false

0001841425

0001841425

2024-02-13

2024-02-13

0001841425

dei:FormerAddressMember

2024-02-13

2024-02-13

0001841425

VGAS:ClassCommonStockParValue0.0001PerShareMember

2024-02-13

2024-02-13

0001841425

VGAS:WarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2024-02-13

2024-02-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 13, 2024 (February 13, 2024)

Verde Clean Fuels,

Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40743 |

|

85-1863331 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

711 Louisiana Street, Suite 2160

Houston, TX 77002

(Address of principal executive offices, including zip code)

(908) 281-6000

(Registrant’s telephone number,

including area code)

600 Travis Street, Suite 5050

Houston, TX 77002

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share |

|

VGAS |

|

The Nasdaq Capital Market |

| Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

VGASW |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure.

On February 13, 2024, Verde Clean Fuels, Inc. (the “Company”)

issued a press release announcing its entry into a joint development agreement with Cottonmouth Ventures, LLC, a subsidiary of Diamondback

Energy, which sets forth a pathway, subject to final approval and other conditions precedent, towards developing, constructing and operating

a facility capable of converting natural gas to gasoline in Martin County, Texas.

The information in this Item 7.01, including Exhibit 99.1 attached hereto

and incorporated by reference into this Item 7.01, shall not be deemed "filed" for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, or otherwise subject to the liabilities under that Section. Furthermore, such information in this Item

7.01, including Exhibit 99.1 attached hereto and incorporated by reference into this Item 7.01, shall not be deemed incorporated by reference

into any of the Company's reports or filings with the SEC, whether made before or after the date hereof, except as expressly set forth

by specific reference in such report or filing. The information in this Item 7.01, including Exhibit 99.1 attached hereto and incorporated

by reference into this Item 7.01, shall not be deemed an admission as to the materiality of any information in this Current Report on

Form 8-K that is required to be disclosed solely to satisfy the requirements of Regulation FD.

Item 9.01. Financial Statement and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: February 13, 2024 |

Verde Clean Fuels, Inc. |

| |

|

|

|

| |

By: |

/s/ Ernest Miller |

| |

|

Name: |

Ernest Miller |

| |

|

Title: |

Chief Executive Officer and

Interim Chief Financial Officer |

Exhibit 99.1

Verde Clean

Fuels, Inc. and Cottonmouth Ventures LLC Announce Joint Development Agreement for a Proposed Natural Gas-to-Gasoline Facility in Permian

Basin

Verde Clean Fuels aims to deploy its proprietary

STG+ process utilizing Permian Basin natural gas produced by Diamondback Energy’s operations with the goal to produce approximately

3,000 barrels per day of RBOB gasoline

HOUSTON – February 13, 2024 – Verde Clean Fuels,

Inc. (NASDAQ: VGAS) (“Verde” and “Company”) and Cottonmouth Ventures LLC, a subsidiary of Diamondback Energy (NASDAQ:

FANG) (“Diamondback”), today announced that the parties have executed a Joint Development Agreement (“JDA”) for

the proposed development, construction, and operation of a facility to produce commodity-grade gasoline utilizing associated natural gas

feedstock supplied from Diamondback’s operations in the Permian Basin.

The JDA provides a pathway forward for the parties to reach final

definitive documents and Final Investment Decision (“FID"). The JDA frames the contracts contemplated to be entered into between

the parties, including an operating agreement, ground lease agreement, construction agreement, license agreement and financing agreements

as well as conditions precedent to close such as FID.

The expectation of the project is to produce approximately 3,000

barrels per day of fully-refined gasoline utilizing Verde’s patented STG+® process. By consuming natural gas in the pipeline-constrained

Permian Basin as feedstock, the proposed project could demonstrate the ability to mitigate the flaring of up to 34 million cubic feet

of natural gas per day, while also producing a high-value, salable product.

“The Verde Clean Fuels team is incredibly excited to finalize

this JDA with Diamondback Energy with the goal to produce gasoline from natural gas in the Permian Basin,” said Ernie Miller, CEO

of Verde. “This arrangement brings compounding economic and environmental benefits to West Texas. We believe that the ability to

de-bottleneck midstream constraint along with the potential to reduce flaring of natural gas while creating less carbon intensive gasoline

is of paramount interest to natural gas producers.”

“This agreement, with the first planned project in Martin County,

fits perfectly with Diamondback’s strategy to decarbonize the oil field while ensuring a return for our investors,” said Kaes

Van’t Hof, President of Diamondback. “Additionally, the scalability of the project is incredibly exciting, with similar natural

gas-to-gasoline facilities possible across Diamondback’s locations in West Texas. We are proud to partner with Verde to bring this

technology to the market.”

The proposed facility, which is to be located in Martin County, Texas

in the heart of the Permian Basin, could serve as a template for additional natural gas-to-gasoline projects throughout the Permian Basin

and other pipeline-constrained basins in the U.S., as well as addressing flared or stranded natural gas opportunities internationally.

About Verde Clean Fuels, Inc.

Verde Clean Fuels, Inc. is a renewable energy company

focused on the development of commercial production plants to convert syngas, derived from diverse biomass feedstocks, such as yard waste,

agricultural waste, and sorted municipal solid waste, as well as stranded or flared natural gas (including renewable natural gas) into

gasoline through its innovative and proprietary liquid fuels technology, the STG+® process. Through its STG+® process, Verde converts

syngas into fully finished fuels that require no additional refining, such as Reformulated Blend-stock for Oxygenate Blending (“RBOB”)

gasoline. To learn more, please visit www.verdecleanfuels.com.

About Diamondback Energy

Diamondback is an independent oil and natural gas

company headquartered in Midland, Texas focused on the acquisition, development, exploration and exploitation of unconventional, onshore

oil and natural gas reserves in the Permian Basin in West Texas. For more information, please visit www.diamondbackenergy.com.

Forward-Looking Statements

This document contains statements believed to be

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements other than historical facts are forward-looking statements, and include statements regarding the

contemplated development, construction and operation of the project, business strategy, projected operations, plans and objectives of

management and anticipated production at the project. Words such as "expect," “could,” “goal,” “aim,”

“may,” "anticipate," "intend," "plan," “ability,” "believe," "seek,"

"will," "would," “proposed,” “expectation,” “estimate,” “forecast,”

“outlook,” “opportunity” or “strategy” or similar expressions are generally intended to identify forward-looking

statements. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially

from those expressed in, or implied by, such statements.

Although we believe the expectations and forecasts

reflected in these forward-looking statements are reasonable, they are inherently subject to numerous risks and uncertainties, most of

which are difficult to predict and many of which are beyond either party’s control. No assurance can be given that such forward-looking

statements will be correct or achieved or that the assumptions are accurate or will not change over time. Particular uncertainties that

could cause actual results to be materially different than those expressed in these forward-looking statements include:

| • | ability to finalize definitive documents and reach a FID with respect to the project contemplated by the JDA; |

| • | ability to obtain financing for the facility; |

| • | ability to achieve expected production volumes and flaring reduction; |

| • | ability to successfully execute on the construction of the facility and enter into third party contracts on contemplated terms; |

| • | fluctuations in commodity prices and the potential for sustained low commodity prices; |

| • | equipment, service or labor price inflation or unavailability; |

| • | legislative, legal or regulatory changes that affect operations; and |

| • | other factors discussed in SEC filings, including Part I, Item 1A – Risk Factors in Verde’s periodic filings with the

SEC, including Verde’s Annual Report on From 10-K. Verde’s SEC filings are available publicly on the SEC’s website at

http://www.sec.gov. |

We caution you not to place undue reliance on forward-looking

statements contained in this press release, which speak only as of the date hereof, and neither party undertakes an obligation to update

this information.

Contacts

Verde Investor Relations:

Caldwell Bailey (ICR)

verdeIR@icrinc.com

v3.24.0.1

Cover

|

Feb. 13, 2024 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 13, 2024

|

| Entity File Number |

001-40743

|

| Entity Registrant Name |

Verde Clean Fuels,

Inc.

|

| Entity Central Index Key |

0001841425

|

| Entity Tax Identification Number |

85-1863331

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

711 Louisiana Street

|

| Entity Address, Address Line Two |

Suite 2160

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77002

|

| City Area Code |

908

|

| Local Phone Number |

281-6000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

true

|

| Class A Common Stock, par value $0.0001 per share |

|

| Entity Addresses [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

VGAS

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

| Entity Addresses [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

VGASW

|

| Security Exchange Name |

NASDAQ

|

| Former Address [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

600 Travis Street

|

| Entity Address, Address Line Two |

Suite 5050

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77002

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=VGAS_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=VGAS_WarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

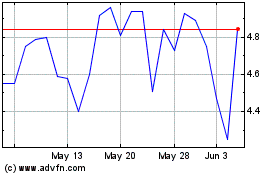

Verde Clean Fuels (NASDAQ:VGAS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Verde Clean Fuels (NASDAQ:VGAS)

Historical Stock Chart

From Jan 2024 to Jan 2025