Franklin Templeton Expands ETF Lineup, Launching Two New Income Multiplier ETFs

24 January 2025 - 2:17AM

Business Wire

Franklin Templeton today announced the launch of two innovative

ETFs: the Franklin U.S. Dividend Multiplier ETF (XUDV) and the

Franklin International Dividend Multiplier ETF (XIDV). Both funds

are designed to offer enhanced, or multiplied, dividend income and

were developed in collaboration with New Frontier and VettaFi.

The Franklin U.S. Dividend Multiplier ETF seeks to track the

VettaFi New Frontier US Dividend Select Index and the Franklin

International Dividend Multiplier ETF seeks to track the VettaFi

New Frontier International Dividend Select Index.

"XUDV and XIDV demonstrate Franklin Templeton’s commitment to

expanding our suite of portfolio solutions in order to meet the

evolving needs of our clients,” said Todd Mathias, Head of US ETF

Product Strategy at Franklin Templeton. “With competitive expense

ratios of 0.09% for XUDV and 0.19% for XIDV, these ETFs provide

cost-effective access to strategies that combine enhanced dividend

income with next generation portfolio design, serving as a

compelling option for investors seeking access to long-only equity

income. These strategies are particularly well-suited for fee-based

advisors, sophisticated clients, and general retail investors

seeking efficient, diversified equity solutions.”

New Frontier’s proprietary optimization techniques, which have

been refined over years of research and practical application, form

the foundation of these ETFs. By integrating these advanced

optimization techniques into the ETF structure, New Frontier is

empowering a diverse range of investors to achieve more robust,

reliable outcomes aligned with their investment goals.

“Our collaboration with Franklin Templeton and VettaFi on XIDV

and XUDV marks a new era in both dividend investing and ETF

innovation. These ETFs embody New Frontier's mission to solve

complex investor challenges using optimization techniques, creating

highly efficient portfolios for reliable, long-term wealth

building,” said Robert Michaud, Chief Investment Officer of New

Frontier. “By applying our time-tested optimization to dividend

strategies, we've built an index to pursue enhanced dividend yield

coupled with risk-managed capital appreciation. This launch is

setting a new standard in the ETF industry through effective

investment technology. We're confident these ETFs will redefine

expectations for dividend-focused investments and demonstrate the

power of advanced optimization in portfolio construction.”

About Franklin Templeton

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 150 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company offers specialization on a global scale, bringing

extensive capabilities in fixed income, equity, alternatives and

multi-asset solutions. With more than 1,500 investment

professionals, and offices in major financial markets around the

world, the California-based company has over 75 years of investment

experience and over $1.6 trillion in assets under management as of

December 31, 2024. For more information, please visit

franklintempleton.com and follow us on LinkedIn, X and

Facebook.

About Franklin Templeton ETFs

At Franklin Templeton, we've built an all-weather ETF and ETP

platform. With over $32 billion in AUM and 100+ ETFs across all

asset classes, we offer comprehensive solutions to keep clients

invested in any market. Backed by 11 specialist investment managers

delivering an established lineup of active, passive and smart beta

+ innovation-focused ETP strategies, we partner to serve wealth

managers in a variety of ways across an entire portfolio.

Experience the power of a partnership that opens doors to endless

possibilities. For more information, please visit

https://www.franklintempleton.com/investments/capabilities/etfs/index.

Before investing, carefully consider a fund's investment

objectives, risks, charges and expenses. You can find this and

other information in each prospectus, or summary prospectus, if

available, at www.franklintempleton.com. Please read

it carefully.

XUDV -- All investments involve risks, including possible

loss of principal. Equity securities are subject to price

fluctuation and possible loss of principal. To the extent the

portfolio invests in a concentration of certain securities, regions

or industries, it is subject to increased volatility. Dividends may

fluctuate and are not guaranteed, and a company may reduce or

eliminate its dividend at any time. Performance of the fund may

vary significantly from the performance of an index, as a result of

transaction costs, expenses and other factors. There can be no

assurance that the underlying index's calculation methodology or

sources of information will provide an accurate assessment of

included issuers or that the included issuers will provide the fund

with the market exposure it seeks. Small- and mid-cap stocks

involve greater risks and volatility than large-cap stocks. The

fund is newly organized, with a limited history of operations.

These and other risks are discussed in the fund’s

prospectus.

XIDV -- All investments involve risks, including possible

loss of principal. Equity securities are subject to price

fluctuation and possible loss of principal. International

investments are subject to special risks, including currency

fluctuations and social, economic and political uncertainties,

which could increase volatility. These risks are magnified in

emerging markets. To the extent the portfolio invests in a

concentration of certain securities, regions or industries, it is

subject to increased volatility. Dividends may fluctuate and are

not guaranteed, and a company may reduce or eliminate its dividend

at any time. Performance of the fund may vary significantly from

the performance of an index, as a result of transaction costs,

expenses and other factors. There can be no assurance that the

underlying index's calculation methodology or sources of

information will provide an accurate assessment of included issuers

or that the included issuers will provide the fund with the market

exposure it seeks. Small- and mid-cap stocks involve greater risks

and volatility than large-cap stocks. The fund is newly organized,

with a limited history of operations. These and other risks are

discussed in the fund’s prospectus.

Franklin Distributors, LLC. Member FINRA, SIPC.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE.

Copyright © 2025. Franklin Templeton. All rights reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250123751431/en/

Rebecca Radosevich, (212) 632-3207,

rebecca.radosevich@franklintempleton.com

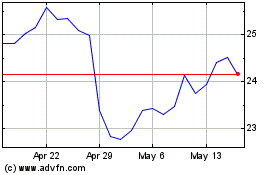

Franklin Resources (NYSE:BEN)

Historical Stock Chart

From Dec 2024 to Jan 2025

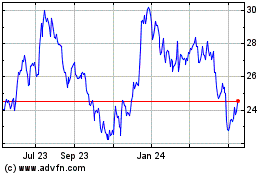

Franklin Resources (NYSE:BEN)

Historical Stock Chart

From Jan 2024 to Jan 2025