0000868671false00008686712025-01-132025-01-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 8-K

____________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 13, 2025

____________________________________________________________

GLACIER BANCORP, INC.

(Exact name of registrant as specified in its charter)

____________________________________________________________

| | | | | | | | |

| Montana | 000-18911 | 81-0519541 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

| 49 Commons Loop, | Kalispell, | Montana | 59901 |

| (Address of principal executive offices) | (Zip Code) |

| | | | | | | | | | | |

| (406) | 756-4200 |

| (Registrant’s telephone number, including area code) |

____________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | GBCI | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On January 13, 2025, Glacier Bancorp, Inc. (“GBCI”) issued a press release regarding the matters described in Item 8.01 of this current report on Form 8-K, a copy of which is furnished as Exhibit 99.1 and is incorporated herein by reference.

Attached as Exhibit 99.2 and incorporated by reference herein is an investor presentation dated January 13, 2025, that will be used by GBCI in its presentation regarding the matters described in Item 8.01 of this current report on Form 8-K.

The information in this Item 7.01, including Exhibits 99.1 and 99.2, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of GBCI under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filings.

Item 8.01 Other Events

On January 13, 2025, GBCI and its wholly owned subsidiary, Glacier Bank, entered into a Plan and Agreement of Merger (the “Merger Agreement”) with Bank of Idaho Holding Co. (“BOID”) and its wholly owned subsidiary, Bank of Idaho. Under the terms of the Merger Agreement, BOID will merge with and into GBCI, with GBCI as the surviving entity (the “Holding Company Merger”). Immediately thereafter, Bank of Idaho will merge with and into Glacier Bank, with Glacier Bank surviving as a wholly owned subsidiary of GBCI (the “Bank Merger”). Following the Bank Merger, the former branches of Bank of Idaho will be integrated with Glacier Bank’s existing divisions operating in Idaho and eastern Washington.

Concurrently with the execution of the Merger Agreement, the directors, certain executive officers, and certain shareholders owning more than 5% of BOID’s outstanding common stock entered into voting agreements with GBCI pursuant to which each such director, executive officer, or shareholder in his, her or its capacity as a shareholder, has agreed, among other things, to vote shares of BOID common stock in favor of the proposed transactions contemplated by the Merger Agreement.

Subject to the terms and conditions of the Merger Agreement, at the date and time when the Holding Company Merger becomes effective, each share of BOID stock issued and outstanding will be converted into and represent the right to receive from GBCI merger consideration in the form of 1.100 shares of GBCI common stock (subject to adjustment under certain circumstances).

As of the date of this report, the anticipated merger consideration has a total aggregate value of $245.4 million (based on the closing price of $47.70 for GBCI common stock on January 10, 2025).

Consummation of the transaction is subject to receipt of required regulatory approvals, BOID shareholder approval, and other customary conditions of closing. It is currently anticipated that the closing of the transaction will take place in the second quarter of 2025. For additional information regarding the terms of the proposed transaction, reference is made to the press release dated January 13, 2025, which is attached as Exhibit 99.1.

Forward-Looking Statements

This current report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “estimate,” “anticipate,” “expect,” “will,” and similar references to future periods. Such forward-looking statements include but are not limited to statements regarding the expected closing of the transaction and its timing and the potential benefits of the business combination transaction involving GBCI and BOID, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts regarding either company or the proposed combination of the companies. These forward-looking statements are subject to risks and uncertainties, many of which are outside of our control, that may cause actual results or events to differ materially from those projected, including but not limited to the following: risks that the merger transaction will not close when expected or at all because required regulatory, shareholder or other approvals or conditions to closing are delayed or not received or satisfied on a timely basis or at all; risks that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which GBCI and BOID operate; uncertainties regarding the ability of Glacier Bank and Bank of Idaho to promptly and effectively integrate their businesses, including into Glacier Bank’s existing division structure; changes in business and operational strategies that may occur between signing and closing; uncertainties regarding the reaction to the transaction of the companies’ respective customers, employees, and contractual counterparties; and risks relating to the diversion of management time on merger-related issues. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are made and reflect management’s current estimates, projections, expectations and beliefs. GBCI undertakes no obligation to publicly revise or update the forward-looking statements to reflect events or circumstances that arise after the date of this report. For more information, see the risk factors described in GBCI’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission (“SEC”) from time to time.

Additional Information and Where to Find It

In connection with the proposed merger transaction, GBCI expects to file with the SEC a Registration Statement on Form S-4 (the “Registration Statement”) that will include a Proxy Statement of BOID and a Prospectus of GBCI, as well as other relevant documents concerning the proposed transaction. Shareholders of BOID are urged to read carefully the Registration Statement and the Proxy Statement/Prospectus included therein regarding the proposed merger transaction when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Proxy Statement/Prospectus included in the Registration Statement, as well as other filings containing information about GBCI, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from GBCI at www.glacierbancorp.com under the tab “SEC Filings” or by requesting them in writing or by telephone from GBCI at: Glacier Bancorp, Inc., 49 Commons Loop, Kalispell, Montana 59901, ATTN: Corporate Secretary; Telephone (406) 751-7706.

Item 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

99.1 Press Release dated January 13, 2025 99.2 Investor Presentation dated January 13, 2025 104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Dated: | January 13, 2025 | GLACIER BANCORP, INC. |

| | | |

| | /s/ Randall M. Chesler |

| | By: | Randall M. Chesler |

| | | President and Chief Executive Officer |

NEWS RELEASE January 13, 2025 FOR IMMEDIATE RELEASE CONTACT: Randall M. Chesler (406) 751-4722 Ron J. Copher (406) 751-7706 Glacier Bancorp, Inc. Announces Acquisition of Bank of Idaho Holding Co. KALISPELL, MONTANA (GLOBE NEWSWIRE) – Glacier Bancorp, Inc. (“Glacier” or the “Company”) (NYSE: GBCI) today announced the signing of a definitive agreement to acquire Bank of Idaho Holding Co. (“BOID”) (OTCQX: BOID), the bank holding company for Bank of Idaho, a leading community bank headquartered in Idaho Falls, Idaho. The acquisition marks Glacier’s 26th bank acquisition since 2000 and its 12th announced transaction in the past 10 years. As of September 30, 2024, BOID had total assets of $1.3 billion, total loans of $1.0 billion and total deposits of $1.1 billion. The boards of Glacier and BOID unanimously approved the transaction, which is subject to regulatory approval, BOID shareholder approval and other customary conditions of closing. The definitive agreement provides that upon closing of the transaction, BOID shareholders are to receive 1.100 shares of Glacier stock for each BOID share (subject to adjustment under certain circumstances). Based on the closing price of $47.70 for Glacier shares on January 10, 2025, the transaction would result in an aggregate consideration of $245.4 million (inclusive of the value to BOID stock option and stock appreciation right holders) and value of $52.47 per BOID share. Upon closing of the transaction, which is anticipated to take place in the second quarter of 2025, the Bank of Idaho operations will join three existing Glacier Bank divisions. The Eastern Idaho operations of Bank of Idaho will join Citizens Community Bank, the Boise operations will join Mountain West Bank and the Eastern Washington operations will join Wheatland Bank. "We are excited to add Bank of Idaho to the Glacier family of banks,” said Randy Chesler, Glacier's President and CEO. “This is a unique opportunity to find a bank that not only fits strategically within our existing footprint but will also meaningfully expand our presence in strong core growth markets for Glacier. Idaho is the fastest growing state in the country and the addition of Bank of Idaho to our existing Mountain West Bank and Citizens Community Bank divisions will secure our position as the leading community bank in the state. In addition, we will expand our growing Eastern Washington franchise by combining Bank of Idaho with our Wheatland Bank division.” Chesler also noted that “This acquisition continues our long history of consistently adding high quality community banks to our proven banking model and we are enthusiastic about the future growth opportunities this acquisition will provide.”

“Bank of Idaho is a true community bank, and we are pleased to find a partner that shares the same vision, values and relationship banking model that has been core to our success over the years,” said Jeff Newgard, Bank of Idaho’s Chairman, President and CEO. “We are excited to join the Glacier family of banks and look forward to the opportunities and benefits this combination will bring to our clients, employees and shareholders.” Glacier management will review additional information regarding the transaction on a conference call beginning at 9:00 a.m. Mountain Time on Tuesday, January 14, 2025. Please note that our conference call host no longer offers a general dial-in number. Investors who would like to join the call may now register by following this link to obtain dial-in instructions: https://register.vevent.com/register/BI853a1a4cd7b143d18cb4dbf900914588 To participate via the webcast, log on to: https://edge.media-server.com/mmc/p/dpkop98f If you are unable to participate during the live webcast, the call will be archived on our website, www.glacierbancorp.com. A slide presentation to accompany management’s commentary may be accessed from Glacier’s January 13, 2025, Form 8-K filing with the Securities and Exchange Commission (the "SEC") or at https://www.glacierbancorp.com/news-market-information/annual-reports-presentations. Glacier was advised in the transaction by D.A. Davidson & Co. as financial advisor and Miller Nash LLP as legal counsel. BOID was advised by MJC Partners as financial advisor and Otteson Shapiro LLP as legal counsel. About Glacier Bancorp, Inc. Glacier Bancorp, Inc. is the parent company for Glacier Bank and its bank divisions: Altabank (American Fork, UT), Bank of the San Juans (Durango, CO), Citizens Community Bank (Pocatello, ID), Collegiate Peaks Bank (Buena Vista, CO), First Bank of Montana (Lewistown, MT), First Bank of Wyoming (Powell, WY), First Community Bank Utah (Layton, UT), First Security Bank (Bozeman, MT), First Security Bank of Missoula (Missoula, MT), First State Bank (Wheatland, WY), Glacier Bank (Kalispell, MT), Heritage Bank of Nevada (Reno, NV), Mountain West Bank (Coeur d’Alene, ID), The Foothills Bank (Yuma, AZ), Valley Bank (Helena, MT), Western Security Bank (Billings, MT), and Wheatland Bank (Spokane, WA). Visit GBCI’s website at www.glacierbancorp.com. Important Information and Where You Can Find It This communication relates to the proposed merger transaction involving Glacier and BOID. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities. In connection with the proposed merger transactions, Glacier expects to file with the SEC a Registration Statement on Form S-4 (the “Registration Statement”) that will include a Proxy Statement of BOID and a Prospectus of Glacier, as well as other relevant documents concerning

the proposed transaction. Shareholders of BOID are urged to read carefully the Registration Statement and the Proxy Statement/Prospectus included therein regarding the proposed merger transaction when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Proxy Statement/Prospectus included in the Registration Statement, as well as other filings containing information about Glacier, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Glacier at www.glacierbancorp.com under the tab “SEC Filings” or by requesting them in writing or by telephone from Glacier at: Glacier Bancorp, Inc., 49 Commons Loop, Kalispell, Montana 59901, ATTN: Corporate Secretary; Telephone (406) 751-7706. Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “estimate,” “anticipate,” “expect,” “will,” and similar references to future periods. Such forward- looking statements include but are not limited to statements regarding the expected closing of the transaction and its timing and the potential benefits of the business combination transaction involving Glacier and BOID, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts regarding either company or the proposed combination of the companies. These forward-looking statements are subject to risks and uncertainties, many of which are outside of our control, that may cause actual results or events to differ materially from those projected, including but not limited to the following: risks that the merger transaction will not close when expected or at all because required regulatory, shareholder or other approvals or conditions to closing are delayed or not received or satisfied on a timely basis or at all; risks that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which Glacier and BOID operate; uncertainties regarding the ability of Glacier Bank and Bank of Idaho to promptly and effectively integrate their businesses, including into Glacier Bank’s existing division structure; changes in business and operational strategies that may occur between signing and closing; uncertainties regarding the reaction to the transaction of the companies’ respective customers, employees, and contractual counterparties; and risks relating to the diversion of management time on merger-related issues. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are made and reflect management’s current estimates, projections, expectations and beliefs. Glacier undertakes no obligation to publicly revise or update the forward-looking statements to reflect events or circumstances that arise after the date of this report. For more information, see the risk factors described in Glacier’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the SEC.

Acquisition of January 13, 2025

Forward-Looking Statements This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about the Company’s plans, objectives, expectations and intentions that are not historical facts, and other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “should,” “projects,” “seeks,” “estimates,” “will”, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are based on current beliefs and expectations of management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. The following factors, among others, could cause actual results to differ materially from the anticipated results (express or implied) or other expectations in the forward-looking statements, including those set forth in this presentation: 1) the occurrence of any event, change or other circumstance that could give rise to the right of one or both parties to terminate the definitive merger agreement between the Company and BOID; 2) the possibility that the proposed transaction will not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all, or are obtained subject to conditions that are not anticipated; 3) the risk that any announcements related to the proposed transaction could have adverse effects on the market price of the common stock of either or both parties; 4) the possibility that the anticipated benefits of the transaction will not be realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies (including into Glacier Bank’s existing division structure) or as a result of the strength of the economy and competitive factors in the areas where the Company and BOID do business; 5) potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction that could make it difficult to retain or hire key personnel and maintain relationships with customers; 6) the Company’s and BOID’s success in executing their respective business plans and strategies and managing the risks involved; 7) the risk that the proposed transaction may be more difficult or time-consuming than anticipated, including in areas such as asset realization, systems integration and other key strategies; 8) the unforeseen risk relating to liabilities of the Company or BOID that may exist; 9) the Company’s success in managing risks involved in the foregoing; and 10) the effects of any reputational damage to the Company resulting from the foregoing. The foregoing are representative of the factors that could affect the outcome of our forward-looking statements. In addition, such statements could be affected by general industry and market conditions and growth rates, general interest rate and currency exchange rate fluctuations, changes and trends in the securities markets, changes in regulations, and other factors. The Company provides further detail regarding these risks and uncertainties in its latest Form 10-K and subsequent Form 10-Qs, including in the respective “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” sections of such reports, as well as in subsequent filings with the Securities and Exchange Commission. Please take into account that these forward-looking statements speak only as of the date of this presentation. The Company does not undertake any obligation to publicly correct, revise, or update any forward-looking statement if it later becomes aware that actual results are likely to differ materially from those expressed in such forward-looking statement, except as required under federal securities laws. 2

Transaction Highlights 3 Transaction Overview Financially Attractive ➢ Glacier Bancorp, Inc. (“GBCI”) (NYSE: GBCI) will acquire Bank of Idaho Holding Co. (“BOID”) (OTCQX: BOID), the bank holding company for Bank of Idaho, a regional community bank headquartered in Idaho Falls, Idaho − High-performing banking franchise with $1.3 billion in total assets and 15 branch locations across Eastern Idaho, Boise and Eastern Washington ➢ Unique opportunity to acquire a high-growth community bank operating in existing Glacier markets which provides meaningful EPS accretion and low integration risk − Bank of Idaho will become part of Glacier’s three existing bank divisions in Idaho and Washington − Idaho is the fastest growing state in the country(1) and the acquisition will position Glacier as the third largest bank in Idaho by deposit market share − Significantly enhances Glacier’s presence in the robust Eastern Washington market ➢ Transaction is consistent with Glacier’s focused M&A strategy – will be Glacier’s 26th bank acquisition since 2000 and its 12th announced transaction in the past 10 years ➢ Pricing metrics, deal structure and conservative assumptions reflective of Glacier’s disciplined approach to acquisitions − Immediately accretive to EPS – accretion of 1.4% in 2025, 3.0% in 2026 and 3.5% in 2027 − Minimal dilution to tangible book value per share with <1 year payback period − Internal rate of return (IRR) above 15% − Conservative cost savings, estimated at 30% of BOID’s noninterest expense − Pay-to-Trade ratio of 75.9%(2) − Achievable revenue synergies identified, but not factored into the model Source: S&P Capital IQ Pro, FDIC Summary of Deposits data as of 6/30/2024 (1) Based on percentage population growth from 2020-2024 and projected population growth in 2025-2030 (2) Ratio of the tangible book value multiple per share paid to BOID and GBCI’s tangible book value per share multiple as of 1/10/2025

Strategic Rationale 4 Glacier is a “Company of Banks” Source: S&P Capital IQ Pro, FDIC Summary of Deposits data as of 6/30/2024 (1) Based on deposit market share. Excludes money-center institutions (2) Based on deposit market share. Excludes money-center institutions. Eastern Washington includes Adams, Asotin, Benton, Chelan, Columbia, Douglas, Ferry, Franklin, Garfield, Grant, Kittitas, Klickitat, Lincoln, Okanogan, Pend Oreille, Spokane, Stevens, Walla Walla, Whitman and Yakima counties ➢ Acquisition complements Glacier’s existing strong loan and deposit portfolios and deepens its presence in several of the top growth markets in the United States ➢ Aligns with Glacier’s long-term strategy of acquiring quality banks in strong markets with exceptional teams ➢ Further strengthens a market-leading franchise across Idaho and Eastern Washington ‒ Positions Glacier as the 3rd largest bank and largest community bank in the state of Idaho, based on deposit market share(1) ‒ Transaction positions Glacier as the 5th largest community bank in Eastern Washington(2) ‒ Synergistic expansion of Glacier’s existing footprint in Eastern Idaho, Boise Metro and Eastern Washington ➢ Bank of Idaho will merge into three existing Glacier divisions: Wheatland Bank, Mountain West Bank and Citizens Community Bank

Total Assets 1,293$ Net Income 3.86$ Gross Loans (Incl. HFS) 1,002$ ROAA 1.16% Total Deposits 1,097$ ROATCE 13.43% Loans / Deposits 91.3% Net Interest Margin 4.19% Non-Int. Bearing Deposits (% of Total) 27.2% Efficiency Ratio 57.4% Tangible Common Equity Ratio 9.49% Yield on Loans 7.19% Bank Leverage Ratio 11.50% Cost of Total Deposits 2.19% NPAs / Total Assets(1) 0.24% Loan Loss Reserves / Gross Loans 1.25% Balance Sheet Income Statement Bank of Idaho Overview 5 ➢ Founded in 1985 and headquartered in Idaho Falls, Idaho ➢ Full-service community bank, providing comprehensive financial services to businesses and individuals with 15 branch locations throughout Eastern Idaho, Boise Metro and Eastern Washington ➢ Strong performer with Q3 2024 ROAA of 1.16%, 7.19% yield on loans and 20% loan growth over the last-twelve-months ➢ Bank of Idaho has three dynamic market areas ➢ Core Eastern Idaho markets with sticky, low-cost deposit base and long- term lending relationships (35+ year history in Eastern Idaho) ➢ Opened a branch in the Boise market in early 2019 – has since grown to four branches and approximately $290 million of loans and $223 million of deposits in Boise (79% deposit CAGR and 53% loan CAGR since 2019) ➢ Entered the Eastern Washington market in 2022 with the acquisition of five Eastern Washington branches from HomeStreet Bank Financial Highlights (Q3 2024) Company Overview Source: S&P Capital IQ Pro, Financial data as of the quarter ended 9/30/2024 Note: All dollars in millions, unless noted otherwise (1) Excluding government guaranteed balances BOID Branches (15) BOID Mortgage Offices (3)

Unique Expansion Opportunity In Existing Glacier Markets 6 BOID Branch BOID Mortgage Office GBCI Branch ➢ 20 existing branches in Eastern Washington, plus 5 new Bank of Idaho branches ➢ 6 existing branches in Eastern Idaho, plus 6 new Bank of Idaho branches ➢ 10 existing branches in Southern Idaho, plus 4 new Boise Bank of Idaho branches

Expanded Growth in Fast-Growing Markets 7 Source: S&P Capital IQ Pro, Micron, Federal Reserve Economic Data, Build Idaho, Boise Valley Economic Partnership, Milken Institute, Regional Economic Development for Eastern Idaho, U.S. News and World Reports, City of Yakima (1) USDA 2022 Census of Agriculture (2) Based on percentage population growth from 2020-2024 and projected population growth in 2025-2030; Major MSA includes any MSA with total population of 500,000 or more; Western U.S. states include AK, AZ, CA, CO, HI, ID, MT, NV, NM, OR, UT, WA, WY (3) Based on 2024 Milken Institute Best-Performing Cities Index ▪ With a population of approximately 850,000, Boise is the 5th largest MSA (by population) Glacier operates in ▪ Boise MSA is the 2nd fastest growing major MSA in the Western U.S.(2) ▪ Diverse regional economy supported by technology, government, education, manufacturing and transportation ▪ $15 billion Micron development program currently in progress, estimated to create 17,000 new jobs in Boise market BOISE Major Employers #1 Best Performing Small Metro in U.S.(3) (Idaho Falls) EASTERN IDAHO Major Employers Key Agriculture and Transportation Hub EASTERN WASHINGTON ▪ Tri-Cities (Kennewick, Pasco and Richland) is a regional agriculture, transportation and manufacturing hub with a total population of ~320k ▪ One of the fastest growing markets in Washington state ▪ Yakima economy is grounded in agriculture with farmers producing apples, cherries, grapes, wheat and other crops ▪ Over $2.2 billion of agriculture products are sold annually in Yakima County(1) Major Employers 2nd Fastest Growing Major MSA(2) ▪ Eastern Idaho represents the 2nd largest workforce in Idaho ▪ Idaho Falls ranked #1 best performing small metro area in the U.S. in 2024 – Twin Falls and Pocatello ranked #5 and #7, respectively(3) ▪ Eastern Idaho is home to four major universities and colleges (75,000+ students) and the Idaho National Laboratory, one of the largest Department of Energy sites ▪ Highly productive agriculture region – #1 Potato Capital of the World

Transaction Overview and Assumptions 8 Consideration Mix ▪ 100% stock consideration to BOID common shareholders ▪ 1.100x shares of Glacier stock for each BOID share ▪ BOID options and stock appreciation rights will be cashed out for their in-the-money value Implied Transaction Value(1) ▪ $234.3 million to common shareholders, or $52.47 per share(2) ▪ $11.0 million to option and stock appreciation rights holders(3) ▪ $245.4 million total transaction value Loan Credit Mark Estimate ▪ Gross credit mark discount of $14.2 million, or 1.41% of BOID’s gross loans ▪ 95% allocated to non-PCD loans, or $13.5 million ▪ Non-PCD credit mark accreted over 5 years using the sum-of-years’ digits methodology ▪ Establishment of CECL reserve for non-PCD loans of $13.5 million, reflected in pro forma TBV at closing Other Adjustments and Fair Value Estimates ▪ Loan interest rate mark premium of $3.2 million, or 0.32% of BOID’s gross loans, amortized over 5 years using the sum-of-years’ digits methodology ▪ Core deposit intangible of 1.75%, or $15.5 million, amortized over 10 years using the sum-of-years’ digits methodology ▪ Elimination of BOID’s AOCI of $(9.4) million, accreted over 6 years using the sum-of-years’ digits methodology ▪ Fixed asset write-up of $3.3 million; amortized over 20 years straight-line ▪ Net fair value adjustment of $0.4 million for CDs and subordinated debt combined Cost Savings ▪ Cost savings of 30.0% of BOID’s non-interest expense ▪ 30.0% realized in 2025, 80.0% realized in 2026 and 100.0% thereafter Durbin Impact ▪ Estimated reduction of BOID’s interchange income by approximately $0.5 million annually, pre-tax Transaction Expenses(4) ▪ Estimated one-time transaction costs of approximately $17.7 million, pre-tax Price Protection ▪ Fixed exchange ratio with collars set between $35.74 and $53.60 (+/- 20% from GBCI stock price in LOI) Minimum Tangible Equity ▪ $122.1 million at closing ▪ Excess tangible common equity, net of any adjustments for BOID’s final transaction expenses, to be paid out to BOID shareholders at closing Expected Closing ▪ Second Quarter of 2025 (1) Based on GBCI closing price of $47.70 on 1/10/2025 (2) Includes 4,420,332 BOID shares and 45,413 RSUs which will vest at closing (3) Includes 370,725 options with a weighted average exercise price of $24.87 and 24,291 SARs with a weighted average grant price of $19.08 (4) Including employment and benefit plan costs, data contract termination and conversion costs and combined professional and advisory fees

Transaction Multiples and Pro Forma Impact 9 At LOI(1) Today(2) Transaction Value / Tangible Book Value Per Share(3) ▪ 179.7% ▪ 191.9% Pay-to-Trade Ratio(4) ▪ 75.9% ▪ 75.9% Transaction Value / LTM Earnings Per Share ▪ 19.1x ▪ 20.4x Transaction Value / 2025E Earnings Per Share(5) ▪ 14.5x ▪ 15.5x Projected 2025E EPS Accretion(5) (with 30% Cost Savings Phase-In) 1.4% Projected 2026E EPS Accretion(5) (with 80% Cost Savings Phase-In) 3.0% Projected 2027E EPS Accretion(5) (with 100% Cost Savings Phase-In) 3.5% TBV Per Share Dilution(6) 0.4% TBV Per Share Payback Period <1 Year Internal Rate of Return 15%+ (1) Based on GBCI closing price of $44.67 as of 10/3/2024 (2) Based on GBCI closing price of $47.70 as of 1/10/2025 (3) Based on required tangible book value of $122.1 million (4) Ratio of the tangible book value multiple paid to BOID (based on required tangible common equity of $122.1 million) to GBCI’s tangible book value multiple (5) Based on S&P Capital IQ Pro Street consensus estimates for GBCI and GBCI management estimates for BOID (6) Inclusive of all estimated transaction related expenses

Concluding Observations 10 ➢ Bank of Idaho acquisition continues Glacier’s long tradition of adding best-in-class banks that align with the Glacier community banking model ➢ Unique opportunity to acquire a high-growth community bank operating in existing Glacier markets which provides meaningful EPS accretion and low integration risk ➢ Pricing metrics, deal structure and conservative assumptions reflective of Glacier’s consistent, disciplined approach to acquisitions ➢ Transaction will further enhance Glacier’s long-term track record of creating shareholder value ➢ Unique opportunity to acquire one of the highest performing banks in the Rocky Mountain region ➢ Acquisition significantly expands Glacier’s presence in Idaho and Washington – two key growth states − Glacier will become the 3rd largest bank in Idaho(1), the fastest growing state in the country(2) − Adds scale to Glacier’s Wheatland Bank division, which joined the organization in early 2024 ➢ Bank of Idaho management and staff provide Glacier with a team of experienced lenders, deep market knowledge and strong customer relationships Source: S&P Capital IQ Pro (1) FDIC Summary of Deposits data as of 6/30/2024 (2) Based on percentage population growth from 2020-2024 and projected population growth in 2025-2030

Appendix 11

Comprehensive Due Diligence Process 12 ➢ Completed a coordinated comprehensive due diligence review with executives from Glacier and Bank of Idaho, along with advisors and consultants ➢ Glacier team has significant acquisition and integration experience ➢ Conducted detailed diligence calls with Bank of Idaho management to evaluate each due diligence focus area ➢ Engaged industry consultants to conduct enhanced loan review and compliance assessment Comprehensive Credit Due Diligence Process 100% Loan Review $1.0 Billion Total Loan Balance Reviewed Due Diligence Focus Areas Compliance Audit Consumer Lending IT and Systems Operations Legal Commercial Lending and Asset Quality Human Resources Product Management Financial and Accounting/Treasury Mortgage Highlights Enterprise Risk Management Two-Tiered Approach to Assess Every Loan Detailed In-Depth Review of Key Loans

NIBD 31% NOW & IBD 26% MMDA & Sav. 28% CDs < $100k 4% CDs > $100k 12% NIBD 28% NOW & IBD 19% MMDA & Sav. 34% CDs < $100k 6% CDs > $100k 13% NIBD 31% NOW & IBD 25% MMDA & Sav. 28% CDs < $100k 4% CDs > $100k 12% Pro Forma Bank-Level Deposit Composition 13 Source: S&P Capital IQ Pro, Bank call report data as of the quarter ended 9/30/2024 Note: All dollars in thousands (1) Does not include purchase accounting adjustments Cost of Deposits: 1.42% Loans / Deposits: 82.9% Cost of Deposits: 2.19% Loans / Deposits: 91.3% Cost of Deposits: 1.38% Loans / Deposits: 82.5% Pro Forma(1) $20.9 B $1.1 B $22.0 B

Non-OO CRE 23% OO CRE 18% C&I 8% 1-4 Fam. 21% Multifam. 5% C&D 10% Consumer 1% Farm & Ag. 6% Other 7% Non-OO CRE 19% OO CRE 23% C&I 13% 1-4 Fam. 13% Multifam. 6% C&D 14% Consumer 1% Farm & Ag. 9% Other 1% Non-OO CRE 23% OO CRE 18% C&I 8% 1-4 Fam. 20% Multifam. 5% C&D 11% Consumer 1% Farm & Ag. 6% Other 7% Yield on Loans: 5.81%Yield on Loans: 7.19%Yield on Loans: 5.73% Pro Forma Bank-Level Loan Composition 14 Pro Forma(1) Source: S&P Capital IQ Pro, Bank call report data as of the quarter ended 9/30/2024 Note: All dollars in thousands (1) Does not include purchase accounting adjustments $17.2 B $1.0 B $18.2 B

0.20% 0.06% 0.05% 0.05% 0.17% 0.11% 0.08% 0.07% 0.02% 0.05% 0.07% 0.06% 0.14% 0.19% -0.05% -0.13% 0.19% 0.25% 0.21% 0.05% -0.02% -0.07% 0.17% 0.02% 0.70% 0.49% 0.43% 0.46% 0.48% 0.46% 0.49% 0.24% 0.26% 0.26% 0.49% 0.64% 2013Y 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y 2020Y 2021Y 2022Y 2023Y 2024Q3 GBCI BOID All U.S. Commercial Banks Strong Asset Quality 15 Net Charge-offs / Average Loans (%) Source: S&P Capital IQ Pro, Financial data as of the quarter ended 9/30/2024 Note: Net charge-offs are annualized (1) Aggregate of all U.S. commercial banks as reported by the Federal Reserve (1) ➢ Bank of Idaho has averaged only 0.08% annual net charge-offs since 2013 ➢ Aggregate net charge-offs since 2013 of only $2.7 million

Important Information and Where You Can Find It 16 In connection with the proposed merger transaction, Glacier expects to file with the SEC a Registration Statement on Form S-4 (the “Registration Statement”) that will include a Proxy Statement of BOID and a Prospectus of Glacier, as well as other relevant documents concerning the proposed transaction. Shareholders of BOID are urged to read carefully the Registration Statement and the Proxy Statement/Prospectus included therein regarding the proposed merger transaction when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Proxy Statement/Prospectus included in the Registration Statement, as well as other filings containing information about Glacier, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Glacier at www.glacierbancorp.com under the tab “SEC Filings” or by requesting them in writing or by telephone from Glacier at: Glacier Bancorp, Inc., 49 Commons Loop, Kalispell, Montana 59901, ATTN: Corporate Secretary; Telephone (406) 751-7706. Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “estimate,” “anticipate,” “expect,” “will,” and similar references to future periods. Such forward-looking statements include but are not limited to statements regarding the expected closing of the transaction and its timing and the potential benefits of the business combination transaction involving Glacier and BOID, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts regarding either company or the proposed combination of the companies. These forward-looking statements are subject to risks and uncertainties, many of which are outside of our control, that may cause actual results or events to differ materially from those projected, including but not limited to the following: risks that the merger transaction will not close when expected or at all because required regulatory, shareholder or other approvals or conditions to closing are delayed or not received or satisfied on a timely basis or at all; risks that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which Glacier and BOID operate; uncertainties regarding the ability of Glacier Bank and Bank of Idaho to promptly and effectively integrate their businesses, including into Glacier Bank’s existing division structure; changes in business and operational strategies that may occur between signing and closing; uncertainties regarding the reaction to the transaction of the companies’ respective customers, employees, and contractual counterparties; and risks relating to the diversion of management time on merger-related issues. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are made and reflect management’s current estimates, projections, expectations and beliefs. Glacier undertakes no obligation to publicly revise or update the forward-looking statements to reflect events or circumstances that arise after the date of this report. For more information, see the risk factors described in Glacier’s Annual Report on Form 10-K, Quarterly Reports on Form 10- Q and other filings with the SEC.

17

v3.24.4

Cover Page

|

Jan. 13, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 13, 2025

|

| Entity Registrant Name |

GLACIER BANCORP, INC.

|

| Entity Incorporation, State or Country Code |

MT

|

| Entity File Number |

000-18911

|

| Entity Tax Identification Number |

81-0519541

|

| Entity Address, Address Line One |

49 Commons Loop,

|

| Entity Address, City or Town |

Kalispell,

|

| Entity Address, State or Province |

MT

|

| Entity Address, Postal Zip Code |

59901

|

| City Area Code |

(406)

|

| Local Phone Number |

756-4200

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

GBCI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000868671

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

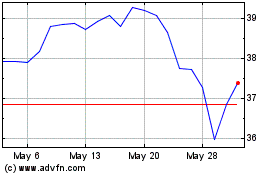

Glacier Bancorp (NYSE:GBCI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Glacier Bancorp (NYSE:GBCI)

Historical Stock Chart

From Feb 2024 to Feb 2025