FALSE0001703056000170305600017030562024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | | | | |

| | |

| FORM 8-K | |

| | |

| CURRENT REPORT | |

| | |

| Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934 |

Date of Report (Date of earliest event reported): August 1, 2024 | | | | | | | | |

| | |

| | |

| ADT Inc. | |

| (Exact name of registrant as specified in its charter) |

| | |

| | | | | | | | |

| Delaware | 001-38352 | 47-4116383 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

| 1501 Yamato Road Boca Raton, Florida 33431 | |

| (Address of principal executive offices) | |

Registrant’s telephone number, including area code: (561) 988-3600

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | ADT | | New York Stock Exchange |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On August 1, 2024, ADT Inc. (the “Company”) issued a press release announcing its financial results for the three and six months ended June 30, 2024. A copy of the Company’s press release is being furnished herewith as Exhibit 99.1 and is incorporated herein by reference in its entirety.

Item 7.01 Regulation FD Disclosure.

Common Stock Dividends

In the press release issued on August 1, 2024, the Company also announced a dividend of $0.055 per share to holders of the Company’s common stock and Class B common stock of record on September 13, 2024. The dividend will be paid on October 4, 2024.

The information furnished in this Form 8-K, including pursuant to Items 2.02 and 7.01 and including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit | Description |

| |

| |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | August 1, 2024 | ADT Inc. |

| | | |

| | By: | /s/ Jeffrey Likosar |

| | | Jeffrey Likosar |

| | | President, Corporate Development and Transformation, and Chief Financial Officer |

ADT Reports Second Quarter 2024 Results

Continued strong operating cash generation

Solid revenue growth, up 3% versus prior year period

Improved leverage and over $150 million debt reduction in the quarter

Affirming full year 2024 guidance metrics

BOCA RATON, Fla., Aug. 1, 2024 – ADT Inc. (NYSE: ADT), the most trusted brand in smart home and small business security, today reported results for the second quarter of 2024.

Financial highlights for the second quarter are below with variances on a year-over-year basis unless otherwise noted. Results of the former commercial and solar segments are presented as discontinued operations, except for cash flow measures.

Second Quarter 2024

•Total revenue increased by 3% to $1.2 billion and end-of-period recurring monthly revenue (RMR) increased 2% to $355 million ($4.3 billion on an annualized basis)

•Strong customer retention with gross revenue attrition of 12.9% and revenue payback at 2.2 years

•GAAP income from continuing operations of $126 million, or $0.13 per diluted share, down $54 million

•Adjusted income from continuing operations of $156 million, or $0.17 per diluted share, up $3 million

•Adjusted EBITDA from continuing operations of $629 million, down $12 million

“ADT delivered a solid first half with continued revenue growth momentum, as well as strong operating profitability and cash flow generation. With our streamlined focus on the consumer and small business markets, we continue to expand and improve our innovative offerings, unrivaled safety, and premium experience for security and smart home customers,” said ADT Chairman, President, and CEO, Jim DeVries. “Our success is powered by our employees’ dedication to the proposition that every second counts. We are well positioned to achieve our 2024 commitments with continued focus on driving significant cash flow while continuing to invest in our future and simultaneously returning capital to our shareholders.”

Business Highlights

•ADT+ platform for professional installation – The Company continued its phased rollout of the ADT+ platform across the country in the second quarter. Customers can now take advantage of next-generation hardware and technology through a proprietary app, which is designed to be the conduit for future innovations such as Trusted Neighbor.

•ADT’s Trusted Neighbor – The Company announced its new Trusted Neighbor offering in partnership with Google and Yale. ADT’s Trusted Neighbor lets customers grant secure, temporary access to their homes based on schedules or events, such as a package delivery or water leak, through the ADT+ app. The offering is expected to become available for select new customers in the third quarter of 2024.

•Implementing AI in operations – In addition to its strong Google Nest partnership, ADT is leveraging Google Cloud’s AI technology platform to enhance efficiency in its business and enhance the customer experience. Early efforts focus on implementing AI in customer care operations and customer retention programs.

•Alarm Scoring live nationwide – ADT’s Alarm Scoring program rolled out nationwide in the second quarter. With this innovative method of classifying alarms, first responders receive the most precise and crucial alarm data to prioritize dispatch.

•Monitoring Center of the Year – ADT won The Monitoring Association’s Monitoring Center of the Year award, recognizing ADT’s significant contribution to the alarm industry, including demonstration of exceptional customer service.

•When Every Second Counts – ADT introduced its new brand promise: When Every Second Counts. The Company launched new advertisements on social media platforms, major television networks, streaming services and in theaters, as well as placements in the summer Olympic Games.

•Mental Health America certification – Mental Health America awarded ADT a Platinum-level Bell Seal certification, the highest level of certification, for its commitment to improving employee mental health.

•ADT Multifamily Partnership – ADT Multifamily announced a partnership with RPM Living, a leading multifamily property management company overseeing more than 200,000 units. ADT Multifamily is the preferred automation vendor for RPM living.

Results of Continuing Operations (1)(2)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except revenue payback, attrition, and per share data) | | Three Months Ended June 30, | |

| 2024 | | 2023 | | $ Change | | % Change | | | |

| GAAP |

| Monitoring and related services | | $ | 1,068 | | $ | 1,043 | | $ | 25 | | 2% | | | |

| Security installation, product, and other | | 136 | | 125 | | 12 | | 9% | | | |

Total revenue | | $ | 1,205 | | $ | 1,168 | | $ | 36 | | 3% | | | |

| | | | | | | | | | | |

Income (loss) from continuing operations | | $ | 126 | | | $ | 180 | | | $ | (54) | | | (30) | % | | | |

| | | | | | | | | | | |

| Income (loss) from continuing operations per share - diluted | | $ | 0.13 | | | $ | 0.19 | | | $ | (0.06) | | | (32) | % | | | |

| | | | | | | | | | | |

| Net cash provided by (used in): | | | | | | | | | | | |

| Operating activities | | $ | 563 | | | $ | 493 | | | $ | 70 | | | 14 | % | | | |

| Investing activities | | $ | (333) | | | $ | (319) | | | $ | (14) | | | 4 | % | | | |

| Financing activities | | $ | (200) | | | $ | (217) | | | $ | 17 | | | (8) | % | | | |

| | | | | | | | | | | |

| | Non-GAAP Measures |

Adjusted EBITDA from continuing operations | | $ | 629 | | | $ | 641 | | | $ | (12) | | | (2) | % | | | |

Adjusted Income (Loss) from continuing operations | | $ | 156 | | | $ | 153 | | | $ | 3 | | | 2 | % | | | |

Adjusted Diluted Income (Loss) per share from continuing operations | | $ | 0.17 | | | $ | 0.17 | | | $ | — | | | — | % | | | |

| | | | | | | | | | | |

| Adjusted Free Cash Flow (including interest rate swaps) | | $ | 251 | | | $ | 221 | | | $ | 30 | | | 14 | % | | | |

| | | | | | | | | | | |

| | Other Measures |

| Trailing twelve-month revenue payback | | 2.2 years | | 2.1 years | | 0.1 | | | 5 | % | | | |

| Trailing twelve-month gross customer revenue attrition | | 12.9 | % | | 12.9 | % | | — | | | — | | | | |

| End of period RMR | | $ | 355 | | | $ | 348 | | | $ | 8 | | | 2 | % | | | |

Total revenue was $1,205 million for the second quarter, up 3%. Monitoring and related services (M&S) revenue growth was driven by an increase in the recurring revenue base due primarily to higher average pricing. Security installation, product, and other revenue increased primarily from higher amortization of deferred subscriber acquisition revenue.

Income from continuing operations was $126 million, or $0.13 per diluted share, down $54 million. This was primarily attributable to a current year charge and prior year credit related to legal settlements in aggregate amount of approximately $40 million, an increase in the allowance for credit losses, and higher net interest expense due to a decrease in unrealized gains on interest rate swaps, partially offset by continued recurring revenue growth.

Adjusted income from continuing operations was $156 million, or $0.17 per diluted share, up $3 million. Adjusted EBITDA was $629 million, down $12 million. These measures included improvements from increases in recurring revenue, and were negatively impacted by the aforementioned legal settlements and allowance for credit losses.

Balance Sheet and Cash Flow

Net cash provided by operating activities during the second quarter was $563 million, up $70 million or 14% and Adjusted Free Cash Flow (including interest rate swaps) increased by $30 million. These measures, which benefited from lower cash interest resulting from debt reduction and timing of working capital and other items, were partially offset by the net results of the commercial and solar businesses. In addition, Adjusted Free Cash Flow also includes the lower net cash flows associated with the receivables facility.

The Company returned $50 million to shareholders in dividends. As of June 30, 2024, approximately $257 million remains available for future repurchases under the Share Repurchase Plan.

Total cash and cash equivalents were $38 million and no amounts were outstanding under the Company’s first lien revolving credit facility at the end of the quarter.

In April, the Company redeemed the remaining $100 million of its First Lien Senior Secured Notes due 2024 and completed a repricing of the $1.4 billion First Lien Term Loan B reducing borrowing costs by 25 basis points. There are no other significant debt maturities until 2026.

In May, the Company amended and restated its First Lien Credit Agreement, which included the refinancing of $618 million principal amount of loans under the Company’s Term Loan A Facility for its First Lien Term Loan B due 2030. The Term Loan A Facility has been terminated, and there is approximately $2.0 billion of First Lien Term Loan B outstanding.

2024 Financial Outlook

The Company is reiterating its 2024 financial guidance for Total Revenue, Adjusted EBITDA, and Adjusted Free Cash Flow while updating the range for Adjusted EPS to reflect the presentation of the solar business as a discontinued operation.

| | | | | | | | |

(in millions, except per share data) | | |

Total Revenue | | $4,800 - $5,000 |

Adjusted EBITDA | | $2,525 - $2,625 |

Adjusted EPS | | $0.65 - $0.75 |

Adjusted Free Cash Flow (including interest rate swaps) | | $700 - $800 |

| | |

The Company is not providing forward-looking guidance for U.S. GAAP financial measures other than Total Revenue or a quantitative reconciliation to the most directly comparable GAAP measure for its non-GAAP financial guidance shown above because the GAAP measures cannot be reliably estimated and the reconciliations cannot be performed without unreasonable effort due to their dependence on future uncertainties and adjusting items that the Company cannot reasonably predict at this time but which may be material. Please see "Non-GAAP Measures" for additional information. |

Total Revenue and Adjusted EBITDA reflect the results of the former CSB segment. GAAP cash flows include results of Solar discontinued operations. Adjusted Free Cash Flow excludes amounts related to the exit from the solar business, consistent with the definition of this measure. Beginning in the third quarter of 2024, all remaining cash flows attributable to activities of the solar business will be excluded from Adjusted Free Cash Flow as the business is now substantially wound down. |

Dividend Declaration

Effective Aug. 1, 2024, the Company’s Board of Directors declared a cash dividend of $0.055 per share to holders of the Company’s common stock and Class B common stock of record as of Sep. 13, 2024. This dividend will be paid on Oct. 4, 2024.

_____________________ | | | | | |

| (1) | All variances are year-over-year unless otherwise noted. Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Free Cash Flow, Adjusted Free Cash Flow (including interest rate swaps), Adjusted Income (Loss), Adjusted Diluted Income (Loss) per share (or, Adjusted EPS), Net Debt, and Net Leverage Ratio are non-GAAP measures. Refer to the “Non-GAAP Measures” section for the definitions of the terms and reconciliations to the most comparable GAAP measures included herein. The operating metrics such as Gross Customer Revenue Attrition, Unit Count, RMR, Gross RMR Additions, and Revenue Payback are approximated as there may be variations to reported results in each period due to certain adjustments the Company might make in connection with the integration over several periods of acquired companies that calculated these metrics differently, or otherwise, including periodic reassessments and refinements in the ordinary course of business. These refinements, for example, may include changes due to systems conversion or historical methodology differences in legacy systems. Results of the commercial and solar businesses are presented as discontinued operations. Except for cash flow measures, and unless otherwise noted, amounts herein have been recast to reflect the results of the Company’s continuing operations. |

| (2) | Amounts may not sum due to rounding. |

Conference Call

As previously announced, management will host a conference call at 10 a.m. ET today to discuss the Company’s second quarter 2024 results and lead a question-and-answer session. Participants may listen to a live webcast through the investor relations website at investor.adt.com. A replay of the webcast will be available on the website within 24 hours of the live event.

Alternatively, participants may listen to the live call by dialing 1-800-715-9871 (domestic) or 1-646-307-1963 (international), and providing the access code 4948265. An audio replay will be available for two weeks following the call, and can be accessed by dialing 1-800-770-2030 (domestic) or 1-609-800-9909 (international), and providing the access code 4948265.

A slide presentation highlighting the Company’s results will also be available on the Investor Relations section of the Company’s website. From time to time, the Company may use its website as a channel of distribution of material Company information. Financial and other material information regarding the Company is routinely posted on and accessible at investor.adt.com.

About ADT Inc.

ADT provides safe, smart and sustainable solutions for people, homes and small businesses. Through innovative offerings, unrivaled safety and a premium customer experience, all delivered by the largest networks of smart home security professionals in the U.S., we empower people to protect and connect to what matters most. For more information, visit www.adt.com.

| | | | | |

| Investor Relations: | Media Relations: |

investorrelations@adt.com Tel: 888-238-8525 | media@adt.com |

Forward-Looking Statements

ADT has made statements in this press release that are forward-looking and therefore subject to risks and uncertainties, including those described below. All statements, other than statements of historical fact, included in this document are, or could be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and the applicable rules and regulations of the Securities and Exchange Commission (the “SEC”) and are made in reliance on the safe harbor protections provided thereunder. These forward-looking statements relate to, among other things, the divestiture of the commercial business which was completed in October 2023 (the “Commercial Divestiture”); the Company’s exit of the residential solar business and the expected costs and benefits of such exit (the “ADT Solar Exit”); the repurchase of shares of the Company’s common stock under the authorized share repurchase program; the Company’s ability to reduce debt or improve leverage ratios, or to achieve or maintain its long-term leverage goals; the integration of strategic bulk purchases of customer accounts; the Company’s outlook and/or guidance, which includes total revenue, Adjusted EBITDA, Adjusted Diluted Income (Loss) per Share (“Adjusted EPS”) and Adjusted Free Cash Flow (including interest rate swaps); any stated or implied outcomes with regards to the foregoing; and other matters. Without limiting the generality of the preceding sentences, any time we use the words “expects,” “intends,” “will,” “anticipates,” “believes,” “confident,” “continue,” “propose,” “seeks,” “could,” “may,” “should,” “estimates,” “forecasts,” “might,” “goals,” “objectives,” “targets,” “planned,” “projects,” and, in each case, their negative or other various or comparable terminology, and similar expressions, we intend to clearly express that the information deals with possible future events and is forward-looking in nature. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. These forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to management. We caution that these statements are subject to risks and uncertainties, many of which are outside of our control and could cause future events or results to be materially different from those stated or implied in this press release, including, among others, factors relating to uncertainties as to any difficulties with respect to the effect of the Commercial Divestiture and ADT Solar Exit on our ability to retain and hire key personnel and to maintain relationships with customers, suppliers and other business partners; risks related to the Commercial Divestiture and ADT Solar Exit, including ADT’s business becoming less diversified and the possible diversion of management’s attention from ADT’s core CSB business operations; uncertainties as to our ability and the amount of time necessary to realize the expected benefits of the Commercial Divestiture and ADT Solar Exit, including the risk that the ADT Solar Exit may not be completed in a timely manner, or that the costs of the ADT Solar Exit may exceed our best estimates; our ability to maintain and grow our existing customer base and to integrate strategic bulk purchases of customer accounts; activity in repurchasing shares of ADT’s common stock under the authorized share repurchase program; dividend rates or yields for any future quarter; and risks that are described in the Company’s Annual Report and its Quarterly Reports on Form 10-Q, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in those reports, and in our other filings with the SEC. Any forward-looking statement made in this press release speaks only as of the date on which it is made. ADT undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise.

ADT INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share data) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | $ Change | | % Change | | 2024 | | 2023 | | $ Change | | % Change |

| Revenue: | | | | | | | | | | | | | | | | |

| Monitoring and related services | | $ | 1,068 | | | $ | 1,043 | | | $ | 25 | | | 2% | | $ | 2,131 | | | $ | 2,072 | | | $ | 59 | | | 3% |

| Security installation, product, and other | | 136 | | | 125 | | | 12 | | | 9% | | 264 | | | 229 | | | 35 | | | 15% |

| | | | | | | | | | | | | | | | |

| Total revenue | | 1,205 | | | 1,168 | | | 36 | | | 3% | | 2,394 | | | 2,301 | | | 94 | | | 4% |

Cost of revenue (exclusive of depreciation and amortization shown separately below): | | | | | | | | | | | | | | | | |

| Monitoring and related services | | 151 | | | 142 | | | 9 | | | 6% | | 306 | | | 304 | | | 2 | | | 1% |

| Security installation, product, and other | | 45 | | | 45 | | | — | | | —% | | 85 | | | 75 | | | 10 | | | 13% |

| | | | | | | | | | | | | | | | |

| Total cost of revenue | | 196 | | | 188 | | | 9 | | | 5% | | 391 | | | 379 | | | 11 | | | 3% |

| Selling, general, and administrative expenses | | 388 | | | 319 | | | 69 | | | 22% | | 747 | | | 654 | | | 93 | | | 14% |

| Depreciation and intangible asset amortization | | 334 | | | 321 | | | 13 | | | 4% | | 667 | | | 679 | | | (12) | | | (2)% |

| Merger, restructuring, integration, and other | | 2 | | | 8 | | | (6) | | | (78)% | | 14 | | | 23 | | | (9) | | | (40)% |

| | | | | | | | | | | | | | | | |

| Operating income (loss) | | 284 | | | 332 | | | (48) | | | (14)% | | 576 | | | 565 | | | 11 | | | 2% |

| Interest expense, net | | (110) | | | (83) | | | (26) | | | 31% | | (197) | | | (254) | | | 57 | | | (23)% |

| | | | | | | | | | | | | | | | |

| Other income (expense) | | 12 | | | 1 | | | 11 | | | N/M | | 27 | | | (1) | | | 28 | | | N/M |

| Income (loss) from continuing operations before income taxes and equity in net earnings (losses) of equity method investee | | 186 | | | 249 | | | (63) | | | (25)% | | 406 | | | 310 | | | 96 | | | 31% |

| Income tax benefit (expense) | | (60) | | | (67) | | | 7 | | | (11)% | | (116) | | | (86) | | | (31) | | | 36% |

| Income (loss) from continuing operations before equity in net earnings (losses) of equity method investee | | 126 | | | 182 | | | (56) | | | (31)% | | 290 | | | 224 | | | 66 | | | 29% |

| Equity in net earnings (losses) of equity method investee | | — | | | (2) | | | 2 | | | N/M | | — | | | (4) | | | 4 | | | N/M |

| Income (loss) from continuing operations | | 126 | | | 180 | | | (54) | | | (30)% | | 290 | | | 220 | | | 70 | | | 32% |

| Income (loss) from discontinued operations, net of tax | | (34) | | | (88) | | | 54 | | | (62)% | | (106) | | | (247) | | | 140 | | | (57)% |

| Net income (loss) | | $ | 92 | | | $ | 92 | | | $ | — | | | —% | | $ | 184 | | | $ | (27) | | | $ | 211 | | | N/M |

| | | | | | | | | | | | | | | | |

| Common Stock: | | | | | | | | | | | | | | | | |

| Income (loss) from continuing operations per share - basic | | $ | 0.14 | | | $ | 0.20 | | | | | | | $ | 0.32 | | | $ | 0.24 | | | | | |

| Income (loss) from continuing operations per share - diluted | | $ | 0.13 | | | $ | 0.19 | | | | | | | $ | 0.30 | | | $ | 0.23 | | | | | |

| | | | | | | | | | | | | | | | |

| Net income (loss) per share - basic | | $ | 0.10 | | | $ | 0.10 | | | | | | | $ | 0.20 | | | $ | (0.03) | | | | | |

| Net income (loss) per share - diluted | | $ | 0.10 | | | $ | 0.09 | | | | | | | $ | 0.19 | | | $ | (0.03) | | | | | |

| | | | | | | | | | | | | | | | |

| Weighted-average shares outstanding - basic | | 848 | | | 858 | | | | | | | 852 | | | 856 | | | | | |

| Weighted-average shares outstanding - diluted | | 909 | | | 917 | | | | | | | 913 | | | 919 | | | | | |

| | | | | | | | | | | | | | | | |

| Class B Common Stock: | | | | | | | | | | | | | | | | |

| Income (loss) from continuing operations per share - basic | | $ | 0.14 | | | $ | 0.20 | | | | | | | $ | 0.32 | | | $ | 0.24 | | | | | |

| Income (loss) from continuing operations per share - diluted | | $ | 0.13 | | | $ | 0.19 | | | | | | | $ | 0.30 | | | $ | 0.23 | | | | | |

| | | | | | | | | | | | | | | | |

| Net income (loss) per share - basic | | $ | 0.10 | | | $ | 0.10 | | | | | | | $ | 0.20 | | | $ | (0.03) | | | | | |

| Net income (loss) per share - diluted | | $ | 0.10 | | | $ | 0.09 | | | | | | | $ | 0.19 | | | $ | (0.03) | | | | | |

| | | | | | | | | | | | | | | | |

| Weighted-average shares outstanding - basic | | 55 | | | 55 | | | | | | | 55 | | | 55 | | | | | |

| Weighted-average shares outstanding - diluted | | 55 | | | 55 | | | | | | | 55 | | | 55 | | | | | |

Note: amounts may not sum due to rounding

ADT INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions) (Unaudited)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 38 | | | $ | 15 | |

| Restricted cash and restricted cash equivalents | 111 | | | 115 | |

| Accounts receivable, net | 386 | | | 370 | |

| Inventories, net | 203 | | | 201 | |

| | | |

| Prepaid expenses and other current assets | 241 | | | 242 | |

| Current assets of discontinued operations | 6 | | | 61 | |

| Total current assets | 986 | | | 1,005 | |

| Property and equipment, net | 263 | | | 254 | |

| Subscriber system assets, net | 3,019 | | | 3,006 | |

| Intangible assets, net | 4,836 | | | 4,877 | |

| Goodwill | 4,904 | | | 4,904 | |

| Deferred subscriber acquisition costs, net | 1,249 | | | 1,176 | |

| Other assets | 727 | | | 699 | |

| Noncurrent assets of discontinued operations | 3 | | | 43 | |

| Total assets | $ | 15,986 | | | $ | 15,964 | |

| | | |

| Liabilities and stockholders' equity | | | |

| Current liabilities: | | | |

| Current maturities of long-term debt | $ | 192 | | | $ | 312 | |

| Accounts payable | 222 | | | 277 | |

| Deferred revenue | 247 | | | 255 | |

| Accrued expenses and other current liabilities | 605 | | | 556 | |

| Current liabilities of discontinued operations | 49 | | | 80 | |

| Total current liabilities | 1,315 | | | 1,480 | |

| Long-term debt | 7,532 | | | 7,513 | |

| Deferred subscriber acquisition revenue | 2,035 | | | 1,915 | |

| Deferred tax liabilities | 1,080 | | | 1,027 | |

| Other liabilities | 200 | | | 219 | |

| Noncurrent liabilities of discontinued operations | 16 | | | 21 | |

| Total liabilities | 12,178 | | | 12,175 | |

| | | |

| Total stockholders' equity | 3,808 | | | 3,789 | |

| Total liabilities and stockholders' equity | $ | 15,986 | | | $ | 15,964 | |

Note: amounts may not sum due to rounding

ADT INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | | | | |

| Net income (loss) | $ | 92 | | | $ | 92 | | | $ | 184 | | | $ | (27) | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | | | | |

| Depreciation and intangible asset amortization | 334 | | | 346 | | | 669 | | | 729 | |

| Amortization of deferred subscriber acquisition costs | 55 | | | 48 | | | 109 | | | 95 | |

| Amortization of deferred subscriber acquisition revenue | (86) | | | (76) | | | (170) | | | (148) | |

| Share-based compensation expense | 21 | | | 12 | | | 29 | | | 27 | |

| Deferred income taxes | 38 | | | (61) | | | 49 | | | (131) | |

| Provision for losses on receivables and inventory | 46 | | | 41 | | | 107 | | | 67 | |

| | | | | | | |

| Goodwill, intangible, and other asset impairments | 1 | | | 185 | | | 21 | | | 428 | |

| | | | | | | |

| Unrealized (gain) loss on interest rate swap contracts | 8 | | | (55) | | | (2) | | | (22) | |

| | | | | | | |

| Other non-cash items, net | 22 | | | 24 | | | 43 | | | 53 | |

| Changes in operating assets and liabilities, net of effects of acquisitions and dispositions: | | | | | | | |

| Deferred subscriber acquisition costs | (94) | | | (98) | | | (183) | | | (185) | |

| Deferred subscriber acquisition revenue | 69 | | | 75 | | | 135 | | | 148 | |

| Other, net | 57 | | | (40) | | | (65) | | | (235) | |

| Net cash provided by (used in) operating activities | 563 | | | 493 | | | 927 | | | 799 | |

| | | | | | | |

| Cash flows from investing activities: | | | | | | | |

| Dealer generated customer accounts and bulk account purchases | (142) | | | (136) | | | (260) | | | (252) | |

| Subscriber system asset expenditures | (143) | | | (161) | | | (284) | | | (320) | |

| Purchases of property and equipment | (47) | | | (30) | | | (87) | | | (89) | |

| | | | | | | |

| | | | | | | |

| Proceeds (payments) from interest rate swaps | (2) | | | — | | | (4) | | | — | |

| Other investing, net | 2 | | | 9 | | | 3 | | | 7 | |

| Net cash provided by (used in) investing activities | (333) | | | (319) | | | (633) | | | (655) | |

| | | | | | | |

| Cash flows from financing activities: | | | | | | | |

| | | | | | | |

| Proceeds from long-term borrowings | 811 | | | 50 | | | 906 | | | 650 | |

| Proceeds from receivables facility | 80 | | | 76 | | | 146 | | | 140 | |

| Proceeds (payments) from interest rate swaps | 24 | | | 20 | | | 48 | | | 36 | |

| Repurchases of common stock | — | | | — | | | (93) | | | — | |

| Repayment of long-term borrowings, including call premiums | (961) | | | (266) | | | (1,018) | | | (873) | |

| Repayment of receivables facility | (100) | | | (48) | | | (158) | | | (92) | |

| Dividends on common stock | (50) | | | (32) | | | (82) | | | (64) | |

| Payments on finance leases | (8) | | | (10) | | | (15) | | | (21) | |

| | | | | | | |

| Other financing, net | 4 | | | (7) | | | (8) | | | (33) | |

| Net cash provided by (used in) financing activities | (200) | | | (217) | | | (275) | | | (258) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Cash and cash equivalents and restricted cash and restricted cash equivalents: | | | | | | | |

| Net increase (decrease) | 30 | | | (43) | | | 19 | | | (113) | |

| Beginning balance | 119 | | | 304 | | | 130 | | | 374 | |

| Ending balance | $ | 149 | | | $ | 261 | | | $ | 149 | | | $ | 261 | |

Note: amounts may not sum due to rounding

ADT INC. AND SUBSIDIARIES

NON-GAAP MEASURES

ADT sometimes uses information (“non-GAAP financial measures”) that is derived from the consolidated financial statements, but that is not presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). Under SEC rules, non-GAAP financial measures may be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results.

The following information includes definitions of the Company’s non-GAAP financial measures used in this release, reasons management believes these measures are useful to investors regarding the Company’s financial condition and results of operations, additional purposes, if any, for which management uses the non-GAAP financial measures, and limitations to using these non-GAAP financial measures, as well as reconciliations of these non-GAAP financial measures to the most comparable GAAP measures. Each non-GAAP financial measure is presented following the corresponding GAAP measure so as not to imply that more emphasis should be placed on the non-GAAP measure. The limitations of non-GAAP financial measures are best addressed by considering these measures in conjunction with the appropriate GAAP measures. In addition, computations of these non-GAAP measures may not be comparable to other similarly titled measures reported by other companies.

With regard to the Company’s financial guidance for 2024, the Company is not providing a quantitative reconciliation for forward-looking Adjusted EBITDA to GAAP income (loss) from continuing operations, Adjusted EPS to GAAP diluted income (loss) per share from continuing operations, and Adjusted Free Cash Flow (including interest rate swaps) to GAAP net cash provided by operating activities, which are the most directly comparable respective GAAP measures. These GAAP measures cannot be reliably predicted or estimated without unreasonable effort due to their dependence on future uncertainties, such as the adjustment of items used in the following reconciliations. Additionally, information not currently available to the Company about other adjusting items could have a potentially unpredictable and potentially significant impact on future GAAP financial results.

Unless otherwise noted, non-GAAP measures herein reflect the results of only the Company’s continuing operations. Free Cash Flow, Adjusted Free Cash Flow, and Adjusted Free Cash Flow (including interest rate swaps) reflect the results of both continuing and discontinued operations, which is consistent with the presentation of the GAAP measure net cash provided by (used in) operating activities. Adjusted Free Cash Flow and Adjusted Free Cash Flow (including interest rate swaps) exclude amounts related to the exit from the solar business, consistent with the definition of these measures. Beginning in the third quarter of 2024, all remaining cash flows attributable to activities of the solar business will be excluded from these measures as the business is now substantially wound down.

ADT INC. AND SUBSIDIARIES

NON-GAAP MEASURES

Free Cash Flow, Adjusted Free Cash Flow, and Adjusted Free Cash Flow including interest rate swaps

The Company defines Free Cash Flow as cash flows from operating activities less cash outlays related to capital expenditures. The Company defines capital expenditures to include accounts purchased through the Company’s network of authorized dealers or third parties outside of the Company’s authorized dealer network, subscriber system asset expenditures, and purchases of property and equipment. These items are subtracted from cash flows from operating activities because they represent long-term investments that are required for normal business activities.

The Company defines Adjusted Free Cash Flow as Free Cash Flow adjusted for net cash flows related to (i) net proceeds from the Company’s consumer receivables facility; (ii) restructuring and integration payments; (iii) integration-related capital expenditures; and (iv) transaction costs and other payments or receipts that may mask operating results or business trends. Adjusted Free Cash Flow including interest rate swaps reflects Adjusted Free Cash Flow plus net cash settlements on interest rate swaps presented outside of net cash provided by (used in) operating activities.

The Company believes the presentations of these non-GAAP measures are appropriate to provide investors with useful information about the Company’s ability to repay debt, make other investments, and pay dividends. The Company believes the presentation of Adjusted Free Cash Flow is also a useful measure of the cash flow attributable to normal business activities, inclusive of the net cash flows associated with the acquisition of subscribers, as well as the Company’s ability to repay other debt, make other investments, and pay dividends. Further, Adjusted Free Cash Flow including interest rate swaps is a useful measure of Adjusted Free Cash Flow inclusive of all cash interest.

There are material limitations to using these non-GAAP measures. These non-GAAP measures adjust for cash items that are ultimately within management’s discretion to direct, and therefore, may imply that there is less or more cash available than the most comparable GAAP measure. These non-GAAP measures are not intended to represent residual cash flow for discretionary expenditures since debt repayment requirements and other non-discretionary expenditures are not deducted.

The non-GAAP measures in the table below include cash flows associated with both continuing and discontinued operations consistent with the applicable GAAP presentation on the Statement of Cash Flows.

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | |

| (in millions) | 2024 | | 2023 | | | | |

| Net cash provided by (used in): | | | | | | | |

| Operating activities | $ | 563 | | | $ | 493 | | | | | |

| Investing activities | $ | (333) | | | $ | (319) | | | | | |

| Financing activities | $ | (200) | | | $ | (217) | | | | | |

| | | | | | | |

| Net cash provided by (used in) operating activities | $ | 563 | | | $ | 493 | | | | | |

| Dealer generated customer accounts and bulk account purchases | (142) | | | (136) | | | | | |

| Subscriber system asset expenditures | (143) | | | (161) | | | | | |

| Purchases of property and equipment | (47) | | | (30) | | | | | |

| Free Cash Flow | 231 | | | 165 | | | | | |

| Net proceeds (payments) from receivables facility | (20) | | | 28 | | | | | |

| | | | | | | |

Restructuring and integration payments(1) | 12 | | | 7 | | | | | |

| Integration-related capital expenditures | — | | | — | | | | | |

| | | | | | | |

| | | | | | | |

Other, net(2) | 7 | | | (1) | | | | | |

| Adjusted Free Cash Flow | $ | 229 | | | $ | 201 | | | | | |

Interest rate swaps presented outside operating activities(3) | 22 | | | 20 | | | | | |

| Adjusted Free Cash Flow (including interest rate swaps) | $ | 251 | | | $ | 221 | | | | | |

Note: amounts may not sum due to rounding

_______________________

(1)During 2024, primarily includes costs related to the ADT Solar Exit. During 2023, primarily represents ADT Solar integration costs and restructuring activities.

(2)During 2024, primarily includes third party costs associated with implementation of a new ERP system that the Company will not continue to incur once the ERP system is fully implemented, which is expected to complete in the second half of 2025.

(3)Includes net settlements related to interest rate swaps presented outside of net cash provided by (used in) operating activities.

ADT INC. AND SUBSIDIARIES

NON-GAAP MEASURES

Adjusted EBITDA from Continuing Operations (“Adjusted EBITDA”) and Adjusted EBITDA Margin from Continuing Operations (“Adjusted EBITDA Margin”)

The Company believes Adjusted EBITDA is useful to investors to measure the operational strength and performance of its business. The Company believes the presentation of Adjusted EBITDA is useful as it provides investors additional information about operating profitability adjusted for certain non-cash items, non-routine items the Company does not expect to continue at the same level in the future, as well as other items not core to its operations. Further, the Company believes Adjusted EBITDA provides a meaningful measure of operating profitability because the Company uses it for evaluating business performance, making budgeting decisions, and comparing company performance against other peer companies using similar measures.

The Company defines Adjusted EBITDA as income (loss) from continuing operations adjusted for (i) interest; (ii) taxes; (iii) depreciation and amortization, including depreciation of subscriber system assets and other fixed assets and amortization of dealer and other intangible assets; (iv) amortization of deferred costs and deferred revenue associated with subscriber acquisitions; (v) share-based compensation expense; (vi) merger, restructuring, integration, and other items; (vii) impairment charges; and (viii) non-cash, non-routine, or other adjustments or charges not necessary to operate our business.

There are material limitations to using Adjusted EBITDA as it does not include certain significant items which directly affect income (loss) from continuing operations (the most comparable GAAP measure).

The discussion above is also applicable to Adjusted EBITDA margin, which is calculated as Adjusted EBITDA as a percentage of total revenue.

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | |

| (in millions) | 2024 | | 2023 | | | | |

| Income (loss) from continuing operations | $ | 126 | | | $ | 180 | | | | | |

| Interest expense, net | 110 | | | 83 | | | | | |

| Income tax expense (benefit) | 60 | | | 67 | | | | | |

| Depreciation and intangible asset amortization | 334 | | | 321 | | | | | |

| Amortization of deferred subscriber acquisition costs | 55 | | | 46 | | | | | |

| Amortization of deferred subscriber acquisition revenue | (86) | | | (74) | | | | | |

| Share-based compensation expense | 21 | | | 8 | | | | | |

Merger, restructuring, integration and other | 2 | | | 8 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Other, net(1) | 8 | | | — | | | | | |

| Adjusted EBITDA from continuing operations | $ | 629 | | | $ | 641 | | | | | |

| | | | | | | |

| Income (loss) from continuing operations to total revenue ratio | 10 | % | | 15 | % | | | | |

| Adjusted EBITDA Margin (as percentage of Total Revenue) | 52 | % | | 55 | % | | | | |

Note: amounts may not sum due to rounding

_______________________

(1)During 2024, primarily includes unrealized (gains) / losses related to interest rate swaps presented in other income (expense) and loss on extinguishment of debt.

ADT INC. AND SUBSIDIARIES

NON-GAAP MEASURES

Adjusted Income (Loss) from Continuing Operations (“Adjusted Income (Loss)”) and Adjusted Diluted Income (Loss) per Share from Continuing Operations (“Adjusted Diluted Income (Loss) per Share” or “Adjusted EPS”)

The Company defines Adjusted Income (Loss) as income (loss) from continuing operations adjusted for (i) merger, restructuring, integration, and other; (ii) share-based compensation expense; (iii) unrealized gains and losses on interest rate swap contracts not designated as hedges; (iv) impairment charges; (v) non-cash, non-routine, or other adjustments or charges not necessary to operate our business; and (vi) the impact these adjusted items have on taxes.

Adjusted Diluted Income (Loss) per share is Adjusted Income (Loss) divided by diluted weighted-average shares outstanding of common stock. When the control number for the GAAP calculation is negative, diluted weighted-average shares outstanding of common stock does not include the assumed conversion of Class B common stock and other potential shares, such as share-based compensation awards, to shares of common stock.

The Company believes Adjusted Income (Loss) and Adjusted Diluted Income (Loss) per share are benchmarks used by analysts and investors who follow the industry for comparison of its performance with other companies in the industry, although these measures may not be directly comparable to similar measures reported by other companies.

There are material limitations to using these measures, as they do not reflect certain significant items which directly affect income (loss) from continuing operations and related per share amounts (the most comparable GAAP measures).

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | |

| (in millions, except per share data) | 2024 | | 2023 | | | | |

| Income (loss) from continuing operations | $ | 126 | | | $ | 180 | | | | | |

Merger, restructuring, integration, and other | 2 | | | 8 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Share-based compensation expense | 21 | | | 8 | | | | | |

Interest rate swaps, net(1) | 8 | | | (55) | | | | | |

Other, net | 5 | | | — | | | | | |

Tax impact on adjustments(2) | (6) | | | 10 | | | | | |

| Adjusted Income (Loss) from continuing operations | $ | 156 | | | $ | 153 | | | | | |

| | | | | | | |

Weighted-average shares outstanding - diluted(3): | | | | | | | |

| Common Stock | 909 | | | 917 | | | | | |

| Class B Common Stock | 55 | | | 55 | | | | | |

| | | | | | | |

| Income (loss) per share from continuing operations - diluted: | | | | | | | |

| Common Stock | $ | 0.13 | | | $ | 0.19 | | | | | |

| Class B Common Stock | $ | 0.13 | | | $ | 0.19 | | | | | |

| | | | | | | |

Adjusted Diluted Income (Loss) per share(4) | $ | 0.17 | | | $ | 0.17 | | | | | |

Note: amounts may not sum due to rounding.

_______________________

(1)Primarily includes the unrealized (gain) or loss on interest rate swaps not designated as cash flow hedges.

(2)Represents the federal and state blended statutory rate.

(3)Refer to the Company’s Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K for further discussion regarding the computation of diluted weighted-average shares outstanding of common stock.

(4)Calculated as Adjusted Income (Loss) divided by diluted weighted-average shares outstanding of common stock.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

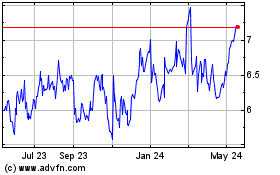

ADT (NYSE:ADT)

Historical Stock Chart

From Oct 2024 to Nov 2024

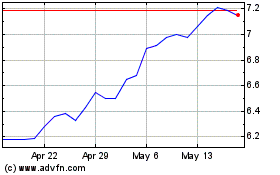

ADT (NYSE:ADT)

Historical Stock Chart

From Nov 2023 to Nov 2024