FALSE000081772000008177202025-01-282025-01-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________________

FORM 8-K

________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 28, 2025

________________________________________________________

SYNAPTICS INCORPORATED

(Exact name of Registrant as Specified in Its Charter)

________________________________________________________

| | | | | | | | |

| Delaware | 000-49602 | 77-0118518 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | |

| 1109 McKay Drive | | |

San Jose, California | | 95131 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: 408 904-1100

_______________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $0.001 per share | | SYNA | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01. Regulation FD Disclosure.

On January 28, 2025, Synaptics Incorporated (the “Company”) issued a press release regarding the entry into a definitive licensing agreement with Broadcom Inc. (“Broadcom”) that includes Broadcom’s Wi-Fi 8, ultra-wideband, Wi-Fi 7, advanced Bluetooth and next-generation GPS / GNSS products and technology for the IoT and AndroidTM ecosystem as further described in Item 8.01 below. The press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information contained in this Item 7.01 and in the accompanying Exhibit 99.1 shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, whether made before or after the due date hereof, except as shall be expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

On January 19, 2025, the Company and its affiliates entered into an Asset Purchase Agreement with Broadcom to acquire certain assets and assume certain liabilities related to an Android customer (the “Acquired Customer Business”), and obtain non-exclusive licenses relating to, certain of Broadcom’s Wi-Fi 8, ultra-wideband, Wi-Fi 7, advanced Bluetooth and next-generation GPS / GNSS products and technology for the IoT and Android TM ecosystem (the “Field of Use”), for $198 million in cash payable at the closing of the transactions thereunder (the “Closing”).

The parties have agreed to enter into at Closing an amendment to the Existing Product License Agreement between the Company and Broadcom and an amendment to the existing Derivative and Roadmap Products Agreement between the Company and Broadcom, pursuant to which Broadcom will provide (i) certain non-exclusive licenses to the Company for the right to manufacture and sell products relating to the Field of Use, (ii) development services for certain roadmap products, (iii) an agreement not to grant any third party the right to manufacture and sell the newly licensed products for the Acquired Customer Business for 42 months following Closing, and (iv) an agreement not to grant any third party the right to manufacture and sell a certain roadmap product for the Field of Use for one year after production readiness.

The parties have also agreed to enter into a Transition Services Agreement, under which the parties will provide one another with certain transition services following Closing.

Pursuant to the definitive agreements, each party has also agreed to indemnify the other for certain agreed items, including breaches of representations and warranties and breach of covenants in the definitive agreements, subject to certain limitations of liability.

The Closing is expected to occur on January 30, 2025.

Item 9.01. Financial Statements and Exhibits.

Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover page interactive data file (embedded within the inline XBRL document). |

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of federal securities laws, including statements regarding the Asset Purchase Agreement, the proposed acquisition, the anticipated timeline and completion of the acquisition, and other statements using words such as “anticipates,” “believes,” “expects,” “intends,” “plans,” “will” and words of similar import and the negatives thereof. Forward-looking statements are subject to a number of risks, uncertainties and other factors, many of which are outside the Company’s control, and which may cause actual results to differ materially from expectations expressed or implied in the forward-looking statements, including, among others: the occurrence of any event, change or other circumstances that could give rise to the termination of the Asset

Purchase Agreement; failure by the Company or Broadcom to satisfy any closing conditions of the acquisition; and macroeconomic and geopolitical conditions that could adversely affect the acquisition or its parties.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | SYNAPTICS INCORPORATED |

| | | |

| Date: | January 28, 2025 | By: | /s/ Lisa Bodensteiner |

| | | Lisa Bodensteiner

Senior Vice President, Chief Legal Officer and Secretary

|

Synaptics Accelerates Edge AI Strategy with New Broadcom Agreement

Solidifies wireless roadmap with Wi-Fi 8 and UWB, grows addressable market, and expands its Android™ ecosystem.

San Jose, CA, January 28, 2025 — Synaptics® Incorporated (Nasdaq: SYNA) announced it has accelerated its Edge AI strategy by signing a definitive licensing agreement with Broadcom that includes Wi-Fi® 8, ultra-wideband (UWB), Wi-Fi 7, advanced Bluetooth®, and next-generation GPS/GNSS products and technology for IoT and Android™ ecosystem.

Strategic benefits:

•Accelerates Edge AI strategy: Solidifies Synaptics’ leadership position for end-to-end AI Internet of Things (IoT) connectivity and expands our ability to service the Android™ ecosystem.

•Solidifies Synaptics’ Veros™ wireless product roadmap for next 5+ years: Adds Wi-Fi 8 combo, UWB, GPS/GNSS, as well as Wi-Fi 7 combo products.

•Increases addressable market: Expands serviceable wireless market to include augmented and virtual reality (AR/VR) platforms, Android™ smartphones, and consumer audio.

•Strengthens wireless team: Establishes one of the largest and most highly qualified teams in cutting-edge wireless research and development.

•Accretive to financials: Expected to add $40+ million in annualized sales and to be immediately accretive to non-GAAP EPS.

“Our wireless technology and capabilities are cornerstones of our success in IoT markets,” said Michael Hurlston, President and CEO of Synaptics. “We are now developing this expertise to enable ecosystems with centralized control and seamless connectivity to a rapidly growing array of Edge AI devices. Our platform history, proven track record, and strategy uniquely position us to integrate Broadcom’s technology and fully deliver on the potential of IoT connectivity.”

Key technology focus and growth:

●Wi-Fi 8: Reinforces and builds on Synaptics’ field-proven Wi-Fi/Bluetooth combo solutions for the IoT, including Wi-Fi 7. The rapid incorporation of Wi-Fi 8 gives us first-mover advantage in new markets such as automotive and positions Synaptics among the leaders deploying this technology for AR/VR and Android™ smartphones.

●UWB: Allows Synaptics to participate in a growing market for precise location tracking and complements our market-leading Wi-Fi combo connectivity.

●GPS/GNSS: Synaptics is already among the leaders in GPS/GNSS for the IoT. The widely acclaimed SYN4778 is a prime example. Next-generation devices will build upon this success through lower power, greater accuracy, reduced system-level cost and complexity, and more functionality. These enhancements will allow Synaptics to further penetrate markets such as wearables, navigation devices, and asset trackers.

The all-cash transaction is expected to close on January 30, 2025.

Synaptics will provide further details on the transaction at its scheduled fiscal Q2 2025 investor conference call on February 6th, 2025.

###

About Synaptics Incorporated

Synaptics (Nasdaq: SYNA) is driving innovation in AI at the Edge, bringing AI closer to end users and transforming how we engage with intelligent connected devices, whether at home, at work, or on the move. As a go-to partner for forward-thinking product innovators, Synaptics powers the future with its cutting-edge Synaptics Astra™ AI-Native embedded compute, Veros™ wireless connectivity, and multimodal sensing solutions. We’re making the digital experience smarter, faster, more intuitive, secure, and seamless. From touch, display, and biometrics to AI-driven wireless connectivity, video, vision, audio, speech, and security processing, Synaptics is the force behind the next generation of technology enhancing how we live, work, and play. Follow Synaptics on LinkedIn, X, and Facebook, or visit www.synaptics.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains statements that are not historical facts but rather forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include those that address activities, events or developments that the Company or its management believes or anticipates may occur in the future. All forward-looking statements are based upon our current expectations or various assumptions. Our expectations and assumptions are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that such forward-looking statements will materialize or prove to be correct as forward-looking statements are inherently subject to known and unknown risks, uncertainties and other factors which may cause actual future results, performance or achievements to differ materially from the future results, performance or achievements expressed in or implied by such forward-looking statements. Numerous risks, uncertainties and other factors may cause actual results to differ materially from those set out in the forward-looking statements, including risks related to our ability to consummate and realize anticipated benefits from the transaction and our ability to grow sales and expand into the serviceable wireless market as expected, and other risks as identified in the “Risk Factors,” “Management’ Discussion and Analysis of Financial Condition and Results of Operations” and “Business” sections of our most recent Annual Report on Form 10-K and our most recent Quarterly Report on Form 10-Q; and other risks as identified from time to time in our Securities and Exchange Commission reports. For any forward-looking statements contained in this or any other document, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and we assume no obligation to update publicly or revise any forward-looking statements in light of new information or future events, except as required by law.

Synaptics and the Synaptics logo are trademarks of Synaptics in the United States and/or other countries. All other marks are the property of their respective owners.

For further information, please contact:

Investor Relations

Munjal Shah

Synaptics

+1-408-518-7639

munjal.shah@synaptics.com

Media Contact

Patrick Mannion

Synaptics

+1-631-678-1015

patrick.mannion@synaptics.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

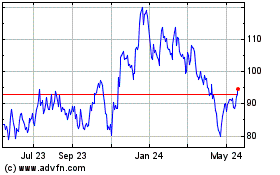

Synaptics (NASDAQ:SYNA)

Historical Stock Chart

From Feb 2025 to Mar 2025

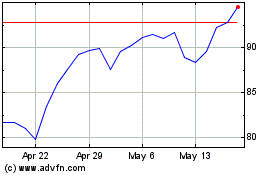

Synaptics (NASDAQ:SYNA)

Historical Stock Chart

From Mar 2024 to Mar 2025