Xenon Pharmaceuticals Inc. (Nasdaq:XENE), a neuroscience-focused

biopharmaceutical company dedicated to discovering, developing, and

delivering life-changing therapeutics for patients in need, today

provided a corporate update and reported financial results for the

second quarter ended June 30, 2024.

“We are proud to have the only Kv7 potassium

channel opener in development with Phase 2b efficacy and long-term

safety data in epilepsy patients. Today people living with epilepsy

are still struggling to control seizures despite current

medications, and we believe the compelling profile of azetukalner

has the potential to be paradigm shifting in the future treatment

of epilepsy,” stated Ian Mortimer, President and Chief Executive

Officer of Xenon. “We continue to progress our epilepsy program

with plans to deliver X-TOLE2 topline data in the second half of

2025, in support of our expected NDA submission.”

Mr. Mortimer continued, “Beyond azetukalner,

we continue to build upon our Kv7 leadership with a broad portfolio

of diverse chemistries to support our ‘pipeline in a mechanism’

approach. In parallel, we are advancing promising Nav1.7 candidates

towards early human proof-of-concept in pain. We believe that the

advancements in our azetukalner development programs in epilepsy

and MDD, with our maturing pre-clinical pipeline, position Xenon

with one of the most exciting CNS portfolios that exists

today.”

Quarterly Business Highlights and

Anticipated Milestones

Azetukalner Clinical

Development

Azetukalner (XEN1101) is a novel, potent Kv7

potassium channel opener being developed for the treatment of

epilepsy, including focal onset seizures (FOS) and primary

generalized tonic-clonic seizures (PGTCS), as well as major

depressive disorder (MDD), with the Company exploring applicability

in other neuropsychiatric disorders.

- Phase 3 FOS studies continue to advance, with the first topline

data readout from X-TOLE2 anticipated in the second half of 2025.

The Phase 3 FOS clinical trials are multicenter, randomized,

double-blind, placebo-controlled studies evaluating the clinical

efficacy, safety, and tolerability of azetukalner in patients with

FOS.

- Phase 3 X-ACKT clinical trial is currently enrolling patients

and is intended to support potential regulatory submissions in an

additional epilepsy indication of PGTCS. This multicenter,

randomized, double-blind, placebo-controlled trial is evaluating

the clinical efficacy, safety and tolerability of azetukalner in

patients with PGTCS.

- X-TOLE Phase 2b open-label extension (OLE) has been extended to

seven years and continues to generate important long-term data for

azetukalner beyond the 600 patient-years of exposure to date. Upon

completion of the double-blind period in the Phase 3 epilepsy

studies, eligible patients may enter an OLE study for up to three

years.

- The Company presented Phase 2 X-NOVA data at the American

Society of Clinical Psychopharmacology (ASCP) meeting in May. The

X-NOVA study evaluated azetukalner in patients with MDD. The first

of three planned Phase 3 clinical trials is expected to initiate in

the second half of 2024.

- Xenon will present three epilepsy related posters at the

upcoming 15th European Epilepsy Congress in Rome, Italy from

September 7 to 11. The Company will also present a poster on MDD at

the Psych Congress in Boston, MA from October 29 to November

2.

- The Company continues to support the investigator-sponsored

Phase 2 proof-of-concept study of azetukalner in MDD led by Icahn

School of Medicine at Mount Sinai, with patient enrollment

anticipated to complete this quarter.

Early-Stage Pipeline: Next Generation Ion

Channel Modulators

As leaders in the small molecule ion channel

space, Xenon continues to leverage its extensive expertise to

discover and develop potassium and sodium channel therapeutics. The

Company is evaluating multiple therapeutic candidates targeting

Kv7, Nav1.7, and Nav1.1 across various indications with the goal of

filing multiple INDs, or equivalent, in 2025.

- The Company has nominated multiple Kv7 development candidates,

with a lead candidate in IND-enabling studies. Kv7 may have utility

in a broad range of therapeutic indications including seizures,

pain, and neuropsychiatric disorders, such as MDD.

- A lead Nav1.7 candidate is expected to enter IND-enabling

studies in the near term. Nav1.7 is an important pain-related

target, based on strong human genetic validation, that may

represent a new class of medicines without the limitations of

opioids.

- The Company expects to nominate a lead Nav1.1 candidate, as

pre-clinical data suggests that targeting Nav1.1 could potentially

address the underlying cause and symptoms of Dravet Syndrome.

Partnered Program

- As part of Xenon’s ongoing collaboration with Neurocrine

Biosciences to develop treatments for epilepsy, a Phase 2 clinical

trial is evaluating NBI-921352 (formerly XEN901) in an orphan

pediatric epilepsy (SCN8A-DEE), and the next lead candidate, a

Nav1.2/1.6 inhibitor, is in IND-enabling studies with the intent to

progress into human clinical trials in 2025 as a potential

treatment for focal onset seizures.

Second Quarter Financial

Results

- Cash and cash equivalents and marketable securities were $850.6

million as of June 30, 2024, compared to $930.9 million as of

December 31, 2023. Based on current operating plans, including the

completion of the azetukalner Phase 3 epilepsy studies and fully

supporting late-stage clinical development of azetukalner in MDD,

Xenon anticipates having sufficient cash to fund operations into

2027. As of June 30, 2024, there were 75,667,550 common shares and

2,173,081 pre-funded warrants outstanding.

- Research and development expenses for the quarter ended June

30, 2024 were $49.7 million, compared to $44.0 million for the same

period in 2023. The increase of $5.7 million was primarily

attributable to increased expenses related to our pre-clinical and

discovery programs to advance multiple potential drug candidates

targeting Kv7, Nav1.7, and Nav1.1, increased personnel-related

costs due to an increase in employee headcount, and higher

stock-based compensation expense. These increases were partially

offset by a decrease in expenses for the XEN496 program as a result

of Xenon's decision in early 2023 to no longer pursue the clinical

development of XEN496.

- General and administrative expenses for the quarter ended June

30, 2024 were $19.4 million, compared to $11.6 million for the same

period in 2023. The increase of $7.8 million was primarily

attributable to personnel-related costs due to an increase in

employee headcount and higher stock-based compensation expense, and

an increase in professional and consulting fees.

- Other income for the quarter ended June 30, 2024 was $10.8

million, compared to $7.9 million for the same period in 2023. The

increase of $2.9 million was primarily attributable to higher

interest income, partially offset by a decrease in the unrealized

fair value gain on trading securities.

- Net loss for the quarter ended June 30, 2024 was $57.9 million,

compared to $47.5 million for the same period in 2023. The increase

in net loss was primarily attributable to higher research and

development expenses driven by pre-clinical and discovery programs,

and increased personnel-related costs and stock-based compensation

expense across the organization, partially offset by an increase in

interest income.

Conference Call Information

Xenon will host a conference call and webcast

today at 4:30 pm Eastern Time (1:30 pm Pacific Time) to discuss its

second quarter results. A listen-only webcast can be accessed on

the Investors section of the Xenon website. Participants can access

the conference call by dialing (800) 715-9871 or (646) 307-1963 for

international callers and referencing conference ID 1631616. A

replay of the webcast will be available on the website.

About Xenon Pharmaceuticals

Inc.

Xenon Pharmaceuticals (Nasdaq:XENE) is a

neuroscience-focused biopharmaceutical company committed to

discovering, developing, and commercializing innovative

therapeutics to improve the lives of people living with

neurological and psychiatric disorders. We are advancing a novel

product pipeline to address areas of high unmet medical need,

including epilepsy and depression. Azetukalner, our lead Kv7

channel opener, represents the most advanced, clinically validated

potassium channel modulator in late-stage clinical development for

multiple indications. For more information, please visit

www.xenon-pharma.com.

About the Azetukalner Phase 3 Epilepsy

Program

Xenon’s Phase 3 epilepsy program includes three

ongoing Phase 3 clinical trials in focal onset seizures (FOS) and

primary generalized tonic-clonic seizures (PGTCS). Designed closely

after the Phase 2b X-TOLE clinical trial, the Phase 3 X-TOLE

clinical trials are multicenter, randomized, double-blind,

placebo-controlled studies evaluating the clinical efficacy,

safety, and tolerability of 15 mg or 25 mg of azetukalner

administered with food as adjunctive treatment in approximately 360

patients with FOS per study. The primary efficacy endpoint is the

median percent change (MPC) in monthly seizure frequency from

baseline through the double-blind period (DBP) of azetukalner

compared to placebo. X-ACKT is a multicenter, randomized,

double-blind, placebo-controlled study evaluating the clinical

efficacy, safety, and tolerability of 25 mg of azetukalner

administered with food as adjunctive treatment in approximately 160

patients with PGTCS. The primary efficacy endpoint is the MPC in

monthly PGTCS frequency from baseline through the DBP of

azetukalner compared to placebo.

About the Azetukalner Phase 3 Major

Depressive Disorder (MDD) Program

Xenon completed its Phase 2 proof-of-concept

X-NOVA clinical trial, which evaluated the clinical efficacy,

safety, and tolerability of 10 mg and 20 mg of azetukalner in 168

patients with moderate to severe MDD. The primary objective was to

assess the efficacy of azetukalner compared to placebo on

improvement of depressive symptoms using the Montgomery-Åsberg

Depression Rating Scale (MADRS) score change through week 6. Based

on X-NOVA results, Xenon plans on initiating the first of three

Phase 3 clinical trials in MDD in the second half of 2024.

Safe Harbor Statement

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, and the Private Securities Litigation Reform

Act of 1995 and Canadian securities laws. These forward-looking

statements are not based on historical fact, and include statements

regarding the timing of and potential results from clinical trials;

the potential efficacy, safety profile, future development plans in

current and anticipated indications, addressable market, regulatory

success and commercial potential of our and our partners’ product

candidates; the efficacy of our clinical trial designs; our ability

to successfully develop and achieve milestones in our azetukalner

and other pipeline and development programs; the timing and results

of our interactions with regulators; our ability to successfully

develop and obtain regulatory approval of azetukalner and our other

product candidates; anticipated timing of topline data readout from

our clinical trials of azetukalner; and our expectation that we

will have sufficient cash to fund operations into 2027. These

forward-looking statements are based on current assumptions that

involve risks, uncertainties and other factors that may cause the

actual results, events, or developments to be materially different

from those expressed or implied by such forward-looking statements.

These risks and uncertainties, many of which are beyond our

control, include, but are not limited to: clinical trials may not

demonstrate safety and efficacy of any of our or our collaborators’

product candidates; promising results from pre-clinical development

activities or early clinical trial results may not be replicated in

later clinical trials; our assumptions regarding our planned

expenditures and sufficiency of our cash to fund operations may be

incorrect; our ongoing discovery and pre-clinical efforts may not

yield additional product candidates; any of our or our

collaborators’ product candidates, including azetukalner, may fail

in development, may not receive required regulatory approvals, or

may be delayed to a point where they are not commercially viable;

we may not achieve additional milestones in our proprietary or

partnered programs; regulatory agencies may impose additional

requirements or delay the initiation of clinical trials; the impact

of market, industry, and regulatory conditions on clinical trial

enrollment; the impact of competition; the impact of expanded

product development and clinical activities on operating expenses;

the impact of new or changing laws and regulations; the impact of

pandemics, epidemics and other public health crises on our research

and clinical development plans and timelines and results of

operations, including impact on our clinical trial sites,

collaborators, regulatory agencies and related review times, and

contractors who act for or on our behalf; the impact of unstable

economic conditions in the general domestic and global economic

markets; adverse conditions from geopolitical events; as well as

the other risks identified in our filings with the U.S. Securities

and Exchange Commission and the securities commissions in British

Columbia, Alberta, and Ontario. These forward-looking statements

speak only as of the date hereof and we assume no obligation to

update these forward-looking statements, and readers are cautioned

not to place undue reliance on such forward-looking statements.

“Xenon” and the Xenon logo are registered

trademarks or trademarks of Xenon Pharmaceuticals Inc. in various

jurisdictions. All other trademarks belong to their respective

owner.

Contacts: For Investors: Chad

Fugere Vice

President, Investor Relations (857) 675-7275

investors@xenon-pharma.com

For Media: Colleen Alabiso Senior Vice President,

Corporate Affairs (617) 671-9238 media@xenon-pharma.com

XENON PHARMACEUTICALS INC. Condensed

Consolidated Balance Sheets (Expressed in thousands of U.S.

dollars)

|

|

|

June 30, |

|

|

December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Assets |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents and marketable securities |

|

$ |

721,535 |

|

|

$ |

638,082 |

|

|

Other current assets |

|

|

6,554 |

|

|

|

6,880 |

|

|

Marketable securities, long-term |

|

|

129,062 |

|

|

|

292,792 |

|

|

Other long-term assets |

|

|

26,860 |

|

|

|

27,044 |

|

|

Total assets |

|

$ |

884,011 |

|

|

$ |

964,798 |

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

29,931 |

|

|

$ |

25,974 |

|

|

Other current liabilities |

|

|

1,354 |

|

|

|

1,299 |

|

|

Other long-term liabilities |

|

|

8,679 |

|

|

|

9,604 |

|

|

Total liabilities |

|

$ |

39,964 |

|

|

$ |

36,877 |

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity |

|

$ |

844,047 |

|

|

$ |

927,921 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

884,011 |

|

|

$ |

964,798 |

|

XENON PHARMACEUTICALS INC. Condensed

Consolidated Statements of Operations and Comprehensive Loss

(Expressed in thousands of U.S. dollars except share and per share

amounts)

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

49,702 |

|

|

$ |

44,040 |

|

|

$ |

93,952 |

|

|

$ |

83,556 |

|

|

General and administrative |

|

|

19,402 |

|

|

|

11,584 |

|

|

|

34,193 |

|

|

|

21,119 |

|

|

|

|

|

69,104 |

|

|

|

55,624 |

|

|

|

128,145 |

|

|

|

104,675 |

|

|

Loss from operations |

|

|

(69,104 |

) |

|

|

(55,624 |

) |

|

|

(128,145 |

) |

|

|

(104,675 |

) |

|

Other income |

|

|

10,847 |

|

|

|

7,943 |

|

|

|

22,369 |

|

|

|

15,557 |

|

|

Loss before income taxes |

|

|

(58,257 |

) |

|

|

(47,681 |

) |

|

|

(105,776 |

) |

|

|

(89,118 |

) |

|

Income tax recovery (expense) |

|

|

333 |

|

|

|

220 |

|

|

|

(79 |

) |

|

|

(70 |

) |

|

Net loss |

|

|

(57,924 |

) |

|

|

(47,461 |

) |

|

$ |

(105,855 |

) |

|

$ |

(89,188 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized loss on available-for-sale securities |

|

$ |

(443 |

) |

|

$ |

(1,479 |

) |

|

$ |

(2,135 |

) |

|

$ |

(299 |

) |

|

Comprehensive loss |

|

$ |

(58,367 |

) |

|

$ |

(48,940 |

) |

|

$ |

(107,990 |

) |

|

$ |

(89,487 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.75 |

) |

|

$ |

(0.72 |

) |

|

$ |

(1.36 |

) |

|

$ |

(1.36 |

) |

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

77,671,128 |

|

|

|

65,861,138 |

|

|

|

77,632,864 |

|

|

|

65,792,910 |

|

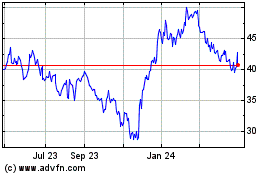

Xenon Pharmaceuticals (NASDAQ:XENE)

Historical Stock Chart

From Dec 2024 to Jan 2025

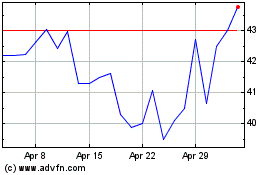

Xenon Pharmaceuticals (NASDAQ:XENE)

Historical Stock Chart

From Jan 2024 to Jan 2025