Statement of Changes in Beneficial Ownership (4)

03 November 2021 - 3:35AM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Steamboat Capital Partners, LLC |

2. Issuer Name and Ticker or Trading Symbol

Wheeler Real Estate Investment Trust, Inc.

[

WHLR

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

31 OLD WAGON ROAD |

3. Date of Earliest Transaction

(MM/DD/YYYY)

10/29/2021 |

|

(Street)

OLD GREENWICH,, CT 06870

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Series B Convertible Preferred Stock | $40 | 10/29/2021 | | S | | | 255 | (1) | (1) | Common Stock, $0.01 par value | 159 | $8.0068 (2)(3) | 39599 (4) | I | See footnote (4)(12) |

| Series B Convertible Preferred Stock | $40 | | | | | | | (1) | (1) | Common Stock, $0.01 par value | 0 | | 185230 (5) | I | See footnote (5)(12) |

| Series B Convertible Preferred Stock | $40 | | | | | | | (1) | (1) | Common Stock, $0.01 par value | 0 | | 2568 (6) | I | See footnote (6)(12) |

| Series D Cumulative Convertible Preferred Stock | $16.96 | 10/29/2021 | | S | | | 748 | (7) | (7) | Common Stock, $0.01 par value | 1102 | $16.0584 (8)(3) | 96631 (9) | I | See footnote (9)(12) |

| Series D Cumulative Convertible Preferred Stock | $16.96 | | | | | | | (7) | (7) | Common Stock, $0.01 par value | 0 | | 328828 (10) | I | See footnote (10)(12) |

| Series D Cumulative Convertible Preferred Stock | $16.96 | | | | | | | (7) | (7) | Common Stock, $0.01 par value | 0 | | 4319 (11) | I | See footnote (11)(12) |

| Explanation of Responses: |

| (1) | Convertible at any time with no expiration date, but subject to mandatory conversion if the 20 trading day volume-weighted average closing price of the Common Stock, $0.01 par value, exceeds $58. |

| (2) | This is the average price. The prices at which shares were actually sold range from $7.85 to $8.16. |

| (3) | The reporting person hereby undertakes to provide upon request to the SEC staff, the issuer or a security holder of the issuer full information regarding the number of shares and prices at which the transaction was effected. |

| (4) | The transaction was effected for certain accounts managed by Steamboat Capital Partners, LLC (IA), which after such transaction, own 39,599 shares of Series B Convertible Preferred Stock (Series B). |

| (5) | Ownership of Steamboat Capital Partners Master Fund, LP (Master) which has delegated investment discretion to Steamboat Capital Partners, LLC (IA), and which continues to own 185,230 shares of Series B. |

| (6) | Ownership of Steamboat Capital Partners II, LP (II) which continues to own 2568 shares of Series B. |

| (7) | Convertible at any time, with no expiration date. |

| (8) | This is the average price. The prices at which shares were actually sold range from $16 to $16.20. |

| (9) | The transaction was effected for certain accounts managed by Steamboat Capital Partners, LLC (IA), which after such transaction, own 96,631 shares of Series D Cumulative Convertible Preferred Stock (Series D). |

| (10) | Ownership of Steamboat Capital Partners Master Fund, LP (Master) which has delegated investment discretion to Steamboat Capital Partners, LLC (IA), and which continues to own 328,828 shares of Series D Cumulative Convertible Preferred Stock (Series D). |

| (11) | Ownership of Steamboat Capital Partners II, LP (II) which continues to own 4319 shares of Series D Cumulative Convertible Preferred Stock (Series D). |

| (12) | Steamboat Capital Partners GP, LLC (GP) is general partner of, and entitled to receive a performance allocation from, each of Master and II. IA is entitled to receive a performance fee from the managed accounts referred to in footnotes 4 and 9 (the "MA"). Parsa Kiai ("Kiai") is the Managing Member of GP and IA. Accordingly, Kiai may be deemed to have a pecuniary interest in the shares owned by Master and II and IA and Kiai may be deemed to have a pecuniary interest in the shares owned by the MA. Kiai and IA are filers of this report, filing jointly but not as a group and each disclaims beneficial ownership of securities reported hereon except to the extent of its or his pecuniary interest therein. |

Remarks:

The ticker symbol referenced in item 2 is the symbol for the Common Stock. The symbols for the securities in which transactions actually occurred are WHLRD and WHLRP. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Steamboat Capital Partners, LLC

31 OLD WAGON ROAD

OLD GREENWICH,, CT 06870 |

| X |

|

|

Kiai Parsa

31 OLD WAGON ROAD

OLD GREENWICH, CT 06870 |

| X |

|

|

Signatures

|

| Steamboat Capital Partners, LLC, /s/ Parsa Kiai, Managing Member | | 11/2/2021 |

| **Signature of Reporting Person | Date |

| /s/ Parsa Kiai | | 11/2/2021 |

| **Signature of Reporting Person | Date |

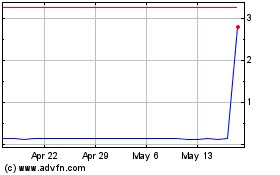

Wheeler Real Estate Inve... (NASDAQ:WHLR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Wheeler Real Estate Inve... (NASDAQ:WHLR)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Wheeler Real Estate Investment Trust Inc (NASDAQ): 0 recent articles

More Wheeler Real Estate Investment Trust, Inc. News Articles