WISeKey’s Extensive Expertise Lays the

Foundation for the Development of a Semiconductor Manufacturing

Project in Switzerland

Geneva, Switzerland – October 1, 2024: WISeKey International

Holding Ltd. (“WISeKey”) (SIX: WIHN, NASDAQ: WKEY), a leader in

cybersecurity, AI, Blockchain, and IoT operating as a holding

company, today announced that will be initiating a awareness

campaign to promote a major semiconductor fabrication facility

(fab) project in Switzerland which marks a crucial step in the

country’s journey toward self-reliance in chip production and

positions Switzerland as an emerging hub in the semiconductor

industry.

For many years, WISeKey has been at the forefront of such

efforts and has built an extensive expertise in semiconductors. Via

its subsidiary. SEALSQ Corp (Nasdaq: LAES), which focuses on

semiconductors, PKI, and post-quantum technology products, WISeKey

offers countries the opportunity to develop their own semiconductor

personalization centers through Public-Private Partnerships (PPPs).

This initiative aims to reduce reliance on foreign semiconductor

manufacturing, thereby enhancing global supply chain security.

The development of a ab in Switzerland will require a careful

balance of incentives, support, R&D, innovation, and access to

capital. As highly advanced facilities, semiconductor fabs face

escalating costs due to various factors, and each project presents

unique requirements and cost considerations. WISeKey aims to raise

awareness of the essential role a Swiss-based fab will play in

building the foundations for the country’s innovation landscape.

Given the project's complexity and cost, establishing a close

partnership and a solid investment case is crucial to its

success.

The project's objective in Switzerland is to start with a mini

fab (a smaller-scale semiconductor fabrication facility) and

gradually expand it into a full-scale semiconductor fab over the

next 10 years. This phased approach allows for manageable

investment, initial production capabilities, and flexibility to

scale operations in line with technological advancements and market

demands. Starting with a mini fab can cost between $100 million to

$1.5 billion, depending on the desired technology node and

production capacity. Over time, the facility can be expanded with

the latest equipment and processes, eventually reaching the scale

and capability of a full fab, which may involve a total investment

of several billion. This gradual growth strategy aligns with

Switzerland's goal of fostering a domestic semiconductor ecosystem

and innovation cluster.

Currently, Switzerland heavily relies on imports to meet its

semiconductor needs. This new fab project is set to mitigate that

dependence, enhance the domestic chip production ecosystem, create

new jobs, and attract further investments in the technology and

space sector. Locally produced chips will become essential for

various industries within Switzerland, contributing to a more

resilient global supply chain.

Why a Fab in Switzerland? The National and Economic

Benefits

Switzerland stands to gain multiple benefits from establishing a

semiconductor fab within its borders:

- Technological

Sovereignty: By building a local fab, Switzerland can

reduce its dependency on foreign semiconductor suppliers. This

sovereignty will be crucial for the country's industries, including

healthcare, automotive, health, aerospace, and IoT. In times of

global shortages or geopolitical tensions, Switzerland will have

direct access to semiconductor production, ensuring its key

industries can continue to operate and innovate.

- Economic Growth and Job

Creation: The establishment of a fab will create thousands

of high-skilled jobs, both directly in semiconductor manufacturing

and indirectly in related sectors, such as logistics, supply chain

management, and R&D. This influx of talent and investment will

help to boost Switzerland's economic growth, establishing the

country as a leader in the global technology market.

- Innovation and R&D

Hub: Switzerland is known for its world-class research

institutions and a thriving innovation ecosystem. The presence of a

semiconductor fab will further cement the country’s status as an

innovation hub, attracting global companies to invest in research

and development in Switzerland. This synergy will foster advanced

research in fields such as quantum computing, artificial

intelligence, and secure communications, accelerating the

development of cutting-edge technologies.

- Strengthened Global Supply

Chains: By creating an alternative source for high-quality

semiconductor chips, Switzerland can contribute to the

diversification of the global semiconductor supply chain. This

diversification will make the global supply chain more resilient

against disruptions, whether due to natural disasters, geopolitical

conflicts, or economic crises. Switzerland’s reputation for quality

and reliability will be an asset in providing a steady supply of

critical chips to industries worldwide.

- Attracting Further

Investments: The fab will serve as a magnet for investment

in Switzerland’s electronics and technology sectors. With a robust

semiconductor industry, the country can attract global companies

looking to establish a European foothold in semiconductor design,

manufacturing, and R&D. This influx of capital and talent will

drive the growth of a high-tech ecosystem around the fab,

stimulating further economic development.

Tackling Global Demand and Geopolitical

Pressures

Today’s growth sectors—such as AI, vehicle electrification,

autonomous driving, artificial intelligence, cloud computing, space

exploration, renewable energy, supercomputing, connectivity, and

defense—are increasingly dependent on semiconductor chips. In light

of the global semiconductor shortage, the world's largest economies

are planning to invest heavily in new pilot lines and fabs within

their national borders. Many countries, recognizing the

inequalities in the global distribution of chip fabs, have enacted

"chips acts" and stimulus packages to support local chip design and

manufacturing. This push toward semiconductor sovereignty has

become critical as geopolitical factors, market turbulence, export

controls, and trade tensions threaten to disrupt the delicate

balance of the global economy.

Given these dynamics, Switzerland is positioned to step into the

semiconductor spotlight, leveraging its resources and capabilities

to strengthen chip development efforts. This effort aims to foster

a new cluster of semiconductor innovation in the country, offering

an alternative to existing dominant players and contributing to the

diversification of the global semiconductor supply chain.

Cost Projections for Fab Development

The cost of building a mini fab is significantly lower than that

of a large-scale, cutting-edge fab. However, the cost still depends

on several factors, such as the facility's technology level,

production capacity, and the complexity of the chips being

manufactured.

Typical Costs for Mini Fabs:

- Older or Legacy Node Mini

Fabs: For fabs producing chips at older technology nodes

(28nm, 65nm, 130nm, etc.), the cost can range from $100

million to $500 million. These fabs are suitable for

producing chips used in a variety of applications like automotive,

industrial electronics, IoT devices, and other areas that do not

require the most advanced nodes.

- Advanced Mini Fabs:

For mini fabs equipped with more modern technology and capable of

producing chips at nodes around 28nm or slightly below, the cost

can be higher, ranging from $500 million to $1.5

billion. These facilities might not have the full

capabilities of a large-scale fab but can still produce a variety

of chips needed for more advanced applications.

- Specialized Mini Fabs

(R&D, Prototyping): Mini fabs focused on research and

development, prototyping, or small-scale production can have costs

ranging from $50 million to $200 million. These

fabs typically do not require high-volume production equipment and

instead focus on flexibility and experimentation with different

semiconductor processes.

The landscape of government incentives for building and

operating advanced semiconductor fabs has been increasingly active

in recent years. Political leaders worldwide now view a thriving

domestic semiconductor industry and secure access to critical chips

as fundamental components of economic and national security. These

government incentives could significantly impact the cost outcomes

for fab development, providing countries like Switzerland with a

unique opportunity to strengthen their semiconductor

capabilities.

WISeKey's Vision for Semiconductor

Sovereignty

WISeKey has built extensive expertise in semiconductors since

acquiring the semiconductors company VaultIC from Inside Secure in

2016 and subsequently spinning off its semiconductor subsidiary,

SEALSQ (Nasdaq: LAES). SEALSQ offers countries the opportunity to

develop their own semiconductor personalization centers through

Public-Private Partnerships (PPPs). This initiative aims to reduce

reliance on foreign semiconductor manufacturing, thereby enhancing

global supply chain security.

WISeKey's offering through SEALSQ includes a suite of services

and technologies such as secure elements, root of trust,

cryptographic keys, and hardware security modules. The company

provides the hardware, software, training, and ongoing support

needed to establish and operate these centers. This solution is

particularly relevant for industries like automotive, aerospace,

and healthcare, where the need for secure and reliable microchips

is paramount. By creating local personalization centers, countries

can maintain a consistent supply of essential microchips, even

amidst global shortages. Additionally, this initiative promises to

spur economic development and job creation within participating

countries.

WISeKey and SEALSQ are currently in discussions with several

countries regarding the establishment of semiconductor

personalization centers. Earlier this year, WISeKey began offering

security services and semiconductors to IoT device manufacturers

adopting the Matter Protocol, the leading standard for smart home

devices from the Connectivity Standards Alliance (CSA). WISeKey’s

Root Certificate Authority (CA) has been approved by the CSA for

Matter device attestation, establishing the company as a Product

Attestation Authority (PAA).

Advancements in Post-Quantum Technology

SEALSQ is also making significant progress in post-quantum

technology. Its engineering team has successfully integrated Kyber

and Dilithium CRYSTAL quantum-resistant NIST-selected algorithms

into the MS6003, a WISeKey Common Criteria EAL5+ Certified secure

hardware platform powered by an ARMSC300 core. This breakthrough

marks the creation of the first quantum-resistant USB token,

advancing the QUASARS project closer to building a Post-Quantum

Hardware Security Module and Root-of-Trust.

Through SEALSQ, WISeKey is implementing the QUASARS project, an

innovative solution based on the WISeKey Secure RISC V platform.

This platform is paving the way for the Post-Quantum Cryptography

era, offering hybrid solutions aligned with the recommendations of

ANSSI (the National Cybersecurity Agency of France). SEALSQ has

also received strong support from the French Secured Communicating

Solutions (SCS) Cluster for this project.

WISeKey is also part of the National Institute of Standards and

Technology (NIST) National Cybersecurity Center of Excellence

(NCCoE) project, a new secure platform designed to establish best

practices for trusted network-layer onboarding and aid in the

scalable implementation of trusted IoT device onboarding solutions.

More information on this consortium can be found at: NCCoE Trusted

IoT Project.

With the establishment of this new semiconductor fab and the

potential development of personalization centers, Switzerland is

poised to become a new cluster of semiconductor innovation. This

effort will provide an alternative to existing dominant players,

contributing to the diversification of the globalWISeKey is

actively consulting with various technology partners, Swiss

cantons, and government authorities to identify the optimal

location for this project.

About WISeKeyWISeKey

International Holding Ltd (“WISeKey”, SIX: WIHN; Nasdaq: WKEY) is a

global leader in cybersecurity, digital identity, and IoT solutions

platform. It operates as a Swiss-based holding company through

several operational subsidiaries, each dedicated to specific

aspects of its technology portfolio. The subsidiaries include (i)

SEALSQ Corp (Nasdaq: LAES), which focuses on semiconductors, PKI,

and post-quantum technology products, (ii) WISeKey SA which

specializes in RoT and PKI solutions for secure authentication and

identification in IoT, Blockchain, and AI, (iii) WISeSat AG which

focuses on space technology for secure satellite communication,

specifically for IoT applications, (iv) WISe.ART Corp which focuses

on trusted blockchain NFTs and operates the WISe.ART marketplace

for secure NFT transactions, and (v) SEALCOIN AG which focuses on

decentralized physical internet with DePIN technology and house the

development of the SEALCOIN platform.Each subsidiary contributes to

WISeKey’s mission of securing the internet while focusing on their

respective areas of research and expertise. Their technologies

seamlessly integrate into the comprehensive WISeKey platform.

WISeKey secures digital identity ecosystems for individuals and

objects using Blockchain, AI, and IoT technologies. With over 1.6

billion microchips deployed across various IoT sectors, WISeKey

plays a vital role in securing the Internet of Everything. The

company’s semiconductors generate valuable Big Data that, when

analyzed with AI, enable predictive equipment failure prevention.

Trusted by the OISTE/WISeKey cryptographic Root of Trust, WISeKey

provides secure authentication and identification for IoT,

Blockchain, and AI applications. The WISeKey Root of Trust ensures

the integrity of online transactions between objects and people.

For more information on WISeKey’s strategic direction and its

subsidiary companies, please visit www.wisekey.com.

DisclaimerThis communication

expressly or implicitly contains certain forward-looking statements

concerning WISeKey International Holding Ltd and its business. Such

statements involve certain known and unknown risks, uncertainties

and other factors, which could cause the actual results, financial

condition, performance or achievements of WISeKey International

Holding Ltd to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. WISeKey International Holding Ltd is

providing this communication as of this date and does not undertake

to update any forward-looking statements contained herein as a

result of new information, future events or otherwise.

This press release does not constitute an offer

to sell, or a solicitation of an offer to buy, any securities, and

it does not constitute an offering prospectus within the meaning of

the Swiss Financial Services Act (“FinSA”), the FinSa's predecessor

legislation or advertising within the meaning of the FinSA.

Investors must rely on their own evaluation of WISeKey and its

securities, including the merits and risks involved. Nothing

contained herein is, or shall be relied on as, a promise or

representation as to the future performance of

WISeKey.Press and Investor Contacts

|

WISeKey International Holding LtdCompany

Contact: Carlos MoreiraChairman & CEOTel: +41 22 594

3000info@wisekey.com |

WISeKey Investor Relations (US) The Equity

Group Inc.Lena CatiTel: +1 212 836-9611 / lcati@equityny.comKatie

MurphyTel: +1 212 836-9612 / kmurphy@equityny.com |

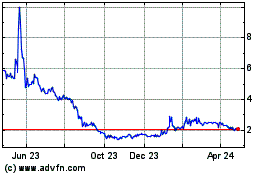

WISeKey (NASDAQ:WKEY)

Historical Stock Chart

From Dec 2024 to Jan 2025

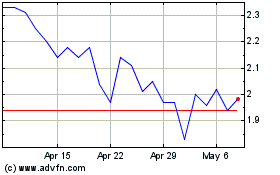

WISeKey (NASDAQ:WKEY)

Historical Stock Chart

From Jan 2024 to Jan 2025