0001070235false00010702352024-12-152024-12-150001070235exch:XNYS2024-12-152024-12-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

December 15, 2024

Date of Report (date of earliest event reported)

BlackBerry Limited

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Canada | | 001-38232 | | 98-0164408 | |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) | |

| | | |

2200 University Ave East | | | | | | |

Waterloo | Ontario | Canada | | | | | N2K 0A7 | |

(Address of Principal Executive Offices) | | | | | (Zip Code) | |

(519) 888-7465

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares | BB | New York Stock Exchange |

| Common Shares | BB | Toronto Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 1.01 Entry Into a Material Definitive Agreement.

On December 15, 2024, BlackBerry Limited (the “Company”) entered into an Equity and Asset Purchase Agreement (the “Equity and Asset Purchase Agreement”) with Arctic Wolf Networks, Inc. (“Arctic Wolf”) and certain subsidiaries of the Company and Arctic Wolf, pursuant to which and upon the terms and subject to the conditions described therein, Arctic Wolf will acquire the Company’s Cylance® endpoint security assets for a purchase price consisting of $160 million of cash, subject to certain purchase price adjustments set forth in the Equity and Asset Purchase Agreement (the “Cash Consideration”), and 5.5 million common shares in Arctic Wolf (the “Equity Consideration”). After giving effect to the purchase price adjustments to the Cash Consideration, the Company will receive approximately $80 million of the Cash Consideration and the Equity Consideration at closing of the transaction, and approximately $40 million of the Cash Consideration on the one-year anniversary of closing.

The Equity and Asset Purchase Agreement contains customary representation, warranties, covenants and indemnification made by the Company and Arctic Wolf. In addition, the Equity and Asset Purchase Agreement provides that, on the closing date of the transaction, the Company and Arctic Wolf will enter into (i) a non-exclusive patent license agreement, (ii) a partner agreement pursuant to which the Company will agree to resell certain products and services of Arctic Wolf, and (iii) a strategic customer support agreement, pursuant to which Arctic Wolf will agree to provide certain customer support services to the Company.

Completion of the transaction is conditional upon the provision of customary closing deliverables and satisfaction of customary conditions.

Item 8.01 Other Events

On December 16, 2024, the Company and Arctic Wolf issued a joint press release announcing the entry into the Equity and Asset Purchase Agreement. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of certain securities laws, including under the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws, including statements regarding the proposed transaction between the Company and Arctic Wolf, the amounts and types of consideration BlackBerry will receive in connection therewith, the anticipated timing and results of the proposed transaction, the potential benefits of the proposed transaction for the Company’s customers and shareholders, the expectations and beliefs of the Company, and other statements that are not historical facts.

The words “expect”, “anticipate”, “estimate”, “may”, “will”, “should”, “could”, “intend”, “believe”, “target”, “plan” and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are based on the Company’s current plans, objectives, estimates, assumptions, expectations and intentions and inherently involve significant risks and uncertainties, many of which are beyond the Company’s control. Many factors could cause actual achievements with respect to the transaction and the timing of events to differ materially from those expressed or implied by the forward-looking statements, including, without limitation, risks and uncertainty associated with Arctic Wolf’s and the Company’s ability to complete the proposed transaction on the proposed terms or on the anticipated timeline, or at all; risks and uncertainties related to the satisfaction of conditions to consummate the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the purchase agreement relating to the proposed transaction; effects relating to the announcement of the proposed transaction or any further announcements or the consummation of the proposed transaction on the market price of the Company’s common shares; failure to realize the expected benefits of the proposed transaction, including risks associated with the payment of consideration post-closing and the availability of funds therefor and risks related to the value of Arctic Wolf’s common shares; risks related to future opportunities and plans for the Company’s business, including its Secure Communications portfolio, and results of the Company following completion of the proposed transaction; the risk of litigation in connection with the proposed transaction, including resulting expense or delay; significant transaction costs and/or unknown or inestimable liabilities; risks related to diverting the attention of the Company’s management from ongoing business operations; risks related to the proposed transaction disrupting the Company’s operations and making it more difficult to conduct business as usual or for the Company to maintain relationships with customers, resellers, channel partners or other third parties; adverse economic, geopolitical and environmental conditions; and other risks and uncertainties affecting the Company, including those described from time to time under the caption “Risk Factors” and elsewhere in the Company filings with the Securities and Exchange Commission, including those discussed in the Company’s Annual Report on Form 10-K and the “Cautionary Note Regarding Forward-Looking Statements” section of the Company’s

MD&A (copies of which filings may be obtained at www.sedar.com or www.sec.gov). All of these factors should be considered carefully and readers should not place undue reliance on the Company’s forward-looking statements. Moreover, other risks and uncertainties of which the Company is not currently aware may also affect its forward-looking statements and may cause actual results and the timing of events to differ materially from those anticipated.

The forward-looking statements made in this Current Report on Form 8-K are made only as of the date hereof or as of the dates indicated in the forward-looking statements and reflect the views stated therein with respect to future events as at such dates. The Company has no intention and undertakes no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit | | Description |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | BlackBerry Limited |

| | |

Date: | | December 16, 2024 | |

By: | /s/ Tim Foote |

| | Name: | Tim Foote |

| Title: | Chief Financial Officer |

Arctic Wolf and BlackBerry Announce Acquisition Agreement for Cylance

Arctic Wolf to enhance its Security Operations Aurora Platform with best-in-class endpoint prevention, detection, and response

WATERLOO, ONTARIO and EDEN PRAIRIE, MINNESOTA – December 16, 2024 – Arctic Wolf® and BlackBerry Limited (NYSE: BB; TSX:BB), two global leaders in security software and services, today announced they have entered into a definitive agreement for Arctic Wolf to acquire BlackBerry’s Cylance® endpoint security assets. Cylance is the pioneer of AI-based endpoint protection trusted by thousands of organizations around the world. With this acquisition, Arctic Wolf ushers in a new era of simplicity, flexibility, and outcomes to the endpoint security market, delivering the security operations results customers have been asking for.

Under the terms of the agreement, BlackBerry will sell its Cylance assets to Arctic Wolf for $160 million of cash, subject to certain adjustments, and approximately 5.5 million common shares of Arctic Wolf. After allowing for the purchase price adjustments, BlackBerry will receive approximately $80 million of cash at closing and approximately $40 million of cash one year following the closing.

The proposed transaction is subject to customary closing conditions and is expected to close in BlackBerry’s fourth fiscal quarter.

Arctic Wolf is a leader in AI-powered security operations, delivering its solutions from a single open platform to meet customers’ needs for effective, comprehensive, and reliable security outcomes. With the addition of Cylance’s trailblazing suite of endpoint security capabilities and enhanced AI functionality, Arctic Wolf will bolster its position as a market-leading platform provider, offering coverage from the endpoint to the edge.

As many organizations are looking to consolidate an increasing number of disparate security tools, there is a rapidly growing demand for end-to-end platforms.

“Security has an operations and effectiveness problem and endpoint solutions alone have failed to live up to the outcomes they have promised for years,” said Nick Schneider, president and chief executive officer, Arctic Wolf. “By incorporating Cylance’s endpoint security capabilities into our open-XDR Aurora platform, we will be addressing a rampant need for a truly unified, effective security operations that delivers better outcomes for customers. We believe we will be able to rapidly eliminate alert fatigue, reduce total risk exposure, and help customers unlock further value with our warranty and insurability programs.”

“I am incredibly excited to partner with Arctic Wolf through this agreement,” said John Giamatteo, chief executive officer of BlackBerry. “We see this transaction as a win-win for our shareholders and all other stakeholders. Our customers will realize the benefits of continuity of

service and the expertise that a global cybersecurity leader like Arctic Wolf provides. Arctic Wolf benefits by adding Cylance’s endpoint security solutions to its native platform. Finally, as Arctic Wolf leverages its scale to build upon and grow the Cylance business, BlackBerry will benefit as a reseller of the portfolio to our large government customers and as a shareholder of the company.”

There will be no impact to BlackBerry’s Secure Communications portfolio of businesses, which include BlackBerry® UEM, BlackBerry® AtHoc® and BlackBerry® SecuSUITE®. The Secure Communications business will remain an integral part of the BlackBerry portfolio.

Redefining the Modern Security Platform for Customers and Partners

With the addition of a native endpoint security solution to its portfolio, Arctic Wolf is building one of the largest open XDR security platforms in the industry, enabling customers and partners to have the option to leverage more than 15 supported endpoint solutions. Arctic Wolf is currently the only security operations leader offering this type of optionality, which combined with its comprehensive approach to minimizing risk through security operations, makes it uniquely positioned to drive value for customers of all sizes and security maturity.

Cylance has a long history of recognition as a market leader, known for stopping 98% of attacks before they begin and trusted by many of the world’s leading organizations for its AI-driven prevention and detection. Recently, Cylance was named 2024 Customers’ Choice for endpoint protection platforms (EPP) by Gartner® Peer Insights™ for the second consecutive year. By integrating Cylance into its portfolio, Arctic Wolf will provide a world-class endpoint protection solution that rivals the best in the industry, complementing its endpoint offering with one of the largest commercial SOCs in the world that delivers unified security operations and comprehensive attack surface coverage.

“Organizations are looking to unify tools and operations via a single platform that can effectively analyze and respond to security threats, drive consistent security outcomes, and demonstrably minimize risk,” said Dan Schiappa, chief product and services officer, Arctic Wolf. “In the past, this has been a near-impossible, costly goal for resource-constrained leaders. By adding endpoint security to our platform, we will be delivering the security outcomes organizations want in one, frictionless operational platform to go toe-to-toe with today’s advanced threats, while maintaining our commitment to customers and partners leveraging other endpoint solutions.”

Perella Weinberg Partners LP served as exclusive financial adviser to BlackBerry and Morrison Foerster LLP served as legal adviser to BlackBerry. Cooley LLP served as legal adviser to Arctic Wolf.

Join BlackBerry’s CEO and CFO today, Monday, December 16, at 5:30 p.m. ET for more information on today’s announcement. The call, which will be live streamed to the general public, can be accessed using the following link (here), through the Company’s investor webpage (BlackBerry.com/Investors), or by dialing toll free +1 (844) 763-8275 and entering Elite

Entry Number 51772. A replay will be available at approximately 8:30 p.m. ET today, using the same webcast link (here) or by dialing toll free +1 (877) 481-4010 and entering Replay Access Code 51772.

Read more about Arctic Wolf’s intent to acquire Cylance in a blog post from Arctic Wolf’s Chief Product and Services Officer, Dan Schiappa.

Additional Resources:

•Join the conversation with Arctic Wolf on Facebook, Twitter, LinkedIn, and YouTube

•Visit arcticwolf.com to learn more about our security operations solutions

•If you’re ready to get started, request a demo, get a quote, or conduct a Security Operations Maturity Assessment

•Want to join Arctic Wolf’s Partner Program? Apply today

About BlackBerry

BlackBerry (NYSE: BB; TSX: BB) provides intelligent security software and services to enterprises and governments around the world. The company’s software powers over 255M vehicles. Based in Waterloo, Ontario, the company leverages AI and machine learning to deliver innovative solutions in the areas of cybersecurity, safety, and data privacy solutions, and is a leader in the areas of endpoint management, endpoint security, encryption, and embedded systems. BlackBerry’s vision is clear - to secure a connected future you can trust. For more information, visit BlackBerry.com and follow @BlackBerry.

Trademarks, including but not limited to BLACKBERRY and EMBLEM Design, are the trademarks or registered trademarks of BlackBerry Limited, and the exclusive rights to such trademarks are expressly reserved. All other trademarks are the property of their respective owners. BlackBerry is not responsible for any third-party products or services.

About Arctic Wolf:

Arctic Wolf® is a global leader in security operations, enabling customers to manage their cyber risk in the face of modern cyber-attacks via a premier cloud-native security operations platform. The Arctic Wolf Aurora Platform ingests and analyzes more than 7 trillion security events a week to help enable cyber defense at an unprecedented capacity and scale, empowering customers of virtually any size across a wide range of industries to feel confident in their security posture, readiness, and long-term resilience. By delivering automated threat protection, response, and remediation capabilities, Arctic Wolf delivers world-class security operations with the push of a button so customers can defend their greatest assets at the speed of data. For more information about Arctic Wolf, visit arcticwolf.com or follow us at @AWNetworks, on LinkedIn or Facebook.

© 2024 Arctic Wolf Networks, Inc., All Rights Reserved. Arctic Wolf, Aurora, Alpha AI, Arctic Wolf Security Operations Cloud, Arctic Wolf Managed Detection and Response, Arctic Wolf Managed Risk, Arctic Wolf Managed Security Awareness, Arctic Wolf Incident Response, and Arctic Wolf Concierge Security Team are either trademarks or registered trademarks of Arctic Wolf

Networks, Inc. or Arctic Wolf Networks Canada, Inc. and any subsidiaries in Canada, the United States, and/or other countries.

BlackBerry Investor Contact:

BlackBerry Investor Relations

+1 (519) 888-7465

investorrelations@blackberry.com

BlackBerry Media Contacts:

BlackBerry Media Relations

+1 (519) 597-7273

mediarelations@BlackBerry.com

Arctic Wolf Press Contact:

Ilina Cashiola

ilina.cashiola@arcticwolf.com

202-340-0517

This news release contains forward-looking statements within the meaning of certain securities laws, including under the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws, including statements regarding the proposed transaction between BlackBerry and Arctic Wolf, the amounts and types of consideration BlackBerry will receive in connection therewith, the anticipated timing and results of the proposed transaction, the potential benefits of the proposed transaction for BlackBerry’s customers and shareholders, the expectations and beliefs of BlackBerry, and other statements that are not historical facts.

The words “expect”, “anticipate”, “estimate”, “may”, “will”, “should”, “could”, “intend”, “believe”, “target”, “plan” and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are based on BlackBerry’s current plans, objectives, estimates, assumptions, expectations and intentions and inherently involve significant risks and uncertainties, many of which are beyond BlackBerry’s control. Many factors could cause actual achievements with respect to the transaction and the timing of events to differ materially from those expressed or implied by the forward-looking statements, including, without limitation, risks and uncertainty associated with Arctic Wolf’s and BlackBerry’s ability to complete the proposed transaction on the proposed terms or on the anticipated timeline, or at all; risks and uncertainties related to the satisfaction of conditions to consummate the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the purchase agreement relating to the proposed transaction; effects relating to the announcement of the proposed transaction or any further announcements or the consummation of the proposed transaction on the market price of BlackBerry’s common shares; failure to realize the expected benefits of the proposed transaction, including risks associated with the payment of consideration post-closing and the availability of funds therefor and risks related to the value of Arctic Wolf’s common shares; risks related to future opportunities and plans for BlackBerry’s business, including its Secure Communications portfolio, and results of BlackBerry following completion of the proposed transaction; the risk of litigation in connection with the proposed

transaction, including resulting expense or delay; significant transaction costs and/or unknown or inestimable liabilities; risks related to diverting the attention of BlackBerry management from ongoing business operations; risks related to the proposed transaction disrupting BlackBerry’s operations and making it more difficult to conduct business as usual or for BlackBerry to maintain relationships with customers, resellers, channel partners or other third parties; adverse economic, geopolitical and environmental conditions; and other risks and uncertainties affecting BlackBerry, including those described from time to time under the caption “Risk Factors” and elsewhere in BlackBerry’s SEC filings and reports, including those discussed in BlackBerry’s Annual Report on Form 10-K and the “Cautionary Note Regarding Forward-Looking Statements” section of BlackBerry’s MD&A (copies of which filings may be obtained at www.sedar.com or www.sec.gov). All of these factors should be considered carefully and readers should not place undue reliance on BlackBerry’s forward-looking statements. Moreover, other risks and uncertainties of which BlackBerry is not currently aware may also affect its forward-looking statements and may cause actual results and the timing of events to differ materially from those anticipated.

The forward-looking statements made in this news release are made only as of the date hereof or as of the dates indicated in the forward-looking statements and reflect the views stated therein with respect to future events as at such dates. BlackBerry has no intention and undertakes no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

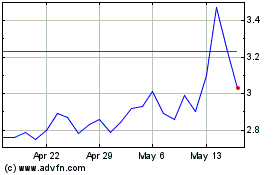

BlackBerry (NYSE:BB)

Historical Stock Chart

From Nov 2024 to Dec 2024

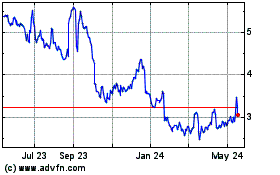

BlackBerry (NYSE:BB)

Historical Stock Chart

From Dec 2023 to Dec 2024