JPMorgan To Settle SEC Claims About ADRs -- WSJ

27 December 2018 - 7:02PM

Dow Jones News

By Gabriel T. Rubin and Samuel Rubenfeld

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 27, 2018).

JPMorgan Chase & Co. agreed to pay $135 million to settle

claims that it improperly handled thousands of transactions

involving foreign companies' shares, the latest penalty in a

wide-ranging probe of misconduct in the market.

JPMorgan improperly provided American depositary receipts for

foreign shares that weren't in the bank's custody, which led the

bank to inflate the number of a foreign company's tradable shares,

the Securities and Exchange Commission said Wednesday. The conduct

cited by regulators occurred between 2011 and early 2015 in the

market for ADRs, a securities product the bank created nearly a

century ago.

"With these charges against JPMorgan, the SEC has now held all

four depositary banks accountable for their fraudulent issuances of

ADRs into an unsuspecting market," said Sanjay Wadhwa, an official

in the SEC's New York office.

"We're pleased to have resolved this matter, which is related to

an industry practice we voluntarily ended a few years ago," said

JPMorgan spokesman Brian Marchiony. The bank, which cooperated with

the investigation, didn't admit or deny the SEC's findings.

The SEC has been looking into whether big banks have been

mishandling securities in the ADR market in recent years, and

Wednesday's settlement with JPMorgan is the eighth action taken as

part of the probe.

In the past six months, the SEC has also announced ADR-related

settlements with three other banks: BNY Mellon, which agreed to pay

more than $54 million; Citigroup Inc., which agreed to pay more

than $38 million; and Deutsche Bank AG, which agreed to pay more

than $75 million.

The SEC said an investigation into broker-dealer conduct in the

market is continuing.

Created by J.P. Morgan in 1927, ADRs were designed to help

investors avoid many of the complexities and costs of directly

owning shares overseas while helping foreign companies widen their

investor base in the U.S.

Foreign companies transfer shares to the banks, which use them

to back corresponding securities issued to U.S. investors. The

securities track the price of the underlying shares. Brokers who

sell or transfer ADRs are typically responsible for ensuring that a

matching number of foreign shares have been deposited with a

custodian.

More than 74 billion depositary receipts, worth more than $2

trillion, were traded in the first half of 2018, according to data

from Bank of New York Mellon Corp.

Write to Gabriel T. Rubin at gabriel.rubin@wsj.com and Samuel

Rubenfeld at samuel.rubenfeld@wsj.com

(END) Dow Jones Newswires

December 27, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

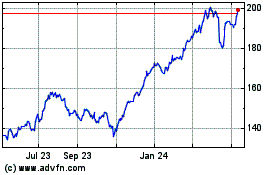

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to May 2024

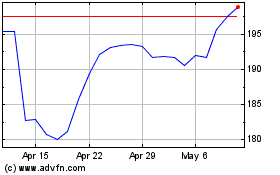

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From May 2023 to May 2024