Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

16 August 2024 - 10:33PM

Edgar (US Regulatory)

| |

Filed pursuant to Rule 433 |

| |

Issuer Free Writing Prospectus, dated August 16, 2024 |

| |

Registration No. 333-267092 |

GATES

Announces PRICING OF Secondary Offering of 20,000,000 Ordinary Shares

August 16, 2024

DENVER, CO, August 16,

2024. Gates Industrial Corporation plc (NYSE: GTES, “Gates” or the “Company”) announced today the pricing of the

previously announced secondary offering of 20,000,000 ordinary shares (the “Offering”) by certain selling stockholders affiliated

with Blackstone Inc. (the “Selling Stockholders”). The Selling Stockholders have also granted the underwriters a 30-day option

to purchase up to 3,000,000 additional ordinary shares. The underwriters may offer the shares from time to time for sale in one or more

transactions on the New York Stock Exchange, in the over-the-counter market, through negotiated transactions or otherwise at market prices

prevailing at the time of sale, at prices related to such prevailing market prices or at negotiated prices. The Offering is expected to

close on August 21, 2024, subject to customary closing conditions.

Gates is not

offering any ordinary shares in the Offering and will not receive any proceeds from the sale of ordinary shares in the Offering.

Citigroup, Goldman Sachs & Co. LLC, and Jefferies are serving as the joint lead book-running managers of, and as

representatives of the underwriters for, the Offering. BMO Capital Markets, BTIG, Evercore ISI, Mizuho, Morgan Stanley, MUFG, PJT

Partners, RBC Capital Markets, UBS Investment Bank and Santander are also serving as joint book-running managers for the

Offering.

In addition, as previously

announced, in connection with its existing share repurchase program, Gates has entered into a share repurchase contract with Citigroup

Global Markets Inc. to repurchase $125 million of ordinary shares at a price per share equal to the price paid by the underwriters in

the Offering, for a total of 7,539,203 ordinary shares, and has advised Citigroup Global Markets Inc. to purchase such shares from the

Selling Stockholders. The share repurchase is expected to be consummated promptly following the Offering and is conditioned upon the closing

of the Offering. The closing of the Offering is not conditioned upon the consummation of the share repurchase.

One of our directors has indicated an interest in purchasing ordinary shares in the Offering.

The Company has filed

a registration statement (including a prospectus) with the Securities and Exchange Commission (the “SEC”) for the Offering

to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents

the Company has filed with the SEC for more complete information about the Company and the Offering. You may get these documents for free

by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating in

the Offering will arrange to send you the prospectus if you request it by contacting Citigroup, c/o Broadridge Financial Solutions, 1155

Long Island Avenue, Edgewood, NY 11717 (Tel: 800-831-9146); Goldman Sachs & Co. LLC, Attn: Prospectus Department, 200 West Street,

New York, NY 10282 (Tel: 866-471-2526) or by e-mail at prospectus-ny@ny.email.gs.com; or Jefferies LLC, Attn: Equity Syndicate Prospectus

Department, 520 Madison Avenue, New York, NY 10022 (Tel: 877-821-7388) or by email at prospectus_department@jefferies.com.

This press release shall

not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities

laws of any such state or jurisdiction.

About Gates:

Gates is a global manufacturer of innovative,

highly engineered power transmission and fluid power solutions. Gates offers a broad portfolio of products to diverse replacement channel

customers, and to original equipment ("first-fit") manufacturers as specified components. Gates participates in many sectors

of the industrial and consumer markets. Our products play essential roles in a diverse range of applications across a wide variety of

end markets ranging from harsh and hazardous industries to everyday consumer applications including virtually every form of transportation.

Our products are sold in more than 130 countries across our four commercial regions: the Americas; Europe, Middle East & Africa;

Greater China; and East Asia & India.

Forward-Looking Statements

and Information:

This press release contains

forward-looking statements, which involve risks and uncertainties. Forward-looking statements include all statements that are not historical

facts. In some cases you can identify these forward-looking statements by the use of words such as “outlook,” “believes,”

“expects,” “potential,” “continues,” “may,” “will,” “should,”

“could,” “seeks,” “predicts,” “intends,” “trends,” “plans,” “estimates,”

“anticipates” or the negative version of these words or other comparable words. Forward-looking statements are based on the

Company’s current expectations and actual results may differ materially. Other risks and uncertainties are more fully described

in the section entitled “Item 1A. Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year

ended December 30, 2023, as filed with the SEC, as such factors may be updated from time to time in the Company’s periodic

filings with the SEC. Investors are urged to consider carefully the disclosure in our filings with the SEC, which are accessible on the

SEC’s website at www.sec.gov. Gates undertakes no obligation to update or supplement any forward-looking statements as a result

of new information, future events or otherwise, except as required by law.

Contact:

Gates Investor Relations

Rich Kwas

(303) 744-4887

investorrelations@gates.com

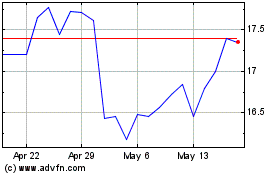

Gates Industrial (NYSE:GTES)

Historical Stock Chart

From Oct 2024 to Nov 2024

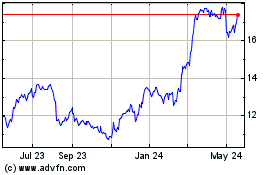

Gates Industrial (NYSE:GTES)

Historical Stock Chart

From Nov 2023 to Nov 2024