false

0000100378

0000100378

2024-10-31

2024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported) October 31, 2024

TWIN DISC, INCORPORATED

(Exact name of registrant as specified in its charter)

|

Wisconsin

|

001-7635

|

39-0667110

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

222 East Erie Street, Suite 400 Milwaukee, Wisconsin 53202

(Address of principal executive offices)

Registrant's telephone number, including area code: (262) 638-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock (No Par Value)

|

TWIN

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

The Annual Meeting of Shareholders of the Company was held on October 31, 2024. Matters submitted to shareholders at the meeting and the voting results thereof were as follows:

Proposal No. 1 – Election of Directors.

The shareholders of the Company elected each of the Director nominees proposed by the Company’s Board of Directors. Ms. Janet P. Giesselman and Mr. David W. Johnson were elected to serve until the 2027 Annual Meeting of Shareholders or until their successor is duly elected and qualified. The following is a breakdown of the voting results:

| |

Votes For

|

Percent(1)

|

Votes

Withheld

|

Percent(1)

|

Broker Non-Votes

|

|

Janet P. Giesselman

|

10,735,081

|

97.89%

|

231,330

|

2.11%

|

1,119,856

|

|

David W. Johnson

|

9,470,900

|

86.36%

|

1,495,511

|

13.64%

|

1,119,856

|

Proposal No. 2 – Advisory Vote on the Compensation of the Company’s Named Executive Officers.

In an advisory vote, the shareholders of the Company approved the compensation of the Company’s Named Executive Officers. The Company includes such an advisory vote on the Company’s Named Executive Officer compensation in its proxy materials every year, and intends to continue to provide such an advisory vote on an annual basis until the next required non-binding advisory vote on the frequency of such votes on executive compensation. The following is a breakdown of the voting results:

|

Votes For

|

Votes Against

|

Abstentions

|

Broker Non-Votes

|

|

10,506,436

|

96,055

|

363,920

|

1,119,856

|

Proposal No. 3 – Approval of the Twin Disc, Incorporated Amended and Restated Omnibus Incentive Plan.

The shareholders of the Company approved the Twin Disc, Incorporated Amended and Restated Omnibus Incentive Plan. The following is a breakdown of the voting results:

|

Votes For

|

Votes Against

|

Abstentions

|

Broker Non-Votes

|

|

8,747,488

|

2,213,944

|

4,980

|

1,119,856

|

Proposal No. 4 – Appointment of RSM US LLP as Independent Registered Public Accounting Firm.

The shareholders of the Company ratified the appointment of RSM US LLP as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2025. Because brokers holding shares are permitted to vote on this proposal without specific instruction from the beneficial owners of such shares, there are no “broker non-votes” for this proposal. The following is a breakdown of the voting results:

|

Votes For

|

Votes Against

|

Abstentions

|

|

12,008,523

|

68,585

|

9,160

|

(1) Percentages shown for election of Directors (Proposal No. 1) are based on totals of votes cast for and votes withheld from each indicated Director. Broker non-votes were not considered as part of the totals on which percentages were based.

Item 8.01 Other Events.

On October 31, 2024, each of the non-employee Directors of the Company who continued to serve on the Board of Directors after the Company’s Annual Meeting of Shareholders received 6,747 shares of Restricted Stock under the Twin Disc, Incorporated Amended and Restated 2021 Omnibus Incentive Plan (the “Omnibus Plan”), representing approximately 55% of their annual Board retainer (exclusive of Committee chair fees). A copy of the Omnibus Plan was included as Appendix A of the Proxy Statement for the Annual Meeting of Shareholders held on October 31, 2024 (File No. 001-07635). In conjunction with the issuance of Restricted Stock under the Omnibus Plan, the Company entered into a Restricted Stock Agreement with each of its non-employee Directors covering awards of restricted stock under the Plan. A form of the Restricted Stock Agreement is attached hereto as Exhibit 10.1 and incorporated herein by reference.

FORWARD LOOKING STATEMENTS

The disclosures in this report on Form 8-K and in the documents incorporated herein by reference contain or may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believes,” “expects,” “intends,” “plans,” “anticipates,” “hopes,” “likely,” “will,” and similar expressions identify such forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of the Company (or entities in which the Company has interests), or industry results, to differ materially from future results, performance or achievements expressed or implied by such forward-looking statements. Certain factors that could cause the Company’s actual future results to differ materially from those discussed are noted in connection with such statements, but other unanticipated factors could arise. Readers are cautioned not to place undue reliance on these forward-looking statements which reflect management’s view only as of the date of this Form 8-K. The Company undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, conditions or circumstances.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| EXHIBIT NUMBER |

DESCRIPTION

|

|

10.1

|

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Pursuant to the requirements of section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: November 6, 2024

|

Twin Disc, Incorporated

|

| |

|

| |

/s/Jeffrey S. Knutson

|

| |

Jeffrey S. Knutson

|

| |

Vice President-Finance, Chief Financial

Officer, Treasurer & Secretary

|

Exhibit 10.1

TWIN DISC, INCORPORATED

NON-EMPLOYEE DIRECTOR

RESTRICTED STOCK AGREEMENT

This RESTRICTED STOCK AGREEMENT (the “Agreement”), by and between TWIN DISC, INCORPORATED (the “Company”) and _____________________ (the “Director”) is dated this ___ day of __________, 20___, to memorialize awards of restricted stock under the Twin Disc, Incorporated Amended and Restated 2021 Omnibus Incentive Plan (the “Plan”). Capitalized terms not otherwise defined in this Agreement shall have the definition ascribed to those terms by the Plan.

WHEREAS, the Company has adopted, and the shareholders of the Company have approved, the Plan, pursuant to which non-employee directors of the Company may receive a portion of their annual retainer in the form of restricted stock as of the day of each annual shareholders meeting, and pursuant to which non-employee directors of the Company may elect to receive all or a portion of the annual retainer they would otherwise receive in cash in the form of restricted stock; and

WHEREAS, the Director and the Company wish to memorialize their agreement with respect to awards of restricted stock to the Director under the Plan.

NOW, THEREFORE, in consideration of the premises and of the covenants and agreements herein set forth, the parties hereto agree as follows:

1. Restricted Stock Awards. Subject to the terms of the Plan, a copy of which has been provided to the Director and is incorporated herein by reference, and subject to the terms and conditions and restrictions set forth below, the Company agrees to grant to the Director the following number of shares of the common stock (“Restricted Stock”) of the Company:

| |

a.

|

The portion of the Director’s annual retainer (exclusive of Board chair or meeting fees) that the Board determines shall be paid in the form of Restricted Stock. The number of shares of Restricted Stock shall be determined by dividing the dollar value of the portion of such annual retainer designated as payable in Restricted Stock by the Fair Market Value per share of Common Stock as of the date of the annual meeting of the Company’s shareholders, and rounding down to the nearest whole share.

|

| |

|

|

| |

b.

|

The portion of the Director’s annual retainer (exclusive of Board chair or committee fees) that would otherwise be paid in cash that the Director elects to receive in the form of Restricted Stock pursuant to a timely-filed and valid election delivered to the Company pursuant to the terms of the Plan. Any such retainer fee that the Director elects to receive in the form of Restricted Stock in lieu of cash shall be converted to a fixed number of shares of Restricted Stock by dividing the dollar value of the cash that would otherwise have been paid to the Director by the Fair Market Value per share of Common Stock as of the date such payment would have been made, and rounding down to the nearest whole share.

|

2. Fair Market Value. The Fair Market Value per share of Common Stock on the dates shares of Restricted Stock are granted shall be determined pursuant to the terms of the Plan, and shall be communicated to the Director by the Company.

3. Restrictions on Transferability. Except as otherwise provided in Section 4, the shares granted shall not be subject to sale, assignment, pledge or other transfer or disposition by the Director, except by reason of an exchange or conversion of such shares because of merger, consolidation, reorganization or other corporate action. Any shares into which the granted shares may be converted or for which the granted shares may be exchanged in a merger, consolidation, reorganization or other corporate action shall be subject to the same transferability restrictions as the granted shares.

4. Lapse of Restrictions on Transferability. The shares of Restricted Stock awarded under the Plan in accordance with Section 1(a) of this Agreement shall become freely transferable as of the date of the annual meeting of the Company’s shareholders that is subsequent to the date the Restricted Stock was awarded if the Director continues to serve on the Board of Directors of the Company up to such meeting, and the shares of Restricted Stock awarded under the Plan in accordance with Section 1(b) of this Agreement shall become freely transferable on the first anniversary of the date that the cash would have otherwise been paid to the Director; provided, however, that all Restricted Stock held by the Director shall become freely transferable upon the death or disability of the Director, as provided in Sections 8.1 and 8.2 of the Plan.

5. Forfeitability. Notwithstanding Section 4 of this Agreement:

| |

a.

|

If the Director’s service as a member of the Board ends prior to the date the transfer restrictions lapse;

|

| |

|

|

| |

b.

|

If the Director is recommended by the Company to be re-elected to the Board and fails to be re-elected by the shareholders of the Company to the Board in that election; or

|

| |

|

|

| |

c.

|

If the Director is prohibited from serving on the Board by any court of competent jurisdiction or other government authority, or in the discretion of the Board is no longer competent to serve on the Board due to the Director’s violation of state or federal securities law or other rule of the NASDAQ Stock Market (or such other listing standards then applicable to the Company), then any Restricted Stock held by the Director that remains subject to the transfer restrictions set forth in Section 3 shall be immediately forfeited.

|

6. Rights of Shareholder. Except for the restrictions on transfer and risk of forfeiture, the Director shall have, with respect to shares of Restricted Stock, all of the rights of a shareholder of Common Stock, including, if applicable, the right to vote the shares and the right to receive any cash or stock dividends. Notwithstanding the foregoing, cash or stock dividends on shares of Restricted Stock shall be automatically deferred, and shall be paid to the Director only if and to the extent the underlying shares of Restricted Stock vest. Cash or stock dividends payable with respect to shares of Restricted Stock that are forfeited shall also be forfeited. Cash or stock dividends payable under this paragraph shall be paid within 30 days after the restrictions on the shares of Restricted Stock to which such dividends relate lapse. Cash dividends shall be paid with an appropriate rate of interest, as determined by the Board.

7. Section 83(b) Election. The Director acknowledges that: (1) the stock granted pursuant to the Plan and this Agreement is restricted property for purposes of Section 83(b) of the Internal Revenue Code and that the shares granted are subject to a substantial risk of forfeiture as therein defined until the year in which such shares are no longer subject to a substantial risk of forfeiture; and (2) the Director may make an election to include the fair market value of the shares in income in the year of the grant in which case no income is included in the year the shares are no longer subject to a substantial risk of forfeiture. Responsibility for determining whether or not to make such an election and compliance with the necessary requirements is the sole responsibility of the Director.

8. Restrictions on Transfer. The Director agrees for himself or herself, and his or her heirs, legatees and legal representatives, with respect to all shares granted hereunder (or any securities issued in lieu of or in substitution or exchange therefore) that such shares will not be sold or transferred except pursuant to an effective registration statement under the Securities Act of 1933, as amended, or pursuant to an applicable exemption from registration (such as SEC Rule 144). The Director represents that such shares are being acquired for the Director’s own account and for purposes of investment, and not with a view to, or for sale in connection with, the distribution of such shares, nor with any present intention of distributing such shares.

| |

TWIN DISC, INCORPORATED

By: ____________________________________

Its: ____________________________________

DIRECTOR:

__________________________________________

|

v3.24.3

Document And Entity Information

|

Oct. 31, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

TWIN DISC, INCORPORATED

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 31, 2024

|

| Entity, Incorporation, State or Country Code |

WI

|

| Entity, File Number |

001-7635

|

| Entity, Tax Identification Number |

39-0667110

|

| Entity, Address, Address Line One |

222 East Erie Street, Suite 400

|

| Entity, Address, City or Town |

Milwaukee

|

| Entity, Address, State or Province |

WI

|

| Entity, Address, Postal Zip Code |

53202

|

| City Area Code |

262

|

| Local Phone Number |

638-4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

TWIN

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000100378

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

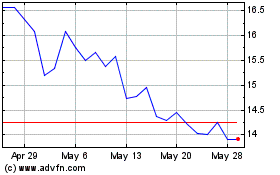

Twin Disc (NASDAQ:TWIN)

Historical Stock Chart

From Oct 2024 to Nov 2024

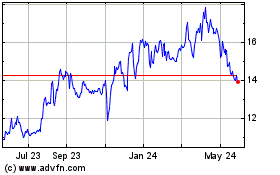

Twin Disc (NASDAQ:TWIN)

Historical Stock Chart

From Nov 2023 to Nov 2024