0000885508false00008855082024-11-132024-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2024

Stratus Properties Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37716 | | 72-1211572 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | | | | | | | | | |

| 212 Lavaca St., Suite 300 | |

| Austin, | | Texas | 78701 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code: (512) 478-5788

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | STRS | The NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

Stratus Properties Inc. issued a press release dated November 13, 2024, announcing its third-quarter and nine-month 2024 results. A copy of the press release is furnished hereto as Exhibit 99.1.

The information furnished in this Item 2.02 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit Number | Exhibit Title |

| Press release dated November 13, 2024, titled “Stratus Properties Inc. Reports Third-Quarter and Nine-Month 2024 Results.” |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Stratus Properties Inc.

| | | | | | | | |

| By: | /s/ Erin D. Pickens |

| | Erin D. Pickens |

| | Senior Vice President and Chief Financial Officer (authorized signatory and Principal Financial Officer and Principal Accounting Officer) |

Date: November 13, 2024

| | | | | |

| NEWS RELEASE |

| NASDAQ Symbol: “STRS” |

| Stratus Properties Inc. | Financial and Media Contact: |

| 212 Lavaca St., Suite 300 | William H. Armstrong III |

| Austin, Texas 78701 | (512) 478-5788 |

STRATUS PROPERTIES INC.

REPORTS THIRD-QUARTER AND NINE-MONTH 2024 RESULTS

——————————————————————————————————————————

AUSTIN, TX, November 13, 2024 - Stratus Properties Inc. (NASDAQ: STRS), a residential and retail focused real estate company with operations in the Austin, Texas area and other select markets in Texas, today reported third-quarter and nine-month 2024 results.

Highlights and Recent Developments:

•Net loss attributable to common stockholders totaled $0.4 million, or $0.05 per diluted share, in third-quarter 2024, compared to net loss attributable to common stockholders of $2.8 million, or $0.36 per diluted share, in third-quarter 2023. During the first nine months of 2024, net income attributable to common stockholders totaled $2.5 million, or $0.30 per diluted share, compared to net loss attributable to common stockholders of $13.9 million, or $1.74 per diluted share, during the first nine months of 2023.

•Revenues for third-quarter 2024 were $8.9 million compared to revenues of $3.7 million for third-quarter 2023, with the increase primarily due to the sale of one Amarra Villas home in third-quarter 2024 for $4.0 million, compared to none sold in third-quarter 2023, as well as an increase in rental revenue primarily related to The Saint June, which had minimal rental revenue in third-quarter 2023 as it commenced operations in mid-2023. Revenues totaled $43.9 million for the first nine months of 2024 compared to revenues of $13.0 million for the first nine months of 2023. The increase was primarily the result of the sales of approximately 47 acres of undeveloped land at Magnolia Place for $14.5 million and four Amarra Villas homes for an aggregate of $15.2 million in the first nine months of 2024, compared with the sale of one Amarra Villas home in the first nine months of 2023 for $2.5 million.

•In third-quarter 2024, Stratus closed on the sale of Magnolia Place – Retail for $8.9 million. The sale generated pre-tax net cash proceeds of approximately $8.6 million and a pre-tax gain of $1.6 million. With the completion of the sale of Magnolia Place – Retail, as of November 8, 2024, property sales at our Magnolia Place development project totaled approximately $30.0 million. Following the sales, Stratus retained potential development of approximately 11 acres planned for 275 multi-family units and approximately $12 million of potential future reimbursements from the municipal utility district (MUD), with no project debt.

•Stratus had $19.6 million of cash and cash equivalents at September 30, 2024 and no amounts drawn on its revolving credit facility. As of September 30, 2024, Stratus had $39.6 million available under the revolving credit facility.

•Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) totaled $3.9 million in the first nine months of 2024, compared to $(9.9) million in the first nine months of 2023. For a reconciliation of net loss to EBITDA, see the supplemental schedule, “Reconciliation of Non-GAAP Measure EBITDA,” below.

•As of November 8, 2024, occupancy at The Saint June, a 182-unit luxury garden-style multi-family project in Barton Creek, which was completed in fourth-quarter 2023, was approximately 97 percent.

•Stratus continues construction on The Saint George, the last four Amarra Villas homes and Holden Hills.

William H. Armstrong III, Chairman of the Board and Chief Executive Officer of Stratus, stated, “During the first nine months of 2024, we completed property sales totaling $38.6 million, consisting of the sales of undeveloped land at Magnolia Place for $14.5 million, Magnolia Place – Retail for $8.9 million and four Amarra Villas homes for an aggregate of $15.2 million. The average sales price of the Amarra Villas homes was substantially higher than the prior-year period. Our retail projects are performing well, and it bears repeating that our stabilized and under-construction projects and future development plans have no exposure to commercial office space. Although the real estate business remains challenging, we see reasons for optimism that real estate market conditions will improve in our markets over the next 12 months.”

Summary Financial Results | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In Thousands, Except Per Share Amounts) (Unaudited) |

| Revenues | | | | | | | |

| Real Estate Operations | $ | 3,971 | | | $ | — | | | $ | 29,723 | | | $ | 2,551 | |

| Leasing Operations | 4,920 | | | 3,669 | | | 14,165 | | | 10,450 | |

| | | | | | | |

| Total consolidated revenue | $ | 8,891 | | | $ | 3,669 | | | $ | 43,888 | | | $ | 13,001 | |

| | | | | | | |

| Operating (loss) income | | | | | | | |

| Real Estate Operations | $ | (1,421) | | | $ | (1,505) | | | $ | 4,541 | | | $ | (6,215) | |

Leasing Operations a | 3,249 | | | 1,354 | | | 6,327 | | | 3,900 | |

Corporate, eliminations and other b | (3,347) | | | (3,178) | |

| (11,622) | | | (11,959) | |

| Total consolidated operating loss | $ | (1,519) | | | $ | (3,329) | | | $ | (754) | | | $ | (14,274) | |

| | | | | | | |

| Net loss | $ | (1,414) | | | $ | (3,217) | | | $ | (495) | | | $ | (14,799) | |

Net loss attributable to noncontrolling interests in subsidiaries c | $ | 1,050 | | | $ | 373 | | | $ | 2,958 | | | $ | 853 | |

Net (loss) income attributable to common stockholders | $ | (364) | | | $ | (2,844) | | | $ | 2,463 | | | $ | (13,946) | |

| | | | | | | |

Basic net (loss) income per share attributable to common stockholders | $ | (0.05) | | | $ | (0.36) | | | $ | 0.31 | | | $ | (1.74) | |

| | | | | | | |

Diluted net (loss) income per share attributable to common stockholders | $ | (0.05) | | | $ | (0.36) | | | $ | 0.30 | | | $ | (1.74) | |

| | | | | | | |

EBITDA | $ | 9 | | | $ | (1,894) | | | $ | 3,877 | | | $ | (9,918) | |

| | | | | | | |

Capital expenditures and purchases and development of real estate properties | $ | 13,428 | | | $ | 26,314 | | | $ | 45,887 | | | $ | 70,875 | |

| | | | | | | |

Weighted-average shares of common stock outstanding: | | | | | | | |

Basic | 8,080 | | | 8,003 | | | 8,059 | | | 7,993 | |

| Diluted | 8,080 | | | 8,003 | | | 8,186 | | | 7,993 | |

a.Includes a pre-tax gain on the sale of Magnolia Place – Retail in third-quarter 2024 of $1.6 million.

b.Includes consolidated general and administrative expenses and eliminations of intersegment amounts.

c.Represents noncontrolling interest partners’ share in the results of the consolidated projects in which they participate.

Results of Operations

Stratus’ revenues totaled $8.9 million in third-quarter 2024 compared with $3.7 million in third-quarter 2023. The $4.0 million increase in revenue from the Real Estate Operations segment in third-quarter 2024, compared to third-quarter 2023, reflects the sale of one Amarra Villas home for $4.0 million, compared to none sold in third-quarter 2023.

The $1.3 million increase in revenue from the Leasing Operations segment in third-quarter 2024, compared to third-quarter 2023, primarily reflects new revenue from The Saint June, which had minimal rental revenue in third-quarter 2023 as it commenced operations in mid-2023, as well as increased revenue from Kingwood Place and Lantana Place – Retail, primarily due to new leases.

Debt and Liquidity

At September 30, 2024, consolidated debt totaled $181.5 million and consolidated cash and cash equivalents totaled $19.6 million, compared with consolidated debt of $175.2 million and consolidated cash and cash equivalents of $31.4 million at December 31, 2023. Debt increased primarily due to draws on project construction loans for The Saint George and Holden Hills and the Amarra Villas credit facility, partially offset by the payoff of the Magnolia Place construction loan and paydowns on the Amarra Villas credit facility and The Annie B land loan.

In October 2024, The Saint June construction loan was modified to (i) extend the maturity date of the loan to October 2, 2025; (ii) increase the aggregate commitment under the loan by $2.0 million to $32.3 million; (iii) decrease the interest rate applicable margin from 2.85 percent to 2.35 percent; and (iv) require payment of an exit fee for prepayments and repayments of the loan of 1.00 percent of the principal amount of such amounts repaid, subject to certain exceptions. Accordingly, the loan bears interest at the one-month Term SOFR plus 2.35 percent, subject to a 3.50 percent floor. The loan is payable in monthly installments of principal and interest of approximately $40,000, with the outstanding principal due at maturity. The Saint June, L.P. has an option to extend the maturity of the loan for an additional 12-month term if certain conditions are met.

As of September 30, 2024, Stratus had $39.6 million available under its revolving credit facility and no amount was borrowed. Letters of credit, totaling $13.3 million, had been issued under the revolving credit facility as of September 30, 2024, $11.0 million of which secure Stratus’ obligation to build certain roads and utilities facilities benefiting Holden Hills and Section N and $2.3 million of which secure Stratus’ obligations, which are subject to certain conditions, to construct and pay for certain utility infrastructure in Lakeway, Texas, estimated to cost approximately $2.3 million, which is expected to be utilized by the planned multi-family project on Stratus’ remaining land in Lakeway.

Purchases and development of real estate properties (included in operating cash flows) and capital expenditures (included in investing cash flows) totaled $45.9 million for the first nine months of 2024, primarily related to the development of Barton Creek properties (including Amarra Villas and Holden Hills) and The Saint George and to a lesser extent for tenant improvements at Lantana Place – Retail, compared with $70.9 million for the first nine months of 2023, primarily related to the development of Barton Creek properties (including The Saint June, Amarra Villas and Holden Hills) and The Saint George.

Stratus is currently discussing options to refinance the Kingwood Place construction loan, the Lantana Place construction loan and the Jones Crossing loan, with the expectation of tighter spreads and with potential additional proceeds. Stratus expects to refinance the Kingwood Place construction loan on or before the December 6, 2024 maturity date. In addition, if market rates continue to decline, interest on Stratus’ outstanding debt, all of which is variable rate, will continue to decline.

Share Repurchase Program

Following the completion of Stratus’ $10.0 million share repurchase program in October 2023 and with written consent from Comerica Bank, Stratus’ Board approved a new share repurchase program, which authorizes repurchases of up to $5.0 million of Stratus’ common stock. The share repurchase program

authorizes Stratus, in management’s and the Capital Committee of the Board’s discretion, to repurchase shares from time to time, subject to market conditions and other factors. The timing, price and number of shares that may be repurchased under the share repurchase program will be based on market conditions, applicable securities laws and other factors considered by management and the Capital Committee of the Board. Share repurchases under the program may be made from time to time through solicited or unsolicited transactions in the open market, in privately negotiated transactions or by other means in accordance with securities laws. The share repurchase program does not obligate Stratus to repurchase any specific amount of shares, does not have an expiration date, and may be suspended, modified or discontinued at any time without prior notice. As of September 30, 2024, Stratus had not purchased any shares under the program.

About Stratus

Stratus Properties Inc. is engaged primarily in the entitlement, development, management, leasing and sale of multi-family and single-family residential and commercial real estate properties in the Austin, Texas area and other select markets in Texas. In addition to our developed properties, we have a development portfolio that consists of approximately 1,600 acres of commercial and residential projects under development or undeveloped land held for future use. Our commercial real estate portfolio consists of stabilized retail properties or future retail and mixed-use development projects with no commercial office space. We generate revenues from the sale of our developed and undeveloped properties, the lease of our retail, mixed-use and multi-family properties and development and asset management fees received from our properties.

----------------------------------------------

CAUTIONARY STATEMENT

This press release contains forward-looking statements in which Stratus discusses factors it believes may affect its future performance. Forward-looking statements are all statements other than statements of historical fact, such as plans, projections or expectations related to inflation, interest rates, supply chain constraints, Stratus’ ability to pay or refinance its debt obligations as they become due, availability of bank credit, Stratus’ ability to meet its future debt service and other cash obligations, projected future operating loans or capital contributions to Stratus’ joint ventures, future cash flows and liquidity, the Austin and Texas real estate markets, the planning, financing, development, construction, completion and stabilization of Stratus’ development projects, plans to sell, recapitalize, or refinance properties, future operational and financial performance, municipal utility district (MUD) reimbursements for infrastructure costs, regulatory matters including the expected impact of Texas Senate Bill 2038 (the ETJ Law) and related ongoing litigation, leasing activities, tax rates, future capital expenditures and financing plans, possible joint ventures, partnerships, or other strategic relationships, other plans and objectives of management for future operations and development projects, and potential future cash returns to shareholders, including the timing and amount of repurchases under Stratus’ share repurchase program. The words “anticipate,” “may,” “can,” “plan,” “believe,” “potential,” “estimate,” “expect,” “project,” “target,” “intend,” “likely,” “will,” “should,” “to be” and any similar expressions and/or statements are intended to identify those assertions as forward-looking statements.

Under Stratus’ Comerica Bank debt agreements, Stratus is not permitted to repurchase its common stock in excess of $1.0 million or pay dividends on its common stock without Comerica Bank’s prior written consent, which we obtained in connection with our current $5.0 million share repurchase program. Any future declaration of dividends or decision to repurchase Stratus’ common stock is at the discretion of Stratus’ Board, subject to restrictions under Stratus’ Comerica Bank debt agreements, and will depend on Stratus’ financial results, cash requirements, projected compliance with covenants in its debt agreements, outlook and other factors deemed relevant by the Board. Stratus’ future debt agreements, future refinancings of or amendments to existing debt agreements or other future agreements may restrict Stratus’ ability to declare dividends or repurchase shares.

Stratus cautions readers that forward-looking statements are not guarantees of future performance, and its actual results may differ materially from those anticipated, expected, projected or assumed in the forward-looking statements. Important factors that can cause Stratus’ actual results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, Stratus’ ability to implement its business strategy successfully, including its ability to develop, construct and sell or lease properties on terms its Board considers acceptable, increases in operating and construction costs, including real estate taxes, maintenance and insurance costs, and the cost of building materials and labor, increases in inflation and interest rates, supply chain constraints, Stratus’ ability to pay or refinance its debt, extend maturity dates of its loans or comply with or obtain waivers of financial and other covenants in debt agreements and to meet other cash obligations, availability of bank credit, defaults by contractors and subcontractors, declines in the market value of Stratus’ assets, market conditions or corporate developments that could preclude, impair or delay any opportunities with respect to plans to sell, recapitalize or refinance properties, a decrease in the demand for real estate in select markets in Texas where Stratus operates, particularly in Austin, changes in economic, market, tax, business and geopolitical conditions, potential U.S. or local economic downturn or recession, the availability and terms of financing for development projects and other corporate purposes, Stratus’ ability to collect anticipated rental payments and close projected asset sales, loss of key personnel, Stratus’ ability to enter into and maintain joint ventures, partnerships, or other strategic relationships, including risks associated with such joint ventures, any major public health crisis, eligibility for and potential receipt and timing of receipt of MUD reimbursements, industry risks, changes in buyer preferences, potential additional impairment charges, competition from other real estate developers, Stratus’ ability to obtain various entitlements and permits, changes in laws, regulations or the regulatory environment affecting the development of real estate, opposition from special interest groups or local governments with respect to development projects, weather- and climate-related risks, environmental and litigation risks including the timing and resolution of the ongoing litigation challenging the ETJ Law and our ability to implement any revised development plans in light of the ETJ Law, the failure to attract buyers or tenants for Stratus’ developments or such buyers’ or tenants’ failure to satisfy their purchase commitments or leasing obligations, cybersecurity incidents and other factors described in more detail under the heading “Risk Factors” in Stratus’ Annual Report on Form 10-K for the year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission (SEC).

Investors are cautioned that many of the assumptions upon which Stratus’ forward-looking statements are based are likely to change after the date the forward-looking statements are made. Further, Stratus may make changes to its business plans that could affect its results. Stratus cautions investors that it undertakes no obligation to update any forward-looking statements, which speak only as of the date made, notwithstanding any changes in its assumptions, business plans, actual experience or other changes.

This press release also includes EBITDA, which is not recognized under U.S. generally accepted accounting principles (GAAP). Stratus’ management believes this measure can be helpful to investors in evaluating its business because EBITDA is a financial measure frequently used by securities analysts, lenders and others to evaluate Stratus' recurring operating performance. EBITDA is intended to be a performance measure that should not be regarded as more meaningful than GAAP measures. Other companies may calculate EBITDA differently. As required by SEC rules, a reconciliation of Stratus’ net loss to EBITDA is included in the supplemental schedule of this press release.

A copy of this release is available on Stratus’ website, stratusproperties.com.

STRATUS PROPERTIES INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME (Unaudited)

(In Thousands, Except Per Share Amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Real estate operations | $ | 3,971 | | | $ | — | | | $ | 29,723 | | | $ | 2,551 | |

| Leasing operations | 4,920 | | | 3,669 | | | 14,165 | | | 10,450 | |

| Total revenues | 8,891 | | | 3,669 | | | 43,888 | | | 13,001 | |

| Cost of sales: | | | | | | | |

| Real estate operations | 5,344 | | | 1,467 | | | 25,046 | | | 8,651 | |

| Leasing operations | 1,964 | | | 1,381 | | | 5,384 | | | 3,786 | |

| Depreciation and amortization | 1,365 | | | 967 | | | 4,168 | | | 2,865 | |

| Total cost of sales | 8,673 | | | 3,815 | | | 34,598 | | | 15,302 | |

| Gain on sale of assets | (1,626) | | | — | | | (1,626) | | | — | |

| General and administrative expenses | 3,363 | | | 3,183 | | | 11,670 | | | 11,973 | |

| Total | 10,410 | | | 6,998 | | | 44,642 | | | 27,275 | |

| Operating loss | (1,519) | | | (3,329) | | | (754) | | | (14,274) | |

| Loss on extinguishment of debt | — | | | — | | | (59) | | | — | |

| Other income, net | 163 | | | 472 | | | 522 | | | 1,501 | |

| Loss before income taxes and equity in unconsolidated affiliate’s loss | (1,356) | | | (2,857) | | | (291) | | | (12,773) | |

| Provision for income taxes | (58) | | | (356) | | | (204) | | | (2,016) | |

| Equity in unconsolidated affiliate’s loss | — | | | (4) | | | — | | | (10) | |

| Net loss and total comprehensive loss | (1,414) | | | (3,217) | | | (495) | | | (14,799) | |

Total comprehensive loss attributable to noncontrolling interests a | 1,050 | | | 373 | | | 2,958 | | | 853 | |

| Net (loss) income and total comprehensive (loss) income attributable to common stockholders | $ | (364) | | | $ | (2,844) | | | $ | 2,463 | | | $ | (13,946) | |

| | | | | | | |

Basic net (loss) income per share attributable to common stockholders | $ | (0.05) | | | $ | (0.36) | | | $ | 0.31 | | | $ | (1.74) | |

| | | | | | | |

| Diluted net (loss) income per share attributable to common stockholders | $ | (0.05) | | | $ | (0.36) | | | $ | 0.30 | | | $ | (1.74) | |

| | | | | | | |

Weighted-average shares of common stock outstanding: | | | | | | | |

| Basic | 8,080 | | | 8,003 | | | 8,059 | | | 7,993 | |

| Diluted | 8,080 | | | 8,003 | | | 8,186 | | | 7,993 | |

| | | | | | | |

| | | | | | | |

a.Represents noncontrolling interest partners’ share in the results of the consolidated projects in which they participate.

STRATUS PROPERTIES INC.

CONSOLIDATED BALANCE SHEETS (Unaudited)

(In Thousands) | | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 19,638 | | | $ | 31,397 | |

| Restricted cash | 698 | | | 1,035 | |

| Real estate held for sale | 4,884 | | | 7,382 | |

| Real estate under development | 261,212 | | | 260,642 | |

| Land available for development | 74,912 | | | 47,451 | |

| Real estate held for investment, net | 137,177 | | | 144,112 | |

| Lease right-of-use assets | 10,368 | | | 11,174 | |

| Deferred tax assets | 173 | | | 173 | |

| Other assets | 14,118 | | | 14,400 | |

| Total assets | $ | 523,180 | | | $ | 517,766 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Liabilities: | | | |

| Accounts payable | $ | 12,341 | | | $ | 15,629 | |

| Accrued liabilities, including taxes | 6,283 | | | 6,660 | |

| Debt | 181,540 | | | 175,168 | |

| Lease liabilities | 15,564 | | | 15,866 | |

| Deferred gain | 2,131 | | | 2,721 | |

| Other liabilities | 5,186 | | | 7,117 | |

| Total liabilities | 223,045 | | | 223,161 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Equity: | | | |

| Stockholders’ equity: | | | |

| Common stock | 97 | | | 96 | |

| Capital in excess of par value of common stock | 200,557 | | | 197,735 | |

| Retained earnings | 29,108 | | | 26,645 | |

| Common stock held in treasury | (33,395) | | | (32,997) | |

| Total stockholders’ equity | 196,367 | | | 191,479 | |

| Noncontrolling interests in subsidiaries | 103,768 | | | 103,126 | |

| Total equity | 300,135 | | | 294,605 | |

| Total liabilities and equity | $ | 523,180 | | | $ | 517,766 | |

STRATUS PROPERTIES INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(In Thousands) | | | | | | | | | | | | |

| Nine Months Ended | |

| September 30, | |

| 2024 | | 2023 | |

| Cash flow from operating activities: | | | | |

| Net loss | $ | (495) | | | $ | (14,799) | | |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | |

| Depreciation and amortization | 4,168 | | | 2,865 | | |

| Cost of real estate sold | 19,115 | | | 2,080 | | |

| Loss on extinguishment of debt | 59 | | | — | | |

| Stock-based compensation | 1,314 | | | 1,479 | | |

| Debt issuance cost amortization | 1,028 | | | 631 | | |

| Gain on sale of assets | (1,626) | | | — | | |

| Equity in unconsolidated affiliate’s loss | — | | | 10 | | |

| | | | |

| Purchases and development of real estate properties | (22,925) | | | (34,697) | | |

| Write-off of capitalized project costs | 721 | | | — | | |

| Decrease in other assets | 233 | | | 2,223 | | |

| (Decrease) increase in accounts payable, accrued liabilities and other | (3,994) | | | 908 | | |

| Net cash used in operating activities | (2,402) | | | (39,300) | | |

| | | | |

| Cash flow from investing activities: | | | | |

| Capital expenditures | (22,962) | | | (36,178) | | |

| Proceeds from sale of assets, net of fees | 8,586 | | | — | | |

| Payments on master lease obligations | (649) | | | (730) | | |

| Other, net | — | | | 5 | | |

| Net cash used in investing activities | (15,025) | | | (36,903) | | |

| | | | |

| Cash flow from financing activities: | | | | |

| Borrowings from project loans | 27,672 | | | 41,656 | | |

| Payments on project and term loans | (25,058) | | | (8,472) | | |

Payment of dividends | (356) | | | (678) | | |

| Finance lease principal payments | (12) | | | (11) | | |

Stock-based awards net payments | (376) | | | (789) | | |

| Noncontrolling interest contribution | 3,600 | | | 40,000 | | |

| Purchases of treasury stock | — | | | (2,064) | | |

| Financing costs | (139) | | | (2,758) | | |

| Net cash provided by financing activities | 5,331 | | | 66,884 | | |

| Net decrease in cash, cash equivalents and restricted cash | (12,096) | | | (9,319) | | |

| Cash, cash equivalents and restricted cash at beginning of year | 32,432 | | | 45,709 | | |

| Cash, cash equivalents and restricted cash at end of period | $ | 20,336 | | | $ | 36,390 | | |

STRATUS PROPERTIES INC.

BUSINESS SEGMENTS

Stratus has two operating segments: Real Estate Operations and Leasing Operations.

The Real Estate Operations segment is comprised of Stratus’ real estate assets (developed for sale, under development and available for development), which consists of its properties in Austin, Texas (including the Barton Creek Community, which includes Section N, Holden Hills, Amarra multi-family and commercial land, Amarra Villas, Amarra Drive lots and other vacant land; the Circle C community; the Lantana community, which includes a portion of Lantana Place planned for a multi-family phase known as The Saint Julia; The Saint George; and the land for The Annie B); in Lakeway, Texas, located in the greater Austin area (Lakeway); in College Station, Texas (land for future phases of retail and multi-family development and retail pad sites at Jones Crossing); and in Magnolia, Texas (potential development of approximately 11 acres planned for future multi-family use), Kingwood, Texas (a retail pad site) and New Caney, Texas (New Caney), each located in the greater Houston area.

The Leasing Operations segment is comprised of Stratus’ real estate assets held for investment that are leased or available for lease and includes The Saint June, West Killeen Market, Kingwood Place, the retail portion of Lantana Place, the completed retail portion of Jones Crossing, retail pad sites subject to ground leases at Lantana Place, Kingwood Place and Jones Crossing, and, prior to its sale in third-quarter 2024, the retail portion of Magnolia Place.

Stratus uses operating income or loss to measure the performance of each segment. General and administrative expenses, which primarily consist of employee salaries, wages and other costs, are managed on a consolidated basis and are not allocated to Stratus’ operating segments. The following segment information reflects management determinations that may not be indicative of what the actual financial performance of each segment would be if it were an independent entity.

Summarized financial information by segment for the three months ended September 30, 2024, based on Stratus’ internal financial reporting system utilized by its chief operating decision maker, follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Real Estate Operations a | | Leasing Operations | | Corporate, Eliminations and Other b | | Total |

| Revenues: | | | | | | | |

| Unaffiliated customers | $ | 3,971 | | | $ | 4,920 | | | $ | — | | | $ | 8,891 | |

| Cost of sales, excluding depreciation and amortization | (5,344) | | | (1,964) | | | — | | | (7,308) | |

| Depreciation and amortization | (48) | | | (1,333) | | | 16 | | | (1,365) | |

Gain on sale of assets c | — | | | 1,626 | | | — | | | 1,626 | |

| General and administrative expenses | — | | | — | | | (3,363) | | | (3,363) | |

| Operating (loss) income | $ | (1,421) | | | $ | 3,249 | | | $ | (3,347) | | | $ | (1,519) | |

Capital expenditures and purchases and development of real estate properties | $ | 6,608 | | | $ | 6,820 | | | $ | — | | | $ | 13,428 | |

Total assets at September 30, 2024 d | 349,701 | | | 154,257 | | | 19,222 | | | 523,180 | |

a.Includes sales commissions and other revenues together with related expenses.

b.Includes consolidated general and administrative expenses and eliminations of intersegment amounts.

c.Represents a pre-tax gain on the sale of Magnolia Place – Retail in third-quarter 2024 of $1.6 million.

d.Corporate, eliminations and other includes cash and cash equivalents and restricted cash of $18.7 million. The remaining cash and cash equivalents and restricted cash is reflected in the operating segments’ assets.

Summarized financial information by segment for the three months ended September 30, 2023, based on Stratus’ internal financial reporting system utilized by its chief operating decision maker, follows (in thousands): | | | | | | | | | | | | | | | | | | | | | | | |

| Real Estate Operations a | | Leasing Operations | | Corporate, Eliminations and Other b | | Total |

| Revenues: | | | | | | | |

| Unaffiliated customers | $ | — | | | $ | 3,669 | | | $ | — | | | $ | 3,669 | |

| Cost of sales, excluding depreciation and amortization | (1,467) | | | (1,381) | | | — | | | (2,848) | |

| Depreciation and amortization | (38) | | | (934) | | | 5 | | | (967) | |

| General and administrative expenses | — | | | — | | | (3,183) | | | (3,183) | |

| Operating (loss) income | $ | (1,505) | | | $ | 1,354 | | | $ | (3,178) | | | $ | (3,329) | |

Capital expenditures and purchases and development of real estate properties | $ | 13,613 | | | $ | 12,701 | | | $ | — | | | $ | 26,314 | |

Total assets at September 30, 2023 c | 302,927 | | | 164,565 | | | 34,529 | | | 502,021 | |

a.Includes sales commissions and other revenues together with related expenses.

b.Includes consolidated general and administrative expenses and eliminations of intersegment amounts.

c.Corporate, eliminations and other includes cash and cash equivalents and restricted cash of $34.3 million. The remaining cash and cash equivalents and restricted cash is reflected in the operating segments’ assets.

Summarized financial information by segment for the first nine months ended September 30, 2024, based on Stratus’ internal financial reporting system utilized by its chief operating decision maker, follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Real Estate Operations a | | Leasing Operations | | Corporate, Eliminations and Other b | | Total |

| Revenues: | | | | | | | |

| Unaffiliated customers | $ | 29,723 | | | $ | 14,165 | | | $ | — | | | $ | 43,888 | |

| Cost of sales, excluding depreciation and amortization | (25,046) | | | (5,384) | | | — | | | (30,430) | |

| Depreciation and amortization | (136) | | | (4,080) | | | 48 | | | (4,168) | |

Gain on sale of assets c | — | | | 1,626 | | | — | | | 1,626 | |

| General and administrative expenses | — | | | — | | | (11,670) | | | (11,670) | |

| Operating income (loss) | $ | 4,541 | | | $ | 6,327 | | | $ | (11,622) | | | $ | (754) | |

Capital expenditures and purchases and development of real estate properties | $ | 22,925 | | | $ | 22,962 | | | $ | — | | | $ | 45,887 | |

a.Includes sales commissions and other revenues together with related expenses.

b.Includes consolidated general and administrative expenses and eliminations of intersegment amounts.

c.Represents a pre-tax gain on the sale of Magnolia Place – Retail in third-quarter 2024 of $1.6 million.

Summarized financial information by segment for the first nine months ended September 30, 2023, based on Stratus’ internal financial reporting system utilized by its chief operating decision maker, follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Real Estate Operations a | | Leasing Operations | | Corporate, Eliminations and Other b | | Total |

| Revenues: | | | | | | | |

| Unaffiliated customers | $ | 2,551 | | | $ | 10,450 | | | $ | — | | | $ | 13,001 | |

| Cost of sales, excluding depreciation and amortization | (8,651) | |

| (3,786) | | | — | | | (12,437) | |

Depreciation and amortization | (115) | | | (2,764) | | | 14 | | | (2,865) | |

| General and administrative expenses | — | | | — | | | (11,973) | | | (11,973) | |

| Operating (loss) income | $ | (6,215) | | | $ | 3,900 | | | $ | (11,959) | | | $ | (14,274) | |

Capital expenditures and purchases and development of real estate properties | $ | 34,697 | | | $ | 36,178 | | | $ | — | | | $ | 70,875 | |

a.Includes sales commissions and other revenues together with related expenses.

b.Includes consolidated general and administrative expenses and eliminations of intersegment amounts.

RECONCILIATION OF NON-GAAP MEASURE

EBITDA

EBITDA (earnings before interest, taxes, depreciation and amortization) is a non-GAAP (generally accepted accounting principles in the U.S.) financial measure that is frequently used by securities analysts, investors, lenders and others to evaluate companies’ recurring operating performance, including, among other things, profitability before the effect of financing and similar decisions. Because securities analysts, investors, lenders and others use EBITDA, management believes that Stratus’ presentation of EBITDA affords them greater transparency in assessing its financial performance. This information differs from net loss determined in accordance with GAAP and should not be considered in isolation or as a substitute for measures of performance determined in accordance with GAAP. EBITDA may not be comparable to similarly titled measures reported by other companies, as different companies may calculate such measures differently. Management strongly encourages investors to review Stratus’ consolidated financial statements and publicly filed reports in their entirety. A reconciliation of Stratus’ net loss to EBITDA follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net loss | $ | (1,414) | | | $ | (3,217) | | | $ | (495) | | | $ | (14,799) | |

| Depreciation and amortization | 1,365 | | | 967 | | | 4,168 | | | 2,865 | |

| Interest expense, net | — | | | — | | | — | | | — | |

| Provision for income taxes | 58 | | | 356 | | | 204 | | | 2,016 | |

| EBITDA | $ | 9 | | | $ | (1,894) | | | $ | 3,877 | | | $ | (9,918) | |

v3.24.3

Cover Page

|

Nov. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 13, 2024

|

| Entity Registrant Name |

Stratus Properties Inc.

|

| Entity Central Index Key |

0000885508

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37716

|

| Entity Tax Identification Number |

72-1211572

|

| Entity Address, Address Line One |

212 Lavaca St., Suite 300

|

| Entity Address, City or Town |

Austin,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78701

|

| City Area Code |

512

|

| Local Phone Number |

478-5788

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

STRS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Document Information [Line Items] |

|

| Security Exchange Name |

NASDAQ

|

| Soliciting Material |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

STRS

|

| Entity Central Index Key |

0000885508

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

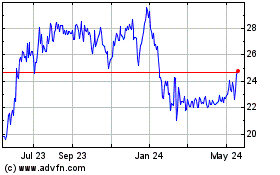

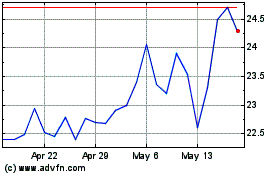

Stratus Properties (NASDAQ:STRS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Stratus Properties (NASDAQ:STRS)

Historical Stock Chart

From Dec 2023 to Dec 2024