Kodiak Gas Services, Inc. (NYSE: KGS) (“Kodiak” or the

“Company”), a leading provider of critical energy infrastructure

and contract compression services, today reported financial and

operating results for the quarter ended September 30, 2024, updated

full-year 2024 guidance and provided an early outlook on 2025

Adjusted EBITDA(1).

Third Quarter 2024 and Recent Highlights

- Contract Services segment revenue and Adjusted Gross Margin

Percentage(1) were $284.3 million and 66.0%, respectively

- Net loss of $6.2 million included a $9.9 million long-lived

asset impairment, a $10.4 million loss on asset sales and a $20.3

million non-cash, mark-to-market loss on interest rate hedges

- Record quarterly Adjusted EBITDA of $168.4 million

- Record quarterly Free Cash Flow(1) of $52.5 million

- Deployed 50,000 horsepower of new large horsepower compression

units

- Divested approximately 95,000 horsepower of small horsepower

compression units both in the U.S and internationally

- Fleet utilization ended the third quarter at 96.4%, a

sequential increase of 2.1%

- Repurchased one million shares for $25 million

- Raised full-year 2024 Adjusted EBITDA guidance to a range of

$600 to $610 million, a $10 million increase to the low end of the

range

2025 Early Outlook

- Providing full-year 2025 Adjusted EBITDA early outlook range of

$675 to $725 million

"We delivered an outstanding third quarter with new quarterly

records in revenue, adjusted EBITDA and free cash flow," stated

Mickey McKee, Kodiak’s President and Chief Executive Officer. "I

could not be more proud of the progress we have made improving

margins through the realization of cost synergies, increased fleet

utilization and favorable contract compression market pricing.

"During the quarter, we successfully completed the sale of over

2,000 small horsepower units and exited Canada, high-grading our

fleet and simplifying our business. Our high-quality, large

horsepower asset base continues to be in high demand and puts us in

a position to drive further improvements in margins and cash flow.

Our new unit deliveries are effectively fully contracted through

2025. The positive compression market outlook along with our solid

execution gives us confidence to raise the low end of our 2024

Adjusted EBITDA guidance range and provide an early outlook on 2025

Adjusted EBITDA."

(1) Adjusted EBITDA, Adjusted Gross Margin Percentage and Free

Cash Flow are Non-GAAP Financial Measures. Definitions and

reconciliations to the most comparable GAAP financial measure are

included herein.

Third Quarter 2024 Financial Results

Net loss for the third quarter of 2024 was $6.2 million,

compared to net income of $21.8 million in the third quarter of

2023. Net loss for the third quarter of 2024 included a $9.9

million long-lived asset impairment, a $10.4 million loss on the

sale of assets and a $20.3 million non-cash, mark-to-market loss on

interest rate hedges. Adjusted EBITDA for the third quarter of 2024

was $168.4 million, compared to $110.1 million in the third quarter

of 2023.

Segment Information

Contract Services segment revenue was $284.3 million in the

third quarter of 2024, a 52% increase compared to $186.7 million in

the third quarter of 2023. Contract Services segment gross margin

was $114.2 million in the third quarter of 2024, compared to $75.1

million in the third quarter of 2023. Contract Services segment

Adjusted Gross Margin was $187.7 million in the third quarter of

2024, a 55% increase compared to $121.2 million in the third

quarter of 2023.

Other Services segment revenue was $40.3 million in the third

quarter of 2024, compared to $44.3 million in the third quarter of

2023. Other Services segment gross margin and Adjusted Gross Margin

were each $7.7 million in the third quarter of 2024, compared to

$5.5 million in the third quarter of 2023.

Long-Term Debt and Liquidity

Total debt outstanding was $2.6 billion as of September 30,

2024, comprised primarily of borrowings on the ABL Facility and

senior notes due 2029. At September 30, 2024, the Company had

$305.9 million available on its ABL Facility, and our credit

agreement leverage ratio was 3.9x.

Summary Financial Data

(in thousands, except percentages)

Three Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

Total revenues

$

324,647

$

309,653

$

230,983

Net income (loss)

$

(6,211

)

$

6,713

$

21,766

Adjusted EBITDA (1)

$

168,374

$

154,342

$

110,067

Adjusted EBITDA percentage (1)

51.9

%

49.8

%

47.7

%

Contract Services revenue

$

284,313

$

276,250

$

186,673

Contract Services Adjusted Gross Margin

(1)

$

187,696

$

176,917

$

121,203

Contract Services Adjusted Gross Margin

Percentage (1)

66.0

%

64.0

%

64.9

%

Other Services revenue

$

40,334

$

33,403

$

44,310

Other Services Adjusted Gross Margin

(1)

$

7,660

$

5,467

$

5,490

Other Services Adjusted Gross Margin

Percentage (1)

19.0

%

16.4

%

12.4

%

Maintenance capital expenditures

$

21,553

$

19,147

$

12,312

Growth capital expenditures (2)

$

65,115

$

90,390

$

55,671

Discretionary Cash Flow (1)

$

103,049

$

90,617

$

63,044

Free Cash Flow (1)

$

52,500

$

638

$

7,373

(1)

Adjusted EBITDA, Adjusted EBITDA

Percentage, Adjusted Gross Margin, Adjusted Gross Margin

Percentage, Discretionary Cash Flow and Free Cash Flow are non-GAAP

financial measures. For definitions and reconciliations to the most

directly comparable financial measures calculated and presented in

accordance with GAAP, see “Non-GAAP Financial Measures” below.

(2)

For the three months ended September 30,

2024, June 30, 2024 and September 30, 2023, growth capital

expenditures include a non-cash increase in the sales tax accrual

on compression equipment purchases of $1.7 million, $19.8 million

and $0.3 million, respectively. These accrual amounts are estimated

based on the best-known information as it relates to open audit

periods with the state of Texas.

Summary Operating Data

(as of the dates indicated)

September 30, 2024

June 30, 2024

September 30, 2023

Fleet horsepower (1)

4,417,687

4,481,900

3,213,096

Revenue-generating horsepower (2)

4,259,843

4,224,839

3,210,076

Fleet compression units

5,297

7,317

3,051

Revenue-generating compression units

4,757

5,753

3,034

Revenue-generating horsepower per

revenue-generating compression unit (3)

895

734

1,058

Fleet utilization (4)

96.4

%

94.3

%

99.9

%

(1)

Fleet horsepower includes owned horsepower

excluding 46,313, 27,663 and 31,520 of non-marketable or obsolete

horsepower as of September 30, 2024, June 30, 2024, and September

30, 2023, respectively.

(2)

Revenue-generating horsepower includes

fleet horsepower that is (x) under contract, operating and

generating revenue or (y) under contract or subject to a firm

commitment with a customer and available to be deployed.

(3)

Calculated as (i) revenue-generating

horsepower divided by (ii) revenue-generating compression units at

period end.

(4)

Fleet utilization is calculated as (i)

revenue-generating horsepower divided by (ii) fleet horsepower

Full-Year 2024 Guidance

Kodiak is providing revised guidance for the full year 2024. The

full-year 2024 guidance below incorporates three quarters of the

financial impact of the CSI Acquisition that closed on April 1,

2024. Amounts below are in thousands except percentages.

Full-Year 2024

Guidance

Low

High

Adjusted EBITDA (1)

$

600,000

$

610,000

Discretionary Cash Flow (1)(2)

$

365,000

$

385,000

Segment Information

Contract Services revenues

$

1,020,000

$

1,040,000

Contract Services Adjusted Gross Margin

Percentage (1)

64

%

66

%

Other Services revenues

$

125,000

$

135,000

Other Services Adjusted Gross Margin

Percentage (1)

14

%

17

%

Capital Expenditures

Growth capital expenditures (3)

$

210,000

$

230,000

Maintenance capital expenditures

$

60,000

$

70,000

(1)

The Company is unable to reconcile

projected Adjusted EBITDA to projected net income (loss) and

Discretionary Cash Flow to projected net cash provided by operating

activities, the most comparable financial measures calculated in

accordance with GAAP, respectively, without unreasonable efforts

because components of the calculations are inherently

unpredictable, such as changes to current assets and liabilities,

unknown future events, and estimating certain future GAAP measures.

The inability to project certain components of the calculation

would significantly affect the accuracy of the reconciliations.

(2)

Discretionary Cash Flow guidance assumes

no change to Secured Overnight Financing Rate futures.

(3)

Growth capital expenditures guidance

excludes (i) approximately $30 million in one-time capital

expenditures related to the CSI Acquisition, (ii) a $20 million

non-cash accrual for sales taxes on compression units purchased in

prior years and (iii) proceeds from the sale of small horsepower

compression units.

Conference Call

Kodiak will conduct a conference call on Thursday, November 7,

2024, at 11:00 a.m. Eastern Time (10:00 a.m. Central Time) to

discuss financial and operating results for the quarter ended

September 30, 2024. To listen to the call by phone, dial

877-407-4012 and ask for the Kodiak Gas Services call at least 10

minutes prior to the start time. To listen to the call via webcast,

please visit the Investors tab of Kodiak’s website at www.kodiakgas.com.

About Kodiak

Kodiak is the largest contract compression services provider in

the United States, serving as a critical link in the infrastructure

that enables the safe and reliable production and transportation of

natural gas and oil. Headquartered in The Woodlands, Texas, Kodiak

provides contract compression and related services to oil and gas

producers and midstream customers in high–volume gas gathering

systems, processing facilities, multi-well gas lift applications

and natural gas transmission systems. More information is available

at www.kodiakgas.com.

Non-GAAP Financial Measures

Adjusted EBITDA is defined as net income (loss) before interest

expense, net; income tax expense (benefit); and depreciation and

amortization; plus (i) loss (gain) on derivatives; (ii) equity

compensation expense; (iii) severance expenses; (iv) transaction

expenses; and (v) loss (gain) on sale of assets. Adjusted EBITDA

Percentage is defined as Adjusted EBITDA divided by total revenues.

Adjusted EBITDA and Adjusted EBITDA Percentage are used as

supplemental financial measures by our management and external

users of our financial statements, such as investors, commercial

banks and other financial institutions, to assess: (i) the

financial performance of our assets without regard to the impact of

financing methods, capital structure or historical cost basis of

our assets; (ii) the viability of capital expenditure projects and

the overall rates of return on alternative investment

opportunities; (iii) the ability of our assets to generate cash

sufficient to make debt payments and pay dividends; and (iv) our

operating performance as compared to those of other companies in

our industry without regard to the impact of financing methods and

capital structure. We believe Adjusted EBITDA and Adjusted EBITDA

Percentage provide useful information to investors because, when

viewed with our GAAP results and the accompanying reconciliation,

they provide a more complete understanding of our performance than

GAAP results alone. We also believe that external users of our

financial statements benefit from having access to the same

financial measures that management uses in evaluating the results

of our business. Reconciliations of Adjusted EBITDA to net income

(loss), the most directly comparable GAAP financial measure, and

net cash provided by operating activities are presented below.

Adjusted Gross Margin is defined as revenue less cost of

operations, exclusive of depreciation and amortization expense.

Adjusted Gross Margin Percentage is defined as Adjusted Gross

Margin divided by revenues. We believe Adjusted Gross Margin and

Adjusted Gross Margin Percentage are useful as supplemental

measures to investors of our operating profitability.

Reconciliations of Adjusted Gross Margin to gross margin are

presented below.

Discretionary Cash Flow is defined as net cash provided by

operating activities less (i) maintenance capital expenditures;(ii)

gain on sale of capital assets; (iii) certain changes in operating

assets and liabilities; and (iv) certain other expenses; plus (x)

cash loss on extinguishment of debt; and (y) transaction expenses.

We believe Discretionary Cash Flow is a useful liquidity and

performance measure and supplemental financial measure for us and

our investors in assessing our ability to pay cash dividends to our

stockholders, make growth capital expenditures and assess our

operating performance. Reconciliations of Discretionary Cash Flow

to net income (loss) and net cash provided by operating activities

are presented below.

Free Cash Flow is defined as net cash provided by operating

activities less (i) maintenance capital expenditures; (ii) gain on

sale of capital assets; (iii) certain changes in operating assets

and liabilities; (iv) certain other expenses; and (v) net growth

capital expenditures; plus (x) transaction expenses; and (y)

proceeds from sale of capital assets. We believe Free Cash Flow is

a liquidity measure and useful supplemental financial measure for

us and investors in assessing our ability to pursue business

opportunities and investments to grow our business and to service

our debt. Reconciliations of Free Cash Flow to net income (loss)

and net cash provided by operating activities are presented

below.

Cautionary Note Regarding Forward-Looking Statements

This news release contains, and our officers and representatives

may from time to time make, “forward-looking statements” within the

meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are neither historical facts nor assurances of future

performance. Instead, they are based only on our current beliefs,

expectations and assumptions regarding the future of our business,

future plans and strategies, projections, anticipated events and

trends, the economy and other future conditions. Forward-looking

statements can be identified by words such as: “anticipate,”

“intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,”

“expect,” “strategy,” “future,” “likely,” “may,” “should,” “will”

and similar references to future periods. Examples of

forward-looking statements include, among others, statements we

make regarding: (i) expected operating results, such as revenue

growth and earnings, including changes due to CSI Acquisition, and

our ability to service our indebtedness; (ii) anticipated levels of

capital expenditures and uses of capital; (iii) current or future

volatility in the credit markets and future market conditions; (iv)

potential and pending acquisition transactions or other strategic

transactions, the timing thereof, the receipt of necessary

approvals to close those transactions, our ability to finance such

transactions and our ability to achieve the intended operational,

financial and strategic benefits from any such transactions; (v)

expected synergies and efficiencies to be achieved as a result of

the CSI Acquisition; (vi) expectations regarding leverage and

dividend profile as a result of the CSI Acquisition, including the

amount and timing of future dividend payments; (vii) expectations

of the effect on our financial condition of claims, litigation,

environmental costs, contingent liabilities and governmental and

regulatory investigations and proceedings; (viii) production and

capacity forecasts for the natural gas and oil industry; (ix)

strategy for customer retention, growth, fleet maintenance, market

position, and financial results; (x) our interest rate hedges; and

(xi) strategy for risk management.

Because forward-looking statements relate to the future, they

are subject to inherent uncertainties, risks and changes in

circumstances that are difficult to predict and many of which are

outside of our control. Our actual results and financial condition

may differ materially from those indicated in the forward-looking

statements. Therefore, you should not place undue reliance on any

of these forward-looking statements. Important factors that could

cause our actual results and financial condition to differ

materially from those indicated in the forward-looking statements

include, among others, the following: (i) a reduction in the demand

for natural gas and oil; (ii) the loss of, or the deterioration of

the financial condition of, any of our key customers; (iii)

nonpayment and nonperformance by our customers, suppliers or

vendors; (iv) competitive pressures that may cause us to lose

market share; (v) the structure of our Contract Services contracts

and the failure of our customers to continue to contract for

services after expiration of the primary term; (vi) our ability to

successfully integrate any acquired business, including CSI

Compressco, and realize the expected benefits thereof; (vii) our

ability to fund purchases of additional compression equipment;

(viii) a deterioration in general economic, business, geopolitical

or industry conditions, including as a result of the conflict

between Russia and Ukraine, inflation, and slow economic growth in

the United States; (ix) tax legislation and administrative

initiatives or challenges to our tax positions; (x) the loss of key

management, operational personnel or qualified technical personnel;

(xi) our dependence on a limited number of suppliers; (xii) the

cost of compliance with existing governmental regulations and

proposed governmental regulations, including climate change

legislation; (xiii) the cost of compliance with regulatory

initiatives and stakeholder pressures, including environmental,

social and governance scrutiny; (xiv) the inherent risks associated

with our operations, such as equipment defects and malfunctions;

(xv) our reliance on third-party components for use in our

information technology systems; (xvi) legal and reputational risks

and expenses relating to the privacy, use and security of employee

and client information; (xvii) threats of cyber-attacks or

terrorism; (xviii) agreements that govern our debt contain features

that may limit our ability to operate our business and fund future

growth and also increase our exposure to risk during adverse

economic conditions; (xix) volatility in interest rates; (xx) our

ability to access the capital and credit markets or borrow on

affordable terms to obtain additional capital that we may require;

(xxi) the effectiveness of our disclosure controls and procedures;

and (xxii) such other factors as discussed throughout the "Risk

Factors" and "Management's Discussion and Analysis of Financial

Condition and Results of Operations" sections of our Annual Report

on Form 10-K for the year ended December 31, 2023, as filed with

the U.S. Securities and Exchange Commission (“SEC”) and those risks

disclosed in subsequent filings on Forms 10-Q and 8-K with the SEC,

which can be obtained free of charge on the SEC’s website at

http://www.sec.gov.

Any forward-looking statement made by us in this news release is

based only on information currently available to us and speaks only

as of the date on which it is made. Except as may be required by

applicable law, we undertake no obligation to publicly update any

forward-looking statement whether as a result of new information,

future developments or otherwise.

KODIAK GAS SERVICES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(UNAUDITED)

(in thousands, except share and

per share data)

Three Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

Revenues:

Contract Services

$

284,313

$

276,250

$

186,673

Other Services

40,334

33,403

44,310

Total revenues

324,647

309,653

230,983

Operating expenses:

Cost of operations (exclusive of

depreciation and amortization shown below)

Contract Services

96,617

99,333

65,470

Other Services

32,674

27,936

38,820

Depreciation and amortization

73,452

69,463

46,087

Long-lived asset impairment

9,921

—

—

Selling, general and administrative

35,528

59,927

19,648

(Gain) loss on sale of property, plant and

equipment

10,376

(1,173

)

—

Total operating expenses

258,568

255,486

170,025

Income from operations

66,079

54,167

60,958

Other income (expenses):

Interest expense, net

(53,991

)

(52,133

)

(39,710

)

Loss on extinguishment of debt

—

—

(6,757

)

Gain (loss) on derivatives

(20,327

)

6,797

15,141

Other income (expense), net

(156

)

218

38

Total other expenses, net

(74,474

)

(45,118

)

(31,288

)

Income (loss) before income taxes

(8,395

)

9,049

29,670

Income tax expense (benefit)

(2,184

)

2,336

7,904

Net income (loss)

(6,211

)

6,713

21,766

Less: Net income (loss) attributable to

noncontrolling interests

(563

)

485

—

Net income (loss) attributable to common

shareholders

$

(5,648

)

$

6,228

$

21,766

Earnings (loss) per share attributable to

common shareholders:

Basic net earnings (loss) per share

$

(0.07

)

$

0.07

$

0.28

Diluted net earnings (loss) per share

$

(0.07

)

$

0.06

$

0.28

Basic weighted average shares of common

stock outstanding

84,292,083

84,202,352

76,731,868

Diluted weighted average shares of common

stock outstanding

84,292,083

90,669,239

76,899,483

KODIAK GAS SERVICES,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

(in thousands, except share and

per share data)

As of September 30,

2024

As of December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

7,434

$

5,562

Accounts receivable, net

280,436

113,192

Inventories, net

118,085

76,238

Fair value of derivative instruments

4,110

8,194

Contract assets

13,491

17,424

Prepaid expenses and other current

assets

19,801

10,353

Total current assets

443,357

230,963

Property, plant and equipment, net

3,406,325

2,536,091

Operating lease right-of-use assets,

net

54,489

33,716

Finance lease right-of-use assets, net

4,702

—

Goodwill

413,532

305,553

Identifiable intangible assets, net

161,263

122,888

Fair value of derivative instruments

5,121

14,256

Deferred tax assets

17

—

Other assets

3,202

639

Total assets

$

4,492,008

$

3,244,106

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

85,848

$

49,842

Accrued liabilities

192,762

97,078

Contract liabilities

70,178

63,709

Total current liabilities

348,788

210,629

Long-term debt, net of unamortized debt

issuance cost

2,595,398

1,791,460

Operating lease liabilities

50,491

34,468

Finance lease liabilities

2,737

—

Deferred tax liabilities

94,231

62,748

Other liabilities

3,971

2,148

Total liabilities

$

3,095,616

$

2,101,453

Commitments and contingencies (Note

14)

Stockholders’ equity:

Preferred stock, par value $0.01 per

share; 50,000,000 shares of preferred stock authorized, 5,562,273

and zero issued and outstanding as of September 30, 2024, and

December 31, 2023, respectively

56

—

Common stock, par value $0.01 per share;

750,000,000 shares of common stock authorized, 84,509,612 and

77,400,000 shares of common stock issued as of September 30, 2024,

and December 31, 2023, respectively

845

774

Additional paid-in capital

1,159,431

963,760

Treasury stock, at cost; 1,000,000 and

zero shares as of September 30, 2024, and December 31, 2023,

respectively

(25,000

)

—

Noncontrolling interest

149,846

—

Retained earnings

111,214

178,119

Total stockholders’ equity

1,396,392

1,142,653

Total liabilities and stockholders’

equity

$

4,492,008

$

3,244,106

KODIAK GAS SERVICES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(UNAUDITED)

(in thousands)

Nine Months Ended September

30,

2024

2023

Cash flows from operating

activities:

Net income

$

30,734

$

26,940

Adjustments to reconcile net income to net

cash provided by operating activities

Depreciation and amortization

189,859

136,414

Long-lived asset impairment

9,921

—

Equity compensation expense

12,064

3,452

Amortization of debt issuance costs

8,079

11,260

Non-cash lease expense

3,164

3,132

Provision for credit losses

4,625

2,047

Inventory reserve

476

375

(Gain) loss on sale of property, plant and

equipment

9,203

(721

)

Change in fair value of derivatives

13,219

13,551

Deferred tax provision

4,821

6,312

Loss on extinguishment of debt

—

4,359

Changes in operating assets and

liabilities, exclusive of effects of business acquisition:

Accounts receivable

(126,941

)

(21,371

)

Inventories

(7,895

)

1,174

Contract assets

3,934

(6,053

)

Prepaid expenses and other current

assets

(747

)

(3,733

)

Accounts payable

40,204

3,257

Accrued and other liabilities

9,593

8,497

Contract liabilities

5,068

14,807

Other assets

121

—

Net cash provided by operating

activities

209,502

203,699

Cash flows from investing

activities:

Net cash acquired in acquisition of CSI

Compressco LP

9,458

—

Purchase of property, plant and

equipment

(263,719

)

(145,573

)

Proceeds from sale of property, plant and

equipment

14,977

1,055

Other

(35

)

(45

)

Net cash used in investing activities

(239,319

)

(144,563

)

Cash flows from financing

activities:

Borrowings on debt instruments

2,297,435

756,418

Payments on debt instruments

(2,114,013

)

(1,021,556

)

Principal payments on other borrowings

(3,721

)

—

Payment of debt issuance cost

(16,346

)

(32,759

)

Principal payments on finance leases

(870

)

—

Proceeds from initial public offering, net

of underwriter discounts

—

277,840

Offering costs

(1,162

)

(9,247

)

Loss on extinguishment of debt

—

(1,835

)

Dividends paid to stockholders

(97,506

)

—

Repurchase of common shares

(25,000

)

—

Cash paid for shares withheld to cover

taxes

(2,665

)

—

Net effect on deferred taxes and taxes

payable related to the vesting of restricted stock

418

—

Distribution to parent

—

(42,300

)

Distributions to noncontrolling

interest

(4,881

)

—

Net cash provided by (used in) financing

activities

31,689

(73,439

)

Net increase (decrease) in cash and cash

equivalents

1,872

(14,303

)

Cash and cash equivalents - beginning of

period

5,562

20,431

Cash and cash equivalents - end of

period

$

7,434

$

6,128

Supplemental cash disclosures:

Cash paid for interest

$

106,463

$

173,006

Cash paid for taxes

$

10,333

$

5,946

Supplemental disclosure of non-cash

investing activities:

(Increase) decrease in accrued capital

expenditures

$

2,961

$

(6,498

)

Supplemental disclosure of non-cash

financing activities:

Dividends equivalent

$

687

$

—

Issuance of common shares in acquisition

of CSI Compressco LP

$

188,167

$

—

Issuance of preferred shares and

noncontrolling interest in acquisition of CSI Compressco LP

$

154,118

$

—

Non-cash debt novation

$

—

$

(689,829

)

Non-cash loss on extinguishment of

debt

$

—

$

(563

)

Non-cash offering costs

$

—

$

(792

)

KODIAK GAS SERVICES,

INC.

RECONCILIATION OF NET INCOME

(LOSS) TO ADJUSTED EBITDA

(in thousands, excluding

percentages; unaudited)

Three Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

Net income (loss)

$

(6,211

)

$

6,713

$

21,766

Interest expense, net

53,991

52,133

39,710

Income tax (benefit) expense

(2,184

)

2,336

7,904

Depreciation and amortization

73,452

69,463

46,087

Long-lived asset impairment

9,921

—

—

Loss on extinguishment of debt

—

—

6,757

(Gain) loss on derivatives

20,327

(6,797

)

(15,141

)

Equity compensation expense (1)

3,905

5,311

2,544

Severance expense (2)

2,243

8,969

—

Transaction expenses (3)

2,554

17,387

440

(Gain) loss on sale of property, plant and

equipment

10,376

(1,173

)

—

Adjusted EBITDA

$

168,374

$

154,342

$

110,067

Adjusted EBITDA Percentage

51.9

%

49.8

%

47.7

%

(1)

For the three months ended September 30,

2024, June 30, 2024, and September 30, 2023, there were $3.9

million, $5.3 million and $2.5 million, respectively, of non-cash

adjustments for equity compensation expense.

(2)

For the three months ended September 30,

2024 and June 30, 2024 there were $2.2 million and $9.0 million,

respectively, of severance expenses related to the CSI Acquisition.

There were no such expenses for the three months ended September

30, 2023.

(3)

Represents certain costs associated with

non-recurring professional services, primarily related to the CSI

Acquisition for the three months ended September 30, 2024 and June

30, 2024.

KODIAK GAS SERVICES,

INC.

RECONCILIATION OF NET CASH

PROVIDED BY OPERATING ACTIVITIES TO ADJUSTED EBITDA

(in thousands; unaudited)

Three Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

Net cash provided by operating

activities

$

36,878

$

121,082

$

85,731

Interest expense, net

53,991

52,133

39,710

Income tax (benefit) expense

(2,184

)

2,336

7,904

Deferred tax provision

2,283

(843

)

(5,551

)

Cash received on derivatives

(7,185

)

(6,745

)

(7,163

)

Loss on extinguishment of debt

—

—

2,398

Severance expense (1)

2,243

8,969

—

Transaction expenses (2)

2,554

17,387

440

Other (3)

(4,685

)

(7,605

)

(3,705

)

Change in operating assets and

liabilities

84,479

(32,372

)

(9,697

)

Adjusted EBITDA

$

168,374

$

154,342

$

110,067

(1)

For the three months ended September 30,

2024 and June 30, 2024 there were $2.2 million and $9.0 million,

respectively, of severance expenses related to the CSI Acquisition.

There were no such expenses for the three months ended September

30, 2023.

(2)

Represents certain costs associated with

non-recurring professional services, primarily related to the CSI

Acquisition for the three months ended September 30, 2024 and June

30, 2024.

(3)

Includes amortization of debt issuance

costs, non-cash lease expense, provision for credit losses and

inventory reserve.

KODIAK GAS SERVICES,

INC.

RECONCILIATION OF ADJUSTED

GROSS MARGIN TO GROSS MARGIN FOR CONTRACT SERVICES

(in thousands, excluding

percentages; unaudited)

Three Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

Total revenues

$

284,313

$

276,250

$

186,673

Cost of sales (excluding depreciation and

amortization)

(96,617

)

(99,333

)

(65,470

)

Depreciation and amortization

(73,452

)

(69,463

)

(46,087

)

Gross margin

$

114,244

$

107,454

$

75,116

Gross margin percentage

40.2

%

38.9

%

40.2

%

Depreciation and amortization

73,452

69,463

46,087

Adjusted Gross Margin

$

187,696

$

176,917

$

121,203

Adjusted Gross Margin Percentage (1)

66.0

%

64.0

%

64.9

%

(1)

Calculated using Adjusted Gross Margin for

Contract Services as a percentage of total Contract Services

revenues.

KODIAK GAS SERVICES,

INC.

RECONCILIATION OF ADJUSTED

GROSS MARGIN TO GROSS MARGIN FOR OTHER SERVICES

(in thousands, excluding

percentages; unaudited)

Three Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

Total revenues

$

40,334

$

33,403

$

44,310

Cost of sales (excluding depreciation and

amortization)

(32,674

)

(27,936

)

(38,820

)

Depreciation and amortization

—

—

—

Gross margin

$

7,660

$

5,467

$

5,490

Gross margin percentage

19.0

%

16.4

%

12.4

%

Depreciation and amortization

—

—

—

Adjusted Gross Margin

$

7,660

$

5,467

$

5,490

Adjusted Gross Margin Percentage (1)

19.0

%

16.4

%

12.4

%

(1)

Calculated using Adjusted Gross Margin for

Other Services as a percentage of total Other Services

revenues.

KODIAK GAS SERVICES,

INC.

RECONCILIATION OF NET INCOME

(LOSS) TO DISCRETIONARY CASH FLOW AND FREE CASH FLOW

(in thousands; unaudited)

Three Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

Net income (loss)

$

(6,211

)

$

6,713

$

21,766

Depreciation and amortization

73,452

69,463

46,087

Long-lived asset impairment

9,921

—

—

Change in fair value of derivatives

27,512

(52

)

(7,978

)

Loss on extinguishment of debt

—

—

6,757

Deferred tax provision

(2,283

)

843

5,551

Amortization of debt issuance costs

3,133

2,303

189

Equity compensation expense (1)

3,905

5,311

2,544

Severance expense (2)

2,243

8,969

—

Transaction expenses (3)

2,554

17,387

440

(Gain) loss on sale of property, plant and

equipment

10,376

(1,173

)

—

Maintenance capital expenditures

(21,553

)

(19,147

)

(12,312

)

Discretionary Cash Flow

$

103,049

$

90,617

$

63,044

Growth capital expenditures (4)(5)(6)

(65,115

)

(90,390

)

(55,671

)

Proceeds from sale of property, plant and

equipment

14,566

411

—

Free Cash Flow

$

52,500

$

638

$

7,373

(1)

For the three months ended September 30,

2024, June 30, 2024, and September 30, 2023, there were $3.9

million, $5.3 million and $2.5 million, respectively, of non-cash

adjustments for equity compensation expense.

(2)

For the three months ended September 30,

2024 and June 30, 2024 there were $2.2 million and $9.0 million,

respectively, of severance expenses related to the CSI Acquisition.

There were no such expenses for the three months ended September

30, 2023.

(3)

Represents certain costs associated with

non-recurring professional services, primarily related to the CSI

Acquisition for the three months ended September 30, 2024 and June

30, 2024, and other costs.

(4)

For the three months ended September 30,

2024, June 30, 2024, and September 30, 2023, growth capital

expenditures include a $0.3 million decrease, a $12.6 million

decrease and a $16.4 million increase in accrued capital

expenditures, respectively.

(5)

For the three months ended September 30,

2024, June 30, 2024 and September 30, 2023, there were $51.7

million, $75.3 million and $52.0 million of new unit growth capital

expenditures, respectively.

(6)

For the three months ended September 30,

2024, June 30, 2024 and September 30, 2023, growth capital

expenditures include a non-cash increase in the sales tax accrual

on compression equipment purchases of $1.7 million, $19.8 million

and $0.3 million, respectively. These accrual amounts are estimated

based on the best-known information as it relates to open audit

periods with the state of Texas.

KODIAK GAS SERVICES,

INC.

RECONCILIATION OF NET CASH

PROVIDED BY OPERATING ACTIVITIES TO DISCRETIONARY CASH FLOW AND

FREE CASH FLOW

(in thousands; unaudited)

Three Months Ended

September 30, 2024

June 30, 2024

September 30, 2023

Net cash provided by operating

activities

$

36,878

$

121,082

$

85,731

Maintenance capital expenditures

(21,553

)

(19,147

)

(12,312

)

Loss on extinguishment of debt

—

—

2,398

Severance expense (1)

2,243

8,969

—

Transaction expenses (2)

2,554

17,387

440

(Gain) loss on sale of property, plant and

equipment

10,376

(1,173

)

—

Change in operating assets and

liabilities

84,479

(32,372

)

(9,697

)

Other (3)

(11,928

)

(4,129

)

(3,516

)

Discretionary Cash Flow

$

103,049

$

90,617

$

63,044

Growth capital expenditures (4)(5)(6)

(65,115

)

(90,390

)

(55,671

)

Proceeds from sale of property, plant and

equipment

14,566

411

—

Free Cash Flow

$

52,500

$

638

$

7,373

(1)

For the three months ended September 30,

2024 and June 30, 2024 there were $2.2 million and $9.0 million,

respectively, of severance expenses related to the CSI Acquisition.

There were no such expenses for the three months ended September

30, 2023.

(2)

Represents certain costs associated with

non-recurring professional services, primarily related to the CSI

Acquisition for the three months ended September 30, 2024 and June

30, 2024, and other costs.

(3)

Includes non-cash lease expense, provision

for credit losses and inventory reserve.

(4)

For the three months ended September 30,

2024, June 30, 2024, and September 30, 2023, growth capital

expenditures include a $0.3 million decrease, a $12.6 million

decrease and a $16.4 million increase in accrued capital

expenditures, respectively.

(5)

For the three months ended September 30,

2024, June 30, 2024 and September 30, 2023, there were $51.7

million, $75.3 million and $52.0 million of new unit growth capital

expenditures, respectively.

(6)

For the three months ended September 30,

2024, June 30, 2024 and September 30, 2023, growth capital

expenditures include a non-cash increase in the sales tax accrual

on compression equipment purchases of $1.7 million, $19.8 million

and $0.3 million, respectively. These accrual amounts are estimated

based on the best-known information as it relates to open audit

periods with the state of Texas.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106306941/en/

Investor Contact Graham Sones, VP – Investor Relations

ir@kodiakgas.com (936) 755-3529

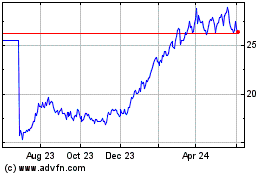

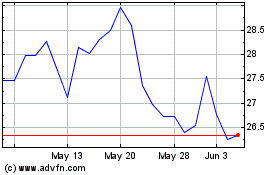

Kodiak Gas Services (NYSE:KGS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Kodiak Gas Services (NYSE:KGS)

Historical Stock Chart

From Nov 2023 to Nov 2024