0001603923false00016039232025-02-052025-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2025

Weatherford International plc

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Ireland | 001-36504 | 98-0606750 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | |

| 2000 St. James Place | , | Houston, | | Texas | | | 77056 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: 713.836.4000

| | | | | | | | | | | | | | |

| N/A | |

| (Former Name or Former Address, if Changed Since Last Report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Ordinary shares, $0.001 par value per share | WFRD | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On February 5, 2025, Weatherford International plc (“Weatherford” and together with its subsidiaries, “we” or the “Company”) issued a news release announcing results for the fourth quarter ended December 31, 2024. A copy of the news release is furnished as Exhibit 99.1 and incorporated into this Item 2.02.

Weatherford will host a conference call on Thursday, February 6, 2025, to discuss the Company’s results for the fourth quarter ended December 31, 2024. The conference call will begin at 8:30 a.m. Eastern Time (7:30 a.m. Central Time).

Listeners are encouraged to download the accompanying presentation slides which will be available in the investor relations section of the Company’s website.

Listeners can participate in the conference call via a live webcast at https://www.weatherford.com/investor-relations/investor-news-and-events/events/ or by dialing +1 877-328-5344 (within the U.S.) or +1 412-902-6762 (outside of the U.S.) and asking for the Weatherford conference call. Participants should log in or dial in approximately 10 minutes prior to the start of the call.

A telephonic replay of the conference call will be available until February 20, 2025, at 5:00 p.m. Eastern Time. To access the replay, please dial +1 877-344-7529 (within the U.S.) or +1 412-317-0088 (outside of the U.S.) and reference conference number 9530137. A replay and transcript of the earnings call will also be available in the investor relations section of the Company’s website

| | | | | |

| Item 8.01 | Other Information. |

On February 5, 2025, Weatherford announced that its Board of Directors (the “Board”) has declared a cash dividend of $0.25 per share on the Company’s ordinary shares, par value $0.001 per share, payable on March 19, 2025 to shareholders of record as of February 21, 2025. The declaration of any future dividends is subject to the Board’s discretion.

A copy of the press release announcing the dividend is attached as Exhibit 99.1 to this Form 8-K and the portions related to the dividend are incorporated herein by reference.

| | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits. |

| | |

| (d) | | Exhibits |

| | | | | | | | |

| Exhibit Number | | Exhibit Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Weatherford International plc |

| Date: February 5, 2025 | |

| /s/ Arunava Mitra |

| Arunava Mitra |

| Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Weatherford Announces Fourth Quarter and Full Year 2024 Results

•Fourth quarter revenue of $1,341 million decreased 5% sequentially and 2% year-over-year; full year revenue of $5,513 million increased 7% from prior year, driven by international revenue growth of 10%

•Fourth quarter operating income of $198 million decreased 19% sequentially and 8% year-over-year; full year operating income of $938 million increased 14% from prior year

•Fourth quarter net income of $112 million, an 8.4% margin, decreased 29% sequentially and 20% year-over-year; full year net income of $506 million, a 9.2% margin, increased by 21% from prior year

•Fourth quarter adjusted EBITDA* of $326 million, a 24.3% margin, decreased 8%, or 88 basis points, sequentially and increased 2%, or 74 basis points, year-over-year; full year adjusted EBITDA* of $1,382 million, a 25.1% margin, increased 17%, or 197 basis points, from prior year

•Fourth quarter cash provided by operating activities of $249 million and adjusted free cash flow* of $162 million; full year cash provided by operating activities of $792 million and adjusted free cash flow* of $524 million

•Shareholder return of $67 million for the quarter, which included dividend payments of $18 million and share repurchases of $49 million

•Board approved quarterly cash dividend of $0.25 per share, payable on March 19, 2025, to shareholders of record as of February 21, 2025

*Non-GAAP - refer to the section titled Non-GAAP Financial Measures Defined and GAAP to Non-GAAP Financial Measures Reconciled

Houston, February 5, 2025 – Weatherford International plc (NASDAQ: WFRD) (“Weatherford” or the “Company”) announced today its results for the fourth quarter of 2024 and full year 2024.

Revenues for the fourth quarter of 2024 were $1,341 million, a decrease of 5% sequentially and 2% year-over-year. Operating income was $198 million in the fourth quarter of 2024, compared to $243 million in the third quarter of 2024 and $216 million in the fourth quarter of 2023. Net income in the fourth quarter of 2024 was $112 million, with an 8.4% margin, a decrease of 29%, or 279 basis points, sequentially, and a decrease of 20%, or 193 basis points, year-over-year. Adjusted EBITDA* was $326 million, a 24.3% margin, a decrease of 8%, or 88 basis points, sequentially, and an increase of 2%, or 74 basis points, year-over-year. Basic income per share in the fourth quarter of 2024 was $1.54 compared to $2.14 in the third quarter of 2024 and $1.94 in the fourth quarter of 2023. Diluted income per share in the fourth quarter of 2024 was $1.50 compared to $2.06 in the third quarter of 2024 and $1.90 in the fourth quarter of 2023.

Fourth quarter 2024 cash flows provided by operating activities were $249 million, compared to $262 million in the third quarter of 2024, and $375 million in the fourth quarter of 2023. Adjusted free cash flow* was $162 million, a decrease of $22 million sequentially, and $153 million year-over-year. Capital expenditures were $100 million in the fourth quarter of 2024, compared to $78 million in the third quarter of 2024, and $67 million in the fourth quarter of 2023.

Revenue for the full year 2024 was $5,513 million, compared to revenues of $5,135 million in 2023. Operating income for the full year was $938 million, compared to $820 million in 2023. The Company’s full year 2024 net income was $506 million, compared to $417 million in 2023. Full year cash flows provided by operations were $792 million, compared to $832 million in 2023. Adjusted free cash flow* for the full year was $524 million compared to $651 million in 2023. Capital expenditures for the full year 2024 were $299 million, compared to $209 million in 2023.

Girish Saligram, President and Chief Executive Officer, commented, “The fourth quarter witnessed a significant drop in activity levels in Latin America and a more cautious tone in a few key geographies. Despite a challenging environment in the fourth quarter, the overall full year 2024 was another one of setting new operational highs, and I would like to express my gratitude to the One Weatherford team for that. We ended the year with the best safety record we have ever had, strong margin expansion and solid cash generation.

While the activity outlook continues to evolve, margins and cash flow performance continue to be the cornerstone of our financial and strategic objectives. We are well-positioned to deliver another year of strong cash flow generation in 2025. While there is some temporary activity reduction, we continue to believe in the industry’s mid to long-term resilience and remain committed to our goal of achieving EBITDA margins in the high 20’s over the next few years.”

*Non-GAAP - refer to the section titled Non-GAAP Financial Measures Defined and GAAP to Non-GAAP Financial Measures Reconciled

Operational & Commercial Highlights

•ADNOC awarded Weatherford a three-year contract for the provision of rigless services as part of the reactivation of ADNOC’s onshore strings.

•Kuwait Oil Company (KOC) awarded Weatherford a Managed Pressure Drilling (MPD) services contract focused on improving operational efficiency, enhancing safety, accelerating well-delivery timelines, and reducing costs by deploying Weatherford’s innovative VictusTM Intelligent MPD system.

•KOC awarded Weatherford a one-year contract to provide and operate two onshore Real Time Decision Centers.

•A National Oil Company (NOC) in Qatar awarded Weatherford a five-year contract to provide fishing and drilling tools, with a five-year extension option.

•An NOC in Asia awarded Weatherford a three-year contract for the provision of Wireline conveyance and tooling services and a three-year contract for Tubular Running Services (TRS) in onshore India.

•OMV Petrom awarded Weatherford a two-year contract for openhole and cased-hole logging services in Romania.

•A major operator in Asia awarded Weatherford a three-year contract for providing ModusTM MPD services for two zones in North and South Sumatra, and awarded a five-year contract to provide openhole and cased-hole Wireline in onshore Indonesia.

•Khalda awarded Weatherford a three-year contract to deploy up to 300 wells in Egypt using CygNet® SCADA and ForeSite® platform.

•Azule Energy awarded Weatherford a three-year contract to provide TRS for the NGC Project in offshore Angola. This is in addition to the recently awarded TRS contract in block 15/06 in the deepwater block.

•PTTEP awarded Weatherford a 24-month contract to provide openhole Wireline Services in onshore Thailand.

•A major operator in Asia awarded Weatherford with a four-year contract to provide Rotating Control Devices to enable MPD in offshore Indonesia.

•Shell Petroleum Development Company awarded Weatherford a three-year contract to provide Well Completions and other related specialized services in onshore Nigeria.

Technology Highlights

On January 14, 2025, at the annual IKTVA forum held at Dahan Dharan Expo, Weatherford signed an agreement with SPARK, a fully integrated industrial ecosystem aimed at making Saudi Arabia a global energy hub. This strategic partnership, aligned with Saudi Arabia’s Vision 2030, enhances Weatherford’s local presence, boosts production capabilities, and supports the region’s energy goals. By advancing local content, fostering talent, and driving innovation, Weatherford demonstrates its commitment to economic growth and to supporting Saudi Arabia’s leadership in energy innovation.

•Drilling & Evaluation (“DRE”)

◦In the North Sea, Weatherford successfully deployed the world’s first Dual Advanced Kickover Tool for Equinor. The unique solution enables gas lift valve replacements in just a single run, which significantly increases efficiency and reduces cost of conventional systems.

◦In Saudi Arabia, Weatherford deployed its compact wireline logging tools with shuttle technology to achieve a record total depth for Aramco. This extended reach well features the longest horizontal section, measuring 23,000 feet.

•Well Construction and Completions (“WCC”)

◦In deepwater Brazil, Weatherford successfully installed the first OptiRoss® RFID Multi-Cycle Sliding Sleeve Valve for a major operator. The system enhances acid stimulation efficiency, improving production and boosting the reservoir’s oil recovery factor.

◦In the Middle East, Weatherford successfully deployed its market-leading Optimax Tubing Retrievable Safety Valve for an NOC. This deployment enabled gas lift valve replacements in a single run, significantly increasing efficiency and reducing costs compared to conventional systems.

•Production and Intervention (“PRI”)

◦In the Middle East, Weatherford's Alpha1Go remote re-entry system was deployed for an NOC, optimizing rig site operations by significantly reducing whipstock preparation time and minimizing red-zone exposure. This deployment improved both efficiency and safety, demonstrating the system's effectiveness in facilitating well re-entry operations and real-time team collaboration in various rig environments.

◦In US land operations, Weatherford successfully deployed its first Reclaim Dual Barrier Plug and Abandon (P&A) system for a major operator. This innovative dual barrier P&A system safely and reliably abandons wells without the need to pull tubing. By eliminating the requirement for conventional drilling rigs, it significantly reduces costs and minimizes the carbon footprint.

Shareholder Return

During the fourth quarter of 2024, Weatherford repurchased shares for approximately $49 million and paid dividends of $18 million, resulting in total shareholder return of $67 million. Since the inception of the shareholder return program introduced earlier in 2024, the Company repurchased shares for approximately $99 million and paid dividends of $36 million, resulting in total shareholder return of $135 million.

On January 29, 2025, our Board declared a cash dividend of $0.25 per share of the Company’s ordinary shares, payable on March 19, 2025, to shareholders of record as of February 21, 2025.

Results by Reportable Segment

Drilling and Evaluation (“DRE”)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Variance | | Twelve Months Ended | | Variance |

| ($ in Millions) | | Dec 31, 2024 | | Sep 30, 2024 | | Dec 31, 2023 | | Seq. | | YoY | | Dec 31, 2024 | | Dec 31, 2023 | | YoY |

| Revenue | | $ | 398 | | | $ | 435 | | | $ | 382 | | | (9) | % | | 4 | % | | $ | 1,682 | | | $ | 1,536 | | | 10 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Segment Adjusted EBITDA | | $ | 96 | | | $ | 111 | | | $ | 97 | | | (14) | % | | (1) | % | | $ | 467 | | | $ | 422 | | | 11 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Segment Adj EBITDA Margin | | 24.1 | % | | 25.5 | % | | 25.4 | % | | (140) | bps | | (127) | bps | | 27.8 | % | | 27.5 | % | | 29 | bps |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Fourth quarter 2024 DRE revenue of $398 million decreased by $37 million, or 9% sequentially, primarily from lower activity in Latin America, partly offset by higher international Wireline activity. Year-over-year DRE revenues increased by $16 million, or 4%, primarily from higher activity in North America and higher international Wireline activity, partly offset by lower activity in Latin America.

Fourth quarter 2024 DRE segment adjusted EBITDA of $96 million decreased by $15 million, or 14% sequentially, primarily driven by lower activity in Latin America, partly offset by higher international Wireline activity. Year-over-year DRE segment adjusted EBITDA decreased by $1 million, or 1%, primarily due to lower activity in Latin America, partly offset by improved performance in Middle East/North Africa/Asia.

Full year 2024 DRE revenues of $1,682 million increased by $146 million, or 10% compared to 2023, as higher Wireline and Drilling-related services activity were partly offset by lower Drilling Services in Latin America.

Full year 2024 DRE segment adjusted EBITDA of $467 million increased by $45 million, or 11% compared to 2023, as higher MPD and Wireline activity were partly offset by lower activity in Latin America.

Well Construction and Completions (“WCC”)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Variance | | Twelve Months Ended | | Variance |

| ($ in Millions) | | Dec 31, 2024 | | Sep 30, 2024 | | Dec 31, 2023 | | Seq. | | YoY | | Dec 31, 2024 | | Dec 31, 2023 | | YoY |

| Revenue | | $ | 505 | | | $ | 509 | | | $ | 480 | | | (1) | % | | 5 | % | | $ | 1,976 | | | $ | 1,800 | | | 10 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Segment Adjusted EBITDA | | $ | 148 | | | $ | 151 | | | $ | 131 | | | (2) | % | | 13 | % | | $ | 564 | | | $ | 455 | | | 24 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Segment Adj EBITDA Margin | | 29.3 | % | | 29.7 | % | | 27.3 | % | | (36) | bps | | 202 | bps | | 28.5 | % | | 25.3 | % | | 326 | bps |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Fourth quarter 2024 WCC revenue of $505 million decreased by $4 million, or 1% sequentially, primarily due to

lower activity in Europe/Sub-Sahara Africa/Russia, partly offset by higher Completions and TRS activity in Middle East/North Africa/Asia. Year-over-year WCC revenues increased by $25 million, or 5%, primarily due to higher activity in Middle East/North Africa/Asia and higher Liner Hangers and Well Services activity in Latin America, partly offset by lower activity in North America.

Fourth quarter 2024 WCC segment adjusted EBITDA of $148 million decreased by $3 million, or 2% sequentially, primarily due to lower activity in Europe/Sub-Sahara Africa/Russia, partly offset by higher Completions and TRS activity in Middle East/North Africa/Asia. Year-over-year WCC segment adjusted EBITDA increased by $17 million, or 13%, primarily due to higher activity in Middle East/North Africa/Asia, partly offset by lower activity in Europe/Sub-Sahara Africa/Russia.

Full year 2024 WCC revenues of $1,976 million increased by $176 million, or 10% compared to 2023, primarily from higher activity in Middle East/North Africa/Asia and Latin America, partly offset by lower activity in North America.

Full year 2024 WCC segment adjusted EBITDA of $564 million increased by $109 million, or 24% compared to 2023, primarily due to improved fall through in major product lines across all geographies.

Production and Intervention (“PRI”)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Variance | | Twelve Months Ended | | Variance |

| ($ in Millions) | | Dec 31, 2024 | | Sep 30, 2024 | | Dec 31, 2023 | | Seq. | | YoY | | Dec 31, 2024 | | Dec 31, 2023 | | YoY |

| Revenue | | $ | 364 | | | $ | 371 | | | $ | 386 | | | (2) | % | | (6) | % | | $ | 1,452 | | | $ | 1,472 | | | (1) | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Segment Adjusted EBITDA | | $ | 78 | | | $ | 83 | | | $ | 88 | | | (6) | % | | (11) | % | | $ | 319 | | | $ | 323 | | | (1) | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Segment Adj EBITDA Margin | | 21.4 | % | | 22.4 | % | | 22.8 | % | | (94) | bps | | (137) | bps | | 22.0 | % | | 21.9 | % | | 3 | bps |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Fourth quarter 2024 PRI revenue of $364 million decreased by $7 million, or 2% sequentially, primarily due to lower activity in Latin America and lower Intervention Services and Drilling Tools (ISDT) activity in Europe/Sub-Sahara Africa/Russia and North America. Year-over-year PRI revenue decreased by $22 million, or 6%, as lower activity in Middle East/North Africa/Asia and Latin America was partly offset by higher Artificial Lift activity in North America.

Fourth quarter 2024 PRI segment adjusted EBITDA of $78 million, decreased by $5 million, or 6% sequentially, primarily from lower activity in Latin America and lower ISDT activity in Europe/Sub-Sahara Africa/Russia and North America, partly offset by higher Artificial Lift activity in Middle East/North Africa/Asia. Year-over-year PRI segment adjusted EBITDA decreased by $10 million, or 11% year-over-year, primarily due to lower activity in Latin America and Europe/Sub-Sahara Africa/Russia, partly offset by better ISDT and Artificial Lift fall through in North America.

Full year 2024 PRI revenues of $1,452 million decreased by $20 million, or 1% compared to 2023, primarily due to lower international Pressure Pumping and Digital Solutions activity, partly offset by higher ISDT activity in Europe/Sub-Sahara Africa/Russia and Middle East/North Africa/Asia.

Full year 2024 PRI segment adjusted EBITDA of $319 million decreased by $4 million, or 1% compared to 2023, as lower activity in international Pressure Pumping and Digital Solutions was partly offset by improved performance in Artificial Lift.

Revenue by Geography

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Variance | | Twelve Months Ended | | Variance |

| ($ in Millions) | | Dec 31, 2024 | | Sep 30, 2024 | | Dec 31, 2023 | | Seq. | | YoY | | Dec 31, 2024 | | Dec 31, 2023 | | YoY |

| North America | | $ | 261 | | | $ | 266 | | | $ | 248 | | | (2) | % | | 5 | % | | $ | 1,046 | | | $ | 1,068 | | | (2) | % |

| | | | | | | | | | | | | | | | |

| International | | $ | 1,080 | | | $ | 1,143 | | | $ | 1,114 | | | (6) | % | | (3) | % | | $ | 4,467 | | | $ | 4,067 | | | 10 | % |

| Latin America | | 312 | | | 358 | | | 342 | | | (13) | % | | (9) | % | | 1,393 | | | 1,387 | | | — | % |

| Middle East/North Africa/Asia | | 542 | | | 542 | | | 547 | | | — | % | | (1) | % | | 2,123 | | | 1,815 | | | 17 | % |

| Europe/Sub-Sahara Africa/Russia | | 226 | | | 243 | | | 225 | | | (7) | % | | — | % | | 951 | | | 865 | | | 10 | % |

| Total Revenue | | $ | 1,341 | | | $ | 1,409 | | | $ | 1,362 | | | (5) | % | | (2) | % | | $ | 5,513 | | | $ | 5,135 | | | 7 | % |

North America

Fourth quarter 2024 North America revenue of $261 million decreased by $5 million, or 2% sequentially, primarily due to activity decreases in the North and South regions, partly offset by activity increase offshore in the Gulf of Mexico. Year-over-year, North America increased by $13 million, or 5%, primarily from higher Artificial Lift and Wireline activity, partly offset by a decrease in activity across the WCC segment.

Full year 2024 North America revenue of $1,046 million decreased by $22 million, or 2%, compared to 2023, primarily due to lower activity in the WCC and PRI segments, partly offset by higher Wireline activity.

International

Fourth quarter 2024 international revenue of $1,080 million decreased 6% sequentially and decreased 3% year-over-year, and full year 2024 international revenue of $4,467 million increased 10%, compared to 2023.

Fourth quarter 2024 Latin America revenue of $312 million decreased by $46 million, or 13% sequentially, primarily due to lower Drilling-related Services, partly offset by higher Liner Hangers activity. Year-over-year, Latin America revenue decreased by $30 million, primarily due to lower activity in the DRE and PRI segments, partly offset by higher activity in Liner Hangers and Well Services.

Full year 2024 Latin America revenue of $1,393 million was largely flat, compared to 2023.

Fourth quarter 2024 revenue of $542 million in Middle East/North Africa/Asia was flat sequentially, as higher activity from Completions and Artificial Lift were largely offset by lower MPD and Integrated Services & Projects. Year-over-year, the Middle East/North Africa/Asia revenue decreased by $5 million, or 1%, primarily due to lower activity in the PRI segment, partly offset by higher Drilling-related services and Completions activity.

Full year 2024 revenue of $2,123 million in Middle East/North Africa/Asia increased by $308 million, or 17%, compared to 2023, mainly due to increased activity in the DRE and WCC segments, partly offset by lower activity in Digital Solutions, Artificial Lift and Pressure Pumping.

Fourth quarter 2024 Europe/Sub-Sahara Africa/Russia revenue of $226 million decreased by $17 million, or 7%, sequentially, mainly driven by lower Completions and ISDT activity, partly offset by higher Wireline activity. Year-over-year Europe/Sub-Sahara Africa/Russia revenue was largely flat due to increased activity in the DRE segment, largely offset by lower activity in the WCC and PRI segments.

Full year 2024 Europe/Sub-Sahara Africa/Russia revenue of $951 million increased by $86 million, or 10% compared to 2023, due to increased activity in the DRE and WCC segments, partly offset by lower Pressure Pumping and Artificial Lift activity.

About Weatherford

Weatherford delivers innovative energy services that integrate proven technologies with advanced digitalization to create sustainable offerings for maximized value and return on investment. Our world-class experts partner with customers to optimize their resources and realize the full potential of their assets. Operators choose us for strategic solutions that add efficiency, flexibility, and responsibility to any energy operation. The Company conducts business in approximately 75 countries and has approximately 19,000 team members representing more than 110 nationalities and 330 operating locations. Visit weatherford.com for more information and connect with us on social media.

Conference Call Details

Weatherford will host a conference call on Thursday, February 6, 2025, to discuss the Company’s results for the fourth quarter ended December 31, 2024. The conference call will begin at 8:30 a.m. Eastern Time (7:30 a.m. Central Time).

Listeners are encouraged to download the accompanying presentation slides which will be available in the investor relations section of the Company’s website.

Listeners can participate in the conference call via a live webcast at https://www.weatherford.com/investor-relations/investor-news-and-events/events/ or by dialing +1 877-328-5344 (within the U.S.) or +1 412-902-6762 (outside of the U.S.) and asking for the Weatherford conference call. Participants should log in or dial in approximately 10 minutes prior to the start of the call.

A telephonic replay of the conference call will be available until February 20, 2025, at 5:00 p.m. Eastern Time. To access the replay, please dial +1 877-344-7529 (within the U.S.) or +1 412-317-0088 (outside of the U.S.) and reference conference number 9530137. A replay and transcript of the earnings call will also be available in the investor relations section of the Company’s website.

Contacts

For Investors:

Luke Lemoine

Senior Vice President, Corporate Development & Investor Relations

+1 713-836-7777

investor.relations@weatherford.com

For Media:

Kelley Hughes

Senior Director, Communications & Employee Engagement

media@weatherford.com

Forward-Looking Statements

This news release contains projections and forward-looking statements concerning, among other things, the Company’s quarterly and full-year revenues, adjusted EBITDA*, adjusted EBITDA margin*, adjusted free cash flow*, net leverage*, shareholder return program, forecasts or expectations regarding business outlook, prospects for its operations, capital expenditures, expectations regarding future financial results, and are also generally identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “outlook,” “budget,” “intend,” “strategy,” “plan,” “guidance,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions, although not all forward-looking statements contain these identifying words. Such statements are based upon the current beliefs of Weatherford’s management and are subject to significant risks, assumptions, and uncertainties. Should one or more of these risks or uncertainties materialize, or underlying assumptions prove incorrect, actual results may vary materially from those indicated in our forward-looking statements. Readers are cautioned that forward-looking statements are only predictions and may differ materially from actual future events or results, based on factors including but not limited to: global political disturbances, war, terrorist attacks, changes in global trade policies and tariffs, weak local economic conditions and international currency fluctuations; general global economic repercussions related to U.S. and global inflationary pressures and potential recessionary concerns; various effects from conflicts in the Middle East and the Russia Ukraine conflict, including, but not limited to, nationalization of assets, extended business interruptions, sanctions, treaties and regulations imposed by various countries, associated operational and logistical challenges, and impacts to the overall global energy supply; cybersecurity issues; our ability to comply with, and respond to, climate change, environmental, social and governance and other sustainability initiatives and future legislative and regulatory measures both globally and in specific geographic regions; the potential for a resurgence of a pandemic in a given geographic area and related disruptions to our business, employees, customers, suppliers and other partners; the price and price volatility of, and demand for, oil and natural gas; the macroeconomic outlook for the oil and gas industry; our ability to generate cash flow from operations to fund our operations; our ability to effectively and timely adapt our technology portfolio, products and services to remain competitive, and to address and participate in changes to the market demands, including for the transition to alternate sources of energy such as geothermal, carbon capture and responsible abandonment, including our digitalization efforts; our ability to effectively execute our capital allocation framework; our ability to return capital to shareholders, including those related to the timing and amounts (including any plans or commitments in respect thereof) of any dividends and share repurchases; and the realization of additional cost savings and operational efficiencies.

These risks and uncertainties are more fully described in Weatherford’s reports and registration statements filed with the Securities and Exchange Commission, including the risk factors described in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Accordingly, you should not place undue reliance on any of the Company’s forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made, and the Company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law, and we caution you not to rely on them unduly.

*Non-GAAP - refer to the section titled Non-GAAP Financial Measures Defined and GAAP to Non-GAAP Financial Measures Reconciled

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weatherford International plc |

| Selected Statements of Operations (Unaudited) |

| | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| ($ in Millions, Except Per Share Amounts) | | December 31, 2024 | | September 30, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 |

| Revenues: | | | | | | | | | | |

| DRE Revenues | | $ | 398 | | | $ | 435 | | | $ | 382 | | | $ | 1,682 | | | $ | 1,536 | |

| WCC Revenues | | 505 | | | 509 | | | 480 | | | 1,976 | | | 1,800 | |

| PRI Revenues | | 364 | | | 371 | | | 386 | | | 1,452 | | | 1,472 | |

| | | | | | | | | | |

| All Other | | 74 | | | 94 | | | 114 | | | 403 | | | 327 | |

| Total Revenues | | 1,341 | | | 1,409 | | | 1,362 | | | 5,513 | | | 5,135 | |

| | | | | | | | | | |

| Operating Income: | | | | | | | | | | |

DRE Segment Adjusted EBITDA[1] | | $ | 96 | | | $ | 111 | | | $ | 97 | | | $ | 467 | | | $ | 422 | |

WCC Segment Adjusted EBITDA[1] | | 148 | | | 151 | | | 131 | | | 564 | | | 455 | |

PRI Segment Adjusted EBITDA[1] | | 78 | | | 83 | | | 88 | | | 319 | | | 323 | |

| | | | | | | | | | |

All Other[2] | | 11 | | | 23 | | | 13 | | | 84 | | | 38 | |

Corporate[2] | | (7) | | | (13) | | | (8) | | | (52) | | | (52) | |

| | | | | | | | | | |

| Depreciation and Amortization | | (83) | | | (89) | | | (83) | | | (343) | | | (327) | |

| Share-based Compensation | | (10) | | | (10) | | | (9) | | | (45) | | | (35) | |

| | | | | | | | | | |

Other Charges | | (35) | | | (13) | | | (13) | | | (56) | | | (4) | |

| | | | | | | | | | |

| | | | | | | | | | |

| Operating Income | | 198 | | | 243 | | | 216 | | | 938 | | | 820 | |

| | | | | | | | | | |

| Other Expense: | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Interest Expense, Net of Interest Income of $12, $13, $12, $56 and $59 | | (25) | | | (24) | | | (31) | | | (102) | | | (123) | |

| Loss on Blue Chip Swap Securities | | — | | | — | | | — | | | (10) | | | (57) | |

| | | | | | | | | | |

| Other Expense, Net | | (4) | | | (41) | | | (36) | | | (87) | | — | | (134) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Income Before Income Taxes | | 169 | | | 178 | | | 149 | | | 739 | | | 506 | |

| Income Tax Provision | | (45) | | | (12) | | | (2) | | | (189) | | | (57) | |

| Net Income | | 124 | | | 166 | | | 147 | | | 550 | | | 449 | |

| Net Income Attributable to Noncontrolling Interests | | 12 | | | 9 | | | 7 | | | 44 | | | 32 | |

| Net Income Attributable to Weatherford | | $ | 112 | | | $ | 157 | | | $ | 140 | | | $ | 506 | | | $ | 417 | |

| | | | | | | | | | |

| Basic Income Per Share | | $ | 1.54 | | | $ | 2.14 | | | $ | 1.94 | | | $ | 6.93 | | | $ | 5.79 | |

| Basic Weighted Average Shares Outstanding | | 72.6 | | | 73.2 | | | 72.1 | | | 73.0 | | | 71.9 | |

| | | | | | | | | | |

Diluted Income Per Share[3] | | $ | 1.50 | | | $ | 2.06 | | | $ | 1.90 | | | $ | 6.75 | | | $ | 5.66 | |

| Diluted Weighted Average Shares Outstanding | | 74.5 | | | 75.2 | | | 73.9 | | | 74.9 | | 73.7 | |

[1]Segment adjusted EBITDA is our primary measure of segment profitability under U.S. GAAP ASC 280 “Segment Reporting” and represents segment earnings before interest, taxes, depreciation, amortization, share-based compensation and other adjustments. Research and development expenses are included in segment adjusted EBITDA.

[2]All Other includes results from non-core business activities (including integrated services and projects), and Corporate includes overhead support and centrally managed or shared facilities costs. All Other and Corporate do not individually meet the criteria for segment reporting.

[3]Included the maximum potentially dilutive shares contingently issuable for an acquisition consideration during the three months ended September 30, 2024, the value of which was adjusted out of Net Income Attributable to Weatherford in calculating diluted income per share.

| | | | | | | | | | | |

| Weatherford International plc |

| Selected Balance Sheet Data (Unaudited) |

| | | |

| ($ in Millions) | December 31, 2024 | | December 31, 2023 |

| Assets: | | | |

| Cash and Cash Equivalents | $ | 916 | | | $ | 958 | |

| Restricted Cash | 59 | | | 105 | |

| Accounts Receivable, Net | 1,261 | | | 1,216 | |

| Inventories, Net | 880 | | | 788 | |

| Property, Plant and Equipment, Net | 1,061 | | | 957 | |

| Intangibles, Net | 325 | | | 370 | |

| | | |

| Liabilities: | | | |

| Accounts Payable | 792 | | | 679 | |

| Accrued Salaries and Benefits | 302 | | | 387 | |

| Current Portion of Long-term Debt | 17 | | | 168 | |

| Long-term Debt | 1,617 | | | 1,715 | |

| | | |

| Shareholders’ Equity: | | | |

| Total Shareholders’ Equity | 1,283 | | | 922 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

[1] Net debt is a non-GAAP measure calculated as total short and long-term debt less cash and cash equivalents and restricted cash.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weatherford International plc |

| Selected Cash Flows Information (Unaudited) |

| | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended | | |

| ($ in Millions) | | December 31, 2024 | | September 30, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 | | | | |

| Cash Flows From Operating Activities: | | | | | | | | | | | | | | |

| Net Income | | $ | 124 | | | $ | 166 | | | $ | 147 | | | $ | 550 | | | $ | 449 | | | | | |

| Adjustments to Reconcile Net Income to Net Cash Provided By Operating Activities: | | | | | | | | | | | | | | |

| Depreciation and Amortization | | 83 | | | 89 | | | 83 | | | 343 | | | 327 | | | | | |

Foreign Exchange Losses (Gain) | | (2) | | | 35 | | | 43 | | | 56 | | | 116 | | | | | |

| Loss on Blue Chip Swap Securities | | — | | | — | | | — | | | 10 | | | 57 | | | | | |

| | | | | | | | | | | | | | |

| Gain on Disposition of Assets | | (2) | | | (1) | | | — | | | (35) | | | (11) | | | | | |

Deferred Income Tax Provision (Benefit) | | — | | | (19) | | | (19) | | | 8 | | | (86) | | | | | |

| Share-Based Compensation | | 10 | | | 10 | | | 9 | | | 45 | | | 35 | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Changes in Accounts Receivable, Inventory, Accounts Payable and Accrued Salaries and Benefits | | 24 | | | 30 | | | 151 | | | (120) | | | (84) | | | | | |

| | | | | | | | | | | | | | |

| Other Changes, Net | | 12 | | | (48) | | | (39) | | | (65) | | | 29 | | | | | |

| Net Cash Provided By Operating Activities | | 249 | | | 262 | | | 375 | | | 792 | | | 832 | | | | | |

| | | | | | | | | | | | | | |

| Cash Flows From Investing Activities: | | | | | | | | | | | | | | |

| Capital Expenditures for Property, Plant and Equipment | | (100) | | | (78) | | | (67) | | | (299) | | | (209) | | | | | |

| Proceeds from Disposition of Assets | | 13 | | | — | | | 7 | | | 31 | | | 28 | | | | | |

| Purchases of Blue Chip Swap Securities | | — | | | — | | | — | | | (50) | | | (110) | | | | | |

| Proceeds from Sales of Blue Chip Swap Securities | | — | | | — | | | — | | | 40 | | | 53 | | | | | |

| Business Acquisitions, Net of Cash Acquired | | — | | | (15) | | | — | | | (51) | | | (4) | | | | | |

| | | | | | | | | | | | | | |

| Other Investing Activities | | 1 | | | 1 | | | (71) | | | 36 | | | (47) | | | | | |

| Net Cash Used In Investing Activities | | (86) | | | (92) | | | (131) | | | (293) | | | (289) | | | | | |

| | | | | | | | | | | | | | |

| Cash Flows From Financing Activities: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Repayments of Long-term Debt | | (23) | | | (5) | | | (80) | | | (287) | | | (386) | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Distributions to Noncontrolling Interests | | (20) | | | (10) | | | (31) | | | (39) | | | (52) | | | | | |

Tax Remittance on Equity Awards | | (22) | | | — | | | (2) | | | (31) | | | (56) | | | | | |

Share Repurchases | | (49) | | | (50) | | | — | | | (99) | | | — | | | | | |

Dividends Paid | | (18) | | | (18) | | | — | | | (36) | | | — | | | | | |

| Other Financing Activities | | (1) | | | (6) | | | (13) | | | (19) | | | (20) | | | | | |

| Net Cash Used In Financing Activities | | $ | (133) | | | $ | (89) | | | $ | (126) | | | $ | (511) | | | $ | (514) | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Weatherford International plc |

| Non-GAAP Financial Measures Defined (Unaudited) |

We report our financial results in accordance with U.S. generally accepted accounting principles (GAAP). However, Weatherford’s management believes that certain non-GAAP financial measures (as defined under the SEC’s Regulation G and Item 10(e) of Regulation S-K) may provide users of this financial information additional meaningful comparisons between current results and results of prior periods and comparisons with peer companies. The non-GAAP amounts shown in the following tables should not be considered as substitutes for results reported in accordance with GAAP but should be viewed in addition to the Company’s reported results prepared in accordance with GAAP.

Adjusted EBITDA* - Adjusted EBITDA* is a non-GAAP measure and represents consolidated income before interest expense, net, income taxes, depreciation and amortization expense, and excludes, among other items, restructuring charges, share-based compensation expense, as well as other charges and credits. Management believes adjusted EBITDA* is useful to assess and understand normalized operating performance and trends. Adjusted EBITDA* should be considered in addition to, but not as a substitute for consolidated net income and should be viewed in addition to the Company's reported results prepared in accordance with GAAP.

Adjusted EBITDA margin* - Adjusted EBITDA margin* is a non-GAAP measure which is calculated by dividing consolidated adjusted EBITDA* by consolidated revenues. Management believes adjusted EBITDA margin* is useful to assess and understand normalized operating performance and trends. Adjusted EBITDA margin* should be considered in addition to, but not as a substitute for consolidated net income margin and should be viewed in addition to the Company's reported results prepared in accordance with GAAP.

Adjusted Free Cash Flow* - Adjusted Free Cash Flow* is a non-GAAP measure and represents cash flows provided by (used in) operating activities, less capital expenditures plus proceeds from the disposition of assets. Management believes adjusted free cash flow* is useful to understand our performance at generating cash and demonstrates our discipline around the use of cash. Adjusted free cash flow* should be considered in addition to, but not as a substitute for cash flows provided by operating activities and should be viewed in addition to the Company's reported results prepared in accordance with GAAP.

Net Debt* - Net Debt* is a non-GAAP measure that is calculated taking short and long-term debt less cash and cash equivalents and restricted cash. Management believes the net debt* is useful to assess the level of debt in excess of cash and cash and equivalents as we monitor our ability to repay and service our debt. Net debt* should be considered in addition to, but not as a substitute for overall debt and total cash and should be viewed in addition to the Company’s results prepared in accordance with GAAP.

Net Leverage* - Net Leverage* is a non-GAAP measure which is calculated by dividing by taking net debt* divided by adjusted EBITDA* for the trailing 12 months. Management believes the net leverage* is useful to understand our ability to repay and service our debt. Net leverage* should be considered in addition to, but not as a substitute for the individual components of above defined net debt* divided by consolidated net income attributable to Weatherford and should be viewed in addition to the Company’s reported results prepared in accordance with GAAP.

*Non-GAAP - as defined above and reconciled to the GAAP measures in the section titled GAAP to Non-GAAP Financial Measures Reconciled

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weatherford International plc | | | | |

| GAAP to Non-GAAP Financial Measures Reconciled (Unaudited) | | | | |

|

| | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended | | | | |

| ($ in Millions, Except Margin in Percentages) | | December 31, 2024 | | September 30, 2024 | | December 31, 2023 | | December 31, 2024 | | December 31, 2023 | | | | |

| Revenues | | $ | 1,341 | | | $ | 1,409 | | | $ | 1,362 | | | $ | 5,513 | | | $ | 5,135 | | | | | |

| Net Income Attributable to Weatherford | | $ | 112 | | | $ | 157 | | | $ | 140 | | | $ | 506 | | | $ | 417 | | | | | |

| Net Income Margin | | 8.4 | % | | 11.1 | % | | 10.3 | % | | 9.2 | % | | 8.1 | % | | | | |

| Adjusted EBITDA* | | $ | 326 | | | $ | 355 | | | $ | 321 | | | $ | 1,382 | | | $ | 1,186 | | | | | |

| Adjusted EBITDA Margin* | | 24.3 | % | | 25.2 | % | | 23.6 | % | | 25.1 | % | | 23.1 | % | | | | |

| | | | | | | | | | | | | | |

| Net Income Attributable to Weatherford | | $ | 112 | | | $ | 157 | | | $ | 140 | | | $ | 506 | | | $ | 417 | | | | | |

| Net Income Attributable to Noncontrolling Interests | | 12 | | | 9 | | | 7 | | | 44 | | | 32 | | | | | |

| Income Tax Provision | | 45 | | | 12 | | | 2 | | | 189 | | | 57 | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Interest Expense, Net of Interest Income of $12, $13, $12, $56 and $59 | | 25 | | | 24 | | | 31 | | | 102 | | | 123 | | | | | |

| Loss on Blue Chip Swap Securities | | — | | | — | | | — | | | 10 | | | 57 | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Other Expense, Net | | 4 | | | 41 | | | 36 | | | 87 | | | 134 | | | | | |

| Operating Income | | 198 | | | 243 | | | 216 | | | 938 | | | 820 | | | | | |

| Depreciation and Amortization | | 83 | | | 89 | | | 83 | | | 343 | | | 327 | | | | | |

Other Charges[1] | | 35 | | | 13 | | | 13 | | | 56 | | | 4 | | | | | |

| | | | | | | | | | | | | | |

| Share-Based Compensation | | 10 | | | 10 | | | 9 | | | 45 | | | 35 | | | | | |

| Adjusted EBITDA* | | $ | 326 | | | $ | 355 | | | $ | 321 | | | $ | 1,382 | | | $ | 1,186 | | | | | |

| | | | | | | | | | | | | | |

| Net Cash Provided By Operating Activities | | $ | 249 | | | $ | 262 | | | $ | 375 | | | $ | 792 | | | $ | 832 | | | | | |

| Capital Expenditures for Property, Plant and Equipment | | (100) | | | (78) | | | (67) | | | (299) | | | (209) | | | | | |

| Proceeds from Disposition of Assets | | 13 | | | — | | | 7 | | | 31 | | | 28 | | | | | |

| Adjusted Free Cash Flow* | | $ | 162 | | | $ | 184 | | | $ | 315 | | | $ | 524 | | | $ | 651 | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

[1]Other charges in the three and twelve months ended December 31, 2024, primarily included severance and restructuring costs and fees to third-party financial institutions related to collections of certain receivables from our largest customer in Mexico.

*Non-GAAP - as reconciled to the GAAP measures above and defined in the section titled Non-GAAP Financial Measures Defined

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Weatherford International plc | | | | |

| GAAP to Non-GAAP Financial Measures Reconciled Continued (Unaudited) | | | | |

|

| | | | | | | | | | | | | | |

| | | | | | | |

| ($ in Millions) | | December 31, 2024 | | September 30, 2024 | | December 31, 2023 | | | | | | | | |

| Current Portion of Long-term Debt | | $ | 17 | | | $ | 21 | | | $ | 168 | | | | | | | | | |

| Long-term Debt | | 1,617 | | | 1,627 | | | 1,715 | | | | | | | | | |

| Total Debt | | $ | 1,634 | | | $ | 1,648 | | | $ | 1,883 | | | | | | | | | |

| | | | | | | | | | | | | | |

| Cash and Cash Equivalents | | $ | 916 | | | $ | 920 | | | $ | 958 | | | | | | | | | |

| Restricted Cash | | 59 | | | 58 | | | 105 | | | | | | | | | |

| Total Cash | | $ | 975 | | | $ | 978 | | | $ | 1,063 | | | | | | | | | |

| | | | | | | | | | | | | | |

| Components of Net Debt | | | | | | | | | | | | | | |

| Current Portion of Long-term Debt | | $ | 17 | | | $ | 21 | | | $ | 168 | | | | | | | | | |

| Long-term Debt | | 1,617 | | | 1,627 | | | 1,715 | | | | | | | | | |

| Less: Cash and Cash Equivalents | | 916 | | | 920 | | | 958 | | | | | | | | | |

| Less: Restricted Cash | | 59 | | | 58 | | | 105 | | | | | | | | | |

| Net Debt* | | $ | 659 | | | $ | 670 | | | $ | 820 | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net Income for trailing 12 months | | $ | 506 | | | $ | 534 | | | $ | 417 | | | | | | | | | |

| Adjusted EBITDA* for trailing 12 months | | $ | 1,382 | | | $ | 1,377 | | | $ | 1,186 | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net Leverage* (Net Debt*/Adjusted EBITDA*) | | 0.48 | | x | 0.49 | | x | 0.69 | | x | | | | | | | |

*Non-GAAP - as reconciled to the GAAP measures above and defined in the section titled Non-GAAP Financial Measures Defined

v3.25.0.1

Document and Entity Information

|

Feb. 05, 2025 |

| Document Information [Line Items] |

|

| Document Period End Date |

Feb. 05, 2025

|

| Document Type |

8-K

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 05, 2025

|

| Entity Registrant Name |

Weatherford International plc

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity File Number |

001-36504

|

| Entity Tax Identification Number |

98-0606750

|

| Entity Address, Address Line One |

2000 St. James Place

|

| Entity Address, City or Town |

Houston,

|

| Entity Address, State |

TX

|

| Entity Address, Postal Zip Code |

77056

|

| City Area Code |

713

|

| Local Phone Number |

836.4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary shares, $0.001 par value per share

|

| Trading Symbol |

WFRD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001603923

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

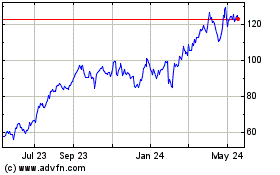

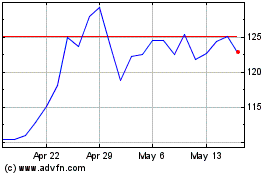

Weatherford (NASDAQ:WFRD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Weatherford (NASDAQ:WFRD)

Historical Stock Chart

From Feb 2024 to Feb 2025