Crane Company (NYSE:CR) (“Crane” or the “Company”), a premier

industrial manufacturing and technology company, announced that it

has entered into a definitive agreement to sell its Engineered

Materials business to KPS Capital Partners, LP (“KPS”) for $227

million.

Max Mitchell, Chairman of the Board, President and Chief

Executive Officer of Crane Company said, “This divestiture reflects

yet another important step forward following the numerous actions

we have taken over the last few years to simplify our portfolio and

focus our resources on our two strategic growth platforms:

Aerospace & Electronics and Process Flow Technologies. Those

simplification actions have included the divestiture of non-core

assets including Crane Supply and the defeasement of legacy

liabilities in 2022, followed by our 2023 separation transaction.

Since the separation, we have continued to invest in our strategic

growth platforms organically, and further strengthened those

businesses with four strategic acquisitions: Baum Lined Piping,

Vian Enterprises, CryoWorks, and Technifab Products. We will

continue to actively manage our portfolio to drive sustainable,

profitable growth for all our stakeholders.”

Mr. Mitchell concluded: “Engineered Materials is a great

business with leadership positions in the markets in which it

operates with dedicated Crane associates that I am very proud of,

and we look forward to watching its continued growth under the

ownership of KPS. I wish to thank our Engineered Materials team for

their support and understanding regarding this decision."

Crane Company and KPS anticipate closing the transaction in the

first quarter of fiscal year 2025 subject to customary closing

conditions, including receipt of regulatory approvals.

Engineered Materials will be presented as discontinued

operations beginning with results for the fourth quarter of 2024,

and retrospectively for prior periods. Our last full-year 2024

adjusted earnings per diluted share (EPS) guidance published on

October 28, 2024 was a range of $5.05 to $5.20. We are now updating

that guidance solely to reflect Engineered Materials’ presentation

as discontinued operations, and our revised adjusted EPS from

continuing operations guidance is $4.71 to $4.86. For the fourth

quarter of 2024, we expect adjusted EPS from continuing operations

of $1.10 to $1.25.

About Crane Company

Crane Company has delivered innovation and technology-led

solutions to its customers since its founding in 1855. Today, Crane

is a leading manufacturer of highly engineered components for

challenging, mission-critical applications focused on the

aerospace, defense, space and process industry end markets. The

Company has two strategic growth platforms, Aerospace &

Electronics and Process Flow Technologies. Crane has approximately

7,500 employees in the Americas, Europe, the Middle East, Asia and

Australia. For more information, visit www.craneco.com.

About KPS Capital Partners

KPS, through its affiliated management entities, is the manager

of the KPS Special Situations Funds, a family of investment funds

with approximately $21.4 billion of assets under management (as of

September 30, 2024). For over three decades, the Partners of KPS

have worked exclusively to realize significant capital appreciation

by making controlling equity investments in manufacturing and

industrial companies across a diverse array of industries,

including basic materials, branded consumer, healthcare and luxury

products, automotive parts, capital equipment, and general

manufacturing. KPS creates value for its investors by working

constructively with talented management teams to make businesses

better and generates investment returns by structurally improving

the strategic position, competitiveness, and profitability of its

portfolio companies, rather than primarily relying on financial

leverage. The KPS Funds’ portfolio companies currently generate

aggregate annual revenues of approximately $23.7 billion, operate

251 manufacturing facilities in 30 countries, and have

approximately 65,000 employees, directly and through joint ventures

worldwide (as of September 30, 2024, pro forma for recent

acquisitions). The KPS investment strategy and portfolio companies

are described in detail at www.kpsfund.com.

KPS Mid-Cap focuses on investments in the lower end of the

middle market that require up to $200 million of initial equity

capital. KPS Mid-Cap targets the same type of investment

opportunities and utilizes the same investment strategy that KPS’

flagship funds have for over three decades. KPS Mid-Cap leverages

and benefits from KPS’ global platform, reputation, track record,

infrastructure, best practices, knowledge and experience. The KPS

Mid-Cap investment team is managed by Partners Pierre de

Villeméjane and Ryan Harrison, who lead a team of experienced and

talented professionals.

Forward-Looking Statements Disclaimer

This press release contains forward-looking statements within

the meaning of the federal securities laws. Any statements

contained in this press release, except to the extent that they

contain historical facts, are forward-looking and accordingly are

based on management’s current assumptions, expectations, and

beliefs. Forward-looking statements are subject to risks and

uncertainties that could lead to actual results differing

materially from those expected or implied, including, but not

limited to, risks of being unable to successfully value, integrate

or realize the opportunities and synergies from the businesses we

acquire or to complete dispositions; and specific risks relating to

our reportable segments, including Aerospace & Electronics,

Process Flow Technologies and Engineered Materials. These and other

risk factors are discussed in the section entitled “Risk Factors”

in Item 1A of Crane’s Annual Report on Form 10-K for the year ended

December 31, 2023 and the other documents the Company files with

the Securities and Exchange Commission. We make no representations

or warranties as to the accuracy of any projections, statements or

information contained in this press release. Crane assumes no (and

disclaims any) obligation to revise or update any forward-looking

statements.

Non-GAAP Explanation

Crane Company reports its financial results in accordance with

U.S. generally accepted accounting principles (“GAAP”). This press

release includes a certain non-GAAP financial measure, adjusted EPS

from continuing operation, that is not prepared in accordance with

GAAP. This non-GAAP measure is an addition, and not a substitute

for or superior to, measures of financial performance prepared in

accordance with GAAP and should not be considered as an alternative

to operating income, net income or any other performance measures

derived in accordance with GAAP. We believe that these non-GAAP

measures of financial results (including on a forward-looking or

projected basis) provide useful supplemental information to

investors about Crane Company. Our management uses certain

forward-looking non-GAAP measures to evaluate projected financial

and operating results. However, there are a number of limitations

related to the use of these non-GAAP measures and their nearest

GAAP equivalents. For example, other companies may calculate

non-GAAP measures differently or may use other measures to

calculate their financial performance, and therefore our non-GAAP

measures may not be directly comparable to similarly titled

measures of other companies.

Reconciliations of certain forward-looking and projected

non-GAAP measures for Crane Company, including Adjusted EPS from

Continuing Operations, are not available without unreasonable

efforts due to the high variability, complexity and low visibility

with respect to the charges excluded from these non-GAAP measures,

which could have a potentially significant impact on our future

GAAP results. For Crane Company, these forward looking and

projected non-GAAP measures are calculated as follows:

"Adjusted EPS from Continuing Operations" is calculated as

adjusted net income from continuing operations divided by diluted

shares. Adjusted net income from continuing operations is

calculated as net income from continuing operations adjusted for

Special Items which include transaction related expenses such as

professional fees, repositioning related charges, and the impact of

pension non-service costs. We believe that non-GAAP financial

measures adjusted for these items provide investors with an

alternative metric that can assist in predicting future earnings

and profitability that are complementary to GAAP metrics.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241202077783/en/

Jason D. Feldman, SVP, Investor Relations, Treasury & Tax

Allison Poliniak, VP Investor Relations IR@craneco.com

www.craneco.com

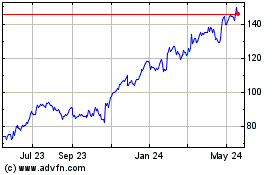

Crane (NYSE:CR)

Historical Stock Chart

From Dec 2024 to Jan 2025

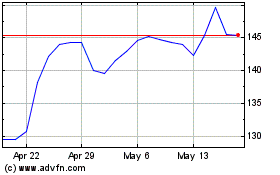

Crane (NYSE:CR)

Historical Stock Chart

From Jan 2024 to Jan 2025