___________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934

Date of Report (Date of earliest event reported): February

10, 2025

EQUUS TOTAL RETURN, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

814-00098 |

76-0345915 |

| (State or Other Jurisdiction |

(Commission File |

(IRS Employer |

| Of Incorporation) |

Number) |

Identification No.) |

|

700 Louisiana Street, 43rd Floor Houston,

Texas |

77002 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including area

code: (713) 529-0900

N/A

(Former Name or Former Address, if Changed Since Last

Report)

Check the appropriate box below if the Form 8-k filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2). ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

On February 10, 2025, Equus Total Return, Inc.

(“Equus” or the “Fund”) entered into a material definitive Securities Purchase Agreement regarding the

issuance of a 1-year senior convertible promissory note bearing interest at the rate of 10.0% per annum in exchange for $2.0 million

in cash ( “Equus Note”). The Equus Note is convertible into shares of the Fund’s common stock at a conversion

price of $1.50 per share. Contemporaneously with the issuance of the Equus Note, the Fund also issued two common stock purchase

warrants to acquire an aggregate of 2,000,000 shares of the Fund’s common stock at an exercise price of $1.50 per share

(collectively, the “Warrants”).

Also on February 10, 2025, the Fund entered into a

material definitive Subscription Agreement with General Enterprise Ventures, Inc. (“GEVI”) regarding the purchase of a 1-year

senior convertible promissory note bearing interest at the rate of 10% per annum, in exchange for $1.5 million in cash (“GEVI Note”).

The GEVI Note is convertible into shares of GEVI’s common stock at a conversion price of $0.40 per share. Contemporaneously with

the purchase of the GEVI Note, the Fund also received a common stock purchase warrant to acquire an aggregate of 1,875,000 shares of GEVI

common stock at an exercise price of $0.50 per share.

| Item 3.02 | Unregistered Sales of Equity Securities. |

On February 10, 2025, the Fund issued the Equus

Note and Warrants as described in Item 1.01 above. No solicitation was made and no underwriting discounts were given or paid in

connection with this transaction. The Fund believes that the issuance of the Equus Note and Warrants was exempt from registration

with the Securities and Exchange Commission pursuant to Section 4(2) of the Securities Act of 1933.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

10.1 Securities Purchase Agreement dated February 10, 2025.

10.2 Subscription Agreement dated February 10, 2025.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Equus Total Return, Inc. |

| Date: February 18,

2025 |

By: /s/ Kenneth I. Denos |

| |

Name: Kenneth I. Denos |

| |

Title: Secretary |

EXHIBIT 10.1

EQUUS TOTAL RETURN, INC.

SECURITIES

PURCHASE AGREEMENT

DATED

AS OF [●], 2025 (“SUBSCRIPTION DATE”)

THE SECURITIES OFFERED HEREBY HAVE NOT BEEN

REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY STATE SECURITIES LAWS, AND,

UNLESS SO REGISTERED, MAY NOT BE OFFERED, SOLD, ASSIGNED, PLEDGED OR OTHERWISE DISPOSED OF, EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN

A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND ANY APPLICABLE STATE SECURITIES LAWS. THE PURCHASE

OF THE SECURITIES INVOLVES A HIGH DEGREE OF RISK AND SHOULD BE CONSIDERED ONLY BY PERSONS WHO CAN BEAR THE RISK OF THE LOSS OF THEIR ENTIRE

INVESTMENT.

In consideration of the

promises and covenants contained herein, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged,

and intending to be legally bound, the parties agree as follows:

1.

Subscription; Issuance. The undersigned hereby agrees to fund to EQUUS TOTAL RETURN, Inc.,

a Delaware corporation (the “Company”), the principal amount of the convertible note of the Company (the “Convertible

Note”) set forth on the signature page of this Securities Purchase Agreement (this “Agreement,” and together

with the Convertible Note, the Warrant (as defined below), the Voting Agreement (as defined in Section 7(a)), the Security Agreement (as

defined in Section 7(b)) , the “Transaction Documents”), payable in full as described below in accordance with the

terms and conditions of this Agreement, including the warrant issued pursuant to this Agreement (the “Warrant”) executed

in connection with the Convertible Note. The execution of this Agreement by the undersigned constitutes a binding offer to fund the principal

of the Convertible Note shown on the signature page. Upon the execution of this Agreement, the undersigned shall deliver to the Company

the full principal amount of the Convertible Note subscribed by the undersigned.

2.

Acceptance, Rejection or Withdrawal of Subscription Offer. Acceptance by the Company of the

undersigned’s offer to fund a Convertible Note pursuant to this Agreement shall be evidenced by the Company’s delivery to

the undersigned of this Agreement executed by the Company. The undersigned understands and agrees that, if this Agreement is accepted,

it may not be cancelled, revoked or withdrawn by the undersigned.

3.

No Assignment. The rights under this Agreement are not transferable or assignable by the undersigned

without the prior written consent of the Company.

4.

Accredited Investor. The undersigned represents and warrants that the undersigned is an Accredited

Investor (as that term is defined in Rule 501(a) of Regulation D promulgated under the Act). In connection with acquiring the

Convertible Note and being issued the Warrant under this Agreement, the undersigned shall deliver to the Company a signed copy of the

Investor Suitability Questionnaire attached hereto as Exhibit A.

5.

Representations, Warranties and Agreements. The undersigned makes the following representations,

warranties, acknowledgments and agreements to induce the Company to accept this subscription:

(a)

Information. The undersigned hereby acknowledges that the undersigned has reviewed and/or

received: Any information and materials requested by the undersigned relating to the Company and its subsidiaries, their proposed activities

and business, their capitalization, their management and key personnel and the offering and sale of the Convertible Note and the issuance

of the Warrant of the Company (collectively, the “Documents”). The undersigned hereby further acknowledges that it

has read, is fully familiar with, and completely understands, the Documents, this Agreement and any other documents and information that

the undersigned deems material to making an investment decision with respect to the Convertible Note. The undersigned has been provided

the Documents at least 48 hours prior to the execution of this Agreement. The undersigned shall keep the Documents and other information

it receives about the Company or any of its subsidiaries confidential.

(b)

Availability of Information. The Company has made all documents pertaining to the matters

described in the Documents and the offering of the Convertible Note of the Company and the issuance of the Warrant available to the undersigned

and has allowed the undersigned, or the undersigned’s purchaser representative, a reasonable opportunity to ask questions and receive

answers concerning the terms and conditions of this offering and to obtain any additional information which the Company possesses or can

acquire without unreasonable effort or expense that is necessary to verify the accuracy of any information provided to the undersigned.

(c)

No Other Representations. The undersigned has relied solely on the Documents and the documents

and materials submitted with the Documents in making the decision to purchase the Convertible Note subscribed for under this Agreement,

and no representations or agreements, written or oral, other than those set forth in this Agreement have been made to the undersigned,

with respect to such purchase of the Convertible Note of the Company and issuance of the Warrant.

(d)

Reliance on Own Investigation and Advisors. The undersigned acknowledges that the undersigned

has been advised to consult with the undersigned’s own legal advisor concerning the legal aspects of the Company and to consult

with the undersigned’s tax advisor regarding the tax consequences of investing in the Company. The undersigned is not relying on

the Company or any of its respective officers, directors, executives, employees, advisors, members, managers, subsidiaries or affiliates

or other personnel for legal, accounting, financial or tax advice in connection with the undersigned’s evaluation of the risks and

merits of an investment in the Company or of the consequences to the undersigned of such an investment.

(e)

Investment Intent. The Convertible Note and Warrant subscribed for under this Agreement will

be acquired solely by, and for the account of, the undersigned (and not for other persons or entities), for investment only, and are not

being purchased with a view to, or for sale in connection with, a distribution of the Convertible Note and/or the Warrant. The undersigned

has no contract, undertaking, agreement or arrangement with any person or entity to sell, transfer, assign or pledge to such person, entity,

or anyone else all or any part of the Convertible Note or the Warrant for which the undersigned subscribes, and the undersigned has no

current plans or intentions to enter into any such contract, undertaking or arrangement.

(f)

Resale Restrictions. The undersigned acknowledges that (i) neither the Convertible Note nor

the Warrant has been registered under the Securities Act or the securities statutes of any state or other jurisdiction, (ii) the Convertible

Note and the Warrant have the status of securities acquired in a transaction under Section 4(2) of the Securities Act, (iii) each

of the Convertible Note and the Warrant is a “restricted security” (as that term is defined in Rule 144(a)(3) under the

Securities Act), (iv) therefore, neither the Convertible Note nor the Warrant can be resold (and the undersigned covenants that the undersigned

will not resell either) unless it is registered under applicable federal and state securities laws (including the Securities Act) or unless

exemptions from all such applicable registration requirements are available, and (v) consequently, the undersigned must bear the economic

risk of investment for an indefinite period of time. The undersigned will not sell or otherwise transfer either the Convertible Note or

Warrant without: (i) either (A) the prior registration of the Convertible Note or Warrant, as applicable, under the Securities Act and

all other applicable statutes, or (B) applicable exemptions from the registration requirements of each of those statutes, and (ii) unless

and until the Company has determined, by obtaining the advice of counsel or otherwise, that the intended disposition will not violate

the Securities Act or any applicable state securities law. The undersigned understands that the Company has no obligation or intention

to register either the Convertible Note or the Warrant under any federal or state securities act, law or regulation.

(g)

Economic Risk; Sophistication. The undersigned acknowledges and recognizes that an investment

in the Company involves a high degree of risk in that (i) the undersigned may not be able to liquidate the investment, (ii) transferability

may be extremely limited, (iii) there is currently no market for the Convertible Note or the Warrant, nor is a market likely to develop,

and (iv) the undersigned could sustain the loss of the entire investment or part of the investment.

(h)

Ability to Bear Risk. The financial condition of the undersigned is such that the undersigned

has no need for liquidity with respect to the undersigned’s investment in the Convertible Note and the Warrant to satisfy any existing

or contemplated undertaking or indebtedness, and the undersigned has no need for a current return on the undersigned’s investment

in the Convertible Note and the Warrant. The undersigned is able to bear the economic risk of the undersigned’s investment in the

Convertible Note and the Warrant for an indefinite period of time, including the risk of losing all of the undersigned’s investment.

(i)

Sophistication; No Agency Review or Endorsement. The undersigned, either alone or with the

undersigned’s purchaser representative, has such knowledge and experience in financial and business matters that the undersigned

is capable of evaluating the merits and risks of the prospective investment. The undersigned acknowledges and understands that no federal

or state agency has passed upon the adequacy or accuracy of the information set forth in any document provided to the undersigned or made

any finding or determination as to the fairness for investment, or any recommendation or endorsement of the Convertible Note and the Warrant

as an investment.

(j)

No General Solicitation. The undersigned acknowledges and represents that neither the Company

nor any person or entity acting on its behalf has offered or sold the Convertible Note and the Warrant to the undersigned by any form

of general solicitation or general advertising, including, but not limited to, (i) any advertisement, article, notice or other communication

published in any newspaper, magazine, or similar media or broadcast over television or radio, and (ii) any seminar or meeting whose attendees

have been invited by any general solicitation or general advertising.

(k)

Status After Purchase; Information. The undersigned acknowledges and accepts that if the undersigned

purchases the Convertible Note and the Warrant, the undersigned will have only a minority interest in the Company with little, if any,

control over the Company or its business and will have no right to become a manager of the Company. In addition, the Company is not subject

to the reporting requirements of the Securities Exchange Act of 1934, and, therefore, is not required to publish periodic information

about its business or financial condition.

(l)

Responsibility for Determining Suitability of Investment. The undersigned is assuming full

responsibility independently: (i) to determine whether an investment in the Convertible Note and the Warrant is suitable for the undersigned,

(ii) to evaluate the undersigned’s potential purchase of the Convertible Note and the Warrant, and (iii) to obtain, verify and evaluate

all material information necessary or desired by the undersigned to make the undersigned’s decision, including, without limitation,

information concerning the Company and its subsidiaries, their officers, directors, executives, employees and managers, their related

party transactions, their financial condition and needs, their business, their obligations, their equity holders and their rights, preferences

and privileges and any potential issuance of additional securities.

(m)

Residence. The undersigned, at all times since the undersigned received a copy of the Documents,

had, and has, its principal office and principal place of business in the state set forth in its address on the signature page. In making

such representation and warranty, the undersigned understands that: (i) if the undersigned is a trust, partnership, corporation or other

form of business organization, it is deemed to be a resident of the state where its principal office is located; and (ii) notwithstanding

the foregoing, if the undersigned is a trust, partnership, corporation or other form of business organization that is organized for the

specific purpose of acquiring the Convertible Note and the Warrant, it is deemed to be a resident of the state of all of the beneficial

owners of the undersigned.

(n)

Accuracy of Information About the Undersigned. All information that the undersigned has provided

in this Agreement, including, without limitation, information concerning the undersigned and the undersigned’s financial condition,

is correct and complete as of the date of this Agreement, and if there should be any material change in such information before the acceptance

of the undersigned’s subscription for the Convertible Note and the Warrant subscribed for under this Agreement, the undersigned

will immediately so inform the Company. If the undersigned is a trust, partnership, corporation, or other form of entity, it expressly

undertakes to provide the Company with such information as it may reasonable require regarding any of its beneficial owners.

(o)

Authority; Binding Obligation. If the undersigned is a trust, partnership, corporation or

other form of entity, (i) it has the right, power and authority to execute (and the signatory is duly authorized to execute, on its behalf)

this Agreement, (ii) it has the right, power and authority to perform the terms of, this Agreement, (iii) its state of organization is

as set forth on the signature page, (iv) this Agreement constitutes a valid, binding and enforceable agreement of the undersigned, and

(v) it has been duly formed, is validly existing, and is in good standing in the state of its formation.

(p)

Cooperation in Regulatory Compliance. The undersigned will cooperate with the Company, at

the Company’s expense, in any manner reasonably requested by the Company in connection with the Company’s and its direct and

indirect subsidiaries’ compliance with regulatory requirements either now existing or arising during the time the undersigned is

a shareholder holder of the Company.

(q)

Brokers and Finders. The undersigned is not a party to any agreement with any finder or broker,

or is in any way obligated to any finder or broker for any commissions, fees or expenses in connection with the negotiation, execution

or performance of this Agreement or the transactions contemplated hereby.

6.

Representations and Warranties of Company. The Company makes the following representations

and warranties: The Company has all requisite power and authority to execute, deliver and perform its obligations under this Agreement.

The execution and delivery of this Agreement, and the consummation by the Company of the transactions contemplated hereby, have been duly

authorized by all necessary company action. This Agreement has been validly executed and delivered by the Company and constitutes the

legal, valid and binding agreement of the Company, enforceable against the Company in accordance with its terms, subject to bankruptcy,

insolvency, reorganization, moratorium and similar laws of general application relating to creditors’ rights and to general equity

principles.

7.

Covenants of the Company.

(a)

Voting Agreement. On or prior to the Subscription Date, the Company shall cause the stockholders

listed on the Schedule of Stockholders attached hereto to execute a Voting Agreement, in the form attached hereto as Exhibit B

(the “Voting Agreement”), pursuant to which they shall agree to vote shares of Common Stock beneficially owned by each

stockholder in favor of the transactions contemplated by the Transaction Documents, including (i) the issuance of all of the shares of

Common Stock issuable upon conversion of the Note (the “Conversion Shares”), (ii) the issuance of all of the shares

of Common Stock issuable upon exercise of the Warrant (the “Warrant Shares,” and together with the Note, the Warrant

and the Conversion Shares, the “Securities”) in excess of 19.99% of the issued and outstanding Common Stock at the

time the Company enters into this Agreement, and (iii) any subsequent issuance(s) of the Conversion Shares or Warrants Shares in excess

of 19.99% of the issued and outstanding Common Stock as a consequence of any corporate action, including the implementation of a reverse

stock split.

(b)

Security Agreement. On or prior to the Subscription Date, the Company shall execute and deliver

a Security Agreement, in the form attached hereto as Exhibit C (the “Security Agreement”),

reflecting the grant of security interests by the Company and its subsidiaries in the Collateral (as described in the Security Agreement)

to secure the obligations of the Company under the Note and the other Transaction Documents.

(c)

Incurrence of Indebtedness. For as long as the Note remains outstanding, the Company shall

not, directly or indirectly, incur or guarantee, assume or suffer to exist any Indebtedness without first obtaining approval from Lender

which will not be reasonably withheld (other than (i) the Indebtedness evidenced by the Note and (ii) other the Indebtedness set forth

on Schedule 7(b) attached hereto (the “Permitted Indebtedness”)). “Indebtedness” of any person means,

without duplication (A) all indebtedness for borrowed money, (B) all obligations issued, undertaken or assumed as the deferred purchase

price of property or services (including, without limitation, “capital leases” in accordance with GAAP) (other than trade

payables entered into in the ordinary course of business consistent with past practice), (C) all reimbursement or payment obligations

with respect to letters of credit, surety bonds and other similar instruments, (D) all obligations evidenced by notes, bonds, debentures

or similar instruments, including obligations so evidenced incurred in connection with the acquisition of property, assets or businesses,

(E) all indebtedness created or arising under any conditional sale or other title retention agreement, or incurred as financing, in either

case with respect to any property or assets acquired with the proceeds of such indebtedness (even though the rights and remedies of the

seller or bank under such agreement in the event of default are limited to repossession or sale of such property), (F) all monetary obligations

under any leasing or similar arrangement which, in connection with GAAP, consistently applied for the periods covered thereby, is classified

as a capital lease, (G) all indebtedness referred to in clauses (A) through (F) above secured by (or for which the holder of such Indebtedness

has an existing right, contingent or otherwise, to be secured by) any lien upon or in any property or assets (including accounts and contract

rights) owned by any person, even though the person which owns such assets or property has not assumed or become liable for the payment

of such indebtedness, and (H) all contingent obligations in respect of indebtedness or obligations of others of the kinds referred to

in clauses (A) through (G) above.

(d)

Stockholder Approval. The Company shall either (x) if the Company shall have obtained the

prior written consent of the requisite stockholders (the “Stockholder Consent”) to obtain the Stockholder Approval

(as defined below), inform the stockholders of the Company of the receipt of the Stockholder Consent by preparing and filing with the

SEC, as promptly as practicable after the date hereof, but prior to the [seventy-fifth (75th)] calendar day after the Subscription Date

(or, if such filing is delayed by a court or regulatory agency, in no event later than [ninety (90) calendar days] after the Subscription

Date), an information statement with respect thereto or (y) provide each stockholder entitled to vote at a special or annual meeting of

stockholders of the Company (the “Stockholder Meeting”) for the purpose of approving the issuance of in excess of 19.99%

of the Company’s outstanding shares of Common Stock pursuant to the Transaction Documents, which shall be promptly called and held

not later than the [ninetieth (90th)] calendar day after the Subscription Date (the “Stockholder Meeting Deadline”),

a proxy statement, in each case, in a form reasonably acceptable to the undersigned, at the expense of the Company. The proxy statement,

if any, shall solicit each of the Company’s stockholder’s affirmative vote at the Stockholder Meeting for approval of resolutions

(“Stockholder Resolutions”) providing for the approval of the issuance of all of the Securities in compliance with

the rules and regulations of The New York Stock Exchange (without regard to any limitations on conversion set forth in the Notes) (such

affirmative approval being referred to herein as the “Stockholder Approval”, and the date such Stockholder Approval

is obtained, the “Stockholder Approval Date”), and the Company shall use its commercially reasonable efforts to solicit

its stockholders’ approval of such resolutions and to cause the board of directors of the Company to recommend to the stockholders

that they approve such resolutions. The Company shall seek to obtain the Stockholder Approval by the Stockholder Meeting Deadline. If,

despite the Company’s commercially reasonable efforts the Stockholder Approval is not obtained on or prior to the Stockholder Meeting

Deadline, cause an additional Stockholder Meeting to be held every three (3) months thereafter until such Stockholder Approval is obtained.

8.

Miscellaneous.

(a)

Indemnification. The undersigned shall indemnify, defend and hold harmless the Company and

each member, manager, officer and employee from and against any and all loss, damage, liability or expense, including attorneys’

fees and court costs, which they or any of them may suffer, sustain or incur by reason of, or in connection with, any misrepresentation

or breach of warranty or agreement made by the undersigned under this Agreement, or in connection with the further sale or distribution

of the Convertible Note and the Warrant purchased by the undersigned pursuant to this Agreement in violation of the Act or any other applicable

law.

(b)

Choice of Law. This Agreement, its construction and the determination of any rights, duties

or remedies of the parties arising out of, or relating to, this Agreement shall be governed by the internal laws of the State of Delaware.

In the event of a dispute under this Agreement, the parties agree to the exclusive jurisdiction of the courts located in _____ County,

Delaware.

(c)

Entire Agreement. The terms of this Agreement is intended by the parties as the final expression

of their agreement with respect to the terms included in this Agreement and may not be contradicted by evidence of any prior or contemporaneous

agreement, arrangement, understanding, representations, warranties, covenants or negotiations (whether oral or written).

(d)

No Waiver. No waiver or modification of any of the terms of this Agreement shall be valid

unless in writing. No waiver of a breach of, or default under, any provision of this Agreement shall be deemed a waiver of such provision

or of any subsequent breach or default of the same or similar nature or of any other provision or condition of this Agreement.

(e)

Counterparts; Electronic Signatures. This Agreement may be executed in counterparts, each

of which shall be deemed an original, but all of which together shall constitute the same instrument. A manual signature of this Agreement

or an image of which shall have been transmitted electronically, will constitute an original signature for all purposes.

(f)

Survival. All representations, warranties and covenants contained in this Agreement shall

survive acceptance of the subscription.

(g)

Gender and Number. Terms used in this Agreement in any gender or in the singular or plural

include other genders and the plural or singular, as the context may require. If the Subscriber is an entity, all reference to “him”

and “his” shall be deemed to include “it” or “its.”

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK. SIGNAURE

PAGES FOLLOW.]

SIGNATURE PAGE TO SECURITIES PURCHASE AGREEMENT

The undersigned subscribes for the Convertible Note

and the Warrant of the Company set forth below. This Agreement and the representations, warranties, acknowledgements and agreements contained

in this Agreement shall be binding upon the heirs, executors, administrators, successors and assigns of the undersigned.

| (Signature

block as applicable.) |

|

INDIVIDUAL |

ENTITY |

| |

|

| |

|

| Signature |

Name of Company |

| Name |

By: |

|

Title: |

Principal amount of Convertible

Note subscribed for: $2,000,000.

Total funds to be tendered: $2,000,000

(payable to EQUUS TOTAL RETURN, Inc. upon execution of this Agreement) by wire transfer of immediately available U.S. dollars.

| FOR COMPLETION BY ALL SUBSCRIBERS |

|

Subscriber’s Mailing Address:

(for formal notice) |

Subscriber’s Other Address:

(home, business or main office) |

| |

|

| |

|

| Attention: |

Attention: |

| Phone No: |

Phone No: |

| Fax No.: |

Fax No.: |

| E-mail: |

E-mail: |

Signature Page to Securities Purchase Agreement

of EQUUS TOTAL RETURN, Inc.

ACCEPTANCE

Accepted as of the Subscription Date set forth above.

|

EQUUS TOTAL RETURN, INC. |

| |

|

|

By: |

| |

|

| |

Name: JOHN HARDY |

| |

Title: CEO |

EXHIBIT 10.2

EXECUTION

COPY

GENERAL ENTERPRISE VENTURES,

INC. SUBSCRIPTION AGREEMENT

THE SECURITIES OFFERED BY THIS SUBSCRIPTION

AGREEMENT HAVE NOT BEEN

REGISTERED UNDER THE SECURITIES

ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY STATE SECURITIES LAWS, AND, UNLESS SO REGISTERED, MAY NOT BE

OFFERED, SOLD, ASSIGNED, PLEDGED OR OTHERWISE DISPOSED OF, EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE

REGISTRATION REQUIREMENTS OF THE ACT AND ANY APPLICABLE STATE SECURITIES LAWS. THE PURCHASE OF THE SECURITIES INVOLVES A HIGH DEGREE OF

RISK AND SHOULD BE CONSIDERED ONLY BY PERSONS WHO CAN BEAR THE RISK OF THE LOSS OF THEIR ENTIRE INVESTMENT.

In consideration

of the promises and covenants contained herein, and other good and valuable consideration, the receipt and sufficiency of which is hereby

acknowledged, and intending to be legally bound, the parties agree as follows:

1.

Subscription; Issuance. The undersigned hereby agrees to fund to General Enterprise Ventures, Inc., a Wyoming corporation

(the “Company”), the principal amount of the convertible note of the Company (the “Convertible Note”)

set forth on the signature page of this Subscription Agreement, payable in full as described below in accordance with the terms and conditions

of this Subscription Agreement, including warrant issued pursuant to the certain Warrant Agreement (the “Warrant”)

executed in connection with the Convertible Note. The execution of this Subscription Agreement by the undersigned constitutes a binding

offer to fund the principal of the Convertible Note shown on the signature page. Upon the execution of this Subscription Agreement, the

undersigned shall deliver to the Company the full principal amount of the Convertible Note subscribed by the undersigned.

2.

Acceptance, Rejection or Withdrawal of Subscription Offer. Acceptance by the Company of the undersigned’s offer to

fund a Convertible Note pursuant to this Subscription Agreement shall be evidenced by the Company’s delivery to the undersigned

of this Subscription Agreement executed by the Company. The undersigned understands and agrees that, if this Subscription Agreement is

accepted, it may not be cancelled, revoked or withdrawn by the undersigned.

3.

No Assignment. The rights under this Subscription Agreement are not transferable or assignable by the undersigned without

the prior written consent of the Company.

4.

Accredited Investor. The undersigned represents and warrants that the undersigned is an Accredited Investor (as that term

is defined in Rule 501(a) of Regulation D promulgated under the Act). In connection with acquiring the Convertible Note and being issued

the Warrant under this Agreement, the undersigned shall deliver to the Company a signed copy of the Investor Suitability Questionnaire

attached hereto as Exhibit A.

5.

Representations, Warranties and Agreements. The undersigned makes the following representations, warranties, acknowledgments

and agreements to induce the Company to accept this subscription:

(a)

Information. The undersigned hereby acknowledges that the undersigned has reviewed and/or received: Any information and

materials requested by the undersigned relating to the Company and its subsidiaries, their proposed activities and business, their capitalization,

their management and key personnel and the offering and sale of the Convertible Note and the issuance of the Warrant of the Company (collectively,

the “Documents”). The undersigned hereby further acknowledges that it has read, is fully familiar with, and

EXECUTION

COPY

completely understands, the Documents,

this Subscription Agreement and any other documents and information that the undersigned deems material to making an investment decision

with respect to the Convertible Note. The undersigned has been provided the Documents at least 48 hours prior to the execution of this

Subscription Agreement. The undersigned shall keep the Documents and other information it receives about the Company or any of its subsidiaries

confidential.

(b)

Availability of Information. The Company has made all documents pertaining to the matters described in the Documents and

the offering of the Convertible Note of the Company and the issuance of the Warrant available to the undersigned and has allowed the undersigned,

or the undersigned’s purchaser representative, a reasonable opportunity to ask questions and receive answers concerning the terms

and conditions of this offering and to obtain any additional information which the Company possesses or can acquire without unreasonable

effort or expense that is necessary to verify the accuracy of any information provided to the undersigned.

(c)

No Other Representations. The undersigned has relied solely on the Documents and the documents and materials submitted with

the Documents in making the decision to purchase the Convertible Note subscribed for under this Subscription Agreement, and no representations

or agreements, written or oral, other than those set forth in this Subscription Agreement have been made to the undersigned, with respect

to such purchase of the Convertible Note of the Company and issuance of the Warrant.

(d)

Reliance on Own Investigation and Advisors. The undersigned acknowledges that the undersigned has been advised to consult

with the undersigned’s own legal advisor concerning the legal aspects of the Company and to consult with the undersigned’s

tax advisor regarding the tax consequences of investing in the Company. The undersigned is not relying on the Company or any of its respective

officers, directors, executives, employees, advisors, members, managers, subsidiaries or affiliates or other personnel for legal, accounting,

financial or tax advice in connection with the undersigned’s evaluation of the risks and merits of an investment in the Company

or of the consequences to the undersigned of such an investment.

(e)

Investment Intent. The Convertible Note and Warrant subscribed for under this Subscription Agreement will be acquired solely

by, and for the account of, the undersigned (and not for other persons or entities), for investment only, and are not being purchased

with a view to, or for sale in connection with, a distribution of the Convertible Note and/or the Warrant. The undersigned has no contract,

undertaking, agreement or arrangement with any person or entity to sell, transfer, assign or pledge to such person, entity, or anyone

else all or any part of the Convertible Note or the Warrant for which the undersigned subscribes, and the undersigned has no current plans

or intentions to enter into any such contract, undertaking or arrangement.

(f)

Resale Restrictions. The undersigned acknowledges that (i) neither the Convertible Note nor the Warrant has been registered

under the Securities Act or the securities statutes of any state or other jurisdiction, (ii) the Convertible Note and the Warrant have

the status of securities acquired in a transaction under Section 4(2) of the Securities Act, (iii) each of the Convertible Note and the

Warrant is a “restricted security” (as that term is defined in Rule 144(a)(3) under the Securities Act), (iv) therefore, neither

the Convertible Note nor the Warrant can be resold (and the undersigned covenants that the undersigned will not resell either) unless

it is registered under applicable federal and state securities laws (including the Securities Act) or unless exemptions from all such

applicable registration requirements are available, and (v) consequently, the undersigned must bear the economic risk of investment for

an indefinite period of time. The undersigned will not sell or otherwise transfer either the Convertible Note or Warrant without: (i)

either (A) the prior registration of the Convertible Note or Warrant, as applicable, under the Securities Act and all other applicable

statutes, or (B) applicable exemptions from the registration requirements of each of those statutes, and (ii) unless and until the Company

has determined, by obtaining the advice of counsel or otherwise, that the intended disposition will not violate the Securities Act or

any applicable state securities law. The undersigned understands that the Company has no obligation or intention to register either the

Convertible Note or the Warrant under any federal or state securities act, law or regulation.

EXECUTION

COPY

(g)

Economic Risk; Sophistication. The undersigned acknowledges and recognizes that an investment

in the Company involves a high degree of risk in that (i) the undersigned may not be able to liquidate the investment, (ii) transferability

may be extremely limited, (iii) there is currently no market for the Convertible Note or the Warrant, nor is a market likely to develop,

and (iv) the undersigned could sustain the loss of the entire investment or part of the investment.

(h)

Ability to Bear Risk. The financial condition of the undersigned is such that the undersigned has no need for liquidity

with respect to the undersigned’s investment in the Convertible Note and the Warrant to satisfy any existing or contemplated undertaking

or indebtedness, and the undersigned has no need for a current return on the undersigned’s investment in the Convertible Note and

the Warrant. The undersigned is able to bear the economic risk of the undersigned’s investment in the Convertible Note and the Warrant

for an indefinite period of time, including the risk of losing all of the undersigned’s investment.

(i)

Sophistication; No Agency Review or Endorsement. The undersigned, either alone or with the undersigned’s purchaser

representative, has such knowledge and experience in financial and business matters that the undersigned is capable of evaluating the

merits and risks of the prospective investment. The undersigned acknowledges and understands that no federal or state agency has passed

upon the adequacy or accuracy of the information set forth in any document provided to the undersigned or made any finding or determination

as to the fairness for investment, or any recommendation or endorsement of the Convertible Note and the Warrant as an investment.

(j)

No General Solicitation. The undersigned acknowledges and represents that neither the Company nor any person or entity acting

on its behalf has offered or sold the Convertible Note and the Warrant to the undersigned by any form of general solicitation or general

advertising, including, but not limited to, (i) any advertisement, article, notice or other communication published in any newspaper,

magazine, or similar media or broadcast over television or radio, and (ii) any seminar or meeting whose attendees have been invited by

any general solicitation or general advertising.

(k)

Status After Purchase; Information. The undersigned acknowledges and accepts that if the undersigned purchases the Convertible

Note and the Warrant, the undersigned will have only a minority interest in the Company with little, if any, control over the Company

or its business and will have no right to become a manager of the Company. In addition, the Company is not subject to the reporting requirements

of the Securities Exchange Act of 1934, and, therefore, is not required to publish periodic information about its business or financial

condition.

(l)

Responsibility for Determining Suitability of Investment. The undersigned is assuming full responsibility independently:

(i) to determine whether an investment in the Convertible Note and the Warrant is suitable for the undersigned, (ii) to evaluate the undersigned’s

potential purchase of the Convertible Note and the Warrant, and (iii) to obtain, verify and evaluate all material information necessary

or desired by the undersigned to make the undersigned’s decision, including, without limitation, information concerning the Company

and its subsidiaries, their officers, directors, executives, employees and managers, their related party transactions, their financial

condition and needs, their business, their obligations, their equity holders and their rights, preferences and privileges and any potential

issuance of additional securities.

(m)

Residence. The undersigned, at all times since the undersigned received a copy of the Documents, had, and has, its principal

office and principal place of business in the state set forth in its address on the signature page. In making such representation and

warranty, the undersigned understands that: (i) if the undersigned is a trust, partnership, corporation or other form of business organization,

it is deemed to be a resident of the state where its principal office is located; and (ii) notwithstanding the foregoing, if the undersigned

is a trust, partnership, corporation or other form of business organization that is organized for the specific purpose of acquiring the

Convertible Note and the Warrant, it is deemed to be a resident of the state of all of the beneficial owners of the undersigned.

EXECUTION

COPY

(n)

Accuracy of Information About the Undersigned. All information that the undersigned has provided in this Subscription Agreement,

including, without limitation, information concerning the undersigned and the undersigned’s financial condition, is correct and

complete as of the date of this Subscription Agreement, and if there should be any material change in such information before the acceptance

of the undersigned’s subscription for the Convertible Note and the Warrant subscribed for under this Subscription Agreement, the

undersigned will immediately so inform the Company. If the undersigned is a trust, partnership, corporation, or other form of entity,

it expressly undertakes to provide the Company with such information as it may reasonable require regarding any of its beneficial owners.

(o)

Authority; Binding Obligation. If the undersigned is a trust, partnership, corporation or other form of entity, (i) it has

the right, power and authority to execute (and the signatory is duly authorized to execute, on its behalf) this Subscription Agreement,

(ii) it has the right, power and authority to perform the terms of, this Subscription Agreement, (iii) its state of organization is as

set forth on the signature page, (iv) this Subscription Agreement constitutes a valid, binding and enforceable agreement of the undersigned,

and

(v) it has been duly formed, is validly

existing, and is in good standing in the state of its formation.

(p)

Cooperation in Regulatory Compliance. The undersigned will cooperate with the Company, at the Company’s expense, in

any manner reasonably requested by the Company in connection with the Company’s and its direct and indirect subsidiaries’

compliance with regulatory requirements either now existing or arising during the time the undersigned is a shareholder holder of the

Company.

(q)

Brokers and Finders. The undersigned is not a party to any agreement with any finder or broker, or is in any way obligated

to any finder or broker for any commissions, fees or expenses in connection with the negotiation, execution or performance of this Subscription

Agreement or the transactions contemplated hereby.

6.

Representations and Warranties of Company. The Company makes the following representations and warranties: The Company has

all requisite power and authority to execute, deliver and perform its obligations under this Subscription Agreement. The execution and

delivery of this Subscription Agreement, and the consummation by the Company of the transactions contemplated hereby, have been duly authorized

by all necessary company action. This Subscription Agreement has been validly executed and delivered by the Company and constitutes the

legal, valid and binding agreement of the Company, enforceable against the Company in accordance with its terms, subject to bankruptcy,

insolvency, reorganization, moratorium and similar laws of general application relating to creditors’ rights and to general equity

principles.

(a)

Resale Registration Statement. As soon as practicable (and in any event within 60 calendar days of the closing date of the

Qualified Financing), the Company shall file a registration statement on Form S-1 providing for the resale by the undersigned of the shares

issued and issuable upon conversion of the Convertible Note (“Conversion Shares”) and shares issued and issuable upon

exercise of the Warrants (“Warrant Shares”) or shall include such Warrant Shares and Conversion Shares in any other

registration statement on Form S-1 filed by the Company. The Company shall use commercially reasonable efforts to cause such registration

to become effective within 90 days (or 120 days if subject to a full review by the Commission) following the Qualified Financing and to

keep such registration statement effective at all times (except for any periods in connection with the filing of post-effective amendments

as reasonably determined by Company’s counsel to be required) until no undersigned owns any Warrants, Convertible Note, Conversion

Shares or Warrant Shares issuable upon exercise or conversion thereof.

(b)

Indemnification. The undersigned shall indemnify, defend and hold harmless the Company and each member, manager, officer

and employee from and against any and all loss, damage, liability or expense, including attorneys’ fees and court costs, which they

or any of them may suffer, sustain or incur by

EXECUTION

COPY

reason of, or in connection with,

any misrepresentation or breach of warranty or agreement made by the undersigned under this Subscription Agreement, or in connection with

the further sale or distribution of the Convertible Note and the Warrant purchased by the undersigned pursuant to this Subscription Agreement

in violation of the Act or any other applicable law.

Subject

to the provisions of this Section 7(b), the Company will indemnify and hold each of the undersigned and its directors, officers, shareholders,

members, partners, employees and agents (and any other Persons with a functionally equivalent role of a Person holding such titles notwithstanding

a lack of such title or any other title), each Person who controls such Purchaser (within the meaning of Section 15 of the Securities

Act and Section 20 of the Exchange Act), and the directors, officers, shareholders, agents, members, partners or employees (and any other

Persons with a functionally equivalent role of a Person holding such titles notwithstanding a lack of such title or any other title) of

such controlling persons (each, a “Purchaser Party”) harmless from any and all losses, liabilities, obligations, claims,

contingencies, damages, costs and expenses, including all judgments, amounts paid in settlements, court costs and reasonable attorneys’

fees and costs of investigation that any such Purchaser Party may suffer or incur as a result of or relating to (a) any breach of any

of the representations, warranties, covenants or agreements made by the Company in this Agreement or

(b) any action instituted against the

Purchaser Parties in any capacity, or any of them or their respective Affiliates, by any stockholder of the Company who is not an Affiliate

of such Purchaser Party, with respect to any of the transactions contemplated by the Agreement (unless such action is solely based upon

a material breach of such Purchaser Party’s representations, warranties or covenants under this Agreement or any agreements or understandings

such Purchaser Party may have with any such stockholder or any violations by such Purchaser Party of state or federal securities laws

or any conduct by such Purchaser Party which is finally judicially determined to constitute fraud, gross negligence or willful misconduct)

or (c) in connection with any registration statement of the Company providing for the resale by the Purchasers of the Warrant Shares issued

and issuable upon exercise of the Warrants, the Company will indemnify each Purchaser Party, to the fullest extent permitted by applicable

law, from and against any and all losses, claims, damages, liabilities, costs (including, without limitation, reasonable attorneys’

fees) and expenses, as incurred, arising out of or relating to (i) any untrue or alleged untrue statement of a material fact contained

in such registration statement, any prospectus or any form of prospectus or in any amendment or supplement thereto or in any preliminary

prospectus, or arising out of or relating to any omission or alleged omission of a material fact required to be stated therein or necessary

to make the statements therein (in the case of any prospectus or supplement thereto, in the light of the circumstances under which they

were made) not misleading, except to the extent, but only to the extent, that such untrue statements or omissions are based solely upon

information regarding such Purchaser Party furnished in writing to the Company by such Purchaser Party expressly for use therein, or (ii)

any violation or alleged violation by the Company of the Securities Act, the Exchange Act or any state securities law, or any rule or

regulation thereunder in connection therewith. If any action shall be brought against any Purchaser Party in respect of which indemnity

may be sought pursuant to this Agreement, such Purchaser Party shall promptly notify the Company in writing, and the Company shall have

the right to assume the defense thereof with counsel of its own choosing reasonably acceptable to the Purchaser Party. Any Purchaser Party

shall have the right to employ separate counsel in any such action and participate in the defense thereof, but the fees and expenses of

such counsel shall be at the expense of such Purchaser Party except to the extent that (i) the employment thereof has been specifically

authorized by the Company in writing, (ii) the Company has failed after a reasonable period of time to assume such defense and to employ

counsel or (iii) in such action there is, in the reasonable opinion of counsel, a material conflict on any material issue between the

position of the Company and the position of such Purchaser Party, in which case the Company shall be responsible for the reasonable fees

and expenses of no more than one such separate counsel. The indemnification required by this Section 7(b) shall be made by periodic payments

of the amount thereof during the course of the investigation or defense, as and when bills are received or are incurred. The indemnity

agreements contained herein shall be in addition to any cause of action or similar right of any Purchaser Party against the Company or

others and any liabilities the Company may be subject to pursuant to law.

EXECUTION

COPY

(c)

Choice of Law. This Subscription Agreement, its construction and the determination of any rights, duties or remedies of

the parties arising out of, or relating to, this Subscription Agreement shall be governed by the internal laws of the State of Wyoming.

In the event of a dispute under this Subscription Agreement, the parties agree to the exclusive jurisdiction of the courts located in

County, Wyoming.

(d)

Entire Agreement. The terms of this Subscription Agreement is intended by the parties as the final expression of their agreement

with respect to the terms included in this Subscription Agreement and may not be contradicted by evidence of any prior or contemporaneous

agreement, arrangement, understanding, representations, warranties, covenants or negotiations (whether oral or written).

(e)

No Waiver. No waiver or modification of any of the terms of this Subscription Agreement shall be valid unless in writing.

No waiver of a breach of, or default under, any provision of this Subscription Agreement shall be deemed a waiver of such provision or

of any subsequent breach or default of the same or similar nature or of any other provision or condition of this Subscription Agreement.

(f)

Counterparts; Electronic Signatures. This Subscription Agreement may be executed in counterparts, each of which shall be

deemed an original, but all of which together shall constitute the same instrument. A manual signature of this Subscription Agreement

or an image of which shall have been transmitted electronically, will constitute an original signature for all purposes.

(g)

Survival. All representations, warranties and covenants contained in this Subscription Agreement shall survive acceptance

of the subscription.

(h)

Gender and Number. Terms used in this Subscription Agreement in any gender or in the singular or plural include other genders

and the plural or singular, as the context may require. If the Subscriber is an entity, all reference to “him” and “his”

shall be deemed to include “it” or “its.”

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK. SIGNATURE PAGES

FOLLOW.]

EXECUTION

COPY

SIGNATURE PAGE TO SUBSCRIPTION AGREEMENT

The undersigned

subscribes for the Convertible Note and the Warrant of the Company set forth below. This Subscription Agreement and the representations,

warranties, acknowledgements and agreements contained in this Subscription Agreement shall be binding upon the heirs, executors, administrators,

successors and assigns of the undersigned.

| Executed at Houston,

Texas

as of February 13, 2025 |

|

(City) (State) |

| |

|

| (Signature block as applicable.) |

|

| |

|

| |

|

| INDIVIDUAL |

ENTITY |

| |

|

| |

EQUUS TOTAL RETURN, INC. |

| Signature |

Name of Company |

| |

|

| Name |

|

Principal amount of Convertible Note subscribed for: [$1,500,000].

Total funds to be tendered: [$1,500,000

] (payable to General Enterprise Ventures, Inc. upon execution of this Agreement) by wire transfer of immediately available U.S.

dollars.

| FOR COMPLETION BY ALL SUBSCRIBERS |

|

Subscriber’s Mailing Address: (for formal notice)

700 Louisiana St, 48th Fl |

Subscriber’s Other Address: (home, business or main office) |

|

Houston, TX 77002

Attention: |

Attention: |

| Phone No: |

Phone No: |

| E-mail: |

E-mail: |

[SIGNATURE PAGE TO CONVERTIBLE

NOTE SUBSCRIPTION AGREEMENT

OF GENERAL ENTERPRISE VENTURES, INC.]

EXECUTION

COPY

ACCEPTANCE

| Accepted

as of February 18, 2025 |

|

| |

GENERAL

ENTERPRISE VENTURES, INC. |

| |

|

| |

By:

|

| |

Name:

|

| |

Title:

|

[SIGNATURE PAGE TO CONVERTIBLE

NOTE SUBSCRIPTION AGREEMENT

OF GENERAL ENTERPRISE VENTURES, INC.]

EXECUTION

COPY

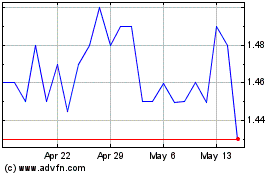

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jan 2025 to Feb 2025

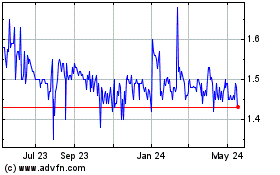

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Feb 2024 to Feb 2025