BILL Announces Repurchase of Additional 0.0% Convertible Senior Notes Due 2025

30 May 2024 - 10:00PM

Business Wire

BILL (NYSE: BILL), a leading financial operations platform for

small and midsize businesses (SMBs), today announced that it has

entered into various privately negotiated repurchase transactions

(collectively, the Repurchases) to repurchase approximately $234.5

million aggregate principal amount of BILL’s outstanding 0.0%

Convertible Senior Notes due 2025 (the 2025 Notes). The aggregate

cash repurchase price is approximately $221.7 million. The

Repurchases are expected to close on June 4, 2024, subject to

customary closing conditions. Following the closing of the

Repurchases, BILL intends to cancel the repurchased 2025 Notes and,

after such cancellation of repurchased 2025 Notes, approximately

$167.3 million aggregate principal amount of 2025 Notes will remain

outstanding. The Repurchases could affect the market price of BILL

common stock.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor shall there

be any offer or sale of these securities in any state or

jurisdiction in which the offer, solicitation, or sale would be

unlawful prior to the registration or qualification thereof under

the securities laws of any such state or jurisdiction.

About BILL

BILL (NYSE: BILL) is a leading financial operations platform for

small and midsize businesses (SMBs). As a champion of SMBs, we are

automating the future of finance so businesses can thrive. Our

integrated platform helps businesses to more efficiently control

their payables, receivables and spend and expense management.

Hundreds of thousands of businesses rely on BILL’s proprietary

member network of millions to pay or get paid faster. Headquartered

in San Jose, California, BILL is a trusted partner of leading U.S.

financial institutions, accounting firms, and accounting software

providers. For more information, visit bill.com.

Note on Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, which are statements other than statements of historical

facts, and statements in the future tense. Forward-looking

statements are based on our expectations as of the date of this

press release and are subject to a number of risks, uncertainties

and assumptions, many of which involve factors or circumstances

that are beyond our control. These statements include, but are not

limited to, statements related to the amount of 2025 Notes to be

repurchased, the ability to complete the Repurchases on the

timeline described herein or at all, the ultimate cash purchase

price for the Repurchases, and the impact of the Repurchases on the

market price of BILL common stock. Among the factors that could

cause actual results to differ materially from those indicated in

the forward-looking statements are: changes in the price of BILL

common stock and changes in the convertible note and other capital

markets. You should not rely on these forward-looking statements,

as actual results may differ materially from those contemplated by

these forward-looking statements as a result of such risks and

uncertainties. All forward-looking statements in this press release

are based on information available to us as of the date hereof. We

assume no obligation to update or revise the forward-looking

statements contained in this press release because of new

information, future events, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240530515989/en/

IR Contact: Karen Sansot ksansot@hq.bill.com

Press Contact: John Welton john.welton@hq.bill.com

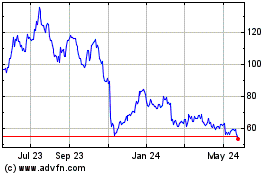

BILL (NYSE:BILL)

Historical Stock Chart

From Dec 2024 to Jan 2025

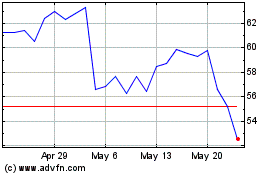

BILL (NYSE:BILL)

Historical Stock Chart

From Jan 2024 to Jan 2025