Blackstone's Hedge-Fund Business to Launch Growth Strategy

15 March 2021 - 11:30PM

Dow Jones News

By Juliet Chung

The world's biggest investor in hedge funds has hired former

hedge-fund manager Scott Bommer to launch a new growth strategy, a

move aimed at expanding Blackstone Group Inc.'s hedge-fund business

with offerings intended to generate big returns for clients.

The Blackstone Horizon platform, to be run by Mr. Bommer, will

thematically invest in money managers focused on fast-growing

public and private companies, Blackstone said. Horizon also will

invest directly in stock markets.

The main fund of hedge funds at the Blackstone business had

missed out on some of the rich returns coming from growth investing

in recent years because its conservative, low-volatility approach

aims to hedge clients' portfolios. Blackstone in January hired

former Brown University endowment chief Joe Dowling to run its

hedge-fund business with John McCormick, saying at the time that

his hire signaled a new focus on hedge funds as vehicles that can

generate big returns and withstand volatility.

Mr. Bommer, 54 years old, is Mr. Dowling's first hire. The

private-equity firm broadly has been pushing to invest more in

fast-growing companies and recently has taken stakes in the owner

of dating app Bumble and Swedish oat-milk maker Oatly AB.

"There's big opportunity with the disruption that's going on as

tech now permeates all these different industries," said Mr.

Bommer, who previously headed New York-based SAB Capital Management

for 17 years before shutting it in 2015 to manage his own

money.

Mr. Bommer is in charge of building a team for Horizon.

Blackstone said eight managers have already been selected for the

platform, two of whom are women, a high proportion in a

male-dominated industry.

Mr. Bommer said Blackstone's deep partnerships with hedge-fund

managers will help it access top investors and their best

co-investment ideas in private companies poised to go public, a

model Mr. Dowling employed at Brown. Mr. Bommer said those deals

would benefit from "almost a double layer of vetting" from managers

and Blackstone.

He also expressed interest in PIPE deals -- private investments

in public equity -- in companies going public through blank-check

companies. Horizon also could scoop up shares of companies that

have recently gone public when lockups on early investors expire,

or be a cornerstone investor in companies that do a direct listing.

Direct listings are an increasingly popular way for companies to go

public that sidesteps the traditional process of initial public

offerings.

"I can't think of someone who's better at evaluating,

underwriting and then assessing both risk and reward," Mr. Dowling

said of Mr. Bommer, a friend since their days at business school

together in the 1990s.

"He's had thousands and thousands of reps [repetitions] across

industries and asset classes and that's what you need to be really

good, " Mr. Dowling said.

During his time at SAB, Mr. Bommer largely invested in

comparatively cheap public companies as a value investor and also

invested in special situations. He saw SAB grow to a height of $2

billion.

While it underperformed rivals toward its end, SAB bested the

total-return of the S&P 500 by more than 7% on an annualized

basis over its lifetime, with less risk, according to an investor

document viewed by The Wall Street Journal.

Mr. Bommer has been focused on late-stage growth investing with

his personal wealth since he closed SAB while also continuing to

invest in public markets. He was a seed investor in Latin American

delivery startup Rappi Inc. when it was valued around $20 million.

Its most recent round in September valued the company at $4.3

billion post-money.

Keeping a low profile as a hedge-fund manager, Mr. Bommer has

attracted attention for his real-estate transactions. He and his

wife, Donya, spent $93.9 million on three adjoining East Hampton

parcels that they sold in 2016 for $110 million. The Bommers in

2008 set what were records at the time for New York City co-op

apartment purchase and sales figures.

Write to Juliet Chung at juliet.chung@wsj.com

(END) Dow Jones Newswires

March 15, 2021 08:15 ET (12:15 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

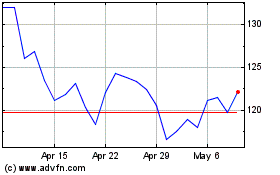

Blackstone (NYSE:BX)

Historical Stock Chart

From Mar 2024 to May 2024

Blackstone (NYSE:BX)

Historical Stock Chart

From May 2023 to May 2024