UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission File Number: 001-34152

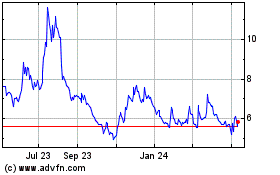

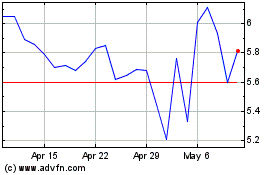

WESTPORT FUEL SYSTEMS INC.

(Translation of registrant's name into English)

1691 West 75th Avenue, Vancouver, British Columbia, Canada, V6P 6P2

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

£ Form 20-F S Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

EXHIBIT INDEX

| | | | | | | | |

| Exhibit | | Description |

| 99.1 | | |

| 99.2 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | WESTPORT FUEL SYSTEMS INC. |

| | |

| | By: | /s/ William E. Larkin |

| | Name: | William E. Larkin |

| | Title: | Chief Financial Officer |

Date: August 8, 2023

| | | | | | | | |

| | Management's Discussion and Analysis |

BASIS OF PRESENTATION

This Management’s Discussion and Analysis (“MD&A”) for Westport Fuel Systems Inc. (“Westport”, the “Company”, “we”, “us”, “our”) for the three and six months ended June 30, 2023 provides an update to our annual MD&A dated March 13, 2023 for the fiscal year ended December 31, 2022. This information is intended to assist readers in analyzing our financial results and should be read in conjunction with the audited consolidated financial statements, including the accompanying notes, for the fiscal year ended December 31, 2022 and our unaudited condensed consolidated interim financial statements for the three and six months ended June 30, 2023. Our unaudited condensed consolidated interim financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). The Company’s reporting currency is the United States dollar ("U.S. dollar"). This MD&A is dated as of August 8, 2023.

Additional information relating to Westport, including our Annual Information Form (“AIF”) and Form 40-F each for the year ended December 31, 2022, is available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov, respectively. All financial information is reported in U.S. dollars unless otherwise noted.

FORWARD-LOOKING STATEMENTS

This MD&A contains forward-looking statements that are based on the beliefs of management and reflects our current expectations as contemplated under the safe harbor provisions of Section 21E of the United States Securities Act of 1934, as amended. Such forward-looking statements include, but are not limited to, the orders or demand for our products (including from our HPDI 2.0TM fuel systems) supply agreement with Weichai Westport Inc. ("WWI"), the timing for the launch of WWI's engine equipped with Westport's HPDI 2.0 fuel systems, the variation of gross margins from our HPDI 2.0 fuel systems product and causes thereof, and the timing for relief of supply chain issues (including those related to semiconductor supply restrictions), opportunities available to sell and supply our products in North America, consumer confidence levels, the recovery of our revenues and the timing thereof, our ability to strengthen our liquidity, growth in our heavy-duty business and improvements in our light-duty original equipment manufacturer ("OEM") business and timing thereof, improved aftermarket revenues, our capital expenditures, our investments, cash and capital requirements, the intentions of our partners and potential customers, monetization of joint venture intellectual property, the performance of our products, our future market opportunities, our ability to continue our business as a going concern and generate sufficient cash flows to fund operations, the availability of funding and funding requirements, our future cash flows, our estimates and assumptions used in our accounting policies, our accruals, including warranty accruals, our financial condition, the timing of when we will adopt or meet certain accounting and regulatory standards and the alignment of our business segments.

These forward-looking statements are neither promises nor guarantees but involve known and unknown risks and uncertainties that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed in or implied by these forward-looking statements. These risks include risks related to revenue growth, operating results, liquidity, our industry and products, the general economy, conditions of the capital and debt markets, government or accounting policies and regulations, regulatory investigations, climate change legislation or regulations, technology innovations, as well as other factors discussed below and elsewhere in this report, including the risk factors contained in the Company’s most recent AIF filed on SEDAR at www.sedar.com. The forward-looking statements contained in this MD&A are based upon a number of material factors and assumptions which include, without limitation, market acceptance of our products, product development delays in contractual commitments, the ability to attract and retain business partners, competition from other technologies, conditions or events affecting cash flows or our ability to continue as a going concern, price differential between compressed natural gas, liquefied natural gas, and liquefied petroleum gas relative to petroleum-based fuels, unforeseen claims, exposure to factors beyond our control as well as the additional factors referenced in our AIF. Readers should not place undue reliance on any such forward-looking statements, which are pertinent only as of the date they were made.

The forward-looking statements contained in this document speak only as of the date of this MD&A. Except as required by applicable legislation, Westport does not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after this MD&A, including the occurrence of unanticipated events. The forward-looking statements contained in this MD&A are expressly qualified by this cautionary statement.

| | | | | | | | |

| | Management's Discussion and Analysis |

GENERAL DEVELOPMENTS

•In February 2023, Westport announced a plan to invest up to $10.0 million in a global manufacturing facility in Changzhou Hydrogen Valley, China.

•In March 2023, Westport signed a third global heavy-duty OEM collaboration agreement to demonstrate Hydrogen HPDI fuel system on an internal combustion engine platform. This collaboration will be funded by the OEM with work commencing immediately and expected to continue throughout 2023.

•In April 2023, we entered into a settlement agreement with Cartesian Capital Group to terminate the Tranche 1 Financing and Consent Agreement in exchange for mutual releases and cash consideration, which included the release of the security interest in our HPDI 2.0 fuel system intellectual property. We paid Cartesian Capital Group $8.7 million, which resulted in the extinguishment of the long-term royalty payable and a loss on extinguishment on royalty payable of $2.9 million.

•In May 2023, Westport showcased its market ready HPDI™ fuel system for commercial vehicles at the Advanced Clean Transportation Expo 2023.

•In June 2023, we completed the share consolidation of our issued and outstanding common shares on a 10:1 basis and regained compliance with NASDAQ's minimum bid requirement. No fractional common shares were issued and any fractional shares were rounded down to the nearest whole common shares. Effective this quarter, the number of outstanding common shares and share units issued have been retroactively adjusted for all periods presented.

•In July 2023, Westport and the Volvo Group signed a letter of intent to establish a joint venture to reduce CO2 emissions from long-hual transport utilizing HPDI technology to accelerate the decarbonization efforts of global OEM customers.

•In August 2023, we announced the expansion of the previously awarded Euro 7 program to develop and supply LPG fuel systems for several vehicle applications for a global OEM. This expanded program is forecasted to generate approximately €63 million in total revenue from 2025 to 2028 and increases the revenue generated from LPG fuel system supply agreements for Euro 6 and 7 programs with this OEM to approximately €255 million.

BUSINESS OVERVIEW

Westport is a global company focused on engineering, manufacturing, and supplying alternative fuel systems and components for transportation applications. Our diverse product offerings, sold under a wide range of established global brands, enable the use of a number of alternative fuels in the transportation sector which provide environmental and/or economic advantages as compared to diesel, gasoline, batteries or fuel cell powered vehicles. The Company's fuel systems and associated components control the pressure and flow of these alternative fuels, including LPG, compressed natural gas ("CNG"), liquified natural gas ("LNG"), renewable natural gas ("RNG") or biomethane, and hydrogen. We supply our products in more than 70 countries through a network of distributors, service providers for the aftermarket and directly to OEMs and Tier 1 and Tier 2 OEM suppliers. We also provide delayed OEM (“DOEM”) offerings and engineering services to our customers and partners globally. Today, our products and services are available for passenger car and light-, medium- and heavy-duty truck and off-road applications.

| | | | | | | | |

| | Management's Discussion and Analysis |

The majority of our revenues are generated through the following IAM and OEM businesses:

| | | | | |

| Independent Aftermarket ("IAM") | We sell systems and components across a wide range of brands, primarily through a global network of distributors that consumers can purchase and have installed onto their vehicles to use LPG or CNG fuels, in addition to gasoline. |

| |

| OEM Businesses | |

| Heavy-duty OEM | We sell systems and components, including HPDI 2.0 fuel system products, to engine OEMs and commercial vehicle OEMs. Our fully integrated HPDI 2.0 fuel systems, enables diesel engines using primarily natural gas fuel to match the power, torque, and fuel economy benefits found in traditional compression ignition engines, resulting in reduced greenhouse gas emissions and the capability to cost-effectively run on renewable fuels. |

| Delayed OEM | We directly or indirectly convert new passenger cars for OEMs or importers, to address local market needs when a global LPG or CNG bi-fuel vehicle platform is not available directly from the OEM. |

| Light-duty OEM | We sell systems and components to OEMs that are used to manufacture new, direct off the assembly line LPG or CNG-fueled vehicles. |

| Electronics | We design, industrialize and assemble electronic control modules. |

| Hydrogen | We design, develop, produce and sell hydrogen components for transportation and industrial applications. Also, we are adapting our HPDI fuel systems to use hydrogen or hydrogen/natural gas blends in internal combustion engines. |

| Fuel storage | We manufacture LPG fuel storage solutions and supply fuel storage tanks to the aftermarket, OEM, and other market segments. |

RISKS, LONG-TERM PROFITABILITY & LIQUIDITY

Global Supply Chain Challenges and Inflationary Environment

Westport continues to experience supply chain challenges in order to source semiconductors and other inputs to production due to supply shortages that continue to plague the automotive industry. While demand for more climate-friendly vehicles with favorable fuel price economics is growing, the global shortage of semiconductors and raw materials is impacting automotive manufacturing and creating bottlenecks. We expect that the global semiconductor supply and raw materials shortages affecting the automotive industry will continue to impact our business for the foreseeable future. Aside from aforementioned shortages, we are experiencing inflationary pressure on production input costs for semiconductors, raw materials and parts, higher energy costs in operating our factories, and increased labor costs that are impacting margins. The prolonged supply chain disruption continues to have material impacts on production delays and end-customer demand declines. We are closely monitoring and making efforts to mitigate the impact of the global shortage of semiconductors, raw materials and parts on our businesses, however, we do not expect this shortage to impact our long-term growth.

Russia-Ukraine conflict

We conduct a portion of our light-duty OEM and IAM businesses in Russia by selling our products to numerous OEMs and other IAM customers. Our Russian business has been a growing and important market for gaseous fuel systems and components. Due to the Russian invasion of Ukraine in late February 2022, the United States, European Union, Canada and other Western countries and organizations have announced and enacted numerous sanctions against Russia to impose severe economic pressure on the Russian economy and government. The sanctions have had a significant impact on our ability to conduct business with our Russian customers due to restrictions caused by ownership and the ability of some Russian customers to pay for goods because of banking restrictions. In addition, recent limitations and restrictions imposed on the export of Russian natural gas have had a significant impact on the price of natural gas (see "Fuel Prices" below). While the full impact of the commercial and economic consequences of the conflict are uncertain at this time, revenues generated in the Russian market were $4.3 million and $7.6 million for the three and six months ended June 30, 2023 compared to $1.3 million and $4.3 million for the same periods in 2022, with the increase of revenue from both light-duty OEM and IAM businesses. We have realized growth on our 2023 revenue compared to 2022; however, we cannot provide assurance that future developments in the Russian-Ukraine conflict will not continue to have an adverse impact on the ongoing operations and financial condition of our business in Russia.

| | | | | | | | |

| | Management's Discussion and Analysis |

Fuel Prices

Although we have seen a recent decline in LNG and CNG pricing, it remained above historical levels in the first half of 2023. This volatility extends to liquid fuels including crude oil, diesel, and gasoline, given uncertainty in supply levels and European geopolitical risk due to the Russia-Ukraine conflict. Higher gaseous fuel price negatively impacts the price differential of gaseous fuels versus diesel and gasoline, which may impact our customers' decisions to adopt such gaseous fuels as a transportation energy solution in the short-term. We continue to observe softness in demand in our heavy-duty and light-duty OEM sales volumes caused by the uncertainty over the elevated prices of CNG and LNG relative to diesel and gasoline in Europe. Despite pressure on CNG and LNG prices, the increased LPG price differential to gasoline in Europe since the end of 2022 continued in the first half of 2023 and was favourable to customer demand, which supported increased sales in our IAM and our Fuel Storage businesses.

Long-term Profitability and Liquidity

We continue to observe high inflationary pressures, global supply chain disruptions, higher interest rates and volatile fuel prices which negatively affect customer demand going forward and have an adverse impact on our production and cost structure.

We believe that we have considered all possible impacts of known events arising from the risks discussed above related to supply chain, fuel prices, and the Russian-Ukraine conflict in the preparation of the unaudited condensed consolidated interim financial statements for the three and six months ended June 30, 2023. However, changes in circumstances due to the forementioned risks could affect our judgments and estimates associated with our liquidity and other critical accounting assessments.

We continue to generate operating losses and negative cash flows from operating activities primarily due to the lack of scale in our heavy-duty OEM business. Despite customer interest in HPDI 2.0 fuel systems, sales of our HPDI 2.0 fuel systems to Volvo Trucks continue to be adversely affected by the impact of the continued volatility in natural gas prices and decreasing end-customer demand. Cash used in operating activities was $8.6 million for the six months ended June 30, 2023. Despite the successful monetization of the CWI joint venture's intellectual property and the sale of CWI in the first quarter of 2022, the loss of income from the equity interest in the former CWI business has a significant impact on our annual cash flows. In July 2023, we signed a non-binding letter of intent with Volvo Group to establish a joint venture ("HPDI JV") with the intention to accelerate the commercialization and global adoption of our HPDI fuel system technology.

As at June 30, 2023, we had cash and cash equivalents of $52.3 million. Although we believe we have sufficient liquidity to continue as a going concern beyond August 2024, the long-term financial sustainability will depend on our ability to generate sufficient positive cash flows from all of our operations specifically through working capital improvement, profitable and sustainable growth and on our ability to finance our long-term strategic objectives and operations. In addition to new customer announcements, entering new markets and the recent announcement of the signing of letter of intent to establish HPDI JV with Volvo Group, we are focused on improving profitability through growth in our heavy-duty OEM business driving economies of scale and improvements in our light-duty OEM and IAM businesses, including pricing measures and manufacturing strategies driving margin expansion. If, as a result of future events, we were to determine we were no longer able to continue as a going concern, significant adjustments would be required to the carrying value of assets and liabilities in the accompanying unaudited condensed consolidated interim financial statements and the adjustments could be material.

| | | | | | | | |

| | Management's Discussion and Analysis |

SECOND QUARTER 2023 RESULTS

Revenues for the three months ended June 30, 2023 increased 6% to $85.0 million compared to $80.0 million in the same quarter last year, primarily driven by increased sales volumes in delayed OEM, electronics, fuel storage businesses and additional revenues from the IAM business generated from Eastern Europe and South America markets. These were offset by lower sales to customers in India in the light-duty OEM business and lower sales volumes in the hydrogen and heavy-duty OEM businesses.

We reported a net loss of $13.2 million for the three months ended June 30, 2023 compared to net loss of $11.6 million for the same quarter last year. This was primarily the result of:

•$2.9 million loss on extinguishment due to the settlement of the Cartesian royalty payable;

•$1.5 million increase in general and administrative expenses related to increased consulting, staff compensation, and travel costs; and

•$0.9 million increase in sales and, marketing expenses related to outside services used for trade shows, exhibitions and advertising;

•which was partially offset by an increase in gross margin of $3.9 million related to higher revenues.

Westport reported negative $4.0 million Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization ("Adjusted EBITDA", see "Non-GAAP Measures" section in this MD&A) during the second quarter as compared to negative $4.3 million Adjusted EBITDA for the same period in 2022.

| | | | | | | | |

| | Management's Discussion and Analysis |

SELECTED FINANCIAL INFORMATION

The following table sets forth a summary of our financial results:

Selected Consolidated Statements of Operations Data

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended June 30, | | Six months ended June 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| (expressed in millions of U.S. dollars, except for per share amounts) |

| | | | | | | | |

| | | | | | | | |

| Revenue | | $ | 85.0 | | | $ | 80.0 | | | $ | 167.3 | | | $ | 156.5 | |

Gross margin1 | | $ | 14.4 | | | $ | 10.5 | | | $ | 27.7 | | | $ | 20.4 | |

Gross margin %1 | | 17 | % | | 13 | % | | 17 | % | | 13 | % |

| Income from investments accounted for by the equity method | | $ | 0.1 | | | $ | 0.5 | | | $ | 0.2 | | | $ | 0.8 | |

| Net loss | | $ | (13.2) | | | $ | (11.6) | | | $ | (23.8) | | | $ | (3.9) | |

| Net loss per share - basic and diluted | | $ | (0.77) | | | $ | (0.68) | | | $ | (1.39) | | | $ | (0.23) | |

| | | | | | | | |

| Weighted average basic shares outstanding in millions | | 17.2 | | | 17.1 | | | 17.2 | | | 17.1 | |

| | | | | | | | |

EBIT1 | | $ | (13.1) | | | $ | (10.8) | | | $ | (22.4) | | | $ | (2.2) | |

EBITDA1 | | $ | (10.1) | | | $ | (7.7) | | | $ | (16.4) | | | $ | 4.0 | |

Adjusted EBITDA1 | | $ | (4.0) | | | $ | (4.3) | | | $ | (8.5) | | | $ | (10.4) | |

1These financial measures or ratios are non-GAAP financial measures or ratios. See the section 'Non-GAAP Financial Measures' for explanations and discussions of these non-GAAP financial measures or ratios.

Selected Balance Sheet Data

The following table sets forth a summary of our financial position as at June 30, 2023 and December 31, 2022:

| | | | | | | | | | | | | | |

| | | June 30, 2023 | | December 31, 2022 |

| (expressed in millions of U.S. dollars) | | | | |

| Cash and cash equivalents | | $ | 52.3 | | | $ | 86.2 | |

Net working capital1 | | 78.5 | | | 77.5 | |

| Total assets | | 377.6 | | | 407.5 | |

| Short-term debt | | 5.2 | | | 9.1 | |

| Long-term debt, including current portion | | 41.0 | | | 43.9 | |

| Royalty payable, including current portion | | — | | | 5.5 | |

Other non-current liabilities1 | | 31.4 | | | 31.3 | |

| Total liabilities | | 190.8 | | | 203.5 | |

| Shareholders' equity | | 186.9 | | | 204.0 | |

1These financial measures or ratios are non-GAAP financial measures or ratios. See the section 'Non-GAAP Financial Measures' for explanations and discussions of these non-GAAP financial measures or ratios.

| | | | | | | | |

| | Management's Discussion and Analysis |

RESULTS FROM OPERATIONS

OPERATING SEGMENTS

We manage and report the results of our business through three segments: OEM, IAM, and Corporate as described in the Business Overview. The Corporate business segment is responsible for public company activities, corporate oversight, financing, capital allocation and general administrative duties, such as securing our intellectual property.

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2023 |

| (expressed in millions of U.S. dollars) | Revenue | Operating Income (Loss) | Depreciation & Amortization | Equity Income | |

| OEM | $ | 52.4 | | $ | (7.3) | | $ | 2.3 | | $ | 0.1 | | |

| IAM | 32.6 | | 1.7 | | 0.6 | | — | | |

| Corporate | — | | (4.6) | | 0.1 | | — | | |

| Total Consolidated | $ | 85.0 | | $ | (10.2) | | $ | 3.0 | | $ | 0.1 | | |

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2022 |

| Revenue | Operating Income (Loss) | Depreciation & Amortization | Equity Income | |

| OEM | $ | 54.3 | | $ | (5.6) | | $ | 2.2 | | $ | 0.5 | | |

| IAM | 25.7 | | 0.1 | | 0.8 | | — | | |

| Corporate | — | | (5.8) | | 0.1 | | — | | |

| Total Consolidated | $ | 80.0 | | $ | (11.3) | | $ | 3.1 | | $ | 0.5 | | |

Revenue for the three and six months ended June 30, 2023

(expressed in millions of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Change | | Six months ended June 30, | | Change |

| | 2023 | | 2022 | | $ | | % | | 2023 | | 2022 | | $ | | % |

| OEM | $ | 52.4 | | | $ | 54.3 | | | $ | (1.9) | | | (3) | % | | $ | 108.7 | | | $ | 106.1 | | | $ | 2.6 | | | 2 | % |

| IAM | 32.6 | | | 25.7 | | | 6.9 | | | 27 | % | | 58.6 | | | 50.4 | | | 8.2 | | | 16 | % |

| Total Revenue | $ | 85.0 | | | $ | 80.0 | | | $ | 5.0 | | | 6 | % | | $ | 167.3 | | | $ | 156.5 | | | $ | 10.8 | | | 7 | % |

OEM

Revenue for the three and six months ended June 30, 2023 was $52.4 million and $108.7 million, respectively, compared with $54.3 million and $106.1 million for the three and six months ended June 30, 2022.

The decrease in revenue for the three months ended June 30, 2023 was primarily driven by lower sales volumes and sales mix for the heavy duty OEM business, lower sales to customers in India in the light-duty OEM business and lower sales volumes to hydrogen customers. The decrease is partially offset by increase in sales volumes from delayed OEM, fuel storage and electronics businesses compared to the same quarter last year.

The increase in revenue for the six months ended June 30, 2023 was primarily driven by higher sales volumes in the delayed OEM business, increased sales volumes in the electronics and fuel storage business. This was offset by lower sales volumes and sales mix for the heavy duty OEM businesses, lower sales to customers in India in the light-duty OEM business and low sales volume from the hydrogen business.

| | | | | | | | |

| | Management's Discussion and Analysis |

IAM

Revenue for the three and six months ended June 30, 2023 was $32.6 million and $58.6 million, respectively, compared with $25.7 million and $50.4 million for the three and six months ended June 30, 2022.

The increase in revenue for the three and six months ended June 30, 2023 was primarily driven by increased sales volumes to Africa, Eastern Europe and South America.

Gross Margin for the three months ended June 30, 2023

(expressed in millions of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended June 30, | | % of | | Three months ended June 30, | | % of | | Change |

| | | 2023 | | Revenue | | 2022 | | Revenue | | $ | | % |

| OEM | | $ | 8.4 | | | 16 | % | | $ | 4.7 | | | 9 | % | | $ | 3.7 | | | 79 | % |

| IAM | | 6.0 | | | 18 | % | | 5.8 | | 23 | % | | 0.2 | | | 3 | % |

| Total gross margin | | $ | 14.4 | | | 17 | % | | $ | 10.5 | | | 13 | % | | $ | 3.9 | | | 37 | % |

OEM

Gross margin increased by $3.7 million to $8.4 million, or 16% of revenue, for the three months ended June 30, 2023 compared to $4.7 million, or 9% of revenue, for the three months ended June 30, 2022. The increase in gross margin is primarily driven by increase in sales volumes in the delayed OEM and fuel storage businesses, as well as increased gross margin in the heavy-duty OEM business due to higher spare parts sales, higher unit pricing on HPDI system sales and higher engineering service revenue. This was partially offset by higher production input costs stemming from global supply chain challenges and inflation in logistics, utilities, labor and other costs, which we have only partially been able to pass on to our OEM customers.

IAM

Gross margin increase by $0.2 million to $6.0 million, or 18% of revenue, for the three months ended June 30, 2023 compared to $5.8 million or 23% of revenue, for the three months ended June 30, 2022. The increase in gross margin related to higher sales in South America. The decrease in gross margin percentage was due to lower margin sales mix and inflation in South America.

Gross Margin for the six months ended June 30, 2023

(expressed in millions of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended June 30, 2023 | | % of Revenue | | Six months ended June 30, 2022 | | % of Revenue | | Change |

| | | | | | | $ | | % |

| OEM | | $ | 16.5 | | | 15 | % | | $ | 9.7 | | | 9 | % | | $ | 6.8 | | | 70 | % |

| IAM | | 11.2 | | | 19 | % | | 10.7 | | | 21 | % | | 0.5 | | | 5 | % |

| Total gross margin | | $ | 27.7 | | | 17 | % | | $ | 20.4 | | | 13 | % | | $ | 7.3 | | | 36 | % |

OEM

Gross margin increased by $6.8 million to $16.5 million, or 15% of revenue, for the six months ended June 30, 2023 compared to $9.7 million, or 9% of revenue, for the six months ended June 30, 2022.

The increase in gross margin for the six months ended June 30, 2023 was driven primarily by increased sales volumes in delayed OEM and fuel storage businesses, and higher spare parts, sales, higher unit pricing on HPDI systems sales as well as higher engineering service revenue. This is partially offset by higher production input costs incurred in materials, transportation, and energy costs, which we have only partially been able to pass on to our OEM customers.

| | | | | | | | |

| | Management's Discussion and Analysis |

IAM

Gross margin increased by $0.5 million to $11.2 million, or 19% of revenue, for the six months ended June 30, 2023 compared to $10.7 million, or 21% of revenue, for the six months ended June 30, 2022. The increase in gross margin was primarily driven by higher sales in the North America and South America markets which is partially offset by increased material and labour costs and inflation in South America, which also impacted the gross margin percentage compared to the six months ended June 30, 2022.

Research and Development Expenses ("R&D")

(expressed in millions of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended June 30, | | Change | | Six months ended June 30, | | Change |

| | | 2023 | | 2022 | | $ | | % | | 2023 | | 2022 | | $ | | % |

| OEM | | $ | 4.7 | | | $ | 4.1 | | | $ | 0.6 | | | 15 | % | | $ | 11.0 | | | $ | 8.9 | | | $ | 2.1 | | | 24 | % |

| IAM | | 1.1 | | | 1.2 | | | (0.1) | | | (8) | % | | 2.0 | | | 2.3 | | | (0.3) | | | (13) | % |

| | | | | | | | | | | | | | | | |

| Total R&D expenses | | $ | 5.8 | | | $ | 5.3 | | | $ | 0.5 | | | 9 | % | | $ | 13.0 | | | $ | 11.2 | | | $ | 1.8 | | | 16 | % |

OEM

R&D expenses expenses for the three and six months ended June 30, 2023 were $4.7 million and $11.0 million compared to $4.1 million and $8.9 million for the three and six months ended June 30, 2022, respectively. The increases compare to the same periods in the prior year are mainly due to increased engineering resources for our HPDI fuel systems and R&D expenses related to our Hydrogen business.

IAM

R&D expenses expenses for the three and six months ended June 30, 2023 were $1.1 million and $2.0 million compared to $1.2 million and $2.3 million for the three and six months ended June 30, 2022, respectively.

Selling, General and Administrative Expenses ("SG&A")

(expressed in millions of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended June 30, | | Change | | Six months ended June 30, | | Change |

| | | 2023 | | 2022 | | $ | | % | | 2023 | | 2022 | | $ | | % |

| OEM | | $ | 6.4 | | | $ | 5.6 | | | $ | 0.8 | | | 14 | % | | $ | 12.5 | | | $ | 11.4 | | | $ | 1.1 | | | 10 | % |

| IAM | | 4.5 | | | 4.4 | | | 0.1 | | | 2 | % | | 8.4 | | | 8.2 | | | 0.2 | | | 2 | % |

| Corporate | | 4.5 | | | 2.9 | | | 1.6 | | | 55 | % | | 7.9 | | | 6.2 | | | 1.7 | | | 27 | % |

| Total SG&A expenses | | $ | 15.4 | | | $ | 12.9 | | | $ | 2.5 | | | 19 | % | | $ | 28.8 | | | $ | 25.8 | | | $ | 3.0 | | | 12 | % |

OEM

SG&A expenses for the three and six months ended June 30, 2023 were $6.4 million and $12.5 million, compared with $5.6 million and $11.4 million for the three and six months ended June 30, 2022, respectively. The increase of SG&A expenses were primarily driven by higher outside service costs incurred on trade shows and exhibitions for our HPDI fuel system technology in North America and Asia and higher travel costs.

IAM

SG&A expenses for the three and six months ended June 30, 2023 were $4.5 million and $8.4 million, compared with $4.4 million and $8.2 million for the three and six months ended June 30, 2022, respectively. The increase of SG&A expenses were primarily driven by higher compensation and outside service costs compared to the same period last year.

| | | | | | | | |

| | Management's Discussion and Analysis |

Corporate

SG&A expenses for the three and six months ended June 30, 2023 were $4.5 million and $7.9 million, respectively, compared with $2.9 million and $6.2 million for the three and six months ended June 30, 2022. The increase of SG&A expenses were primarily driven by higher compensation cost, outside services and travelling costs compared to the same period last year.

Other significant expense and income items for the three and six months ended June 30, 2023

Foreign exchange gains and losses reflect net realized gains and losses on foreign currency transactions and net unrealized gains and losses on our net U.S. dollar denominated monetary assets and liabilities in our Canadian operations that were mainly comprised of cash and cash equivalents, accounts receivable and accounts payable. In addition, we have foreign exchange exposure on Euro denominated monetary assets and liabilities where the functional currency of the subsidiary is not the Euro. For the three and six months ended June 30, 2023, we recognized foreign exchange losses of $2.4 million and $3.5 million, respectively, compared to foreign exchange losses of $2.6 million and $3.3 million for the three and six months ended June 30, 2022, respectively. The foreign exchange losses recognized in the current quarter were primarily driven by unrealized foreign exchange losses that resulted from the translation of Euro dominated debt in our Argentinian subsidiary as well as our U.S. dollar denominated debt in our Canadian legal entities.

Depreciation and amortization for the three and six months ended June 30, 2023 was $3.0 million and $6.0 million, compared to $3.1 million and $6.1 million for the three and six months ended June 30, 2022, respectively. The amounts included in cost of revenue for the three and six months ended June 30, 2023 were $2.0 million and $4.0 million, respectively, compared with $2.0 million and $3.9 million for the three and six months ended June 30, 2022.

Interest on long-term debt and amortization of discount

(expressed in millions of U.S. dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, | | |

| | | 2023 | | 2022 | | 2023 | | 2022 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Interest expense on long-term debt | | $ | 0.6 | | | $ | 0.5 | | | $ | 1.2 | | | $ | 1.3 | | | |

| Royalty payable accretion expense | | — | | | 0.3 | | | 0.2 | | | 0.6 | | | |

| Total interest on long-term debt and accretion on royalty payable | | $ | 0.6 | | | $ | 0.8 | | | $ | 1.4 | | | $ | 1.9 | | | |

The decreases in interest expense on long-term debt for the three months ended June 30, 2023 compared to the prior year period was primarily due to the extinguishment of the royalty payable, partially offset by increased interest rates in the current period.

Income tax expense was $0.2 million and $1.2 million for the three and six months ended June 30, 2023 compared to income tax expense of $0.1 million and income tax recovery of $0.1 million for the three and six months ended June 30, 2022. The increase in income tax expense during the six months ended June 30, 2023 compared to the six months ended June 30, 2022 was mainly due to higher taxes from higher profitability of our European operations.

| | | | | | | | |

| | Management's Discussion and Analysis |

CAPITAL REQUIREMENTS, RESOURCES AND LIQUIDITY

Our cash and cash equivalents position decreased by $19.7 million during the second quarter of 2023 to $52.3 million from $72.0 million at March 31, 2023 and decreased by $33.9 million during the first six months of 2023 from $86.2 million at December 31, 2022. The decrease in cash during the three months ended June 30, 2023 was primarily driven by net cash used in our financing activities for the settlement of the long-term royalty payable and net repayment of debt, and purchase of equipment.

Cash Used In Operating Activities

Higher natural gas prices, especially in Europe, global supply chain disruptions and high inflation continue to challenge the automotive industry with rising manufacturer costs, this is causing pressure on gross margin and gross margin percentage in the near-term. We are responding with pricing and productivity countermeasures to manage our profitability. For further discussion, see the "Long-term Profitability and Liquidity" sections in this MD&A. These conditions continue to persist. Consequently, the duration and severity of the impact on future quarters is currently uncertain.

For the three months ended June 30, 2023, our net cash used in operating activities was $0.0 million, a decrease of $16.5 million from net cash used of $16.5 million in the three months ended June 30, 2022. The decrease in cash used in operating activities was primarily driven by the change in working capital, specifically in accounts receivable and prepaid expenses. We had built up inventory to manage against supply chain risk against shortages of raw materials and components. We continue to take actions to monetize the existing inventory and optimize our inventory levels as well as our continuous efforts in collecting from our accounts receivable during the current quarter.

Cash Flow Used In Investing Activities

For the three months ended June 30, 2023, our net cash used in investing activities was $4.9 million compared to $3.5 million for the three months ended June 30, 2022. The increase in net cash used in investing activities was primarily driven by increased capital investments of $1.7 million to $4.9 million in the three months ended June 30, 2023 compared to $3.2 million in the three months ended June 30, 2022.

Cash Flow Used In Financing Activities

For the three months ended June 30, 2023, our net cash used in financing activities was $15.0 million compared to net cash used in financing activities of $8.5 million for the three months ended June 30, 2022. In the current quarter, we repaid $8.7 million to settle our long-term royalty obligation with Cartesian and reduced the borrowing from our revolving financing facilities compared to the same period last year.

| | | | | | | | |

| | Management's Discussion and Analysis |

CONTRACTUAL OBLIGATIONS AND COMMITMENTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Carrying amount | | Contractual cash flows | | < 1 year | | 1 - 3 years | | 4-5 years | | > 5 years |

| Accounts payable and accrued liabilities | | $ | 100.7 | | | $ | 100.7 | | | $ | 100.7 | | | $ | — | | | $ | — | | | $ | — | |

| Short-term debt (1) | | 5.2 | | | 5.2 | | | 5.2 | | | — | | | — | | | — | |

| Long-term debt, principal, (2) | | 41.1 | | | 38.6 | | | 12.0 | | | 22.4 | | | 4.0 | | | 0.2 | |

| Long-term debt, interest (2) | | — | | | 5.4 | | | 2.5 | | | 2.4 | | | 0.5 | | | — | |

| | | | | | | | | | | | |

| Operating lease obligations (3) | | 23.9 | | | 26.1 | | | 3.5 | | | 5.6 | | | 2.5 | | | 14.5 | |

| | $ | 170.9 | | | $ | 176.0 | | | $ | 123.9 | | | $ | 30.4 | | | $ | 7.0 | | | $ | 14.7 | |

Notes

(1) For details of our short-term debt, see note 12 in the unaudited condensed consolidated interim financial statements.

(2) For details of our long-term debt, principal and interest, see note 13 in the unaudited condensed consolidated interim financial statements.

(3) For additional information on operating lease obligations, see note 11 of the unaudited condensed consolidated interim financial statements.

SHARES OUTSTANDING

On June 1, 2023, we completed a consolidation of our issued and outstanding common shares on the basis of one common share to ten common shares (see note 16 of the unaudited condensed consolidated interim financial statements). Effective this quarter, the shares of outstanding common stock and share units have been retroactively restated for all periods presented. For the three months ended June 30, 2023 and June 30, 2022, the weighted average number of shares used in calculating the basic and diluted loss per share was 17,173,252 and 17,119,893, respectively. For the six months ended June 30, 2023 and June 30, 2022, the weighted average number of shares used in calculating the basic and diluted loss per share was 17,171,137 and 17,117,719, respectively. The Common Shares and Share Units (comprising of performance share units, restricted share units and deferred share units) outstanding and exercisable as at the following dates are shown below:

| | | | | | | | | | | | | | | | | | |

| | | June 30, 2023 | | | | August 8, 2023 |

| | | Number | | | | Number | |

| | | | | | | | | |

| Common Shares outstanding | | 17,174,972 | | | | | | 17,174,972 | | |

| Share Units | | | | | | | | |

| Outstanding | | 608,305 | | | | | | 608,305 | | |

| Exercisable | | — | | | | | | — | | |

| | | | | | | | |

| | Management's Discussion and Analysis |

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our unaudited condensed consolidated interim financial statements are prepared in accordance with U.S. GAAP, which requires us to make estimates and assumptions that affect the amounts reported in our consolidated financial statements. We have identified several policies as critical to our business operations and in understanding our results of operations. These policies, which require the use of judgment, estimates and assumptions in determining their reported amounts, include the assessment of liquidity and going concern, warranty liability, revenue recognition, inventories and property, plant and equipment. The application of these and other accounting policies are described in note 3 of our annual consolidated financial statements and our MD&A, for the year ended December 31, 2022, filed on March 13, 2023. Actual amounts may vary significantly from estimates used. There have been no significant changes in accounting policies applied to the June 30, 2023 unaudited condensed consolidated interim financial statements and we do not expect to adopt any significant changes at this time.

DISCLOSURE CONTROLS AND PROCEDURES AND INTERNAL CONTROLS OVER FINANCIAL REPORTING

During the six months ended June 30, 2023, there were no changes to our internal control over financial reporting that materially affected, or are reasonably likely to materially affect, our internal controls over financial reporting.

SUMMARY OF QUARTERLY RESULTS

Our revenues and operating results can vary significantly from quarter to quarter depending on the timing of product deliveries, product mix, product launch dates, R&D project cycles, timing of related government funding, impairment charges, restructuring charges, stock-based compensation awards and foreign exchange impacts. Net income and net loss have and can vary significantly from one quarter to another depending on operating results, gains and losses from investing activities, recognition of tax benefits and other similar events.

The following table provides summary unaudited consolidated financial data for the past years as comparison :

Selected Consolidated Quarterly Operations Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended |

| Three months ended | 30-Sep-21 | | 31-Dec-21 | | 31-Mar-22 | | 30-Jun-22 | | 30-Sep-22 | | 31-Dec-22 | | | | 31-Mar-23 | | 30-Jun-23 | |

| (expressed in millions of U.S. dollars except for per share amounts) | | | | | (1) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Total revenue | $ | 74.3 | | | $ | 82.7 | | | $ | 76.5 | | | $ | 80.0 | | | $ | 71.2 | | | $ | 78.0 | | | | | $ | 82.2 | | | $ | 85.0 | | |

| Cost of revenue | $ | 64.2 | | | $ | 73.4 | | | $ | 66.6 | | | $ | 69.5 | | | $ | 59.9 | | | $ | 73.5 | | | | | $ | 68.9 | | | $ | 70.6 | | |

| Gross margin (2) | $ | 10.1 | | | $ | 9.3 | | | $ | 9.9 | | | $ | 10.5 | | | $ | 11.3 | | | $ | 4.5 | | | | | $ | 13.3 | | | $ | 14.4 | | |

| Gross margin percentage (2) | 13.6% | | 11.2% | | 12.9% | | 13.1% | | 15.9% | | 5.8% | | | | 16.2% | | 16.9% | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Net income (loss) | $ | (5.8) | | | $ | 5.4 | | | $ | 7.7 | | | $ | (11.6) | | | $ | (11.9) | | | $ | (16.9) | | | | | $ | (10.6) | | | $ | (13.2) | | |

| EBITDA (2) | $ | (1.2) | | | $ | 8.4 | | | $ | 11.7 | | | $ | (7.7) | | | $ | (8.0) | | | $ | (13.5) | | | | | $ | (6.3) | | | $ | (10.1) | | |

| Adjusted EBITDA (2) | $ | (1.4) | | | $ | 10.0 | | | $ | (6.1) | | | $ | (4.3) | | | $ | (4.5) | | | $ | (12.9) | | | | | $ | (4.5) | | | $ | (4.0) | | |

| U.S. dollar to Euro average exchange rate | 0.85 | | 0.87 | | 0.89 | | 0.94 | | 0.99 | | 0.98 | | | | 0.93 | | 0.92 | |

| U.S. dollar to Canadian dollar average exchange rate | 1.26 | | 1.26 | | 1.27 | | 1.28 | | 1.31 | | 1.36 | | | | 1.35 | | 1.34 | |

| Earnings (loss) per share | | | | | | | | | | | | | | | | | | |

| Basic | $ | (0.30) | | | $ | 0.40 | | | $ | 0.50 | | | $ | (0.70) | | | $ | (0.70) | | | $ | (1.00) | | | | | $ | (0.62) | | | $ | (0.77) | | |

| Diluted | $ | (0.30) | | | $ | 0.30 | | | $ | 0.40 | | | $ | (0.60) | | | $ | (0.70) | | | $ | (1.00) | | | | | $ | (0.62) | | | $ | (0.77) | | |

Notes

(1) During the first quarter of 2022, we recorded a $19.1 million gain on sale of investment from the sale of our interest in Cummins Westport Inc. ("CWI") and the monetization of the related intellectual property.

(2) These financial measures or ratios are non-GAAP financial measures or ratios. See the section 'Non-GAAP Financial Measures' for explanations and discussion of these non-GAAP financial measures or ratios.

| | | | | | | | |

| | Management's Discussion and Analysis |

Non-GAAP Measures:

In addition to the results presented in accordance with U.S. GAAP, we used EBIT, EBITDA, Adjusted EBITDA, gross margin, gross margin as a percentage of revenue, net working capital, and non-current liabilities (collectively, the “Non-GAAP Measures") throughout this MD&A. We believe these non-GAAP measures provide additional information that is useful to stakeholders in understanding our underlying performance and trends through the same financial measures employed by our management. We believe that EBIT, EBITDA, and Adjusted EBITDA are useful to both management and investors in their analysis of our ability to generate liquidity by producing operating cash flow to fund working capital needs, service debt obligations and fund capital expenditures. Management also uses these non-GAAP measures in its review and evaluation of the financial performance of the Company. EBITDA is also frequently used by stakeholders for valuation purposes whereby EBITDA is multiplied by a factor or "EBITDA multiple" that is based on an observed or inferred relationship between EBITDA and market values to determine the approximate total enterprise value of a company. We believe these non-GAAP financial measures also provide additional insight to stakeholders as supplemental information to our U.S. GAAP results and as a basis to compare our financial performance period-over-period and to compare our financial performance with that of other companies. We believe that these non-GAAP financial measures facilitate comparisons of our core operating results from period to period and to other companies by, in the case of EBITDA, removing the effects of our capital structure (net interest income on cash deposits, interest expense on outstanding debt and debt facilities), asset base (depreciation and amortization) and tax consequences. Adjusted EBITDA provides this same indicator of Westport's EBITDA from operations and removing such effects of our capital structure, asset base and tax consequences, but additionally excludes any unrealized foreign exchange gains or losses, stock-based compensation charges and other one-time impairments and costs that are not expected to be repeated in order to provide greater insight into the cash flow being produced from our operating business, without the influence of extraneous events. Readers should be aware that non-GAAP measures have no standardized meaning under U.S. GAAP and accordingly may not be comparable to the calculation of similar measures by other companies. Non-GAAP measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with U.S. GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | | | | | | | | | | | | | | 30-Sep-21 | | 31-Dec-21 | | 31-Mar-22 | | 30-Jun-22 | | 30-Sep-22 | | 31-Dec-22 | | 31-Mar-23 | | 30-Jun-23 |

| (expressed in millions of U.S dollars) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | | | | | | | | | | | | | | | | | $ | 74.3 | | | $ | 82.7 | | | $ | 76.5 | | | $ | 80.0 | | | $ | 71.2 | | | $ | 78.0 | | | $ | 82.2 | | | $ | 85.0 | |

| Less: Cost of revenue | | | | | | | | | | | | | | | | | 64.2 | | | 73.4 | | | 66.6 | | | 69.5 | | | 59.9 | | | 73.5 | | | 68.9 | | | 70.6 | |

| Gross margin | | | | | | | | | | | | | | | | | $ | 10.1 | | | $ | 9.3 | | | $ | 9.9 | | | $ | 10.5 | | | $ | 11.3 | | | $ | 4.5 | | | $ | 13.3 | | | $ | 14.4 | |

| Gross margin % | | | | | | | | | | | | | | | | | 13.6 | % | | 11.2 | % | | 12.9 | % | | 13.1 | % | | 15.9 | % | | 5.8 | % | | 16.2 | % | | 16.9 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | June 30, 2023 | | December 31, 2022 | | |

| (expressed in millions of U.S. dollars) | | | | | | | | | | |

| Accounts receivable | | | | | | $ | 102.1 | | $ | 101.6 | | |

| Inventories | | | | | | 82.9 | | 81.6 | | |

| Prepaid expenses | | | | | | 6.6 | | 7.8 | | |

| | | | | | | | | | |

| Accounts payable and accrued liabilities | | | | | | (100.7) | | (98.8) | | |

| Current portion of operating lease liabilities | | | | | | (3.5) | | (3.4) | | |

| Current portion of warranty liability | | | | | | (8.9) | | (11.3) | | |

| Net working capital | | | | | | $ | 78.5 | | $ | 77.5 | | |

| | | | | | | | |

| | Management's Discussion and Analysis |

| | | | | | | | | | | | | | | | | | | | |

| | | | June 30, 2023 | | December 31, 2022 | | |

| (expressed in millions of U.S. dollars) | | | | | | | | | | |

| Total liabilities | | | | | | $ | 190.8 | | $ | 203.5 | | |

| Less: | | | | | | | | | | |

| Total current liabilities | | | | | | 132.5 | | 135.5 | | |

| Long-term debt | | | | | | 26.9 | | 32.2 | | |

| Long-term royalty payable | | | | | | — | | 4.4 | | |

| Other non-current liabilities | | | | | | $ | 31.4 | | $ | 31.4 | | |

EBIT and EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | | | | | | | | | | | | | | | | | | | 30-Sep-21 | | 31-Dec-21 | | 31-Mar-22 | | | 30-Jun-22 | | 30-Sep-22 | | 31-Dec-22 | | 31-Mar-23 | | 30-Jun-23 |

| (expressed in millions of U.S. dollars) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loss before income taxes | | | | | | | | | | | | | | | | | | | | | | $ | (5.4) | | | $ | 4.6 | | | $ | 7.6 | | | | $ | (11.5) | | | $ | (11.0) | | | $ | (16.4) | | | $ | (9.7) | | | $ | (13.0) | |

| Interest expense, net (1) | | | | | | | | | | | | | | | | | | | | | | 0.9 | | | 0.3 | | | 1.0 | | | | 0.7 | | | 0.2 | | | 0.1 | | | 0.4 | | | (0.1) | |

| EBIT | | | | | | | | | | | | | | | | | | | | | | (4.5) | | | 4.9 | | | 8.6 | | | | (10.8) | | | (10.8) | | | (16.3) | | | (9.3) | | | (13.1) | |

| Depreciation and amortization | | | | | | | | | | | | | | | | | | | | | | 3.3 | | | 3.5 | | | 3.1 | | | | 3.1 | | | 2.8 | | | 2.8 | | | 3.0 | | | 3.0 | |

| EBITDA | | | | | | | | | | | | | | | | | | | | | | $ | (1.2) | | | $ | 8.4 | | | $ | 11.7 | | | | $ | (7.7) | | | $ | (8.0) | | | $ | (13.5) | | | $ | (6.3) | | | $ | (10.1) | |

Notes

(1) Interest expense, net is calculated as interest and other income, net of bank charges and interest on long-term debt and accretion of royalty payables.

Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | | | | | | | | | | | | | | | | 30-Sep-21 | | 31-Dec-21 | | 31-Mar-22 | | | 30-Jun-22 | | 30-Sep-22 | | 31-Dec-22 | | 31-Mar-23 | | 30-Jun-23 |

| (expressed in millions of U.S. dollars) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA | | | | | | | | | | | | | | | | | | | $ | (1.2) | | | $ | 8.4 | | | $ | 11.7 | | | | $ | (7.7) | | | $ | (8.0) | | | $ | (13.5) | | | $ | (6.3) | | | $ | (10.1) | |

| Stock-based compensation | | | | | | | | | | | | | | | | | | | 0.7 | | | 0.6 | | | 0.5 | | | | 0.9 | | | 0.8 | | | 0.2 | | | 0.7 | | | 0.8 | |

| Unrealized foreign exchange loss | | | | | | | | | | | | | | | | | | | (0.9) | | | 0.5 | | | 0.8 | | | | 2.5 | | | 2.7 | | | 0.4 | | | 1.1 | | | 2.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Asset impairment | | | | | | | | | | | | | | | | | | | — | | | 0.5 | | | — | | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gain on sale of investment | | | | | | | | | | | | | | | | | | | — | | | — | | | (19.1) | | | | — | | | — | | | — | | | — | | | — | |

| Loss on extinguishment of royalty payable | | | | | | | | | | | | | | | | | | | — | | | — | | | — | | | | — | | | — | | | — | | | — | | | 2.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA | | | | | | | | | | | | | | | | | | | $ | (1.4) | | | $ | 10.0 | | | $ | (6.1) | | | | $ | (4.3) | | | $ | (4.5) | | | $ | (12.9) | | | $ | (4.5) | | | $ | (4.0) | |

Condensed Consolidated Interim Financial Statements (unaudited)

(Expressed in thousands of United States dollars)

WESTPORT FUEL SYSTEMS INC.

For the three and six months ended June 30, 2023 and 2022

| | |

| WESTPORT FUEL SYSTEMS INC. |

| Condensed Consolidated Interim Balance Sheets (unaudited) |

| (Expressed in thousands of United States dollars, except share amounts) |

June 30, 2023 and December 31, 2022 |

| | | | | | | | | | | | | | |

| | | June 30, 2023 | | December 31, 2022 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents (including restricted cash) | | $ | 52,265 | | | $ | 86,184 | |

| | | | |

| | | | |

| Accounts receivable (note 4) | | 102,101 | | | 101,640 | |

| Inventories (note 5) | | 82,886 | | | 81,635 | |

| Prepaid expenses | | 6,620 | | | 7,760 | |

| | | | |

| Total current assets | | 243,872 | | | 277,219 | |

| Long-term investments (note 7) | | 4,895 | | | 4,629 | |

| Property, plant and equipment (note 8) | | 66,159 | | | 62,641 | |

| Operating lease right-of-use assets | | 24,067 | | | 23,727 | |

| Intangible assets (note 9) | | 7,348 | | | 7,817 | |

| Deferred income tax assets | | 10,838 | | | 10,430 | |

| Goodwill | | 3,022 | | | 2,958 | |

| Other long-term assets | | 17,430 | | | 18,030 | |

| | | | |

| Total assets | | $ | 377,631 | | | $ | 407,451 | |

| Liabilities and shareholders’ equity | | | | |

| Current liabilities: | | | | |

| Accounts payable and accrued liabilities (note 10) | | $ | 100,724 | | | $ | 98,863 | |

| | | | |

| | | | |

| Current portion of operating lease liabilities (note 11) | | 3,507 | | | 3,379 | |

| Short-term debt (note 12) | | 5,224 | | | 9,102 | |

| Current portion of long-term debt (note 13) | | 14,087 | | | 11,698 | |

| Current portion of long-term royalty payable (note 14) | | — | | | 1,162 | |

| Current portion of warranty liability (note 15) | | 8,914 | | | 11,315 | |

| | | | |

| Total current liabilities | | 132,456 | | | 135,519 | |

| | | | |

| | | | |

| Long-term operating lease liabilities (note 11) | | 20,408 | | | 20,080 | |

| Long-term debt (note 13) | | 26,945 | | | 32,164 | |

| Long-term royalty payable (note 14) | | — | | | 4,376 | |

| Warranty liability (note 15) | | 2,974 | | | 2,984 | |

| Deferred income tax liabilities | | 3,496 | | | 3,282 | |

| Other long-term liabilities | | 4,494 | | | 5,080 | |

| | | | |

| Total liabilities | | 190,773 | | | 203,485 | |

| Shareholders’ equity: | | | | |

| Share capital (Adjusted, note 16): | | | | |

| | | | |

| Unlimited common and preferred shares, no par value | | | | |

| | | | |

| | | | |

17,174,972 (2022 - 17,130,316) common shares issued and outstanding | | 1,244,547 | | | 1,243,272 | |

| Other equity instruments | | 9,312 | | | 9,212 | |

| Additional paid in capital | | 11,516 | | | 11,516 | |

| Accumulated deficit | | (1,048,551) | | | (1,024,716) | |

| Accumulated other comprehensive loss | | (29,966) | | | (35,318) | |

| Total shareholders' equity | | 186,858 | | | 203,966 | |

| Total liabilities and shareholders' equity | | $ | 377,631 | | | $ | 407,451 | |

| Commitments and contingencies (note 18) | | | | |

| | | | |

See accompanying notes to condensed consolidated interim financial statements.

| | | | | | | | | | | | | | | | | |

| Approved on behalf of the Board: | Anthony Guglielmin | Director | Brenda J. Eprile | | Director |

| | |

| WESTPORT FUEL SYSTEMS INC. |

| Condensed Consolidated Interim Statements of Operations and Comprehensive Income (Loss) (unaudited) |

| (Expressed in thousands of United States dollars, except share and per share amounts) |

Three and six months ended June 30, 2023 and 2022 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended June 30, | | Six months ended June 30, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | $ | 85,022 | | | $ | 79,964 | | | $ | 167,262 | | | $ | 156,508 | |

| | | | | | | | |

| | | | | | | | |

| Cost of revenue and expenses: | | | | | | | | |

| Cost of revenue | | 70,653 | | | 69,457 | | | 139,532 | | | 136,076 | |

| Research and development | | 5,785 | | | 5,254 | | | 13,048 | | | 11,188 | |

| General and administrative | | 10,546 | | | 9,013 | | | 20,314 | | | 18,204 | |

| Sales and marketing | | 4,820 | | | 3,914 | | | 8,469 | | | 7,563 | |

| | | | | | | | |

| Foreign exchange loss | | 2,420 | | | 2,566 | | | 3,496 | | | 3,337 | |

| Depreciation and amortization | | 1,021 | | | 1,085 | | | 2,058 | | | 2,268 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | 95,245 | | | 91,289 | | | 186,917 | | | 178,636 | |

| Loss from operations | | (10,223) | | | (11,325) | | | (19,655) | | | (22,128) | |

| | | | | | | | |

| Income from investments accounted for by the equity method | | 56 | | | 458 | | | 185 | | | 751 | |

| Gain on sale of investments and assets | | 21 | | | — | | | 21 | | | 19,119 | |

| Interest on long-term debt and accretion on royalty payable | | (643) | | | (839) | | | (1,490) | | | (1,899) | |

| Loss on extinguishment of royalty payable (note 14) | | (2,909) | | | — | | | (2,909) | | | — | |

| Interest and other income, net of bank charges | | 712 | | | 197 | | | 1,178 | | | 238 | |

| Loss before income taxes | | (12,986) | | | (11,509) | | | (22,670) | | | (3,919) | |

| | | | | | | | |

| Income tax expense (recovery) | | 221 | | | 70 | | | 1,165 | | | (50) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net loss for the period | | (13,207) | | | (11,579) | | | (23,835) | | | (3,869) | |

| Other comprehensive loss: | | | | | | | | |

| Cumulative translation adjustment | | (7,322) | | | (4,314) | | | (5,352) | | | (4,645) | |

| Comprehensive loss | | $ | (20,529) | | | $ | (15,893) | | | $ | (29,187) | | | $ | (8,514) | |

| | | | | | | | |

| Loss per share: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net loss per share - basic and diluted | | $ | (0.77) | | | $ | (0.68) | | | $ | (1.39) | | | $ | (0.23) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | |

| Basic and diluted | | 17,173,252 | | | 17,119,893 | | | 17,171,137 | | | 17,117,719 | |

| | | | | | | | |

See accompanying notes to condensed consolidated interim financial statements.

| | |

|

| WESTPORT FUEL SYSTEMS INC. |

| Condensed Consolidated Interim Statements of Shareholders' Equity (unaudited) |

| (Expressed in thousands of United States dollars, except share amounts) |

Three and six months ended June 30, 2023 and 2022 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Shares Outstanding (Adjusted, note 16) | | Share capital | | Other equity instruments | | Additional paid in capital | | Accumulated deficit | | Accumulated other comprehensive income (loss) | | Total shareholders' equity |

| | Three months ended June 30, 2022 |

| April 1, 2022 | | 17,118,005 | | | $ | 1,243,077 | | | $ | 7,813 | | | $ | 11,516 | | | $ | (984,311) | | | $ | (33,825) | | | $ | 244,270 | |

| | | | | | | | | | | | | | |

| Issuance of common shares on exercise of share units | | 3,898 | | | 66 | | | (66) | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Stock-based compensation | | — | | | — | | | 769 | | | — | | | — | | | — | | | 769 | |

| Net loss for the period | | — | | | — | | | — | | | — | | | (11,579) | | | — | | | (11,579) | |

| Other comprehensive loss | | — | | | — | | | — | | | — | | | — | | | (4,314) | | | (4,314) | |

| June 30, 2022 | | 17,121,903 | | | $ | 1,243,143 | | | $ | 8,516 | | | $ | 11,516 | | | $ | (995,890) | | | $ | (38,139) | | | $ | 229,146 | |

| | | | | | | | | | | | | | |

| | Six months ended June 30, 2022 |

| January 1, 2022 | | 17,079,932 | | | $ | 1,242,006 | | | $ | 8,412 | | | $ | 11,516 | | | $ | (992,021) | | | $ | (33,494) | | | $ | 236,419 | |

| | | | | | | | | | | | | | |

| Issuance of common shares on exercise of share units | | 41,971 | | | 1,137 | | | (1,137) | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Stock-based compensation | | — | | | — | | | 1,241 | | | — | | | — | | | — | | | 1,241 | |

| Net loss for the period | | — | | | — | | | — | | | — | | | (3,869) | | | — | | | (3,869) | |

| Other comprehensive loss | | — | | | — | | | — | | | — | | | — | | | (4,645) | | | (4,645) | |

| June 30, 2022 | | 17,121,903 | | | $ | 1,243,143 | | | $ | 8,516 | | | $ | 11,516 | | | $ | (995,890) | | | $ | (38,139) | | | $ | 229,146 | |

| | | | | | | | | | | | | | |

| | Three months ended June 30, 2023 |

| April 1, 2023 | | 17,171,933 | | | $ | 1,244,507 | | | $ | 8,610 | | | $ | 11,516 | | | $ | (1,035,344) | | | $ | (33,348) | | | $ | 195,941 | |

| Issuance of common shares on exercise of share units | | 3,039 | | | 40 | | | (40) | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Stock-based compensation | | — | | | — | | | 742 | | | — | | | — | | | — | | | 742 | |

| Net loss for the period | | — | | | — | | | — | | | — | | | (13,207) | | | — | | | (13,207) | |

| Other comprehensive gain | | — | | | — | | | — | | | — | | | — | | | 3,382 | | | 3,382 | |

| June 30, 2023 | | 17,174,972 | | | $ | 1,244,547 | | | $ | 9,312 | | | $ | 11,516 | | | $ | (1,048,551) | | | $ | (29,966) | | | $ | 186,858 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Six months ended June 30, 2023 |

| January 1, 2023 | | 17,130,316 | | | $ | 1,243,272 | | | $ | 9,212 | | | $ | 11,516 | | | $ | (1,024,716) | | | $ | (35,318) | | | $ | 203,966 | |

| Issuance of common shares on exercise of share units | | 44,656 | | | 1,275 | | | (1,275) | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Stock-based compensation | | — | | | — | | | 1,375 | | | — | | | — | | | — | | | 1,375 | |

| Net loss for the period | | — | | | — | | | — | | | — | | | (23,835) | | | — | | | (23,835) | |

| Other comprehensive gain | | — | | | — | | | — | | | — | | | — | | | 5,352 | | | 5,352 | |

| June 30, 2023 | | 17,174,972 | | | $ | 1,244,547 | | | $ | 9,312 | | | $ | 11,516 | | | $ | (1,048,551) | | | $ | (29,966) | | | $ | 186,858 | |

| | | | | | | | | | | | | | |

| | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

See accompanying notes to condensed consolidated interim financial statements.

| | |

| WESTPORT FUEL SYSTEMS INC. |

| Condensed Consolidated Interim Statements of Cash Flows (unaudited) |

| (Expressed in thousands of United States dollars) |

Three and six months ended June 30, 2023 and 2022 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Operating activities: | | | | | | | | |

| Net loss for the period | | $ | (13,207) | | | $ | (11,579) | | | $ | (23,835) | | | $ | (3,869) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | |

| Depreciation and amortization | | 2,993 | | | 3,051 | | | 6,020 | | | 6,140 | |

| Stock-based compensation expense | | 742 | | | 769 | | | 1,375 | | | 1,241 | |

| Unrealized foreign exchange loss | | 2,420 | | | 2,566 | | | 3,496 | | | 3,337 | |

| Deferred income tax | | 125 | | | (96) | | | (23) | | | (531) | |

| Income from investments accounted for by the equity method | | (56) | | | (458) | | | (185) | | | (751) | |

| Interest on long-term debt and accretion on royalty payable | | 643 | | | 839 | | | 1,490 | | | 1,899 | |

| Change in inventory write-downs to net realizable value | | 992 | | | 792 | | | 1,578 | | | 549 | |

| Loss on extinguishment of royalty payable | | 2,909 | | | — | | | 2,909 | | | — | |

| Change in bad debt expense | | 288 | | | (32) | | | 372 | | | 59 | |

| | | | | | | | |

| Gain on sale of assets | | (21) | | | — | | | (21) | | | — | |

| Gain on sale of investment | | — | | | — | | | — | | | (19,119) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | 469 | | | (3,557) | | | (572) | | | 2,471 | |

| Inventories | | (537) | | | (3,499) | | | (1,128) | | | (11,883) | |

| Prepaid expenses | | 3,091 | | | 1,082 | | | 1,407 | | | (1,188) | |

| Accounts payable and accrued liabilities | | 287 | | | (3,770) | | | 1,050 | | | (7,280) | |

| | | | | | | | |

| Warranty liability | | (1,179) | | | (2,623) | | | (2,561) | | | (4,479) | |

| | | | | | | | |

| Net cash used in operating activities | | (41) | | | (16,515) | | | (8,628) | | | (33,404) | |

| | | | | | | | |

| | | | | | | | |

| Investing activities: | | | | | | | | |

| Purchase of property, plant and equipment and other assets | | (4,905) | | | (3,185) | | | (7,912) | | | (5,983) | |

| | | | | | | | |

| Purchase of intangible assets | | — | | | (296) | | | — | | | (296) | |

| | | | | | | | |

| Proceeds on sale of assets | | 35 | | | — | | | 133 | | | 31,949 | |

| | | | | | | | |

| | | | | | | | |

| Net cash (used in) provided by investing activities | | (4,870) | | | (3,481) | | | (7,779) | | | 25,670 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Financing activities: | | | | | | | | |

| | | | | | | | |

| Repayments of short and long-term facilities | | (11,140) | | | (13,406) | | | (22,876) | | | (36,599) | |

| Drawings on operating lines of credit and long-term facilities | | 4,845 | | | 10,086 | | | 13,096 | | | 25,392 | |

| Payment of royalty payable | | (8,687) | | | (5,200) | | | (8,687) | | | (5,200) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net cash used in financing activities | | (14,982) | | | (8,520) | | | (18,467) | | | (16,407) | |

| | | | | | | | |

| Effect of foreign exchange on cash and cash equivalents | | 195 | | | (874) | | | 955 | | | (2,577) | |

| Net decrease in cash and cash equivalents | | (19,698) | | | (29,390) | | | (33,919) | | | (26,718) | |

| Cash and cash equivalents, beginning of period (including restricted cash) | | 71,963 | | | 127,564 | | | 86,184 | | | 124,892 | |

| Cash and cash equivalents, end of period (including restricted cash) | | $ | 52,265 | | | $ | 98,174 | | | $ | 52,265 | | | $ | 98,174 | |

| | |

| WESTPORT FUEL SYSTEMS INC. |

| Condensed Consolidated Interim Statements of Cash Flows (unaudited) |

| (Expressed in thousands of United States dollars) |

Three and six months ended June 30, 2023 and 2022 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Supplementary information: | | | | | | | | |

| Interest paid | | $ | 755 | | | $ | 722 | | | $ | 1,497 | | | $ | 1,634 | |

| Taxes paid, net of refunds | | 526 | | | 541 | | | 1,032 | | | 839 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

See accompanying notes to condensed consolidated interim financial statements.

| | |

| WESTPORT FUEL SYSTEMS INC. |

Notes to Condensed Consolidated Interim Financial Statements (unaudited)

|

| (Expressed in thousands of United States dollars, except share and per share amounts) |

Three and six months ended June 30, 2023 and 2022 |

1. Company organization and operations:

Westport Fuel Systems Inc. (the “Company”) was incorporated under the Business Corporations Act (Alberta) on March 20, 1995. Westport Fuel Systems is a global company focused on engineering, manufacturing, and supplying alternative fuel systems and components for transportation applications. The Company’s diverse product offerings sold under a wide range of established global brands enable the use of a number of alternative fuels in the transportation sector which provide environmental and/or economic advantages as compared to diesel, gasoline, batteries or fuel cell powered vehicles. The Company's fuel systems and associated components control the pressure and flow of these alternative fuels, including liquid petroleum gas ("LPG"), compressed natural gas ("CNG"), liquified natural gas ("LNG"), renewable natural gas ("RNG") or biomethane, and hydrogen. The Company supplies its products in more than 70 countries through a network of distributors, service providers for the aftermarket and directly to original equipment manufacturers (“OEMs”) and Tier 1 and Tier 2 OEM suppliers. The Company’s products and services are available for passenger car and light-, medium- and heavy-duty truck and off-road applications.

2. Liquidity and going concern:

In connection with preparing consolidated financial statements for each annual and interim reporting period, the Company is required to evaluate whether there are conditions or events, considered in aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the financial statements are issued. Substantial doubt exists when conditions and events, considered in aggregate, indicate that it is probable that a company will be unable to meet its obligations as they become due within one year after the date that the consolidated financial statements are issued. This evaluation initially does not take into consideration the potential mitigating effect of management’s plans and actions that have not been fully implemented as of the date that the financial statements are issued. When substantial doubt exists, management evaluates whether the mitigating effect of its plans sufficiently alleviates substantial doubt about the Company’s ability to continue as a going concern. The mitigating effect of management’s plans, however, is only considered if both: (1) it is probable that the plans will be effectively implemented within one year after the date that the financial statements are issued; and (2) it is probable that the plans, when implemented, will mitigate the relevant conditions or events that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the financial statements are issued. Generally, to be considered probable of being effectively implemented, the plans must have been approved before the date that the financial statements are issued.

Management's evaluation has concluded that there are no known or currently foreseeable conditions or events that raise substantial doubt about the Company's ability to continue as a going concern within one year after the date these unaudited condensed consolidated interim financial statements ("interim financial statements") are issued. These interim financial statements have therefore been prepared on the basis that the Company will continue as a going concern.

The assessment of liquidity and going concern requires the Company to make judgments about the existence of conditions or events that raise substantial doubt about the ability to continue as a going concern within one year after the date that these interim financial statements are issued. This includes judgments about the Company's future activities and the timing thereof and estimates of future cash flows. Significant assumptions used in the Company's forecasted model of liquidity include forecasted sales, including forecasted increases in sales of the heavy-duty OEM business, forecasted costs and capital expenditures, amongst others. Changes in the assumptions could have a material impact on the forecasted liquidity and going concern assessment.

The Company continues to sustain operating losses and negative cash flows from operating activities. As at June 30, 2023, the Company has cash and cash equivalents of $52,265 and cash flow used in operating activities of $8,628 for the six months ended June 30, 2023 primarily driven by the operating losses of $22,670 and an increase in working capital. The Company's short-term and long-term debt was $46,256, net of deferred financing fees, of which $19,621 of these debts mature within one year from June 30, 2023. The Company has a term loan with Export Development Canada (“EDC”), which has a covenant requiring the Company to maintain a $40,000 minimum balance of cash and cash equivalents. If the Company’s cash and cash equivalents fall below the minimum cash requirement, the Company may be required to repay the outstanding amount of the term loan, which was $12,719 at June 30, 2023.

| | |

| WESTPORT FUEL SYSTEMS INC. |

Notes to Condensed Consolidated Interim Financial Statements (unaudited)

|

| (Expressed in thousands of United States dollars, except share and per share amounts) |

Three and six months ended June 30, 2023 and 2022 |