UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22011

Morgan Stanley Emerging

Markets Domestic Debt Fund, Inc.

(Exact name of registrant as specified in charter)

| 1585 Broadway, New York, New York |

10036 |

| (Address of principal executive offices) |

(Zip code) |

| |

|

| John H. Gernon |

|

| 1585 Broadway, New York, New York 10036 |

|

| (Name and address of agent for service) |

|

Registrant's telephone number, including area code: 212-762-1886

Date of fiscal year end: October 31,

Date of reporting period: April 30, 2024

Item 1 - Report to Shareholders

Morgan Stanley Investment Management Inc.

Adviser

Morgan Stanley Emerging Markets

Domestic Debt Fund, Inc.

NYSE: EDD

Semi-Annual Report

April 30, 2024

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

April 30, 2024 (unaudited)

|

Letter to Stockholders |

|

|

3 |

|

|

|

Performance Summary |

|

|

5 |

|

|

|

Portfolio of Investments |

|

|

6 |

|

|

|

Statement of Assets and Liabilities |

|

|

21 |

|

|

|

Statement of Operations |

|

|

22 |

|

|

|

Statements of Changes in Net Assets |

|

|

23 |

|

|

|

Statement of Cash Flows |

|

|

24 |

|

|

|

Financial Highlights |

|

|

25 |

|

|

|

Notes to Financial Statements |

|

|

26 |

|

|

|

Portfolio Management |

|

|

39 |

|

|

|

Investment Policy |

|

|

40 |

|

|

|

Dividend Reinvestment Plan |

|

|

51 |

|

|

|

Important Notices |

|

|

52 |

|

|

|

U.S. Customer Privacy Notice |

|

|

53 |

|

|

|

Directors and Officers Information |

|

|

Back Cover |

|

|

2

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

April 30, 2024 (unaudited)

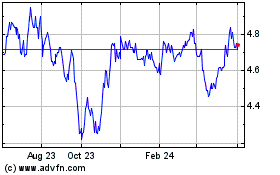

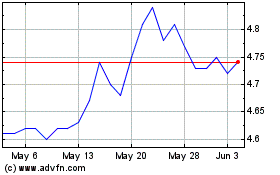

Performance

For the six months ended April 30, 2024, the Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. (the "Fund") had total returns of 7.66%, based on net asset value, and 8.05% based on market value per share (including reinvestment of distributions), compared to its benchmark, the J.P. Morgan Government Bond Index — Emerging Markets Global Diversified Index (the "Index"), which returned 4.07%. On April 30, 2024, the closing price of the Fund's shares on the New York Stock Exchange was $4.50, representing a 14.45% discount to the Fund's net asset value per share. Past performance is no guarantee of future results.

Factors Affecting Performance

• Emerging market (EM) domestic debt assets posted positive returns over the six-month period ended April 30, 2024 (as measured by the Index). The strong EM debt rally during the end of 2023 helped to boost assets during this period overall, despite the broad sell-off in local assets during the first quarter of 2024.

• Broadly, for the Fund, yield curve, duration and currency positioning positively contributed to relative performance versus the Index.

• The Fund's overweight positioning to Egyptian, Nigerian and Uzbekistani local bonds contributed to relative performance versus the Index. Conversely, the Fund's underweight to China and overweight to Indonesia detracted from performance relative to the Index.

• During the period, the portfolio management team added to exposures in Egypt, Turkey and Poland while reducing positioning in South Africa, Thailand and Sri Lanka.

• The Fund's use of derivatives did not have a material impact on performance relative to the Index during the period. The primary instruments used were bond futures (U.S. Treasury and German bund), currency forwards, and interest rate swaps. Bond futures and interest rate swaps were used to gain or hedge interest rate exposure, and currency forwards were used to hedge or add to currency exposure.

Management Strategies

• As of the end of the reporting period, EM debt valuations remained compelling, and EM assets were cheap, in the portfolio management team's view. Real yields in emerging markets were near 10-year highs and inflation continued to come down, leaving room for EM central banks to make additional rate cuts. Improving global growth outlooks, especially in emerging markets, may

3

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

April 30, 2024 (unaudited)

Letter to Stockholders (cont'd)

be supportive for EM assets, even as U.S. yields may stay elevated for longer, in the portfolio management team's view. The portfolio management team believed local assets, particularly currencies, were an attractive area of the asset class, while sovereign and corporate spreads were broadly tight, offering little additional value. However, higher spread credits — especially found in off-benchmark credits — presented interesting investment opportunities, in the portfolio management team's view.

Sincerely,

John H. Gernon

President and Principal Executive Officer May 2024

4

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

April 30, 2024 (unaudited)

Average Annual Total Returns as of April 30, 2024(1)

|

|

|

6 Month* |

|

One Year |

|

Five Years |

|

Ten Years |

|

|

NAV |

|

|

7.66 |

% |

|

|

3.69 |

% |

|

|

0.12 |

% |

|

|

-2.22 |

% |

|

|

Market price |

|

|

8.05 |

% |

|

|

5.27 |

% |

|

|

-0.43 |

% |

|

|

-2.58 |

% |

|

J.P. Morgan Government Bond Index —

Emerging Markets Global Diversified Index(2) |

|

|

4.07 |

% |

|

|

1.79 |

% |

|

|

-0.27 |

% |

|

|

-0.62 |

% |

|

* Cumulative return

Performance data quoted on the table represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. Performance assumes that all dividends and distributions, if any, were reinvested at prices obtained under the Fund's dividend reinvestment plan. For the most recent month-end performance figures, please visit www.morganstanley.com/im/closedendfundsshareholderreports. Investment returns and principal value will fluctuate so that Fund shares, when sold, may be worth more or less than their original cost. The table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the sale of fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. The Fund's total returns are based upon the market value and net asset value on the last business day of the period.

|

Distributions |

|

|

Total Distributions per share for the period |

|

$ |

0.18 |

|

|

|

Distribution Rate at NAV(3) |

|

|

6.84 |

% |

|

|

Distribution Rate at Market Price(3) |

|

|

8.00 |

% |

|

|

% Premium/(Discount) to NAV(4) |

|

|

(14.45 |

)% |

|

(1) All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

(2) The J.P. Morgan Government Bond Index — Emerging Markets Global Diversified Index tracks local currency government bonds issued by emerging markets. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(3) The Distribution Rate is based on the Fund's last regular distribution per share in the period (annualized) divided by the Fund's NAV or market price at the end of the period. The Fund's distributions may be comprised of amounts characterized for federal income tax purposes as qualified and non-qualified ordinary dividends, capital gains and non-dividend distributions, also known as return of capital. The Fund will determine the federal income tax character of distributions paid to a shareholder after the end of the calendar year. The Fund's distributions are determined by the investment adviser based on its current assessment of the Fund's long-term return potential. Fund distributions may be affected by numerous factors including changes in Fund performance, the cost of financing for leverage, portfolio holdings, realized and projected returns, and other factors. As portfolio and market conditions change, the rateof distributions paid by the Fund could change.

(4) The shares of the Fund often trade at a discount or premium to their net asset value. The discount or premium may vary over time and may be higher or lower than what is quoted in this report.

5

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

April 30, 2024 (unaudited)

Portfolio of Investments

(Showing Percentage of Total Value of Investments)

|

|

|

Face

Amount

(000) |

|

Value

(000) |

|

|

FIXED INCOME SECURITIES (94.2%) |

|

|

Argentina (0.5%) |

|

|

Sovereign (0.5%) |

|

Bonos Para La

Reconstruccion De

Una Argentina Libre,

0.00%, 6/30/25 |

|

$ |

1,090 |

|

|

$ |

1,006 |

|

|

|

3.00%, 5/31/26 |

|

|

1,069 |

|

|

|

848 |

|

|

|

|

|

|

|

|

1,854 |

|

|

|

Armenia (2.9%) |

|

|

Sovereign (2.9%) |

|

Republic of Armenia

Treasury Bond,

9.00%, 4/29/26 |

|

AMD |

99,880 |

|

|

|

255 |

|

|

|

9.25%, 4/29/28 |

|

|

976,910 |

|

|

|

2,487 |

|

|

|

9.60%, 10/29/33 |

|

|

2,505,588 |

|

|

|

6,463 |

|

|

|

9.75%, 10/29/50 - 10/29/52 |

|

|

757,312 |

|

|

|

1,971 |

|

|

|

|

|

|

|

|

11,176 |

|

|

|

Benin (1.1%) |

|

|

Sovereign (1.1%) |

|

Benin Government

International Bond,

4.88%, 1/19/32 |

|

EUR |

1,314 |

|

|

|

1,192 |

|

|

|

6.88%, 1/19/52 |

|

|

1,086 |

|

|

|

946 |

|

|

|

7.96%, 2/13/38 |

|

$ |

2,065 |

|

|

|

1,952 |

|

|

|

|

|

|

|

|

4,090 |

|

|

|

Chile (0.6%) |

|

|

Sovereign (0.6%) |

|

Bonos de la Tesoreria de la

Republica en pesos,

5.30%, 11/1/37 |

|

CLP |

2,410,000 |

|

|

|

2,405 |

|

|

|

Colombia (6.2%) |

|

|

Corporate Bond (0.3%) |

|

Fideicomiso PA Costera,

6.25%, 1/15/34 (a) |

|

COP |

4,979,415 |

|

|

|

1,123 |

|

|

|

Sovereign (5.9%) |

|

Colombian TES, Series B

5.75%, 11/3/27 |

|

|

24,995,000 |

|

|

|

5,593 |

|

|

|

6.00%, 4/28/28 |

|

|

8,982,000 |

|

|

|

1,998 |

|

|

|

6.25%, 7/9/36 |

|

|

4,382,700 |

|

|

|

778 |

|

|

|

7.00%, 3/26/31 - 6/30/32 |

|

|

23,679,600 |

|

|

|

4,984 |

|

|

|

|

|

Face

Amount

(000) |

|

Value

(000) |

|

|

7.75%, 9/18/30 |

|

COP |

6,916,000 |

|

|

$ |

1,568 |

|

|

|

9.25%, 5/28/42 |

|

|

11,117,300 |

|

|

|

2,425 |

|

|

Financiera de Desarrollo

Territorial SA Findeter,

7.88%, 8/12/24 (a) |

|

|

20,551,000 |

|

|

|

5,169 |

|

|

|

|

|

|

|

|

22,515 |

|

|

|

|

|

|

|

|

23,638 |

|

|

|

Czech Republic (2.7%) |

|

|

Sovereign (2.7%) |

|

Czech Republic

Government Bond,

1.20%, 3/13/31 |

|

CZK |

57,320 |

|

|

|

1,998 |

|

|

|

2.75%, 7/23/29 |

|

|

214,430 |

|

|

|

8,480 |

|

|

|

|

|

|

|

|

10,478 |

|

|

|

Dominican Republic (6.9%) |

|

|

Sovereign (6.9%) |

|

Dominican Republic

Central Bank Note,

8.00%, 3/12/27 (a) |

|

DOP |

15,000 |

|

|

|

239 |

|

|

|

12.00%, 10/3/25 (a) |

|

|

59,260 |

|

|

|

1,024 |

|

|

|

13.00%, 12/5/25 (a) |

|

|

217,000 |

|

|

|

3,813 |

|

|

Dominican Republic

International Bond,

8.00%, 1/15/27 - 2/12/27 (a) |

|

|

114,000 |

|

|

|

1,818 |

|

|

|

11.25%, 9/15/35 (a) |

|

|

261,150 |

|

|

|

4,717 |

|

|

|

12.00%, 8/8/25 (a) |

|

|

262,700 |

|

|

|

4,560 |

|

|

|

12.75%, 9/23/29 (a) |

|

|

357,200 |

|

|

|

6,921 |

|

|

|

13.63%, 2/3/33 |

|

|

160,750 |

|

|

|

3,284 |

|

|

|

|

|

|

|

|

26,376 |

|

|

|

Egypt (13.4%) |

|

|

Sovereign (13.4%) |

|

Egypt Treasury Bills,

28.40%, 12/17/24 |

|

EGP |

107,150 |

|

|

|

1,933 |

|

|

|

28.50%, 12/17/24 |

|

|

10,000 |

|

|

|

180 |

|

|

|

28.52%, 3/18/25 |

|

|

35,725 |

|

|

|

610 |

|

|

|

28.75%, 12/3/24 |

|

|

91,950 |

|

|

|

1,673 |

|

|

|

28.75%, 12/10/24 |

|

|

459,725 |

|

|

|

8,328 |

|

|

|

28.83%, 9/24/24 |

|

|

841,175 |

|

|

|

15,993 |

|

|

|

29.25%, 12/17/24 |

|

|

389,125 |

|

|

|

7,018 |

|

|

|

31.50%, 12/10/24 |

|

|

282,650 |

|

|

|

5,120 |

|

|

|

32.50%, 3/11/25 |

|

|

605,625 |

|

|

|

10,389 |

|

|

|

|

|

|

|

|

51,244 |

|

|

The accompanying notes are an integral part of the financial statements.

6

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

April 30, 2024 (unaudited)

Portfolio of Investments (cont'd)

(Showing Percentage of Total Value of Investments)

|

|

|

Face

Amount

(000) |

|

Value

(000) |

|

|

Hungary (2.7%) |

|

|

Sovereign (2.7%) |

|

Hungary Government Bond,

2.25%, 4/20/33 |

|

HUF |

438,100 |

|

|

$ |

819 |

|

|

|

3.00%, 10/27/27 - 4/25/41 |

|

|

2,685,730 |

|

|

|

5,451 |

|

|

|

3.25%, 10/22/31 |

|

|

687,060 |

|

|

|

1,461 |

|

|

|

4.00%, 4/28/51 |

|

|

139,450 |

|

|

|

245 |

|

|

|

4.50%, 5/27/32 |

|

|

110,380 |

|

|

|

253 |

|

|

|

4.75%, 11/24/32 |

|

|

977,610 |

|

|

|

2,267 |

|

|

|

|

|

|

|

|

10,496 |

|

|

|

Indonesia (10.4%) |

|

|

Sovereign (10.4%) |

|

Indonesia Treasury Bond,

6.50%, 2/15/31 |

|

IDR |

114,953,000 |

|

|

|

6,764 |

|

|

|

6.63%, 2/15/34 |

|

|

87,251,000 |

|

|

|

5,142 |

|

|

|

7.00%, 9/15/30 - 2/15/33 |

|

|

142,861,000 |

|

|

|

8,736 |

|

|

|

7.13%, 6/15/42 - 6/15/43 |

|

|

83,550,000 |

|

|

|

5,113 |

|

|

|

7.38%, 5/15/48 |

|

|

7,875,000 |

|

|

|

496 |

|

|

|

7.50%, 6/15/35 |

|

|

83,000,000 |

|

|

|

5,216 |

|

|

|

8.38%, 4/15/39 |

|

|

65,600,000 |

|

|

|

4,468 |

|

|

|

8.75%, 5/15/31 |

|

|

58,978,000 |

|

|

|

3,926 |

|

|

|

|

|

|

|

|

39,861 |

|

|

|

Jordan (0.7%) |

|

|

Sovereign (0.7%) |

|

Jordan Government

International Bond,

4.95%, 7/7/25 |

|

$ |

2,735 |

|

|

|

2,632 |

|

|

|

Kazakhstan (1.1%) |

|

|

Corporate Bond (1.1%) |

|

Development Bank of

Kazakhstan JSC,

13.00%, 4/15/27 (a) |

|

KZT |

1,922,000 |

|

|

|

4,298 |

|

|

|

Kenya (1.5%) |

|

|

Sovereign (1.5%) |

|

Republic of Kenya

Infrastructure Bond,

18.46%, 8/9/32 |

|

KES |

750,700 |

|

|

|

5,794 |

|

|

|

Malaysia (3.5%) |

|

|

Sovereign (3.5%) |

|

Malaysia Government Bond,

3.58%, 7/15/32 |

|

MYR |

6,289 |

|

|

|

1,280 |

|

|

|

3.76%, 5/22/40 |

|

|

24,620 |

|

|

|

4,920 |

|

|

|

|

|

Face

Amount

(000) |

|

Value

(000) |

|

|

4.23%, 6/30/31 |

|

MYR |

29,504 |

|

|

$ |

6,316 |

|

|

|

4.70%, 10/15/42 |

|

|

3,900 |

|

|

|

867 |

|

|

|

|

|

|

|

|

13,383 |

|

|

|

Mexico (0.9%) |

|

|

Sovereign (0.9%) |

|

Mexican Bonos,

8.50%, 11/18/38 |

|

MXN |

32,679 |

|

|

|

1,692 |

|

|

Petroleos Mexicanos,

6.88%, 10/16/25 |

|

$ |

1,720 |

|

|

|

1,696 |

|

|

|

|

|

|

|

|

3,388 |

|

|

|

Nigeria (3.5%) |

|

|

Sovereign (3.5%) |

|

Nigeria OMO Bill,

0.00%, 6/4/24 - 2/25/25 |

|

NGN |

3,515,201 |

|

|

|

2,371 |

|

|

Nigeria Treasury Bill,

0.00%, 2/20/25 - 3/27/25 |

|

|

10,534,428 |

|

|

|

6,427 |

|

|

|

22.96%, 2/6/25 |

|

|

395,331 |

|

|

|

246 |

|

|

|

23.30%, 2/6/25 |

|

|

716,636 |

|

|

|

447 |

|

|

|

23.88%, 4/10/25 |

|

|

564,758 |

|

|

|

338 |

|

|

|

24.03%, 4/10/25 |

|

|

943,147 |

|

|

|

564 |

|

|

|

25.27%, 4/10/25 |

|

|

1,976,654 |

|

|

|

1,182 |

|

|

|

25.60%, 4/10/25 |

|

|

1,129,517 |

|

|

|

676 |

|

|

|

27.02%, 3/6/25 |

|

|

1,673,200 |

|

|

|

1,024 |

|

|

|

|

|

|

|

|

13,275 |

|

|

|

Paraguay (2.1%) |

|

|

Corporate Bond (0.7%) |

|

Itau BBA International PLC,

0.00%, 2/19/30 |

|

PYG |

18,493,970 |

|

|

|

2,673 |

|

|

|

Sovereign (1.4%) |

|

Paraguay Government

International Bond,

7.90%, 2/9/31 (a) |

|

|

39,279,000 |

|

|

|

5,425 |

|

|

|

|

|

|

|

|

8,098 |

|

|

|

Peru (7.2%) |

|

|

Sovereign (7.2%) |

|

Peru Government Bond,

5.40%, 8/12/34 |

|

PEN |

20,217 |

|

|

|

4,645 |

|

|

|

5.94%, 2/12/29 |

|

|

47,048 |

|

|

|

12,455 |

|

|

|

6.15%, 8/12/32 |

|

|

15,580 |

|

|

|

3,910 |

|

|

|

6.35%, 8/12/28 |

|

|

10,000 |

|

|

|

2,707 |

|

|

|

7.30%, 8/12/33 |

|

|

14,016 |

|

|

|

3,752 |

|

|

|

|

|

|

|

|

27,469 |

|

|

The accompanying notes are an integral part of the financial statements.

7

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

April 30, 2024 (unaudited)

Portfolio of Investments (cont'd)

(Showing Percentage of Total Value of Investments)

|

|

|

Face

Amount

(000) |

|

Value

(000) |

|

|

Romania (2.3%) |

|

|

Sovereign (2.3%) |

|

Romania Government Bond,

2.50%, 10/25/27 |

|

RON |

9,000 |

|

|

$ |

1,711 |

|

|

|

4.25%, 4/28/36 |

|

|

8,910 |

|

|

|

1,500 |

|

|

|

4.75%, 10/11/34 |

|

|

25,000 |

|

|

|

4,515 |

|

|

|

8.75%, 10/30/28 |

|

|

3,970 |

|

|

|

924 |

|

|

|

|

|

|

|

|

8,650 |

|

|

|

Serbia (4.2%) |

|

|

Sovereign (4.2%) |

|

Serbia Treasury Bonds,

4.50%, 8/20/32 |

|

RSD |

869,800 |

|

|

|

7,244 |

|

|

|

7.00%, 10/26/31 |

|

|

926,490 |

|

|

|

9,030 |

|

|

|

|

|

|

|

|

16,274 |

|

|

|

South Africa (7.8%) |

|

|

Sovereign (7.8%) |

|

Republic of South Africa

Government Bond,

8.00%, 1/31/30 |

|

ZAR |

72,930 |

|

|

|

3,442 |

|

|

|

8.75%, 1/31/44 |

|

|

106,539 |

|

|

|

4,018 |

|

|

|

9.00%, 1/31/40 |

|

|

343,230 |

|

|

|

13,630 |

|

|

|

10.50%, 12/21/26 - 12/21/26 |

|

|

164,400 |

|

|

|

8,947 |

|

|

|

|

|

|

|

|

30,037 |

|

|

|

Supranational (1.5%) |

|

|

Corporate Bonds (1.3%) |

|

European Bank for

Reconstruction &

Development,

6.75%, 3/14/31 |

|

INR |

342,000 |

|

|

|

3,976 |

|

|

Inter-American

Development Bank,

7.35%, 10/6/30 |

|

|

92,000 |

|

|

|

1,104 |

|

|

|

|

|

|

|

|

5,080 |

|

|

|

Sovereign (0.2%) |

|

International Finance Corp.,

16.00%, 2/21/25 |

|

UZS |

7,000,000 |

|

|

|

549 |

|

|

|

|

|

|

|

|

5,629 |

|

|

|

Suriname (0.2%) |

|

|

Sovereign (0.2%) |

|

Suriname Government

International Bond,

7.95%, 7/15/33 (a)(b) |

|

$ |

19 |

|

|

|

17 |

|

|

|

9.00%, 12/31/50 (a)(c) |

|

|

1,207 |

|

|

|

910 |

|

|

|

|

|

|

|

|

927 |

|

|

|

|

|

Face

Amount

(000) |

|

Value

(000) |

|

|

Thailand (2.1%) |

|

|

Sovereign (2.1%) |

|

Thailand Government Bond,

1.60%, 6/17/35 |

|

THB |

30,700 |

|

|

$ |

732 |

|

|

|

1.88%, 6/17/49 |

|

|

50,000 |

|

|

|

1,014 |

|

|

|

2.00%, 6/17/42 |

|

|

226,000 |

|

|

|

5,123 |

|

|

|

3.30%, 6/17/38 |

|

|

50,000 |

|

|

|

1,391 |

|

|

|

|

|

|

|

|

8,260 |

|

|

|

Turkey (0.6%) |

|

|

Sovereign (0.6%) |

|

Turkiye Government Bond,

17.30%, 7/19/28 |

|

TRY |

52,600 |

|

|

|

1,241 |

|

|

|

26.20%, 10/5/33 |

|

|

30,000 |

|

|

|

925 |

|

|

|

|

|

|

|

|

2,166 |

|

|

|

Uruguay (2.1%) |

|

|

Sovereign (2.1%) |

|

Uruguay Government

International Bond,

3.88%, 7/2/40 |

|

UYU |

105,748 |

|

|

|

2,982 |

|

|

|

8.25%, 5/21/31 |

|

|

3,794 |

|

|

|

95 |

|

|

|

9.75%, 7/20/33 |

|

|

184,737 |

|

|

|

5,025 |

|

|

|

|

|

|

|

|

8,102 |

|

|

|

Uzbekistan (5.3%) |

|

|

Corporate Bonds (2.0%) |

|

European Bank for

Reconstruction &

Development,

17.20%, 4/9/26 |

|

$ |

1,700 |

|

|

|

1,700 |

|

|

|

17.35%, 3/1/27 |

|

|

700 |

|

|

|

689 |

|

|

Ipoteka-Bank ATIB,

20.50%, 4/25/27 |

|

UZS |

15,590,000 |

|

|

|

1,236 |

|

|

Uzbek Industrial &

Construction Bank ATB

via Daryo Finance BV,

18.75%, 6/15/25 |

|

|

48,515,300 |

|

|

|

4,133 |

|

|

|

|

|

|

|

|

7,758 |

|

|

|

Senior Loan Interests (1.1%) |

|

Europe Asia Investment

Finance BV,

18.70%, 7/21/26 |

|

|

51,573,170 |

|

|

|

4,232 |

|

|

The accompanying notes are an integral part of the financial statements.

8

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

April 30, 2024 (unaudited)

Portfolio of Investments (cont'd)

(Showing Percentage of Total Value of Investments)

|

|

|

Face

Amount

(000) |

|

Value

(000) |

|

|

Sovereign (2.2%) |

|

Republic of Uzbekistan

International Bond,

14.00%, 7/19/24 |

|

UZS |

48,410,000 |

|

|

$ |

3,804 |

|

|

|

16.25%, 10/12/26 |

|

|

55,720,000 |

|

|

|

4,437 |

|

|

|

|

|

|

|

|

8,241 |

|

|

|

|

|

|

|

|

20,231 |

|

|

|

Venezuela (0.2%) |

|

|

Sovereign (0.2%) |

|

Venezuela Government

International Bond,

7.00%, 3/31/38 (d)(e)(f) |

|

$ |

359 |

|

|

|

62 |

|

|

|

7.65%, 4/21/25 (d)(e)(f) |

|

|

593 |

|

|

|

108 |

|

|

|

8.25%, 10/13/24 (d)(e)(f) |

|

|

899 |

|

|

|

166 |

|

|

|

9.00%, 5/7/23 (d)(e)(f) |

|

|

307 |

|

|

|

60 |

|

|

|

9.25%, 9/15/27 - 5/7/28 (d)(e)(f) |

|

|

1,482 |

|

|

|

307 |

|

|

|

9.38%, 1/13/34 (d)(e)(f) |

|

|

108 |

|

|

|

22 |

|

|

|

11.75%, 10/21/26 (d)(e)(f) |

|

|

138 |

|

|

|

30 |

|

|

|

|

|

|

|

|

755 |

|

|

|

TOTAL FIXED INCOME SECURITIES (Cost $379,268) |

|

|

|

|

360,986 |

|

|

|

SHORT-TERM INVESTMENTS (5.6%) |

|

|

U.S. Treasury Security (3.1%) |

|

U.S. Treasury Bill,

5.31%, 8/1/24 (g) |

|

|

9,308 |

|

|

|

9,183 |

|

|

|

5.34%, 8/1/24 (g) |

|

|

200 |

|

|

|

197 |

|

|

|

5.35%, 8/1/24 (g) |

|

|

2,500 |

|

|

|

2,467 |

|

|

|

5.36%, 8/1/24 (g) |

|

|

100 |

|

|

|

99 |

|

|

|

TOTAL U.S. TREASURY SECURITY (Cost $11,949) |

|

|

|

|

11,946 |

|

|

|

|

|

Shares |

|

|

|

|

Investment Company (2.5%) |

|

Morgan Stanley Institutional

Liquidity Funds — Treasury Securities

Portfolio — Institutional Class

(See Note F) (Cost $9,654) |

|

|

9,654,494 |

|

|

|

9,654 |

|

|

|

TOTAL SHORT-TERM INVESTMENTS (Cost $21,603) |

|

|

|

|

21,600 |

|

|

TOTAL INVESTMENTS EXCLUDING PURCHASED

OPTIONS (99.8%) (Cost $400,871) |

|

|

|

|

382,586 |

|

|

TOTAL PURCHASED OPTIONS

OUTSTANDING (0.2%) (Cost $1,505) |

|

|

|

|

590 |

|

|

|

TOTAL INVESTMENTS (100%) (Cost $402,376) (h)(i) |

|

|

|

|

383,176 |

|

|

|

LIABILITIES IN EXCESS OF OTHER ASSETS |

|

|

|

|

(41,955 |

) |

|

|

NET ASSETS |

|

|

|

$ |

341,221 |

|

|

Country assignments and aggregations are based generally on third party vendor classifications and information, and may be different from the assignments and aggregations under the policies set forth in the Fund's prospectus and/or statement of additional information relating to geographic classifications.

(a) 144A security — Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid.

(b) Income may be paid in additional securities and/or cash at the discretion of the issuer.

(c) Floating or variable rate securities: The rates disclosed are as of April 30, 2024. For securities based on a published reference rate and spread, the reference rate and spread are indicated in the description in the Portfolio of Investments. Certain variable rate securities may not be based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description in the Portfolio of Investments.

(d) Issuer in bankruptcy.

(e) Non-income producing security; bond in default.

(f) All or a portion of the security is subject to delayed delivery.

(g) Rate shown is the yield to maturity at April 30, 2024.

(h) Securities are available for collateral in connection with securities purchased on a forward commitment basis, open foreign currency forward exchange contracts, futures contracts and swap agreements.

(i) At April 30, 2024, the aggregate cost for federal income tax purposes approximates the aggregate cost for book purposes. The aggregate gross unrealized appreciation is approximately $15,594,000 and the aggregate gross unrealized depreciation is approximately $41,289,000, resulting in net unrealized depreciation of approximately $25,695,000.

The accompanying notes are an integral part of the financial statements.

9

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

April 30, 2024 (unaudited)

Portfolio of Investments (cont'd)

Foreign Currency Forward Exchange Contracts:

The Fund had the following foreign currency forward exchange contracts open at April 30, 2024:

|

Counterparty |

|

Contracts

to

Deliver

(000) |

|

In

Exchange

For

(000) |

|

Delivery

Date |

|

Unrealized

Appreciation

(Depreciation)

(000) |

|

|

Bank of America NA |

|

EUR |

2,305 |

|

|

HUF |

911,000 |

|

|

5/29/24 |

|

$ |

18 |

|

|

|

Bank of America NA |

|

PEN |

34,349 |

|

|

$ |

9,096 |

|

|

6/20/24 |

|

|

(22 |

) |

|

|

Bank of America NA |

|

PEN |

14,294 |

|

|

$ |

3,785 |

|

|

6/20/24 |

|

|

(9 |

) |

|

|

Bank of America NA |

|

PEN |

1,290 |

|

|

$ |

342 |

|

|

6/20/24 |

|

|

(1 |

) |

|

|

Barclays Bank PLC |

|

CNH |

24,950 |

|

|

$ |

3,495 |

|

|

6/20/24 |

|

|

48 |

|

|

|

Barclays Bank PLC |

|

EUR |

394 |

|

|

CZK |

10,000 |

|

|

6/20/24 |

|

|

3 |

|

|

|

Barclays Bank PLC |

|

EUR |

4,846 |

|

|

PLN |

21,000 |

|

|

6/20/24 |

|

|

(7 |

) |

|

|

Barclays Bank PLC |

|

EUR |

741 |

|

|

RON |

3,700 |

|

|

6/20/24 |

|

|

1 |

|

|

|

Barclays Bank PLC |

|

EUR |

3,736 |

|

|

RON |

18,667 |

|

|

6/20/24 |

|

|

5 |

|

|

|

Barclays Bank PLC |

|

EUR |

3,609 |

|

|

RON |

18,020 |

|

|

6/20/24 |

|

|

3 |

|

|

|

Barclays Bank PLC |

|

IDR |

8,372,883 |

|

|

$ |

536 |

|

|

6/20/24 |

|

|

22 |

|

|

|

Barclays Bank PLC |

|

PLN |

3,500 |

|

|

EUR |

811 |

|

|

6/20/24 |

|

|

5 |

|

|

|

Barclays Bank PLC |

|

RON |

18,632 |

|

|

EUR |

3,730 |

|

|

6/20/24 |

|

|

(4 |

) |

|

|

Barclays Bank PLC |

|

TRY |

69,301 |

|

|

$ |

1,809 |

|

|

9/20/24 |

|

|

(29 |

) |

|

|

Barclays Bank PLC |

|

TRY |

16,168 |

|

|

$ |

460 |

|

|

6/21/24 |

|

|

(14 |

) |

|

|

Barclays Bank PLC |

|

TRY |

17,879 |

|

|

$ |

466 |

|

|

9/23/24 |

|

|

(6 |

) |

|

|

Barclays Bank PLC |

|

$ |

360 |

|

|

MYR |

1,700 |

|

|

6/20/24 |

|

|

(3 |

) |

|

|

Barclays Bank PLC |

|

$ |

1,892 |

|

|

TRY |

69,301 |

|

|

9/20/24 |

|

|

(53 |

) |

|

|

Barclays Bank PLC |

|

$ |

478 |

|

|

TRY |

16,168 |

|

|

6/21/24 |

|

|

(4 |

) |

|

|

Barclays Bank PLC |

|

$ |

481 |

|

|

TRY |

17,879 |

|

|

9/23/24 |

|

|

(9 |

) |

|

|

Barclays Bank PLC |

|

$ |

4,296 |

|

|

TRY |

167,216 |

|

|

12/16/24 |

|

|

(249 |

) |

|

|

Barclays Bank PLC |

|

$ |

2,857 |

|

|

TRY |

97,185 |

|

|

6/20/24 |

|

|

(1 |

) |

|

|

Barclays Bank PLC |

|

$ |

1,537 |

|

|

TRY |

66,738 |

|

|

1/29/25 |

|

|

11 |

|

|

|

Barclays Bank PLC |

|

$ |

1,780 |

|

|

TRY |

69,688 |

|

|

9/23/24 |

|

|

63 |

|

|

|

Barclays Bank PLC |

|

$ |

1,862 |

|

|

TRY |

78,718 |

|

|

1/6/25 |

|

|

4 |

|

|

|

Barclays Bank PLC |

|

ZAR |

5,051 |

|

|

$ |

266 |

|

|

6/20/24 |

|

|

(1 |

) |

|

|

Barclays Bank PLC |

|

ZAR |

69,759 |

|

|

$ |

3,644 |

|

|

6/20/24 |

|

|

(48 |

) |

|

|

BNP Paribas SA |

|

BRL |

15,170 |

|

|

$ |

3,052 |

|

|

5/3/24 |

|

|

131 |

|

|

|

BNP Paribas SA |

|

BRL |

29,896 |

|

|

$ |

5,780 |

|

|

5/3/24 |

|

|

23 |

|

|

|

BNP Paribas SA |

|

BRL |

158,073 |

|

|

$ |

30,564 |

|

|

5/3/24 |

|

|

122 |

|

|

|

BNP Paribas SA |

|

EUR |

550 |

|

|

CZK |

14,000 |

|

|

6/20/24 |

|

|

6 |

|

|

|

BNP Paribas SA |

|

EUR |

7,453 |

|

|

CZK |

190,029 |

|

|

6/20/24 |

|

|

95 |

|

|

|

BNP Paribas SA |

|

EUR |

2,147 |

|

|

HUF |

850,117 |

|

|

5/2/24 |

|

|

27 |

|

|

|

BNP Paribas SA |

|

EUR |

2,304 |

|

|

HUF |

911,000 |

|

|

5/29/24 |

|

|

19 |

|

|

|

BNP Paribas SA |

|

EUR |

2,198 |

|

|

HUF |

864,163 |

|

|

6/3/24 |

|

|

3 |

|

|

|

BNP Paribas SA |

|

HUF |

864,163 |

|

|

EUR |

2,205 |

|

|

5/2/24 |

|

|

(3 |

) |

|

|

BNP Paribas SA |

|

TRY |

60,800 |

|

|

$ |

1,752 |

|

|

5/13/24 |

|

|

(108 |

) |

|

|

BNP Paribas SA |

|

$ |

6,015 |

|

|

BRL |

29,896 |

|

|

5/3/24 |

|

|

(258 |

) |

|

|

BNP Paribas SA |

|

$ |

31,805 |

|

|

BRL |

158,073 |

|

|

5/3/24 |

|

|

(1,363 |

) |

|

|

BNP Paribas SA |

|

$ |

2,933 |

|

|

BRL |

15,170 |

|

|

5/3/24 |

|

|

(12 |

) |

|

|

BNP Paribas SA |

|

$ |

1,105 |

|

|

PEN |

4,110 |

|

|

6/20/24 |

|

|

(13 |

) |

|

|

BNP Paribas SA |

|

$ |

954 |

|

|

TRY |

40,367 |

|

|

1/6/25 |

|

|

3 |

|

|

|

BNP Paribas SA |

|

$ |

1,162 |

|

|

TRY |

49,321 |

|

|

1/6/25 |

|

|

7 |

|

|

The accompanying notes are an integral part of the financial statements.

10

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

April 30, 2024 (unaudited)

Portfolio of Investments (cont'd)

Foreign Currency Forward Exchange Contracts: (cont'd)

|

Counterparty |

|

Contracts

to

Deliver

(000) |

|

In

Exchange

For

(000) |

|

Delivery

Date |

|

Unrealized

Appreciation

(Depreciation)

(000) |

|

|

BNP Paribas SA |

|

$ |

1,090 |

|

|

TRY |

43,890 |

|

|

10/17/24 |

|

$ |

40 |

|

|

|

BNP Paribas SA |

|

$ |

1,408 |

|

|

TRY |

61,476 |

|

|

1/29/25 |

|

|

17 |

|

|

|

BNP Paribas SA |

|

$ |

10,813 |

|

|

TWD |

346,000 |

|

|

6/20/24 |

|

|

(129 |

) |

|

|

BNP Paribas SA |

|

ZAR |

4,154 |

|

|

$ |

219 |

|

|

6/20/24 |

|

|

(1 |

) |

|

|

Citibank NA |

|

AMD |

74,630 |

|

|

$ |

187 |

|

|

9/6/24 |

|

|

(2 |

) |

|

|

Citibank NA |

|

AMD |

225,194 |

|

|

$ |

554 |

|

|

9/16/24 |

|

|

(16 |

) |

|

|

Citibank NA |

|

COP |

8,792,170 |

|

|

$ |

2,222 |

|

|

6/20/24 |

|

|

(3 |

) |

|

|

Citibank NA |

|

COP |

4,636,000 |

|

|

$ |

1,173 |

|

|

6/20/24 |

|

|

— |

@ |

|

|

Citibank NA |

|

CZK |

24,000 |

|

|

$ |

1,032 |

|

|

6/20/24 |

|

|

14 |

|

|

|

Citibank NA |

|

EUR |

236 |

|

|

CZK |

6,000 |

|

|

6/20/24 |

|

|

2 |

|

|

|

Citibank NA |

|

EUR |

2,068 |

|

|

HUF |

813,376 |

|

|

6/3/24 |

|

|

4 |

|

|

|

Citibank NA |

|

EUR |

2,755 |

|

|

PLN |

11,860 |

|

|

6/20/24 |

|

|

(24 |

) |

|

|

Citibank NA |

|

EUR |

11,960 |

|

|

PLN |

51,487 |

|

|

6/20/24 |

|

|

(103 |

) |

|

|

Citibank NA |

|

EUR |

4,803 |

|

|

PLN |

21,000 |

|

|

6/20/24 |

|

|

39 |

|

|

|

Citibank NA |

|

EUR |

4,805 |

|

|

PLN |

21,000 |

|

|

6/20/24 |

|

|

36 |

|

|

|

Citibank NA |

|

EUR |

565 |

|

|

$ |

611 |

|

|

5/10/24 |

|

|

7 |

|

|

|

Citibank NA |

|

EUR |

3,719 |

|

|

$ |

4,016 |

|

|

5/10/24 |

|

|

46 |

|

|

|

Citibank NA |

|

EUR |

8,472 |

|

|

$ |

9,150 |

|

|

5/10/24 |

|

|

106 |

|

|

|

Citibank NA |

|

EUR |

1,131 |

|

|

$ |

1,221 |

|

|

5/10/24 |

|

|

14 |

|

|

|

Citibank NA |

|

EUR |

5,675 |

|

|

$ |

6,129 |

|

|

5/10/24 |

|

|

71 |

|

|

|

Citibank NA |

|

EUR |

3,520 |

|

|

$ |

3,802 |

|

|

5/10/24 |

|

|

44 |

|

|

|

Citibank NA |

|

EUR |

1,840 |

|

|

$ |

1,987 |

|

|

5/10/24 |

|

|

23 |

|

|

|

Citibank NA |

|

HUF |

813,376 |

|

|

EUR |

2,074 |

|

|

5/2/24 |

|

|

(4 |

) |

|

|

Citibank NA |

|

PLN |

6,950 |

|

|

EUR |

1,615 |

|

|

6/20/24 |

|

|

14 |

|

|

|

Citibank NA |

|

THB |

31,700 |

|

|

$ |

890 |

|

|

6/20/24 |

|

|

32 |

|

|

|

Citibank NA |

|

THB |

8,200 |

|

|

$ |

229 |

|

|

6/20/24 |

|

|

7 |

|

|

|

Citibank NA |

|

THB |

339,120 |

|

|

$ |

9,487 |

|

|

6/20/24 |

|

|

302 |

|

|

|

Citibank NA |

|

$ |

217 |

|

|

COP |

860,000 |

|

|

6/20/24 |

|

|

1 |

|

|

|

Citibank NA |

|

$ |

1,728 |

|

|

EGP |

104,021 |

|

|

2/13/25 |

|

|

259 |

|

|

|

Citibank NA |

|

$ |

346 |

|

|

EGP |

21,392 |

|

|

2/20/25 |

|

|

62 |

|

|

|

Citibank NA |

|

$ |

576 |

|

|

EGP |

34,846 |

|

|

2/20/25 |

|

|

88 |

|

|

|

Citibank NA |

|

$ |

288 |

|

|

EGP |

17,999 |

|

|

2/20/25 |

|

|

55 |

|

|

|

Citibank NA |

|

$ |

288 |

|

|

EGP |

18,806 |

|

|

2/27/25 |

|

|

69 |

|

|

|

Citibank NA |

|

$ |

15,125 |

|

|

EUR |

14,005 |

|

|

5/10/24 |

|

|

(175 |

) |

|

|

Citibank NA |

|

$ |

16,740 |

|

|

EUR |

15,500 |

|

|

5/10/24 |

|

|

(193 |

) |

|

|

Citibank NA |

|

$ |

2,679 |

|

|

PEN |

10,045 |

|

|

6/20/24 |

|

|

(13 |

) |

|

|

Citibank NA |

|

$ |

3,059 |

|

|

PEN |

11,294 |

|

|

6/20/24 |

|

|

(61 |

) |

|

|

Citibank NA |

|

$ |

22,604 |

|

|

THB |

808,012 |

|

|

6/20/24 |

|

|

(719 |

) |

|

|

Citibank NA |

|

$ |

1,341 |

|

|

TRY |

56,708 |

|

|

1/6/25 |

|

|

3 |

|

|

|

Citibank NA |

|

ZAR |

8,718 |

|

|

$ |

458 |

|

|

6/20/24 |

|

|

(4 |

) |

|

|

Goldman Sachs International |

|

BRL |

29,896 |

|

|

$ |

5,777 |

|

|

5/3/24 |

|

|

20 |

|

|

|

Goldman Sachs International |

|

BRL |

15,170 |

|

|

$ |

2,905 |

|

|

8/2/24 |

|

|

9 |

|

|

|

Goldman Sachs International |

|

BRL |

158,073 |

|

|

$ |

30,546 |

|

|

5/3/24 |

|

|

104 |

|

|

|

Goldman Sachs International |

|

BRL |

15,170 |

|

|

$ |

2,933 |

|

|

5/3/24 |

|

|

12 |

|

|

The accompanying notes are an integral part of the financial statements.

11

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

April 30, 2024 (unaudited)

Portfolio of Investments (cont'd)

Foreign Currency Forward Exchange Contracts: (cont'd)

|

Counterparty |

|

Contracts

to

Deliver

(000) |

|

In

Exchange

For

(000) |

|

Delivery

Date |

|

Unrealized

Appreciation

(Depreciation)

(000) |

|

|

Goldman Sachs International |

|

CLP |

2,466,386 |

|

|

$ |

2,594 |

|

|

6/21/24 |

|

$ |

26 |

|

|

|

Goldman Sachs International |

|

CLP |

745,030 |

|

|

$ |

784 |

|

|

6/21/24 |

|

|

8 |

|

|

|

Goldman Sachs International |

|

COP |

15,751,829 |

|

|

$ |

3,975 |

|

|

6/20/24 |

|

|

(11 |

) |

|

|

Goldman Sachs International |

|

COP |

6,068,350 |

|

|

$ |

1,531 |

|

|

6/20/24 |

|

|

(4 |

) |

|

|

Goldman Sachs International |

|

COP |

822,290 |

|

|

$ |

207 |

|

|

6/20/24 |

|

|

(1 |

) |

|

|

Goldman Sachs International |

|

EUR |

375 |

|

|

CZK |

9,500 |

|

|

6/20/24 |

|

|

2 |

|

|

|

Goldman Sachs International |

|

EUR |

2,756 |

|

|

PLN |

11,860 |

|

|

6/20/24 |

|

|

(25 |

) |

|

|

Goldman Sachs International |

|

EUR |

11,964 |

|

|

PLN |

51,487 |

|

|

6/20/24 |

|

|

(108 |

) |

|

|

Goldman Sachs International |

|

EUR |

4,828 |

|

|

PLN |

21,000 |

|

|

6/20/24 |

|

|

12 |

|

|

|

Goldman Sachs International |

|

EUR |

381 |

|

|

RON |

1,900 |

|

|

6/20/24 |

|

|

— |

@ |

|

|

Goldman Sachs International |

|

IDR |

48,113,256 |

|

|

$ |

3,081 |

|

|

6/20/24 |

|

|

126 |

|

|

|

Goldman Sachs International |

|

IDR |

14,000,000 |

|

|

$ |

895 |

|

|

6/20/24 |

|

|

35 |

|

|

|

Goldman Sachs International |

|

KRW |

4,795,000 |

|

|

$ |

3,653 |

|

|

6/20/24 |

|

|

175 |

|

|

|

Goldman Sachs International |

|

MXN |

24,000 |

|

|

$ |

1,401 |

|

|

6/20/24 |

|

|

10 |

|

|

|

Goldman Sachs International |

|

MXN |

31,700 |

|

|

$ |

1,883 |

|

|

6/20/24 |

|

|

46 |

|

|

|

Goldman Sachs International |

|

MXN |

104,116 |

|

|

$ |

6,227 |

|

|

6/24/24 |

|

|

199 |

|

|

|

Goldman Sachs International |

|

MXN |

104,315 |

|

|

$ |

6,227 |

|

|

7/8/24 |

|

|

201 |

|

|

|

Goldman Sachs International |

|

MYR |

2,000 |

|

|

$ |

419 |

|

|

6/20/24 |

|

|

(1 |

) |

|

|

Goldman Sachs International |

|

PLN |

6,950 |

|

|

EUR |

1,615 |

|

|

6/20/24 |

|

|

15 |

|

|

|

Goldman Sachs International |

|

SGD |

1,000 |

|

|

$ |

736 |

|

|

6/20/24 |

|

|

2 |

|

|

|

Goldman Sachs International |

|

TRY |

79,900 |

|

|

$ |

1,806 |

|

|

12/16/24 |

|

|

(128 |

) |

|

|

Goldman Sachs International |

|

$ |

30,271 |

|

|

BRL |

158,073 |

|

|

8/2/24 |

|

|

(95 |

) |

|

|

Goldman Sachs International |

|

$ |

5,725 |

|

|

BRL |

29,896 |

|

|

8/2/24 |

|

|

(18 |

) |

|

|

Goldman Sachs International |

|

$ |

2,931 |

|

|

BRL |

15,170 |

|

|

5/3/24 |

|

|

(10 |

) |

|

|

Goldman Sachs International |

|

$ |

5,780 |

|

|

BRL |

29,896 |

|

|

5/3/24 |

|

|

(23 |

) |

|

|

Goldman Sachs International |

|

$ |

30,564 |

|

|

BRL |

158,073 |

|

|

5/3/24 |

|

|

(122 |

) |

|

|

Goldman Sachs International |

|

$ |

3,499 |

|

|

CLP |

3,326,715 |

|

|

6/21/24 |

|

|

(35 |

) |

|

|

Goldman Sachs International |

|

$ |

159 |

|

|

EGP |

8,605 |

|

|

2/26/25 |

|

|

4 |

|

|

|

Goldman Sachs International |

|

$ |

20,081 |

|

|

KRW |

26,357,000 |

|

|

6/20/24 |

|

|

(963 |

) |

|

|

Goldman Sachs International |

|

$ |

15,173 |

|

|

MXN |

258,777 |

|

|

6/20/24 |

|

|

(182 |

) |

|

|

Goldman Sachs International |

|

$ |

20,608 |

|

|

MXN |

349,936 |

|

|

6/20/24 |

|

|

(336 |

) |

|

|

Goldman Sachs International |

|

$ |

20,461 |

|

|

MXN |

347,432 |

|

|

6/20/24 |

|

|

(334 |

) |

|

|

Goldman Sachs International |

|

$ |

2,164 |

|

|

MXN |

37,000 |

|

|

6/20/24 |

|

|

(20 |

) |

|

|

Goldman Sachs International |

|

$ |

13,245 |

|

|

MYR |

61,790 |

|

|

6/20/24 |

|

|

(258 |

) |

|

|

Goldman Sachs International |

|

$ |

3,370 |

|

|

MYR |

15,714 |

|

|

6/20/24 |

|

|

(68 |

) |

|

|

Goldman Sachs International |

|

$ |

3,384 |

|

|

MYR |

15,762 |

|

|

6/20/24 |

|

|

(71 |

) |

|

|

Goldman Sachs International |

|

$ |

19,357 |

|

|

SGD |

25,678 |

|

|

6/20/24 |

|

|

(504 |

) |

|

|

Goldman Sachs International |

|

$ |

1,794 |

|

|

THB |

64,400 |

|

|

6/20/24 |

|

|

(50 |

) |

|

|

Goldman Sachs International |

|

$ |

564 |

|

|

THB |

20,600 |

|

|

6/20/24 |

|

|

(6 |

) |

|

|

Goldman Sachs International |

|

$ |

1,058 |

|

|

TRY |

38,809 |

|

|

9/20/24 |

|

|

(29 |

) |

|

|

Goldman Sachs International |

|

$ |

1,383 |

|

|

TRY |

55,620 |

|

|

10/17/24 |

|

|

49 |

|

|

|

Goldman Sachs International |

|

ZAR |

34,845 |

|

|

$ |

1,821 |

|

|

6/20/24 |

|

|

(23 |

) |

|

|

HSBC Bank PLC |

|

CZK |

94,320 |

|

|

EUR |

3,703 |

|

|

6/20/24 |

|

|

(43 |

) |

|

|

HSBC Bank PLC |

|

EUR |

2,320 |

|

|

HUF |

914,853 |

|

|

5/13/24 |

|

|

16 |

|

|

The accompanying notes are an integral part of the financial statements.

12

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

April 30, 2024 (unaudited)

Portfolio of Investments (cont'd)

Foreign Currency Forward Exchange Contracts: (cont'd)

|

Counterparty |

|

Contracts

to

Deliver

(000) |

|

In

Exchange

For

(000) |

|

Delivery

Date |

|

Unrealized

Appreciation

(Depreciation)

(000) |

|

|

HSBC Bank PLC |

|

EUR |

1,084 |

|

|

PLN |

4,700 |

|

|

6/20/24 |

|

$ |

(1 |

) |

|

|

HSBC Bank PLC |

|

IDR |

59,758,785 |

|

|

$ |

3,821 |

|

|

6/20/24 |

|

|

150 |

|

|

|

HSBC Bank PLC |

|

IDR |

26,731,000 |

|

|

$ |

1,709 |

|

|

6/20/24 |

|

|

67 |

|

|

|

HSBC Bank PLC |

|

$ |

292 |

|

|

EGP |

16,193 |

|

|

2/27/25 |

|

|

16 |

|

|

|

HSBC Bank PLC |

|

$ |

292 |

|

|

EGP |

15,099 |

|

|

11/27/24 |

|

|

4 |

|

|

|

HSBC Bank PLC |

|

$ |

2,503 |

|

|

EUR |

2,300 |

|

|

5/10/24 |

|

|

(48 |

) |

|

|

HSBC Bank PLC |

|

$ |

13,198 |

|

|

IDR |

206,413,973 |

|

|

6/20/24 |

|

|

(519 |

) |

|

|

HSBC Bank PLC |

|

$ |

1,729 |

|

|

THB |

62,878 |

|

|

6/20/24 |

|

|

(26 |

) |

|

|

HSBC Bank PLC |

|

$ |

876 |

|

|

TRY |

31,855 |

|

|

9/20/24 |

|

|

(30 |

) |

|

|

HSBC Bank PLC |

|

$ |

1,726 |

|

|

TRY |

57,930 |

|

|

5/13/24 |

|

|

46 |

|

|

|

HSBC Bank PLC |

|

ZAR |

35,502 |

|

|

$ |

1,864 |

|

|

6/20/24 |

|

|

(15 |

) |

|

|

HSBC Bank PLC |

|

ZAR |

69,461 |

|

|

$ |

3,632 |

|

|

6/20/24 |

|

|

(44 |

) |

|

|

JPMorgan Chase Bank NA |

|

CZK |

24,520 |

|

|

EUR |

962 |

|

|

6/20/24 |

|

|

(12 |

) |

|

|

JPMorgan Chase Bank NA |

|

EUR |

1,342 |

|

|

CZK |

34,190 |

|

|

6/20/24 |

|

|

16 |

|

|

|

JPMorgan Chase Bank NA |

|

EUR |

6,263 |

|

|

CZK |

159,598 |

|

|

6/20/24 |

|

|

75 |

|

|

|

JPMorgan Chase Bank NA |

|

EUR |

4,669 |

|

|

HUF |

1,829,708 |

|

|

5/13/24 |

|

|

1 |

|

|

|

JPMorgan Chase Bank NA |

|

EUR |

5,997 |

|

|

HUF |

2,362,800 |

|

|

5/17/24 |

|

|

33 |

|

|

|

JPMorgan Chase Bank NA |

|

EUR |

403 |

|

|

$ |

429 |

|

|

5/10/24 |

|

|

(1 |

) |

|

|

JPMorgan Chase Bank NA |

|

HUF |

333,000 |

|

|

EUR |

840 |

|

|

6/20/24 |

|

|

(7 |

) |

|

|

JPMorgan Chase Bank NA |

|

HUF |

1,038,348 |

|

|

EUR |

2,636 |

|

|

5/17/24 |

|

|

(14 |

) |

|

|

JPMorgan Chase Bank NA |

|

HUF |

2,172,149 |

|

|

EUR |

5,513 |

|

|

5/17/24 |

|

|

(30 |

) |

|

|

JPMorgan Chase Bank NA |

|

KRW |

4,333,500 |

|

|

$ |

3,117 |

|

|

6/20/24 |

|

|

(26 |

) |

|

|

JPMorgan Chase Bank NA |

|

MXN |

107,888 |

|

|

$ |

6,343 |

|

|

5/21/24 |

|

|

63 |

|

|

|

JPMorgan Chase Bank NA |

|

TRY |

48,200 |

|

|

$ |

1,390 |

|

|

5/13/24 |

|

|

(84 |

) |

|

|

JPMorgan Chase Bank NA |

|

$ |

996 |

|

|

BRL |

5,010 |

|

|

7/2/24 |

|

|

(37 |

) |

|

|

JPMorgan Chase Bank NA |

|

$ |

1,770 |

|

|

BRL |

8,922 |

|

|

7/2/24 |

|

|

(62 |

) |

|

|

JPMorgan Chase Bank NA |

|

$ |

2,115 |

|

|

BRL |

10,666 |

|

|

7/2/24 |

|

|

(73 |

) |

|

|

JPMorgan Chase Bank NA |

|

$ |

140 |

|

|

NGN |

118,852 |

|

|

6/20/24 |

|

|

(54 |

) |

|

|

JPMorgan Chase Bank NA |

|

$ |

615 |

|

|

NGN |

1,016,429 |

|

|

2/25/25 |

|

|

47 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

1,056 |

|

|

PEN |

3,912 |

|

|

6/20/24 |

|

|

(18 |

) |

|

|

JPMorgan Chase Bank NA |

|

$ |

1,919 |

|

|

TRY |

64,401 |

|

|

5/13/24 |

|

|

52 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

1,972 |

|

|

TRY |

68,354 |

|

|

5/13/24 |

|

|

120 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

674 |

|

|

TRY |

28,930 |

|

|

1/15/25 |

|

|

6 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

573 |

|

|

UZS |

7,827,844 |

|

|

11/1/24 |

|

|

12 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

503 |

|

|

UZS |

7,044,984 |

|

|

1/6/25 |

|

|

13 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

349 |

|

|

UZS |

4,745,798 |

|

|

10/22/24 |

|

|

7 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

349 |

|

|

UZS |

4,763,246 |

|

|

10/24/24 |

|

|

8 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

2,578 |

|

|

UZS |

36,224,675 |

|

|

2/13/25 |

|

|

47 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

904 |

|

|

UZS |

12,708,426 |

|

|

2/18/25 |

|

|

16 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

900 |

|

|

UZS |

12,643,992 |

|

|

2/13/25 |

|

|

16 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

327 |

|

|

UZS |

4,611,719 |

|

|

3/17/25 |

|

|

4 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

339 |

|

|

UZS |

4,780,770 |

|

|

3/20/25 |

|

|

4 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

754 |

|

|

UZS |

10,116,802 |

|

|

10/4/24 |

|

|

9 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

377 |

|

|

UZS |

5,350,413 |

|

|

4/4/25 |

|

|

5 |

|

|

The accompanying notes are an integral part of the financial statements.

13

Morgan Stanley Emerging Markets Domestic Debt Fund, Inc.

April 30, 2024 (unaudited)

Portfolio of Investments (cont'd)

Foreign Currency Forward Exchange Contracts: (cont'd)

|

Counterparty |

|

Contracts

to

Deliver

(000) |

|

In

Exchange

For

(000) |

|

Delivery

Date |

|

Unrealized

Appreciation

(Depreciation)

(000) |

|

|

JPMorgan Chase Bank NA |

|

$ |

1,785 |

|

|

UZS |

24,701,691 |

|

|

1/29/25 |

|

$ |

13 |

|

|

|

JPMorgan Chase Bank NA |

|

$ |

1,373 |

|

|

UZS |

19,426,908 |

|

|

4/4/25 |

|

|

15 |

|

|

|

JPMorgan Chase Bank NA |

|

ZAR |

17,751 |

|

|

$ |

934 |

|

|

6/20/24 |

|

|

(6 |

) |

|

|

Standard Chartered Bank |

|

CNH |

5,600 |

|

|

$ |

782 |

|

|

6/20/24 |

|

|

8 |

|

|

|

Standard Chartered Bank |

|

EUR |

1,000 |

|

|

$ |

1,070 |

|

|

6/20/24 |

|

|

1 |

|

|

|

Standard Chartered Bank |

|

EUR |

2,274 |

|

|

$ |

2,435 |

|

|

5/10/24 |

|

|

8 |

|

|

|

Standard Chartered Bank |

|

KES |

110,236 |

|

|

$ |

750 |

|

|

12/18/24 |

|

|

(38 |

) |

|

|

Standard Chartered Bank |

|

KES |

112,486 |

|

|

$ |

750 |

|

|

3/21/25 |

|

|

(40 |

) |

|

|

Standard Chartered Bank |

|

KES |

163,950 |

|

|

$ |

1,125 |

|

|

4/4/25 |

|

|

(23 |

) |

|

|

Standard Chartered Bank |

|

KES |

31,143 |

|

|

$ |

213 |

|

|

4/9/25 |

|

|

(4 |

) |

|

|

Standard Chartered Bank |

|

KES |

31,111 |

|

|

$ |

213 |

|

|

4/16/25 |

|

|

(4 |

) |

|

|

Standard Chartered Bank |

|

$ |

3,628 |

|

|

CLP |

3,523,778 |

|

|

6/21/24 |

|

|

40 |

|

|

|

Standard Chartered Bank |

|

$ |

712 |

|

|

NGN |

1,309,603 |

|

|

2/24/25 |

|

|

141 |

|

|

|

Standard Chartered Bank |

|

$ |

356 |

|

|

NGN |

663,698 |

|

|

2/24/25 |

|

|

76 |

|

|

|

Standard Chartered Bank |

|

$ |

53 |

|

|

PEN |

196 |

|

|

6/20/24 |

|

|

(1 |

) |

|

|

Standard Chartered Bank |

|

$ |

682 |

|

|

PEN |

2,540 |

|

|

6/20/24 |

|

|

(8 |

) |

|

|

Standard Chartered Bank |

|

$ |

358 |

|

|

SGD |

480 |

|

|

6/20/24 |

|

|

(5 |

) |

|

|

Standard Chartered Bank |

|

$ |

1,888 |

|

|

TRY |

74,437 |

|

|

9/23/24 |

|

|

81 |

|

|

|

Standard Chartered Bank |

|

$ |

1,006 |

|

|

TRY |

42,528 |

|

|

1/6/25 |

|

|

2 |

|

|

|

Standard Chartered Bank |

|

$ |

1,444 |

|

|

TRY |

60,238 |

|

|

12/18/24 |

|

|

11 |

|

|

|

Standard Chartered Bank |

|

$ |

401 |

|

|

UZS |

5,743,639 |

|

|

4/15/25 |

|

|

8 |

|

|

|

State Street Bank and Trust Co. |

|

CNH |

83,300 |

|

|

$ |

11,640 |

|

|

6/20/24 |

|

|

132 |

|

|

|

State Street Bank and Trust Co. |

|

MXN |

148,470 |

|

|

$ |

8,878 |

|

|

6/20/24 |

|

|

278 |

|