UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

Solicitation/Recommendation

Statement

Under Section 14(d)(4) of

the Securities Exchange Act of 1934

(Amendment No. 1)

Theseus Pharmaceuticals, Inc.

(Name of Subject Company)

Theseus Pharmaceuticals, Inc.

(Name of Persons Filing Statement)

Common Stock, $0.0001 par value

per share

(Title of Class of Securities)

88369M1018

(CUSIP Number of Class of

Securities)

Bradford

D. Dahms

President and Chief Financial Officer

Theseus Pharmaceuticals, Inc.

314 Main Street

Cambridge, Massachusetts 02142

(857) 400-9491

(Name, address, and telephone number

of person authorized to receive notices and communications

on behalf of the persons filing statement)

With a copy to:

Robert Puopolo, Esq.

Blake Liggio, Esq.

Marishka DeToy, Esq.

Goodwin Procter LLP

100 Northern Ave

Boston, MA 02210

(617) 570-1000

| ¨ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

This Amendment No. 1

(this “Amendment”) to Schedule 14D-9 amends and supplements the Schedule 14D-9 previously filed by Theseus Pharmaceuticals, Inc.,

a Delaware corporation (“Theseus” or the “Company”), with the U.S. Securities and Exchange Commission on January 10,

2024 (as amended or supplemented from time to time, the “Schedule 14D-9”), with respect to the tender offer made by Concentra

Merger Sub II, Inc., a Delaware corporation (“Purchaser”) and a wholly owned subsidiary of Concentra Biosciences, LLC,

a Delaware limited liability company (“Parent”), to purchase all of the issued and outstanding shares of common stock, par

value $0.0001 per share (the “Shares”) of Theseus (other than Shares held in the treasury by Theseus, Shares owned, directly

or indirectly, by Parent or Purchaser immediately prior to the Effective Time or Shares held by any stockholders of Theseus who are entitled

to and who properly exercise appraisal rights under Delaware law, which, in each case, will be canceled without any consideration), for

(i) $3.90 per Share in cash (the “Base Price Per Share”), (ii) an additional amount of cash up to $0.15 per Share

(such amount as finally determined pursuant to the Merger Agreement, the “Additional Price Per Share” and together with the

Base Price Per Share, the “Cash Amount”), plus (iii) one non-transferable contractual contingent value right per Share

(a “CVR,” and each CVR together with the Cash Amount, the “Offer Price”), all upon the terms and subject to the

conditions as set forth in the Offer to Purchase, dated January 9, 2024 (as amended or supplemented from time to time, the “Offer

to Purchase”), and in the related Letter of Transmittal (as amended or supplemented from time to time, the “Letter of Transmittal,”

which, together with the Offer to Purchase, as each may be amended or supplemented from time to time, constitute the “Offer”).

On January 29, 2024,

pursuant to the terms of the Merger Agreement, Theseus, Parent and Purchaser calculated the Additional Price Per Share, based on Theseus’

expected Closing Net Cash (as defined in the Merger Agreement) as of immediately prior to the expiration date of the Offer and determined

that the Additional Price Per Share will be $0.15 per Share. As a result, the total Cash Amount is $4.05 per Share, as determined in accordance

with Section 2.01(d) of the Merger Agreement.

The Offer is described in

a Tender Offer Statement filed under cover of Schedule TO with the SEC on January 9, 2024, by Parent and Purchaser (as amended and

supplemented on January 30, 2024 and as may be further amended or supplemented from time to time).

Capitalized terms used in

this Amendment but not defined herein shall have the respective meaning given to such terms in the Schedule 14D-9. The information set

forth in the Schedule 14D-9 remains unchanged and is incorporated herein by reference, except that such information is hereby amended

or supplemented to the extent specifically provided herein. This Amendment is being filed to disclose certain updates as reflected below.

| ITEM 2. | IDENTITY AND BACKGROUND OF FILING PERSON |

Item 2 (“Identity

and Background of Filing Person”) of the Schedule 14D-9 is hereby amended and supplemented by adding, immediately following

the sixth paragraph of the section titled “—Tender Offer,” the following paragraph:

“On January 30,

2024, the Offer was extended pursuant to the Merger Agreement. The Offer was previously scheduled to expire one minute after 11:59 p.m.,

Eastern Time, on February 7, 2024. The expiration date of the Offer is extended to 6:00 p.m., Eastern Time, on February 13,

2024, unless it is extended further in accordance with the Merger Agreement.”

| ITEM 3. | PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS |

Item 3 (“Past Contacts,

Transactions, Negotiations and Agreements”) of the Schedule 14D-9 is hereby amended and supplemented by inserting the underlined

words in the second paragraph of the section titled “—Form of Contingent Value Rights Agreement” on page 4

of the Schedule 14D-9:

“In the

event that neither a Disposition of CVR Products occurs within the Disposition Period nor the conditions described in clause (ii) above

occurs during the prior to the CVR Expiration Date (as defined below), the CVR Holders will not receive any payment pursuant to the CVR

Agreement. The date on which the Disposition Period expires is the “CVR Expiration Date,” provided that to the extent a Disposition

of certain CVR Products takes place during the Disposition Period, the CVR Expiration Date, solely as it relates to such CVR Products,

shall be the earlier to occur of three (3) years following the date of the Closing (the “Closing Date”) and the mailing

by the Rights Agent to the address of each CVR Holder of all potential contingent payments required to be paid under the terms of the

CVR Agreement. In connection with any Disposition occurring within the Disposition Period, CVR Holders shall continue to be entitled

to 80% of the Net Proceeds from such Disposition of those certain CVR Products until the earlier to occur of three (3) years following

the date of the Closing and the mailing by the Rights Agent to the address of each CVR Holder of all potential contingent payments required

to be paid under the terms of the CVR Agreement.”

| ITEM 4. | THE SOLICITATION OR RECOMMENDATION |

Item 4 (“The Solicitation

or Recommendation—Background of the Offer and the Merger”) of the Schedule 14D-9 is hereby amended and supplemented as

follows:

(i) The

paragraph on page 13 of the Schedule 14D-9 that begins “In October 2023 and November 2023…” is hereby

supplemented and amended by inserting the underlined words:

“In October 2023

and November 2023, of the seven parties with whom the Company engaged in due diligence and preliminary negotiations, the Company

determined one party (“Party X”) with whom to engage in final negotiations with respect to a potential reverse merger transaction.

In early November 2023, due to changes in market conditions and the resultant unfavorable impact on the highest value of stock

consideration reasonably obtainable in a reverse merger transaction, the Theseus Board determined to disengage from discussions

with Party X, to abandon discussions with respect to the contemplated transactions with the other six parties and to further discontinue

pursuit of a potential reverse merger transaction, given the robust process the Company and its advisors had already undertaken,

but determined the need to pursue potential strategic alternatives of a different structure.”

(ii) All

references to “Party A” throughout the Schedule 14D-9 shall be replaced with “Foresite Capital Management, LLC”

and all references to “Party B” throughout the Schedule 14D-9 shall be replaced with “OrbiMed Advisors LLC.”

(iii) The

paragraph on page 16 of the Schedule 14D-9 that begins “Also on December 7, 2023, the Special Committee held a meeting…”

is hereby supplemented and amended by inserting the underlined words:

“Also on

December 7, 2023, the Special Committee held a meeting at which all members of the Special Committee, a representative of management,

representatives of Leerink Partners and representatives of Goodwin were in attendance. Representatives of Leerink Partners reviewed the

Initial Party A/B Proposal, the Second Revised Parent Offer, the Revised Party E Offer and the Revised Party F Offer, and reviewed other

considerations including execution risk and anticipated timeline to executing a definitive transaction with the various counterparties.

Following discussion, the Special Committee determined that the Second Revised Parent Offer reflected Parent’s best offer,

there was substantial risk of losing Parent’s offer in the Second Revised Parent Offer if the Company should pursue a higher price

or delay execution of a definitive transaction agreement and that, as compared to the other proposals received to date, the Second Revised

Parent Offer represented the highest price reasonably obtainable by the Company under the circumstances and thus provided for

premium shareholder value., The Special Committee also determined that, in light of the Company’s

concerns regarding timeline to executing a definitive transaction and execution risk, Parent’s experience in executing similar

transactions in the same industry in which the Company operates yielded a higher probability of successful transaction execution and that

Parent’s ability to more rapidly wind-down operations could result in higher value for Theseus stockholders. The Special Committee

further determined to recommend to the Theseus Board to proceed in pursuing the Second Revised Parent Offer.”

(iv) The

paragraph on page 17 of the Schedule 14D-9 that begins “Also on December 8, 2023, representatives of Leerink Partners

provided an initial draft of the Merger Agreement…” is hereby supplemented and amended by inserting the underlined words:

“Also on

December 8, 2023, representatives of Leerink Partners provided an initial draft of the Merger Agreement to representatives of Parent.

The draft Merger Agreement generally included customary terms and conditions for such an agreement including, among other things, for

(i) the transaction to be structured as a cash tender offer followed immediately by a back-end merger pursuant to DGCL Section 251(h),

(ii) the acceleration and cash out of certain Company equity awards, (iii) customary exceptions to the definition of “Company

Material Adverse Effect,” which generally defines the standard for certain closing risk, (iv) customary representations and

warranties with respect to the Company and Parent and Purchaser, including a representation by Parent and Purchaser regarding the

concurrent delivery of an executed limited guaranty to guarantee Parent and Purchaser’s obligations under the Merger Agreement and

the CVR Agreement, (v) the Company’s ability to provide due diligence to, and negotiate a merger agreement with, a

party making an unsolicited acquisition proposal that constitutes or would reasonably be expected to lead to a superior proposal and (vi) the

Company’s ability to terminate the Merger Agreement to accept a superior proposal after providing Parent with a right to match such

proposal.”

(v) The

paragraph on page 18 of the Schedule 14D-9 that begins “Between December 20, 2023 and December 21, 2023…”

is hereby supplemented and amended by inserting the underlined words:

“Between December 20,

2023 and December 21, 2023, representatives of Parent and representatives of Gibson Dunn & Crutcher, LLP (“Gibson

Dunn”), Parent’s external counsel, on one hand, and representatives of Goodwin and representatives of Leerink Partners, on

the other hand, exchanged drafts of the CVR Agreement, Limited Guaranty and Merger Agreement. Revisions to the Limited Guaranty

included revisions to conform terms to the Merger Agreement. Revisions to the Merger Agreement included revisions to (i) the

scope of expenses to be accounted for in the calculation of closing net cash, (ii) the cap on Parent’s monetary damages under

the Merger Agreement, (iv) the closing net cash condition and (iv) certain other revisions with respect to the representations

and warranties and covenants.”

Item 9 of the Schedule 14D-9

is hereby amended and supplemented by adding the following Exhibit to the list of Exhibits:

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth

in this statement is true, complete and correct.

Date: January 30, 2024

| |

Theseus Pharmaceuticals, Inc. |

| |

|

| |

By: |

/s/ Bradford D. Dahms |

| |

|

Bradford D. Dahms |

| |

|

President and Chief Financial

Officer |

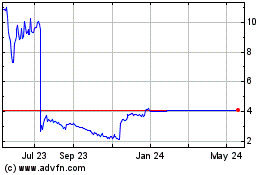

Theseus Pharmaceuticals (NASDAQ:THRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

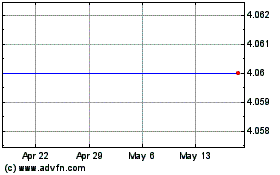

Theseus Pharmaceuticals (NASDAQ:THRX)

Historical Stock Chart

From Dec 2023 to Dec 2024