New Position Focused on Expanding Commercial

Real Estate Credit Asset Management

ORIX Corporation USA (ORIX USA) announced today the appointment

of Dean Dulchinos as Managing Director and Head of Real

Estate Credit. Mr. Dulchinos is based in New York and reports to

Jeff Abrams, Group Head of Private Credit and Real Estate

and Member, Executive Committee. Mr. Dulchinos has over 20 years of

experience building and managing global commercial real estate

(CRE) platforms, including 17 years at Barings/MassMutual companies

in senior leadership positions within global CRE investing,

including as Head of Real Estate Debt Portfolio Management and

Capital Markets and Head of Structured Investments.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240930260747/en/

Dean Dulchinos, Managing Director and

Head of Real Estate Credit, ORIX USA (Photo: Business Wire)

As Head of Real Estate Credit, Mr. Dulchinos will be responsible

for expanding ORIX USA’s third party CRE credit asset management

business. He will serve as a Portfolio Manager, developing

investment products that leverage the firm’s real estate businesses

including Lument, a national leader in commercial real estate

finance and provider of capital solutions for investors in

multifamily, affordable housing, and seniors housing and healthcare

real estate. Mr. Dulchinos will collaborate with Jim Flynn,

CEO of Lument, to raise and deploy capital for Lument-originated

non-agency investment products, expanding the firm’s offerings for

existing and prospective investors. More broadly, he will work with

ORIX USA’s Real Estate lines of business including the Real Estate

Capital Group and Boston Financial to expand origination, oversee

third party CRE debt portfolios, and, with ORIX USA’s Investor

Solutions team, grow the firm’s investor base and product

offerings.

Mr. Dulchinos joins ORIX USA from global real estate investment

manager AEW Capital Management, where he was Head of Debt Portfolio

Management, responsible for investing and managing CRE debt in

stabilized, transitional, and construction strategies. He

previously served as Head of Single-Family Rental Portfolio

Management at the Amherst Group and worked for a total of 17 years

at Barings/MassMutual companies, most recently as Head of Real

Estate Debt Portfolio Management and Capital Markets at Barings. In

that role, he led new CRE debt product development and capital

raising for commingled funds and separately managed accounts, and

was responsible for portfolio construction, investment allocations,

risk-based capital management, as well as global capital markets

activity, for the CRE debt platform. He was previously Senior

Portfolio Manager for CRE structured debt products at Cornerstone

Real Estate Advisors and a founding member of the CRE high yield

team at Babson Capital Management, both of which were

Barings/MassMutual companies.

“Dean is a very strong and experienced addition to our platform

and has the ideal background to expand our third party CRE credit

offering, connecting our private credit asset management platform

with our established real estate businesses to offer investors a

set of investment strategies that ORIX USA has been investing in

for years,” said Mr. Abrams. “We see a compelling market

opportunity in real estate private credit over the next few years

driven by several factors, including significant near-term CRE debt

maturities, structural shifts in the sources of credit for

transitional CRE strategies, and the prospect of a moderating

interest rate environment. Dean will leverage these attractive

market dynamics and the significant debt origination capacity we

have in our Real Estate lines of business with the goal of

delivering excellent investment outcomes for third party

investors.”

“We are looking forward to partnering with Dean on this

cross-business initiative to raise third party capital that will

expand our capital base and our investor relationships,” added

Mr. Flynn. “Having also recently expanded our real estate

capital markets team and launched a conventional multifamily

investment sales platform, we are well positioned to use our

platform to further deliver better results and solutions for our

Lument clients.”

Earlier in his career, Mr. Dulchinos was a practicing attorney,

including serving as Counsel at MassMutual Life Insurance, where he

represented the firm in CRE debt investments, private placements,

and mergers and acquisitions. Mr. Dulchinos holds a BS in Business

Administration - Finance from Western New England University and a

JD from Western New England University School of Law.

About ORIX Corporation USA (ORIX USA)

Established in the U.S. in 1981, ORIX USA has grown organically

and through acquisition into the investment and asset management

firm we are today. With a specialization in private credit, real

estate, and private equity solutions for middle-market focused

borrowers and investors, we combine our robust balance sheet with

funds from third-party investors, providing a strong alignment of

interest. ORIX USA and its subsidiaries — ORIX Advisers, ORIX

Capital Partners, Signal Peak Capital Management, Boston Financial,

Lument, Real Estate Capital, and NXT Capital — have approximately

1300 employees across the U.S. and have $85 billion in assets,

which include $26.3 billion of assets under management, $49.1

billion in servicing and administration assets, and approximately

$10.0 billion in proprietary assets, as of June 2024. Our parent

company, ORIX Corporation, is a publicly owned international

financial services company with operations in 30 countries and

regions worldwide. ORIX Corporation is listed on the Tokyo Stock

Exchange (8591) and New York Stock Exchange (IX). For more

information, visit orix.com.

About Lument

Lument, a subsidiary of ORIX USA, is a national leader in

commercial real estate finance and delivers a comprehensive set of

capital solutions and services customized for investors in

multifamily, affordable housing, and seniors housing and healthcare

real estate. Lument offers Fannie Mae, Freddie Mac, FHA, USDA, and

balance sheet financing, as well as a full suite of capital market

lending products. In addition, Lument provides a suite of real

estate advisory solutions including real estate investment sales,

investment banking, and investment management solutions. The

company has approximately 600 employees in over 30 offices across

the United States.

Securities, investment banking, and advisory services are

provided through Lument Securities, LLC, member FINRA/SIPC. Lument

Investment Management, LLC, is registered as an investment adviser

with the U.S. Securities and Exchange Commission. For more

information, visit https://www.lument.com/.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240930260747/en/

ORIX USA Media Contact Rohini Pragasam

rohini.pragasam@orix.com

Prosek Partners Kayla Heislein kheislein@prosek.com

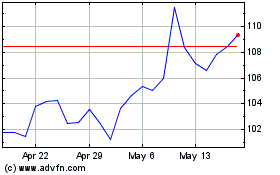

Orix (NYSE:IX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Orix (NYSE:IX)

Historical Stock Chart

From Jan 2024 to Jan 2025