Form S-3ASR - Automatic shelf registration statement of securities of well-known seasoned issuers

02 November 2024 - 7:31AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on November 1, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

COTERRA ENERGY INC.

(Exact name of registrant as specified in its charter)

| |

Delaware

|

|

|

04-3072771

|

|

| |

(State or other jurisdiction of

incorporation or organization)

|

|

|

(I.R.S. Employer

Identification Number)

|

|

Three Memorial City Plaza

840 Gessner Road, Suite 1400

Houston, Texas 77024

(281) 589-4600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Adam M. Vela

Senior Vice President and General Counsel

Coterra Energy Inc.

Three Memorial City Plaza

840 Gessner Road, Suite 1400

Houston, Texas 77024

(281) 589-4600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Clinton W. Rancher

Eileen S. Boyce

Baker Botts L.L.P.

910 Louisiana Street

Houston, Texas 77002

(713) 229-1234

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are to be offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer

☒

|

|

|

Accelerated filer

☐

|

|

| |

Non-accelerated filer

☐

|

|

|

Smaller reporting company

☐

|

|

| |

|

|

|

Emerging growth company

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

Coterra Energy Inc. (“Coterra”) has filed this Registration Statement on Form S-3 to register the issuance of up to 250,000 shares of Coterra’s common stock, par value $0.10 per share (“Common Stock”), upon the conversion of shares of 81∕8% Series A Cumulative Perpetual Convertible Preferred Stock, par value $0.01 per share (“Cimarex Preferred Stock”), of Cimarex Energy Co., a subsidiary of Coterra. Coterra originally registered the issuance of shares of Common Stock upon conversion of shares of Cimarex Preferred Stock under a Registration Statement on Form S-4 filed with the Securities and Exchange Commission (the “SEC”) on June 30, 2021, as amended on August 13, 2021. Subsequently, Coterra registered the issuance of shares of Common Stock upon conversion of shares of Cimarex Preferred Stock under a Registration Statement on Form S-3 filed with the SEC on October 14, 2021.

As of August 15, 2024, each holder of Cimarex Preferred Stock had the right to convert each share of Cimarex Preferred Stock into cash consideration of $471.3975 and 41.53769 fully paid and nonassessable shares of Coterra Common Stock, subject to adjustment upon the occurrence of certain events, including the payment of future cash dividends to holders of Common Stock, as provided in the Certificate of Designations relating to the Cimarex Preferred Stock.

Prospectus

COTERRA ENERGY INC.

250,000 Shares of Common Stock Issuable Upon Conversion of

81∕8% Series A Cumulative Perpetual Convertible Preferred Stock of Cimarex Energy Co.

This prospectus relates to the issuance of up to 250,000 shares of our common stock, par value $0.10 per share (“Common Stock”), issuable upon conversion of shares of 81∕8% Series A Cumulative Perpetual Convertible Preferred Stock, par value $0.01 per share (“Cimarex Preferred Stock”), of Cimarex Energy Co. (“Cimarex”). We will not receive any proceeds upon the issuance of the Common Stock upon conversion of shares of Cimarex Preferred Stock. You should read this prospectus carefully before making a decision with respect to the conversion of Cimarex Preferred Stock.

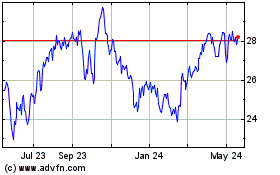

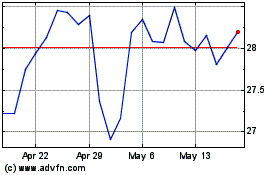

Our Common Stock is listed on the New York Stock Exchange (“NYSE”) under the trading symbol “CTRA.”

You should carefully read and consider the risk factors included in our periodic reports and other information that we file with the Securities and Exchange Commission. See “Risk Factors” beginning on page 3 of this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Prospectus dated November 1, 2024

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

12

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Using this process, we may issue the Common Stock in one or more transactions upon conversions of the Cimarex Preferred Stock. This prospectus provides you with a general description of the Common Stock. Please carefully read this prospectus in addition to the information contained in the documents we refer to under the heading “Where You Can Find More Information.”

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by reference to the actual documents. For additional information about our business, operations and financial results, please read the documents incorporated by reference herein under the heading “Where You Can Find More Information.”

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “Coterra,” the “Company,” “we,” “us,” or “our” relate to Coterra Energy Inc. and include our subsidiaries. In the “Description of Capital Stock,” section of this prospectus, however, references to “Company,” “we,” “us,” or “our” relate only to Coterra Energy Inc. and do not include any of our subsidiaries.

We have not authorized anyone to provide any information or to make any representations other than those contained in or incorporated by reference in this prospectus and any written communication prepared by us or on our behalf. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should not assume that the information in this prospectus is accurate as of any date other than the date on the cover page of this prospectus or that the information incorporated by reference in this prospectus is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus constitutes an offer to sell only under circumstances and in jurisdictions where it is lawful to do so.

ABOUT COTERRA ENERGY INC.

We are an independent oil and gas company engaged in the development, exploration and production of oil, natural gas and natural gas liquids. Our assets are concentrated in areas with known hydrocarbon resources that are conducive to multi-well, repeatable development programs. Our Common Stock is listed on the NYSE under the symbol “CTRA.” Our principal executive office is located at Three Memorial City Plaza, 840 Gessner Road, Suite 1400, Houston, Texas 77024, and our telephone number at that address is (281) 589-4600. For further discussion of the material elements of our business, please refer to our most recent Annual Report on Form 10-K and any subsequent reports we file with the SEC, which are incorporated by reference in this prospectus.

SUMMARY

| |

Issuer

|

|

|

Coterra Energy Inc. (“Coterra,” “we” or “us”)

|

|

| |

Shares issued

|

|

|

Up to 250,000 shares of Common Stock, par value $0.10 per share, plus additional shares that may be issued in connection with stock splits, stock dividends, anti-dilution provisions or other transactions.

|

|

| |

Use of proceeds

|

|

|

We will not receive any proceeds from the issuance of our Common Stock covered by this prospectus.

|

|

| |

New York Stock Exchange Symbol

|

|

|

“CTRA”

|

|

RISK FACTORS

Investing in our Common Stock involves risk. Before making a decision with respect to our Common Stock, you should read and carefully consider the risks and uncertainties discussed under “Cautionary Statement Regarding Forward-Looking Statements” and the risk factors set forth in our most recent Annual Report on Form 10-K, and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K filed with the SEC prior to the date of this prospectus, and in the documents and reports that we file with the SEC after the date of this prospectus that are incorporated by reference into this prospectus, as well as any risks described in any documents that are incorporated by reference herein. Additional risks not currently known to us or that we currently deem immaterial may also have a material adverse effect on us.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the statements incorporated by reference herein include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical fact, included in this prospectus or incorporated by reference herein, are forward-looking statements. Such forward-looking statements include, but are not limited to, statements regarding future financial and operating performance and results, strategic pursuits and goals, market prices, future hedging and risk management activities, timing and amount of capital expenditures and other statements that are not historical facts contained in this prospectus or incorporated by reference herein. The words “expect,” “project,” “estimate,” “believe,” “anticipate,” “intend,” “budget,” “plan,” “forecast,” “target,” “predict,” “potential,” “possible,” “may,” “should,” “could,” “would,” “will,” “strategy,” “outlook” and similar expressions are also intended to identify forward-looking statements. We can provide no assurance that the forward-looking statements contained in this prospectus or incorporated by reference herein will occur as expected, and actual results may differ materially from those included in this prospectus or incorporated by reference herein. Forward-looking statements are based on current expectations and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those included in this prospectus or incorporated by reference herein. These risks and uncertainties include, without limitation, the availability of cash on hand and other sources of liquidity to fund our capital expenditures, actions by, or disputes among or between, members of the Organization of Petroleum Exporting Countries and other exporting nations, market factors, market prices (including geographic basis differentials) of oil and natural gas, impacts of inflation, labor shortages and economic disruption, geopolitical disruptions such as the war in Ukraine or the conflict in the Middle East or further escalation thereof, results of future drilling and marketing activities, future production and costs, legislative and regulatory initiatives, electronic, cyber or physical security breaches, the impact of public health crises, including pandemics (such as the coronavirus pandemic) and epidemics and any related company or governmental policies or actions, and other factors detailed herein and in our other SEC filings. Additional important risks, uncertainties and other factors are described in “Risk Factors” in Part I. Item 1A in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and in other reports we file from time to time with the SEC that are incorporated by reference herein.

We caution you not to place undue reliance on the forward-looking statements. Forward-looking statements are based on the estimates and opinions of management as of the date they are made, and other than as required under the securities laws, we assume no obligation to update or revise these forward-looking statements, all of which are expressly qualified by the statements in or incorporated into this section, or provide reasons why actual results may differ. All forward-looking statements, expressed or implied, included in this prospectus, including the information incorporated by reference herein, are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. We urge you to carefully review and consider the disclosures made in this prospectus and our reports filed with the SEC and incorporated by reference herein that attempt to advise interested parties of the risks and factors that may affect our business. Please see “Where You Can Find More Information.”

USE OF PROCEEDS

The shares of Common Stock to be issued pursuant to this registration statement are being issued upon conversion of shares of Cimarex Preferred Stock. We will not receive any proceeds from the issuance of such shares.

DESCRIPTION OF CAPITAL STOCK

Set forth below is a description of the material terms of our capital stock. The following description is only a summary. This summary does not purport to be complete, or to give full effect to, the provisions of statutory or common laws, and is subject to, and is qualified in its entirety by reference to, the terms and detailed provisions of our amended and restated certificate of incorporation (including any certificate of designation) and our amended and restated bylaws. We urge you to read these documents. Please read “Where You Can Find More Information.”

Authorized Capital Stock

At October 29, 2024, our authorized capital consisted of:

•

1,800,000,000 shares of Common Stock, par value $0.10 per share, of which approximately 736,613,020 were outstanding, and

•

5,000,000 shares of Preferred Stock, par value $0.10 per share, issuable in series, of which no shares were issued and outstanding.

Common Stock

Holders of Common Stock may receive dividends if and when declared by our board of directors. The payment of dividends on our Common Stock may be limited by obligations to holders of any preferred stock and covenants contained in debt agreements.

Holders of Common Stock are entitled to one vote per share on matters submitted to them. Cumulative voting of shares is prohibited, meaning that the holders of a majority of the voting power of the shares voting for the election of directors can elect all directors to be elected if they choose to do so.

Our Common Stock has no preemptive rights and is not convertible, redeemable or assessable, or entitled to the benefits of any sinking fund.

If we liquidate or dissolve our business, the holders of Common Stock will share ratably in all assets available for distribution to stockholders after creditors are paid and preferred stockholders receive their distributions.

All issued and outstanding shares of Common Stock are fully paid and nonassessable. Any shares of Common Stock we offer under this prospectus will be fully paid and nonassessable. In October 2021, in connection with a merger involving Cimarex, we effectively assumed the obligations associated with the Cimarex Preferred Stock. Each holder of Cimarex Preferred Stock has the right at any time, at its option, to convert any or all of such holder’s shares of Cimarex Preferred Stock at an initial conversion rate of 34.1008 fully paid and nonassessable shares of our Common Stock and $471.3975 in cash per share of Cimarex Preferred Stock. The initial conversion rate of 34.1008 fully paid and nonassessable shares of our Common Stock adjusts upon the occurrence of certain events, including the payment of cash dividends to our common stockholders, and is 41.53769 as of August 15, 2024.

Additionally, beginning on and continuing after October 15, 2021, Cimarex has the right, at its option, if the closing sale price of our Common Stock meets certain criteria, to elect to cause all, and not part, of the outstanding shares of Cimarex Preferred Stock to be converted into that number of shares of our Common Stock for each eligible share of Cimarex Preferred Stock equal to the conversion rate in effect on the mandatory conversion date as such conversion rate is determined pursuant to the Certificate of Designations for the Cimarex Preferred Stock and $471.3975 in cash per share of Cimarex Preferred Stock.

Our Common Stock is listed on the NYSE and trades under the symbol “CTRA.”

Preferred Stock

The preferred stock may be issued in one or more series. Our board of directors may establish attributes of any series, including, without limitation, the designation and number of shares in the series, dividend rates (cumulative or noncumulative), conversion rights, redemption rights, voting rights, and any other rights

and qualifications, preferences and limitations or restrictions on shares of a series. The issuance of preferred stock may have the effect of delaying, deferring or preventing a change in control of us without any vote or action by the stockholders and may adversely affect the voting and other rights of the holders of shares of Common Stock. The specific terms of a particular series of preferred stock will be described in a certificate of designation relating to that series.

Subject to our amended and restated certificate of incorporation and to any limitations imposed by any then outstanding preferred stock, we may issue additional series of preferred stock, at any time or from time to time, with such powers, preferences, rights and qualifications, limitations or restrictions as our board of directors determines, and without further action of the stockholders, including holders of our then outstanding preferred stock, if any.

Limitation on Directors’ and Officers’ Liability and Certain Indemnification Obligations

Delaware law allows corporations to limit or eliminate the personal liability of directors and officers to corporations and their stockholders for monetary damages for breach of directors’ and officer’s fiduciary duty of care. Our amended and restated certificate of incorporation limits the liability of our directors and officers to the fullest extent permitted by this law. Specifically, our directors and officers will not be personally liable for monetary damages for any breach of their fiduciary duty, except for liability:

•

for any breach of their duty of loyalty to us or our stockholders;

•

for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law;

•

for any transaction from which the director or officer derived an improper personal benefit;

•

solely with respect to our directors, under provisions relating to unlawful payments of dividends or unlawful stock repurchases or redemptions; and

•

solely with respect to our officers, for any action by or in the right of Coterra.

These limitations may have the effect of reducing the likelihood of derivative litigation against our directors and officers, and may discourage or deter a lawsuit for breach of their duty of care being brought by stockholders (and, solely with regard to directors, by management), even though such an action, if successful, might otherwise have benefited our stockholders.

Additionally, our amended and restated bylaws provide indemnification to our directors and officers and other specified persons with respect to their conduct in various capacities, and we have entered into agreements with each of our directors and executive officers that indemnify them to the fullest extent permitted by Delaware law.

Effects of Certain Provisions of our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws and Delaware Law

Certain provisions of our amended and restated certificate of incorporation and amended and restated bylaws and Delaware law could have the effect of delaying, deferring or preventing a change in control or the removal of existing management, of deterring potential acquirors from making an offer to our stockholders and of limiting any opportunity to realize premiums over prevailing market prices for our Common Stock in connection therewith. This could be the case notwithstanding that a majority of our stockholders might benefit from such a change in control or offer.

Advance Notice for Stockholder Proposals and Director Nominations

Our amended and restated bylaws contain provisions requiring that advance notice be delivered to us of any business to be brought by a stockholder before an annual meeting of stockholders and providing for certain procedures to be followed by stockholders in nominating persons for election to our board of directors. Generally, the advance notice provisions provide that the stockholder must give written notice to our Secretary not less than 90 days nor more than 120 days prior to the anniversary date of the immediately preceding annual meeting, except that in the event that the annual meeting is called for a date that is more

than 30 days before or more than 60 days after such anniversary date, notice by the stockholder to be timely must be so delivered not earlier than the 120th day prior to the date of such annual meeting and not later than the 90th day prior to the date of such annual meeting (or, if less than 100 days’ prior notice or public announcement of the scheduled meeting date is given or made, then the 10th day following the earlier of the day on which the notice of such meeting was mailed to our stockholders or the day on which such public announcement was made). The notice must set forth specific information regarding that stockholder and that business or director nominee, as well as certain representations of the applicable stockholder (or beneficial owner), each as described in our amended and restated bylaws.

Proxy Access

Our amended and restated bylaws permit a stockholder, or a group of up to 20 stockholders (with a group of any two or more funds that are under common management and investment control constituting a single stockholder), owning 3% or more of our outstanding Common Stock continuously for at least three years to nominate and include in our proxy materials director candidates constituting up to 20% of our board of directors (or, if such amount is not a whole number, the closest whole number below 20%), provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in the amended and restated bylaws and subject to the other terms and conditions set forth in the amended and restated bylaws.

Vacancies on the Board of Directors

Our amended and restated bylaws provide that vacancies on the board of directors arising through death, resignation, retirement or removal shall be filled only by a majority of the directors then in office whether or not the remaining directors constitute a quorum.

Stockholder Action by Written Consent

Our amended and restated bylaws permit stockholders to act by written consent without a meeting. Any stockholder of record seeking to have the stockholders act by written consent must by written notice request our board of directors fix a record date, which must be fixed promptly (but in all events within 10 days) after the date on which such request is received.

Special Meetings of Stockholders

Our amended and restated bylaws provide that special meetings of stockholders may be called at any time only by our chairman, our chief executive officer, our president or our board of directors. The only business that may be conducted at a special meeting of stockholders is that business specified in the notice of the meeting.

Delaware Anti-Takeover Statute

As a Delaware corporation, we are subject to Section 203 of the Delaware General Corporation Law (“DGCL”). In general, Section 203 prevents us from engaging in a business combination with an “interested stockholder” (generally, a person owning 15% or more of our outstanding voting stock) for three years following the time that person becomes a 15% stockholder unless either:

•

before that person became a 15% stockholder, our board of directors approved the transaction in which the stockholder became a 15% stockholder or approved the business combination;

•

upon completion of the transaction that resulted in the stockholder’s becoming a 15% stockholder, the stockholder owns at least 85% of our voting stock outstanding at the time the transaction began (excluding stock held by directors who are also officers and by employee stock plans that do not provide employees with the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer); or

•

after the transaction in which that person became a 15% stockholder, the business combination is approved by our board of directors and authorized at a stockholder meeting by at least two-thirds of the outstanding voting stock not owned by the 15% stockholder.

Under Section 203, these restrictions also do not apply to certain business combinations proposed by a 15% stockholder following the disclosure of an extraordinary transaction with a person who was not a 15% stockholder during the previous three years or who became a 15% stockholder with the approval of a majority of our directors. This exception applies only if the extraordinary transaction is approved or not opposed by a majority of our directors who were directors before any person became a 15% stockholder in the previous three years, or the successors of these directors.

Exclusive Forum for Adjudication of Disputes

Our amended and restated bylaws provide that unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware shall, to the fullest extent permitted by applicable law, be the sole and exclusive forum for (1) any derivative action or proceeding brought on our behalf, (2) any action asserting a claim of breach of a fiduciary duty owed by any current or former director, officer, other employee or agent of ours to us or our stockholders, including a claim alleging the aiding and abetting of such a breach of fiduciary duty, (3) any action asserting a claim arising pursuant to any provision of the DGCL or our amended and restated bylaws or amended and restated certificate of incorporation (as either may be amended from time to time) or (4) any action asserting a claim governed by the internal affairs doctrine or asserting an “internal corporate claim” (as that term is defined in Section 115 of the DGCL) . In addition, unless we consent in writing to the selection of an alternative forum, the Federal District Courts of the United States of America shall be the sole and exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act.

Under the Securities Act, federal and state courts have concurrent jurisdiction over all suits brought to enforce any duty or liability created by the Securities Act, and stockholders cannot waive compliance with the federal securities laws and the rules and regulations thereunder. The exclusive forum provision would not apply to suits brought to enforce any liability or duty created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. To the extent that any such claims may be based upon federal law claims, Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. Although we believe these provisions are beneficial by providing increased consistency in the application of Delaware law or U.S. securities laws in the types of lawsuits to which they apply, the provisions may have the effect of discouraging lawsuits against our directors and officers or against us. Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the Company will be deemed to have notice of and have consented to the provisions of our amended and restated bylaws related to choice of forum. The enforceability of similar exclusive forum provisions in other companies’ organizational documents has been challenged in legal proceedings, and it is possible that, in connection with one or more actions or proceedings described above, a court could rule that this provision in our amended and restated bylaws is inapplicable or unenforceable.

Transfer Agent and Registrar

The transfer agent and registrar for the Common Stock is Equiniti Trust Company.

PLAN OF DISTRIBUTION

We are registering the issuance of up to 250,000 shares of our Common Stock issuable upon conversion of the shares of Cimarex Preferred Stock, plus an indeterminate number of shares of our Common Stock that may be issued from time to time upon conversion of shares of Cimarex Preferred Stock in connection with stock splits, stock dividends, anti-dilution provisions or other transactions. The shares of our Common Stock covered by this prospectus will be issued from time to time to holders of Cimarex Preferred Stock who convert their shares of Cimarex Preferred Stock into a combination of cash consideration and shares of our Common Stock in accordance with the Certificate of Designations relating to the Cimarex Preferred Stock. The holders of the Cimarex Preferred Stock will act independently of us in making decisions with respect to the timing of any such conversion. We will bear all fees and expenses incident to the registration of the Common Stock issued in connection with any such conversion.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other business and financial information with the SEC. Our SEC filings are available to the public at the internet website maintained by the SEC at www.sec.gov. You will also be able to obtain many of these documents, free of charge, from us by accessing our website at http://www.coterra.com under the “Investor Relations” link and then the “SEC Filings” link. The information contained on, or that can be accessed through, our website is not part of, and is not incorporated into, this prospectus. This prospectus is part of a registration statement we have filed with the SEC relating to our Common Stock.

As permitted by SEC rules, this prospectus does not contain all of the information we have included in the registration statement and the accompanying exhibits and schedules we file with the SEC. You may refer to the registration statement, exhibits and schedules for more information about us and our Common Stock.

The SEC allows us to “incorporate by reference” the information we have filed with it, which means that we can disclose important information to you by referring you to those documents. The information we incorporate by reference is an important part of this prospectus, and later information that we file with the SEC will automatically update and supersede this information. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus. We incorporate by reference the documents listed below and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (excluding any information furnished pursuant to Item 2.02 or Item 7.01 of any Current Report on Form 8-K, unless otherwise specified in such current report) until the termination of the issuances under this prospectus. The documents we incorporate by reference include:

•

•

•

•

•

the description of our Common Stock contained in our Registration Statement on Form 8-A filed on January 24, 1990, as updated by Exhibit 4.1 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, together with any other amendment or report filed for the purpose of updating such description.

You may request a copy of these filings, other than an exhibit to these filings unless we have specifically incorporated that exhibit by reference into this prospectus, at no cost, by writing or telephoning us at the following address:

Coterra Energy Inc.

Three Memorial City Plaza

840 Gessner Road, Suite 1400

Houston, Texas 77024

Attention: Investor Relations

Telephone: (281) 589-4600

LEGAL MATTERS

The validity of the shares of Common Stock issued hereby have been passed upon for us by Baker Botts L.L.P., Houston, Texas.

EXPERTS

The financial statements and management’s assessment of the effectiveness of internal control over financial reporting (which is included in Management’s Report on Internal Control over Financial Reporting) incorporated in this prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2023 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

DeGolyer and MacNaughton, an independent petroleum engineering firm, prepared independent estimates of Coterra’s proved reserve estimates for properties comprising greater than 90% of the total future net revenue discounted at 10% attributable to the proved reserves estimates related to our properties and found that such estimates were reasonable in the aggregate. Estimated quantities of such oil and gas reserves and the net present value of such reserves have been incorporated by reference in this prospectus in reliance on the authority of said firm as experts in petroleum engineering.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth expenses payable by Coterra in connection with the issuance and distribution of the securities being registered. All the amounts shown are estimates with the exception of the SEC registration fee.

| |

SEC registration fee

|

|

|

|

$ |

903.67 |

|

|

| |

Printing expenses

|

|

|

|

|

5,000 |

|

|

| |

Legal fees and expenses

|

|

|

|

|

25,000 |

|

|

| |

Accounting fees and expenses

|

|

|

|

|

10,000 |

|

|

| |

Miscellaneous

|

|

|

|

|

10,000 |

|

|

| |

Total

|

|

|

|

$ |

50,903.67 |

|

|

Item 15. Indemnification of Directors and Officers

Section 145 of the DGCL empowers a Delaware corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of such corporation) by reason of the fact that such person is or was a director or officer, employee or agent of such corporation, or is or was serving at the request of such corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise. The indemnity may include expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding, provided that he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. A Delaware corporation may indemnify directors, officers, employees and others in an action by or in the right of the corporation under the same conditions, except that no indemnification is permitted without judicial approval if the person to be indemnified has been adjudged to be liable to the corporation. Where a director or officer is successful on the merits or otherwise in the defense of any action referred to above or in defense of any claim, issue or matter therein, the corporation must indemnify such director or officer against the expenses (including attorneys’ fees) which he or she actually and reasonably incurred in connection therewith.

Article VI of Coterra’s amended and restated bylaws provides for indemnification of Coterra’s directors and officers to the full extent permitted by law, as now in effect or later amended. Article VI of Coterra’s amended and restated bylaws provides that expenses incurred by a director or officer in defending a suit or other similar proceeding shall be paid by Coterra upon receipt of an undertaking by or on behalf of the director or officer to repay such amount if it is ultimately determined that such director or officer is not entitled to be indemnified by Coterra.

Additionally, Coterra’s amended and restated certificate of incorporation contains a provision eliminating the personal liability of Coterra’s directors and officers to Coterra or Coterra’s stockholders for monetary damages for breaches of the fiduciary duty of care as a director or officer. As a result, Coterra’s stockholders may be unable to recover monetary damages against directors and officers for negligent or grossly negligent acts or omissions in violation of their duty of care. The provision does not change the liability of a director or officer for breach of their duty of loyalty to Coterra or to Coterra’s stockholders, for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law, for any transaction from which the director or officer receives an improper personal benefit, solely with respect to directors, under provisions relating to unlawful payments of dividends or unlawful stock repurchases or redemption and, solely with respect to officers, for any action by or in the right of Coterra.

In addition to the indemnification provisions in Coterra’s amended and restated certificate of incorporation and Coterra’s amended and restated bylaws, Coterra has taken such other steps as are

reasonably necessary to effect its indemnification policy. Included among such other steps is liability insurance provided by Coterra for its directors and officers for certain losses arising from claims or charges made against them in their capacities as directors or officers of Coterra. Coterra has also entered into indemnity agreements with certain individual officers. These agreements generally provide such officers with a contractual right to indemnification to the full extent provided by applicable law and Coterra’s amended and restated bylaws as in effect at the respective dates of such agreements.

Coterra has placed in effect insurance which purports (1) to insure it against certain costs of indemnification which may be incurred by it pursuant to the aforementioned bylaw provision or otherwise and (2) to insure Coterra’s officers and directors and of specified subsidiaries against certain liabilities incurred by them in the discharge of their functions as officers and directors except for liabilities arising from their own malfeasance.

Item 16. Exhibits*

The exhibits listed below are filed or incorporated by reference as part of this registration statement.

EXHIBIT INDEX

| |

Exhibit No.

|

|

|

|

|

|

Description

|

|

| |

2.1*

|

|

|

—

|

|

|

Agreement and Plan of Merger, dated as of May 23, 2021, by and among Cabot Oil & Gas Corporation, Double C Merger Sub, Inc. and Cimarex Energy Co. (incorporated herein by reference to Exhibit 2.1 of Coterra’s Current Report on Form 8-K filed with the SEC on May 24, 2021).

|

|

| |

2.2*

|

|

|

—

|

|

|

Amendment No. 1 to Agreement and Plan of Merger, dated as of June 29, 2021, by and among Cabot Oil & Gas Corporation, Double C Merger Sub, Inc. and Cimarex Energy Co. (incorporated herein by reference to Annex A to the Joint Proxy Statement/Prospectus included in Coterra’s Registration Statement on Form S-4 (Reg. No. 333-257534) filed with the SEC on June 30, 2021).

|

|

| |

3.1*

|

|

|

—

|

|

|

|

|

| |

3.2*

|

|

|

—

|

|

|

|

|

| |

4.1*

|

|

|

—

|

|

|

|

|

| |

4.2*

|

|

|

—

|

|

|

Certificate of Designations to 81∕8% Series A Cumulative Perpetual Convertible Preferred Stock of Cimarex Energy Co. (incorporated herein by reference to Exhibit 4.3 of Coterra’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021).

|

|

| |

4.3*

|

|

|

—

|

|

|

Amendment to Certificate of Designations to 81∕8% Series A Cumulative Perpetual Convertible Preferred Stock of Cimarex Energy Co. (incorporated herein by reference to Exhibit 4.4 of Coterra’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021).

|

|

| |

4.4*

|

|

|

—

|

|

|

Amendment to Certificate of Designations to 81∕8% Series A Cumulative Perpetual Convertible Preferred Stock of Cimarex Energy Co. (incorporated herein by reference to Exhibit 4.3 of Coterra’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2022).

|

|

| |

5.1

|

|

|

—

|

|

|

|

|

| |

23.1

|

|

|

—

|

|

|

|

|

| |

23.2

|

|

|

—

|

|

|

|

|

| |

23.3

|

|

|

—

|

|

|

|

|

| |

Exhibit No.

|

|

|

|

|

|

Description

|

|

| |

24.1

|

|

|

—

|

|

|

|

|

| |

107

|

|

|

—

|

|

|

|

|

*

Incorporated by reference to the indicated filing.

Item 17. Undertakings

(a)

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of a prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act to any purchaser:

(i)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration

statement relating to the securities in the registration statement to which such prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5)

That, for purposes of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to the registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii)

That portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv)

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(b)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the undersigned registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, Coterra certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Houston, State of Texas, on November 1, 2024.

COTERRA ENERGY INC.

By:

/s/ THOMAS E. JORDEN

Thomas E. Jorden

Chairman, Chief Executive Officer and President

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints each of Thomas E. Jorden, Shannon E. Young, III, Todd M. Roemer, Adam M. Vela and Marcus G. Bolinder, as his or her true and lawful attorney or attorney-in-fact and agent, with full power to act with or without the others and with full power of substitution and resubstitution, to execute in his or her name, place and stead, in any and all capacities, any or all amendments (including post-effective amendments) to this Registration Statement and any registration statement for the same offering filed pursuant to Rule 462 under the Securities Act of 1933, as amended, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents and each of them full power and authority, to do and perform in the name and on behalf of the undersigned, in any and all capacities, each and every act and thing necessary or desirable to be done in and about the premises, to all intents and purposes and as fully as they might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or their substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities indicated on November 1, 2024.

| |

Signature

|

|

|

Title

|

|

| |

/s/ THOMAS E. JORDEN

Thomas E. Jorden

|

|

|

Chairman, Chief Executive Officer and President (Principal Executive Officer)

|

|

| |

/s/ SHANNON E. YOUNG, III

Shannon E. Young, III

|

|

|

Executive Vice President and Chief Financial Officer (Principal Financial Officer)

|

|

| |

/s/ TODD M. ROEMER

Todd M. Roemer

|

|

|

Vice President and Chief Accounting Officer (Principal Accounting Officer)

|

|

| |

/s/ ROBERT S. BOSWELL

Robert S. Boswell

|

|

|

Lead Independent Director

|

|

| |

/s/ DOROTHY M. ABLES

Dorothy M. Ables

|

|

|

Director

|

|

| |

/s/ AMANDA M. BROCK

Amanda M. Brock

|

|

|

Director

|

|

| |

Signature

|

|

|

Title

|

|

| |

/s/ DAN. O. DINGES

Dan O. Dinges

|

|

|

Director

|

|

| |

/s/ PAUL N. ECKLEY

Paul N. Eckley

|

|

|

Director

|

|

| |

/s/ HANS HELMERICH

Hans Helmerich

|

|

|

Director

|

|

| |

/s/ LISA A. STEWART

Lisa A. Stewart

|

|

|

Director

|

|

| |

/s/ FRANCES M. VALLEJO

Frances M. Vallejo

|

|

|

Director

|

|

| |

/s/ MARCUS A. WATTS

Marcus A. Watts

|

|

|

Director

|

|

Exhibit 5.1

|

910 LOUISIANA

HOUSTON, TEXAS

77002-4995

TEL +1 713.229.1234

FAX +1 713.229.1522

BakerBotts.com

| AUSTIN

Brussels

DALLAS

DUBAI

HOUSTON

London

| NEW YORK

PALO ALTO

RIYADH

San Francisco

Singapore

WASHINGTON

|

November 1, 2024

Coterra Energy Inc.

Three Memorial City Plaza

840 Gessner Road, Suite 1400

Houston, Texas 77024

Ladies and Gentlemen:

As set forth in the Registration

Statement on Form S-3 (the “Registration Statement”) to be filed on the date hereof by Coterra Energy Inc., a Delaware

corporation (“Coterra”), with the Securities and Exchange Commission (the “Commission”) under the Securities

Act of 1933, as amended (the “Act”), relating to the issuance from time to time, pursuant to Rule 415 under the Act,

of up to 250,000 shares of Coterra’s common stock, par value $0.10 per share (“Common Stock”), issuable upon conversion

of up to 4,265 shares of 8⅛% Series A Cumulative Perpetual Convertible Preferred Stock, par value $0.01 per share (“Cimarex

Preferred Stock”), of Cimarex Energy Co., a Delaware corporation and subsidiary of Coterra (“Cimarex”), at the current

conversion rate of 41.53769 shares of Common Stock per share of Cimarex Preferred Stock plus an estimate of 72,841 additional shares

of Common Stock that could become issuable upon conversion of the outstanding shares of the Cimarex Preferred Stock due to possible future

adjustments to such conversion rate as a result of future dividends on the Common Stock during the period in which the Registration Statement

is expected to remain effective (such Common Stock, as issued from time to time upon conversion of such Cimarex Preferred Stock, the

“Conversion Shares”), certain legal matters in connection with the Conversion Shares are being passed upon for you by us.

At your request, we are furnishing this opinion to you for filing as Exhibit 5.1 to the Registration Statement.

In our capacity as your counsel

in connection with the matter referred to above, we have examined originals, or copies certified or otherwise identified, of: the amended

and restated certificate of incorporation of Coterra, as amended to date, the amended and restated bylaws of Coterra, as amended to date

(collectively, the “Coterra Charter Documents”), the amended and restated certificate of incorporation of Cimarex (including,

for the avoidance of doubt, the certificate of designations relating to the Cimarex Preferred Stock (the “Certificate of Designations”)),

as amended to date, and such corporate records, certificates of public officials, statutes and such other instruments and documents as

we have deemed necessary or advisable for the purpose of rendering the opinion set forth below. In giving the opinion set forth herein,

we have relied, to the extent we deemed appropriate, on certificates, statements or other representations of officers of Coterra and

Cimarex and other representatives of Coterra and Cimarex and of public officials with respect to the accuracy of the factual matters

contained in such certificates and we have assumed, without independent investigation, that all signatures on documents examined by us

are genuine, all documents submitted to us as originals are authentic and complete, all documents submitted to us as copies of original

documents conform to the original documents and those original documents are authentic and complete.

| | |

| | | |

| Coterra Energy Inc. | - 2 - | November 1, 2024 |

In connection with the opinion

set forth herein, we have assumed that: (1) the Registration Statement and any amendments thereto (including any post-effective

amendments) will have become effective under the Act; (2) at the time of issuance of any Conversion Shares, there will be sufficient

shares of Common Stock authorized for issuance under Coterra’s restated certificate of incorporation, as then amended, that have

not otherwise been issued or reserved or otherwise committed for issuance; (3) all Conversion Shares will be issued in compliance

with applicable federal and state securities laws and in the manner stated in the Registration Statement; and (5) certificates representing

the Conversion Shares will have been duly executed, countersigned, registered and delivered, or if issued in book-entry form, (a) an

appropriate account statement evidencing the Conversion Shares credited to the recipient’s account maintained by Coterra’s

transfer agent and registrar will be issued by such transfer agent and (b) the issuance of the Conversion Shares will be properly

recorded in the share registry of Coterra.

On the basis of the foregoing,

and subject to the assumptions, limitations and qualifications set forth herein, we are of the opinion that, with respect to the Conversion

Shares, when the Conversion Shares are issued and delivered upon conversion of the Cimarex Preferred Stock in accordance with the terms

of the Certificate of Designations and in the manner contemplated by the Registration Statement, the Conversion Shares will be validly

issued, fully paid and non-assessable.

The opinion set forth above

is limited in all respects to matters of the General Corporation Law of the State of Delaware as in effect on the date hereof.

We hereby consent to the filing

of this opinion of counsel as Exhibit 5.1 to the Registration Statement. We also consent to the reference to our firm under the

heading “Legal Matters” in the prospectus forming a part of the Registration Statement. In giving this consent, we do not

thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act and the rules and

regulations of the Commission thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ Baker Botts L.L.P. |

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent to the incorporation by reference in this Registration

Statement on Form S-3 of Coterra Energy Inc. of our report dated February 23, 2024 relating to the financial statements and the effectiveness

of internal control over financial reporting, which appears in Coterra Energy Inc.’s Annual Report on Form 10-K for the year ended

December 31, 2023. We also consent to the reference to us under the heading “Experts” in such Registration Statement.

/s/ PricewaterhouseCoopers LLP

Houston, Texas

November 1, 2024

Exhibit 23.3

DEGOLYER AND MACNAUGHTON

5001 SPRING VALLEY ROAD

SUITE 800 EAST

DALLAS, TEXAS 75244

November 1, 2024

Coterra Energy Inc.

Three Memorial City Plaza

840 Gessner Road, Suite 1400

Houston, Texas 77024

Ladies and Gentlemen:

We

hereby consent to the reference to DeGolyer and MacNaughton and to the incorporation by reference of our review of the proved oil, condensate,

natural gas liquids, and gas reserves, as of December 31, 2023, estimated by Coterra Energy Inc. (“Coterra”), that was presented

in our report of third party dated January 26, 2024 as an exhibit in the Annual Report on Form 10-K of Coterra for the fiscal year ended

December 31, 2023, in the form and context in which it appears or is incorporated by reference into the Registration Statement on Form

S-3 of Coterra to be filed on or about November 1, 2024 (the “Registration Statement”). We further consent to the use of

the name DeGolyer and MacNaughton under the heading “Experts” in the Registration Statement.

| Very truly yours, |

| | |

| /s/ DeGOLYER and MacNAUGHTON |

| DeGOLYER and MacNAUGHTON |

| Texas Registered Engineering Firm F-716 |

S-3

S-3ASR

EX-FILING FEES

0000858470

Coterra Energy Inc.

0000858470

2024-10-29

2024-10-29

0000858470

1

2024-10-29

2024-10-29

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-3

|

|

Coterra Energy Inc.

|

|

Table 1: Newly Registered and Carry Forward Securities

|

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation or Carry Forward Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

Carry Forward Form Type

|

Carry Forward File Number

|

Carry Forward Initial Effective Date

|

Filing Fee Previously Paid in Connection with Unsold Securities to be Carried Forward

|

|

Newly Registered Securities

|

|

Fees to be Paid

|

1

|

Equity

|

Common stock, par value $0.10 per share

|

457(a)

|

250,000

|

$

23.61

|

$

5,902,500.00

|

0.0001531

|

$

903.67

|

|

|

|

|

|

Fees Previously Paid

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carry Forward Securities

|

|

Carry Forward Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Offering Amounts:

|

|

$

5,902,500.00

|

|

$

903.67

|

|

|

|

|

|

|

|

|

Total Fees Previously Paid:

|

|

|

|

$

0.00

|

|

|

|

|

|

|

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

|

|

|

|

|

|

|

Net Fee Due:

|

|

|

|

$

903.67

|

|

|

|

|

|

1

|

The amount registered is estimated based on (a) the total number of shares of common stock, par value $0.10 per share ("Common Stock") issuable upon conversion of the 4,265 outstanding shares of 81/8% Series A Cumulative Perpetual Convertible Preferred Stock, par value $0.01 per share ("Cimarex Preferred Stock"), of Cimarex Energy Co. ("Cimarex"), at the current conversion rate of 41.53769 shares of Common Stock per share of Cimarex Preferred Stock, plus (b) an estimate of 72,841 additional shares of Common Stock that could become issuable upon conversion of the outstanding shares of Cimarex Preferred Stock due to possible future adjustments to such conversion rate as a result of future dividends on the Common Stock during the period in which this registration statement is expected to remain effective. Pursuant to Rule 416 under the Securities Act, the number of shares of Common Stock registered also includes an indeterminate number of shares of Common Stock that may be issued from time upon conversion of the Cimarex Preferred Stock in connection with stock splits, stock dividends, anti-dilution provisions or similar transactions.

The proposed maximum offering price is estimated solely for the purpose of calculating the amount of the registration fee and is based on the average of the high and low sales prices of Common Stock of $23.61 per share as of October 28, 2024 as reported on the New York Stock Exchange, pursuant to Rule 457(c) under the Securities Act.

|

|

|

v3.24.3

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

Offerings - Offering: 1

|

Oct. 29, 2024

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Rule 457(a) |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common stock, par value $0.10 per share

|

| Amount Registered | shares |

250,000

|

| Proposed Maximum Offering Price per Unit |

23.61

|

| Maximum Aggregate Offering Price |

$ 5,902,500.00

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 903.67

|

| Offering Note |

The amount registered is estimated based on (a) the total number of shares of common stock, par value $0.10 per share ("Common Stock") issuable upon conversion of the 4,265 outstanding shares of 81/8% Series A Cumulative Perpetual Convertible Preferred Stock, par value $0.01 per share ("Cimarex Preferred Stock"), of Cimarex Energy Co. ("Cimarex"), at the current conversion rate of 41.53769 shares of Common Stock per share of Cimarex Preferred Stock, plus (b) an estimate of 72,841 additional shares of Common Stock that could become issuable upon conversion of the outstanding shares of Cimarex Preferred Stock due to possible future adjustments to such conversion rate as a result of future dividends on the Common Stock during the period in which this registration statement is expected to remain effective. Pursuant to Rule 416 under the Securities Act, the number of shares of Common Stock registered also includes an indeterminate number of shares of Common Stock that may be issued from time upon conversion of the Cimarex Preferred Stock in connection with stock splits, stock dividends, anti-dilution provisions or similar transactions.

The proposed maximum offering price is estimated solely for the purpose of calculating the amount of the registration fee and is based on the average of the high and low sales prices of Common Stock of $23.61 per share as of October 28, 2024 as reported on the New York Stock Exchange, pursuant to Rule 457(c) under the Securities Act.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using Rule 457(a) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 457

| Name: |

ffd_Rule457aFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.3

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |