0001501697FALSE00015016972024-05-082024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 8, 2024

| | | | | | | | |

| | |

| X4 PHARMACEUTICALS, INC. |

| (Exact name of registrant as specified in its charter) |

| | |

| | | | | | | | | | | | | | |

| Delaware | | 001-38295 | | 27-3181608 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 61 North Beacon Street, | 4th Floor | | |

| Boston, | Massachusetts | | 02134 |

| (Address of principal executive offices) | | (Zip Code) |

(857) 529-8300

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

_______________________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | XFOR | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 1.01 | Entry Into a Material Definitive Agreement. |

On May 8, 2024, X4 Pharmaceuticals, Inc. (the “Company”), entered into an asset purchase agreement (the “Asset Purchase Agreement”) to sell a Rare Pediatric Disease Priority Review Voucher (“PRV”) for a lump sum payment of $105.0 million, payable in cash upon the closing of the sale, which occurred simultaneously with the parties entering into the Asset Purchase Agreement. The Company received the PRV under a United States Food and Drug Administration (“FDA”) program intended to encourage the development of treatments for rare pediatric diseases. The Company was awarded the PRV in April 2024 when the FDA approved XOLREMDITM (mavorixafor) which is indicated in patients 12 years of age and older with WHIM syndrome (warts, hypogammaglobulinemia, infections and myelokathexis) to increase the number of circulating mature neutrophils and lymphocytes.

The transactions contemplated by the Asset Purchase Agreement contains customary representations, warranties and covenants.

The foregoing description of the Asset Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the text of the Asset Purchase Agreement, which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ending June 30, 2024.

| | | | | |

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

The information contained above in Item 1.01 is hereby incorporated by reference into this Item 2.01.

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On May 8, 2024, the Compensation Committee (the “Committee”) of the Board of Directors of the Company (the “Board”) approved a one-time discretionary cash bonus to Adam Mostafa, the Company’s Chief Financial Officer, in the aggregate amount of $102,000 (the “Bonus”). The Committee approved the Bonus given Mr. Mostafa’s extensive efforts in obtaining, negotiating and finalizing the sale of the PRV.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On May 9, 2024, the Company issued a press release pursuant to which it announced that it had entered into the Asset Purchase Agreement and that it had drawn down an additional tranche of $20.0 million under its existing loan facility with Hercules Capital (the “Press Release”). A copy of the Press Release is furnished as Exhibit 99.1 hereto.

The information in this Item 7.01, including Exhibit 99.1 to this report, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The information contained in this Item 7.01 and in the accompanying Exhibit 99.1 shall not be incorporated by reference into any other filing under the Exchange Act or under the Securities Act, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 8.01 | Other Information. |

On May 9, 2024 the Company issued the Press Release and announced that it had completed the sale of its PRV to an undisclosed purchaser for $105.0 million and that it had drawn an additional tranche of $20.0 million under its existing loan facility with Hercules Capital (“Hercules”). The $105 million of gross funds received from the sale of the PRV and the $20 million drawn from the existing loan facility add to the $82 million in cash, cash equivalents, restricted cash, and short-term marketable securities reported as of March 31, 2024. The Company anticipates that these transactions extends its projected cash runway into late 2025, excluding expected commercial product sales.

Forward-Looking Statements

This Form 8-K contains forward-looking statements within the meaning of applicable securities laws, including the Private Securities Litigation Reform Act of 1995, as amended. These statements may be identified by the words “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “target,” or other similar terms or expressions that concern X4's expectations, strategy, plans, or intentions. Forward-looking statements include, without limitation, implied or express statements regarding X4’s plans with respect to the use of PRV sale proceeds and the drawdown from the loan facility with Hercules; X4’s expected cash runway with the PRV sale proceeds and the drawdown from the loan facility with Hercules and its existing cash balance as of March 31, 2024; X4’s commercialization plans and ongoing efforts with respect to XOLREMDI and the expected timing thereof.

Any forward-looking statements in this Form 8-K are based on management's current expectations and beliefs. These forward-looking statements are neither promises nor guarantees of future performance, and are subject to a variety of risks and uncertainties, many of which are beyond X4’s control, which could cause actual results to differ materially from those contemplated in these forward-looking statements, including the risks that: X4’s launch and commercialization efforts in the U.S. with respect to XOLREMDI may not be successful, and X4 may be unable to generate revenues at the levels or on the timing we expect or at levels or on the timing necessary to support our goals; unanticipated costs and expenses may be greater than anticipated; the company’s cash and cash equivalents may not be sufficient to support its operating plan for as long as anticipated; delays, interruptions or failures in the manufacture and supply of our products; and the company’s ability to obtain additional funding to support its clinical development and commercial programs; and other risks and uncertainties, including those described in the section entitled “Risk Factors” in X4’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (SEC) on May 7, 2024, and in other filings X4 makes with the SEC from time to time. X4 undertakes no obligation to update the information contained in this press release to reflect new events or circumstances, except as required by law.

| | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits. |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | X4 PHARMACEUTICALS, INC. |

| | | |

| Date: May 9, 2024 | | By: | /s/ Adam Mostafa |

| | | Adam Mostafa |

| | | Chief Financial Officer |

Exhibit 99.1

X4 Pharmaceuticals Announces $125 Million Capital Infusion from $105

Million Sale of Priority Review Voucher and $20 Million Drawdown from

Existing Loan Facility

$125 million of non-dilutive capital extends projected cash runway into late 2025, excluding expected commercial sales from XOLREMDI™ (mavorixafor)

XOLREMDI, the first drug indicated in patients with WHIM syndrome, received U.S. FDA approval in April 2024

BOSTON, May 9, 2024 – X4 Pharmaceuticals (Nasdaq: XFOR), a company driven to improve the lives of people with rare diseases of the immune system, today announced that it has completed the sale of its Rare Pediatric Disease Priority Review Voucher (PRV) to an undisclosed purchaser for $105 million and that it has drawn an additional tranche of $20 million under its existing loan facility with Hercules Capital, Inc. (NYSE: HTGC). Both transactions result from the U.S. Food and Drug Administration (FDA) approval of the company’s first product, XOLREMDI™ (mavorixafor), in late April.

“This infusion of non-dilutive capital provided by these transactions extends our projected cash runway into late 2025, excluding expected commercial product sales, and provides us with additional financial strength and flexibility as we execute on the XOLREMDI launch in WHIM syndrome and continue to advance mavorixafor into a potential second indication, with the planned initiation of a Phase 3 trial this quarter in certain chronic neutropenic disorders,” said Adam Mostafa, Chief Financial Officer of X4 Pharmaceuticals.

Under the Rare Pediatric Disease program, the FDA awards PRVs to sponsors of rare pediatric disease product applications that meet certain criteria to encourage development of new drugs and biologics for the prevention and treatment of rare pediatric diseases. The term loan facility with Hercules Capital provides for up to $115 million of term loans in the aggregate, available to be funded in multiple tranches, and is in an interest-only period until July 2027. The $105 million of gross funds received from the sale of the PRV and the $20 million drawn from the existing loan facility add to the $82 million in cash, cash equivalents, restricted cash, and short-term marketable securities reported as of March 31, 2024.

About WHIM Syndrome and XOLREMDI™ (mavorixafor)

WHIM (warts, hypogammaglobulinemia, infections and myelokathexis) syndrome is a rare, combined primary immunodeficiency and chronic neutropenic disorder; people with WHIM syndrome characteristically have low blood levels of neutrophils (neutropenia) and lymphocytes (lymphopenia), and as a result, experience serious and/or frequent infections. XOLREMDI (mavorixafor) is a selective CXCR4 receptor antagonist approved in the U.S. for use in patients 12 years of age and older with WHIM syndrome to increase the number of circulating mature neutrophils and lymphocytes.

About X4 Pharmaceuticals

X4 is delivering progress for patients by developing and commercializing innovative therapies for those with rare diseases of the immune system and significant unmet needs. Leveraging our expertise in CXCR4 and immune system biology, we have successfully developed mavorixafor, which has received U.S. approval as XOLREMDI™ (mavorixafor) capsules in its first indication. We are also evaluating the use of mavorixafor in additional potential indications. X4 corporate headquarters are in Boston, Massachusetts and our research center of excellence is in Vienna, Austria. For more information, please visit our website at www.x4pharma.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of applicable securities laws, including the Private Securities Litigation Reform Act of 1995, as amended. These statements may be identified by the words “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “target,” or other similar terms or expressions that concern X4's expectations, strategy, plans, or intentions. Forward-looking statements include, without limitation, implied or express statements regarding X4’s plans with respect to the use of the PRV sale proceeds and the drawdown from the loan facility with Hercules; X4’s expected cash runway with the PRV sale proceeds and the drawdown from the loan facility with Hercules and its existing cash balance as of March 31, 2024; X4’s commercialization plans and ongoing efforts with respect to XOLREMDI and the expected timing thereof; X4’s continued advancement of mavorixafor into a second indication, including timing of the initiation of a Phase 3 clinical trial in the second quarter of 2024 in certain chronic neutropenic disorders; and other statements regarding X4’s future operations, financial performance, financial position, prospectus, objectives and other future events. Any forward-looking statements in this press release are based on management's current expectations and beliefs. These forward-looking statements are neither promises nor guarantees of future performance, and are subject to a variety of risks and uncertainties, many of which are beyond X4’s control, which could cause actual results to differ materially from those contemplated in these forward-looking statements, including the risks that: unanticipated costs and expenses may be greater than anticipated; the company’s cash and cash equivalents may not be sufficient to support its operating plan for as long as anticipated; delays, interruptions or failures in the manufacture and supply of our products; the company’s ability to obtain additional funding to support its clinical development and commercial programs; and other risks and uncertainties, including those described in the section entitled “Risk Factors” in X4’s Annual Report on Form 10-Q filed with the Securities and Exchange Commission (SEC) on May 7, 2024, and in other filings X4 makes with the SEC from time to time. X4 undertakes no obligation to update the information contained in this press release to reflect new events or circumstances, except as required by law.

Company Contact:

José Juves

Head of Corporate & Patient Affairs

jose.juves@x4pharma.com

Investor Contact:

Daniel Ferry

Managing Director, LifeSci Advisors

daniel@lifesciadvisors.com

(617) 430-7576

v3.24.1.u1

Cover

|

May 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 08, 2024

|

| Entity Registrant Name |

X4 PHARMACEUTICALS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38295

|

| Entity Tax Identification Number |

27-3181608

|

| Entity Address, Address Line One |

61 North Beacon Street,

|

| Entity Address, Address Line Two |

4th Floor

|

| Entity Address, City or Town |

Boston,

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02134

|

| City Area Code |

857

|

| Local Phone Number |

529-8300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

XFOR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001501697

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

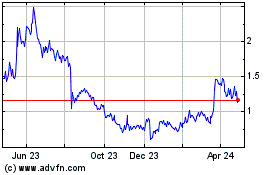

X4 Pharmaceuticals (NASDAQ:XFOR)

Historical Stock Chart

From Nov 2024 to Dec 2024

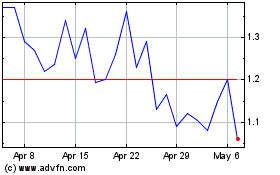

X4 Pharmaceuticals (NASDAQ:XFOR)

Historical Stock Chart

From Dec 2023 to Dec 2024