Albertsons Companies, Inc. Announces Pricing of Its Senior Notes Offering

20 February 2025 - 8:05AM

Business Wire

Albertsons Companies, Inc. (NYSE: ACI) (the “Company”) today

announced the pricing of its private offering of $600 million

aggregate principal amount of its 6.250% senior notes due 2033 (the

“Notes”). The Company and its subsidiaries, Safeway Inc., New

Albertsons L.P., Albertson’s LLC and Albertsons Safeway LLC, will

be co-issuers of the Notes. The offering is expected to close on or

about March 11, 2025, subject to customary closing conditions.

The Company intends to use the net proceeds from the offering,

together with cash on hand, to (i) redeem in full the $600 million

outstanding of its 7.500% senior notes due 2026 which are scheduled

to mature on March 15, 2026 (the “Refinancing”) and (ii) pay fees

and expenses related to the Refinancing and the issuance of the

Notes.

The Notes were offered in the United States to persons

reasonably believed to be qualified institutional buyers pursuant

to Rule 144A under the Securities Act of 1933, as amended (the

“Securities Act”), and to persons outside the United States in

compliance with Regulation S under the Securities Act. The Notes

have not been registered under the Securities Act and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of the

Notes in any jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. This notice is being

issued pursuant to and in accordance with Rule 135c under the

Securities Act.

About Albertsons Companies

Albertsons Companies is a leading food and drug retailer in the

United States. As of November 30, 2024, the Company operated 2,273

retail food and drug stores with 1,732 pharmacies, 405 associated

fuel centers, 22 dedicated distribution centers and 19

manufacturing facilities. The Company operates stores across 34

states and the District of Columbia under more than 20 well known

banners including Albertsons, Safeway, Vons, Jewel-Osco, Shaw’s,

ACME, Tom Thumb, Randalls, United Supermarkets, Pavilions, Star

Market, Haggen, Carrs, Kings Food Markets and Balducci’s Food

Lovers Market. In 2023, along with the Albertsons Companies

Foundation, the Company contributed more than $350 million in food

and financial support, including more than $35 million through our

Nourishing Neighbors Program to ensure those living in our

communities and those impacted by disasters have enough to eat.

Important Notice Regarding Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of the federal securities laws. The

“forward-looking statements” include our current expectations,

assumptions, estimates and projections about our ability to

consummate the offering of Notes, the intended use of proceeds

thereof, other pending transactions, and other future events. They

include statements which the Company believes to be reasonable at

this time. You can identify forward-looking statements by the use

of words such as “outlook,” “may,” “should,” “could,” “estimates,”

“predicts,” “potential,” “continue,” “anticipates,” “believes,”

“plans,” “expects,” “future” and “intends” and similar expressions

which are intended to identify forward-looking statements.

These statements are not guarantees of future performance and

are subject to numerous risks and uncertainties which are beyond

our control and difficult to predict and could cause actual results

to differ materially from the results expressed or implied by the

statements.

All forward-looking statements attributable to us or persons

acting on our behalf are expressly qualified in their entirety by

these cautionary statements and risk factors. Forward-looking

statements contained in this press release reflect our view only as

of the date of this press release. We undertake no obligation,

other than as required by law, to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. In evaluating our forward-looking

statements, you should carefully consider the risks and

uncertainties more fully described in the “Risk Factors” section or

other sections in our reports filed with the SEC including the most

recent annual report on Form 10-K and any subsequent periodic

reports on Form 10-Q and current reports on Form 8-K.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219223596/en/

For Investor Relations, contact

investor-relations@albertsons.com For Media Relations, contact

media@albertsons.com

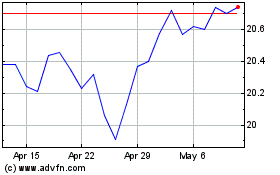

Albertsons Companies (NYSE:ACI)

Historical Stock Chart

From Jan 2025 to Feb 2025

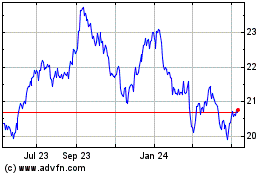

Albertsons Companies (NYSE:ACI)

Historical Stock Chart

From Feb 2024 to Feb 2025