Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

19 January 2024 - 4:31AM

Edgar (US Regulatory)

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES

EXCHANGE ACT OF 1934

Dated January 18, 2024

Commission File Number 1-14878

GERDAU S.A.

(Translation of Registrant’s Name into English)

Av. Dra. Ruth Cardoso, 8,501 – 8° andar

São Paulo, São Paulo - Brazil CEP

05425-070

(Address of principal executive

offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Exhibit Index

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: January 18, 2024

| |

GERDAU S.A. |

| |

|

| |

By: |

/s/ Rafael Dorneles Japur |

| |

Name: |

Rafael Dorneles Japur |

| |

Title: |

Executive Vice President |

| |

|

Investor Relations Director |

Exhibit 99.1

GERDAU S.A.

Corporate Tax ID (CNPJ/MF): 33.611.500/0001-19

Registry (NIRE): 35300520696

MATERIAL FACT

GERDAU S.A. (B3:

GGBR / NYSE: GGB) (“Gerdau” or “Company”) hereby informs its shareholders and the market in general that, on January 17,

2024, it entered into definitive binding agreements to divest the totality of its 49.85% equity interest of the joint venture Gerdau Diaco

S.A. (and subsidiaries), and its 50.00% equity interest of the joint venture Gerdau Metaldom Corp. (and subsidiaries), joint ventures

operating in the markets of Colombia, Dominican Republic, Panama and Costa Rica (“Transaction”). The acquirer of the equity

interests being divested is INICIA Group, Gerdau’s current partner in the above-mentioned joint ventures.

The assets held by joint ventures comprise industrial

facilities dedicated to long steel production with capacities of 360 thousand tonnes of meltshop and 1,250 thousand tonnes of rolling

mill. During the past 6 years, the average combined EBITDA of both operations totaled US$ 134 million, with Gerdau’s share corresponding

to approximately 50% of this number. These facilities were part of the Company’s South America Business Division and were accounted for

using the equity method.

The Transaction value has a US$ 325 million base

price. The Company estimates that the Transaction will close within the first half of 2024, subject to the satisfaction of conditions

precedent customary in operations of this nature, particularly the approval by the Colombian antitrust authority.

The Company reinforces that the Transaction is

aligned with its capital allocation strategy, by emphasizing the growth and competitiveness of assets with greater potential for generating

long-term value. The resources arising from the Transaction will be utilized to execute the Company’s Strategic CAPEX program.

São Paulo, January 17, 2024.

Rafael Dorneles Japur

Executive Vice-President and

Investor Relations Officer

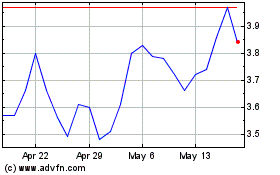

Gerdau (NYSE:GGB)

Historical Stock Chart

From Nov 2024 to Dec 2024

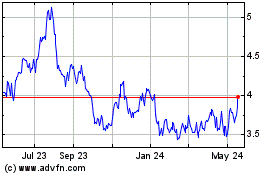

Gerdau (NYSE:GGB)

Historical Stock Chart

From Dec 2023 to Dec 2024