Star Equity Holdings, Inc. (Nasdaq: STRR; STRRP) (“Star” or the

“Company”), a diversified holding company, reported today its

financial results for the third quarter (Q3) ended

September 30, 2024. All 2024 and 2023 amounts in this release

are unaudited.

Following the sale of our Digirad Health

business on May 4, 2023, all financial results for the 2023

reporting period, unless stated otherwise, relate to continuing

operations, which currently include two divisions: Building

Solutions (formerly known as Construction) and Investments.

Q3 2024 Financial

Highlights vs. Q3 2023

(unaudited)

- Revenues increased by 30.9% to

$13.7 million from $10.4 million.

- Gross profit increased by 27.9% to

$2.8 million from $2.2 million.

- Net loss from continuing operations

was $2.0 million (or $0.61 per basic and diluted share)

compared to net loss from continuing operations of

$2.4 million (or $0.75 per basic and diluted share).

- Non-GAAP adjusted net loss was $0.9

million (or $0.29 per basic and diluted share) compared to net

income of $0.2 million (or $0.07 per basic and diluted share).

- Non-GAAP adjusted EBITDA was a loss

of $0.3 million versus a loss of $14 thousand.

Year-to-Date

2024 Financial Highlights vs.

Year-to-Date 2023

(unaudited)

- Revenues increased by 14.5% to

$36.3 million from $31.7 million.

- Gross profit decreased by 27.2% to

$6.6 million from $9.1 million.

- Net loss from continuing operations

was $8.0 million (or $2.53 per basic and diluted share)

compared to a net loss from continuing operations of

$3.7 million (or $1.19 per basic and diluted share).

- Non-GAAP adjusted net loss from

continuing operations was $3.2 million (or $1.03 per basic and

diluted share) compared to a net loss of $0.2 million (or

$0.06 per basic and diluted share).

- Non-GAAP adjusted EBITDA from

continuing operations was a loss of $1.9 million versus a loss

of $50 thousand.

“In the third quarter of 2024, the acquisition

of Timber Technologies (“TT”) drove a quarterly Building Solutions

revenue increase versus the third quarter of 2023,” commented Rick

Coleman, Chief Executive Officer. “While third quarter results on

an organic basis were mixed, we were pleased to have recently

announced two large commercial contract wins by our KBS business,

totaling $4.6 million. We are seeing increased activity and

interest from customers who had put projects on hold earlier in the

year, and fourth quarter project signings indicate a material

improvement in activity across our entire Building Solutions

division. For example, we’ve received letters of intent and

substantial deposits on two additional KBS projects totaling over

$5 million which we expect to announce within weeks. We believe

this momentum shift will translate into significantly improved

financial results for both Q4 2024 and FY 2025.”

Mr. Coleman added, “At our Investments division,

we marked a diversification of our portfolio beyond Building

Solutions with our initial entrance into the Energy Services and

Transportation & Logistics sectors. Our third quarter

investment in Colorado-based Enservco creates an opportunity to

broaden the scope of our operations in areas we believe will

generate long-term shareholder value.”

Revenues

The Company’s Q3 2024 revenues increased 30.9%

to $13.7 million from $10.4 million in Q3 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues in $ thousands |

Q3 2024 |

|

Q3 2023 |

|

% change |

|

9M 2024 |

|

9M 2023 |

|

% change |

|

Building Solutions |

$ |

13,663 |

|

|

$ |

10,435 |

|

|

30.9 |

% |

|

$ |

36,264 |

|

|

$ |

31,674 |

|

|

14.5 |

% |

|

Investments |

|

156 |

|

|

|

89 |

|

|

75.3 |

% |

|

|

538 |

|

|

|

405 |

|

|

32.8 |

% |

|

Intersegment elimination |

|

(156 |

) |

|

|

(89 |

) |

|

75.3 |

% |

|

|

(538 |

) |

|

|

(405 |

) |

|

32.8 |

% |

|

Total Revenues |

$ |

13,663 |

|

|

$ |

10,435 |

|

|

30.9 |

% |

|

$ |

36,264 |

|

|

$ |

31,674 |

|

|

14.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q3 2024 and 9M 2024 Building Solutions revenue

increased by 30.9% and 14.5%, respectively, from the prior year,

mainly as a result of the inclusion of revenues from TT from the

date of acquisition and the inclusion of revenues from Big Lake

Lumber (“BLL”), which we acquired in the fourth quarter of 2023.

Economic headwinds, higher interest rates, and project delays

contributed to slowdowns at both KBS and EBGL. Certain large

commercial projects were delayed from the first half of 2024;

however, we are beginning to see improvement, as evidenced by our

announcement of $4.6 million in contracts signed at KBS. Our

backlog and sales pipeline indicate continued strong demand for new

projects, and although the revenue impact and timing are uncertain,

customer feedback and the improving interest rate environment give

us confidence in our ability to convert our pipeline into signed

contracts in the coming months.

Gross Profit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit (loss) in $ thousands |

Q3 2024 |

|

Q3 2023 |

|

% change |

|

9M 2024 |

|

9M 2023 |

|

% change |

|

Building Solutions |

$ |

2,846 |

|

|

$ |

2,248 |

|

|

26.6 |

% |

|

$ |

6,753 |

|

|

$ |

9,241 |

|

|

(26.9) |

% |

|

Building Solutions gross margin |

|

20.8 |

% |

|

|

21.5 |

% |

|

(0.7) |

% |

|

|

18.6 |

% |

|

|

29.2 |

% |

|

(10.6) |

% |

|

Investments |

|

127 |

|

|

|

44 |

|

|

188.6 |

% |

|

|

392 |

|

|

|

236 |

|

|

66.1 |

% |

|

Intersegment elimination |

|

(156 |

) |

|

|

(89 |

) |

|

75.3 |

% |

|

|

(538 |

) |

|

|

(405 |

) |

|

32.8 |

% |

|

Total gross profit |

$ |

2,817 |

|

|

$ |

2,203 |

|

|

27.9 |

% |

|

$ |

6,607 |

|

|

$ |

9,072 |

|

|

(27.2) |

% |

|

Total gross margin |

|

20.6 |

% |

|

|

21.1 |

% |

|

(0.5) |

% |

|

|

18.2 |

% |

|

|

28.6 |

% |

|

(10.4) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q3 2024 and 9M 2024 Building Solutions gross

profit increased 26.6% and decreased 26.9% respectively vs the same

periods last year. The decline for the 9M period was primarily due

to fixed costs remaining at constant levels as revenue declined at

KBS and EBGL as well as a one-time purchase price accounting

adjustment of approximately $574 thousand related to the TT

acquisition. The increase for the Q3 period was due to the

inclusion of BLL and TT.

Operating Expenses

On a consolidated basis, Q3 2024 sales, general

and administrative (“SG&A”) expenses increased by

$4.0 million, or 115.9%, versus the prior year period.

SG&A as a percentage of revenue increased in Q3 2024 to 54.3%

versus 32.9% in Q3 2023. The major driver of the increase in

SG&A was an impairment of approximately $2.8 million

related to our cost method investment in TTG Imaging Solutions

(“TTG”) that was part of the Digirad sale. We recorded this

impairment after consideration of the financial performance of TTG

Parent LLC relative to comparable company valuation multiples.

Excluding this impairment, SG&A expenses for the third quarter

of 2024 as a percentage of revenue were 33.8% versus 32.9% in Q3

2023. For the 9M 2024 period, we have recorded impairments to the

TTG cost method investment of $4.1 million

Net Income

Q3 2024 net loss from continuing operations was

$2.0 million, or $0.61 per basic and diluted share, compared to a

net loss of $2.4 million, or $0.75 per basic and diluted share

in the same period in the prior year. Q3 2024 non-GAAP adjusted net

loss from continuing operations was $0.9 million, or $0.28 per

basic and diluted share, compared to non-GAAP adjusted net income

from continuing operations of $0.2 million, or $0.07 per basic and

diluted share, in the prior year period.

Year-to-date 2024 net loss from continuing

operations was $8.0 million, or $2.53 per basic and diluted

share, compared to net loss of $3.7 million, or $1.19 per

basic and diluted share, in the same period in the prior year.

Year-to-date 2024 non-GAAP adjusted net loss from continuing

operations was $3.2 million, or $1.03 per basic and diluted

share, compared to adjusted net loss from continuing operations of

$0.2 million, or $0.06 per basic and diluted share, in the

prior year period.

Non-GAAP Adjusted EBITDA

Q3 2024 non-GAAP adjusted EBITDA was a loss of

$0.3 million versus a loss of $14 thousand in the same

quarter of the prior year, primarily due to increased operating

expenses. Year-to-date 2024 non-GAAP adjusted EBITDA was a loss of

$1.9 million, compared to a loss of $50 thousand in

year-to-date 2023, primarily due to lower margins at our Building

Solutions division.

Operating Cash Flow

9M 2024 cash flow from operations was an outflow

of $3.7 million, compared to an inflow of $2.7 million

for 9M 2023. The decrease in net cash provided by operating

activities is attributable to lower results from operations,

particularly in our Building Solutions division, and increased net

working capital expenditures.

Preferred Stock Dividends

In Q3 2024, the Company’s board of directors

declared a cash dividend to holders of our Series A Preferred Stock

of $0.25 per share, for an aggregate amount of approximately

$0.5 million. The record date for this dividend was September

1, 2024, and the payment date was September 10, 2024.

NOL Carryforward

As of December 31, 2023, Star had $43.2 million

of U.S. federal and state net operating losses (“NOL”), which the

Company considers to be a valuable asset for its stockholders.

Certain of these NOLs will expire in 2025 through 2042 unless

previously utilized. In order to protect the value of the NOL for

all stockholders, the Company has a rights agreement and charter

amendment in place that limit beneficial ownership of the Company’s

common stock to 4.99%. Stockholders who wish to own more than 4.99%

of Star common stock, or who already own more than 4.99% of Star

common stock and wish to buy more, may only acquire additional

shares with the Board’s prior written approval.

Share Repurchase Program

On August 7th, 2024, the Company’s board of

directors authorized a new stock repurchase program under which the

Company is authorized to repurchase up to $1.0 million of its

issued and outstanding shares of common stock. The Company

repurchased 50,717 shares for $0.2 million under this program

in the third quarter of 2024.

Conference Call Information

A conference call is scheduled for 10:00 a.m. ET

(7:00 a.m. PT) on November 19, 2024 to discuss the results and

management’s outlook. The call may be accessed by dialing (833)

630-1956 (toll free) or (412) 317-1837 (international), five

minutes prior to the scheduled start time and referencing Star

Equity. A simultaneous webcast of the call may be accessed online

from the Events & Presentations link on the Investor Relations

page at www.starequity.com/events-and-presentations/presentations;

an archived replay of the webcast will be available within 15

minutes of the end of the conference call.

If you have any questions, either prior to or

after our scheduled Earnings Conference call, please e-mail

admin@starequity.com or lcati@equityny.com.

Use of Non-GAAP Financial Measures by

Star Equity Holdings, Inc.

This release presents the non-GAAP financial

measures “adjusted net income (loss),” “adjusted net income (loss)

per basic and diluted share,” and “adjusted EBITDA from continuing

operations.” The most directly comparable measures for these

non-GAAP financial measures are “net income (loss),” “net income

(loss) per basic and diluted share,” and “cash flows from operating

activities.” The Company has included below unaudited adjusted

financial information, which presents the Company’s results of

operations after excluding acquired intangible asset amortization,

unrealized gain (loss) on equity securities and lumber derivatives,

litigation costs, transaction costs, financing costs, and income

tax adjustments. Further excluded in the measure of adjusted EBITDA

are stock-based compensation, interest, depreciation, and

amortization.

A discussion of the reasons why management

believes that the presentation of non-GAAP financial measures

provides useful information to investors regarding the Company’s

financial condition and results of operations is included as

Exhibit 99.2 to the Company’s report on Form 8-K filed with the

Securities and Exchange Commission on November 19, 2024.

About Star Equity Holdings,

Inc.

Star Equity Holdings, Inc. is a diversified

holding company with two divisions: Building Solutions and

Investments.

Building Solutions

Our Building Solutions division operates in

three businesses: (i) modular building manufacturing; (ii)

structural wall panel and wood foundation manufacturing, including

building supply distribution operations; and (iii) glue-laminated

timber (glulam) column, beam, and truss manufacturing.

Investments

Our Investments division manages and finances the Company’s real

estate assets as well as its investment positions in private and

public companies.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements in this press release that are

not statements of historical fact are hereby identified as

“forward-looking statements” for the purpose of the safe harbor

provided by Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

Such statements are based upon management’s current beliefs, views,

estimates and expectations, including as pertains to (i) the plans

and objectives of management for future operations, including plans

or objectives relating to acquisitions and related integration,

(ii) projections of income, EBITDA, earnings per share, capital

expenditures, cost reductions, capital structure or other financial

items, (iii) the future financial performance of the Company or

acquisition targets and (iv) the assumptions underlying or relating

to any statement described above. Forward-looking statements

generally are identified by the words “believe”, “expect”,

“anticipate”, “estimate”, “project”, “intend”, “plan”, “should”,

“may”, “will”, “would”, “will be”, “will continue” or similar

expressions. Such forward-looking statements are not meant to

predict or guarantee actual results, performance, events or

circumstances and may not be realized because they are based upon

the Company's current projections, plans, objectives, beliefs,

expectations, estimates and assumptions and are subject to a number

of risks and uncertainties and other influences, many of which the

Company has no control over. Actual results and the timing of

certain events and circumstances may differ materially from those

described above as a result of these risks and uncertainties.

Factors that may influence or contribute to the inaccuracy of

forward-looking statements or cause actual results to differ

materially from expected or desired results may include, without

limitation, the cyclical nature of our operating businesses, the

Company’s debt and its ability to repay, refinance, or incur

additional debt in the future; the Company’s need for a significant

amount of cash to service, repay the debt, and to pay dividends on

the Company’s preferred stock; the restrictions contained in the

debt agreements that limit the discretion of management in

operating the business; legal, regulatory, political and economic

risks in markets and public health crises that reduce economic

activity and cause restrictions on operations; the length of time

associated with servicing customers; losses of significant

contracts or failure to get potential contracts being discussed;

disruptions in the relationship with third party vendors; accounts

receivable turnover; insufficient cash flows and resulting lack of

liquidity; the Company's inability to expand its business

operations; the liability and compliance costs regarding

environmental regulations; the lack of product diversification;

existing or increased competition; risks to the price and

volatility of the Company’s common stock and preferred stock; stock

volatility and in liquidity; risks to preferred stockholders of not

receiving dividends and risks to the Company’s ability to pursue

growth opportunities if the Company continues to pay dividends

according to the terms of the Company’s preferred stock; the

Company’s ability to execute on its business strategy (including

any cost reduction plans); the Company’s failure to realize

expected benefits of restructuring and cost-cutting actions; the

Company’s ability to preserve and monetize its net operating

losses; risks associated with the Company’s possible pursuit of

acquisitions; the Company’s ability to consummate successful

acquisitions and execute related integration; general economic and

financial market conditions; failure to keep pace with evolving

technologies and difficulties integrating technologies; system

failures; losses of key management personnel and the inability to

attract and retain highly qualified management and personnel in the

future; and the continued demand for and market acceptance of the

Company’s services. For a detailed discussion of cautionary

statements and risks that may affect the Company’s future results

of operations and financial results, please refer to the Company’s

filings with the Securities and Exchange Commission, including, but

not limited to, the risk factors in the Company’s most recent

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. This

press release reflects management’s views as of the date

presented.

All forward-looking statements are necessarily

only estimates of future results, and there can be no assurance

that actual results will not differ materially from expectations.

Therefore, you are cautioned not to place undue reliance on such

statements. Further, any forward-looking statement speaks only as

of the date on which it is made, and we undertake no obligation to

update any forward-looking statement to reflect events or

circumstances after the date on which the statement is made or to

reflect the occurrence of unanticipated events.

|

For more information contact: |

|

|

| Star Equity Holdings,

Inc. |

The Equity Group |

|

| Rick Coleman |

Lena Cati |

|

| Chief Executive Officer |

Senior Vice President |

|

| 203-489-9508 |

212-836-9611 |

|

|

rick.coleman@starequity.com |

lcati@equityny.com |

|

| |

|

|

(Financial tables follow)

|

|

|

Star Equity Holdings, Inc.Condensed

Consolidated Statements of Operations(Unaudited)

(In thousands, except for per share amounts) |

| |

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

Building Solutions** |

|

$ |

13,663 |

|

|

$ |

10,435 |

|

|

$ |

36,264 |

|

|

$ |

31,674 |

|

|

Investments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total revenues |

|

|

13,663 |

|

|

|

10,435 |

|

|

|

36,264 |

|

|

|

31,674 |

|

| |

|

|

|

|

|

|

|

|

| Cost of revenues: |

|

|

|

|

|

|

|

|

|

Building Solutions** |

|

|

10,817 |

|

|

|

8,187 |

|

|

|

29,511 |

|

|

|

22,433 |

|

|

Investments |

|

|

29 |

|

|

|

45 |

|

|

|

146 |

|

|

|

169 |

|

|

Total cost of revenues |

|

|

10,846 |

|

|

|

8,232 |

|

|

|

29,657 |

|

|

|

22,602 |

|

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

|

2,817 |

|

|

|

2,203 |

|

|

|

6,607 |

|

|

|

9,072 |

|

| |

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

7,415 |

|

|

|

3,434 |

|

|

|

16,848 |

|

|

|

11,327 |

|

|

Amortization of intangible assets |

|

|

724 |

|

|

|

430 |

|

|

|

1,756 |

|

|

|

1,290 |

|

|

Total operating expenses |

|

|

8,139 |

|

|

|

3,864 |

|

|

|

18,604 |

|

|

|

12,617 |

|

| |

|

|

|

|

|

|

|

|

| Income (loss) from continuing

operations |

|

|

(5,322 |

) |

|

|

(1,661 |

) |

|

|

(11,997 |

) |

|

|

(3,545 |

) |

| |

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

Other income (expense), net |

|

|

3,293 |

|

|

|

(965 |

) |

|

|

3,358 |

|

|

|

(506 |

) |

|

Interest income (expense), net |

|

|

41 |

|

|

|

433 |

|

|

|

636 |

|

|

|

569 |

|

|

Total other income (expense), net |

|

|

3,334 |

|

|

|

(532 |

) |

|

|

3,994 |

|

|

|

63 |

|

| |

|

|

|

|

|

|

|

|

| Income (loss) before income

taxes from continuing operations |

|

|

(1,988 |

) |

|

|

(2,193 |

) |

|

|

(8,003 |

) |

|

|

(3,482 |

) |

| Income tax benefit (provision)

from continuing operations |

|

|

18 |

|

|

|

(172 |

) |

|

|

22 |

|

|

|

(233 |

) |

| Income (loss) from continuing

operations, net of tax |

|

|

(1,970 |

) |

|

|

(2,365 |

) |

|

|

(7,981 |

) |

|

|

(3,715 |

) |

| Income (loss) from

discontinued operations, net of tax |

|

|

— |

|

|

|

(257 |

) |

|

|

— |

|

|

|

27,119 |

|

| Net income (loss) |

|

|

(1,970 |

) |

|

|

(2,622 |

) |

|

|

(7,981 |

) |

|

|

23,404 |

|

| Dividend on Series A perpetual

preferred stock |

|

|

(541 |

) |

|

|

(479 |

) |

|

|

(1,499 |

) |

|

|

(1,437 |

) |

| Net income (loss) attributable

to common shareholders |

|

$ |

(2,511 |

) |

|

$ |

(3,101 |

) |

|

$ |

(9,480 |

) |

|

$ |

21,967 |

|

| |

|

|

|

|

|

|

|

|

| Net income (loss) per

share |

|

|

|

|

|

|

|

|

| Net income (loss) per share,

continuing operations |

|

|

|

|

|

|

|

|

|

Basic and diluted* |

|

$ |

(0.61 |

) |

|

$ |

(0.75 |

) |

|

$ |

(2.53 |

) |

|

$ |

(1.19 |

) |

| Net income (loss) per share,

discontinued operations |

|

|

|

|

|

|

|

|

|

Basic and diluted* |

|

$ |

— |

|

|

$ |

(0.08 |

) |

|

$ |

— |

|

|

$ |

8.71 |

|

| Net income (loss) per

share |

|

|

|

|

|

|

|

|

|

Basic and diluted* |

|

$ |

(0.61 |

) |

|

$ |

(0.84 |

) |

|

$ |

(2.53 |

) |

|

$ |

7.51 |

|

| Net income (loss) per share,

attributable to common shareholders |

|

|

|

|

|

|

|

|

|

Basic and diluted* |

|

$ |

(0.78 |

) |

|

$ |

(0.99 |

) |

|

$ |

(3.01 |

) |

|

$ |

7.05 |

|

| Weighted-average common shares

outstanding *** |

|

|

|

|

|

|

|

|

|

Basic and diluted* |

|

|

3,210 |

|

|

|

3,137 |

|

|

|

3,150 |

|

|

|

3,115 |

|

| |

|

|

|

|

|

|

|

|

| Dividends declared per share

of Series A perpetual preferred stock |

|

$ |

0.25 |

|

|

$ |

0.25 |

|

|

$ |

0.69 |

|

|

$ |

0.75 |

|

| |

|

*Earnings per share may not add due to rounding |

|

**Formerly known as Construction |

|

***All share amounts reflect 1 for 5 reverse stock split effective

June 14, 2024, retroactively |

| |

|

Star Equity Holdings, Inc.Condensed

Consolidated Balance Sheets (Unaudited) (In

thousands, except share amounts) |

| |

| |

September 30, 2024

(unaudited) |

|

December 31,2023 |

| Assets: |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

5,492 |

|

|

$ |

18,326 |

|

|

Restricted cash |

|

1,603 |

|

|

|

620 |

|

|

Investments in equity securities |

|

3,245 |

|

|

|

4,838 |

|

|

Lumber derivative contracts |

|

— |

|

|

|

19 |

|

|

Accounts receivable, net of allowances of $275 and $191,

respectively |

|

6,503 |

|

|

|

6,004 |

|

|

Note receivable, current portion |

|

1,426 |

|

|

|

399 |

|

|

Inventories, net |

|

5,530 |

|

|

|

3,420 |

|

|

Other current assets |

|

1,451 |

|

|

|

1,180 |

|

|

Assets held for sale |

|

— |

|

|

|

4,346 |

|

|

Total current assets |

|

25,250 |

|

|

|

39,152 |

|

| Property and equipment,

net |

|

10,292 |

|

|

|

3,482 |

|

| Operating lease right-of-use

assets, net |

|

7,145 |

|

|

|

1,470 |

|

| Intangible assets, net |

|

19,654 |

|

|

|

12,518 |

|

| Goodwill |

|

8,453 |

|

|

|

4,438 |

|

| Long term investments |

|

3,899 |

|

|

|

6,000 |

|

| Notes receivable |

|

8,758 |

|

|

|

8,427 |

|

| Other assets |

|

2,272 |

|

|

|

9 |

|

|

Total assets |

$ |

85,723 |

|

|

$ |

75,496 |

|

| |

|

|

|

| Liabilities and

Stockholders’ Equity: |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

1,728 |

|

|

$ |

1,571 |

|

|

Accrued liabilities |

|

3,239 |

|

|

|

1,506 |

|

|

Accrued compensation |

|

1,264 |

|

|

|

1,772 |

|

|

Accrued warranty |

|

48 |

|

|

|

44 |

|

|

Deferred revenue |

|

2,454 |

|

|

|

1,377 |

|

|

Short-term debt |

|

3,284 |

|

|

|

2,019 |

|

|

Operating lease liabilities |

|

305 |

|

|

|

403 |

|

|

Finance lease liabilities |

|

22 |

|

|

|

42 |

|

|

Total current liabilities |

|

12,344 |

|

|

|

8,734 |

|

| Long-term debt, net of current

portion |

|

7,830 |

|

|

|

— |

|

| Deferred tax liabilities |

|

225 |

|

|

|

318 |

|

| Operating lease liabilities,

net of current portion |

|

6,926 |

|

|

|

1,102 |

|

| Finance lease liabilities, net

of current portion |

|

24 |

|

|

|

43 |

|

|

Total liabilities |

|

27,349 |

|

|

|

10,197 |

|

| |

|

|

|

| Stockholders’

Equity: |

|

|

|

|

Preferred stock, $0.0001 par value: 10,000,000 shares authorized:

Series A Preferred Stock, 8,000,000 shares authorized, liquidation

preference ($10.00 per share), 2,165,637 and 1,915,637 shares

issued and outstanding at September 30, 2024 and

December 31, 2023 (Liquidation preference: $21,488,629 and

$18,988,390 as of September 30, 2024 and December 31,

2023, respectively) |

|

21,593 |

|

|

|

18,988 |

|

|

Series C Preferred stock, $0.0001 par value: 25,000 shares

authorized; no shares issued or outstanding |

|

— |

|

|

|

— |

|

|

Common stock, $0.0001 par value: 10,000,000 shares authorized;

3,218,429 and 3,165,243 shares issued and outstanding (net of

treasury shares) at September 30, 2024 and December 31,

2023, respectively * |

|

2 |

|

|

|

2 |

|

|

Treasury stock, at cost; 102,487 and 51,770 shares at

September 30, 2024 and December 31, 2023, respectively

* |

|

(5,946 |

) |

|

|

(5,728 |

) |

| Additional paid-in

capital |

|

158,795 |

|

|

|

160,126 |

|

| Accumulated deficit |

|

(116,070 |

) |

|

|

(108,089 |

) |

|

Total stockholders’ equity |

|

58,374 |

|

|

|

65,299 |

|

|

Total liabilities and stockholders’ equity |

$ |

85,723 |

|

|

$ |

75,496 |

|

|

|

|

*All share amounts reflect 1 for 5 reverse stock split effective

June 14, 2024, retroactively |

|

|

|

Star Equity Holdings, Inc.Reconciliation

of Non-GAAP Financial Measures(Unaudited) (In

thousands, except per share amounts) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income (loss) from

continuing operations |

$ |

(1,970 |

) |

|

$ |

(2,365 |

) |

|

$ |

(7,981 |

) |

|

$ |

(3,715 |

) |

|

Acquired intangible amortization |

|

724 |

|

|

|

430 |

|

|

|

1,756 |

|

|

|

1,290 |

|

|

Unrealized loss (gain) on equity securities (1) |

|

221 |

|

|

|

971 |

|

|

|

296 |

|

|

|

24 |

|

|

Unrealized loss (gain) on lumber derivatives (2) |

|

— |

|

|

|

137 |

|

|

|

19 |

|

|

|

(10 |

) |

|

Litigation costs |

|

96 |

|

|

|

— |

|

|

|

151 |

|

|

|

— |

|

|

Transaction costs related to sale (3) |

|

1 |

|

|

|

123 |

|

|

|

93 |

|

|

|

1,281 |

|

|

Transaction costs related to mergers and acquisitions (4) |

|

218 |

|

|

|

17 |

|

|

|

762 |

|

|

|

17 |

|

|

Purchase accounting adjustment (5) |

|

212 |

|

|

|

— |

|

|

|

786 |

|

|

|

— |

|

|

Impairment of cost method investment |

|

2,796 |

|

|

|

— |

|

|

|

4,086 |

|

|

|

— |

|

|

Loss (gain) on equity method investment |

|

621 |

|

|

|

— |

|

|

|

621 |

|

|

|

— |

|

|

Gains on sale and leaseback transactions |

|

(3,755 |

) |

|

|

— |

|

|

|

(3,755 |

) |

|

|

— |

|

|

Write off of lease liabilities |

|

(74 |

) |

|

|

240 |

|

|

|

(74 |

) |

|

|

240 |

|

|

Financing costs (6) |

|

13 |

|

|

|

2 |

|

|

|

28 |

|

|

|

151 |

|

|

Income tax (benefit) provision |

|

(18 |

) |

|

|

171 |

|

|

|

(22 |

) |

|

|

232 |

|

| Non-GAAP adjusted net

income (loss) from continuing operations |

$ |

(915 |

) |

|

$ |

204 |

|

|

$ |

(3,234 |

) |

|

$ |

(190 |

) |

| |

|

|

|

|

|

|

|

| Net income (loss) from

continuing operations per diluted share |

$ |

(0.61 |

) |

|

$ |

(0.75 |

) |

|

$ |

(2.52 |

) |

|

$ |

(1.18 |

) |

|

Acquired intangible amortization |

|

0.22 |

|

|

|

0.14 |

|

|

|

0.55 |

|

|

|

0.41 |

|

|

Unrealized loss (gain) on equity securities (1) |

|

0.07 |

|

|

|

0.31 |

|

|

|

0.09 |

|

|

|

0.01 |

|

|

Unrealized loss (gain) on lumber derivatives (2) |

|

— |

|

|

|

0.04 |

|

|

|

0.01 |

|

|

|

— |

|

|

Litigation costs |

|

0.03 |

|

|

|

— |

|

|

|

0.05 |

|

|

|

— |

|

|

Transaction costs related to sale (3) |

|

— |

|

|

|

0.04 |

|

|

|

0.03 |

|

|

|

0.41 |

|

|

Transaction costs related to mergers and acquisitions (4) |

|

0.07 |

|

|

|

0.01 |

|

|

|

0.24 |

|

|

|

0.01 |

|

|

Purchase accounting adjustment (5) |

|

0.07 |

|

|

|

— |

|

|

|

0.25 |

|

|

|

— |

|

|

Impairment of cost method investment |

|

0.87 |

|

|

|

— |

|

|

|

1.29 |

|

|

|

— |

|

|

Loss (gain) on equity method investment |

|

0.19 |

|

|

|

— |

|

|

|

0.20 |

|

|

|

— |

|

|

Gains on sale and leaseback transactions |

|

(1.16 |

) |

|

|

— |

|

|

|

(1.18 |

) |

|

|

— |

|

|

Write off of lease liabilities |

|

(0.02 |

) |

|

|

0.08 |

|

|

|

(0.02 |

) |

|

|

0.08 |

|

|

Financing costs (6) |

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

0.05 |

|

|

Income tax (benefit) provision |

|

(0.01 |

) |

|

|

0.05 |

|

|

|

(0.01 |

) |

|

|

0.07 |

|

| Non-GAAP adjusted net

income (loss) from continuing operations per basic and diluted

share (7) |

$ |

(0.29 |

) |

|

$ |

0.07 |

|

|

$ |

(1.03 |

) |

|

$ |

(0.06 |

) |

| |

|

(1) Reflects adjustments for any unrealized gains or losses in

equity securities. |

|

(2) Reflects adjustments for any unrealized gains or losses in

lumber derivatives value. |

|

(3) Reflects transaction costs related to the sale of the

Healthcare Division. |

|

(4) Reflects transaction costs related to potential mergers

and acquisitions. |

|

(5) Reflects the purchase accounting adjustments related to

the fair value of inventory and earn-out that impacted net

income. |

|

(6) Reflects financing costs from our credit facilities. |

|

(7) Per share amounts are computed independently for each

discrete item presented. Therefore, the sum of the quarterly per

share amounts will not necessarily equal the total for the year,

and the sum of individual items may not equal the total. |

|

|

|

Star Equity Holdings, Inc.Reconciliation

of Non-GAAP Financial Measures(Unaudited) (In

thousands) |

| |

| For The

Three Months Ended

September 30, 2024 |

Building Solutions |

|

Investments |

|

Star Equity Corporate |

|

Total |

| |

|

|

|

|

|

|

|

|

Net income (loss) from continuing operations |

$ |

(627 |

) |

|

$ |

569 |

|

|

$ |

(1,912 |

) |

|

$ |

(1,970 |

) |

| Depreciation and

amortization |

|

997 |

|

|

|

29 |

|

|

|

9 |

|

|

|

1,035 |

|

| Interest (income) expense |

|

164 |

|

|

|

(175 |

) |

|

|

(30 |

) |

|

|

(41 |

) |

| Income tax (benefit)

provision |

|

— |

|

|

|

— |

|

|

|

(18 |

) |

|

|

(18 |

) |

| EBITDA from continuing

operations |

|

534 |

|

|

|

423 |

|

|

|

(1,951 |

) |

|

|

(994 |

) |

| |

|

|

|

|

|

|

|

| Unrealized loss (gain) on

equity securities (1) |

|

— |

|

|

|

221 |

|

|

|

— |

|

|

|

221 |

|

| Interest income(3) |

|

— |

|

|

|

264 |

|

|

|

— |

|

|

|

264 |

|

| Litigation costs |

|

— |

|

|

|

— |

|

|

|

96 |

|

|

|

96 |

|

| Stock-based compensation |

|

5 |

|

|

|

— |

|

|

|

53 |

|

|

|

58 |

|

| Transaction costs related to

sale (4) |

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

1 |

|

| Transaction costs related to

mergers and acquisitions (5) |

|

— |

|

|

|

— |

|

|

|

218 |

|

|

|

218 |

|

| Purchase accounting adjustment

(6) |

|

212 |

|

|

|

— |

|

|

|

— |

|

|

|

212 |

|

| Impairment of cost method

investment |

|

— |

|

|

|

2,796 |

|

|

|

— |

|

|

|

2,796 |

|

| Loss (gain) on equity method

investment |

|

— |

|

|

|

621 |

|

|

|

— |

|

|

|

621 |

|

| Gains on sale and leaseback

transactions |

|

— |

|

|

|

(3,755 |

) |

|

|

— |

|

|

|

(3,755 |

) |

| Write off of Lease

liabilities |

|

(74 |

) |

|

|

— |

|

|

|

— |

|

|

|

(74 |

) |

| Financing costs (7) |

|

7 |

|

|

|

— |

|

|

|

6 |

|

|

|

13 |

|

| Non-GAAP adjusted

EBITDA from continuing operations |

$ |

684 |

|

|

$ |

570 |

|

|

$ |

(1,577 |

) |

|

$ |

(323 |

) |

| |

|

|

|

|

|

|

|

|

| For The

Three Months Ended

September 30, 2023 |

|

Building Solutions |

|

Investments |

|

Star Equity Corporate |

|

Total |

| |

|

|

|

|

|

|

|

|

|

Net income (loss) from continuing operations |

|

|

(108 |

) |

|

|

(763 |

) |

|

|

(1,494 |

) |

|

$ |

(2,365 |

) |

| Depreciation and

amortization |

|

|

515 |

|

|

|

45 |

|

|

|

9 |

|

|

|

569 |

|

| Interest (income) expense |

|

|

7 |

|

|

|

(193 |

) |

|

|

(247 |

) |

|

|

(433 |

) |

| Income tax (benefit)

provision |

|

|

1 |

|

|

|

— |

|

|

|

170 |

|

|

|

171 |

|

| EBITDA from continuing

operations |

|

|

415 |

|

|

|

(911 |

) |

|

|

(1,562 |

) |

|

|

(2,058 |

) |

| |

|

|

|

|

|

|

|

|

| Unrealized loss (gain) on

equity securities (1) |

|

|

— |

|

|

|

971 |

|

|

|

— |

|

|

|

971 |

|

| Unrealized loss (gain) on

lumber derivatives (2) |

|

|

137 |

|

|

|

— |

|

|

|

— |

|

|

|

137 |

|

| Interest income(3) |

|

|

— |

|

|

|

440 |

|

|

|

— |

|

|

|

440 |

|

| Litigation costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Stock-based compensation |

|

|

9 |

|

|

|

— |

|

|

|

67 |

|

|

|

76 |

|

| Transaction costs related to

sale (4) |

|

|

— |

|

|

|

— |

|

|

|

123 |

|

|

|

123 |

|

| Transaction costs related to

mergers and acquisitions |

|

|

— |

|

|

|

— |

|

|

|

17 |

|

|

|

17 |

|

| (Gain) Loss on sale of

buildings |

|

|

0 |

|

|

|

38 |

|

|

|

— |

|

|

|

38 |

|

| Write off of lease

liabilities |

|

|

240 |

|

|

|

— |

|

|

|

— |

|

|

|

240 |

|

| Financing costs (7) |

|

$ |

2 |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

| Non-GAAP adjusted

EBITDA from continuing operations |

|

$ |

803 |

|

|

$ |

538 |

|

|

$ |

(1,355 |

) |

|

$ |

(14 |

) |

| |

|

(1) Reflects adjustments for any unrealized gains or losses on

equity securities. |

|

(2) Reflects adjustments for any unrealized gains or losses in

lumber derivatives value. |

|

(3) We allocate all corporate interest income to the

Investments Division. |

|

(4) Reflects transaction costs related to the sale of the

Healthcare Division. |

|

(5) Reflects transaction costs related to potential mergers

and acquisitions |

|

(6) Reflects the purchase accounting adjustments related to

the fair value of inventory and earn-out that impacted net

income. |

|

(7) Reflects financing costs from our credit facilities. |

| |

| For The

Nine Months Ended September 30,

2024 |

Building Solutions |

|

Investments |

|

Star Equity Corporate |

|

Total |

| |

|

|

|

|

|

|

|

|

Net income (loss) from continuing operations |

$ |

(2,667 |

) |

|

$ |

(233 |

) |

|

$ |

(5,081 |

) |

|

$ |

(7,981 |

) |

| Depreciation and

amortization |

|

2,338 |

|

|

|

146 |

|

|

|

34 |

|

|

|

2,518 |

|

| Interest (income) expense |

|

338 |

|

|

|

(565 |

) |

|

|

(409 |

) |

|

|

(636 |

) |

| Income tax (benefit)

provision |

|

— |

|

|

|

— |

|

|

|

(22 |

) |

|

|

(22 |

) |

| EBITDA |

|

9 |

|

|

|

(652 |

) |

|

|

(5,478 |

) |

|

|

(6,121 |

) |

| |

|

|

|

|

|

|

|

| Unrealized loss (gain) on

equity securities (1) |

|

— |

|

|

|

296 |

|

|

|

— |

|

|

|

296 |

|

| Unrealized loss (gain) on

lumber derivatives (2) |

|

19 |

|

|

|

— |

|

|

|

— |

|

|

|

19 |

|

| Interest income (3) |

|

— |

|

|

|

1,034 |

|

|

|

— |

|

|

|

1,034 |

|

| Litigation costs (3) |

|

— |

|

|

|

— |

|

|

|

151 |

|

|

|

151 |

|

| Stock-based compensation |

|

29 |

|

|

|

— |

|

|

|

157 |

|

|

|

186 |

|

| Gain on disposal of Healthcare

Division (3) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Transaction costs related to

sale (4) |

|

— |

|

|

|

— |

|

|

|

93 |

|

|

|

93 |

|

| Transaction costs related to

mergers and acquisitions (5) |

|

— |

|

|

|

— |

|

|

|

762 |

|

|

|

762 |

|

| Purchase accounting adjustment

(6) |

|

786 |

|

|

|

— |

|

|

|

— |

|

|

|

786 |

|

| Impairment of cost method

investment |

|

— |

|

|

|

4,086 |

|

|

|

— |

|

|

|

4,086 |

|

| Loss (gain) on equity method

investment |

|

— |

|

|

|

621 |

|

|

|

— |

|

|

|

621 |

|

| Gains on sale and leaseback

transactions |

|

— |

|

|

|

(3,755 |

) |

|

|

— |

|

|

|

(3,755 |

) |

| Write off of Lease

Liabilities |

|

(74 |

) |

|

|

— |

|

|

|

— |

|

|

|

(74 |

) |

| Financing costs (7) |

|

22 |

|

|

|

— |

|

|

|

6 |

|

|

|

28 |

|

| Non-GAAP adjusted

EBITDA |

$ |

791 |

|

|

$ |

1,630 |

|

|

$ |

(4,309 |

) |

|

$ |

(1,888 |

) |

| |

|

|

|

|

|

|

|

| For The

Nine Months Ended September 30,

2023 |

Building Solutions |

|

Investments |

|

Star Equity Corporate |

|

Total |

| |

|

|

|

|

|

|

|

|

Net income (loss) from continuing operations |

|

1,746 |

|

|

|

178 |

|

|

|

(5,639 |

) |

|

$ |

(3,715 |

) |

| Depreciation and

amortization |

|

1,530 |

|

|

|

169 |

|

|

|

21 |

|

|

|

1,720 |

|

| Interest expense |

|

52 |

|

|

|

(276 |

) |

|

|

(345 |

) |

|

|

(569 |

) |

| Income tax (benefit)

provision |

|

1 |

|

|

|

— |

|

|

|

231 |

|

|

|

232 |

|

| EBITDA |

|

3,329 |

|

|

|

71 |

|

|

|

(5,732 |

) |

|

|

(2,332 |

) |

| |

|

|

|

|

|

|

|

| Unrealized loss (gain) on

equity securities (1) |

|

— |

|

|

|

24 |

|

|

|

— |

|

|

|

24 |

|

| Unrealized loss (gain) on

lumber derivatives (2) |

|

(10 |

) |

|

|

— |

|

|

|

— |

|

|

|

(10 |

) |

| Interest Income |

|

— |

|

|

|

686 |

|

|

|

— |

|

|

|

686 |

|

| Stock-based compensation |

|

18 |

|

|

|

— |

|

|

|

261 |

|

|

|

279 |

|

| Transaction costs related to

sale (4) |

|

— |

|

|

|

— |

|

|

|

1,281 |

|

|

|

1,281 |

|

| Transaction costs related to

mergers and acquisitions (5) |

|

0 |

|

|

|

0 |

|

|

|

17 |

|

|

|

17 |

|

| Loss (Gain) on sale of

assets |

|

— |

|

|

|

(386 |

) |

|

|

— |

|

|

|

(386 |

) |

| Write off of lease

liabilities |

|

240 |

|

|

|

— |

|

|

|

— |

|

|

|

240 |

|

| Financing costs (7) |

|

134 |

|

|

|

17 |

|

|

|

— |

|

|

|

151 |

|

| Non-GAAP adjusted

EBITDA |

$ |

3,711 |

|

|

$ |

412 |

|

|

$ |

(4,173 |

) |

|

$ |

(50 |

) |

| |

|

(1) Reflects adjustments for any unrealized gains or losses on

equity securities. |

|

(2) Reflects adjustments for any unrealized gains or losses in

lumber derivatives value. |

|

(3) We allocate all corporate interest income to the

Investments Division. |

|

(4) Reflects transaction costs related to the sale of the

Healthcare Division. |

|

(5) Reflects transaction costs related to potential mergers

and acquisitions. |

|

(6) Reflects the TT purchase accounting adjustments related to

the fair value of inventory and earn-out that impacted net

income. |

|

(7) Reflects financing costs from our credit facilities. |

| |

A summary of the Company’s credit facilities are

as follows:

|

|

|

Star Equity Holdings, Inc.Supplemental

Debt Information(Unaudited) (In

thousands) |

| |

| |

September 30, 2024 |

|

December 31, 2023 |

| |

Amount |

|

Weighted-Average Interest Rate |

|

Amount |

|

Weighted-Average Interest Rate |

|

Revolving Credit Facility - Premier EBGL |

$ |

1,467 |

|

|

|

8.75 |

% |

|

$ |

2,019 |

|

|

|

9.25 |

% |

| Revolving Credit Facility -

KeyBank KBS |

$ |

58 |

|

|

|

8.38 |

% |

|

$ |

— |

|

|

|

— |

% |

| Total Short-term

Revolving Credit Facilities |

$ |

1,525 |

|

|

|

8.74 |

% |

|

$ |

2,019 |

|

|

|

9.25 |

% |

| Bridgewater - TT Term

Loan |

$ |

1,400 |

|

|

|

7.85 |

% |

|

$ |

— |

|

|

|

— |

% |

| Term Loan Secured by

Mortgage |

|

359 |

|

|

|

7.50 |

% |

|

|

— |

|

|

|

— |

% |

| Total Short-term

debt |

$ |

3,284 |

|

|

|

8.19 |

% |

|

$ |

2,019 |

|

|

|

9.25 |

% |

| |

|

|

|

|

|

|

|

| Bridgewater - TT Term Loan,

net of current portion |

$ |

5,130 |

|

|

|

7.85 |

% |

|

$ |

— |

|

|

|

— |

% |

| Term Loan Secured by Mortgage,

net of current portion |

|

2,700 |

|

|

|

7.50 |

% |

|

|

— |

|

|

|

— |

% |

| Long Term Debt, net of

current portion |

$ |

7,830 |

|

|

|

7.73 |

% |

|

$ |

— |

|

|

|

— |

% |

| |

|

|

|

|

|

|

|

| Total

Debt |

$ |

11,114 |

|

|

|

7.88 |

% |

|

$ |

2,019 |

|

|

|

9.25 |

% |

|

|

|

Star Equity Holdings, Inc.Supplemental

Segment Information(Unaudited) (In

thousands) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue by segment: |

|

|

|

|

|

|

|

|

Building Solutions |

$ |

13,663 |

|

|

$ |

10,435 |

|

|

$ |

36,264 |

|

|

$ |

31,674 |

|

|

Investments |

|

156 |

|

|

|

89 |

|

|

|

538 |

|

|

|

405 |

|

|

Intersegment elimination |

|

(156 |

) |

|

|

(89 |

) |

|

|

(538 |

) |

|

|

(405 |

) |

| Consolidated revenue |

$ |

13,663 |

|

|

$ |

10,435 |

|

|

$ |

36,264 |

|

|

$ |

31,674 |

|

| |

|

|

|

|

|

|

|

| Gross profit (loss) by

segment: |

|

|

|

|

|

|

|

|

Building Solutions |

$ |

2,846 |

|

|

$ |

2,248 |

|

|

$ |

6,753 |

|

|

$ |

9,241 |

|

|

Investments |

|

127 |

|

|

|

44 |

|

|

|

392 |

|

|

|

236 |

|

|

Intersegment elimination |

|

(156 |

) |

|

|

(89 |

) |

|

|

(538 |

) |

|

|

(405 |

) |

| Consolidated gross profit |

$ |

2,817 |

|

|

$ |

2,203 |

|

|

$ |

6,607 |

|

|

$ |

9,072 |

|

| |

|

|

|

|

|

|

|

| Income (loss) from continuing

operations by segment: |

|

|

|

|

|

|

|

|

Building Solutions |

$ |

(578 |

) |

|

$ |

(21 |

) |

|

$ |

(2,318 |

) |

|

$ |

1,960 |

|

|

Investments |

|

(2,745 |

) |

|

|

(71 |

) |

|

|

(3,892 |

) |

|

|

(527 |

) |

|

Corporate, eliminations and other |

|

(1,999 |

) |

|

|

(1,569 |

) |

|

|

(5,787 |

) |

|

|

(4,978 |

) |

| Segment income (loss) from

operations |

$ |

(5,322 |

) |

|

$ |

(1,661 |

) |

|

$ |

(11,997 |

) |

|

$ |

(3,545 |

) |

| |

|

|

|

|

|

|

|

| Depreciation and amortization

by segment: |

|

|

|

|

|

|

|

|

Building Solutions |

$ |

997 |

|

|

$ |

515 |

|

|

$ |

2,338 |

|

|

$ |

1,530 |

|

|

Investments |

|

29 |

|

|

|

45 |

|

|

|

146 |

|

|

|

169 |

|

|

Star Equity corporate |

|

9 |

|

|

|

9 |

|

|

|

34 |

|

|

|

21 |

|

| Total depreciation and

amortization |

$ |

1,035 |

|

|

$ |

569 |

|

|

$ |

2,518 |

|

|

$ |

1,720 |

|

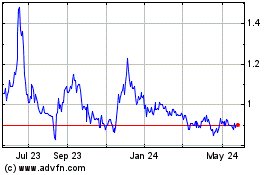

Star Equity (NASDAQ:STRR)

Historical Stock Chart

From Nov 2024 to Dec 2024

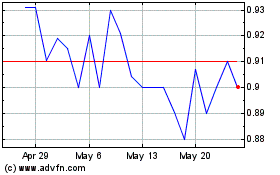

Star Equity (NASDAQ:STRR)

Historical Stock Chart

From Dec 2023 to Dec 2024