false000177078700017707872024-10-242024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 24, 2024

10x Genomics, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-39035 | 45-5614458 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

6230 Stoneridge Mall Road

Pleasanton, California 94588

(925) 401-7300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

___________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Class A common stock, par value $0.00001 per share | | TXG | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 29, 2024, 10x Genomics, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the quarter ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

The information furnished pursuant to Item 2.02 in this Current Report on Form 8-K and the press release attached as Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 24, 2024, Mathai Mammen informed the Company of his decision to resign as a member of the Board of Directors (the “Board”) of the Company and the Nominating and Corporate Governance Committee of the Board, effective immediately. Dr. Mammen’s decision to resign was due solely to professional time commitments and is not due to any disagreement with the Company’s management team, operations, financial statements, policies or procedures.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | | | | |

Exhibit No. | | Description of Exhibits | |

| | | |

| 99.1 | | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| 10x Genomics, Inc. |

| | |

| By: | /s/ Eric S. Whitaker |

| Name: | Eric S. Whitaker |

| Title: | Chief Legal Officer |

| | |

| Date: October 29, 2024 | | |

Exhibit 99.1

10x Genomics Reports Third Quarter 2024 Financial Results

PLEASANTON, Calif. October 29, 2024 – 10x Genomics, Inc. (Nasdaq: TXG), a leader in single cell and spatial biology, today reported financial results for the third quarter ended September 30, 2024.

Recent Highlights

•Revenue was $151.7 million for the third quarter, in line with the company’s preliminary announcement, a 1% decrease over the corresponding period of 2023, primarily driven by lower instrument revenue, offset by stronger contributions from consumables.

•Began shipping GEM-X Flex, setting a new standard for the cost per cell for researchers and enabling them to run millions of cells for less than one cent per cell. GEM-X Flex also delivers a number of improvements that are particularly valuable for clinical FFPE samples.

•Launched GEM-X Universal Multiplex, enabling researchers to run more cost-effective single cell studies decreasing the cost per sample, even for small scale experiments.

•Began shipping Chromium Xo, providing a budget-friendly instrument for routine, high-performance single cell analysis.

“Our results this quarter fell short of our expectations given greater-than-anticipated disruption from the sales restructuring we implemented in the quarter and cautious customer spending. As these dynamics persist, especially under a difficult macro backdrop, our revenue growth this year will be lower than our previous expectations,” said Serge Saxonov, Co-founder and CEO of 10x Genomics. “Despite these challenges, I am confident that the steps we are taking will enable us to reach more customers, execute consistently across the portfolio and drive the broad democratization of our technologies to reach the full potential of the large opportunity ahead.”

Third Quarter 2024 Financial Results

Revenue was $151.7 million for the third quarter of 2024, a 1% decrease from $153.6 million for the corresponding prior year period.

Gross margin was 70% for the third quarter of 2024, as compared to 62% for the corresponding prior year period. The increase in gross margin was primarily due to change in product mix.

Operating expenses were $147.9 million for the third quarter of 2024, a 22% decrease from $190.3 million for the corresponding prior year period. The decrease was primarily driven by a $41.4 million in-process research and development expense related to an agreement to acquire certain intangible and other assets in the prior year period.

Operating loss was $41.5 million for the third quarter of 2024, as compared to $94.8 million for the corresponding prior year period. Operating loss includes $33.9 million of stock-based compensation for the third quarter of 2024, as compared to $40.2 million of stock-based compensation for the corresponding prior year period. Operating loss in the third quarter of 2023 included $41.4 million of in-process research and development expense.

Net loss was $35.8 million for the third quarter of 2024, as compared to a net loss of $93.0 million for the corresponding prior year period.

Cash and cash equivalents were $398.2 million as of September 30, 2024.

2024 Financial Guidance

10x Genomics is updating its outlook for the full year 2024. The company now expects revenue to be in the range of $595 million to $605 million versus a prior range of $640 million to $660 million. The updated range represents a 3% decrease from the full year 2023 revenue at the midpoint.

Webcast and Conference Call Information

10x Genomics will host a conference call to discuss the third quarter 2024 financial results, business developments and outlook after market close on Tuesday, October 29, 2024, 2024 at 1:30 PM Pacific Time / 4:30 PM Eastern Time. A webcast of the conference call can be accessed at http://investors.10xgenomics.com. The webcast will be archived and available for replay at least 45 days after the event.

About 10x Genomics

10x Genomics is a life science technology company building products to accelerate the mastery of biology and advance human health. Our integrated solutions include instruments, consumables and software for single cell and spatial biology, which help academic and translational researchers and biopharmaceutical companies understand biological systems at a resolution and scale that matches the complexity of biology. Our products are behind breakthroughs in oncology, immunology, neuroscience and more, fueling powerful discoveries that are transforming the world’s understanding of health and disease. To learn more, visit 10xgenomics.com or connect with us on LinkedIn or X (Twitter).

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 as contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the "safe harbor" created by those sections. All statements included in this press release, other than statements of historical facts, may be forward-looking statements. Forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "might," "will," "should," "expect," "plan," "anticipate," "could," "intend," "target," "project," "contemplate," "believe," "see," "estimate," "predict," "potential," "would," "likely," "seek" or "continue" or the negatives of these terms or variations of them or similar terminology, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include statements regarding 10x Genomics, Inc.'s organization and organizational restructuring, commercial execution, opportunities, specifications, costs and adoption of 10x Genomics, Inc.’s products and services, expected performance advantages and benefits of using 10x Genomics, Inc.’s products and services and 10x Genomics, Inc.’s financial performance and results of operations, including expectations regarding revenue and guidance. These statements are based on management's current expectations, forecasts, beliefs, assumptions and information currently available to management. Actual outcomes and results could differ materially from these statements due to a number of factors and such statements should not be relied upon as representing 10x Genomics, Inc.'s views as of any date subsequent to the date of this press release. 10x Genomics, Inc. disclaims any obligation to update any forward-looking statements provided to reflect any change in 10x Genomics’ expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law. The material risks and uncertainties that could affect 10x Genomics, Inc.'s financial and operating results and cause actual results to differ materially from those indicated by the forward-looking statements made in this press release include those discussed under the captions "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the company's most recently-filed 10-K for the fiscal year ended December 31, 2023 and the company’s 10-Q for the quarter ended March 31, 2024 to be filed with the Securities and Exchange Commission (SEC) and elsewhere in the documents 10x Genomics, Inc. files with the SEC from time to time.

Disclosure Information

10x Genomics uses filings with the Securities and Exchange Commission, its website (www.10xgenomics.com), press releases, public conference calls, public webcasts and its social media accounts as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Contacts

Investors: investors@10xgenomics.com

Media: media@10xgenomics.com

10x Genomics, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

(In thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Revenue (1) | $ | 151,654 | | | $ | 153,644 | | | $ | 445,764 | | | $ | 434,748 | |

Cost of revenue (2) | 45,261 | | | 58,115 | | | 142,237 | | | 141,217 | |

| Gross profit | 106,393 | | | 95,529 | | | 303,527 | | | 293,531 | |

| Operating expenses: | | | | | | | |

Research and development (2) | 66,174 | | | 66,507 | | | 197,730 | | | 205,065 | |

| In-process research and development | — | | | 41,402 | | | — | | | 41,402 | |

Selling, general and administrative (2) | 81,704 | | | 82,415 | | | 250,517 | | | 257,205 | |

| | | | | | | |

| Total operating expenses | 147,878 | | | 190,324 | | | 448,247 | | | 503,672 | |

| Loss from operations | (41,485) | | | (94,795) | | | (144,720) | | | (210,141) | |

| Other income (expense): | | | | | | | |

| Interest income | 4,971 | | | 4,300 | | | 14,422 | | | 12,269 | |

| Interest expense | (2) | | | (1) | | | (4) | | | (25) | |

| Other income (expense), net | 2,078 | | | (1,248) | | | 982 | | | (4,268) | |

| | | | | | | |

| Total other income, net | 7,047 | | | 3,051 | | | 15,400 | | | 7,976 | |

| Loss before provision for income taxes | (34,438) | | | (91,744) | | | (129,320) | | | (202,165) | |

| Provision for income taxes | 1,315 | | | 1,242 | | | 4,279 | | | 3,982 | |

| Net loss | $ | (35,753) | | | $ | (92,986) | | | $ | (133,599) | | | $ | (206,147) | |

| | | | | | | |

| Net loss per share, basic and diluted | $ | (0.30) | | | $ | (0.79) | | | $ | (1.11) | | | $ | (1.77) | |

| Weighted-average shares of common stock used in computing net loss per share, basic and diluted | 120,733,030 | | | 117,728,293 | | | 120,067,168 | | | 116,693,008 | |

(1)The following table represents revenue by source for the periods indicated (in thousands). Spatial products includes the Company’s Visium and Xenium products:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Instruments | | | | | | | |

| Chromium | $ | 7,641 | | | $ | 12,231 | | | $ | 24,283 | | | $ | 36,716 | |

| Spatial | 11,415 | | | 22,711 | | | 44,078 | | | 48,357 | |

| Total instruments revenue | 19,056 | | | 34,942 | | | 68,361 | | | 85,073 | |

| Consumables | | | | | | | |

| Chromium | 96,536 | | | 100,282 | | | 274,571 | | | 302,172 | |

| Spatial | 29,668 | | | 14,091 | | | 85,330 | | | 37,067 | |

| Total consumables revenue | 126,204 | | | 114,373 | | | 359,901 | | | 339,239 | |

| Services | 6,394 | | | 4,329 | | | 17,502 | | | 10,436 | |

| Total revenue | $ | 151,654 | | | $ | 153,644 | | | $ | 445,764 | | | $ | 434,748 | |

The following table presents revenue by geography based on the location of the customer for the periods indicated (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Americas | | | | | | | | |

| United States | | $ | 84,723 | | | $ | 96,094 | | | $ | 250,032 | | | $ | 260,769 | |

| Americas (excluding United States) | | 3,099 | | | 2,917 | | | 10,511 | | | 8,581 | |

| Total Americas | | 87,822 | | | 99,011 | | | 260,543 | | | 269,350 | |

| Europe, Middle East and Africa | | 37,851 | | | 32,019 | | | 109,934 | | | 91,687 | |

| Asia-Pacific | | | | | | | | |

| China | | 15,030 | | | 12,431 | | | 42,692 | | | 39,217 | |

| Asia-Pacific (excluding China) | | 10,951 | | | 10,183 | | | 32,595 | | | 34,494 | |

| Total Asia-Pacific | | 25,981 | | | 22,614 | | | 75,287 | | | 73,711 | |

| Total revenue | | $ | 151,654 | | | $ | 153,644 | | | $ | 445,764 | | | $ | 434,748 | |

(2)Includes stock-based compensation expense as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

(in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of revenue | $ | 2,169 | | | $ | 1,844 | | | $ | 6,127 | | | $ | 5,140 | |

| Research and development | 15,978 | | | 17,856 | | | 50,728 | | | 55,196 | |

| Selling, general and administrative | 15,763 | | | 20,535 | | | 51,354 | | | 67,696 | |

| Total stock-based compensation expense | $ | 33,910 | | | $ | 40,235 | | | $ | 108,209 | | | $ | 128,032 | |

10x Genomics, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 398,159 | | | $ | 359,284 | |

| Marketable securities | — | | | 29,411 | |

| | | |

| Accounts receivable, net | 83,525 | | | 114,832 | |

| Inventory | 94,050 | | | 73,706 | |

| Prepaid expenses and other current assets | 18,159 | | | 18,789 | |

| Total current assets | 593,893 | | | 596,022 | |

| Property and equipment, net | 258,759 | | | 279,571 | |

| | | |

| Operating lease right-of-use assets | 59,579 | | | 65,361 | |

| Goodwill | 4,511 | | | 4,511 | |

| Intangible assets, net | 16,149 | | | 16,616 | |

| Other noncurrent assets | 4,903 | | | 3,062 | |

| Total assets | $ | 937,794 | | | $ | 965,143 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 26,210 | | | $ | 15,738 | |

| Accrued compensation and related benefits | 30,080 | | | 30,105 | |

| Accrued expenses and other current liabilities | 37,770 | | | 56,648 | |

| | | |

| Deferred revenue | 17,760 | | | 13,150 | |

| Operating lease liabilities | 9,415 | | | 11,521 | |

| | | |

| Total current liabilities | 121,235 | | | 127,162 | |

| | | |

| | | |

| | | |

| | | |

| Operating lease liabilities, noncurrent | 76,461 | | | 83,849 | |

| Deferred revenue, noncurrent | 12,349 | | | 8,814 | |

| Other noncurrent liabilities | 4,945 | | | 4,275 | |

| Total liabilities | 214,990 | | | 224,100 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

| Preferred stock | — | | | — | |

| Common stock | 2 | | | 2 | |

| Additional paid-in capital | 2,140,789 | | | 2,025,890 | |

| Accumulated deficit | (1,418,019) | | | (1,284,420) | |

| Accumulated other comprehensive income (loss) | 32 | | | (429) | |

| Total stockholders’ equity | 722,804 | | | 741,043 | |

| Total liabilities and stockholders’ equity | $ | 937,794 | | | $ | 965,143 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

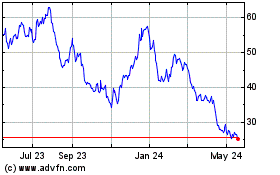

10x Genomics (NASDAQ:TXG)

Historical Stock Chart

From Nov 2024 to Dec 2024

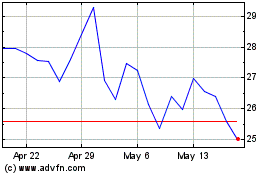

10x Genomics (NASDAQ:TXG)

Historical Stock Chart

From Dec 2023 to Dec 2024