Taysha Gene Therapies, Inc. (Nasdaq: TSHA) (Taysha or the

Company), a clinical-stage biotechnology company focused on

advancing adeno-associated virus (AAV)-based gene therapies for

severe monogenic diseases of the central nervous system (CNS),

today reported financial results for the second quarter ended June

30, 2024, and provided a corporate update.

“In the second quarter, we made strong progress across our

TSHA-102 clinical program, including reporting encouraging

preliminary data in our pediatric trial and longer-term data in our

adolescent and adult trial following the low dose of TSHA-102. We

dosed the first patient in the high dose cohort of our adolescent

and adult trial, and TSHA-102 was generally well tolerated as of

the initial six-week assessment. Subsequently, we received IDMC

approval to proceed with dosing the second adolescent/adult and

first pediatric patient in the high dose cohort of our REVEAL

trials. This progress enables us to build on the promising low dose

data that demonstrated an encouraging safety profile and

improvements across consistent clinical domains impacting daily

activities in adult and pediatric patients suffering from Rett

syndrome,” said Sean P. Nolan, Chairman and Chief Executive Officer

of Taysha. “We remain focused on clinical trial execution and data

collection that will further inform discussions with regulatory

authorities on the development plan for the next phase of our

studies.”

Mr. Nolan continued, “Dosing of the second patient in our

adolescent and adult trial and the first patient in our pediatric

trial in the high dose cohort is scheduled for the third quarter of

2024. We are moving toward reporting cohort-based updates with more

mature data sets to provide more fulsome updates on our clinical

data. In line with this decision, we plan to report clinical data

from the high dose cohorts and an update on clinical data from the

low dose cohorts in both REVEAL trials in the first half of 2025.

With our balance sheet strengthened and runway extended, we believe

we are in an excellent position to execute on key value-creating

milestones.”

Recent Corporate and Program Highlights

- Completed public

follow-on offering with total net proceeds of $76.8 million with

anticipated cash runway into the fourth quarter of 2026

REVEAL Phase 1/2 Adolescent and Adult Trial

(Canada and United States

(U.S.)):

a first-in-human, open-label, randomized, dose-escalation and

dose-expansion study evaluating the safety and preliminary efficacy

of TSHA-102 in adolescent and adult females aged 12 years and older

with Rett syndrome due to MECP2 loss-of-function mutation.

- Presented longer-term data from

cohort one (low dose, n=2) of 5.7x1014 total vector genomes (vg) at

the 2024 International Rett Syndrome Foundation (IRSF) Rett

Syndrome Scientific Meeting:

- Generally well tolerated with no

serious adverse events (SAEs) related to TSHA-102 or dose-limiting

toxicities (DLTs) as of the 52- and 36-week assessment for patient

one and two, respectively

- Sustained and new improvements

across multiple efficacy measures and clinical domains relative to

baseline, including fine and gross motor skills,

communication/socialization, autonomic function and seizure events,

through 52- and 25-weeks post-treatment for patient one and two,

respectively

- Dosed the first patient in cohort

two (high dose, n=3) of 1x1015 total vg, and TSHA-102 was generally

well tolerated with no SAEs or DLTs as of the initial six-week

assessment

- Enrolled the second patient in

cohort two and scheduled dosing for the current quarter, following

Independent Data Monitoring Committee (IDMC) review of initial

six-week clinical data from the first patient dosed in cohort

two

REVEAL Phase 1/2 Pediatric Trial

(U.S., United Kingdom

(U.K.) and

Canada): an open-label, randomized,

dose-escalation and dose-expansion study evaluating the safety and

preliminary efficacy of TSHA-102 in pediatric females aged 5 to 8

years old with Rett syndrome due to MECP2 loss-of-function

mutation.

- Health Canada cleared the pediatric

clinical trial application (CTA), enabling expansion of the ongoing

U.S. and U.K. REVEAL pediatric trial into Canada

- Presented preliminary data from cohort

one (low dose, n=2) of 5.7x1014 total vg at the 2024 IRSF Rett

Syndrome Scientific Meeting:

- Generally well-tolerated with no SAEs related to TSHA-102 or

DLTs as of the 22- and 11-week assessment for patient one and two,

respectively

- Initial improvements across multiple efficacy measures and

clinical domains relative to baseline, including fine and gross

motor skills, communication/socialization, autonomic function and

seizure events, as of 12- and eight-weeks post-treatment for

patient one and two, respectively

- Enrolled the first pediatric patient

in cohort two (high dose, n=3) of 1x1015 total vg and scheduled

dosing for the current quarter, following IDMC approval to proceed

with the Company’s request for early advancement to cohort two

after review of the initial six-week safety data from the first

patient treated with the high dose of TSHA-102 in the adolescent

and adult trial

Anticipated Milestones

- REVEAL Adolescent and Adult Trial

- Dosing of the second patient in cohort two (high dose)

scheduled for the third quarter of 2024

- Safety and efficacy data from cohort two (n=3) and an update on

safety and efficacy data from cohort one (n=2) expected in the

first half of 2025

- REVEAL Pediatric Trial

- Dosing of the first patient in cohort two (high dose) scheduled

for the third quarter of 2024

- Safety and efficacy data from cohort two (n=3) and an update on

safety and efficacy data from cohort one (n=2) expected in the

first half of 2025

Second Quarter 2024 Financial Highlights

Research and Development Expenses: Research and

development expenses were $15.1 million for the three months ended

June 30, 2024, compared to $19.8 million for the three months

ending June 30, 2023. The $4.7 million decrease was primarily due

to a milestone fee payable to Abeona Therapeutics Inc. during the

three months ended June 30, 2023, following the dosing of the first

patient in the REVEAL Phase 1/2 adolescent and adult trial.

General and Administrative

Expenses: General and administrative expenses were

$7.3 million for the three months ended June 30, 2024, compared to

$6.0 million for the three months ended June 30, 2023. The increase

of $1.3 million was primarily due to $0.9 million of higher

stock-based compensation expenses and $0.4 million of higher

consulting, professional fees and other expenses.

Net loss: Net loss for the three months

ended June 30, 2024, was $20.9 million, or $0.09 per

share, compared to a net loss of $24.6 million,

or $0.38 per share, for the three months ended June

30, 2023.

Cash and cash equivalents: As of June 30,

2024, Taysha had $172.7 million in cash and cash equivalents.

Taysha expects that its current cash resources will support planned

operating expenses and capital requirements into the fourth quarter

of 2026.

Conference Call and Webcast InformationTaysha

management will hold a conference call and webcast today

at 8:30 a.m. ET to review its financial and operating results

and provide a corporate update. The dial-in number for the

conference call is 877-407-0792 (U.S./Canada) or 201-689-8263

(international). The conference ID for all callers is 13747741. The

live webcast and replay may be accessed by visiting Taysha’s

website.

About TSHA-102TSHA-102 is a self-complementary

intrathecally delivered AAV9 investigational gene transfer therapy

in clinical evaluation for Rett syndrome. Designed as a one-time

treatment, TSHA-102 aims to address the genetic root cause of the

disease by delivering a functional form of MECP2 to cells in the

CNS. TSHA-102 utilizes a novel miRNA-Responsive Auto-Regulatory

Element (miRARE) technology designed to mediate levels of MECP2 in

the CNS on a cell-by-cell basis without risk of overexpression.

TSHA-102 has received Regenerative Medicine Advanced Therapy, Fast

Track and Orphan Drug and Rare Pediatric Disease designations from

the FDA, Orphan Drug designation from the European Commission and

Innovative Licensing and Access Pathway designation from the

Medicines and Healthcare products Regulatory Agency.

About Rett SyndromeRett syndrome is a rare

neurodevelopmental disorder caused by mutations in the X-linked

MECP2 gene encoding methyl CpG-binding protein 2 (MeCP2), which is

essential for regulating neuronal and synaptic function in the

brain. The disorder is characterized by loss of communication and

hand function, slowing and/or regression of development, motor and

respiratory impairment, seizures, intellectual disabilities and

shortened life expectancy. Rett syndrome progression is divided

into four key stages, beginning with early onset stagnation at 6 to

18 months of age followed by rapid regression, plateau and late

motor deterioration. Rett syndrome primarily occurs in females and

is one of the most common genetic causes of severe intellectual

disability. Currently, there are no approved disease-modifying

therapies that treat the genetic root cause of the disease. Rett

syndrome caused by a pathogenic/likely pathogenic MECP2 mutation is

estimated to affect between 15,000 and 20,000 patients in the U.S.,

EU, and U.K.

About Taysha Gene TherapiesTaysha Gene

Therapies (Nasdaq: TSHA) is a clinical-stage biotechnology company

focused on advancing adeno-associated virus (AAV)-based gene

therapies for severe monogenic diseases of the central nervous

system. Its lead clinical program TSHA-102 is in development for

Rett syndrome, a rare neurodevelopmental disorder with no approved

disease-modifying therapies that address the genetic root cause of

the disease. With a singular focus on developing transformative

medicines, Taysha aims to address severe unmet medical needs and

dramatically improve the lives of patients and their caregivers.

The Company’s management team has proven experience in gene therapy

development and commercialization. Taysha leverages this

experience, its manufacturing process and a clinically and

commercially proven AAV9 capsid in an effort to rapidly translate

treatments from bench to bedside. For more information, please

visit www.tayshagtx.com.

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Words such as

“anticipates,” “believes,” “expects,” “intends,” “projects,”

“plans,” and “future” or similar expressions are intended to

identify forward-looking statements. Forward-looking statements

include, but are not limited to, statements concerning the

potential of TSHA-102, including the reproducibility and durability

of any favorable results initially seen in patients dosed to date

in clinical trials, and our other product candidates to positively

impact quality of life and alter the course of disease in the

patients we seek to treat, our research, development and regulatory

plans for our product candidates, including the timing of

initiating additional trials and reporting data from our clinical

trials, the potential for these product candidates to receive

regulatory approval from the FDA or equivalent foreign regulatory

agencies, and our current cash resources supporting our planned

operating expenses and capital requirements into the fourth quarter

of 2026. Forward-looking statements are based on management’s

current expectations and are subject to various risks and

uncertainties that could cause actual results to differ materially

and adversely from those expressed or implied by such

forward-looking statements. Accordingly, these forward-looking

statements do not constitute guarantees of future performance, and

you are cautioned not to place undue reliance on these

forward-looking statements. Risks regarding our business are

described in detail in our Securities and Exchange Commission

(“SEC”) filings, including in our Annual Report on Form 10-K for

the full-year ended December 31, 2023, which is available on the

SEC’s website at www.sec.gov. Additional information will be made

available in other filings that we make from time to time with the

SEC. These forward-looking statements speak only as of the date

hereof, and we disclaim any obligation to update these statements

except as may be required by law.

|

Taysha Gene Therapies, Inc.Condensed Consolidated

Statements of Operations(in thousands, except share and per share

data) |

| |

|

For the Three MonthsEnded

June 30, |

|

For the Six MonthsEnded

June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

|

$ |

1,112 |

|

|

$ |

2,395 |

|

|

$ |

4,523 |

|

|

$ |

7,101 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Research and development |

|

|

15,073 |

|

|

|

19,791 |

|

|

|

35,730 |

|

|

|

32,305 |

|

| General and

administrative |

|

|

7,338 |

|

|

|

5,988 |

|

|

|

14,422 |

|

|

|

14,739 |

|

| Total operating expenses |

|

|

22,411 |

|

|

|

25,779 |

|

|

|

50,152 |

|

|

|

47,044 |

|

| Loss from

operations |

|

|

(21,299 |

) |

|

|

(23,384 |

) |

|

|

(45,629 |

) |

|

|

(39,943 |

) |

| Other income

(expense): |

|

|

|

|

|

|

|

|

| Change in fair value of

warrant liability |

|

|

195 |

|

|

|

- |

|

|

|

(142 |

) |

|

|

- |

|

| Change in fair value of term

loan |

|

|

(1,279 |

) |

|

|

- |

|

|

|

(2,332 |

) |

|

|

- |

|

| Interest income |

|

|

1,440 |

|

|

|

223 |

|

|

|

3,133 |

|

|

|

542 |

|

| Interest expense |

|

|

(27 |

) |

|

|

(1,440 |

) |

|

|

(56 |

) |

|

|

(2,814 |

) |

| Other (expense) income |

|

|

42 |

|

|

|

3 |

|

|

|

37 |

|

|

|

(5 |

) |

| Total other income

(expense), net |

|

|

371 |

|

|

|

(1,214 |

) |

|

|

640 |

|

|

|

(2,277 |

) |

| Net loss |

|

$ |

(20,928 |

) |

|

$ |

(24,598 |

) |

|

$ |

(44,989 |

) |

|

$ |

(42,220 |

) |

| Net loss per common share,

basic and diluted |

|

$ |

(0.09 |

) |

|

$ |

(0.38 |

) |

|

$ |

(0.19 |

) |

|

$ |

(0.66 |

) |

| Weighted average common shares

outstanding, basic and diluted |

|

|

232,821,553 |

|

|

|

64,244,531 |

|

|

|

232,035,448 |

|

|

|

63,755,435 |

|

|

Taysha Gene Therapies, Inc.Condensed Consolidated

Balance Sheet Data (in thousands, except share and per

share data) |

| |

|

June 30,2024 |

|

December 31,2023 |

| ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

172,743 |

|

|

$ |

143,940 |

|

|

Restricted cash |

|

|

449 |

|

|

|

449 |

|

|

Prepaid expenses and other current assets |

|

|

3,278 |

|

|

|

3,479 |

|

|

Assets held for sale |

|

|

2,000 |

|

|

|

2,000 |

|

| Total current assets |

|

|

178,470 |

|

|

|

149,868 |

|

| Restricted cash |

|

|

2,151 |

|

|

|

2,151 |

|

| Property, plant and equipment,

net |

|

|

10,513 |

|

|

|

10,826 |

|

| Operating lease right-of-use

assets |

|

|

8,971 |

|

|

|

9,582 |

|

| Other non-current assets |

|

|

288 |

|

|

|

304 |

|

| Total

assets |

|

$ |

200,393 |

|

|

$ |

172,731 |

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

8,718 |

|

|

$ |

6,366 |

|

|

Accrued expenses and other current liabilities |

|

|

11,875 |

|

|

|

12,284 |

|

|

Deferred revenue |

|

|

13,583 |

|

|

|

18,106 |

|

| Total current liabilities |

|

|

34,176 |

|

|

|

36,756 |

|

| Term loan, net |

|

|

37,835 |

|

|

|

40,508 |

|

| Operating lease liability, net of

current portion |

|

|

18,134 |

|

|

|

18,953 |

|

| Other non-current

liabilities |

|

|

1,380 |

|

|

|

1,577 |

|

| Total liabilities |

|

|

91,525 |

|

|

|

97,794 |

|

| Stockholders'

equity |

|

|

|

|

| Preferred stock, $0.00001 par

value per share; 10,000,000 shares authorized, and no shares issued

and outstanding as of June 30, 2024, and December 31,

2023 |

|

|

— |

|

|

|

— |

|

| Common stock, $0.00001 par value

per share; 400,000,000 shares authorized and 201,381,450 and

186,960,193 issued and outstanding as of June 30, 2024, and

December 31, 2023, respectively |

|

|

2 |

|

|

|

2 |

|

| Additional paid-in capital |

|

|

664,457 |

|

|

|

587,942 |

|

| Accumulated other comprehensive

income |

|

|

2,405 |

|

|

|

— |

|

| Accumulated deficit |

|

|

(557,996 |

) |

|

|

(513,007 |

) |

|

Total stockholders’ equity |

|

|

108,868 |

|

|

|

74,937 |

|

| Total liabilities and

stockholders' equity |

|

$ |

200,393 |

|

|

$ |

172,731 |

|

Company Contact:Hayleigh Collins Director, Head

of Corporate Communications and Investor RelationsTaysha Gene

Therapies, Inc.hcollins@tayshagtx.com

Media Contact:Carolyn HawleyInizio

EvokeCarolyn.hawley@inizioevoke.com

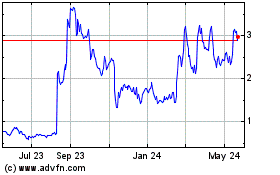

Taysha Gene Therapies (NASDAQ:TSHA)

Historical Stock Chart

From Oct 2024 to Nov 2024

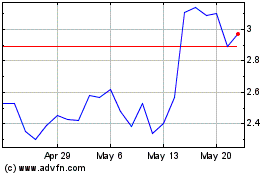

Taysha Gene Therapies (NASDAQ:TSHA)

Historical Stock Chart

From Nov 2023 to Nov 2024