0001794515false00017945152024-07-302024-07-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 30, 2024

ZoomInfo Technologies Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-39310 | 87-3037521 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

805 Broadway Street, Suite 900, Vancouver, Washington 98660

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (800) 914-1220

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8−K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a−12 under the Exchange Act (17 CFR 240.14a−12)

☐ Pre−commencement communications pursuant to Rule 14d−2(b) under the Exchange Act (17 CFR 240.14d−2(b))

☐ Pre−commencement communications pursuant to Rule 13e−4(c) under the Exchange Act (17 CFR 240.13e− 4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | ZI | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 5, 2024, ZoomInfo Technologies Inc. (the “Company”) issued a press release announcing its financial results for the second quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this current report and is incorporated herein by reference. The information contained in Item 2.02 of this current report, including the press release furnished as Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Board of Director Updates

On August 5, 2024, the Company announced the appointment of Domenic Maida and Owen Wurzbacher to its Board of Directors (“Board”), effective as of August 6, 2024. Mr. Maida will serve on the Board’s Privacy, Security, and Technology Committee and Mr. Wurzbacher will serve on the Board’s Nominating and Corporate Governance and Compensation Committees. These appointments follow the resignation of Todd Crockett, which was received and became effective July 30, 2024. Mr. Crockett’s decision was not caused, in whole or in part, by a disagreement with the Company or the Board. Mr. Wurzbacher will serve as a Class I director with a term expiring at the Company’s Annual Meeting of Stockholders in 2027 and Mr. Maida will serve as a Class III director with a term expiring at the Company’s Annual Meeting of Stockholders in 2026.

Messrs. Wurzbacher and Maida will each participate in the Company’s non-employee director compensation program. A summary of the compensation payable to the Company’s non-employee directors was included in the Company’s proxy statement for its 2024 Annual Meeting of Stockholders, filed with the SEC on March 29, 2024, which information is incorporated herein by reference. The initial annual retainer and initial annual restricted stock unit grant to be received by each new director will be prorated for their services during the remainder of fiscal year 2024 and the service period, respectively, starting on August 6, 2024.

In connection with their appointments to the Board, the Company intends to enter into an indemnification agreement with each of Mr. Wurzbacher and Mr. Maida in substantially the same form as the Company has entered into with each of the Company’s existing directors and as previously disclosed in the Company’s public filings.

There were no arrangements or understandings between Messrs. Wurzbacher or Maida and any other persons pursuant to which either of them was selected as a director and there are no family relationships between Messrs. Wurzbacher or Maida and any of the Company’s directors or executive officers. In addition, neither Mr. Wurzbacher nor Mr. Maida is a party to any transaction, or any proposed transaction, required to be disclosed pursuant to Item 404(a) of Regulation S-K.

CFO Transition

On August 5, 2024, the Company announced that the Board and Peter Cameron Hyzer, the Company’s Chief Financial Officer (“CFO”), have agreed that Mr. Hyzer will depart from his position as CFO and principal financial officer (“PFO”), effective as of September 6, 2024. From September 6, 2024 through October 7, 2024, Mr. Hyzer will serve in an advisory role and will remain a full time employee of the Company in accordance with the compensatory terms and subject to the conditions of his Employment Agreement, dated as of December 21, 2018, filed as Exhibit 10.26 to the Company’s Annual Report on Form 10-K, filed February 15, 2024 and incorporated herein by reference. Mr. Hyzer’s departure as CFO and PFO is not due to any disagreement with the Company on any matter relating to the Company’s financial statements, internal control over financial reporting, operations, policies or practices. In connection with his departure, the Company anticipates entering into a customary separation and release agreement, the terms of which will be disclosed if and when determined by the parties.

In connection with Mr. Hyzer’s departure, Michael Graham O’Brien will assume the role of interim CFO and PFO, effective as of September 6, 2024. Mr. O’Brien, age 38, has served as Vice President, Financial Planning and Analysis of the Company since January 2023. Mr. O’Brien previously served in roles with increasing responsibility with the Company since December 2017. There is no arrangement or understanding between Mr. O’Brien and any other person pursuant to which Mr. O’Brien was selected as interim CFO and PFO, and there are no family relationships between Mr. O’Brien and any of the Company’s directors or executive officers. There have been no transactions involving Mr. O’Brien that would be required to be disclosed by Item 404(a) of Regulation S-K.

Item 7.01 Regulation FD Disclosure

On August 5, 2024, the Company issued a press release announcing the resignation of Mr. Crockett and the appointment of Messrs. Wurzbacher and Maida to the Board. A copy of the press release is furnished herewith as Exhibit 99.2 to this Report and incorporated herein by reference.

On August 5, 2024, the Company issued a press release announcing the transition of Mr. Hyzer from his role as CFO and the appointment of Mr. O’Brien as interim CFO, effective as of September 6, 2024. A copy of the press release is furnished herewith as Exhibit 99.3 to this Report and incorporated herein by reference.

The information under Item 7.01 of this Report, including Exhibits 99.2 and 99.3 attached hereto, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or Securities Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

ZoomInfo Technologies Inc.

Date: August 5, 2024

By: /s/ P. Cameron Hyzer

Name: P. Cameron Hyzer

Title: Chief Financial Officer

ZoomInfo Announces Second Quarter 2024 Financial Results

Vancouver, WA, August 5, 2024 - ZoomInfo, (NASDAQ: ZI) the go-to-market platform to find, acquire, and grow customers, today announced its financial results for the second quarter ended June 30, 2024.

“In the second quarter, we implemented a number of initiatives to position the company for long-term success,” said Henry Schuck, ZoomInfo founder and CEO. “Having successfully launched ZoomInfo Copilot, our AI-powered go-to-market platform, we are further accelerating a shift upmarket. To that end, in the quarter we grew our $100k ACV customer cohort sequentially, had our best new business quarter in the mid-market and enterprise, while we stabilized net revenue retention.

Schuck continued, “We deployed a new business risk model to reduce write-offs and made a change in estimates related to the collectibility of receivables. I am confident that this will strengthen our future financial position and enable the company to deliver strong and growing free cash flow.”

During the quarter, the company made a change in estimates related to the collectibility of receivables from customers and changed operational procedures to require upfront pre-payment for services from certain smaller customers. As a result, the company recorded incremental charges of $33 million primarily related to the change in estimates. Of the $33 million, $15 million was recorded against revenue, $14 million was recorded as bad debt expense, and $4 million was related to other discrete items.

Second Quarter 2024 Financial Highlights:

•GAAP Revenue of $291.5 million, a decrease of 6% year-over-year.

•GAAP Operating loss of $20.0 million and Adjusted operating income of $81.6 million.

•GAAP Operating loss margin of 7% and Adjusted operating income margin of 28%.

•GAAP Cash flow from operations of $126.3 million and Unlevered free cash flow of $120.0 million.

Recent Business and Operating Highlights:

•The company released ZoomInfo Copilot, its AI-powered platform bringing insights and actions to sales teams, driving outreach to the most qualified leads at the right time with the right message, to drive more sales.

•Closed the quarter with 1,797 customers with $100,000 or greater in annual contract value, an increase of 37 from the prior quarter.

•ZoomInfo is one of the first companies to collaborate with Google Cloud to provide specialized third-party datasets for Google's Vertex AI, enhancing the grounding capabilities of generative AI models. This partnership will help enterprises integrate third-party data into their generative AI agents to unlock unique use cases, and drive greater enterprise truth across their AI experiences by incorporating reliable, up-to-date information from ZoomInfo's extensive data assets.

•ZoomInfo is the first data company to earn TrustArc’s first-ever AI certification focused on data protection and privacy. This recognition demonstrates ZoomInfo’s commitment to accountability, transparency, and responsible use of AI.

•ZoomInfo received the TrustRadius Top Rated Award for customer satisfaction in all eligible categories. More than 1,600 ratings of ZoomInfo products reflect best-in-class customer satisfaction, with honors in the Intent Data, Sales Intelligence Software, and Market Intelligence Software categories.

•Completed a repricing of its First Lien Credit Agreement to S+175, which resulted in a 50 basis point reduction in interest rate and will reduce interest expense by approximately $3 million annually.

•During the three months ended June 30, 2024, the Company repurchased 10,799,791 shares of Common Stock at an average price of $13.65, for an aggregate $147.4 million.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Q2 2024 Financial Highlights (Unaudited) |

| ($ in millions, except per share amounts) |

| | | | | | | | |

| GAAP Quarterly Results | | Change YoY | | | Non-GAAP Quarterly Results | | Change YoY |

| Revenue | $291.5 | | (6)% | | | | | |

| Operating Loss | $(20.0) | | NM* | | Adjusted Operating Income | $81.6 | | (35)% |

| Operating Loss Margin | 7% | | | | Adjusted Operating Income Margin | 28% | | |

| Net Loss Per Share (Diluted) | $(0.07) | | | | Adjusted Net Income per share (Diluted) | $0.17 | | |

| Cash Flow from Operating Activities | $126.3 | | 8% | | Unlevered Free Cash Flow | $120.0 | | (1)% |

*Change YoY as a percentage is not meaningful

The Company uses a variety of operational and financial metrics, including non-GAAP financial measures, to evaluate its performance and financial condition. The accompanying financial data includes additional information regarding these metrics and a reconciliation of non-GAAP financial information for historical periods to the most directly comparable GAAP financial measure. The presentation of non-GAAP financial information should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

Business Outlook:

Based on information available as of August 5, 2024, ZoomInfo is providing guidance for the third quarter and full year 2024 as follows:

| | | | | | | | | | | | | | | | | |

| Q3 2024 | | Prior FY 2024 | | FY 2024 |

| GAAP Revenue | $298 - $301 million | | $1.255 - $1.27 billion | | $1.190 - $1.205 billion |

| Non-GAAP Adjusted Operating Income | $107 - $109 million | | $488 - $495 million | | $412 - $418 million |

| Non-GAAP Adjusted Net Income per share | $0.21 - $0.22 | | $1.00 - $1.02 | | $0.86 - $0.88 |

| Non-GAAP Unlevered Free Cash Flow | Not Guided | | $440 - $455 million | | $420 - $430 million |

| Weighted Average Shares Outstanding | 366 million | | 394 million | | 375 million |

Conference Call and Webcast Information:

ZoomInfo will host a conference call today, August 5, 2024, to review its results at 4:30 p.m. Eastern Time, 1:30 p.m. Pacific Time. To participate in the live conference call via telephone, please register here. Upon registering, a dial-in number and unique PIN will be provided to join the conference call.

The call will also be webcast live on the Company’s investor relations website at https://ir.zoominfo.com/, where related presentation materials will be posted prior to the conference call. Following the conference call, an archived webcast of the call will be available for one year on ZoomInfo’s Investor Relations website.

Non-GAAP Financial Measures and Other Metrics:

To supplement our consolidated financial statements presented in accordance with GAAP, this press release contains non-GAAP financial measures, including Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted Net Income, Adjusted Net Income Per Share, and Unlevered Free Cash Flow. We believe these non-GAAP measures are useful to investors in evaluating our operating performance because they eliminate certain items that affect period-over-period comparability and provide consistency with past financial performance and additional information about our underlying results and trends by excluding certain items that may not be indicative of our business, results of operations, or outlook.

Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for the comparable GAAP measures, but rather as supplemental information to our business results. This information should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP. There are limitations to these non-GAAP financial measures because they are not prepared in accordance with GAAP and may not be comparable to similarly titled measures of other companies due to potential differences in methods of calculation and items or events being adjusted. In addition, other companies may use different measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. A reconciliation is provided at the end of this press release for each historical non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP. We do not provide a quantitative reconciliation of the forward-looking non-GAAP financial measures included in this press release to the most directly comparable GAAP measures due to the high variability and difficulty to predict certain items excluded from these non-GAAP financial measures; in particular, the effects of stock-based compensation expense, taxes and amounts under the exchange tax receivable agreement, deferred tax assets and deferred tax liabilities, and restructuring and transaction expenses. We expect the variability of these excluded items may have a significant, and potentially unpredictable, impact on our future GAAP financial results.

We define Adjusted Operating Income as income (loss) from operations adjusted for, as applicable, (i) the impact of fair value adjustments to acquired unearned revenue, (ii) amortization of acquired technology and other acquired intangibles, (iii) equity-based compensation expense, (iv) restructuring and transaction-related expenses, (v) integration costs and acquisition-related expenses, and (vi) legal settlement. We define Adjusted Operating Income Margin as Adjusted Operating Income divided by the sum of revenue and the impact of fair value adjustments to acquired unearned revenue.

We define Adjusted Net Income as net income (loss) adjusted for, as applicable, (i) the impact of fair value adjustments to acquired unearned revenue, (ii) loss on debt modification and extinguishment, (iii) amortization of acquired technology and other acquired intangibles, (iv) equity-based compensation expense, (v) restructuring and transaction-related expenses, (vi) integration costs and acquisition-related expenses, (vii) legal settlement, (viii) TRA liability remeasurement (benefit) expense, (ix) other (income) loss, net and (x) tax impacts of adjustments to net income (loss). We define Adjusted Net Income (Loss) Per Share as Adjusted Net Income (Loss) divided by diluted weighted average shares outstanding used for adjusted net income (loss) per share.

We define Unlevered Free Cash Flow as net cash provided by (used in) operating activities less (i) purchases of property and equipment and other assets, plus (ii) cash interest expense, (iii) cash payments related to restructuring and transaction-related expenses, (iv) cash payments related to integration costs and acquisition-related compensation, and (v) legal settlement payments. Unlevered Free Cash Flow does not represent residual cash flow available for discretionary expenditures since, among other things, we have mandatory debt service requirements.

Net revenue retention is a metric that we calculate based on customers of ZoomInfo at the beginning of the twelve-month period, and is calculated as: (a) the total annual contract value ("ACV") for those customers at the end of the twelve-month period, divided by (b) the total ACV for those customers at the beginning of the twelve-month period.

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those expressed or implied by these statements. You can generally identify our forward-looking statements by the words “anticipate”, “believe”, “can”, “continue”, “could”, “estimate”, “expect”, “forecast”, “goal”, “intend”, “may”, “might”, “objective”, “outlook”, “plan”, “potential”, “predict”, “projection”, “seek”, “should”, “target”, “trend”, “will”, “would” or the negative version of these words or other comparable words. Any statements in this press release regarding future revenue, earnings, margins, financial performance, expenses, estimates, cash flow, growth in free cash flow, results of changes in operational procedures, liquidity, or results of operations (including, but not limited to, the guidance provided under “Business Outlook”), and any other statements that are not historical facts are forward-looking statements. We have based our forward-looking statements on beliefs and assumptions based on information available to us at the time the statements are made. We caution you that assumptions, beliefs, expectations, intentions and projections about future events may, and often do, vary materially from actual results. Therefore, we cannot assure you that actual results will not differ materially from those expressed or implied by our forward-looking statements.

Factors that could cause actual results to differ from those expressed or implied by our forward-looking statements include, among other things: future economic, competitive, and regulatory conditions, potential future uses of cash, the successful integration of acquired businesses, and future decisions made by us and our competitors. All of these factors are difficult or impossible to predict accurately and many of them are beyond our control. For a further list and description of these and other important risks and uncertainties that may affect our future operations, see Part I, Item 1A - Risk Factors in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which we may update in Part II, Item 1A - Risk Factors in Quarterly Reports on Form 10-Q we have filed or will file hereafter. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, investments, or other strategic transactions we may make. Each forward-looking statement contained in this presentation speaks only as of the date of this press release, and we undertake no obligation to update or revise any forward-looking statements whether as a result of new information, future developments or otherwise, except as required by law.

About ZoomInfo

ZoomInfo (NASDAQ: ZI) is the trusted go-to-market platform for businesses to find, acquire, and grow their customers. It delivers accurate, real-time data, insights, and technology to more than 35,000 companies worldwide. Businesses use ZoomInfo to increase efficiency, consolidate, technology stacks, and align their sales and marketing teams - all in one platform. ZoomInfo is a recognized leader in data privacy, with industry-leading GDPR and CCPA compliance measures and numerous data security and privacy certifications. For more information about how ZoomInfo can help businesses grow their revenue at scale, please visit www.zoominfo.com.

Website Disclosure

ZoomInfo intends to use its website as a distribution channel of material company information. Financial and other important information regarding the Company is routinely posted on and accessible through the Company’s website at https://ir.zoominfo.com/. Accordingly, you should monitor the investor relations portion of our website at https://ir.zoominfo.com/ in addition to following our press releases, SEC filings, and public conference calls and webcasts. In addition, you may automatically receive email alerts and other information about ZoomInfo when you enroll your email address by visiting the “Email Alerts” section of our investor relations page at https://ir.zoominfo.com/.

###

Investor Contact:

Jeremiah Sisitsky

VP of Investor Relations

IR@zoominfo.com

Media Contact:

Meghan Barr

VP, Communications

(203) 216-1878

pr@zoominfo.com

| | | | | | | | | | | |

| ZoomInfo Technologies Inc. |

| Condensed Consolidated Balance Sheets |

(in millions, except share data) |

| | | |

| June 30, | | December 31, |

| 2024 | | 2023 |

| (unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 385.9 | | | $ | 447.1 | |

| Short-term investments | 13.4 | | | 82.2 | |

| Restricted cash, current | — | | | 0.2 | |

| Accounts receivable, net | 189.9 | | | 272.0 | |

| Prepaid expenses and other current assets | 64.9 | | | 59.6 | |

| Income tax receivable | 5.5 | | | 3.2 | |

| Total current assets | $ | 659.6 | | | $ | 864.3 | |

| | | |

| Restricted cash, non-current | $ | 8.9 | | | $ | 8.9 | |

| Property and equipment, net | 84.1 | | | 65.1 | |

| Operating lease right-of-use assets, net | 117.2 | | | 80.7 | |

| Intangible assets, net | 305.7 | | | 334.6 | |

| Goodwill | 1,692.7 | | | 1,692.7 | |

| Deferred tax assets | 3,698.1 | | | 3,707.1 | |

| Deferred costs and other assets, net of current portion | 117.2 | | | 114.9 | |

| Total assets | $ | 6,683.5 | | | $ | 6,868.3 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 20.3 | | | $ | 34.4 | |

| Accrued expenses and other current liabilities | 141.8 | | | 113.8 | |

| Unearned revenue, current portion | 438.9 | | | 439.6 | |

| Income taxes payable | 0.9 | | | 2.0 | |

| Current portion of tax receivable agreements liability | 63.8 | | | 31.4 | |

| Current portion of operating lease liabilities | 9.1 | | | 11.2 | |

| Current portion of long-term debt | 5.9 | | | 6.0 | |

| Total current liabilities | $ | 680.7 | | | $ | 638.4 | |

| | | |

| Unearned revenue, net of current portion | $ | 1.5 | | | $ | 2.3 | |

| Tax receivable agreements liability, net of current portion | 2,731.7 | | | 2,786.6 | |

| Operating lease liabilities, net of current portion | 177.3 | | | 89.9 | |

| Long-term debt, net of current portion | 1,223.8 | | | 1,226.4 | |

| Deferred tax liabilities | 2.2 | | | 1.9 | |

| Other long-term liabilities | 3.4 | | | 3.5 | |

| Total liabilities | $ | 4,820.6 | | | $ | 4,749.0 | |

| | | |

| | | |

| | | |

| | | |

| Stockholders' Equity: | | | |

| | | |

| Common stock, par value $0.01 | $ | 3.6 | | | $ | 3.8 | |

| | | |

| Additional paid-in capital | 1,560.8 | | | 1,804.9 | |

| Accumulated other comprehensive income | 24.5 | | | 27.3 | |

| Retained earnings | 274.0 | | | 283.3 | |

| | | |

| Total stockholders' equity | $ | 1,862.9 | | | $ | 2,119.3 | |

| Total liabilities and stockholders' equity | $ | 6,683.5 | | | $ | 6,868.3 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| ZoomInfo Technologies Inc. |

Consolidated Statements of Operations |

(in millions, except per share amounts; unaudited) |

| | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 291.5 | | | $ | 308.6 | | | $ | 601.6 | | | $ | 609.3 | |

| | | | | | | |

| Cost of service: | | | | | | | |

Cost of service(1) | 36.3 | | | 34.1 | | | 70.2 | | | 69.1 | |

| Amortization of acquired technology | 9.6 | | | 9.5 | | | 19.1 | | | 20.0 | |

| Gross profit | $ | 245.6 | | | $ | 265.0 | | | $ | 512.3 | | | $ | 520.2 | |

| | | | | | | |

Operating expenses: | | | | | | | |

Sales and marketing(1) | 100.5 | | | 104.5 | | | 200.1 | | | 207.7 | |

Research and development(1) | 48.3 | | | 53.3 | | | 92.0 | | | 95.6 | |

General and administrative(1) | 111.3 | | | 42.1 | | | 186.4 | | | 79.9 | |

Amortization of other acquired intangibles | 5.5 | | | 5.5 | | | 10.8 | | | 11.1 | |

| | | | | | | |

Total operating expenses | $ | 265.6 | | | $ | 205.4 | | | $ | 489.3 | | | $ | 394.3 | |

Income (loss) from operations | $ | (20.0) | | | $ | 59.6 | | | $ | 23.0 | | | $ | 125.9 | |

| | | | | | | |

Interest expense, net | 9.8 | | | 12.0 | | | 19.9 | | | 21.9 | |

Loss on debt modification and extinguishment | 0.7 | | | — | | | 0.7 | | | 2.2 | |

Other income, net | (5.9) | | | (7.1) | | | (2.5) | | | (21.1) | |

Income (loss) before income taxes | $ | (24.6) | | | $ | 54.7 | | | $ | 4.9 | | | $ | 122.9 | |

Provision (benefit) for income taxes | (0.2) | | | 16.6 | | | 14.2 | | | 40.3 | |

| Net income (loss) | $ | (24.4) | | | $ | 38.1 | | | $ | (9.3) | | | $ | 82.6 | |

| | | | | | | |

| | | | | | | |

Net income (loss) per share of common stock: | | | | | | | |

| Basic | $ | (0.07) | | | $ | 0.09 | | | $ | (0.02) | | | $ | 0.21 | |

| Diluted | (0.07) | | | 0.09 | | | (0.02) | | | 0.21 | |

________________

(1)Amounts include equity-based compensation expense, as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (in millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Cost of service | $ | 2.7 | | | $ | 3.4 | | | $ | 5.2 | | | $ | 7.5 | |

| Sales and marketing | 14.0 | | | 17.6 | | | 25.8 | | | 37.1 | |

| Research and development | 10.2 | | | 15.4 | | | 19.0 | | | 22.3 | |

| General and administrative | 9.5 | | | 9.9 | | | 17.6 | | | 17.1 | |

| Total equity-based compensation expense | $ | 36.4 | | | $ | 46.3 | | | $ | 67.6 | | | $ | 84.0 | |

| | | | | | | | | | | |

| ZoomInfo Technologies Inc. |

Consolidated Statements of Cash Flows |

| (in millions; unaudited) |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Operating activities: | | | |

| Net income (loss) | $ | (9.3) | | | $ | 82.6 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Depreciation and amortization | 40.9 | | | 40.7 | |

| Amortization of debt discounts and issuance costs | 1.1 | | | 1.2 | |

| Amortization of deferred commissions costs | 33.6 | | | 38.3 | |

| Asset impairments and lease abandonment charges | 48.7 | | | 0.6 | |

| Loss on debt modification and extinguishment | 0.7 | | | 2.2 | |

| | | |

| | | |

| Equity-based compensation expense | 67.6 | | | 84.0 | |

| | | |

| Deferred income taxes | 8.3 | | | 42.0 | |

| | | |

| Tax receivable agreement remeasurement | 9.2 | | | (11.2) | |

| Provision for bad debt expense | 32.5 | | | 11.3 | |

| Changes in operating assets and liabilities, net of acquisitions: | | | |

| Accounts receivable, net | 49.6 | | | 4.4 | |

| Prepaid expenses and other current assets | (4.7) | | | (11.0) | |

| Deferred costs and other assets, net of current portion | (35.5) | | | (39.2) | |

| Income tax receivable | (2.3) | | | (2.7) | |

| Accounts payable | (15.1) | | | (12.7) | |

| Accrued expenses and other liabilities | 18.3 | | | (28.5) | |

| Unearned revenue | (1.4) | | | 23.2 | |

| Net cash provided by operating activities | $ | 242.2 | | | $ | 225.2 | |

| | | |

| Investing activities: | | | |

| Purchases of short-term investments | $ | — | | | $ | (114.7) | |

| Maturities of short-term investments | 69.0 | | | 94.3 | |

| | | |

| Purchases of property and equipment and other assets | (23.9) | | | (12.6) | |

| Cash paid for acquisitions, net of cash acquired | (0.5) | | | — | |

| Net cash provided by (used in) investing activities | $ | 44.6 | | | $ | (33.0) | |

| | | |

| Financing activities: | | | |

| Payments of deferred consideration | $ | (0.7) | | | $ | (0.4) | |

| | | |

| Repayment of debt | (3.0) | | | (3.0) | |

| Payments of debt issuance and modification costs | (1.9) | | | (2.7) | |

| Proceeds from exercise of stock options | — | | | 0.4 | |

| Taxes paid related to net share settlement of equity awards | (14.6) | | | (8.6) | |

| Proceeds from issuance of common stock under the ESPP | 2.8 | | | 4.4 | |

| | | |

| Tax receivable agreement payments | (31.6) | | | — | |

| Repurchase of common stock | (299.2) | | | (87.0) | |

| | | |

| Net cash used in financing activities | $ | (348.2) | | | $ | (96.9) | |

| | | |

| | | | | | | | | | | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | $ | (61.4) | | | $ | 95.3 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 456.2 | | | 424.1 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 394.8 | | | $ | 519.4 | |

| | | |

| Cash, cash equivalents, and restricted cash at end of period: | | | |

| Cash and cash equivalents | $ | 385.9 | | | $ | 509.7 | |

| | | |

| Restricted cash, non-current | 8.9 | | | 9.7 | |

| Total cash, cash equivalents, and restricted cash | $ | 394.8 | | | $ | 519.4 | |

| | | |

| Supplemental disclosures of cash flow information: | | | |

| Interest paid in cash | $ | 20.3 | | | $ | 24.6 | |

| Cash paid for taxes | 7.9 | | | 4.7 | |

| | | |

| Supplemental disclosures of non-cash investing activities: | | | |

| | | |

| | | |

| Property and equipment included in accounts payable and accrued expenses and other current liabilities | $ | 5.0 | | | $ | 0.2 | |

| Equity-based compensation included in capitalized software | 2.9 | | | 2.6 | |

| | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| ZoomInfo Technologies Inc. |

| Reconciliation of GAAP Cash Flow from Operations to Non-GAAP Unlevered Free Cash Flow |

| (in millions; unaudited) |

| | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities (GAAP) | $ | 126.3 | | | $ | 116.7 | | | $ | 242.2 | | | $ | 225.2 | |

| Purchases of property and equipment and other assets | (11.1) | | | (6.2) | | | (23.9) | | | (12.6) | |

| Interest paid in cash | 2.6 | | | 5.8 | | | 20.3 | | | 24.6 | |

| Restructuring and transaction-related expenses paid in cash | 1.7 | | | 4.7 | | | 2.1 | | | 4.9 | |

| Integration costs and acquisition-related compensation paid in cash | — | | | 0.5 | | | 1.3 | | | 0.5 | |

Litigation settlement payments(1) | 0.5 | | | — | | | 0.7 | | | — | |

| Unlevered Free Cash Flow (Non-GAAP) | $ | 120.0 | | | $ | 121.5 | | | $ | 242.7 | | | $ | 242.6 | |

__________________

(1)Represents payments associated with certain legal settlements. For the three and six months ended June 30, 2024, these payments related to legal costs incurred due to the Class Actions.

| | | | | | | | | | | | | | | | | | | | | | | |

| ZoomInfo Technologies Inc. |

| Reconciliation of GAAP Income from Operations to Non-GAAP Adjusted Operating Income |

| (in millions; unaudited) |

| | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Income (loss) from operations (GAAP) | $ | (20.0) | | $ | 59.6 | | $ | 23.0 | | $ | 125.9 |

Impact of fair value adjustments to acquired unearned revenue(1) | — | | 0.1 | | — | | 0.1 |

| Amortization of acquired technology | 9.6 | | 9.5 | | 19.1 | | 20.0 |

| Amortization of other acquired intangibles | 5.5 | | 5.5 | | 10.8 | | 11.1 |

| Equity-based compensation expense | 36.4 | | 46.3 | | 67.6 | | 84.0 |

Restructuring and transaction-related expenses(2) | 50.0 | | 4.7 | | 50.2 | | 4.8 |

| | | | | | | |

Litigation settlement(3) | — | | — | | 30.2 | | — |

| Adjusted Operating Income (Non-GAAP) | $ | 81.6 | | $ | 125.6 | | $ | 200.9 | | $ | 245.9 |

| | | | | | | |

| Revenue (GAAP) | $ | 291.5 | | $ | 308.6 | | $ | 601.6 | | $ | 609.3 |

| Impact of fair value adjustments to acquired unearned revenue | — | | 0.1 | | — | | 0.1 |

| Revenue for adjusted operating margin calculation (Non-GAAP) | $ | 291.5 | | $ | 308.7 | | $ | 601.6 | | $ | 609.4 |

| | | | | | | |

Operating Income (Loss) Margin (GAAP) | (7) | % | | 19 | % | | 4 | % | | 21 | % |

| Adjusted Operating Income Margin (Non-GAAP) | 28 | % | | 41 | % | | 33 | % | | 40 | % |

__________________

(1)Represents the impact of fair value adjustments to acquired unearned revenue relating to services billed by an acquired company, prior to our acquisition of that company. These adjustments represent the difference between the revenue recognized based on management’s estimate of fair value of acquired unearned revenue and the receipts billed prior to the acquisition less revenue recognized prior to the acquisition.

(2)Represents costs directly associated with acquisition or disposal activities, including employee severance and termination benefits, contract termination fees and penalties, and other exit or disposal costs. For the three and six months ended June 30, 2024, this expense is primarily related to lease impairment and abandonment charges. For the three and six months ended June 30, 2023, this expense is primarily related to costs associated with a June 2023 reduction in force.

(3)Represents charges associated with certain legal settlements. For the six months ended June 30, 2024, these charges related to costs incurred due to the Class Actions.

| | | | | | | | | | | | | | | | | | | | | | | |

| ZoomInfo Technologies Inc. |

| Reconciliation of GAAP Net Income to Non-GAAP Adjusted Net Income |

| (in millions, except per share amounts; unaudited) |

| | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income (loss) (GAAP) | $ | (24.4) | | | $ | 38.1 | | | $ | (9.3) | | | $ | 82.6 | |

Impact of fair value adjustments to acquired unearned revenue(1) | — | | | 0.1 | | | — | | | 0.1 | |

| Loss on debt modification and extinguishment | 0.7 | | | — | | | 0.7 | | | 2.2 | |

| Amortization of acquired technology | 9.6 | | | 9.5 | | | 19.1 | | | 20.0 | |

| Amortization of other acquired intangibles | 5.5 | | | 5.5 | | | 10.8 | | | 11.1 | |

| Equity-based compensation expense | 36.4 | | | 46.3 | | | 67.6 | | | 84.0 | |

Restructuring and transaction-related expenses(2) | 50.0 | | | 4.7 | | | 50.2 | | | 4.8 | |

| | | | | | | |

Litigation settlement(3) | — | | | — | | | 30.2 | | | — | |

| TRA liability remeasurement expense (benefit) | (0.2) | | | (1.1) | | | 9.2 | | | (11.2) | |

Other income, net | (2.6) | | | — | | | (2.6) | | | — | |

Tax impacts of adjustments to net income (loss)(4) | (9.0) | | | 3.2 | | | (9.4) | | | 12.4 | |

| Adjusted Net Income (Non-GAAP) | $ | 66.0 | | | $ | 106.4 | | | $ | 166.4 | | | $ | 206.0 | |

| | | | | | | |

| Diluted Net Income (Loss) Per Share (GAAP) | $ | (0.07) | | | $ | 0.09 | | | $ | (0.02) | | | $ | 0.21 | |

| Impact of fair value adjustments to acquired unearned revenue per diluted share | — | | | — | | | — | | | — | |

| Loss on debt modification and extinguishment per diluted share | — | | | — | | | — | | | — | |

| Amortization of acquired technology per diluted share | 0.02 | | | 0.02 | | | 0.04 | | | 0.05 | |

| Amortization of other acquired intangibles per diluted share | 0.01 | | | 0.01 | | | 0.03 | | | 0.03 | |

| Equity-based compensation expense per diluted share | 0.10 | | | 0.11 | | | 0.17 | | | 0.20 | |

| Restructuring and transaction-related expenses per diluted share | 0.13 | | | 0.01 | | | 0.13 | | | 0.01 | |

| | | | | | | |

| Litigation settlement per diluted share | — | | | — | | | 0.08 | | | — | |

| TRA liability remeasurement expense (benefit) per diluted share | — | | | — | | | 0.02 | | | (0.03) | |

| Other income, net per diluted share | — | | | — | | | — | | | — | |

| Tax impacts of adjustments to net income (loss) per diluted share | (0.02) | | | 0.01 | | | (0.02) | | | 0.03 | |

| Adjusted Net Income Per Share (Non-GAAP) | $ | 0.17 | | | $ | 0.26 | | | $ | 0.43 | | | $ | 0.50 | |

Shares for Adjusted Net Income Per Share(5) | 387 | | | 416 | | | 389 | | | 415 | |

__________________

(1)Represents the impact of fair value adjustments to acquired unearned revenue relating to services billed by an acquired company, prior to our acquisition of that company. These adjustments represent the difference between the revenue recognized based on management’s estimate of fair value of acquired unearned revenue and the receipts billed prior to the acquisition less revenue recognized prior to the acquisition.

(2)Represents costs directly associated with acquisition or disposal activities, including employee severance and termination benefits, contract termination fees and penalties, and other exit or disposal costs. For the three and six months ended June 30, 2024, this expense is primarily related to lease impairment and abandonment charges. For the three and six months ended June 30, 2023, this expense is primarily related to costs associated with a June 2023 reduction in force.

(3)Represents charges associated with certain legal settlements. For the six months ended June 30, 2024, these charges related to costs incurred due to the Class Actions.

(4)Represents tax expense associated with GAAP Net income (loss) excluded from Adjusted Net Income (Non-GAAP). This includes the tax effects associated with equity compensation, remeasurement of deferred tax assets for the effect of state law changes, and TRA liability remeasurement.

(5)Diluted earnings per share is computed by giving effect to all potential weighted average Common Stock, and any securities that are convertible into Common Stock, including options and restricted stock units. The dilutive effect of outstanding awards and convertible securities is reflected in diluted earnings per share by application of the treasury stock method, excluding deemed repurchases assuming proceeds from unrecognized compensation as required by GAAP.

ZoomInfo Announces Board of Directors Appointments

Domenic Maida and Owen Wurzbacher Appointed as Independent Directors

Todd Crockett Steps Down From Board of Directors

Vancouver, WA, August 5, 2024 - ZoomInfo, (NASDAQ: ZI) the go-to-market platform to find, acquire, and grow customers, today announced the appointment of Domenic Maida and Owen Wurzbacher to its Board of Directors, effective August 6, 2024. Mr. Maida will serve on the Board’s Privacy, Security, and Technology Committee and Mr. Wurzbacher will serve on the Board’s Nominating and Corporate Governance and Compensation Committees. These appointments follow the resignation of Todd Crockett, which was received and became effective July 30, 2024.

Henry Schuck, ZoomInfo founder, chairman and CEO, said, “We are pleased to welcome Dom and Owen to our Board of Directors. Both bring impressive experience and expertise that will complement the Board’s skills as we focus on our operational initiatives, including the significant opportunities we see with ZoomInfo Copilot and AI, and position the company for long-term growth and profitability.”

Mr. Maida commented, “I believe that ZoomInfo has tremendous growth potential as it harnesses the power of ZoomInfo Copilot. As a product and technology executive, I am impressed with ZoomInfo’s AI-powered suite of services. It’s an exciting time to join the company, and I look forward to bringing my insights to the Board.”

Mr. Wurzbacher commented, “It is an honor to join the ZoomInfo Board and to support Henry and his team. I believe ZoomInfo has a strong competitive position, a compelling product suite, and a highly cash generative business model. I am confident the company’s best days lie ahead and specifically that its heightened focus on both delighting customers and growing free cash flow per share will create enormous value for shareholders from here. All public companies must compete hard to earn the trust and capital of high-quality shareholders. Going forward, through disciplined and consistent execution, I expect and intend for ZoomInfo to compete very well.”

With these appointments, ZoomInfo’s Board of Directors comprises nine directors, eight of whom are independent.

About Domenic Maida

Domenic Maida has an impressive track record spanning nearly three decades, marked by his contributions as a global executive in data, sales, product development, and technology.

As Bloomberg’s Chief Data Officer from 2013 to 2021, Domenic was instrumental in revolutionizing global data operations through constant innovation. His 25+-year tenure at Bloomberg also included leadership of its flagship product, the “Bloomberg Terminal,” from 2008 to 2012, and several key leadership roles prior to that. Since 2022, Domenic has been a Senior Advisor at Boston Consulting Group, where he consults on data, technology, and product strategies. He received a BS in Mechanical Engineering from Johns Hopkins University.

About Owen Wurzbacher

Owen Wurzbacher is an investment executive with experience managing diverse investment portfolios. As the Chief Investment Officer at HighSage Ventures, Owen sets the firm’s strategy and oversees portfolio management. He received an AB from Harvard University and a Masters of Education and Masters of Business Administration from Stanford University.

Second Quarter 2024 Financial Results

In a separate press release issued today, ZoomInfo issued its second quarter 2024 financial results. A conference call is scheduled to begin today, August 5th, at 4:30 p.m. Eastern Time, 1:30 p.m. Pacific Time. To participate in the live conference call via telephone, please register here. Upon registering, a dial-in number and unique PIN will be provided to join the conference call. The call will also be webcast live on the Company’s investor relations website at https:// ir.zoominfo.com/, where related presentation materials will be posted prior to the conference call. Following the conference call, an archived webcast of the call will be available for one year on ZoomInfo’s Investor Relations website.

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those expressed or implied by these statements. You can generally identify our forward-looking statements by the words “anticipate”, “believe”, “can”, “continue”, “could”, “estimate”, “expect”, “forecast”, “goal”, “intend”, “may”, “might”, “objective”, “outlook”, “plan”, “potential”, “predict”, “projection”, “seek”, “should”, “target”, “trend”, “will”, “would” or the negative version of these words or other comparable words. Any statements in this press release regarding future revenue, earnings, margins, financial performance, cash flow, growth in free cash flow per share, liquidity, or results of operations (including, but not limited to, the guidance provided under “Business Outlook”), and any other statements that are not historical facts are forward-looking statements. We have based our forward-looking statements on beliefs and assumptions based on information available to us at the time the statements are made. We caution you that assumptions, beliefs, expectations, intentions and projections about future events may, and often do, vary materially from actual results. Therefore, we cannot assure you that actual results will not differ materially from those expressed or implied by our forward-looking statements.

Factors that could cause actual results to differ from those expressed or implied by our forward-looking statements include, among other things: future economic, competitive, and regulatory conditions, potential future uses of cash, the successful integration of acquired businesses, and future decisions made by us and our competitors. All of these factors are difficult or impossible to predict accurately and many of them are beyond our control. For a further list and description of these and other important risks and uncertainties that may affect our future operations, see Part I, Item 1A - Risk Factors in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which we may update in Part II, Item 1A - Risk Factors in Quarterly Reports on Form 10-Q we have filed or will file hereafter. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, investments, or other strategic transactions we may make. Each forward-looking statement contained in this presentation speaks only as of the date of this press release, and we undertake no obligation to update or revise any forward-looking statements whether as a result of new information, future developments or otherwise, except as required by law.

About ZoomInfo

ZoomInfo (NASDAQ: ZI) is the trusted go-to-market platform for businesses to find, acquire, and grow their customers. It delivers accurate, real-time data, insights, and technology to more than 35,000 companies worldwide. Businesses use ZoomInfo to increase efficiency, consolidate, technology stacks, and align their sales and marketing teams - all in one platform. ZoomInfo is a recognized leader in data privacy, with industry-leading GDPR and CCPA compliance measures and numerous data security and privacy certifications. For more information about how ZoomInfo can help businesses grow their revenue at scale, please visit www.zoominfo.com.

Website Disclosure

ZoomInfo intends to use its website as a distribution channel of material company information. Financial and other important information regarding the Company is routinely posted on and accessible through the Company’s website at https://ir.zoominfo.com/. Accordingly, you should monitor the investor relations portion of our website at https://ir.zoominfo.com/ in addition to following our press releases, SEC filings, and public conference calls and webcasts. In addition, you may automatically receive email alerts and other information about ZoomInfo when you enroll your email address by visiting the “Email Alerts” section of our investor relations page at https://ir.zoominfo.com/.

###

Investor Contact:

Jeremiah Sisitsky

VP of Investor Relations

IR@zoominfo.com

Media Contact:

Meghan Barr

VP, Communications

(203) 216-1878

pr@zoominfo.com

ZoomInfo Announces CFO Transition

Graham O’Brien to Serve as Interim Chief Financial Officer Effective September 6

Vancouver, WA, August 5, 2024 - ZoomInfo, (NASDAQ: ZI) the go-to-market platform to find, acquire, and grow customers, today announced that Graham O’Brien, the company’s Vice President of FP&A, has been appointed by ZoomInfo’s Board of Directors as the company’s interim Chief Financial Officer beginning September 6, 2024. At that time, the company’s Board of Directors and Cameron Hyzer, Chief Financial Officer, have agreed that Mr. Hyzer will transition to serve in an advisory capacity until October 7, 2024 to facilitate a seamless transition. The company has initiated a search process to help identify a permanent successor.

Henry Schuck, ZoomInfo Founder and CEO, said, “I would like to thank Cameron for his significant contributions and leadership at ZoomInfo over the last six years, as we have grown to $1.2 billion in revenue, navigated the IPO process and public markets, and driven strong margins and cash flow. We are also fortunate to have Graham step up into the CFO role on an interim basis. I am confident he will effectively guide our finance team as we continue focusing on our strategic goals.”

Mr. Hyzer stated, “I am very proud to have helped lead the ZoomInfo team and I am confident the company is well positioned for success. This is the right time for me personally to start my next professional chapter, and I look forward to supporting the transition and being a resource for Henry and Graham.”

About Graham O’Brien

With a successful track record spanning various senior leadership roles, Mr. O’Brien brings extensive expertise in financial planning and analysis, accounting, and driving strategic corporate initiatives. At ZoomInfo, he serves as Vice President of FP&A, overseeing financial forecasting, budgeting, and reporting processes. Previously, Mr. O’Brien held roles at DiscoverOrg, RainKing Solutions, and Kaseya. He holds a B.S. in accounting from Lehigh University and is a licensed CPA in the District of Columbia.

Second Quarter 2024 Financial Results

In a separate press release issued today, ZoomInfo issued its second quarter 2024 financial results. A conference call is scheduled to begin today, August 5th, at 4:30 p.m. Eastern Time, 1:30 p.m. Pacific Time. To participate in the live conference call via telephone, please register here. Upon registering, a dial-in number and unique PIN will be provided to join the conference call. The call will also be webcast live on the Company’s investor relations website at https:// ir.zoominfo.com/, where related presentation materials will be posted prior to the conference call. Following the conference call, an archived webcast of the call will be available for one year on ZoomInfo’s Investor Relations website.

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those expressed or implied by these statements. You can generally identify our forward-looking statements by the words “anticipate”, “believe”, “can”, “continue”, “could”, “estimate”, “expect”, “forecast”, “goal”, “intend”, “may”, “might”, “objective”, “outlook”, “plan”, “potential”, “predict”, “projection”, “seek”, “should”, “target”, “trend”, “will”, “would” or the negative version of these words or other comparable words. Any statements in this press release regarding future revenue, earnings, margins, financial performance, cash flow, liquidity, or results of operations (including, but not limited to, the guidance provided under “Business Outlook”), and any other statements that are not historical facts are forward-looking statements. We have based our forward-looking statements on beliefs and assumptions based on information available to us at the time the statements are made. We caution you that assumptions, beliefs, expectations, intentions and projections about future events may, and often do, vary materially from actual results. Therefore, we cannot assure you that actual results will not differ materially from those expressed or implied by our forward-looking statements.

Factors that could cause actual results to differ from those expressed or implied by our forward-looking statements include, among other things: future economic, competitive, and regulatory conditions, potential future uses of cash, the successful integration of acquired businesses, and future decisions made by us and our competitors. All of these factors are difficult or impossible to predict accurately and many of them are beyond our control. For a further list and description of these and other important risks and uncertainties that may affect our future operations, see Part I, Item 1A - Risk Factors in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which we may update in Part II, Item 1A - Risk Factors in Quarterly Reports on Form 10-Q we have filed or will file hereafter. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, investments, or other strategic transactions we may make. Each forward-looking statement contained in this presentation speaks only as of the date of this press release, and we undertake no obligation to update or revise any forward-looking statements whether as a result of new information, future developments or otherwise, except as required by law.

About ZoomInfo

ZoomInfo (NASDAQ: ZI) is the trusted go-to-market platform for businesses to find, acquire, and grow their customers. It delivers accurate, real-time data, insights, and technology to more than 35,000 companies worldwide. Businesses use ZoomInfo to increase efficiency, consolidate, technology stacks, and align their sales and marketing teams - all in one platform. ZoomInfo is a recognized leader in data privacy, with industry-leading GDPR and CCPA compliance measures and numerous data security and privacy certifications. For more information about how ZoomInfo can help businesses grow their revenue at scale, please visit www.zoominfo.com.

Website Disclosure

ZoomInfo intends to use its website as a distribution channel of material company information. Financial and other important information regarding the Company is routinely posted on and accessible through the Company’s website at https://ir.zoominfo.com/. Accordingly, you should monitor the investor relations portion of our website at https://ir.zoominfo.com/ in addition to following our press releases, SEC filings, and public conference calls and webcasts. In addition, you may automatically receive email alerts and other information about ZoomInfo when you enroll your email address by visiting the “Email Alerts” section of our investor relations page at https://ir.zoominfo.com/.

###

Investor Contact:

Jeremiah Sisitsky

VP of Investor Relations

IR@zoominfo.com

Media Contact:

Meghan Barr

VP, Communications

(203) 216-1878

pr@zoominfo.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

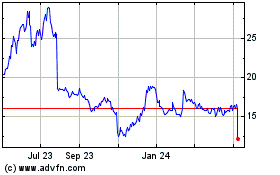

ZoomInfo Technologies (NASDAQ:ZI)

Historical Stock Chart

From Jul 2024 to Aug 2024

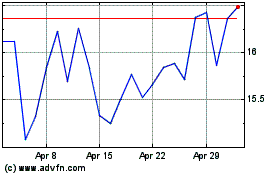

ZoomInfo Technologies (NASDAQ:ZI)

Historical Stock Chart

From Aug 2023 to Aug 2024