Crane Company Announces Acquisition of Technifab Products, Inc.

05 November 2024 - 12:00AM

Business Wire

Crane Company (NYSE:CR) (“Crane” or the “Company”), a premier

industrial manufacturing and technology company, announced that on

Friday, November 1, 2024, it completed the acquisition of Technifab

Products, Inc. (“Technifab”), a leading provider of vacuum

insulated pipe systems and valves for cryogenic applications for

$40.5 million on a cash-free and debt- free basis.

Founded in 1992 by Noel Short, Technifab is headquartered in

Brazil, Indiana. Through September 2024, Technifab had trailing

12-month sales and adjusted EBITDA of approximately $20 million and

$4 million, respectively (please see the Non-GAAP Explanation).

Technifab joins Crane as part of the company’s Process Flow

Technologies (PFT) segment and extends our cryogenics capabilities

into high growth semiconductor, medical and pharmaceutical end

markets, as well as further expanding our geographic footprint to

better serve our customers.

Max H. Mitchell, Chairman of the Board, President and Chief

Executive Officer of Crane Company said, “We are excited to welcome

Technifab to Crane Company. Technifab is highly complementary to

our existing capabilities in cryogenics. Their expertise and

capability in manufacturing vacuum insulated pipe systems will

greatly enhance our ability to provide a broader suite of solutions

across highly attractive end markets.”

Mr. Mitchell concluded: “I would like to personally thank the

Short family for giving Crane the opportunity to acquire this great

company, as well as for all their assistance over the last several

months familiarizing us with Technifab and its sophisticated and

differentiated capabilities. I look forward to welcoming the entire

Technifab team to Crane, all of whom have been so critical to

Technifab’s success over the last few decades. I am also very

excited about the opportunities we have to invest further for

growth, leveraging Technifab’s core areas of strength together with

PFT’s existing cryogenic capabilities, including those provided by

our recent acquisition of CryoWorks in May of this year.”

About Crane Company

Crane Company has delivered innovation and technology-led

solutions to its customers since its founding in 1855. Today, Crane

is a leading manufacturer of highly engineered components for

challenging, mission-critical applications focused on the

aerospace, defense, space and process industry end markets. The

Company has two strategic growth platforms, Aerospace &

Electronics and Process Flow Technologies. Crane has approximately

7,500 employees in the Americas, Europe, the Middle East, Asia and

Australia. For more information, visit www.craneco.com.

Forward-Looking Statements Disclaimer

This press release contains forward-looking statements within

the meaning of the federal securities laws. Any statements

contained in this press release, except to the extent that they

contain historical facts, are forward-looking and accordingly are

based on management’s current assumptions, expectations, and

beliefs. Forward-looking statements are subject to risks and

uncertainties that could lead to actual results differing

materially from those expected or implied, including, but not

limited to, risks of being unable to successfully value, integrate

or realize the opportunities and synergies from the businesses we

acquire. These and other risk factors are discussed in the

Company’s filings with the Securities and Exchange Commission.

Crane assumes no (and disclaims any) obligation to revise or update

any forward-looking statements.

Non-GAAP Explanation

Crane Company reports its financial results in accordance with

U.S. generally accepted accounting principles (“GAAP”). This press

release includes a non-GAAP financial measure, adjusted EBITDA, for

the recently acquired Technifab that is not prepared in accordance

with GAAP. This non-GAAP measure is in addition to, and not a

substitute for or superior to, measures of financial performance

prepared in accordance with GAAP and should not be considered as an

alternative to operating income, net income or any other

performance measures derived in accordance with GAAP. We believe

that this non-GAAP measures of financial results (including on a

forward-looking or projected basis) provides useful supplemental

information to investors about Technifab. Our management uses this

forward-looking non-GAAP measure, among other GAAP and non-GAAP

measures, to evaluate and assess the projected financial and

operating results of Technifab. However, there are a number of

limitations related to the use of this non-GAAP measure and its

nearest GAAP equivalent. For example, other companies may calculate

non-GAAP measures differently or may use other measures to

calculate their financial performance, and therefore our non-GAAP

measures may not be directly comparable to similarly titled

measures of other companies.

Reconciliations of certain forward-looking and projected

non-GAAP measures for Technifab, including Adjusted EBITDA, to the

closest corresponding GAAP measure are not available without

unreasonable efforts due to the high variability, complexity and

low visibility with respect to the charges excluded from these

non-GAAP measures, which could have a potentially significant

impact on our future GAAP results. In the case of Technifab

specifically, access to certain information necessary to fully

reconcile forecasts of non-GAAP measures to their nearest GAAP

equivalent measure is not yet available. The forward looking and

projected non-GAAP measure is calculated as follows:

"Adjusted EBITDA" adds back to net income: net interest expense,

income tax expense, depreciation and amortization, and Special

Items such as transaction related expenses, certain non-recurring

facility move and lease expenses, and prior owner personal and

discretionary expenses. We believe that adjusted EBITDA provides

investors with an alternative metric that may be a meaningful

indicator of Technifab’s performance and provides useful

information to investors regarding its financial conditions that is

complementary to GAAP metrics. Further, for Technifab, adjusted

EBITDA may also be a useful complementary measure to GAAP metrics

because it excludes certain items, namely net interest expense,

income tax expense, and amortization, that could vary significantly

when forecasted for Technifab pre-acquisition as a standalone

entity compared to what those results may be with Technifab under

Crane’s ownership.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104328584/en/

Jason D. Feldman, SVP, Investor Relations, Treasury & Tax

Allison Poliniak, VP Investor Relations IR@craneco.com

www.craneco.com

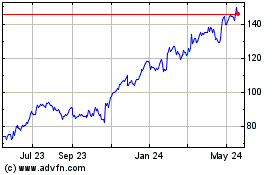

Crane (NYSE:CR)

Historical Stock Chart

From Jan 2025 to Feb 2025

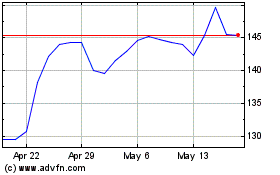

Crane (NYSE:CR)

Historical Stock Chart

From Feb 2024 to Feb 2025