Torrid Holdings Inc. Announces Launch of Secondary Offering of Common Stock

11 September 2024 - 10:56PM

Business Wire

Torrid Holdings Inc. (“Torrid” or the “Company”) today announced

the launch of an underwritten public offering of 8,000,000 shares

of common stock (the “Offering”) to be sold by certain stockholders

of the Company (the “Selling Stockholders”). Torrid will not

receive any of the proceeds from the sale of the shares by the

Selling Stockholders. The Selling Stockholders intend to grant the

underwriters a 30-day option to buy an additional 1,200,000 shares

of common stock at the public offering price, less the underwriting

discount and commissions.

BofA Securities, Goldman Sachs & Co. LLC, Jefferies and

William Blair are acting as joint lead book-running managers for

the Offering. Telsey Advisory Group is acting as co-manager for the

Offering.

A registration statement (including a prospectus) on Form S-3

was initially filed with the Securities and Exchange Commission

(the “SEC”) on February 16, 2024, and has been declared effective.

The Offering will be made only by means of a prospectus supplement

and the accompanying prospectus. Before you invest, you should read

the registration statement, the prospectus supplement, the

accompanying prospectus and other documents the Company has filed

or will file with the SEC for information about the Company and the

Offering. You may obtain these documents free of charge by visiting

EDGAR on the SEC website at www.sec.gov. Alternatively, copies of

the prospectus supplement and the accompanying prospectus, when

available, may be obtained by contacting: BofA Securities,

Attention: Prospectus Department, NC1-022-02-25, 201 North Tryon

Street, Charlotte, North Carolina, 28255-0001, or by email at

dg.prospectus_requests@bofa.com; Goldman Sachs & Co. LLC,

Attention: Prospectus Department, 200 West Street, New York, NY

10282, or by email at prospectus-ny@ny.email.gs.com; Jefferies LLC,

Attention: Equity Syndicate Prospectus Department, 520 Madison

Avenue, New York, NY 10022, or by email at

Prospectus_Department@Jefferies.com; or William Blair &

Company, L.L.C., Attention: Prospectus Department, 150 North

Riverside Plaza, Chicago, IL 60606, or by email at

prospectus@williamblair.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About TORRID

TORRID is a direct-to-consumer brand in North America dedicated

to offering a diverse assortment of stylish apparel, intimates, and

accessories skillfully designed for curvy women. Specializing in

sizes 10 to 30, TORRID’s primary focus is on providing fashionable,

comfortable, and affordable options that meet the unique needs of

its customers. TORRID’s extensive collection features high quality

merchandise, including tops, bottoms, denim, dresses, intimates,

activewear, footwear, and accessories. Revenues are generated

primarily through its e-Commerce platform and its stores in the

United States of America, Puerto Rico and Canada.

Forward-Looking Statements

This press release contains forward-looking statements,

including statements regarding the size and timing of the Offering

and the granting of an option by the Selling Stockholders to the

underwriters to purchase additional shares of the Company's common

stock from the Selling Stockholders. These statements are not

historical facts but rather are based on Torrid's current

expectations and projections regarding its business, operations and

other factors relating thereto. Words such as “expect,” “intend,”

“believe,” “may,” “will,” “should,” and other words and terms of

similar meaning (including their negative counterparts or other

various or comparable terminology) are used to identify these

forward-looking statements. These statements are only predictions

and as such are not guarantees of future performance and involve

risks, uncertainties and assumptions that are difficult to predict.

Actual results may differ materially from those in the

forward-looking statements as a result of a number of factors,

including those set forth in the "Risk Factors" section of the

registration statement and the prospectus supplement for the

Offering and the Company’s other filings with the SEC. Any such

forward-looking statements are made pursuant to the safe harbor

provisions of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934, and speak only as of

the date of this press release. Torrid undertakes no duty to update

any forward-looking statements made herein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240910475375/en/

Investors ICR Lyn Walther IR@torrid.com Media

Joele Frank, Wilkinson Brimmer Katcher Michael Freitag / Arielle

Rothstein / Lyle Weston Media@torrid.com

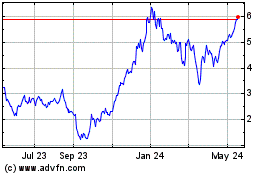

Torrid (NYSE:CURV)

Historical Stock Chart

From Dec 2024 to Jan 2025

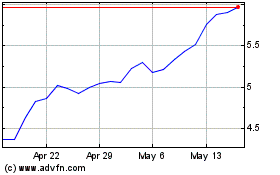

Torrid (NYSE:CURV)

Historical Stock Chart

From Jan 2024 to Jan 2025