Presidio Property Trust Announces Closing of $1.74 Million Public Offering of Series D Preferred Stock

25 June 2024 - 6:15AM

(NASDAQ: SQFT) Presidio Property Trust, an internally managed,

diversified real estate investment trust ("REIT"), today announced

the closing of its public offering of 109,054 shares of its 9.375%

Series D Cumulative Redeemable Perpetual Preferred Stock par value

$0.01 per share (the "Series D Preferred Stock") at a price to the

public of $16.00 per share for gross proceeds of approximately

$1.74 million, before deducting underwriting discounts and offering

expenses.

The Benchmark Company, LLC acted as sole

bookrunning manager for the offering

A shelf registration statement on Form S-3 and

an accompanying prospectus (File No. 333-278960), relating to the

shares of Series D Preferred Stock to be issued in the proposed

offering was filed with the Securities and Exchange Commission

("SEC") on April 26, 2024 and declared effective by the SEC on May

17, 2024. A preliminary prospectus supplement relating to the

proposed offering has been filed with the SEC and is available on

the SEC's website at http://www.sec.gov. A final prospectus

supplement describing the terms of the proposed offering has been

filed with the SEC. Copies of the final prospectus supplement and

accompanying base prospectus relating to this offering may be

obtained from The Benchmark Company, LLC, 150 East 58th Street,

17th floor, New York, NY 10155, by email at

prospectus@benchmarkcompany.com, or by calling +1

(212)-312-6700.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Presidio Property

Trust

Presidio is an internally managed, diversified

REIT with holdings in model home properties which are triple-net

leased to homebuilders, office, industrial, and retail properties.

Presidio's model homes are leased to homebuilders located in

Arizona, Illinois, Texas, Wisconsin, and Florida. Our office,

industrial and retail properties are located primarily in Colorado,

with properties also located in Maryland, North Dakota, Texas, and

Southern California. While geographical clustering of real estate

enables us to reduce our operating costs through economies of scale

by servicing several properties with less staff, it makes us

susceptible to changing market conditions in these discrete

geographic areas, including those that have developed as a result

of COVID-19. Presidio owns approximately 6.5% of the outstanding

common stock of Conduit Pharmaceuticals Inc., a disease agnostic

multi-asset clinical-stage disease-agnostic life science company

providing an efficient model for compound development. For more

information on Presidio, please visit the Company's website at

https://www.PresidioPT.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains statements that are

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and other federal

securities laws. Forward-looking statements are statements that are

not historical, including statements regarding management's

intentions, beliefs, expectations, representations, plans or

predictions of the future, and are typically identified by such

words as "believe," "expect," "anticipate," "intend," "estimate,"

"may," "will," "should" and "could." Because such statements

include risks, uncertainties and contingencies, actual results may

differ materially from those expressed or implied by such

forward-looking statements. These forward-looking statements are

based upon the Company's present expectations, but these statements

are not guaranteed to occur. Except as required by law, the Company

disclaims any obligation to publicly update or revise any

forward-looking statement to reflect changes in underlying

assumptions or factors, of new information, data or methods, future

events or other changes. Investors should not place undue reliance

upon forward-looking statements. For further discussion of the

factors that could affect outcomes, please refer to the "Risk

Factors" section of the final prospectus relating to the offering

and in the Company's other documents filed with the SEC, copies of

which are available on the SEC's website, www.sec.gov.

Investor Relations

Contacts:

Presidio Property Trust, Inc.Lowell Hartkorn, Investor

RelationsLHartkorn@presidiopt.comTelephone: (760) 471-8536

x1244

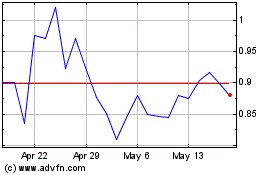

Presidio Property (NASDAQ:SQFT)

Historical Stock Chart

From Jan 2025 to Feb 2025

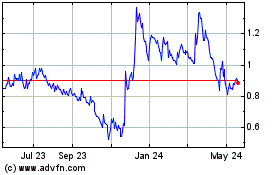

Presidio Property (NASDAQ:SQFT)

Historical Stock Chart

From Feb 2024 to Feb 2025