0001232582false00012325822024-07-312024-07-310001232582us-gaap:CommonStockMember2024-07-312024-07-310001232582us-gaap:SeriesDPreferredStockMember2024-07-312024-07-310001232582us-gaap:SeriesFPreferredStockMember2024-07-312024-07-310001232582us-gaap:SeriesGPreferredStockMember2024-07-312024-07-310001232582us-gaap:SeriesHPreferredStockMember2024-07-312024-07-310001232582aht:SeriesIPreferredStockMember2024-07-312024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): July 31, 2024

ASHFORD HOSPITALITY TRUST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-31775 | | 86-1062192 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (IRS employer identification number) |

| | | | |

| 14185 Dallas Parkway, Suite 1200 | | | | |

| Dallas | | | | |

| Texas | | | | 75254 |

| (Address of principal executive offices) | | | | (Zip code) |

Registrant’s telephone number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock | | AHT | | New York Stock Exchange |

| Preferred Stock, Series D | | AHT-PD | | New York Stock Exchange |

| Preferred Stock, Series F | | AHT-PF | | New York Stock Exchange |

| Preferred Stock, Series G | | AHT-PG | | New York Stock Exchange |

| Preferred Stock, Series H | | AHT-PH | | New York Stock Exchange |

| Preferred Stock, Series I | | AHT-PI | | New York Stock Exchange |

ITEM 7.01 REGULATION FD DISCLOSURE

On July 31, 2024, Ashford Hospitality Trust, Inc. (the “Company”) held an earnings conference call for its second quarter ended June 30, 2024. A copy of the conference call transcript is attached hereto as Exhibit 99.1. On July 30, 2024, the Company filed a Form 8-K that included the actual earnings release text and supplemental tables.

The information in this Form 8-K and Exhibits attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

Exhibit Number Description

104 Cover Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ASHFORD HOSPITALITY TRUST, INC. |

| | |

| Dated: July 31, 2024 | By: | /s/ Alex Rose |

| | Alex Rose |

| | Executive Vice President, General Counsel & Secretary |

ASHFORD HOSPITALITY TRUST

Second Quarter 2024 Conference Call

July 31, 2024

10 a.m. CT

Introductory Comments – Deric Eubanks

Good day everyone and welcome to today’s conference call to review results for Ashford Hospitality Trust for the second quarter 2024 and to update you on recent developments. On the call today will also be: Stephen Zsigray, President and Chief Executive Officer; and Chris Nixon, Executive Vice President and Head of Asset Management. The results as well as notice of the accessibility of this conference call on a listen-only basis over the Internet were distributed yesterday afternoon in a press release.

At this time, let me remind you that certain statements and assumptions in this conference call contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the federal securities regulations. Such forward-looking statements are subject to numerous assumptions, uncertainties and known or unknown risks, which could cause actual results to differ materially from those anticipated. These factors are more fully discussed in the Company’s filings with the Securities and Exchange Commission. The forward-looking statements included in this conference call are only made as of the date of this call, and the Company is not obligated to publicly update or revise them. Statements made during this call do not constitute an offer to sell or a solicitation of an offer to buy any securities. Securities will be offered only by means of a registration statement and prospectus which can be found at www.sec.gov.

In addition, certain terms used in this call are non-GAAP financial measures, reconciliations of which are provided in the Company’s earnings release and accompanying tables or schedules, which have been filed on Form 8-K with the SEC on July 30, 2024, and may also be accessed through the Company’s website at www.ahtreit.com. Each listener is encouraged to review those reconciliations provided in the earnings release together with all other information provided in the release. Also, unless otherwise stated, all reported results discussed in this call compare the second quarter ended June 30, 2024 with the second quarter ended June 30, 2023.

I will now turn the call over to Stephen Zsigray. Please go ahead, sir.

Introduction – Stephen Zsigray

Today marks my first conference call as Ashford Hospitality Trust’s CEO and I look forward to meeting and speaking with many of you over the coming months. I’m also pleased with our solid start to the year and the significant progress that we’ve made in executing our defined strategy.

Earlier this year, we announced an ambitious plan to pay off our strategic corporate financing in 2024, which we believe is a crucial step in positioning Ashford Trust back on a path to growth. We set out to accomplish this through a combination of asset sales, mortgage debt refinancings, and our non-traded preferred capital raise. We made tangible progress in all three areas during the second quarter, and with nearly $90 million in principal payments made since March, we are now well-positioned to achieve our goal with approximately $94 million in remaining principal.

We currently have several assets at various stages of the sales process, and, while we are unlikely to sell all of these assets, we continue to work diligently to determine which assets are capturing the most attractive valuations while also providing the largest impact to our deleveraging efforts.

To date, we have sold 7 assets for more than $310 million, with 6 of those sales closing in the second quarter.

In April, we closed on the sale of the 390-room Hilton Boston Back Bay in Boston, Massachusetts for $171 million or $438,000 per key. All of the proceeds from the sale were used for debt reduction, including approximately $68 million to pay down the Company’s strategic financing.

In April, we closed on the sale of the 85-room Hampton Inn in Lawrenceville, Georgia for $8.1 million. The sale price represented a 6.0% capitalization rate on trailing 12-month net operating income through March 2024.

Additionally, in May we closed on the sale of the 90-room Courtyard located in Manchester, Connecticut for $8.0 million. The property was encumbered with a mortgage loan that had an outstanding balance of approximately $5.6 million.

In mid-June, we closed on the sale of the 90-room SpringHill Suites and the 86-room Fairfield Inn located in Kennesaw, Georgia for $17.5 million. The sale price represented a 4.8% capitalization rate on trailing 12-month net operating income through April 2024. The hotels were encumbered with a mortgage loan that had an outstanding balance of approximately $10.8 million.

In late June, we closed on the sale of the 193-room One Ocean Resort located in Atlantic Beach, Florida for $87 million, with approximately $66.2 million applied to the associated mortgage loan.

We expect additional asset sales to close in the coming months, all of which would generate excess proceeds available for the repayment of our strategic financing.

In addition to asset sales, we closed on a key refinancing during the second quarter. In May, we refinanced our loan secured by the Renaissance Nashville in Nashville, Tennessee, which had a final maturity date in March 2026. The new, non-recourse loan totals $267.2 million, and has a two-year initial term with three one-year extension options, subject to the satisfaction of certain conditions. The loan is interest only and provides for a floating interest rate of SOFR + 3.98%. The previous loan totaled $240.0 million and included the 296-room Westin Hotel in Princeton, New Jersey. As part of this refinancing, the Westin Princeton is now unencumbered, and we have listed this property for sale.

We also remain excited about our non-traded preferred stock offering. We continue to build the selling syndicate and currently have 50 signed dealer agreements representing nearly 6,000 reps selling this security. To date, we have raised approximately $147 million of gross proceeds, including $24 million during the second quarter. This capital is very attractive for the company, and we have committed to applying 50% of all capital raised towards the repayment of our more expensive strategic financing.

With the progress we are making across asset sales, mortgage refinancings, and our non-traded preferred offering, we continue to believe that we are on the right path to pay off the strategic financing in 2024. These focused deleveraging efforts, along with solid second quarter operating results and a broadly diversified, high-quality portfolio with multiple demand drivers, will position the company to outperform for the remainder of 2024 and beyond.

I will now turn the call over to Deric to review our second quarter financial performance.

Financial Review – Deric Eubanks

Thanks, Stephen.

For the second quarter, we reported net income attributable to common stockholders of $44.3 million, or $0.25 per diluted share.

For the quarter, we reported AFFO per diluted share of $0.27.

Adjusted EBITDAre for the quarter was $78.7 million.

At the end of the second quarter, we had $2.7 billion of loans with a blended average interest rate of 8.1%, taking into account in-the-money interest rate caps. Considering the current level of SOFR and the corresponding interest rate caps, approximately 100% of our debt is now effectively fixed.

We ended the quarter with cash and cash equivalents of $121.8 million and restricted cash of $124.5 million. The vast majority of that restricted cash is comprised of lender and manager-held reserve accounts, and $2.7 million related to trapped cash held by lenders. At the end of the quarter, we also had $22.2 million due from third-party hotel managers. This primarily represents cash held by one of our property managers, which is also available to fund hotel operating costs. We ended the quarter with net working capital of approximately $187.4 million.

As of June 30, 2024, our consolidated portfolio consisted of 69 hotels with 17,087 rooms.

At the end of the quarter, our share count consisted of approximately 48.8 million fully diluted shares outstanding, which is comprised of 46.8 million shares of common stock and 2.1 million OP units.

While we are currently paying our preferred dividends quarterly or monthly, we do not anticipate reinstating a common dividend in 2024.

This concludes our financial review, and I would now like to turn it over to Chris to discuss our asset management activities for the quarter.

Asset Management – Chris Nixon

Thank you, Deric.

For the quarter, Comparable Hotel RevPAR for our portfolio increased 1.6% over the prior year quarter. Our team has been actively rolling out several initiatives to grow ancillary revenue, which was up 10% per occupied room compared to the prior year quarter. Group revenue pace for the portfolio continues to accelerate with the back half of the year positioned well. Corporate transient recovery is also accelerating with corporate revenue gains of 15% in the second quarter over the prior year quarter. This is nearly double the year-over-year growth that we experienced in the first quarter. Our urban assets also performed well. Total Revenue increased 3% and Hotel EBITDA margin increased 160 basis points compared to the prior year quarter for these hotels. I will now go into more detail on some of the achievements completed throughout the quarter.

Group pace continues to accelerate across the portfolio. Group room revenue for the full year is pacing ahead of last year by 5% with the third quarter through the balance of year pacing ahead by 11%.

Group business booked in the quarter for all future dates was secured at a 7% ADR premium over the business that was booked during the prior year quarter. We are seeing increases in corporate group and association, which is more than offsetting group government business that has softened as we approach the presidential election. The overall group booking window continues to extend as our 2025 Group revenue pace is ahead by 20%. While year-over-year group lead volume has started to normalize, conversion rates remain strong and the average group booking size continues to increase. Our team has strategically increased our group base heading into 2025, which will protect us from macro headwinds, and allow us to aggressively yield transient business in the year.

Urban hotels performed well during the second quarter. Hotel EBITDA increased 8% compared to the prior year quarter. Renaissance Nashville increased Hotel EBITDA by 16% compared to the prior year quarter. This is impressive considering Total Revenue grew by only 1% compared to the prior year quarter. The hotel was successful in optimizing business mix and driving aggressive rates during the high demand periods in the quarter. The hotel was also nimble during the slower periods, sending several managers to other hotels temporarily which lowered our labor costs. This strategy resulted in a Hotel EBITDA flow-through of 683% for the quarter compared to the prior year quarter.

We have been pleased with the strong performance of our assets in the Dallas/Ft. Worth market, which accounts for 7% of our hotel key count in the portfolio. These assets increased Total Revenue by 6% compared to the prior year quarter. Additionally, Hotel EBITDA margin expanded by approximately 480 basis points relative to the prior year quarter. One hotel that I would like to highlight is the Hilton Ft. Worth, which grew Total Revenue by 15% compared to the prior year quarter. More impressively, Hotel EBITDA grew 69% compared to the prior year quarter. Our team restructured the referral program for internal associates, which allowed us to nearly eliminate contract labor. In addition, the hotel enhanced their scheduling process, which reduced overtime hours while also increasing productivity. These changes resulted in a 585 basis point improvement to departmental profit margin.

A competitive advantage for us is our in-house property tax team. Utilizing a data driven approach to appeals, we realized approximately $1.5 million in property tax savings during the second quarter. This represents a 20% increase in overall savings compared to the prior year quarter. Our team analyzed market tax trends in conjunction with other data points to identify hotels where we could be more aggressive in our appeals process. An example of this is Marriott Sugar Land. After a successful appeal at the appraisal review board level, we strategically decided to continue our pursuit through litigation, which led to further tax assessment reductions. The total taxable value for the property was reduced by $5.5 million compared to the prior year assessment.

Moving on to capital expenditures, during the second quarter of 2024, we completed a comprehensive guestroom renovation at the Marriott Sugar Land, introducing modern touches and improved amenities for an enhanced guest experience. We also made substantial progress toward the extensive renovation of both guestrooms and public spaces at the Embassy Suites Dallas, with expected completion later this year. Looking ahead to the third quarter of 2024, we plan to start on a comprehensive guestroom renovation at the Embassy Suites West Palm Beach. In the fourth quarter of 2024, we plan to start several renovations across the portfolio, including upgrading the restaurant and meeting spaces at the Hilton Garden Inn Austin, as well as guestroom renovations at both the Residence Inn Evansville and the Courtyard Bloomington. In 2024, we anticipate spending between $85 million and $105 million on capital expenditures.

As mentioned earlier, our portfolio is building a solid foundation of group business, our urban hotels continue to improve, and we are experiencing strong performance in various markets. We are excited about the soon to be completed conversions at La Concha Key West, which will be an Autograph

Collection hotel, and Le Pavillon, which will be a Tribute Portfolio hotel. We also continue to evaluate several new initiatives across our portfolio, such as brand conversions, strategic partnerships, and high-yield renovations.

That concludes our prepared remarks. We will now open up the call for Q&A.

Stephen Zsigray

Thank you for joining today’s call, and we look forward to speaking with you all again next quarter.

v3.24.2

Document and Entity Information

|

Jul. 31, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 31, 2024

|

| Entity Registrant Name |

ASHFORD HOSPITALITY TRUST, INC.

|

| Entity Central Index Key |

0001232582

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-31775

|

| Entity Tax Identification Number |

86-1062192

|

| Entity Address, Address Line One |

14185 Dallas Parkway, Suite 1200

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75254

|

| City Area Code |

972

|

| Local Phone Number |

490-9600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AHT

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series D |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series D

|

| Trading Symbol |

AHT-PD

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series F |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series F

|

| Trading Symbol |

AHT-PF

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series G |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series G

|

| Trading Symbol |

AHT-PG

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series H |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series H

|

| Trading Symbol |

AHT-PH

|

| Security Exchange Name |

NYSE

|

| Preferred Stock, Series I |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, Series I

|

| Trading Symbol |

AHT-PI

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesFPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesGPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesHPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aht_SeriesIPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

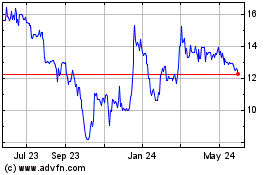

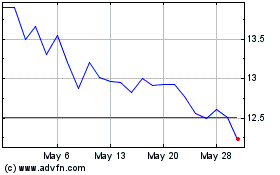

Ashford Hospitality (NYSE:AHT-I)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ashford Hospitality (NYSE:AHT-I)

Historical Stock Chart

From Nov 2023 to Nov 2024