable law) a general release of all claims substantially in the form attached hereto as Exhibit A. Such general

release shall be executed and delivered (and no longer subject to revocation) within fifty-five (55) days following termination. Failure

to timely execute and return such release or revocation thereof shall be a waiver by Executive of Executive’s right to receive

any Severance. In addition, Severance shall be conditioned on Executive’s compliance with Section 8 hereof.

7.

Reimbursement of Expenses. The Company shall reimburse Executive for reasonable and necessary expenses actually incurred by

Executive directly in connection with the business and affairs of the Company and the performance of Executive’s duties hereunder,

in each case subject to appropriate substantiation and itemization of such expenses in accordance with the guidelines and limitations

established by the Company from time to time.

8.

Restrictions on Activities of Executive.

8.1

Non-Competition. During employment (the “Restriction Period”), Executive covenants and agrees that Executive

shall not directly or indirectly (whether for compensation or otherwise) own or hold any interest in, manage, operate, control, consult

with, render services for, or in any manner participate in, any Competitive Business, in each case, either as a general or limited partner,

proprietor, shareholder, officer, director, agent, employee, consultant, trustee, affiliate or otherwise. For purposes of this Agreement,

“Competitive Business” shall mean the satellite and space hardware manufacturing business.

8.2

Non-Solicitation. Executive covenants and agrees that, except in connection with the performance of Executive’s duties to

the Company, during the Restriction Period, Executive shall not directly or indirectly (i) influence or attempt to influence or solicit

any employees or independent contractors of the Company or any of its affiliates to restrict, reduce, sever or otherwise alter their

relationship with the Company or such affiliates, (ii) hire any employees or independent contractors of the Company or any of its affiliates,

(iii) solicit or induce, or attempt to solicit or induce, any Person that is then a client or customer of the Company, or any of its

affiliates to cease being a client or customer of the Company or any of its affiliates or to divert all or any part of such Person’s

business from the Company or any of its affiliates, or (iv) assist any other Person in any way to do, or attempt to do, anything prohibited

by Sections 8.2(i), (ii), or (iii); provided, however, that the foregoing restrictions shall not include (A) general

solicitations of employment or hiring of persons responding to general solicitations of employment (including general advertising via

periodicals, the Internet and other media) not specifically directed towards employees of the Company or its affiliates, or (B) serving

as a third-party reference for any employee or independent contractor or providing advice to any employees.

8.3

Confidentiality. Executive shall not, during the Employment Period or at any time thereafter directly or indirectly, disclose,

reveal, divulge or communicate to any Person other than authorized officers, directors and employees of the Company or use or otherwise

exploit for Executive’s own benefit or for the benefit of anyone other than the Company, any Confidential Information (as defined

below). “Confidential Information” means any information with respect to the Company or any of its affiliates, including

methods of operation, customer lists, products, prices, fees, costs, technology, formulas, inventions, trade secrets, know-how, software,

marketing methods, plans, personnel, suppliers, competitors, markets or other specialized information or proprietary matters; provided,

that, there shall be no obligation hereunder with respect to, information that (i) is generally available to the public on the

Effective Date, (ii) becomes generally available to the public other than as a result of a disclosure not otherwise permissible hereunder,

or (iii) is required to be disclosed by law, court order or other legal or regulatory process and Executive gives the Company prompt

written notice and the opportunity to seek a protective order. For the avoidance of doubt, Executive understands that pursuant to the

federal Defend Trade Secrets Act of 2016, Executive shall not be held criminally or civilly liable under any federal or state trade secret

law for the disclosure of a trade secret that (A) is made (i) in confidence to a federal, state, or local government official, either

directly or indirectly, or to an attorney; and (ii) solely for the purpose of reporting or investigating a suspected violation of law;

or (B) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. Nothing contained

in this Agreement shall limit Executive’s ability to communicate with any federal, state or local governmental agency or commission,

including to provide documents or other information, without notice to the Company. Further, nothing in this Agreement shall be deemed

to preclude Executive from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination

or any other conduct that you have reason to believe is unlawful.

8.4

Assignment of Inventions.

(a)

Executive agrees that during employment with the Company, any and all inventions, discoveries, innovations, writings, domain names, improvements,

trade secrets, designs, drawings, formulas, business processes, secret processes and know-how, whether or not patentable or a copyright

or trademark, which Executive may create, conceive, develop or make, either alone or in conjunction with others and related or in any

way connected with the Company’s strategic plans, products, processes or apparatus or the business (collectively, “Inventions”),

shall be fully and promptly disclosed to the Company and shall be the sole and exclusive property of the Company as against Executive

or any of Executive’s assignees. Regardless of the status of Executive’s employment by the Company, Executive and Executive’s

heirs, assigns and representatives shall promptly assign to the Company any and all right, title and interest in and to such Inventions

made during employment with the Company.

(b)

Whether during or after the Employment Period, Executive further agrees to execute and acknowledge all papers and to do, at the Company’s

expense, any and all other things necessary for or incident to the applying for, obtaining and maintaining of such letters patent, copyrights,

trademarks or other intellectual property rights, as the case may be, and to execute, on request, all papers necessary to assign and

transfer such Inventions, copyrights, patents, patent applications and other intellectual property rights to the Company and its successors

and assigns. In the event that the Company is unable, after reasonable efforts and, in any event, after ten (10) business days, to secure

Executive’s signature on a written assignment to the Company, of any application for letters patent, trademark registration or

to any common law or statutory copyright or other property right therein, whether because of Executive’s physical or mental incapacity,

or for any other reason whatsoever, Executive irrevocably designates and appoints the Secretary of the Company as Executive’s attorney-in-fact

to act on Executive’s behalf to execute and file any such applications and to do all lawfully permitted acts to further the prosecution

or issuance of such assignments, letters patent, copyright or trademark.

8.5

Return of Company Property. Within ten (10) days following the date of any termination of Executive’s employment, Executive

or Executive’s personal representative shall return all property of the Company and its affiliates in Executive’s possession,

including but not limited to all Company-owned computer equipment (hardware and software), smart phones, facsimile machines, tablet computers

and other communication devices, credit cards, office keys, security access cards, badges, identification cards and all copies (including

drafts) of any documentation or information (however stored) relating to the business of the Company and its affiliates, its customers

and clients or its prospective customers and clients. Anything to the contrary notwithstanding, Executive shall be entitled to retain

(i) personal papers and other materials of a personal nature, provided that such papers or materials do not include Confidential Information,

(ii) information showing Executive’s compensation or relating to reimbursement of expenses, and (iii) copies of plans, programs

and agreements relating to Executive’s employment, or termination thereof, with the Company which Executive received in Executive’s

capacity as a participant.

8.6

Cooperation. During the Employment Period and for six years thereafter, Executive shall give Executive’s assistance and

cooperation, upon reasonable advance notice, in any litigation matter relating to Executive’s position with the Company and its

affiliates, or Executive’s knowledge as a result thereof as the Company may reasonably request, including Executive’s attendance

and truthful testimony where deemed appropriate by the Company, with respect to any investigation or the Company’s (or an affiliate’s)

defense or prosecution of any existing or future claims or litigations or other proceeding relating to matters in which Executive was

involved or had knowledge by virtue of Executive’s employment with the Company, in all cases on

schedules that are reasonably consistent with Executive’s other permitted activities and commitments. The Company agrees

to reimburse Executive for any costs Executive incurs in connection with complying with this Section, including Executive’s reasonable

attorney’s fees. If Executive’s compliance with this Section requires Executive to expend more than ten (10) hours (any time

in excess of ten (10) hours, “Excess Time”) in any quarter of a calendar year, the Company agrees to compensate Executive

for such Excess Time at an hourly rate that is equal to the prorata rate the Executive earned while under employment with the Company.

8.7

Non-Disparagement. During Executive’s employment with the Company, and at all times thereafter, (i) Executive shall not

make either orally or in writing any derogatory or disparaging statement with regard to the Company, any of its businesses, products,

services or practices or any of its managers, directors, officers, employees or agents, and (ii) the Company shall direct the members

of the Company Board and its senior executives not to make either orally or in writing any derogatory or disparaging statement with regard

to the Executive, provided that nothing in this Section 8.7 shall prevent either party from giving a deposition, responding to any subpoena

or other lawful request for information or documentation made in the course of a legal or administrative proceeding or testifying in

court or in any other legal proceeding.

8.8

Survival. This Section 8 shall survive any termination or expiration of this Agreement or employment of Executive.

9.

Remedies. It is specifically understood and agreed that any breach of the provisions of Section 8 of this Agreement

is likely to result in irreparable injury to the Company and that the remedy at law alone will be an inadequate remedy for such breach,

and that in addition to any other remedy it may have in the event of a breach or threatened breach of Section 8 above, the Company

shall be entitled to enforce the specific performance of this Agreement by Executive and to seek both temporary and permanent injunctive

relief (to the extent permitted by law) without bond and without liability should such relief be denied, modified or violated.

10.

Blue Pencil. Each of the rights enumerated in this Agreement shall be independent

of the others and shall be in addition to and not in lieu of any other rights and remedies available to the Company or any of its direct

or indirect subsidiaries at law or in equity. If any of the provisions of this Agreement or any part of any of them is hereafter construed

or adjudicated to be invalid or unenforceable because of the duration of such provisions or the area or scope covered thereby, Executive

agrees that the court making such determination shall have the power to reduce the duration, scope and/or area of such provisions to

the maximum and/or broadest duration, scope and/or area permissible by law, and in its reduced form said provision shall then be enforceable.

11.

Severable Provisions. The provisions of this Agreement, or any portions thereof, are severable and the invalidity of any one

or more provisions or portions thereof shall not affect the validity of any other provision. In the event that a court of competent jurisdiction

shall determine that any provision or portion thereof of this Agreement or the application thereof is unenforceable in whole or in part

because of the duration or scope thereof, the parties hereto agree that said court in making such determination shall have the power

to reduce the duration or scope of such provision or portion thereof to the extent necessary to make it enforceable, and that the Agreement

in its reduced form shall be valid and enforceable to the full extent permitted by law.

12.

Notices. All notices hereunder, to be effective, shall be in writing and shall be deemed effective when delivered by hand

or mailed by (a) certified mail, postage and fees prepaid, or (b) nationally recognized overnight express mail service, as follows:

If

to the Company:

Sidus

Space, Inc.

150

N Sykes Creek Pkwy Ste 200

Merritt

Island, FL 32953

Attention:

Carol Craig

with

a copy (which shall not constitute notice) to:

FordHarrison

LLP

Attn:

____________

If

to Executive:

The

last address shown on records of the Company or to such other address as a party may notify the other pursuant to a notice given in accordance

with this Section 12.

13.

Miscellaneous.

13.1

Executive Representation. Executive hereby represents to the Company that Executive’s execution and delivery of this Agreement

and Executive’s performance of Executive’s duties hereunder shall not constitute a breach of, or otherwise contravene, or

be prevented, interfered with or hindered by, the terms of any employment agreement or other agreement or policy to which Executive is

a party or otherwise bound, and further that Executive is not subject to any limitation on Executive’s activities on behalf of

the Company as a result of agreements into which Executive has entered except for obligations of confidentiality with former employers.

To the extent this representation and warranty is not true and accurate, it shall be treated as a Cause event and the Company may terminate

Executive for Cause or not permit Executive to commence employment.

13.2

No Mitigation or Offset. In the event of any termination of Executive’s employment hereunder, Executive shall be under no

obligation to seek other employment or otherwise mitigate the obligations of the Company under this Agreement, and there shall be no

offset against amounts due Executive under this Agreement on account of future earnings by Executive.

13.3

Entire Agreement; Amendment. Except as otherwise expressly provided herein, this Agreement constitutes the entire agreement between

the parties hereto with regard to the subject matter hereof, superseding all prior understandings and agreements, whether written or

oral. This Agreement may not be amended or revised except by a writing signed by the parties.

13.4

Assignment and Transfer. The provisions of this Agreement shall be binding on and shall inure to the benefit of the Company and

any successor in interest to the Company who acquires all or substantially all of the Company’s assets. The Company may assign

this Agreement to an affiliate. Neither this Agreement nor any of the rights, duties or obligations of Executive shall be assignable

by Executive, nor shall any of the payments required or permitted to be made to Executive by this Agreement be encumbered, transferred

or in any way anticipated, except as required by applicable law. All rights of Executive under this Agreement shall inure to the benefit

of and be enforceable by Executive’s personal or legal representatives, estates, executors, administrators, heirs and beneficiaries.

13.5

Waiver of Breach. A waiver by either party of any breach of any provision of this Agreement by the other party shall not operate

or be construed as a waiver of any other or subsequent breach by the other party.

13.6

Withholding. The Company shall be entitled to withhold from any amounts to be paid or benefits provided to Executive hereunder

any federal, state, local or foreign withholding, FICA and FUTA contributions, or other taxes, charges or deductions which it is from

time to time required to withhold.

13.7

Code Section 409A.

(a)

The parties agree that this Agreement shall be interpreted to comply with or be exempt from Section 409A of the Code and the regulations

and guidance promulgated thereunder to the extent applicable (collectively “Code Section 409A”), and all provisions

of this Agreement shall be construed in a manner consistent with the requirements for avoiding taxes or penalties under Code Section

409A. In no event whatsoever will the Company be liable for any additional tax, interest or penalties that may be imposed on Executive

under Code Section 409A or any damages for failing to comply with Code Section 409A.

(b)

A termination of employment shall not be deemed to have occurred for purposes of any provision of this Agreement providing for the payment

of any amounts or benefits considered “nonqualified deferred compensation” under Code Section 409A upon or following a termination

of employment unless such termination is also a “separation from service” within the meaning of Code Section 409A and, for

purposes of any such provision of this Agreement, references to a “termination,” “termination of employment”

or like terms shall mean “separation from service.” If Executive is deemed on the date of termination to be a “specified

employee” within the meaning of that term under Code Section 409A(a)(2)(B), then with regard to any payment or the provision of

any benefit that is considered nonqualified deferred compensation under Code Section 409A payable on account of a “separation from

service,” such payment or benefit shall be made or provided at the date which is the earlier of (i) the expiration of the six (6)-month

period measured from the date of such “separation from service” of Executive, and (ii) the date of Executive’s death

(the “Delay Period”). Upon the expiration of the Delay Period, all payments and benefits delayed pursuant to this

Section 13.7(b) (whether they would have otherwise been payable in a single sum or in installments in the absence of such delay)

shall be paid or reimbursed on the first business day following the expiration of the Delay Period to Executive in a lump sum, and any

remaining payments and benefits due under this Agreement shall be paid or provided in accordance with the normal payment dates specified

for them herein.

(c)

With regard to any provision herein that provides for reimbursement of costs and expenses or in-kind benefits, except as permitted by

Code Section 409A, (i) the right to reimbursement or in-kind benefits shall not be subject to liquidation or exchange for another benefit,

(ii) the amount of expenses eligible for reimbursement, or in-kind benefits, provided during any taxable year shall not affect the expenses

eligible for reimbursement, or in-kind benefits, to be provided in any other taxable year, provided, that, this clause (ii) shall

not be violated with regard to expenses reimbursed under any arrangement covered by Internal Revenue Code Section 105(b) solely because

such expenses are subject to a limit related to the period the arrangement is in effect and (iii) such payments shall be made on or before

the last day of Executive’s taxable year following the taxable year in which the expense occurred.

(d)

For purposes of Code Section 409A, Executive’s right to receive any installment payments pursuant to this Agreement shall be treated

as a right to receive a series of separate and distinct payments. Whenever a payment under this Agreement specifies a payment period

with reference to a number of days (e.g., “payment shall be made within thirty (30) days following the date of termination”),

the actual date of payment within the specified period shall be within the sole discretion of the Company.

13.8

Indemnification. On the [Insert “Effective Date”], Executive and the Company entered into an indemnification agreement

(the “Indemnification Agreement”) substantially in the form attached hereto as Exhibit B. The Company shall

to the maximum extent permitted by applicable law indemnify and hold harmless Executive as provided in the Indemnification Agreement.

13.9

Governing Law. This Agreement shall be construed under and enforced in accordance with the laws of the State of California, without

regard to the conflicts of law provisions thereof.

13.10

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original and shall

have the same effect as if the signatures hereto and thereto were on the same instrument.

[remainder

of page intentionally left blank]

IN

WITNESS WHEREOF, the parties hereto have duly executed this Agreement as of the day and year first above written.

| |

SIDUS SPACE, INC. |

| |

|

|

| |

By: |

/s/ Carol Craig |

| |

Name: |

Carol Craig |

| |

Title: |

CEO |

| |

|

|

| |

EXECUTIVE |

| |

|

|

| |

/s/ Adarsh Parekh |

| |

Adarsh Parekh |

EXHIBIT

A

EXHIBIT B

[Indemnification

Agreement]

EXHIBIT

C

[KPIs]

EXHIBIT

D

[Roles

and Responsibilities]

Exhibit

99.1

Sidus

Space Appoints Adarsh Parekh as New Chief Financial Officer (CFO) to Spearhead Strategic Financial Initiatives

CAPE

CANAVERAL, FL, [January 21, 2025] – Sidus Space (NASDAQ: SIDU), an innovative and agile space mission enabler, today announced

the appointment of Adarsh Parekh as its new Chief Financial Officer, effective January 27, 2025.

Exceptional

Financial Leadership

Mr.

Parekh brings over two decades of financial expertise marked by:

| ● | $3

billion in M&A, capital markets and direct investing experience |

| ● | A

proven record of scaling organizations in industries including aerospace, medical technology,

and agriculture |

| ● | A

history of implementing strategies to drive profitability and sustainable growth. |

Most

recently, Mr. Parekh served as Chief Financial Officer of Terran Orbital Corporation and directed all finance and accounting functions.

Mr. Parekh’s experience in financial services and financial operations also includes serving as CFO of Alio, Inc. and Woodspur

Farms, LLC. He has held senior positions at RRG Capital Management LLC, OneWest Bank FSB, and Libra Securities, LLC and began his career

in the Investment Banking Division at Lehman Brothers, Inc.

Strategic

Vision for Sidus Space

Reporting

directly to Carol Craig, Founder, Chairman, and CEO of Sidus Space, Mr. Parekh will lead all financial operations focusing on optimizing

efficiency and advancing the company’s mission to achieve sustainable growth and profitability.

“Adarsh

Parekh is a natural fit for Sidus Space at this exciting juncture,” said Carol Craig, CEO of Sidus Space. “His extensive

financial expertise and sharp focus on profitability will be critical as we continue to execute on our strategic goals. We are confident

that his leadership will drive our financial objectives and deliver long-term value for our stakeholders during this pivotal period of

growth and expansion.”

Sidus

Space continues to strengthen its leadership team as it expands its position in the rapidly evolving space economy, with a focus on delivering

innovative solutions while achieving financial milestones and operational excellence.

About

Sidus Space

Sidus Space (NASDAQ: SIDU) is a space mission enabler providing flexible, cost-effective solutions including custom satellite design,

payload hosting, mission management, space manufacturing, and AI-enhanced space-based sensor data-as-a-service. With its mission of Space

Access Reimagined™, Sidus Space is committed to rapid innovation, adaptable and cost-effective solutions, and the optimization

of space system and data collection performance. With demonstrated space heritage, including manufacturing and operating its own satellite

and sensor system, LizzieSat™, Sidus Space serves government, defense, intelligence, and commercial companies around the globe.

Strategically headquartered on Florida’s Space Coast, Sidus Space operates a 35,000-square-foot space manufacturing, assembly,

integration, and testing facility and provides easy access to nearby launch facilities. For more information, visit: ww.sidusspace.com.

Forward-Looking

Statements

Statements

in this press release about future expectations, plans and prospects, as well as any other statements regarding matters that are not

historical facts, may constitute ‘forward-looking statements’ within the meaning of The Private Securities Litigation Reform

Act of 1995. These statements include, but are not limited to, statements relating to the expected trading commencement and closing dates.

The words ‘anticipate,’ ‘believe,’ ‘continue,’ ‘could,’ ‘estimate,’ ‘expect,’

‘intend,’ ‘may,’ ‘plan,’ ‘potential,’ ‘predict,’ ‘project,’ ‘should,’

‘target,’ ‘will,’ ‘would’ and similar expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain these identifying words. Actual results may differ materially from those indicated

by such forward-looking statements as a result of various important factors, including: the uncertainties related to market conditions

and other factors described more fully in the section entitled ‘Risk Factors’ in Sidus Space’s Annual Report on Form

10-K for the year ended December 31, 2023, and other periodic reports filed with the Securities and Exchange Commission. Any forward-looking

statements contained in this press release speak only as of the date hereof, and Sidus Space, Inc. specifically disclaims any obligation

to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Contacts:

Sidus

Investor Relations

investorrelations@sidusspace.com

Sidus

Media Inquiries

press@sidusspace.com

v3.24.4

Cover

|

Jan. 14, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 14, 2025

|

| Entity File Number |

001-41154

|

| Entity Registrant Name |

SIDUS

SPACE, INC.

|

| Entity Central Index Key |

0001879726

|

| Entity Tax Identification Number |

46-0628183

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

150

N. Sykes Creek Parkway

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Merritt

Island

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32953

|

| City Area Code |

(321)

|

| Local Phone Number |

613-5620

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class

A Common Stock, $0.0001 par value per share

|

| Trading Symbol |

SIDU

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

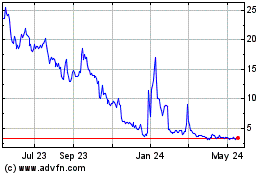

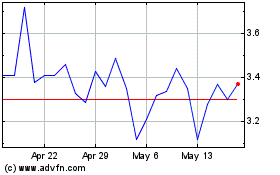

Sidus Space (NASDAQ:SIDU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sidus Space (NASDAQ:SIDU)

Historical Stock Chart

From Jan 2024 to Jan 2025