FALSE000009622300000962232025-01-082025-01-080000096223us-gaap:CommonStockMember2025-01-082025-01-080000096223jef:A4850SeniorNotesDue2027Member2025-01-082025-01-080000096223jef:A5875SeniorNotesDue2028Member2025-01-082025-01-080000096223jef:A2.750SeniorNotesDue2032Member2025-01-082025-01-080000096223jef:A6.200SeniorNotesDue2034Member2025-01-082025-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): January 8, 2025

________________________________

JEFFERIES FINANCIAL GROUP INC.

(Exact name of registrant as specified in its charter)

________________________________

| | | | | | | | | | | | | | | | | | | | |

| New York | 001-05721 | | 13-2615557 | |

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | | (I.R.S. Employer Identification No.) | |

| | | |

| 520 Madison Avenue | New York, | New York | | 10022 | |

| (Address of principal executive offices) | | (Zip Code) | |

Registrant's telephone number, including area code: (212) 284-2300

(Former name or former address, if changed since last report)

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered | |

| Common Shares, par value $1 per share | | JEF | | New York Stock Exchange | |

| 4.850% Senior Notes Due 2027 | | JEF 27A | | New York Stock Exchange | |

| 5.875% Senior Notes Due 2028 | | JEF 28 | | New York Stock Exchange | |

| 2.750% Senior Notes Due 2032 | | JEF 32A | | New York Stock Exchange | |

| 6.200% Senior Notes Due 2034 | | JEF 34 | | New York Stock Exchange | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On January 8, 2025, we issued a press release containing financial results for our quarter and year ended November 30, 2024. A copy of the press release is attached hereto as Exhibit 99 and is incorporated herein by reference.

The information provided in this Item 2.02, including the exhibits hereto, is intended to be “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

The following exhibits are furnished with this report:

| | | | | |

| Exhibit No. | Description |

| |

| 99 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 8, 2025

| | | | | | | | |

| JEFFERIES FINANCIAL GROUP INC. |

| | |

| | |

| By: | /s/ Michael J. Sharp |

| Name: | Michael J. Sharp |

| Title: | Executive Vice President and General Counsel |

| | | | | | | | |

| FOR MORE INFORMATION Jonathan Freedman 212.778.8913 |

For Immediate Release

Jefferies Financial Group Inc. (NYSE: JEF)

January 8, 2025

Jefferies Announces Fourth Quarter 2024 Financial Results

Quarterly Dividend Increased 14.3% to $0.40 Per Common Share

Q4 Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| $ in thousands, except per share amounts | Quarter End | | | Year-to-Date | |

| 4Q24 | | 4Q23 | | | 2024 | 2023 | |

| | | | | | | | |

| Net earnings attributable to common shareholders | $ | 205,746 | | | $ | 65,639 | | | | $ | 669,273 | | $ | 263,072 | | |

| Diluted earnings per common share from continuing operations | $ | 0.91 | | | $ | 0.29 | | | | $ | 2.96 | | $ | 1.10 | | |

Return on adjusted tangible shareholders' equity from continuing operations1 | 12.7 | % | | 4.1 | % | | | 10.8 | % | 3.9 | % | |

| Total net revenues | $ | 1,956,602 | | | $ | 1,197,206 | | | | $ | 7,034,803 | | $ | 4,700,417 | | |

Investment banking net revenues14 | $ | 986,824 | | | $ | 571,828 | | | | $ | 3,444,787 | | $ | 2,272,218 | | |

Capital markets net revenues14 | $ | 651,690 | | | $ | 486,169 | | | | $ | 2,759,554 | | $ | 2,232,161 | | |

| Asset management net revenues | $ | 314,750 | | | $ | 140,646 | | | | $ | 803,669 | | $ | 188,345 | | |

| | | | | | | | |

| | | | | | | | |

| Pre-tax earnings from continuing operations | $ | 304,862 | | | $ | 87,261 | | | | $ | 1,005,546 | | $ | 354,269 | | |

| | | | | | | | |

| | | | | | | | |

| Book value per common share | $ | 49.42 | | | $ | 46.10 | | | | $ | 49.42 | | $ | 46.10 | | |

Adjusted tangible book value per fully diluted share3 | $ | 32.36 | | | $ | 30.82 | | | | $ | 32.36 | | $ | 30.82 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Quarterly Cash Dividend

The Jefferies Board of Directors declared a quarterly cash dividend equal to $0.40 per Jefferies common share, a 14.3% increase from the prior dividend rate, payable on February 27, 2025 to record holders of Jefferies common shares on February 14, 2025.

Management Comments

"Our fourth quarter net revenues of $1.96 billion, pre-tax earnings from continuing operations of $305 million and diluted earnings per share from continuing operations of $0.91 are 63%, 249% and 214%, higher than the prior year quarter, respectively. Our quarterly results reflect strong performance in Investment Banking (up 73%), including a record quarter in Advisory (up 91%), as well as another robust quarter for Equities (up 49%) and solid performance in Fixed income (up 15%). Asset Management fee and investment return net revenues of $116 million were substantially higher than the prior year quarter, reflecting fee growth and strong overall performance from a number of strategies.

“Our 2024 net revenues of $7.03 billion, pre-tax earnings from continuing operations of $1.01 billion and diluted earnings per share from continuing operations of $2.96 are 50%, 184% and 169% higher than the prior year, respectively. Our annual results reflect continued strength and sustained momentum across all lines of business, primarily attributable to market share gains and a stronger overall market for our services.

"We are laser focused on our core mission of building and being the best full-service global investment banking and capital markets firm and we are very excited about our progress. More normalized market conditions and the maturation of our platform are beginning to show our earnings potential, as our core businesses have generated meaningfully improved underlying operating margins. Our non-compensation expense ratio improved from 39% in 2023 to 34% in 2024, as our revenue growth outpaced expense growth. We are optimistic about our ability to continue to further expand operating margins as we continue to grow our core businesses. The consolidation of Stratos and Tessellis caused meaningfully higher gross revenues and expenses to be recorded in Other Investments in our Asset Management segment for the fourth quarter and the full year, however, Other investments had a nominal impact on earnings.

"Our 2024 Investment Banking net revenues of $3.44 billion were up 52% from the prior year, reflecting our second highest annual results on record, as well as record market share across many of our key products, sectors and regions. Following a period of significant investment in our business, today we provide our clients with an exceptional offering of full-service capabilities that extend to the largest and most complex transactions and underwritings, best-in-class talent, true local reach and access across every major market. Critically, these capabilities are underpinned by a culture of service, urgency and creative problem solving.

"Capital Markets net revenues of $2.76 billion for 2024 were up 24% versus the prior year, driven by solid overall market conditions and strength across most of our business lines. Equities net revenues increased 40% from the prior year, with strong performance in our cash and electronic businesses. We continue to invest across our electronic trading, equity finance and equity derivative platforms to deliver effective liquidity and execution globally to our clients. Fixed Income net revenues increased 7% from the prior year, driven by robust client

| | | | | | | | |

1 Jefferies Financial Group | | |

demand and particular strength in our distressed trading and securitization businesses, partially offset by less favorable results in our global structured solutions business. The growth of our Fixed Income franchise is the result of the consistency of our strategy, which focuses on long-term client partnerships and a commitment to fundamental credit analysis, leading to an idea-driven, solutions-oriented approach.

"Our 2024 Asset Management fee and investment return revenues of $316 million were up 27% from the prior year, reflecting fee growth and strong overall performance from a number of our strategies. We are pleased with this performance, considering the unique challenges the business faced during the year from Weiss Multi-Strategy Advisors and 352 Capital. Other investments had 2024 net revenues of $550 million largely due to the consolidation of Stratos and Tessellis causing the inclusion of significant gross revenues and expenses.

"Jefferies begins 2025 in the best position ever in our firm’s sixty-two year history. We believe our team is incredibly talented and special, and they are driving our momentum forward. Our clients are rewarding us with broad global growth and an enhanced market position in almost everything Jefferies offers. After decades of hard work, we are in the front row of the pack of competitors serving clients across all sectors and regions in investment banking and capital markets. We believe we have developed to where we are today because of our unique culture of collaboration and integrity. By emphasizing a sense of long-term ownership, entrepreneurship and purpose, we have been able to achieve our ever-better market position, and we will do everything in our power to preserve and enhance it as we continue our journey."

Richard Handler, CEO, and Brian Friedman, President

Please refer to the just-released Jefferies Financial Group Annual Letter from our CEO and President for broader perspective on 2024, as well as our strategy and outlook.

| | | | | |

2 Jefferies Financial Group | |

Financial Summary (Unaudited)

| | | | | | | | | | | | | | | | | |

| $ in thousands | Three Months Ended | Year Ended |

| November 30,

2024 | August 31,

2024 | November 30,

2023 | November 30,

2024 | November 30,

2023 |

Net revenues by source: | | | | | |

| Advisory | $ | 596,707 | | $ | 592,462 | | $ | 312,310 | | $ | 1,811,634 | | $ | 1,198,916 | |

| Equity underwriting | 191,218 | | 150,096 | | 132,158 | | 799,804 | | 560,243 | |

| Debt underwriting | 171,456 | | 183,078 | | 129,436 | | 689,227 | | 410,208 | |

Other investment banking14 | 27,443 | | 17,930 | | (2,076) | | 144,122 | | 102,851 | |

Total Investment Banking | 986,824 | | 943,566 | | 571,828 | | 3,444,787 | | 2,272,218 | |

Equities14 | 410,768 | | 387,342 | | 276,395 | | 1,592,793 | | 1,139,425 | |

| Fixed income | 240,922 | | 289,183 | | 209,774 | | 1,166,761 | | 1,092,736 | |

Total Capital Markets | 651,690 | | 676,525 | | 486,169 | | 2,759,554 | | 2,232,161 | |

Total Investment Banking and Capital Markets Net revenues5 | 1,638,514 | | 1,620,091 | | 1,057,997 | | 6,204,341 | | 4,504,379 | |

Asset management fees and revenues6 | 13,752 | | 13,261 | | 18,695 | | 103,488 | | 93,678 | |

| Investment return | 101,762 | | (40,135) | | 62,892 | | 212,209 | | 154,461 | |

Allocated net interest4 | (15,104) | | (16,016) | | (14,568) | | (62,135) | | (49,519) | |

Other investments, inclusive of net interest13 | 214,340 | | 101,902 | | 73,627 | | 550,107 | | (10,275) | |

Total Asset Management Net revenues | 314,750 | | 59,012 | | 140,646 | | 803,669 | | 188,345 | |

| Other | 3,338 | | 4,449 | | (1,437) | | 26,793 | | 7,693 | |

| Total Net revenues by source | $ | 1,956,602 | | $ | 1,683,552 | | $ | 1,197,206 | | $ | 7,034,803 | | $ | 4,700,417 | |

| | | | | |

| Expenses: | | | | | |

| Compensation and benefits | $ | 981,626 | | $ | 889,098 | | $ | 612,287 | | $ | 3,659,588 | | $ | 2,535,272 | |

Compensation ratio15 | 50.2 | % | 52.8 | % | 51.1 | % | 52.0 | % | 53.9 | % |

| Non-compensation expenses | $ | 670,114 | | $ | 541,767 | | $ | 497,658 | | $ | 2,369,669 | | $ | 1,810,876 | |

Non-compensation ratio15 | 34.2 | % | 32.2 | % | 41.6 | % | 33.7 | % | 38.5 | % |

| Total expenses | $ | 1,651,740 | | $ | 1,430,865 | | $ | 1,109,945 | | $ | 6,029,257 | | $ | 4,346,148 | |

| | | | | |

| Net earnings from continuing operations before income taxes | $ | 304,862 | | $ | 252,687 | | $ | 87,261 | | $ | 1,005,546 | | $ | 354,269 | |

| Income tax expense | $ | 86,117 | | $ | 78,011 | | $ | 16,828 | | $ | 293,194 | | $ | 91,881 | |

| Income tax rate | 28.2 | % | 30.9 | % | 19.3 | % | 29.2 | % | 25.9 | % |

Net earnings from continuing operations | $ | 218,745 | | $ | 174,676 | | $ | 70,433 | | $ | 712,352 | | $ | 262,388 | |

| Net earnings from discontinued operations (including gain on disposal), net of income taxes | 5,155 | | 6,363 | | — | | 3,667 | | — | |

| Net losses attributable to noncontrolling interests | (8,262) | | (6,874) | | (1,506) | | (27,364) | | (14,846) | |

| Net losses attributable to redeemable noncontrolling interests | — | | — | | — | | — | | (454) | |

| Preferred stock dividends | 26,416 | | 20,785 | | 6,300 | | 74,110 | | 14,616 | |

Net earnings attributable to common shareholders | $ | 205,746 | | $ | 167,128 | | $ | 65,639 | | $ | 669,273 | | $ | 263,072 | |

| | | | | |

| | | | | |

3 Jefferies Financial Group | |

| | | | | | | | |

Quarterly Results 2024 Versus 2023 | | Year-to-Date Results 2024 Versus 2023 |

•Net earnings attributable to common shareholders of $206 million, or $0.91 per diluted common share from continuing operations. •Return on adjusted tangible shareholders' equity from continuing operations1 of 12.7%. •We had 205.5 million common shares outstanding and 253.9 million common shares outstanding on a fully diluted basis2 at November 30, 2024. Our book value per common share was $49.42 and tangible book value per fully diluted share3 was $32.36. •Effective tax rate from continuing operations of 28.2% compared to 19.3% for the prior year quarter. The lower rate for the prior year quarter was driven by the release of certain tax reserves which was not repeated in the current year quarter. |

| •Net earnings attributable to common shareholders of $669 million, or $2.96 per diluted common share from continuing operations. •Return on adjusted tangible shareholders' equity from continuing operations1 of 10.8%. •Repurchased 1.1 million shares of common stock for $44 million, at an average price of $40.72 per share in connection with net-share settlements related to our equity compensation plans. •Effective tax rate from continuing operations of 29.2% compared to 25.9% for the prior year period. |

| | | | | | | | |

| | |

Investment Banking and Capital Markets |

| Investment Banking and Capital Markets |

•Investment Banking net revenues of $987 million were 73% higher than the prior year quarter, with particular strength in Advisory. •Advisory net revenues of $597 million represents our best quarter ever, due to market share gains and increased global mergers and acquisitions activity. •Underwriting net revenues of $363 million were higher than the prior year quarter, due to market share gains and increased activity from both equity and debt underwriting. •Capital Markets net revenues of $652 million were higher compared to the prior year quarter primarily due to stronger performance in Equities attributable to increased volumes and more favorable trading opportunities, while Fixed Income net revenues increased primarily reflecting stronger results across our credit trading businesses. |

| •Investment Banking net revenues of $3.44 billion were 52% higher than the prior year, with strength across all lines of business attributable primarily to market share gains and a stronger overall market for our services. •Advisory net revenues of $1.81 billion were higher than prior year period, attributable primarily to market share gains and increased overall market opportunity. •Underwriting net revenues of $1.49 billion increased from the prior year period, due to increased activity from both equity and debt underwriting. Momentum in the equity markets was compounded by continued market share gains. •Capital Markets net revenues of $2.76 billion were higher compared to the prior year period primarily driven by stronger Equities net revenues attributable to continued market share gains and overall increased levels of activity during the period. Fixed Income net revenues increased from the prior year period driven by strong results in our distressed trading and securitization business, partially offset by less favorable results in our global structured solutions business. |

| | | | | | | | |

| | |

Asset Management |

| Asset Management |

•Asset Management fees and revenues and investment return of $116 million were substantially higher than the prior year quarter, reflecting strong investment return performance from a number of strategies. In addition, Other investments13 net revenues were meaningfully higher, primarily due to the consolidation of Tessellis, as well as asset sales at HomeFed. |

| •Asset Management fees and revenues and investment return of $316 million were substantially higher than the prior year period, reflecting fee growth and strong overall performance from multiple strategies, even with challenges arising from the Weiss Multi-Strategy and 352 Capital funds. In addition, Other investments13 net revenues were meaningfully higher than the prior year period largely due to the consolidation of Stratos and Tessellis. |

| | | | | | | | |

| | |

Expenses |

| Expenses |

•Compensation and benefits expense as a percentage of Net revenues was 50.2%, compared to 51.1% for the prior year period. •Non-compensation expenses were higher primarily due to costs associated with brokerage and clearing fees associated with increased trading volumes, and higher technology and communications and business development expenses. In addition, the increase in Non-Compensation expenses reflects the inclusion of Tessellis as an operating subsidiary following its consolidation at the end of the fourth quarter of 2023 and higher cost of sales largely from the sale of certain assets by HomeFed.

|

| •Compensation and benefits expense as a percentage of Net revenues was 52.0%, compared to 53.9% for the prior year period. •Non-compensation expenses were higher primarily due to increased brokerage and clearing fees associated with increased trading volumes and higher technology and communication and business development expenses. Other expenses include bad debt expenses largely related to our losses associated with Weiss Multi-Strategy Advisers, LLC upon its shutdown in the first quarter of 2024. In addition, the increase in Non-compensation expenses reflects the inclusion of Stratos and Tessellis as operating subsidiaries following the consolidation of these entities in the fourth quarter of 2023, partially offset by the impact of the spin-off of Vitesse Energy in January 2023 and sale of Foursight in April 2024. Non-compensation expenses as a percentage of Net revenues improved from 38.5% in 2023 to 33.7% in 2024 as our revenue growth outpaced expense growth. The ratio includes our Other investments portfolio, which has higher non-compensation expense ratios. |

* * * *

| | | | | |

4 Jefferies Financial Group | |

Amounts herein pertaining to November 30, 2024 represent a preliminary estimate as of the date of this earnings release and may be revised upon filing our Annual Report on Form 10-K with the Securities and Exchange Commission (“SEC”). More information on our results of operations for the year ended November 30, 2024 will be provided upon filing our Annual Report on Form 10-K with the SEC, which we expect to file on or about January 28, 2025.

This press release contains certain “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on current views and include statements about our future and statements that are not historical facts. These forward-looking statements are usually preceded by the words “should,” “expect,” “intend,” “may,” “will,” "would," or similar expressions. Forward-looking statements may contain expectations regarding revenues, earnings, operations, and other results, and may include statements of future performance, plans, and objectives. Forward-looking statements may also include statements pertaining to our strategies for future development of our businesses and products. Forward-looking statements represent only our belief regarding future events, many of which by their nature are inherently uncertain. It is possible that the actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Information regarding important factors, including Risk Factors that could cause actual results to differ, perhaps materially, from those in our forward-looking statements is contained in reports we file with the SEC. You should read and interpret any forward-looking statement together with reports we file with the SEC. We undertake no obligation to update or revise any such forward-looking statement to reflect subsequent circumstances.

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy will be profitable or equal the corresponding indicated performance level(s).

| | | | | |

5 Jefferies Financial Group | |

Consolidated Statements of Earnings (Unaudited)

| | | | | | | | | | |

$ in thousands, except per share amounts | Year Ended November 30, | |

| 2024 | 2023 | | |

| Revenues | | | | |

| Investment banking | $ | 3,309,060 | | $ | 2,169,366 | | | |

| Principal transactions | 1,816,963 | | 1,413,283 | | | |

| Commissions and other fees | 1,085,349 | | 905,665 | | | |

| Asset management fees and revenues | 86,106 | | 82,574 | | | |

| Interest | 3,543,497 | | 2,868,674 | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Other | 674,094 | | 1,837 | | | |

| Total revenues | 10,515,069 | | 7,441,399 | | | |

| Interest expense | 3,480,266 | | 2,740,982 | | | |

| Net revenues | 7,034,803 | | 4,700,417 | | | |

| Non-interest expenses | | | | |

| Compensation and benefits | 3,659,588 | | 2,535,272 | | | |

| Brokerage and clearing fees | 432,721 | | 366,702 | | | |

| Underwriting costs | 68,492 | | 61,082 | | | |

| Technology and communications | 546,655 | | 477,028 | | | |

| Occupancy and equipment rental | 118,611 | | 106,051 | | | |

| Business development | 283,459 | | 177,541 | | | |

| Professional services | 296,204 | | 266,447 | | | |

| Depreciation and amortization | 190,326 | | 112,201 | | | |

| Cost of sales | 206,283 | | 29,435 | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Other expenses | 226,918 | | 214,389 | | | |

| Total non-interest expenses | 6,029,257 | | 4,346,148 | | | |

| Earnings from continuing operations before income taxes | 1,005,546 | | 354,269 | | | |

| Income tax expense | 293,194 | | 91,881 | | | |

| Net earnings from continuing operations | 712,352 | | 262,388 | | | |

| Net earnings from discontinued operations (including gain on disposal), net of income tax | 3,667 | | — | | | |

| Net earnings | 716,019 | | 262,388 | | | |

| Net losses attributable to noncontrolling interests | (27,364) | | (14,846) | | | |

| Net losses attributable to redeemable noncontrolling interests | — | | (454) | | | |

| Preferred stock dividends | 74,110 | | 14,616 | | | |

| Net earnings attributable to common shareholders | $ | 669,273 | | $ | 263,072 | | | |

| | | | |

| | | | | |

6 Jefferies Financial Group | |

Financial Data and Metrics (Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended | Year Ended |

| November 30,

2024 | August 31,

2024 | November 30,

2023 | November 30,

2024 | November 30,

2023 |

| Other Data: | | | | | |

| Number of trading days | 63 | 63 | 63 | 251 | 251 |

Number of trading loss days7 | 8 | 7 | 7 | 19 | 26 |

Average VaR (in millions)8 | $ | 12.75 | $ | 11.35 | $ | 12.36 | $ | 13.13 | $ | 13.57 |

| | | | | | | | | | | |

| In millions, except other data | Three Months Ended |

| November 30,

2024 | August 31,

2024 | November 30,

2023 |

| Financial position: | | | |

| Total assets | $ | 64,360 | | $ | 63,275 | | $ | 57,905 | |

| Cash and cash equivalents | 12,153 | | 10,573 | | 8,526 | |

| Financial instruments owned | 24,138 | | 24,039 | | 21,747 | |

Level 3 financial instruments owned9 | 734 | | 693 | | 681 | |

| Goodwill and intangible assets | 2,054 | | 2,073 | | 2,045 | |

| Total equity | 10,225 | | 10,115 | | 9,802 | |

| Total shareholders' equity | 10,157 | | 10,046 | | 9,710 | |

Tangible shareholders' equity10 | 8,103 | | 7,973 | | 7,665 | |

| Other data and financial ratios: | | | |

Leverage ratio11 | 6.3 | | 6.3 | | 5.9 | |

Tangible gross leverage ratio12 | 7.7 | | 7.7 | | 7.3 | |

| Number of employees at period end | 7,822 | | 7,624 | | 7,564 | |

| Number of employees excluding OpNet, Tessellis and Stratos at period end | 5,968 | | 5,926 | | 5,661 | |

| | | | | |

7 Jefferies Financial Group | |

Components of Numerators and Denominators for Earnings Per Common Share

| | | | | | | | | | | | | | |

| $ in thousands, except per share amounts | Three Months Ended

November 30, | Year Ended

November 30, |

| 2024 | 2023 | 2024 | 2023 |

| Numerator for earnings per common share from continuing operations: | | | | |

| Net earnings from continuing operations | $ | 218,746 | | $ | 70,433 | | $ | 712,352 | | $ | 262,388 | |

| Less: Net losses attributable to noncontrolling interests | (7,826) | | (1,506) | | (24,367) | | (15,300) | |

| Mandatorily redeemable convertible preferred share dividends | — | | — | | — | | (2,016) | |

| Allocation of earnings to participating securities | (26,416) | | (6,389) | | (74,110) | | (14,729) | |

| Net earnings from continuing operations attributable to common shareholders for basic earnings per share | $ | 200,156 | | $ | 65,550 | | $ | 662,609 | | $ | 260,943 | |

| | | | |

| | | | |

| Net earnings from continuing operations attributable to common shareholders for diluted earnings per share | $ | 200,156 | | $ | 65,550 | | $ | 662,609 | | $ | 260,943 | |

| | | | |

| Numerator for earnings per common share from discontinued operations: | | | | |

| Net earnings from discontinued operations (including gain on disposal), net of taxes | $ | 5,155 | | $ | — | | $ | 3,667 | | $ | — | |

| Less: Net losses attributable to noncontrolling interests | (436) | | — | | (2,997) | | — | |

| Net earnings from discontinued operations attributable to common shareholders for basic and diluted earnings per share | $ | 5,591 | | $ | — | | $ | 6,664 | | $ | — | |

| Net earnings attributable to common shareholders for basic earnings per share | $ | 205,747 | | $ | 65,550 | | $ | 669,273 | | $ | 260,943 | |

| Net earnings attributable to common shareholders for diluted earnings per share | $ | 205,747 | | $ | 65,550 | | $ | 669,273 | | $ | 260,943 | |

| | | | |

| Denominator for earnings per common share: | | | | |

| Weighted average common shares outstanding | 205,499 | | 210,505 | | 208,873 | | 222,325 | |

| Weighted average shares of restricted stock outstanding with future service required | (2,298) | | (1,907) | | (2,334) | | (1,920) | |

| Weighted average restricted stock units outstanding with no future service required | 10,546 | | 11,843 | | 10,540 | | 12,204 | |

| Weighted average basic common shares | 213,747 | | 220,441 | | 217,079 | | 232,609 | |

| Stock options and other share-based awards | 4,968 | | 2,224 | | 3,638 | | 2,085 | |

| Senior executive compensation plan restricted stock unit awards | 3,619 | | 1,919 | | 2,933 | | 1,926 | |

| | | | |

| Weighted average diluted common shares | 222,334 | | 224,584 | | 223,650 | | 236,620 | |

| | | | |

| Earnings per common share: | | | | |

| Basic from continuing operations | $ | 0.94 | | $ | 0.30 | | $ | 3.05 | | $ | 1.12 | |

| Basic from discontinued operations | 0.02 | | — | | 0.03 | | — | |

| Basic | $ | 0.96 | | $ | 0.30 | | $ | 3.08 | | $ | 1.12 | |

| Diluted from continuing operations | $ | 0.91 | | $ | 0.29 | | $ | 2.96 | | $ | 1.10 | |

| Diluted from discontinued operations | 0.02 | | — | | 0.03 | | — | |

| Diluted | $ | 0.93 | | $ | 0.29 | | $ | 2.99 | | $ | 1.10 | |

| | | | | |

8 Jefferies Financial Group | |

Non-GAAP Reconciliations

The following tables reconcile our non-GAAP financial measures to their respective U.S. GAAP financial measures. Management believes such non-GAAP financial measures are useful to investors as they allow them to view our results through the eyes of management, while facilitating a comparison across historical periods. These measures should not be considered a substitute for, or superior to, measures prepared in accordance with U.S. GAAP.

Return on Adjusted Tangible Equity Reconciliation

| | | | | | | | | | | | | | |

| $ in thousands | Three Months Ended

November 30, | Year Ended

November 30, |

| 2024 | 2023 | 2024 | 2023 |

| Net earnings attributable to common shareholders (GAAP) | $ | 205,747 | | $ | 65,639 | | $ | 669,273 | | $ | 263,072 | |

| Intangible amortization and impairment expense, net of tax | 5,871 | | 1,939 | | 21,771 | | 6,638 | |

| Adjusted net earnings to common shareholders (non-GAAP) | 211,618 | | 67,578 | | 691,044 | | 269,710 | |

| Preferred stock dividends | 26,416 | | 6,300 | | 74,110 | | 14,616 | |

| Adjusted net earnings to total shareholders (non-GAAP) | $ | 238,034 | | $ | 73,878 | | $ | 765,154 | | $ | 284,326 | |

| | | | |

| | | | |

Adjusted net earnings to total shareholders (non-GAAP)1 | $ | 952,136 | | $ | 295,512 | | $ | 765,154 | | $ | 284,326 | |

| | | | |

| Net earnings impact for net (earnings) losses from discontinued operations, net of noncontrolling interests | (5,591) | | — | | (6,664) | | — | |

| Adjusted net earnings to total shareholders from continuing operations (non-GAAP) | 232,443 | | 73,878 | | 758,490 | | 284,326 | |

Adjusted net earnings to total shareholders from continuing operations (non-GAAP)1 | 929,772 | | 295,512 | | 758,490 | | 284,326 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| August 31, | November 30, |

| 2024 | 2023 | 2023 | 2022 |

| Shareholders' equity (GAAP) | $ | 10,045,945 | $ | 9,698,847 | $ | 9,709,827 | $ | 10,232,845 |

| Less: Intangible assets, net and goodwill | (2,073,105) | (1,872,144) | (2,044,776) | (1,875,576) |

| Less: Deferred tax asset, net | (572,772) | (573,630) | (458,343) | (387,862) |

Less: Weighted average impact of dividends and share repurchases | (58,519) | (50,727) | (199,572) | (732,517) |

| Adjusted tangible shareholders' equity (non-GAAP) | $ | 7,341,549 | $ | 7,202,346 | $ | 7,007,136 | $ | 7,236,890 |

| | | | |

| | | | |

Return on adjusted tangible shareholders' equity (non-GAAP)1 | 13.0 | % | 4.1 | % | 10.9 | % | 3.9 | % |

| | | | |

Return on adjusted tangible shareholders' equity from continuing operations (non-GAAP)1 | 12.7 | % | 4.1 | % | 10.8 | % | 3.9 | % |

| | | | |

| | | | |

| | | | | |

9 Jefferies Financial Group | |

Adjusted Tangible Book Value and Fully Diluted Shares Outstanding GAAP Reconciliation

Reconciliation of book value (shareholders' equity) to adjusted tangible book value and common shares outstanding to fully diluted shares outstanding:

| | | | | | | | |

| $ in thousands, except per share amounts | November 30, 2024 |

| Book value (GAAP) | $ | 10,156,772 | |

Stock options(1) | 114,939 | |

| Intangible assets, net and goodwill | (2,054,310) | |

| Adjusted tangible book value (non-GAAP) | $ | 8,217,401 | |

| | |

| Common shares outstanding (GAAP) | 205,504 | |

| Preferred shares | 27,563 | |

| Restricted stock units ("RSUs") | 14,381 | |

Stock options(1) | 5,065 | |

| Other | 1,388 | |

Adjusted fully diluted shares outstanding (non-GAAP)(2) | 253,901 | |

| | |

| Book value per common share outstanding | $ | 49.42 | |

| Adjusted tangible book value per fully diluted share outstanding (non-GAAP) | $ | 32.36 | |

| |

(1) | Stock options added to book value are equal to the total number of stock options outstanding as of November 30, 2024 of 5.1 million multiplied by the weighted average exercise price of $22.69 on November 30, 2024. |

(2) | Fully diluted shares outstanding include vested and unvested RSUs as well as the target number of RSUs issuable under the senior executive compensation plans until the performance period is complete. Fully diluted shares outstanding also include all stock options and the impact of convertible preferred shares if-converted to common shares. |

| | |

| | | | | |

10 Jefferies Financial Group | |

Notes

1.Return on adjusted tangible shareholders' equity and Return on adjusted tangible shareholders' equity from continuing operations represent non-GAAP financial measures. The quarterly periods are based on annualized amounts. Refer to schedule on page 9 for a reconciliation to U.S. GAAP amounts. 2.Shares outstanding on a fully diluted basis (a non-GAAP financial measure) is defined as common shares outstanding plus preferred shares, restricted stock units, stock options and other shares. Refer to schedule on page 10 for a reconciliation to U.S. GAAP amounts. 3.Adjusted tangible book value per fully diluted share (a non-GAAP financial measure) is defined as adjusted tangible book value (a non-GAAP financial measure) divided by shares outstanding on a fully diluted basis (a non-GAAP financial measure). Refer to schedule on page 10 for a reconciliation to U.S. GAAP amounts. 4.Allocated net interest represents an allocation to Asset Management of certain of our long-term debt interest expense, net of interest income on our Cash and cash equivalents and other sources of liquidity. Allocated net interest has been disaggregated to increase transparency and to present direct Asset Management revenues. We believe that aggregating Allocated net interest would obscure the revenue results by including an amount that is unique to our credit spreads, debt maturity profile, capital structure, liquidity risks and allocation methods.

5.Allocated net interest is not separately disaggregated for Investment Banking and Capital Markets. This presentation is aligned to our Investment Banking and Capital Markets internal performance measurement.

6.Asset management fees and revenues include management and performance fees from funds and accounts managed by us as well as our share of fees received by affiliated asset management companies with which we have revenue and profit share arrangements, as well as earnings on our ownership interest in affiliated asset managers.

7.Number of trading loss days is calculated based on trading activities in our Investment Banking and Capital Markets and Asset Management business segments, excluding certain Other investments.

8.VaR estimates the potential loss in value of trading positions due to adverse market movements over a one-day time horizon with a 95% confidence level. For a further discussion of the calculation of VaR, see "Value-at-Risk" in Part II, Item 7A "Quantitative and Qualitative Disclosures About Market Risk" in our Annual Report on Form 10-K for the year ended November 30, 2024.

9.Level 3 financial instruments represent those financial instruments classified as such under Accounting Standards Codification 820, accounted for at fair value and included within Financial instruments owned.

10.Tangible shareholders' equity (a non-GAAP financial measure) is defined as shareholders' equity less Intangible assets and goodwill. We believe that tangible shareholders' equity is meaningful for valuation purposes, as financial companies are often measured as a multiple of tangible shareholders' equity, making these ratios meaningful for investors.

11.Leverage ratio equals total assets divided by total equity.

12.Tangible gross leverage ratio (a non-GAAP financial measure) equals total assets less goodwill and intangible assets divided by tangible shareholders' equity. The tangible gross leverage ratio is used by rating agencies in assessing our leverage ratio.

13.Beginning in fiscal 2024, we now refer to "Merchant banking" as “Other investments” in our Asset Management reportable segment.

14.Beginning in the fourth quarter of 2024, revenues from corporate equity derivative transactions historically included within Other investment banking net revenues were reclassified to Equities net revenues as the underlying business has matured and has started to generate meaningful revenues. Prior year amounts have been revised to conform to this reclassification change to the current year reporting.

15.Compensation ratio equals total compensation expense divided by total net revenues. Non-compensation ratio equals total non-compensation expense divided by total net revenues.

| | | | | |

11 Jefferies Financial Group | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=jef_A4850SeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=jef_A5875SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=jef_A2.750SeniorNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=jef_A6.200SeniorNotesDue2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

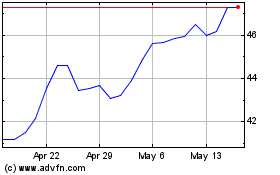

Jefferies Financial (NYSE:JEF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Jefferies Financial (NYSE:JEF)

Historical Stock Chart

From Jan 2024 to Jan 2025