false

0001427925

0001427925

2024-09-30

2024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 30, 2024

TALPHERA, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-35068

|

|

41-2193603

|

|

(State of incorporation)

|

|

(Commission File No.)

|

|

(IRS Employer Identification No.)

|

1850 Gateway Drive, Suite 175

San Mateo, CA 94404

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (650) 216-3500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

TLPH

|

The Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On September 30, 2024, Talphera, Inc. (the “Company”), amended its securities purchase agreements, dated January 17, 2024, with entities affiliated with Nantahala Management, LLC (the “Agreements”), to extend to June 30, 2025 the date by which the Company must achieve the precedent conditions to the second closing thereunder (the “Amendments”). If prior to the second closing, the Company consummates an equity financing, then the purchasers shall be released from their obligation to purchase additional shares of common stock and/or pre-funded warrants pursuant to the Agreements.

The foregoing description of the Amendments is a summary and is qualified in its entirety by reference to the provisions thereof, a copy of which is attached to this Current Report as Exhibit 10.1, which is incorporated by reference herein. The form of the Agreements is filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K (file no. 001-35068) filed with the Securities and Exchange Commission on January 22, 2024.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: October 1, 2024

|

TALPHERA, INC.

|

|

| |

By:

|

/s/ Raffi Asadorian

|

|

| |

|

Raffi Asadorian

|

|

| |

|

Chief Financial Officer

|

|

Exhibit 10.1

TALPHERA, INC.

AMENDMENT NO. 1 TO

SECURITIES PURCHASE AGREEMENT

This Amendment No. 1 to Securities Purchase Agreement (this “Amendment”) is dated as of September 30, 2024, by and between Talphera, Inc., a Delaware corporation (the “Company”), and each purchaser identified on the signature pages hereto (each, including its successors and assigns, a “Purchaser” and collectively the “Purchasers”).

Whereas, the Company and the Purchasers are party that certain Securities Purchase Agreement, dated January 17, 2024, (the “Agreement”) and wish to amend certain sections of Agreement as more fully described in this Amendment.

Now, Therefore, in consideration of the mutual covenants contained in this Amendment, and for other good and valuable consideration the receipt and adequacy of which are hereby acknowledged, the Company and each Purchaser agree as follows:

ARTICLE I

AMENDMENT AND RESTATEMENT

| |

1.1

|

Section 2.3(a) of the Agreement is amended and restated as follows:

|

“(a) If at any time on or prior to June 30, 2025: (i) the Company publicly announces the achievement of the Pivotal Trial Milestone and its intention to submit a pre-market approval application for Niyad to the FDA, or (ii) the Company receives written notice from a Purchaser waiving subsection (i) above and desires to effect the Second Closing (as to the Subscription Amount of such waiving Purchaser only), then the Company will promptly distribute (and in any event within two (2) Trading Days of such public announcement or receipt of such written notice) to each Purchaser a notice identifying the date of the Second Closing (the “Second Closing Notice”)”

| |

1.2

|

Section 2.4 of the Agreement is amended to add the following new subsection (b)(vi):

|

“(b)(vi) If prior to the Second Closing Date, the Company consummates an equity financing involving the issuance of any shares of Common Stock or Common Stock Equivalents (other than an Exempt Issuance) , then the Participating Purchaser shall not be obligated to deliver such Participating Purchaser’s Second Closing Subscription Amount to the Company and shall be released from its obligation hereunder to purchase the Shares or Pre-Funded Warrants, as the case may be, at the Second Closing ”

ARTICLE II

MISCELLANEOUS

2.1 Definitions. Capitalized terms used and not otherwise defined herein shall have the meanings set forth in the Agreement.

2.2 Entire Agreement. Except as set forth herein, no other term of the Agreement is amended, and all other terms of the Agreement remain in full force and effect.

2.3 Headings. The headings herein are for convenience only, do not constitute a part of this Amendment and shall not be deemed to limit or affect any of the provisions hereof.

2.4 Execution. This Amendment may be executed in two or more counterparts, all of which when taken together shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to each other party, it being understood that the parties need not sign the same counterpart. In the event that any signature is delivered by e-mail delivery (including any electronic signature covered by the U.S. federal ESIGN Act of 2000, Uniform Electronic Transactions Act, the Electronic Signatures and Records Act or other applicable law, e.g., www.docusign.com) or other transmission method, such signature shall be deemed to have been duly and validly delivered and shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such “.pdf” signature page were an original thereof.

2.5 Severability. If any term, provision, covenant or restriction of this Amendment is held by a court of competent jurisdiction to be invalid, illegal, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions set forth herein shall remain in full force and effect and shall in no way be affected, impaired or invalidated, and the parties hereto shall use their commercially reasonable efforts to find and employ an alternative means to achieve the same or substantially the same result as that contemplated by such term, provision, covenant or restriction. It is hereby stipulated and declared to be the intention of the parties that they would have executed the remaining terms, provisions, covenants and restrictions without including any of such that may be hereafter declared invalid, illegal, void or unenforceable.

In Witness Whereof, the parties hereto have caused this Amendment No. 1 to Securities Purchase Agreement to be duly executed by their respective authorized signatories as of the date first indicated above.

|

Talphera, Inc.

|

Address for Notice:

1850 Gateway Drive, Suite 175

San Mateo, CA 94404

|

| |

|

|

By:

Name: Vincent J. Angotti

Title: Chief Executive Officer

With a copy to (which shall not constitute notice):

Cooley LLP

3175 Hanover Street

Palo Alto, CA 94304-1130

Attention: John T. McKenna

|

E-Mail: vangotti@talphera.com

|

[Signature Page to Amendment No. 1 to Securities Purchase Agreement]

In Witness Whereof, the parties hereto have caused this Amendment No. 1 to Securities Purchase Agreement to be duly executed by their respective authorized signatories as of the date first indicated above.

Name of Purchaser:

Signature of Authorized Signatory of Purchaser:

Name of Authorized Signatory:

Title of Authorized Signatory:

[Signature Page to Amendment No. 1 to Securities Purchase Agreement]

v3.24.3

Document And Entity Information

|

Sep. 30, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

TALPHERA, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Sep. 30, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-35068

|

| Entity, Tax Identification Number |

41-2193603

|

| Entity, Address, Address Line One |

1850 Gateway Drive, Suite 175

|

| Entity, Address, City or Town |

San Mateo

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94404

|

| City Area Code |

650

|

| Local Phone Number |

216-3500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

TLPH

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001427925

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

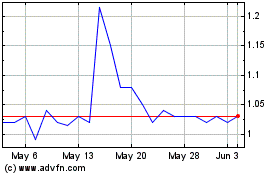

Talphera (NASDAQ:TLPH)

Historical Stock Chart

From Oct 2024 to Nov 2024

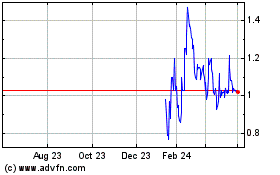

Talphera (NASDAQ:TLPH)

Historical Stock Chart

From Nov 2023 to Nov 2024