- 2024 GAAP earnings per share were $3.44 compared with $3.21 per

share in 2023.

- 2024 ongoing earnings per share were $3.50 compared with $3.35

per share in 2023.

- Xcel Energy reaffirms 2025 EPS guidance of $3.75 to $3.85 per

share.

Xcel Energy Inc. (NASDAQ: XEL) today reported 2024 GAAP earnings

of $1.94 billion, or $3.44 per share, compared with $1.77 billion,

or $3.21 per share in the same period in 2023 and ongoing earnings

of $1.97 billion, or $3.50 per share, compared with $1.85 billion,

or $3.35 per share in the same period in 2023. See Note 6 for

reconciliation from GAAP to ongoing earnings.

The change in ongoing earnings reflect increased recovery of

infrastructure investments, partially offset by higher

depreciation, interest charges and O&M expenses.

“In 2024, we delivered on our earnings guidance for the 20th

year in a row - one of the best track records in the industry -

against a very difficult backdrop of challenges throughout the

year. We significantly increased our investments in the

infrastructure and technology that serves to protect and enhance

the electrical systems for the benefit of our customers and

communities,” said Bob Frenzel, chairman, president and CEO of Xcel

Energy.

“As we look forward into 2025, we are executing on our plans to

build the energy grid that is needed to meet the unprecedented

increases in demand from our customers, protect against extreme

weather, and deliver a compelling customer experience. We are

excited for the future and to make energy work better for our

customers and communities.”

At 9:00 a.m. CST today, Xcel Energy will host a conference call

to review financial results. To participate in the call, please

dial in 5 to 10 minutes prior to the start and follow the

operator’s instructions.

US Dial-In:

1-866-580-3963

International Dial-In:

400-120-0558

Conference ID:

7903558

The conference call also will be simultaneously broadcast and

archived on Xcel Energy’s website at www.xcelenergy.com. To access

the presentation, click on Investors under Company. If you are

unable to participate in the live event, the call will be available

for replay through Feb. 11.

Replay Numbers

US Dial-In:

1-866-583-1035

Access Code:

7903558#

Except for the historical statements contained in this report,

the matters discussed herein are forward-looking statements that

are subject to certain risks, uncertainties and assumptions. Such

forward-looking statements, including those relating to 2025 EPS

guidance, long-term EPS and dividend growth rate objectives, future

sales, future expenses, future tax rates, future operating

performance, estimated base capital expenditures and financing

plans, projected capital additions and forecasted annual revenue

requirements with respect to rider filings, expected rate increases

to customers, expectations and intentions regarding regulatory

proceedings, expected pension contributions, and expected impact on

our results of operations, financial condition and cash flows of

interest rate changes, increased credit exposure, and legal

proceeding outcomes, as well as assumptions and other statements

are intended to be identified in this document by the words

“anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,”

“may,” “objective,” “outlook,” “plan,” “project,” “possible,”

“potential,” “should,” “will,” “would” and similar expressions.

Actual results may vary materially. Forward-looking statements

speak only as of the date they are made, and we expressly disclaim

any obligation to update any forward-looking information. The

following factors, in addition to those discussed in Xcel Energy’s

Annual Report on Form 10-K for the fiscal year ended Dec. 31, 2023

and subsequent filings with the Securities and Exchange Commission,

could cause actual results to differ materially from management

expectations as suggested by such forward-looking information:

operational safety, including our nuclear generation facilities and

other utility operations; successful long-term operational

planning; commodity risks associated with energy markets and

production; rising energy prices and fuel costs; qualified employee

workforce and third-party contractor factors; violations of our

Codes of Conduct; our ability to recover costs and our

subsidiaries’ ability to recover costs from customers; changes in

regulation; reductions in our credit ratings and the cost of

maintaining certain contractual relationships; general economic

conditions, including recessionary conditions, inflation rates,

monetary fluctuations, supply chain constraints and their impact on

capital expenditures and/or the ability of Xcel Energy Inc. and its

subsidiaries to obtain financing on favorable terms; availability

or cost of capital; our customers’ and counterparties’ ability to

pay their debts to us; assumptions and costs relating to funding

our employee benefit plans and health care benefits; our

subsidiaries’ ability to make dividend payments; tax laws;

uncertainty regarding epidemics, the duration and magnitude of

business restrictions including shutdowns (domestically and

globally), the potential impact on the workforce, including

shortages of employees or third-party contractors due to quarantine

policies, vaccination requirements or government restrictions,

impacts on the transportation of goods and the generalized impact

on the economy; effects of geopolitical events, including war and

acts of terrorism; cybersecurity threats and data security

breaches; seasonal weather patterns; changes in environmental laws

and regulations; climate change and other weather events; natural

disaster and resource depletion, including compliance with any

accompanying legislative and regulatory changes; costs of potential

regulatory penalties and wildfire damages in excess of liability

insurance coverage; regulatory changes and/or limitations related

to the use of natural gas as an energy source; challenging labor

market conditions and our ability to attract and retain a qualified

workforce; and our ability to execute on our strategies or achieve

expectations related to environmental, social and governance

matters including as a result of evolving legal, regulatory and

other standards, processes, and assumptions, the pace of scientific

and technological developments, increased costs, the availability

of requisite financing, and changes in carbon markets.

This information is not given in connection

with any sale, offer for sale or offer to buy any security.

XCEL ENERGY INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME (UNAUDITED)

(amounts in millions, except per

share data)

Three Months Ended Dec.

31

Twelve Months Ended Dec.

31

2024

2023

2024

2023

Operating revenues

Electric

$

2,410

$

2,695

$

11,147

$

11,446

Natural gas

695

719

2,230

2,645

Other

15

28

64

115

Total operating revenues

3,120

3,442

13,441

14,206

Operating expenses

Electric fuel and purchased power

925

950

3,788

4,278

Cost of natural gas sold and

transported

287

372

951

1,456

Cost of sales — other

2

12

14

49

Operating and maintenance expenses

618

580

2,540

2,444

Conservation and demand side management

expenses

99

71

394

286

Depreciation and amortization

702

641

2,744

2,448

Taxes (other than income taxes)

140

168

624

657

Loss on Comanche Unit 3 litigation

—

1

—

35

Workforce reduction expenses

—

72

—

72

Total operating expenses

2,773

2,867

11,055

11,725

Operating income

347

575

2,386

2,481

Other income, net

68

3

143

22

Earnings from equity method

investments

—

8

19

35

Allowance for funds used during

construction — equity

49

28

168

91

Interest charges and financing

costs

Interest charges — includes other

financing costs

319

265

1,255

1,055

Allowance for funds used during

construction — debt

(22

)

(15

)

(73

)

(51

)

Total interest charges and financing

costs

297

250

1,182

1,004

Income before income taxes

167

364

1,534

1,625

Income tax benefit

(297

)

(45

)

(402

)

(146

)

Net income

$

464

$

409

$

1,936

$

1,771

Weighted average common shares

outstanding:

Basic

575

554

563

552

Diluted

576

554

563

552

Earnings per average common

share:

Basic

$

0.81

$

0.74

$

3.44

$

3.21

Diluted

0.81

0.74

3.44

3.21

XCEL ENERGY INC. AND SUBSIDIARIES Notes

to Investor Relations Earnings Release (Unaudited)

Due to the seasonality of Xcel Energy’s operating results,

quarterly financial results are not an appropriate base from which

to project annual results.

Non-GAAP Financial Measures

The following discussion includes financial information prepared

in accordance with generally accepted accounting principles (GAAP),

as well as certain non-GAAP financial measures such as ongoing

return on equity (ROE), ongoing earnings and ongoing diluted EPS.

Generally, a non-GAAP financial measure is a measure of a company’s

financial performance, financial position or cash flows that

adjusts measures calculated and presented in accordance with GAAP.

Xcel Energy’s management uses non-GAAP measures for financial

planning and analysis, for reporting of results to the Board of

Directors, in determining performance-based compensation and

communicating its earnings outlook to analysts and investors.

Non-GAAP financial measures are intended to supplement investors’

understanding of our performance and should not be considered

alternatives for financial measures presented in accordance with

GAAP. These measures are discussed in more detail below and may not

be comparable to other companies’ similarly titled non-GAAP

financial measures.

Ongoing ROE

Ongoing ROE is calculated by dividing the net income or loss of

Xcel Energy or each subsidiary, adjusted for certain nonrecurring

items, by each entity’s average stockholder’s equity. We use these

non-GAAP financial measures to evaluate and provide details of

earnings results.

Earnings Adjusted for Certain Items

(Ongoing Earnings and Ongoing Diluted EPS)

GAAP diluted EPS reflects the potential dilution that could

occur if securities or other agreements to issue common stock

(i.e., common stock equivalents) were settled. The weighted average

number of potentially dilutive shares outstanding used to calculate

Xcel Energy Inc.’s diluted EPS is calculated using the treasury

stock method. Ongoing earnings reflect adjustments to GAAP earnings

(net income) for certain items. Ongoing diluted EPS for Xcel Energy

is calculated by dividing net income or loss, adjusted for certain

items, by the weighted average fully diluted Xcel Energy Inc.

common shares outstanding for the period. Ongoing diluted EPS for

each subsidiary is calculated by dividing the net income or loss

for such subsidiary, adjusted for certain items, by the weighted

average fully diluted Xcel Energy Inc. common shares outstanding

for the period.

We use these non-GAAP financial measures to evaluate and provide

details of Xcel Energy’s core earnings and underlying performance.

For instance, to present ongoing earnings and ongoing diluted

earnings per share, we may adjust the related GAAP amounts for

certain items that are non-recurring in nature. We believe these

measurements are useful to investors to evaluate the actual and

projected financial performance and contribution of our

subsidiaries. These non-GAAP financial measures should not be

considered as an alternative to measures calculated and reported in

accordance with GAAP.

Note 1. Earnings Per Share

Summary

Xcel Energy’s 2024 GAAP earnings were $3.44 per share compared

to $3.21 per share in 2023 and ongoing earnings were $3.50 per

share in 2024, compared with $3.35 per share in 2023. The change in

earnings per share was driven by increased recovery of

infrastructure investments, partially offset by higher

depreciation, interest charges and O&M expenses. Fluctuations

in electric and natural gas revenues associated with changes in

fuel and purchased power and/or natural gas sold and transported

generally do not significantly impact earnings (changes in costs

are offset by the related variation in revenues). See Note 6 for

reconciliation of GAAP earnings to ongoing earnings.

Summarized diluted EPS for Xcel Energy:

Three Months Ended Dec.

31

Twelve Months Ended Dec.

31

Diluted Earnings (Loss) Per

Share

2024

2023

2024

2023

NSP-Minnesota

$

0.35

$

0.33

$

1.41

$

1.28

PSCo

0.33

0.29

1.39

1.26

SPS

0.12

0.15

0.70

0.70

NSP-Wisconsin

0.05

0.06

0.24

0.25

Earnings from equity method investments —

WYCO

0.01

0.01

0.03

0.04

Regulated utility (a)

0.85

0.84

3.76

3.52

Xcel Energy Inc. and Other

(0.05

)

(0.10

)

(0.33

)

(0.31

)

GAAP diluted EPS (a)

$

0.81

$

0.74

$

3.44

$

3.21

Loss on Comanche Unit 3 litigation (See

Note 6)

—

—

—

0.05

Workforce reduction expenses (See Note

6)

—

0.09

—

0.09

Sherco Unit 3 2011 outage refunds (See

Note 6)

—

—

0.06

—

Ongoing diluted EPS (a)

$

0.81

$

0.83

$

3.50

$

3.35

(a)

Amounts may not add due to rounding.

NSP-Minnesota — GAAP earnings increased $0.13 per share

and ongoing earnings increased $0.15 per share for 2024 compared to

2023. Ongoing earnings increased due to higher recovery of electric

and natural gas infrastructure investments, partially offset by

increased depreciation and interest charges. See Note 6 for

reconciliation from GAAP to ongoing earnings.

PSCo — GAAP earnings increased $0.13 per share and

ongoing earnings increased $0.06 per share for 2024. Higher ongoing

earnings primarily reflects higher recovery of electric and natural

gas infrastructure investments, which was partially offset by

increased depreciation, O&M and interest charges. See Note 6

for reconciliation from GAAP to ongoing earnings.

SPS — GAAP earnings were flat and ongoing earnings

decreased $0.01 per share for 2024. Ongoing earnings were impacted

by increased depreciation, O&M and interest charges, largely

offset by regulatory rate outcomes and sales growth. See Note 6 for

reconciliation from GAAP to ongoing earnings.

NSP-Wisconsin — GAAP and ongoing earnings decreased $0.01

per share for 2024. The decrease in ongoing earnings was primarily

a result of higher depreciation.

Xcel Energy Inc. and Other — Primarily includes financing

costs and interest income at the holding company and earnings from

investment funds, which are accounted for as equity method

investments. The decline in earnings for 2024 is largely due to

higher debt levels and increased interest rates, partially offset

by a gain on debt repurchases.

Components significantly contributing to changes in 2024 EPS

compared with 2023:

Diluted Earnings (Loss) Per

Share

Three Months Ended Dec.

31

Twelve Months Ended Dec.

31

GAAP diluted EPS — 2023

$

0.74

$

3.21

Components of change — 2024 vs. 2023

Electric regulatory rate outcomes and

riders

0.08

0.73

Higher other income, net

0.09

0.16

Natural gas regulatory rate outcomes and

riders

0.07

0.14

Workforce reduction expenses (See Note

6)

0.09

0.09

Loss on Comanche Unit 3 litigation (See

Note 6)

—

0.05

Higher depreciation and amortization

(0.08

)

(0.40

)

Interest charges, net of AFUDC - debt

(0.06

)

(0.24

)

Higher O&M expenses

(0.05

)

(0.13

)

Sherco Unit 3 2011 outage refunds (See

Note 6)

—

(0.06

)

Other, net

(0.07

)

(0.11

)

GAAP diluted EPS — 2024

$

0.81

$

3.44

Sherco Unit 3 2011 outage refunds (See

Note 6)

—

0.06

Ongoing diluted EPS — 2024

$

0.81

$

3.50

ROE for Xcel Energy and its utility subsidiaries:

2024

NSP- Minnesota

PSCo

SPS

NSP- Wisconsin

Operating Companies

Xcel Energy

GAAP ROE

9.07 %

7.63 %

9.57 %

8.98 %

8.55 %

10.42 %

Ongoing ROE

9.46 %

7.63 %

9.57 %

8.98 %

8.69 %

10.61 %

2023

NSP- Minnesota

PSCo

SPS

NSP- Wisconsin

Operating Companies

Xcel Energy

GAAP ROE

8.82 %

7.32 %

9.80 %

10.38 %

8.45 %

10.33 %

Ongoing ROE

9.11 %

7.77 %

9.98 %

10.67 %

8.79 %

10.79 %

Note 2. Regulated Utility

Results

Estimated Impact of Temperature Changes on Regulated

Earnings — Unusually hot summers or cold winters increase

electric and natural gas sales, while mild weather reduces electric

and natural gas sales. The estimated impact of weather on earnings

is based on the number of customers, temperature variances, the

amount of natural gas or electricity historically used per degree

of temperature and excludes any incremental related operating

expenses that could result due to storm activity or vegetation

management requirements. As a result, weather deviations from

normal levels can affect Xcel Energy’s financial performance.

However, electric sales true-up and gas decoupling mechanisms in

Minnesota predominately mitigate the positive and adverse impacts

of weather in that jurisdiction.

Normal weather conditions are defined as either the 10, 20 or

30-year average of actual historical weather conditions. The

historical period of time used in the calculation of normal weather

differs by jurisdiction, based on regulatory practice. To calculate

the impact of weather on demand, a demand factor is applied to the

weather impact on sales. Extreme weather variations, windchill and

cloud cover may not be reflected in weather-normalized

estimates.

Weather — Estimated impact of temperature variations on

EPS compared with normal weather conditions:

Three Months Ended Dec.

31

Twelve Months Ended Dec.

31

2024 vs. Normal

2023 vs. Normal

2024 vs. 2023

2024 vs. Normal

2023 vs. Normal

2024 vs. 2023

Retail electric

$

(0.022

)

$

(0.022

)

$

—

$

(0.008

)

$

0.013

$

(0.021

)

Decoupling and sales true-up

0.007

0.008

(0.001

)

0.047

(0.007

)

0.054

Electric total

(0.015

)

(0.014

)

(0.001

)

0.039

0.006

0.033

Firm natural gas

(0.030

)

(0.034

)

0.004

(0.070

)

(0.010

)

(0.060

)

Decoupling

0.009

0.012

(0.003

)

0.027

0.013

0.014

Gas total

(0.021

)

(0.022

)

0.001

(0.043

)

0.003

(0.046

)

Total

$

(0.036

)

$

(0.036

)

$

—

$

(0.004

)

$

0.009

$

(0.013

)

Sales — Sales growth (decline) for actual and

weather-normalized sales in 2024 compared to 2023:

Three Months Ended Dec.

31

NSP-Minnesota

PSCo

SPS

NSP-Wisconsin

Xcel Energy

Actual

Electric residential

3.2

%

3.1

%

(2.2

)%

0.8

%

2.2

%

Electric C&I

0.6

(0.9

)

13.4

(1.9

)

3.9

Total retail electric sales

1.4

0.5

10.9

(1.2

)

3.4

Firm natural gas sales

2.9

(2.9

)

N/A

1.6

(0.9

)

Three Months Ended Dec.

31

NSP-Minnesota

PSCo

SPS

NSP-Wisconsin

Xcel Energy

Weather-normalized

Electric residential

2.0

%

3.4

%

(1.4

)%

(0.3

)%

1.9

%

Electric C&I

0.6

(1.0

)

13.4

(1.6

)

3.9

Total retail electric sales

1.0

0.6

10.9

(1.2

)

3.3

Firm natural gas sales

(4.1

)

(1.5

)

N/A

(3.0

)

(2.4

)

Twelve Months Ended Dec.

31

NSP-Minnesota

PSCo

SPS

NSP-Wisconsin

Xcel Energy

Actual

Electric residential

(4.1

)%

3.9

%

0.7

%

(3.5

)%

(0.4

)%

Electric C&I

(2.6

)

—

9.3

(1.9

)

1.7

Total retail electric sales

(3.1

)

1.3

7.8

(2.4

)

1.1

Firm natural gas sales

(8.0

)

(6.9

)

N/A

(7.5

)

(7.2

)

Twelve Months Ended Dec.

31

NSP-Minnesota

PSCo

SPS

NSP-Wisconsin

Xcel Energy

Weather-normalized

Electric residential

0.2

%

0.9

%

(1.2

)%

(1.5

)%

0.2

%

Electric C&I

(1.7

)

(1.1

)

9.3

(1.6

)

1.7

Total retail electric sales

(1.1

)

(0.4

)

7.4

(1.5

)

1.3

Firm natural gas sales

(1.1

)

0.6

N/A

(2.5

)

(0.2

)

Twelve Months Ended Dec. 31

(2024 Leap Year Adjusted)

NSP-Minnesota

PSCo

SPS

NSP-Wisconsin

Xcel Energy

Weather-normalized

Electric residential

(0.1

)%

0.7

%

(1.5

)%

(1.8

)%

(0.1

)%

Electric C&I

(2.0

)

(1.4

)

9.0

(1.8

)

1.5

Total retail electric sales

(1.4

)

(0.7

)

7.1

(1.8

)

1.0

Firm natural gas sales

(1.7

)

0.0

N/A

(3.1

)

(0.7

)

Annual weather-normalized and leap-year

adjusted electric sales growth (decline)

- NSP-Minnesota — Residential sales declined due to a 1.5%

decrease in use per customer, partially offset by a 1.4% increase

in customers. The decline in C&I sales was due to lower use per

customer, particularly in the manufacturing sector.

- PSCo — Residential sales increased due to a 1.4% increase in

customers, partially offset by a 0.7% decrease in use per customer.

The decline in C&I sales was attributable to decreased use per

customer, particularly in the wholesale trade and mining.

- SPS — Residential sales declined due to a 2.2% decrease in use

per customer partially offset by a 0.7% increase in customers.

C&I sales increased due to higher use per customer, primarily

driven by the energy sector and cryptocurrency mining.

- NSP-Wisconsin — Residential sales declined due to a 2.7%

decrease in use per customer, offset by a 1.0% increase in

customers. The C&I sales decline was associated with lower use

per customer, experienced particularly in the professional services

and manufacturing sectors.

Annual weather-normalized and leap year

adjusted natural gas sales growth (decline)

- Natural gas sales reflect 1.7% residential use per customer and

1.4% C&I use per customer decreases. Partially offsetting these

were increased residential and C&I customers in all

jurisdictions.

Electric Revenues — Electric revenues are impacted by

fluctuations in the price of natural gas, coal and uranium,

regulatory outcomes, market prices and seasonality. In addition,

electric customers receive a credit for PTCs generated (wind,

nuclear, and solar), which reduce electric revenue and income

taxes.

(Millions of Dollars)

Three Months Ended Dec. 31,

2024 vs. 2023

Twelve Months Ended Dec. 31,

2024 vs. 2023

Recovery of lower cost of electric fuel

and purchase power

$

(61

)

$

(479

)

PTCs flowed back to customers (offset by

lower ETR)

(266

)

(302

)

Wholesale generation revenues

(19

)

(96

)

Sherco Unit 3 2011 outage refunds (See

Note 6)

(1

)

(47

)

Regulatory rate outcomes (MN, CO, TX, and

NM)

2

372

Non-fuel riders

56

169

Conservation and demand side management

(offset in expense)

20

102

Estimated impact of weather (net of sales

true-up)

(1

)

24

Other, net

(15

)

(42

)

Total decrease

$

(285

)

$

(299

)

Natural Gas Revenues — Natural gas revenues vary with

changing sales, the cost of natural gas and regulatory

outcomes.

(Millions of Dollars)

Three Months Ended Dec. 31,

2024 vs. 2023

Twelve Months Ended Dec. 31,

2024 vs. 2023

Recovery of lower cost of natural gas

$

(78

)

$

(496

)

Estimated impact of weather (net of

decoupling)

1

(35

)

Retail sales decline (net of

decoupling)

(11

)

(1

)

Regulatory rate outcomes (MN, WI, CO, and

ND)

50

91

Infrastructure and integrity riders

2

8

Other, net

12

18

Total decrease

$

(24

)

$

(415

)

Electric Fuel and Purchased Power — Expenses incurred for

electric fuel and purchased power are impacted by fluctuations in

market prices of natural gas, coal and uranium, as well as

seasonality. These incurred expenses are generally recovered

through various regulatory recovery mechanisms. As a result,

changes in these expenses are largely offset in operating revenues

and have minimal earnings impact.

Electric fuel and purchased power expenses decreased $490

million in 2024. The decrease is primarily due to timing of fuel

recovery mechanisms and lower commodity prices, partially offset by

increased volumes.

Cost of Natural Gas Sold and Transported — Expenses

incurred for the cost of natural gas sold are impacted by market

prices and seasonality. These costs are generally recovered through

various regulatory recovery mechanisms. As a result, changes in

these expenses are largely offset in operating revenues and have

minimal earnings impact.

Natural gas sold and transported decreased $505 million in 2024.

The decrease is primarily due to lower commodity prices and

volumes.

O&M Expenses — O&M expenses increased $96 million

in 2024 primarily due to operational activities, including

generation maintenance, storm response, wildfire mitigation costs

and damage prevention. The impact of prior year regulatory

deferrals also contributed to increased O&M expenses, partially

offset by lower labor and benefit costs and lower bad debt

expenses.

Depreciation and Amortization — Depreciation and

amortization increased $296 million for the year, primarily related

to system expansion, partially offset by the impacts of various

rate cases, including recognition of previously deferred costs as

well as wind and nuclear life extensions.

Other Income — Other income increased $121 million for

the year, primarily related to interest earned on significant cash

balances throughout the year and a gain on debt repurchases, which

helped to offset increased spending in our electric and natural gas

operations to reduce risk, including wildfire mitigation.

Interest Charges — Interest charges increased $200

million in 2024. The increase was largely due to higher long-term

debt levels to fund capital investments and higher interest

rates.

AFUDC, Equity and Debt — AFUDC increased $99 million in

2024. This increase was largely due to increased investment in

renewable and transmission projects.

Income Taxes — Effective income tax rate:

Three Months Ended Dec.

31

Twelve Months Ended Dec.

31

2024

2023

2024 vs 2023

2024

2023

2024 vs 2023

Federal statutory rate

21.0

%

21.0

%

—

%

21.0

%

21.0

%

—

%

State tax (net of federal tax effect)

4.4

4.8

(0.4

)

4.8

4.9

(0.1

)

Increases (decreases):

PTCs (a)

(183.3

)

(30.4

)

(152.9

)

(43.2

)

(28.1

)

(15.1

)

Plant regulatory differences (b)

(19.3

)

(5.8

)

(13.5

)

(7.3

)

(5.6

)

(1.7

)

Other tax credits, NOL allowances (net)

and tax credit allowances

(2.6

)

(1.1

)

(1.5

)

(1.3

)

(1.3

)

—

Other (net)

2.0

(0.9

)

2.9

(0.2

)

0.1

(0.3

)

Effective income tax rate

(177.8

)%

(12.4

)%

(165.4

)%

(26.2

)%

(9.0

)%

(17.2

)%

(a)

Wind, Solar and Nuclear PTCs (net of

transfer discounts) are generally credited to customers (reduction

to revenue) and do not materially impact earnings. Nuclear PTCs,

newly available in 2024, resulted in benefits of 103.9% and 11.3%

to the effective tax rate for the quarter and year ended Dec. 31,

2024, respectively.

(b)

Plant regulatory differences primarily

relate to the credit of excess deferred taxes to customers. Income

tax benefits associated with the credit are offset by corresponding

revenue reductions.

Note 3. Capital Structure, Liquidity,

Financing and Credit Ratings

Xcel Energy’s capital structure:

(Millions of Dollars)

Dec. 31, 2024

Percentage of Total

Capitalization

Dec. 31, 2023

Percentage of Total

Capitalization

Current portion of long-term debt

$

1,103

2

%

$

552

1

%

Short-term debt

695

2

785

2

Long-term debt

27,316

56

24,913

57

Total debt

29,114

60

26,250

60

Common equity

19,522

40

17,616

40

Total capitalization

$

48,636

100

%

$

43,866

100

%

Liquidity — As of Feb. 3, 2025, Xcel Energy Inc. and its

utility subsidiaries had the following committed credit facilities

available to meet liquidity needs:

(Millions of Dollars)

Credit Facility (a)

Drawn (b)

Available

Cash

Liquidity

Xcel Energy Inc.

$

1,500

$

575

$

925

$

19

$

944

PSCo

700

196

504

24

528

NSP-Minnesota

700

363

337

6

343

SPS

500

261

239

9

248

NSP-Wisconsin

150

—

150

15

165

Total

$

3,550

$

1,395

$

2,155

$

73

$

2,228

(a)

Expires Sept. 2027.

(b)

Includes outstanding commercial paper and

letters of credit.

Credit Ratings — Access to the capital markets at

reasonable terms is partially dependent on credit ratings. The

following ratings reflect the views of Moody’s, S&P Global

Ratings, and Fitch. The highest credit rating for debt is Aaa/AAA

and the lowest investment grade rating is Baa3/BBB-. The highest

rating for commercial paper is P-1/A-1/F-1 and the lowest rating is

P-3/A-3/F-3. A security rating is not a recommendation to buy, sell

or hold securities. Ratings are subject to revision or withdrawal

at any time by the credit rating agency and each rating should be

evaluated independently of any other rating.

Credit ratings assigned to Xcel Energy Inc. and its utility

subsidiaries as of Feb. 3, 2025:

Moody’s

S&P Global Ratings

Fitch

Company

Credit Type

Rating

Outlook

Rating

Outlook

Rating

Outlook

Xcel Energy Inc.

Unsecured

Baa1

Stable

BBB

Negative

BBB+

Negative

NSP-Minnesota

Secured

Aa3

Stable

A

Negative

A+

Stable

NSP-Wisconsin

Secured

A1

Stable

A

Negative

A+

Stable

PSCo

Secured

A1

Stable

A

Negative

A+

Stable

SPS

Secured

A3

Stable

A-

Negative

A-

Stable

Xcel Energy Inc.

Commercial paper

P-2

A-2

F2

NSP-Minnesota

Commercial paper

P-1

A-2

F2

NSP-Wisconsin

Commercial paper

P-1

A-2

F2

PSCo

Commercial paper

P-2

A-2

F2

SPS

Commercial paper

P-2

A-2

F2

Capital Expenditures — Base capital expenditures for Xcel

Energy for 2025 through 2029:

Base Capital Forecast

(Millions of Dollars)

By Regulated Utility

2025

2026

2027

2028

2029

Total

PSCo

$

5,820

$

5,190

$

3,940

$

3,780

$

3,550

$

22,280

NSP-Minnesota

3,240

2,500

2,830

2,080

2,570

13,220

SPS

1,400

1,540

1,280

1,040

1,040

6,300

NSP-Wisconsin

640

650

690

660

670

3,310

Other (a)

(100

)

(40

)

10

10

10

(110

)

Total base capital expenditures

$

11,000

$

9,840

$

8,750

$

7,570

$

7,840

$

45,000

(a)

Other category includes intercompany

transfers for safe harbor wind turbines.

Base Capital Forecast

(Millions of Dollars)

By Function

2025

2026

2027

2028

2029

Total

Electric distribution

$

2,570

$

3,000

$

3,400

$

3,320

$

3,540

15,830

Electric transmission

2,260

2,860

2,740

2,390

2,310

12,560

Renewables

3,360

1,400

260

—

—

5,020

Electric generation

1,210

1,150

910

580

620

4,470

Natural gas

800

680

690

630

620

3,420

Other

800

750

750

650

750

3,700

Total base capital expenditures

$

11,000

$

9,840

$

8,750

$

7,570

$

7,840

$

45,000

The base plan does not include any potential incremental

generation or transmission assets that are pending commission

approval through a request for proposal (RFP), a resource plan, or

from additional data center load, which could result in additional

capital expenditures of $10 billion or greater. Xcel Energy

generally expects to fund additional capital investment with

approximately 40% equity and 60% debt.

Xcel Energy’s capital expenditure forecast is subject to

continuing review and modification. Actual capital expenditures may

vary from estimates due to changes in electric and natural gas

projected load growth, safety and reliability needs, regulatory

decisions, legislative initiatives, tax policy, reserve

requirements, availability of purchased power, alternative plans

for meeting long-term energy needs, environmental initiatives and

regulation, and merger, acquisition and divestiture

opportunities.

Financing for Capital Expenditures through 2029 — Xcel

Energy issues debt and equity securities to refinance retiring debt

maturities, reduce short-term debt, fund capital programs, infuse

equity in subsidiaries, fund asset acquisitions and for general

corporate purposes. Current estimated financing plans of Xcel

Energy for 2025-2029 (includes the impact of tax credit

transferability)

(Millions of Dollars)

Funding Capital Expenditures

Cash from operations (a)

$

25,320

New debt (b)

15,180

Equity through the Dividend Reinvestment

and Stock Purchase Program and benefit program

500

Other equity

4,000

Base capital expenditures 2025-2029

$

45,000

Maturing debt

$

3,730

(a)

Net of dividends and pension funding.

(b)

Reflects a combination of short and

long-term debt; net of refinancing.

2024 Financing Activity — During 2024, Xcel Energy and

its utility subsidiaries issued the following long-term debt:

Issuer

Security

Amount (Millions of

Dollars)

Tenor

Coupon

Xcel Energy Inc.

Unsecured Senior Notes

$

800

10 Year

5.50

%

PSCo

First Mortgage Bonds

1,200

10 Year &

30 Year

5.35 & 5.75

NSP-Minnesota

First Mortgage Bonds

700

30 Year

5.40

NSP-Wisconsin

First Mortgage Bonds

400

30 Year

5.65

SPS

First Mortgage Bonds

600

30 Year

6.00

Xcel Energy issued approximately $1.1 billion of equity through

its at-the-market program in 2024. In November 2024, Xcel Energy

Inc. entered into forward sale agreements for up to 21.1 million

shares of Xcel Energy common stock. The cash proceeds at settlement

are expected to be approximately $1.36 billion.

2025 Planned Financing Activities — During 2025, Xcel

Energy Inc. and its utility subsidiaries anticipate the following

long-term debt issuances:

Issuer

Security

Amount (Millions of

Dollars)

Expected Tenor

Anticipated Timing

Xcel Energy Inc.

Senior Unsecured Notes

$

1,000

10 Year

First Quarter

PSCo

First Mortgage Bonds

2,000

10 Year &

30 Year

Second & Third Quarter

NSP-Minnesota

First Mortgage Bonds

1,100

10 Year &

30 Year

First & Third Quarter

SPS

First Mortgage Bonds

450

30 Year

Second Quarter

NSP-Wisconsin

First Mortgage Bonds

250

30 Year

Second Quarter

Financing plans are subject to change, depending on capital

expenditures, regulatory outcomes, internal cash generation, market

conditions, changes in tax policies and other factors.

Note 4. Rates, Regulation and

Other

NSP-Minnesota — 2024 Electric Rate Case — In November

2024, NSP-Minnesota filed an electric rate case in Minnesota,

seeking a total revenue increase of $491 million (13.2%) over two

years, based on an ROE of 10.3%, a 52.5% equity ratio and rate base

of $13.2 billion in 2025 and $14 billion in 2026. NSP-Minnesota

also requested interim rates of $224 million for 2025. In December

2024, the MPUC reduced the interim rate request for wildfire

mitigation costs (as these costs were deemed as new costs not

previously approved in a rate case) and approved interim rates of

$192 million, effective January 1, 2025. A decision is expected in

2026.

NSP-Minnesota — 2024 North Dakota Electric Rate Case — In

December 2024, NSP-Minnesota filed a request with the North Dakota

Public Service Commission (NDPSC) for an annual electric rate

increase of approximately $45 million, or 19.3% over current rates

established in 2021. The filing is based on a 2025 forecast test

year and includes a requested return on equity of 10.3%, rate base

of approximately $817 million and an equity ratio of 52.50%. In

January 2025, NDPSC approved interim rates, subject to refund, of

approximately $27 million (implemented on Feb. 1, 2025).

NSP-Minnesota — 2024 Minnesota Natural Gas Rate

Case — In November 2023, NSP-Minnesota filed a request with the

Minnesota Public Utilities Commission (MPUC) for a natural gas rate

increase of approximately $59 million, or 9.6%. The request was

based on a ROE of 10.2%, a 52.5% equity ratio and a 2024 forward

test year with rate base of approximately $1.27 billion. In

December 2023, the MPUC approved NSP-Minnesota’s request for

interim rates, subject to refund, of approximately $51 million

(implemented on Jan. 1, 2024).

In June 2024, NSP-Minnesota and various parties filed an

uncontested settlement, which includes the following terms:

- Natural gas rate increase of $46 million, or 7.5%.

- ROE of 9.6%.

- Equity ratio of 52.5%.

- Rate base of $1.25 billion.

- No change to Commission approved decoupling.

In October 2024, an ALJ recommended the MPUC approve the rate

case settlement. A MPUC decision and order is expected in the first

quarter of 2025.

NSP-Minnesota — North Dakota Natural Gas Rate Case

— In December 2023, NSP-Minnesota filed a request with the NDPSC

seeking an increase in natural gas rates of $8.5 million (9.4%),

based on a ROE of 10.20%, an equity ratio of 52.5%, 2024 test year

and rate base of $168 million.

In November 2024, the NDPSC approved a settlement, reflecting a

natural gas rate increase of $7.2 million (8.0%), based on a ROE of

9.9% and an equity ratio of 52.5%. Rates were implemented on Jan.

1, 2025.

NSP-Minnesota — Minnesota 2023 Fuel Clause

Adjustment — In March 2024, NSP-Minnesota filed its annual fuel

clause adjustment true-up petition to the MPUC.

In 2024, the DOC recommended customer refunds for 2023

replacement power costs incurred during an outage at the Prairie

Island generating station (October 2023 through February 2024).

NSP-Minnesota estimates that customer refunds would be

approximately $22 million if the DOC recommendations are applied to

both 2023 and 2024.

In September 2024, the MPUC ruled NSP-Minnesota was imprudent in

the operation of the Prairie Island nuclear plant based on an

incident that resulted in the extended outage. The MPUC did not

quantify the refund and referred the determination of the refund

amount to the Office of Administrative Hearings. NSP-Minnesota has

recorded an estimated liability for a customer refund.

The procedural schedule is as follows:

- Xcel Energy testimony: May 1, 2025

- Intervenor direct testimony: July 2, 2025

- Rebuttal testimony: August 13, 2025

- ALJ Report: March 16, 2026

NSP-Minnesota — 2024 Minnesota Resource Plan

Settlement — In February 2024, NSP filed its Upper Midwest

Resource Plan with the MPUC. In October 2024, NSP-Minnesota filed a

settlement with several parties reaching agreement on the resource

plan, as well as the proposed projects to be approved in the

pending 800 MW firm dispatchable resource acquisition.

NSP-Minnesota anticipates a MPUC decision in the first quarter

of 2025 and will file a related RFP for remaining resource needs

upon approval. The settlement included the following key items:

- The selection of the company-owned 420 MW Lyon County

combustion turbine.

- The selection of the company-owned 300 MW 4-hour Sherco battery

energy storage system.

- Multiple PPAs to proceed to the negotiation stage.

- The addition of 3,200 MW of wind, 400 MW of solar and 600 MW of

stand-alone storage to be added through 2030 based on an RFP

process. Approximately 2,800 MW of wind resources are projected to

utilize the Minnesota Energy Connection transmission line.

- Planned life extensions of the Prairie Island and Monticello

nuclear plants through the early 2050s.

NSP-Wisconsin — Wisconsin 2025 Stay-Out Proposal — In

June 2024, NSP-Wisconsin filed a 2025 stay-out proposal with the

Public Service Commission of Wisconsin (PSCW). In December 2024,

the PSCW approved NSP-Wisconsin’s filing, which offsets $27 million

in electric deficiencies and $3 million in natural gas deficiencies

by amortizing Inflation Reduction Act (IRA) deferrals, stopping a

deferral related to IRA benefits ordered in a previous rate case,

and deferring revenue requirement impacts of two natural gas

capital projects.

PSCo — Colorado Natural Gas Rate Case — In January

2024, PSCo, filed a request with the Colorado Public Utilities

Commission (CPUC) seeking an increase to retail natural gas rates

of $171 million (9.5%). The request was based on a 10.25% ROE, an

equity ratio of 55%, a 2023 test year and a $4.2 billion year-end

rate base.

In October 2024, the CPUC issued an order including the

following key decisions:

- Use of a historic 2023 test year, with a 13-month average rate

base.

- Weighted-average cost of capital of 7.0%, based on an ROE range

of 9.2%-9.5% and an equity ratio range of 52%-55%.

- Acceleration of $15 million per year of depreciation expense

(incremental to PSCo’s original rate request), to be held in an

external trust for future decommissioning costs.

- Modifications to recoverability of certain operating

expenses.

- Denial of PSCo’s decoupling proposal.

PSCo placed new rates into effect in November, with an annual

revenue increase of approximately $125 million, inclusive of $15

million of accelerated depreciation.

PSCo — 2024 Colorado Electric Resource Plan — In

October 2024, PSCo filed its electric resource plan, known as the

Just Transition Solicitation, with the CPUC. The filing reflects

the expected growth on the system, the generation resources needed

to meet the projected growth and the future evaluation of

competitive bids for new generation resources.

- The plan reflects a base sales forecast with 7% compound annual

sales growth through 2031.

- The plan also presents a low sales forecast with a 3% compound

annual sales growth through 2031.

- The resource plan includes forecasted need of 5-14 GW of new

generation capacity through 2031, including renewables and firm

dispatchable resources to meet the two different scenarios. The

acquisitions of generation resources will be determined through a

competitive solicitation after the CPUC determines the portfolio.

The table below summarizes two of the proposed portfolios based on

the different sales scenarios:

(Megawatts)

Base Plan

Low Load

Wind

7,250

2,800

Solar

3,077

1,200

Natural gas combustion turbine

1,575

1,400

Storage (long duration)

1,600

—

Other storage

450

—

Total

13,952

5,400

The procedural schedule is as follows:

- Answer testimony: April 18, 2025

- Rebuttal testimony: May 23, 2025

- Settlement deadline: June 2, 2025

- Hearing: June 10-20, 2025

- Statements of position: July 14, 2025

A CPUC decision on the resource plan is expected by the fall of

2025 (Phase I) with the competitive solicitation for resource

additions expected in early 2026.

PSCo — Wildfire Mitigation Plan — In June 2024,

PSCo filed an Updated Wildfire Mitigation Plan (the WMP) and

request for recovery of costs covering the years 2025 to 2027 with

the CPUC. The estimated total cost for this plan is approximately

$1.9 billion. A CPUC decision is expected in the third quarter of

2025.

The WMP integrates industry experience; incorporates evolving

risk assessment methodologies; adds new technology; and expands the

scope, pace and scale of our work to reduce wildfire risk in a

comprehensive and efficient manner under four core programs that

include the following:

- Situational awareness – Meteorology, area risk mapping and

modeling, artificial intelligence cameras and continuous

monitoring.

- Operational mitigations – Enhanced powerline safety settings

and public safety power shutoffs (PSPS).

- System resiliency – Asset assessment and remediations, pole

replacements, line rebuilds, targeted undergrounding and vegetation

management.

- Customer support – Coordination and real-time data sharing with

customers and other stakeholders and PSPS resiliency rebates.

The procedural schedule is as follows:

- Answer testimony: Feb. 14, 2025

- Rebuttal testimony: March 21, 2025

- Settlement deadline: April 11, 2025

- Hearing: May 5-15, 2025

- Decision deadline: Aug. 28, 2025

PSCo — Excess Liability Insurance Deferral — In August

2024, PSCo filed a request with the CPUC to establish a tracker to

defer differences in excess liability insurance premiums after the

October 2024 policy renewal (reflecting significantly rising

premiums of approximately $40 million, largely associated with

wildfire risks throughout the United States) and amounts currently

recovered. In January 2025, the CPUC approved a one-year deferral

aligned with the current insurance policy year. Cost recovery for

incremental insurance premiums will be reviewed in a future rate

case.

SPS — New Mexico Resource Plan (IRP) — In October

2023, SPS filed its IRP with the New Mexico Public Regulation

Commission (NMPRC), which supports projected load growth and

increasing reliability requirements, and secures replacement energy

and capacity for retiring resources. SPS’ projected resource needs

ranging from approximately 5,300 MW to 10,200 MW by 2030. In

February 2024, the NMPRC accepted the IRP.

In July 2024, SPS issued a RFP, seeking approximately 3,200 MW

of accredited generation capacity by 2030. The total capacity to be

added to the system is expected to align with the range identified

in the SPS IRP, depending on the types of resources proposed in the

RFP and their accredited capacity factors.

The RFP portfolio selection is expected in May 2025. SPS is

expected to file for a certificate of need for the recommended

portfolio in the summer of 2025. The Public Utility Commission of

Texas (PUCT) and NMPRC are expected to rule on the portfolio in

2026.

SPS — System Resiliency Plan — In December 2024,

SPS filed its Texas System Resiliency Plan (SRP) with the PUCT.

Consistent with PUCT requirements, SPS’ proposed plan discusses

resiliency-related risks and the five measures that have been

designed to help SPS prevent, withstand, mitigate or more promptly

recover from resiliency events, including wildfire.

The SRP includes the following measures:

- Distribution overhead hardening — Replacing and reinforcing key

components of the distribution overhead system.

- Distribution system protection modernization — Installing

enhanced reclosers, communications equipment and replacing

substation relay panels and breakers.

- Communication modernization — Building out a private LTE

network, installing fiber optic cable and adding remote terminal

units.

- Operational flexibility — Procuring mobile substation equipment

and installing additional switching devices.

- Wildfire mitigation — Weather stations, modeling, deploying

artificial intelligence and vegetation management.

The plan covers 2025-2028 and includes the following total

spend:

(Millions of Dollars)

Capital

O&M

Total

Distribution overhead hardening

$

253

$

—

$

253

Distribution system protection

modernization

92

—

92

Communication modernization

112

—

112

Operational flexibility

44

—

44

Wildfire mitigation

20

17

37

Total

$

521

$

17

$

538

A procedural schedule is expected in the first quarter of 2025

and a PUCT decision is expected in the summer of 2025.

Note 5. Wildfire

Litigation

2024 Smokehouse Creek Fire Complex — On February 26,

2024, multiple wildfires began in the Texas Panhandle, including

the Smokehouse Creek Fire and the 687 Reamer Fire, which burned

into the perimeter of the Smokehouse Creek Fire (together, referred

to herein as the “Smokehouse Creek Fire Complex”). The Texas

A&M Forest Service issued incident reports that determined that

the Smokehouse Creek Fire and the 687 Reamer Fire were caused by

power lines owned by SPS after wooden poles near each fire origin

failed. According to the Texas A&M Forest Service’s Incident

Viewer and news reports, the Smokehouse Creek Fire Complex burned

approximately 1,055,000 acres.

SPS is aware of approximately 25 complaints, most of which have

also named Xcel Energy Services Inc. as an additional defendant,

relating to the Smokehouse Creek Fire Complex. The complaints

generally allege that SPS’ equipment ignited the Smokehouse Creek

Fire Complex and seek compensation for losses resulting from the

fire, asserting various causes of action under Texas law. In

addition to seeking compensatory damages, certain of the complaints

also seek exemplary damages. SPS has also received approximately

199 claims for losses related to the Smokehouse Creek Fire Complex

through its claims process and has reached final settlements on 113

of those claims as of the date of this filing. In addition to filed

complaints and claims made through SPS’ claims process, SPS has

also received information from attorneys for claims related to the

Smokehouse Creek Fire Complex which have not been submitted through

the claims process and have also not been filed as lawsuits, and

has reached settlement of a portion of those claims. SPS

anticipates additional complaints and demands will be made. As of

December 2024, SPS has settled claims related to both of the

fatalities believed to be associated with the Smokehouse Creek Fire

Complex.

Texas law does not apply strict liability in determining an

electric utility company’s liability for fire-related damages. For

negligence claims under Texas law, a public utility has a duty to

exercise ordinary and reasonable care.

Potential liabilities related to the Smokehouse Creek Fire

Complex depend on various factors, including the cause of the

equipment failure and the extent and magnitude of potential

damages, including damages to residential and commercial

structures, personal property, vegetation, livestock and livestock

feed (including replacement feed), personal injuries and any other

damages, penalties, fines or restitution that may be imposed by

courts or other governmental entities if SPS is found to have been

negligent.

Based on the current state of the law and the facts and

circumstances available as of the date of this filing, Xcel Energy

believes it is probable that it will incur a loss in connection

with the Smokehouse Creek Fire Complex and accordingly has recorded

a total of $215 million of estimated losses for the matter (before

available insurance). Settlements reached as of the date of this

filing total $73 million of expected loss payments, of which $35

million were paid in 2024, resulting in a remaining estimated

liability of $180 million presented in other current liabilities as

of Dec. 31, 2024.

The cumulative estimated probable losses of $215 million for

complaints and claims in connection with the Smokehouse Creek Fire

Complex (before available insurance) corresponds to the lower end

of the range of Xcel Energy’s reasonably estimable range of losses,

and is subject to change based on additional information. This $215

million estimate does not include, among other things, amounts for

(i) potential penalties or fines that may be imposed by

governmental entities on Xcel Energy, (ii) exemplary or punitive

damages, (iii) compensation claims by federal, state, county and

local government entities or agencies, (iv) compensation claims for

damage to trees, railroad lines, or oil and gas equipment, or (v)

other amounts that are not reasonably estimable.

Xcel Energy remains unable to reasonably estimate any additional

loss or the upper end of the range because there are a number of

unknown facts and legal considerations that may impact the amount

of any potential liability. In the event that SPS or Xcel Energy

Services Inc. was found liable related to the litigation related to

the Smokehouse Creek Fire Complex and was required to pay damages,

such amounts could exceed our insurance coverage of approximately

$500 million for the annual policy period and could have a material

adverse effect on our financial condition, results of operations or

cash flows.

The process for estimating losses associated with potential

claims related to the Smokehouse Creek Fire Complex requires

management to exercise significant judgment based on a number of

assumptions and subjective factors, including the factors

identified above and estimates based on currently available

information and prior experience with wildfires. As more

information becomes available, management estimates and assumptions

regarding the potential financial impact of the Smokehouse Creek

Fire Complex may change.

SPS records insurance recoveries when it is deemed probable that

recovery will occur, and SPS can reasonably estimate the amount or

range. SPS has recorded an insurance receivable, net of recoveries

received, for $210 million, presented within prepayments and other

current assets as of Dec. 31, 2024. While SPS plans to seek

recovery of all insured losses, it is unable to predict the

ultimate amount and timing of such insurance recoveries.

Marshall Wildfire Litigation — In December 2021, a

wildfire ignited in Boulder County, Colorado (Marshall Fire), which

burned over 6,000 acres and destroyed or damaged over 1,000

structures. On June 8, 2023, the Boulder County Sheriff’s Office

released its Marshall Fire Investigative Summary and Review and its

supporting documents (Sheriff’s Report). According to an October

2022 statement from the Colorado Insurance Commissioner, the

Marshall Fire is estimated to have caused more than $2 billion in

property losses.

According to the Sheriff’s Report, on Dec. 30, 2021, a fire

ignited on a residential property in Boulder, Colorado, located in

PSCo’s service territory, for reasons unrelated to PSCo’s power

lines. According to the Sheriff’s Report, approximately one hour

and 20 minutes after the first ignition, a second fire ignited just

south of the Marshall Mesa Trailhead in unincorporated Boulder

County, Colorado, also located in PSCo’s service territory.

According to the Sheriff’s Report, the second ignition started

approximately 80 to 110 feet away from PSCo’s power lines in the

area.

The Sheriff’s Report states that the most probable cause of the

second ignition was hot particles discharged from PSCo’s power

lines after one of the power lines detached from its insulator in

strong winds, and further states that it cannot be ruled out that

the second ignition was caused by an underground coal fire.

According to the Sheriff’s Report, no design, installation or

maintenance defects or deficiencies were identified on PSCo’s

electrical circuit in the area of the second ignition. PSCo

disputes that its power lines caused the second ignition.

PSCo is aware of 307 complaints, most of which have also named

Xcel Energy Inc. and Xcel Energy Services Inc. as additional

defendants, relating to the Marshall Fire. The complaints are on

behalf of at least 4,087 plaintiffs. The complaints generally

allege that PSCo’s equipment ignited the Marshall Fire and assert

various causes of action under Colorado law, including negligence,

premises liability, trespass, nuisance, wrongful death, willful and

wanton conduct, negligent infliction of emotional distress, loss of

consortium and inverse condemnation. In addition to seeking

compensatory damages, certain of the complaints also seek exemplary

damages.

In September 2023, the Boulder County District Court Judge

consolidated the pending lawsuits into a single action for pretrial

purposes and has subsequently consolidated additional lawsuits that

have been filed. At the case management conference in February

2024, a trial date was set for September 2025. Discovery is now

underway.

In September 2024, the Judge presiding over the consolidated

cases in Boulder County issued an order regarding the trial that

resolves, on a preliminary basis, certain disputes over the

structure of the September 2025 trial. The Court ruled that all

Plaintiffs should be bound by a trial on liability unless they

opt-out with good cause. The Court also ruled that liability and

damages should be largely or entirely tried separately, meaning

that common questions of law and fact regarding liability would be

decided first, and a majority or all of the damages phase will

occur separately following the liability phase of trial. The

individual plaintiffs filed a motion for reconsideration of the

opt-out portion of this order, which the Court denied in November

2024, confirming that plaintiffs will have to demonstrate good

cause in order to opt out of the trial. The Court also denied

PSCo’s request for a change in venue, ruling that the trial will

take place in Boulder County.

Colorado courts do not apply strict liability in determining an

electric utility company’s liability for fire-related damages. For

inverse condemnation claims, Colorado courts assess whether a

defendant acted with intent to take a plaintiff’s property or

intentionally took an action which has the natural consequence of

taking the property. For negligence claims, Colorado courts look to

whether electric power companies have operated their system with a

heightened duty of care consistent with the practical conduct of

its business, and liability does not extend to occurrences that

cannot be reasonably anticipated.

Colorado law does not impose joint and several liability in tort

actions. Instead, under Colorado law, a defendant is liable for the

degree or percentage of the negligence or fault attributable to

that defendant, except where the defendant conspired with another

defendant. A jury’s verdict in a Colorado civil case must be

unanimous. Under Colorado law, in a civil action filed before Jan.

1, 2025, other than a medical malpractice action, the total award

for noneconomic loss is capped at $0.6 million per defendant unless

the court finds justification to exceed that amount by clear and

convincing evidence, in which case the maximum doubles.

Colorado law caps punitive or exemplary damages to an amount

equal to the amount of the actual damages awarded to the injured

party, except the court may increase any award of punitive damages

to a sum up to three times the amount of actual damages if the

conduct that is the subject of the claim has continued during the

pendency of the case or the defendant has acted in a willful and

wanton manner during the action which further aggravated

plaintiff’s damages.

In the event Xcel Energy Inc. or PSCo was found liable related

to this litigation and were required to pay damages, such amounts

could exceed our insurance coverage of approximately $500 million

and have a material adverse effect on our financial condition,

results of operations or cash flows. However, due to uncertainty as

to the cause of the fire and the extent and magnitude of potential

damages, Xcel Energy Inc. and PSCo are unable to estimate the

amount or range of possible losses in connection with the Marshall

Fire.

Note 6. Non-GAAP

Reconciliation

Xcel Energy’s reported earnings are prepared in accordance with

GAAP. Xcel Energy’s management believes that ongoing earnings, or

GAAP earnings adjusted for certain items, reflect management’s

performance in operating the company and provides a meaningful

representation of the underlying performance of Xcel Energy’s core

business. In addition, Xcel Energy’s management uses ongoing

earnings internally for financial planning and analysis, reporting

of results to the Board of Directors and when communicating its

earnings outlook to analysts and investors. This non-GAAP financial

measure should not be considered as an alternative to measures

calculated and reported in accordance with GAAP.

Earnings Adjusted for Certain Items (Ongoing

Earnings)

Reconciliation of GAAP earnings (net income) to ongoing

earnings:

Three Months Ended Dec.

31

Twelve Months Ended Dec.

31

(Millions of Dollars)

2024

2023

2024

2023

GAAP net income

$

464

$

409

$

1,936

$

1,771

Loss on Comanche Unit 3 litigation

—

1

—

35

Workforce reduction expenses

—

72

—

72

Sherco Unit 3 2011 outage refunds

1

—

47

—

Less: tax effect of adjustment

—

(19

)

(13

)

(27

)

Ongoing earnings (a)

$

464

$

463

$

1,969

$

1,851

(a)

Amounts may not add due to rounding.

Reconciliation of GAAP EPS to ongoing EPS by operating

company:

Twelve Months Ended Dec. 31,

2024

Twelve Months Ended Dec. 31,

2023

Earnings (Loss) Per Share

GAAP Diluted EPS

Impact of Adjustments

Ongoing Diluted EPS

GAAP Diluted EPS

Impact of Adjustments

Ongoing Diluted EPS

NSP-Minnesota

$

1.41

$

0.06

$

1.47

$

1.28

0.04

$

1.32

PSCo (a)

1.39

—

1.39

1.26

$

0.08

1.33

SPS

0.70

—

0.70

0.70

0.01

0.71

NSP-Wisconsin

0.24

—

0.24

0.25

—

0.25

Earnings from equity method investments —

WYCO

0.03

—

0.03

0.04

—

0.04

Regulated utility (a)

3.76

0.06

3.83

3.52

0.14

3.66

Xcel Energy Inc. and Other

(0.33

)

—

(0.33

)

(0.31

)

—

(0.31

)

Total (a)

3.44

0.06

3.50

3.21

0.14

3.35

(a)

Amounts may not add due to rounding.

Adjustments to GAAP net income include:

Sherco Unit 3 2011 Outage Refunds — NSP-Minnesota’s

Sherco Unit 3 experienced an extended outage following a 2011

incident which damaged its turbine. In October 2024, following

contested case procedures, the MPUC ordered a customer refund of

$46 million for replacement power incurred during the outage.

Comanche Unit 3 Litigation — In the third quarter of

2023, PSCo recognized a non-recurring $34 million charge as a

result of a jury verdict in Denver County District Court awarding

CORE Electric Cooperative lost power damages and other costs.

Workforce Reduction — In 2023, Xcel Energy implemented

workforce actions to align resources and investments with our

evolving business and customer needs and streamline the

organization for long-term success. Xcel Energy initiated a

Voluntary Retirement Program, under which approximately 400

eligible non-bargaining employees retired. Xcel Energy also

eliminated approximately 150 non-bargaining employees through an

involuntary severance program. Workforce reduction expenses of $72

million were recorded in the fourth quarter of 2023.

Note 7. Earnings Guidance and Long-Term

EPS and Dividend Growth Rate Objectives

Xcel Energy 2025 Earnings Guidance — Xcel Energy’s 2025

ongoing earnings guidance is a range of $3.75 to $3.85 per

share.(a)

Key assumptions as compared with 2024 actual levels unless

noted:

- Constructive outcomes in all pending rate case and regulatory

proceedings, including requests for deferral of incremental

insurance costs associated with wildfire risk and recovery of

O&M costs associated with wildfire mitigation plans.

- Normal weather patterns for the year.

- Weather-normalized retail electric sales are projected to

increase ~3%.

- Weather-normalized retail firm natural gas sales are projected

to increase ~1%.

- Capital rider revenue is projected to increase $260 million to

$270 million (net of PTCs).

- O&M expenses are projected to increase ~3%.

- Depreciation expense is projected to increase approximately

$210 million to $220 million.

- Property taxes are projected to increase $55 million to $65

million.

- Interest expense (net of AFUDC - debt) is projected to increase

$165 million to $175 million, net of interest income.

- AFUDC - equity is projected to increase $110 million to $120

million.

(a)

Ongoing earnings is calculated using net

income and adjusting for certain nonrecurring or infrequent items

that are, in management’s view, not reflective of ongoing

operations. Ongoing earnings could differ from those prepared in

accordance with GAAP for unplanned and/or unknown adjustments. As

Xcel Energy is unable to quantify the financial impacts of any

additional adjustments that may occur for the year, we are unable

to provide a quantitative reconciliation of the guidance for

ongoing EPS to corresponding GAAP EPS.

Long-Term EPS and Dividend Growth Rate Objectives — Xcel

Energy expects to deliver an attractive total return to our

shareholders through a combination of earnings growth and dividend

yield, based on the following long-term objectives:

- Deliver long-term annual EPS growth of 6% to 8% based off of

$3.55 per share (the mid-point of 2024 original ongoing earnings

guidance of $3.50 to $3.60 per share).

- Deliver annual dividend increases of 4% to 6%.

- Target a dividend payout ratio of 50% to 60%.

- Maintain senior secured debt credit ratings in the A

range.

XCEL ENERGY INC. AND

SUBSIDIARIES

EARNINGS RELEASE SUMMARY

(UNAUDITED)

(amounts in millions, except per

share data)

Three Months Ended Dec.

31

2024

2023

Operating revenues:

Electric and natural gas

$

3,105

$

3,414

Other

15

28

Total operating revenues

3,120

3,442

Net income

$

464

$

409

Weighted average diluted common shares

outstanding

576

554

Components of EPS —

Diluted

Regulated utility

$

0.85

$

0.84

Xcel Energy Inc. and other costs

(0.05

)

(0.10

)

GAAP diluted EPS (a)

$

0.81

$

0.74

Loss on Comanche Unit 3 litigation (See

Note 6)

—

—

Workforce reduction expenses (See Note

6)

—

0.09

Sherco Unit 3 2011 outage refunds (See

Note 6)

—

—

Ongoing diluted EPS (a)

$

0.81

$

0.83

Book value per share

$

33.88

$

31.79

Cash dividends declared per common

share

0.5475

0.52

Twelve Months Ended Dec.

31

2024

2023

Operating revenues:

Electric and natural gas

$

13,377

$

14,091

Other

64

115

Total operating revenues

13,441

14,206

Net income

$

1,936

$

1,771

Weighted average diluted common shares

outstanding

563

552

Components of EPS —

Diluted

Regulated utility

$

3.76

$

3.52

Xcel Energy Inc. and other costs

(0.33

)

(0.31

)

GAAP diluted EPS (a)

$

3.44

$

3.21

Loss on Comanche Unit 3 litigation (See

Note 6)

—

0.05

Workforce reduction expenses (See Note

6)

—

0.09

Sherco Unit 3 2011 outage refunds (See

Note 6)

0.06

—

Ongoing diluted EPS (a)

$

3.50

$

3.35

Book value per share

$

34.65

$

31.90

Cash dividends declared per common

share

2.19

2.08

(a)

Amounts may not add due to rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206336663/en/

For more information, contact: Roopesh Aggarwal, Vice President

- Investor Relations, (303) 571-2855 Xcel Energy website address:

www.xcelenergy.com, (612) 215-5300

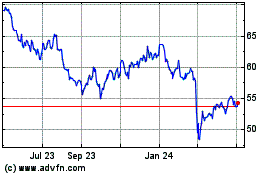

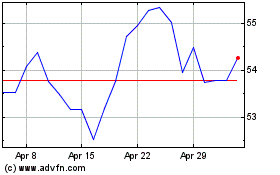

Xcel Energy (NASDAQ:XEL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Xcel Energy (NASDAQ:XEL)

Historical Stock Chart

From Feb 2024 to Feb 2025