false

0001434647

0001434647

2025-03-11

2025-03-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): March 11, 2025

Zevra Therapeutics, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

001-36913

|

20-5894398

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

|

|

1180 Celebration Boulevard, Suite 103, Celebration, FL

|

|

34747 |

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (321) 939-3416

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

ZVRA

|

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 11, 2025, Zevra Therapeutics, Inc., a Delaware corporation (the "Company" or "Zevra"), issued a press release announcing its financial results for the fourth quarter and fiscal year ended December 31, 2024, as well as information regarding a conference call and live audio webcast to discuss its financial results and corporate updates scheduled for Tuesday, March 11, 2025, at 4:30 p.m. ET. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in the press release furnished as Exhibit 99.1 shall not be deemed “filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and is not incorporated by reference into any of Zevra's filings under the Securities Act of 1933, as amended, or under the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in any such filing.

Cautionary Statement Concerning Forward-Looking Statements

This Current Report on Form 8-K may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts, including without limitation statements regarding the Company’s estimated extent of and impacts of the restatements, the timing of the filing of the 2024 Form 10-K, and management's conclusions regarding the Company's internal control over financial reporting, disclosure controls and procedures, or any material weakness. Forward-looking statements are based on information currently available to Zevra and its current plans or expectations. They are subject to several known and unknown uncertainties, risks, and other important factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. These and other important factors are described in detail in the “Risk Factors” section of Zevra’s Annual Report on Form 10-K for the year ended December 31, 2023, as updated in Zevra’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, and Zevra’s other filings with the Securities and Exchange Commission. While we may elect to update such forward-looking statements at some point in the future, except as required by law, we disclaim any obligation to do so, even if subsequent events cause our views to change. Although we believe the expectations reflected in such forward-looking statements are reasonable, we cannot assure that such expectations will prove correct. These forward-looking statements should not be relied upon as representing our views as of any date after the date of this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

Zevra Therapeutics, Inc.

|

|

|

|

|

|

|

Date: March 11, 2025

|

|

By:

|

/s/ Timothy J. Sangiovanni

|

|

|

|

|

Timothy J. Sangiovanni, CPA

|

|

|

|

|

Senior Vice President, Finance and Corporate Controller

|

Exhibit 99.1

Zevra Reports Fourth Quarter and Full Year 2024

Financial Results

FY 2024 net revenue of $23.6 million, driven by record product net revenue of $10.2 million during

Q4 2024

Entered into asset purchase agreement for sale of PRV for $150 million

Company to host conference call and webcast today, Mar. 11, 2025, at 4:30 p.m. ET

CELEBRATION, Fla., Mar. 11, 2025 -- Zevra Therapeutics, Inc. (NasdaqGS: ZVRA) (Zevra, or the Company), a commercial-stage company focused on providing therapies for people living with rare disease, today reported its financial results for the fourth quarter and full year ended Dec. 31, 2024.

“2024 was a transformational year for Zevra. We emerged as a commercial stage company and are executing on the opportunity to positively impact the lives of people living with rare diseases,” said Neil F. McFarlane, Zevra’s President and Chief Executive Officer. “We are starting 2025 from a position of strength. Our priorities are guided by Zevra’s strategic plan, unveiled during our third quarter call and categorized under four actionable pillars: commercial excellence, pipeline and innovation, talent and culture, and corporate foundation.”

Commercial Excellence

| |

●

|

Initiated commercial launch of MIPLYFFA immediately following U.S. FDA approval on Sep. 20, 2024, and organized U.S. commercial availability on Nov. 21, 2024, at the early end of the company’s guidance.

|

| |

●

|

As of Dec. 31, 2024, Zevra received 109 total prescription enrollment forms for MIPLYFFA, including all active U.S. Expanded Access Program (EAP) participants. To date in this early phase of the launch, patients have received payor authorization through direct formulary coverage or via the medical exception process as Zevra’s market access team continues to engage with payors to formalize coverage.

|

| |

●

|

OLPRUVA® had 4 new patient enrollments during Q4 2024 as the team began to execute on its strategy to target adult UCD patients with an active lifestyle where enhanced portability and ease of administration is an important benefit; market access remains consistent at 76% of covered lives.

|

Pipeline and Innovation

| |

●

|

With receipt of the U.S. approval for MIPLYFFA, regulatory approval in the EU is a key priority. Filing of the Marketing Authorisation Application with the European Medicines Agency (EMA) is targeted for the second half of 2025.

|

| |

●

|

New data presented during the WORLDSymposium included eight (8) poster presentations, with one poster highlighting safety and tolerability outcomes of MIPLYFFA in NPC patients aged 6 months to <24 months from a pediatric sub-study to the pivotal phase 3 trial was presented.

|

| |

●

|

As of Dec. 31, 2024, eight additional patients enrolled in the Phase 3 DiSCOVER trial of celiprolol for the treatment of Vascular Ehlers-Danlos Syndrome (VEDS), bringing the total patients enrolled to 27. Zevra is focused on expanding its recruitment efforts through direct outreach with providers and clinics that treat genetically confirmed COL3A1 patients.

|

| |

●

|

Zevra continues its evaluation of strategic alternatives to advance the clinical development and potential future commercialization of KP1077 for the treatment of rare sleep disorders.

|

Talent and Culture

| |

●

|

In Q4 2024, Zevra consolidated its development and scientific functions under the leadership of Adrian Quartel, M.D. FFPM, Zevra’s Chief Medical Officer, for success with continuity of leadership and the appropriate span of control to achieve objectives.

|

Corporate Foundation

| |

●

|

On Feb. 27, 2025, Zevra entered into an asset purchase agreement for the sale of a Rare Pediatric Disease Priority Review Voucher (PRV), issued by the U.S. FDA upon the approval of MIPLYFFA, for $150 million.

|

FY 2024 Financial Highlights

| |

●

|

Revenue, Net: $23.6 million, comprised of $10.1 million in MIPLYFFA net revenue, $0.1 million in OLPRUVA net revenue, $9.1 million in in net reimbursements from the French expanded access program (EAP) for arimoclomol, and $4.3 million in royalties and other reimbursements under the AZSTARYS® license agreement. For full year 2023, net revenue was $27.5 million, which was primarily driven by $18.8 million in royalties, net sales milestone payments and other reimbursements under the AZSTARYS license agreement and included $15 million in one-time net sales milestone payments, and $8.7 million in net reimbursements under the French EAP for arimoclomol.

|

| |

●

|

Cost of Goods Sold: $13.7 million, which includes $6.2 million of non-cash intangible asset amortization, and $5.7 million in inventory obsolescence reserve expense related to OLPRUVA inventory during the year.

|

| |

●

|

Operating Expense: $97.0 million, which includes non-cash stock compensation expense of $14.9 million, of which $2.4 million was accelerated vesting related to severance arrangements, and severance expense of $2.7 million which was recognized as part of both R&D and SG&A expenses during the year.

|

| |

●

|

R&D expenses were $42.1 million, which was an increase of $2.3 million compared to FY 2023 due to an increase of $6.3 million in personnel-related costs offset by a decrease of $3.6 million in third party costs primarily as a result of the completion of the KP1077 phase 2 trial.

|

| |

●

|

SG&A expenses were $54.9 million for 2024, compared to $34.3 million for 2023, which reflects the commercial team fully in place and actively engaged in commercial launch activities.

|

| |

●

|

Net Loss: ($105.5) million, or ($2.28) per basic and diluted share for 2024, compared to a net loss of ($46.0) million, or ($1.30) per basic and diluted share for 2023.

|

| |

●

|

Cash Position: Cash, cash equivalents and investments were $75.5 million as of Dec. 31, 2024. On Feb. 26, 2025, we entered into an agreement to sell the PRV for $150 million in gross proceeds, which upon closing is expected to provide net proceeds of $148.3 million, after fees.

|

| |

●

|

Cash Runway Forecast: Given our execution to date on the MIPLYFFA and OLPRUVA commercial launches and the sale of the PRV, our Form 10-K will not include a Going Concern disclosure. Based on our current operating forecast, existing resources extend our cash runway into 2029. The cash runway forecast does not include proceeds from the sale of the PRV, but it does include anticipated net revenue from MIPLYFFA and OLPRUVA sales, net reimbursements from the French EAP for arimoclomol, royalties under the AZSTARYS license agreement, and continued investments into our development pipeline.

|

| |

●

|

Common and Fully Diluted Shares O/S: As of Dec. 31, 2024, total shares of common stock outstanding were 53,670,709, and fully diluted common shares were 66,943,904, which included 7,789,658 issuable from outstanding awards under equity incentive plans, and 5,483,537 shares issuable upon exercise of warrants.

|

Q4 2024 Financial Highlights

| |

●

|

Revenue, Net: $12.0 million for Q4 2024, which includes $10.1 million of MIPLYFFA net revenue, $0.1 million of OLPRUVA net revenue, $1.1 million in net reimbursements from the French EAP for arimoclomol, which was a decrease of $0.7 million compared to Q4 2023 due to a true-up in program access fees, and royalties and other reimbursements of $0.7 million under the AZSTARYS License Agreement. Net revenue for Q4 2023 was $13.2 million and included a one-time net sales milestone payment of $10 million under the AZSTARYS License Agreement.

|

| |

●

|

Cost of Goods Sold: $3.0 million for Q4 2024, which includes $1.6 million of non-cash intangible asset amortization.

|

| |

●

|

Operating Expense: $24.5 million for Q4 2024, which includes non-cash stock compensation expense of $4.0 million, of which $2.1 million was accelerated vesting expense related to severance arrangements, and severance expense of $1.6 million.

|

| |

●

|

R&D expenses were $8.4 million for Q4 2024, which was a decrease of $3.0 million compared to Q4 2023 due primarily to a decrease in third party costs upon completion of the KP1077 phase 2 trial, offset in part by an increase in personnel-related costs due to recognition of $2.1 million of non-cash stock compensation expense related to severance arrangements, and $1.6 million of severance expense during the quarter.

|

| |

●

|

SG&A expenses were $16.1 million for Q4 2024, which was an increase of $1.4 million compared to $14.7 million for Q4 2023, due primarily to an increase in personnel-related costs for the commercial team being fully in place and actively engaged in commercial launch activities and patient services initiatives.

|

| |

●

|

Net Loss: ($35.7) million, or ($0.67) per basic and diluted share for Q4 2024, compared to a net loss of ($19.6) million, or ($0.51) per basic and diluted share in Q4 2023.

|

Upcoming Events

| |

●

|

Zevra will participate in a fireside chat at the 37th Annual ROTH Conference, on Monday, Mar. 17, 2025, at 2:00 p.m. PT. Management will be available for one-on-one meetings with registered attendees.

|

Conference Call Information

Zevra will host a conference call and audio webcast today at 4:30 p.m. ET to discuss its corporate update and financial results for the fourth quarter and full year 2024.

The audio webcast will be accessible via the Investor Relations section of the Company’s website, http://investors.zevra.com/. An archive of the audio webcast will be available for ninety (90) days beginning at approximately 5:30 p.m. ET on Mar. 11, 2025.

Additionally, interested participants and investors may access the conference call by dialing either:

| |

●

|

(800) 245-3047 (United States)

|

| |

●

|

+1 (203) 518-9765 (International)

|

| |

●

|

Conference ID: ZVRAQ424

|

About MIPLYFFATM (arimoclomol)

MIPLYFFA (arimoclomol) is Zevra’s approved therapy for the treatment of Niemann-Pick disease type C (NPC). Approved by the U.S. Food and Drug Administration on Sep. 20, 2024, MIPLYFFA (arimoclomol) increases the activation of the transcription factors EB (TFEB) and E3 (TFE3) resulting in the upregulation of coordinated lysosomal expression and regulation (CLEAR) genes. MIPLYFFA has also been shown to reduce unesterified cholesterol in the lysosomes of human NPC fibroblasts. The clinical significance of these findings is not fully understood. In the pivotal phase 3 trial, MIPLYFFA halted disease progression compared to placebo over the one-year duration of the trial when measured by the only validated disease progression measurement tool, the NPC Clinical Severity Scale. MIPLYFFA has also received Orphan Medicinal Product designation by the European Medicines Agency (EMA) for the treatment of NPC.

INDICATIONS AND USAGE

MIPLYFFA is indicated for use in combination with miglustat for the treatment of neurological manifestations of Niemann-Pick disease type C (NPC) in adult and pediatric patients 2 years of age and older.

IMPORTANT SAFETY INFORMATION

Hypersensitivity Reactions:

Hypersensitivity reactions such as urticaria and angioedema have been reported in patients treated with MIPLYFFA during Trial 1: two patients reported both urticaria and angioedema (6%) and one patient (3%) experienced urticaria alone within the first two months of treatment. Discontinue MIPLYFFA in patients who develop severe hypersensitivity reactions. If a mild or moderate hypersensitivity reaction occurs, stop MIPLYFFA and treat promptly. Monitor the patient until signs and symptoms resolve.

Embryofetal Toxicity:

MIPLYFFA may cause embryofetal harm when administered during pregnancy based on findings from animal reproduction studies. Advise pregnant females of the potential risk to the fetus and consider pregnancy planning and prevention for females of reproductive potential.

Increased Creatinine without Affecting Glomerular Function:

Across clinical trials of MIPLYFFA, mean increases in serum creatinine of 10% to 20% compared to baseline were reported. These increases occurred mostly in the first month of MIPLYFFA treatment and were not associated with changes in glomerular function.

During MIPLYFFA treatment, use alternative measures that are not based on creatinine to assess renal function. Increases in creatinine reversed upon MIPLYFFA discontinuation.

The most common adverse reactions in Trial 1 (≥15%) in MIPLYFFA-treated patients who also received miglustat were upper respiratory tract infection, diarrhea, and decreased weight.

Three (6%) of the MIPLYFFA-treated patients had the following adverse reactions that led to withdrawal from Trial 1: increased serum creatinine (one patient), and progressive urticaria and angioedema (two patients). Serious adverse reactions reported in MIPLYFFA-treated patients were hypersensitivity reactions including urticaria and angioedema.

To report SUSPECTED ADVERSE REACTIONS, contact Zevra Therapeutics, Inc. at toll-free phone 1-844-600-2237 or FDA at 1‑800-FDA-1088 or www.fda.gov/medwatch.

Drug Interaction(s):

Arimoclomol is an inhibitor of the organic cationic transporter 2 (OCT2) transporter and may increase the exposure of drugs that are OCT2 substrates. When MIPLYFFA is used concomitantly with OCT2 substrates, monitor for adverse reactions and reduce the dosage of the OCT2 substrate.

Use in Females and Males of Reproductive Potential:

Based on animal findings, MIPLYFFA may impair fertility and may increase post-implantation loss and reduce maternal, placental, and fetal weights.

Renal Impairment:

The recommended dosage of MIPLYFFA, in combination with miglustat, in patients with an eGFR ≥15 mL/minute to <50 mL/minute is lower than the recommended dosage (less frequent dosing) in patients with normal renal function.

MIPLYFFA capsules for oral use are available in the following strengths: 47 mg, 62 mg, 93 mg, and 124 mg.

About OLPRUVA®

OLPRUVA (sodium phenylbutyrate) is Zevra’s approved treatment for the treatment of certain UCDs. OLPRUVA (sodium phenylbutyrate) for oral suspension is a prescription medicine used along with certain therapies, including changes in diet, for the long-term management of adults and children weighing 44 pounds (20 kg) or greater and with a body surface area (BSA) of 1.2 m2 or greater, with UCDs, involving deficiencies of carbamylphosphate synthetase (CPS), ornithine transcarbamylase (OTC), or argininosuccinic acid synthetase (AS). OLPRUVA is not used to treat rapid increase of ammonia in the blood (acute hyperammonemia), which can be life-threatening and requires emergency medical treatment. For more information, please visit www.OLPRUVA.com.

Important Safety Information

Certain medicines may increase the level of ammonia in your blood or cause serious side effects when taken during treatment with OLPRUVA. Tell your doctor about all the medicines you or your child take, especially if you or your child take corticosteroids, valproic acid, haloperidol, and/or probenecid.

OLPRUVA can cause serious side effects, including: 1) nervous system problems (neurotoxicity). Symptoms include sleepiness, tiredness, lightheadedness, vomiting, nausea, headache, confusion, 2) low potassium levels in your blood (hypokalemia) and 3) conditions related to swelling (edema). OLPRUVA contains salt (sodium), which can cause swelling from salt and water retention. Tell your doctor right away if you or your child get any of these symptoms. Your doctor may do certain blood tests to check for side effects during treatment with OLPRUVA. If you have certain medical conditions such as heart, liver or kidney problems, are pregnant/planning to get pregnant or breast-feeding, your doctor will decide if OLPRUVA is right for you.

The most common side effects of OLPRUVA include absent or irregular menstrual periods, decreased appetite, body odor, bad taste or avoiding foods you ate prior to getting sick (taste aversion). These are not all of the possible side effects of OLPRUVA. Call your doctor for medical advice about side effects. You may report side effects to U.S. FDA at 1-800-FDA-1088.

About Celiprolol

Celiprolol is Zevra’s investigational clinical candidate for the treatment of Vascular Ehlers-Danlos Syndrome (VEDS). Celiprolol has been granted Orphan Drug and Breakthrough Therapy designations by the U.S. FDA. Zevra recently restarted enrollment in the DiSCOVER trial, a Phase 3 trial being conducted under a Special Protocol Assessment (SPA) agreement with the U.S. FDA. Celiprolol’s mechanism of action is designed to reduce the mechanical stress on collagen fibers within the arterial wall through vascular dilation and smooth muscle relaxation.

About KP1077

KP1077 is Zevra’s product candidate intended for the treatment of rare sleep disorders, and is comprised of serdexmethylphenidate (SDX), Zevra’s proprietary prodrug of d-methylphenidate (d-MPH) and is the sole active pharmaceutical ingredient of KP1077. KP1077 has been granted Orphan Drug designation by the U.S. Food and Drug Administration, and by the European Commission, for the treatment of Idiopathic Hypersomnia (IH). The U.S. Drug Enforcement Agency has classified SDX as a Schedule IV controlled substance based on evidence suggesting SDX has a lower potential for abuse when compared to d-MPH, a Schedule II controlled substance.

About Zevra Therapeutics, Inc.

Zevra Therapeutics, Inc. is a commercial-stage rare disease company combining science, data, and patient need to create transformational therapies for diseases with limited or no treatment options. Our mission is to bring life-changing therapeutics to people living with rare diseases. With unique, data-driven development and commercialization strategies, the Company is overcoming complex drug development challenges to make new therapies available to the rare disease community.

Expanded access programs are made available by Zevra Therapeutics, Inc. and its affiliates and are subject to the Company's Expanded Access Program (EAP) policy, as published on its website. Participation in these programs is subject to the laws and regulations of each jurisdiction under which each respective program is operated. Eligibility for participation in any such program is at the treating physician's discretion.

For more information, please visit www.zevra.com or follow us on X and LinkedIn.

Cautionary Note Concerning Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts, including without limitation statements regarding the sale of the PRV and anticipated proceeds therefrom; promise and potential impact of our preclinical or clinical trial data; the initiation, timing and results of any clinical trials or readouts, the content, information used for, timing or results of any NDA submissions or resubmissions for any products or product candidates for any specific disease indication or at any dosage; the potential benefits of any of our products or product candidates for any specific disease or at any dosage; future research and development activities; our strategic and product development objectives, including with respect to becoming a leading, commercially focused rare disease company; the potential benefits of our debt facility; our financial position, including our cash balance and anticipated cash runway; potential revenues from MIPLYFFA sales; potential revenues from our arimoclomol expanded access program in France; the potential for royalty and milestone contributions, the presentation of data at conferences; and the timing of any of the foregoing. Forward-looking statements are based on information currently available to Zevra and its current plans or expectations. They are subject to several known and unknown uncertainties, risks, and other important factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements, including that the PRV sale is subject to conditions and may not close in the timeframe expected or at all. These and other important factors are described in detail in the “Risk Factors” section of Zevra’s Annual Report on Form 10-K for the year ended December 31, 2024, and Zevra’s other filings with the Securities and Exchange Commission. While we may elect to update such forward-looking statements at some point in the future, except as required by law, we disclaim any obligation to do so, even if subsequent events cause our views to change. Although we believe the expectations reflected in such forward-looking statements are reasonable, we cannot assure that such expectations will prove correct. These forward-looking statements should not be relied upon as representing our views as of any date after the date of this press release.

Zevra Contact

Nichol Ochsner

+1 (732) 754-2545

nochsner@zevra.com

ZEVRA THERAPEUTICS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts)

| |

|

Year Ended December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

Revenue, net

|

|

$ |

23,612 |

|

|

$ |

27,461 |

|

|

Cost of product revenue (excluding $6,235 and $772 in intangible asset amortization for the years ended December 31, 2024, and 2023, respectively, shown separately below)

|

|

|

7,417 |

|

|

|

2,173 |

|

|

Intangible asset amortization

|

|

|

6,235 |

|

|

|

772 |

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

42,095 |

|

|

|

39,806 |

|

|

Selling, general and administrative

|

|

|

54,868 |

|

|

|

34,314 |

|

|

Total operating expenses

|

|

|

96,963 |

|

|

|

74,120 |

|

|

Loss from operations

|

|

|

(87,003 |

) |

|

|

(49,604 |

) |

|

Other (expense) income:

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(7,351 |

) |

|

|

(1,501 |

) |

|

Fair value adjustment related to warrant and CVR liability

|

|

|

2,057 |

|

|

|

(98 |

) |

|

Fair value adjustment related to investments

|

|

|

(18 |

) |

|

|

613 |

|

|

Interest and other income, net

|

|

|

2,175 |

|

|

|

4,541 |

|

|

Total other (expense) income

|

|

|

(3,137 |

) |

|

|

3,555 |

|

|

Loss before income taxes

|

|

|

(90,140 |

) |

|

|

(46,049 |

) |

|

Income tax expense

|

|

|

(15,371 |

) |

|

|

- |

|

|

Net loss

|

|

$ |

(105,511 |

) |

|

$ |

(46,049 |

) |

| |

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share of common stock:

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(2.28 |

) |

|

$ |

(1.30 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted average number of shares of common stock outstanding:

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

46,251,239 |

|

|

|

35,452,460 |

|

ZEVRA THERAPEUTICS, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and par value amounts)

| |

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

33,785 |

|

|

$ |

43,049 |

|

|

Securities at fair value, current

|

|

|

35,711 |

|

|

|

24,688 |

|

|

Accounts and other receivables

|

|

|

10,509 |

|

|

|

17,377 |

|

|

Prepaid expenses and other current assets

|

|

|

4,052 |

|

|

|

1,824 |

|

|

Inventories, current

|

|

|

1,970 |

|

|

|

- |

|

|

Total current assets

|

|

|

86,027 |

|

|

|

86,938 |

|

|

Securities at fair value, noncurrent

|

|

|

6,010 |

|

|

|

- |

|

|

Inventories, noncurrent

|

|

|

10,999 |

|

|

|

9,841 |

|

|

Property and equipment, net

|

|

|

356 |

|

|

|

736 |

|

|

Operating lease right-of-use assets

|

|

|

657 |

|

|

|

790 |

|

|

Goodwill

|

|

|

4,701 |

|

|

|

4,701 |

|

|

Intangible assets, net

|

|

|

68,993 |

|

|

|

69,227 |

|

|

Other long-term assets

|

|

|

384 |

|

|

|

94 |

|

|

Total assets

|

|

$ |

178,127 |

|

|

$ |

172,327 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$ |

25,456 |

|

|

$ |

28,403 |

|

|

Line of credit payable

|

|

|

- |

|

|

|

37,700 |

|

|

Current portion of operating lease liabilities

|

|

|

420 |

|

|

|

543 |

|

|

Current portion of discount and rebate liabilities

|

|

|

4,989 |

|

|

|

4,550 |

|

|

Other current liabilities

|

|

|

3,200 |

|

|

|

2,524 |

|

|

Total current liabilities

|

|

|

34,065 |

|

|

|

73,720 |

|

|

Long-term debt

|

|

|

59,504 |

|

|

|

5,066 |

|

|

Derivative and warrant liability

|

|

|

17,804 |

|

|

|

16,100 |

|

|

Income tax payable, noncurrent

|

|

|

14,431 |

|

|

|

- |

|

|

Operating lease liabilities, less current portion

|

|

|

372 |

|

|

|

456 |

|

|

Discount and rebate liabilities, less current portion

|

|

|

7,655 |

|

|

|

7,663 |

|

|

Other long-term liabilities

|

|

|

4,630 |

|

|

|

7,458 |

|

|

Total liabilities

|

|

|

138,461 |

|

|

|

110,463 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock:

|

|

|

|

|

|

|

|

|

| Undesignated preferred stock, $0.0001 par value, 10,000,000 shares authorized, no shares issued or outstanding as of December 31, 2024 or December 31, 2023 |

|

|

- |

|

|

|

- |

|

|

Common stock, $0.0001 par value, 250,000,000 shares authorized, 55,246,401 shares issued and 53,670,709 shares outstanding as of December 31, 2024; 43,110,360 shares issued and 41,534,668 shares outstanding as of December 31, 2023

|

|

|

5 |

|

|

|

4 |

|

|

Additional paid-in capital

|

|

|

555,302 |

|

|

|

472,664 |

|

|

Treasury stock, at cost

|

|

|

(10,983 |

) |

|

|

(10,983 |

) |

|

Accumulated deficit

|

|

|

(505,289 |

) |

|

|

(399,778 |

) |

|

Accumulated other comprehensive income (loss)

|

|

|

631 |

|

|

|

(43 |

) |

|

Total stockholders' equity

|

|

|

39,666 |

|

|

|

61,864 |

|

|

Total liabilities and stockholders' equity

|

|

$ |

178,127 |

|

|

$ |

172,327 |

|

v3.25.0.1

Document And Entity Information

|

Mar. 11, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Zevra Therapeutics, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Mar. 11, 2025

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-36913

|

| Entity, Tax Identification Number |

20-5894398

|

| Entity, Address, Address Line One |

1180 Celebration Boulevard, Suite 103

|

| Entity, Address, City or Town |

Celebration

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

34747

|

| City Area Code |

321

|

| Local Phone Number |

939-3416

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ZVRA

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001434647

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

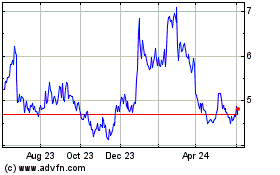

Zevra Therapeutics (NASDAQ:ZVRA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Zevra Therapeutics (NASDAQ:ZVRA)

Historical Stock Chart

From Mar 2024 to Mar 2025