false

0001566610

0001566610

2024-10-11

2024-10-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

| Date

of Report (Date of earliest event reported): |

|

October

11, 2024 |

| Verb

Technology Company, Inc. |

| (Exact

Name of Registrant as Specified in Charter) |

| Nevada |

|

001-38834 |

|

90-1118043 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

3024

Sierra Juniper Court

Las

Vegas, Nevada |

|

89138 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

| Registrant’s

Telephone Number, Including Area Code: |

|

(855)

250-2300 |

| |

| (Former

Name or Former Address, if Changed Since Last Report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 |

|

VERB |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01. Other Events

On

October 11, 2024, the President and Chief Executive Officer of Verb Technology Company, Inc. (the “Company”) issued a letter

to the Company’s stockholders providing them with an update on the Company. A copy of the letter to the stockholders is attached

hereto as Exhibit 99.1.

Item

9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

October 11, 2024 |

VERB

TECHNOLOGY COMPANY, INC. |

| |

|

|

| |

By: |

/s/

Rory J. Cutaia |

| |

Name: |

Rory

J. Cutaia |

| |

Title: |

President

and Chief Executive Officer |

Exhibit

99.1

October

10, 2024

VERB

Stockholders:

I’m

Rory J. Cutaia, VERB CEO, and I wanted to take this opportunity to share some information about the Company. Specifically, I want to

address the recent reverse stock split, the current share price, the current businesses that comprise the Company, our financial condition,

and finally, our future prospects.

But

first – here’s the headline – as of today, October 10, 2024, our market cap is approximately $3.8M, and as of our last

Form 10-Q filing, we had cash in the bank of approximately $17.2M - and the only debt we have is a ridiculously small, low interest (3.75%),

low payment, 30-year term SBA loan of approximately $125K.

So

do the math – this means if we traded at nothing more than our net cash value, the stock should be trading at more than $22

per share.

And

that assumes we get ZERO value for the underlying businesses – ZERO.

It

makes no sense to me that the stock should trade the way it does. I can only assume that people are not reading the filings, analyzing

the financials, and recognizing the amazing opportunity that the new VERB represents.

This

is where I want to direct readers to the safe harbor provision disclosures at the bottom of this letter as I intend to make forward looking

statements in what follows.

We

have completely restructured, realigned, reinvented, reconstituted, and reinvigorated our business. We sold an unprofitable business

unit that was operating in a challenging business sector. We’ve since restructured VERB as a holding company with three distinct,

yet complimentary business units, one of which we have yet to announce. Each is managed by a separate management team, incentivized for

success, and all three are currently generating revenue and are growing and growing at a rate that far outpaces the rate of revenue

growth we have ever experienced. Third quarter results will be exceedingly better than second quarter results as these business units

are now hitting their stride, and based on what we’re seeing right now, fourth quarter will greatly exceed third quarter results.

I

believe we’ve placed ourselves atop a wave of three hot high-growth opportunities that are an outgrowth of recent changes in consumer,

business, and societal behaviors, as well as recent changes in securities regulations, that are currently experiencing meaningful growth

right now and into the foreseeable future.

Our

MARKET.live business has evolved to one of a service provider to brands fueled by our blossoming partnership with TikTok. Our revenue

model has changed from a percent-of-client-sales model to a fixed-price, contract-based, recurring revenue business. Over the past six

months you will have seen fewer MARKET.live businesses stream on MARKET.live - NOT because that business is declining – but because

as we expanded our partnership with TikTok we shifted most of our live productions to TikTok Shop. A completely revamped MARKET.live

is in the works and nearing release. More on that soon.

Our

GO FUND YOURSELF SHOW business vertical, though just-launched, is disrupting the equity crowd-funding sector, offering Reg CF and Reg

A issuers an unmatched opportunity to create broad-based awareness for their equity offerings among the investment community. The GO

FUND YOURSELF show format also reaches the everyman and everywoman non-accredited investor that can learn about and participate in these

types of offerings. Our revenue model includes cash and equity-based fees paid by the issuers for appearances on the show, including

fees for show assets we create for the issuers to use for their own marketing purposes. We also take a percentage of sales revenue from

those issuers who utilize the Show’s unique shoppable platform to sell their products. We also generate revenue from sponsorships

and advertisers.

Our

third business vertical is currently operating in stealth mode as we refine the user/subscriber experience. We believe this business

represents an explosive revenue growth opportunity in one of the fastest-growing business sectors in the world today and I can’t

wait to reveal it to you.

As

to the reverse stock split, we did everything reasonably possible – and then some – to avoid it. In the end, it’s not

our call – let me repeat that because I don’t think some investors realize that – WE DON’T UNILATERALLY DECIDE

TO DO A STOCK SPLIT. IT IS A DECISION MADE BY THE STOCKHOLDERS. Because of the way the stock traded, we received a delisting notice from

Nasdaq.

Our

obligation as management and as board members is to take the steps required to give our stockholders the option to decide our path forward

– delist from Nasdaq and potentially list on the OTC, or reverse split the shares and retain our Nasdaq listing. Neither management,

nor our Board is able to implement a reverse stock split unless the stockholders decide to do so. Our job was to provide every stockholder

with all the information needed to make that decision for themselves. If we had not given stockholders the option to choose, and if we

had unilaterally decided NOT to do a reverse stock split, and we allowed VERB to be delisted – we would have violated our obligations

to all stockholders and we would have been held accountable.

On

September 26, 2024, a significant majority of the stockholders that cast a vote, decided to do a reverse stock split in order to stay

listed on Nasdaq. It was then our job to carry out that decision, which we’ve done. And now we look forward to the value creation

opportunities that lay before us.

We

are extremely well capitalized – on even the most modest revenue assumptions, we have years of cash runway.

We

have virtually no debt to service.

We

have a super clean cap table - all of the warrants have either expired or are so far out of the money as to be irrelevant.

There’s

no hedge fund out there with cheap VERB shares they plan to short against warrants that they picked up for little or no consideration

through a bad financing - as they simply don’t exist.

We

have an unbelievably small, tight float – only 763,230 shares as of October 9, 2024.

We

have three revenue generating, high-performing/growing business units.

And

once again – assuming all three of these businesses are worth zero – no value whatsoever – and we trade on nothing

more than LIQUIDATION VALUE CASH IN THE BANK – we should be trading at more than $22 per share right now.

Think

about that.

And

think about this – as and when we see the stock trading in the range we believe it should – I will absolutely advocate for,

and petition our Board to consider a FORWARD stock split. My interests are completely – 100% aligned with those of every stockholder

– as are the interests of our management team and our Board.

We

win together and now is our time.

Best,

Rory

FORWARD-LOOKING

STATEMENTS

This

communication contains “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act

of 1995. Forward-looking statements involve risks and uncertainties and include, without limitation, any statement that may predict,

forecast, indicate or imply future results, performance, or achievements. Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future

of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that

are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially

from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important

factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking

statements include, among others, those identified in our filings with the Securities and Exchange Commission (the “SEC”),

including our annual, quarterly and current reports filed with the SEC and the risk factors included in our annual report on Form 10-K

filed with the SEC on April 1, 2024. Any forward-looking statement made by us herein is based only on information currently available

to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement

whether as a result of new information, future developments or otherwise.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

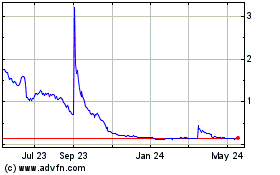

Verb Technology (NASDAQ:VERB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Verb Technology (NASDAQ:VERB)

Historical Stock Chart

From Nov 2023 to Nov 2024