Form SD - Specialized disclosure report

23 May 2024 - 6:16AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

CRANE COMPANY

(Exact name of registrant as specified in its charter)

| | | | | |

| |

| Delaware | 1-41570 |

(State or other jurisdiction of

incorporation or organization) | Commission File Number

|

| | | | | |

| |

| 100 First Stamford Place, Stamford, CT | 06902 |

| (Address of principal executive offices) | (Zip code) |

| | |

|

| Marijane Papanikolaou, 203-363-7300 |

| (Name and telephone number, including area code, of the person to contact in connection with this report). |

|

Check the appropriate box to indicate the rule pursuant to which this form is being filed:

| | | | | |

| ☒ | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023. |

| | | | | |

| ☐ | Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended ____________. |

Section 1 – Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Conflict Minerals Disclosures:

The Conflict Minerals Report for the calendar year ended December 31, 2023 is included as Exhibit 1.01 and may be found on our website at:

https://investors.craneco.com/Investors/corporate-governance

Item 1.02 Exhibit

The Conflict Minerals Report required by Item 1.01 is filed as Exhibit 1.01 to this Form SD.

Section 2 – Resource Extraction Issuer Disclosure

Item 2.01 Resource Extraction Issuer Disclosure and Report

Not Applicable.

Section 3 – Exhibits

Item 3.01 Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

May 22, 2024

| | | | | |

| CRANE COMPANY |

| (Registrant) |

| |

|

|

| By: /s/ Marijane Papanikolaou |

| Marijane Papanikolaou Vice President, Controller Chief Accounting Officer |

Exhibit 1.01

Conflict Minerals Report

Definitions

Unless the context otherwise requires, references to “we,” “us,” “our,” or “the Company” mean Crane Company.

| | | | | |

| Conflict minerals: | Columbite-tantalite (coltan), cassiterite, gold, wolframite or their derivatives, which are limited to gold, tantalum, tin, and tungsten |

| Dodd-Frank Act: | The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 |

| DRC: | The Democratic Republic of Congo and adjoining countries |

| OECD: | Organization for Economic Cooperation and Development |

| |

| RCOI | Reasonable country of origin inquiry |

Applying the relevant provisions of the Dodd-Frank Act to Crane Company

The final conflict minerals rules adopted by the Securities and Exchange Commission (the “SEC”) require a three-step compliance approach. The first step is determining applicability of the conflict minerals rules to Crane Company; the second step is an RCOI to determine whether we have reason to believe that conflict minerals from the DRC or adjoining countries are present in our products; and the third step (referred to as “due diligence” in the SEC rules) is to determine the source and origin of any such conflict minerals and the facilities in which they were processed.

Crane Company Businesses Potentially Subject to Due Diligence

We are a diversified manufacturer of highly engineered industrial products. Our primary end markets include aerospace, defense and space, process industries, non-residential and municipal construction, along with a wide range of general industrial and certain consumer related end markets. As a diversified manufacturer of highly engineered industrial products, Crane Company is several tiers removed from mining operations and smelters or refiners (SORs) and has no visibility into the supply chain beyond our direct suppliers. The Company cannot exclude the possibility that at least a portion of its necessary conflict minerals may have originated in the DRC, and that they may not be from recycled or scrap sources. For that reason, we have included a Conflict Minerals Report as an Exhibit to our Form SD filed with the SEC for 2023.

The purpose of this report is to explain the steps that we have performed to comply with the Dodd-Frank Act and related regulations, as they pertain to conflict minerals. Our first step has consisted of making inquiries to our suppliers to determine whether conflict minerals are present within the products that they sell to us. As conflict minerals are often necessary for the functionality of the electronic components and certain machined metal components we purchase from our first tier suppliers as subcomponents to our manufactured products, we have determined it necessary to simultaneously begin the second compliance step.

Reasonable Country of Origin Inquiry (RCOI)

We have conducted an analysis of our products and found that the conflict minerals tin, tantalum, tungsten, and gold, can be found in multiple Crane Company products. Therefore, we have conducted an RCOI by having each Crane Company business group, as applicable, conduct a survey of its largest vendors whose products are likely to contain conflict minerals. We have used the Conflict Free Sourcing Initiative’s (CFSI) Conflict Minerals Reporting Template (CMRT), which includes standard supply chain survey and information tracking methods to determine if our manufactured products contain conflict minerals necessary to their functionality or production, to perform an RCOI as follows:

•Identified our businesses that manufactured or contracted to manufacture products in 2023.

•Determined that many of our manufactured products could contain conflict minerals.

•Identified vendors of raw materials or components that we used to manufacture our products.

Due Diligence Framework and Resources:

Our due diligence process was designed in conformance with the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High Risk Areas.

Due Diligence Steps Performed:

•Established a process for complying with the applicable rules.

•Developed a Conflict Minerals working group comprised of relevant functions and subject matter experts.

•Sent surveys to vendors representing greater than 80% of our total likely conflict minerals spend, using the CMRT standardized conflict minerals reporting template.

•Received responses from 152 vendors surveyed, representing 88% of the vendors surveyed.

•Requested that vendors report to us (i) any conflict minerals present in the raw materials or components they supplied to us, and (ii) their conflict minerals due diligence processes.

•Compiled and analyzed vendor responses.

•Conducted follow-up with non-responsive vendors or those whose responses required additional information or clarification.

•Established a process to retain relevant documentation in a structured electronic database.

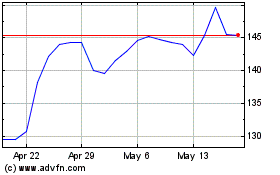

Crane (NYSE:CR)

Historical Stock Chart

From Oct 2024 to Nov 2024

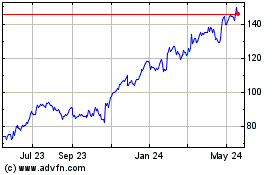

Crane (NYSE:CR)

Historical Stock Chart

From Nov 2023 to Nov 2024