– Q3 2024 Revenues of $230.5 million, Net Loss of $391.5 million

(including a $361.6 million impairment of goodwill and

indefinite-lived intangibles), and Adjusted EBITDA of $141.6

million

– Identified potential medical cost savings of approximately

$6.4 billion in Q3 2024, up 10% from Q3 2023 and up 3% from Q2

2024

MultiPlan Corporation (“MultiPlan” or the “Company”) (NYSE:

MPLN), a leading provider of data-driven cost management solutions

that deliver transparency and promote fairness, quality and

affordability to the U.S. healthcare industry, today reported

financial results for the third quarter ended September 30, 2024

and updated its full-year 2024 guidance.

CEO Travis Dalton said, “During the third quarter, we

experienced growth in volumes of billed charges and identified

potential savings. Our Revenues and Adjusted EBITDA were in line

with the low end of our guidance for the third quarter. We are

tightening our Revenues guidance with a modest decrease to the top

end of our Adjusted EBITDA guidance for full year 2024. We

anticipate the fourth quarter to run similar to our third

quarter.”

“As I shared with our second quarter earnings results, I remain

confident in this Company and its transformation journey. With the

building of my leadership team nearly complete, this talented team

has already marched forward to clearly establish the framework for

developing a data and insights driven and technology focused

company that is fit for growth,” said Mr. Dalton.

“With our new CFO just having completed his first 90 days at

MultiPlan, we are thrilled to also welcome Tiffani Misencik into

our newly created Chief Growth Officer role that is focused on our

sales organization. I am extremely proud of the leadership team and

talent we have been able to attract and the progress we are making.

Our leaders are embedding a growth focused culture where everyone

listens, problem solves and is here to serve our clients.”

Mr. Dalton concluded, “Our multi-year transformation towards a

world-class data and technology company is underway. We will work

with all stakeholders of the healthcare continuum to positively

impact increased transparency, improved quality and lower costs.

This focus will provide the platform for our long-term sustainable

growth. I look forward to sharing the big mileposts of our

transformation journey in the months and quarters to come.”

Business and Financial Highlights

- Revenues of $230.5 million for Q3 2024, a decrease of 5.1%,

compared to revenues of $242.8 million for Q3 2023.

- Net loss of $391.5 million for Q3 2024, compared to net loss of

$24.1 million for Q3 2023. The net loss was principally due to an

impairment charge of $361.6 million for goodwill and

indefinite-lived intangibles.

- Adjusted EBITDA of $141.6 million for Q3 2024, compared to

Adjusted EBITDA of $152.3 million for Q3 2023.

- Net cash provided by operating activities of $72.8 million for

Q3 2024, compared to net cash provided by operating activities of

$72.1 million for Q3 2023.

- Free Cash Flow of $41.1 million for Q3 2024, compared to Free

Cash Flow of $49.7 million for Q3 2023.

- The Company ended Q3 2024 with $86.6 million of unrestricted

cash and cash equivalents on the balance sheet.

- The Company processed approximately $44.7 billion in claim

charges during Q3 2024, identifying potential medical cost savings

of approximately $6.4 billion.

- Based on the results of an impairment test as of September 30,

2024, the estimated fair values of our goodwill and

indefinite-lived assets were less than their carrying value and as

a result impairment charges of $355.8 million for our goodwill and

$5.8 million for our indefinite-lived intangibles were

recorded.

2024 Financial Guidance

The Company is updating certain metrics for its full-year 2024

guidance, as detailed in the table below:

Financial Metric

Prior FY 2024 Guidance

Updated FY 2024

Guidance

Revenues

$935 million to $955 million

$930 million to $940 million

Adjusted EBITDA1

$580 million to $595 million

$580 million to $590 million

Interest expense

$320 million to $330 million

(unchanged)

Cash flow from operations

$135 million to $150 million

$135 million to $145 million

Capital expenditures

$120 million to $130 million

(unchanged)

Depreciation

$80 million to $90 million

(unchanged)

Amortization of intangible assets

$345 million to $350 million

(unchanged)

Effective tax rate

25% to 28%

(unchanged)

Conference Call Information

The Company will host a conference call today, Tuesday, November

5, 2024 at 8:30 a.m. U.S. Eastern Time (ET) to discuss its

financial results. To join the conference call, please pre-register

using the following link at least ten minutes before the call

begins:

https://www.netroadshow.com/events/login?show=95da760a&confId=71678.

Upon registration, you will receive an email with the conference

dial-in details and a unique access code and pin.

A live webcast of the conference call can be accessed through

the Investor Relations section of the Company’s website at

investors.multiplan.com/events-and-presentations. Participants

should join the webcast ten minutes prior to the start of the

conference call. This earnings press release and a supplemental

slide deck will also be available on this section of the Company’s

website.

1 We have not reconciled the forward-looking Adjusted EBITDA

guidance included above to the most directly comparable GAAP (as

defined below) measure because this cannot be done without

unreasonable effort due to the variability and low visibility with

respect to certain costs, the most significant of which are

incentive compensation (including stock-based compensation),

transaction-related expenses, and certain fair value measurements,

which are potential adjustments to future earnings. We expect the

variability of these items to have a potentially unpredictable, and

a potentially significant, impact on our future GAAP financial

results.

For those unable to listen to the live conference call, a replay

will be available approximately two hours after the call through

the archived webcast on the Investor Relations section of the

Company’s website.

About MultiPlan

MultiPlan is committed to bending the cost curve in healthcare

by delivering transparency, fairness, and affordability to the U.S.

healthcare system. Our focus is on identifying medical savings,

helping to lower out-of-pocket costs, and reducing or eliminating

balance billing for healthcare consumers. Leveraging sophisticated

technology, data analytics, and a team rich with industry

experience, MultiPlan interprets customers’ needs and customizes

innovative solutions that combine its payment and revenue

integrity, network-based, data and decision science, and

analytics-based services. MultiPlan delivers value to more than 700

healthcare payors, over 100,000 employers, 60 million consumers,

and 1.4 million contracted providers. For more information, visit

multiplan.com.

Forward Looking Statements

This press release includes statements that express our

management’s opinions, expectations, beliefs, plans, objectives,

assumptions, or projections regarding future events or future

results and therefore are, or may be deemed to be, “forward-looking

statements”. These forward-looking statements can generally be

identified by the use of forward-looking terminology, including the

terms “believes,” “estimates,” “anticipates,” “expects,” “seeks,”

“projects,” “forecasts,” “intends,” “plans,” “may,” “will,” or

“should” or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include

all matters that are not historical facts. They appear in a number

of places throughout this press release, including the discussion

of 2024 outlook and guidance, additions to our leadership team, and

the Company’s ongoing transformation, and the long-term prospects

of the Company. Such forward-looking statements are based on

available current market information and management’s expectations,

beliefs and forecasts concerning future events impacting the

business. Although we believe that these forward-looking statements

are based on reasonable assumptions at the time they are made, you

should be aware that these forward-looking statements involve a

number of risks, uncertainties (some of which are beyond our

control) or other assumptions that may cause actual results or

performance to be materially different from those expressed or

implied by these forward-looking statements. These factors include:

loss of our customers, particularly our largest customers;

interruptions or security breaches of our information technology

systems and other cybersecurity attacks; the impact of reduced

claims volumes resulting from a nationwide outage by a vendor used

by our customers; the ability to achieve the goals of our strategic

plans and recognize the anticipated strategic, operational, growth

and efficiency benefits when expected; our ability to enter new

lines of business and broaden the scope of our services; the loss

of key members of management team or inability to maintain

sufficient qualified personnel; our ability to continue to attract,

motivate and retain a large number of skilled employees, and adapt

to the effects of inflationary pressure on wages; trends in the

U.S. healthcare system, including recent trends of unknown duration

of reduced healthcare utilization and increased patient financial

responsibility for services; effects of competition; effects of

pricing pressure; our ability to identify, complete and

successfully integrate acquisitions; the inability of our customers

to pay for our services; changes in our industry and industry

standards and technology; our ability to protect proprietary

information, processes and applications; our ability to maintain

the licenses or right of use for the software we use; our inability

to expand our network infrastructure; our ability to obtain

additional financing; our ability to pay interest and principal on

our notes and other indebtedness; lowering or withdrawal of our

credit ratings; adverse outcomes related to litigation or

governmental proceedings; inability to preserve or increase our

market share or the size of our PPO networks; decreases in

discounts from providers; pressure to limit access to preferred

provider networks; the loss of our existing relationships with

providers; changes in our regulatory environment, including

healthcare law and regulations; the expansion of privacy and

security laws; heightened enforcement activity by government

agencies; the possibility that we may be adversely affected by

other political economic, business and/or competitive factors;

changes in accounting principles or the incurrence of impairment

charges our ability to remediate any material weaknesses or

maintain effective internal controls over financial reporting;

other factors disclosed in our Securities and Exchange Commission

(“SEC”) filings from time to time, including, without limitation,

those factors described in our Annual Report on Form 10-K for the

fiscal year ended December 31, 2023 and our filings with the SEC;

and other factors beyond our control. Should one or more of these

risks or uncertainties materialize, or should any of the

assumptions prove incorrect, actual results may vary in material

respects from those projected in these forward-looking

statements.

There can be no assurance that future developments affecting our

business will be those that we have anticipated. Forward-looking

statements speak only as of the date made.

We do not undertake any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws.

Non-GAAP Financial Measures

In addition to the financial measures prepared in accordance

with generally accepted accounting principles in the United States

(“GAAP”), this press release contains certain non-GAAP financial

measures, including EBITDA, Adjusted EBITDA, Free Cash Flow,

Unlevered Free Cash Flow and Adjusted Cash Conversion Ratio. A

non-GAAP financial measure is generally defined as a numerical

measure of a company’s financial or operating performance that

excludes or includes amounts so as to be different than the most

directly comparable measure calculated and presented in accordance

with GAAP.

EBITDA, Adjusted EBITDA, Free Cash Flow, Unlevered Free Cash

Flow and Adjusted Cash Conversion Ratio are supplemental measures

of MultiPlan’s performance that are not required by or presented in

accordance with GAAP. These measures are not measurements of our

financial or operating performance under GAAP, have limitations as

analytical tools and should not be considered in isolation or as an

alternative to net income, cash flows or any other measures of

performance prepared in accordance with GAAP.

EBITDA represents net income before interest expense, interest

income, income tax provision, depreciation, amortization of

intangible assets, and non-income taxes. Adjusted EBITDA is EBITDA

as further adjusted by certain items as described in the table

below.

In addition, in evaluating EBITDA and Adjusted EBITDA you should

be aware that, in the future, we may incur expenses similar to the

adjustments in the presentation of EBITDA and Adjusted EBITDA. The

presentation of EBITDA and Adjusted EBITDA should not be construed

as an inference that our future results will be unaffected by

unusual or non-recurring items. The calculations of EBITDA and

Adjusted EBITDA may not be comparable to similarly titled measures

reported by other companies. Based on our industry and debt

financing experience, we believe that EBITDA and Adjusted EBITDA

are customarily used by investors, analysts and other interested

parties to provide useful information regarding a company’s ability

to service and/or incur indebtedness.

We also believe that Adjusted EBITDA is useful to investors and

analysts in assessing our operating performance during the periods

these charges were incurred on a consistent basis with the periods

during which these charges were not incurred. Both EBITDA and

Adjusted EBITDA have limitations as analytical tools, and you

should not consider either in isolation, or as a substitute for

analysis of our results as reported under GAAP. Some of the

limitations are:

- EBITDA and Adjusted EBITDA do not reflect changes in, or cash

requirements for, our working capital needs;

- EBITDA and Adjusted EBITDA do not reflect interest expense, or

the cash requirements necessary to service interest or principal

payments on our debt;

- EBITDA and Adjusted EBITDA do not reflect our tax expense or

the cash requirements to pay our taxes; and

- Although depreciation and amortization are non-cash charges,

the tangible assets being depreciated will often have to be

replaced in the future, and EBITDA and Adjusted EBITDA do not

reflect any cash requirements for such replacements.

MultiPlan’s presentation of Adjusted EBITDA should not be

construed as an inference that our future results and financial

position will be unaffected by unusual items.

Free Cash Flow is defined as net cash provided by operating

activities less capital expenditures, all as disclosed in the

Statements of Cash Flows. Unlevered Free Cash Flow is defined as

net cash provided by operating activities less capital

expenditures, plus cash interest paid, all as disclosed in the

Statements of Cash Flows. Free Cash Flow and Unlevered Free Cash

Flow are measures of our operational performance used by management

to evaluate our business after purchases of property and equipment

and, in the case of Unlevered Free Cash Flow, prior to the impact

of our capital structure. Free Cash Flow and Unlevered Free Cash

Flow should be considered in addition to, rather than as a

substitute for, consolidated net income as a measure of our

performance and net cash provided by operating activities as a

measure of our liquidity. Additionally, MultiPlan’s definitions of

Free Cash Flow and Unlevered Free Cash Flow are limited, in that

they do not represent residual cash flows available for

discretionary expenditures, due to the fact that the measures do

not deduct the payments required for debt service, in the case of

Unlevered Free Cash Flow, and other contractual obligations or

payments made for business acquisitions.

Adjusted Cash Conversion Ratio is defined as Unlevered Free Cash

Flow divided by Adjusted EBITDA. MultiPlan believes that the

presentation of the Adjusted Cash Conversion Ratio provides useful

information to investors because it is a financial performance

measure that shows how much of its Adjusted EBITDA MultiPlan

converts into Unlevered Free Cash Flow.

MULTIPLAN CORPORATION

Unaudited Condensed

Consolidated Balance Sheets

(in thousands, except share and

per share data)

September 30,

2024

December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

86,598

$

71,547

Restricted cash

10,570

9,947

Trade accounts receivable, net

82,132

76,558

Prepaid expenses

16,536

23,432

Prepaid taxes

—

1,364

Unbilled IDR fees, net

13,975

8,197

Other current assets, net

1,719

2,548

Total current assets

211,530

193,593

Property and equipment, net

292,870

267,429

Operating lease right-of-use assets

13,572

19,680

Goodwill

2,403,140

3,829,002

Other intangibles, net

2,366,794

2,633,207

Other assets, net

31,298

21,776

Total assets

$

5,319,204

$

6,964,687

Liabilities and Shareholders’

Equity

Current liabilities:

Accounts payable

$

22,547

$

19,590

Accrued interest

74,314

56,827

Accrued taxes

8,123

—

Operating lease obligation, short-term

4,585

4,792

Current portion of long-term debt

13,250

13,250

Accrued compensation

33,624

44,720

Accrued legal contingencies

23,123

12,123

Other accrued expenses

21,931

15,437

Total current liabilities

201,497

166,739

Long-term debt

4,510,245

4,532,733

Operating lease obligation, long-term

9,716

17,124

Private Placement Warrants and Unvested

Founder Shares

1

477

Deferred income taxes

378,508

521,707

Other liabilities

11,675

16,783

Total liabilities

5,111,642

5,255,563

Shareholders’ equity:

Shareholder interests

Preferred stock, $0.0001 par value —

10,000,000 shares authorized; no shares issued

—

—

Common stock, $0.0001 par value —

1,500,000,000 shares authorized; 16,914,056 and 16,695,207 issued;

16,171,197 and 16,207,984 shares outstanding(1)

2

2

Additional paid-in capital(1)

2,365,928

2,348,570

Accumulated other comprehensive loss

(12,462

)

(11,778

)

Retained deficit

(2,007,173

)

(499,307

)

Treasury stock — 742,859 and 487,223

shares(1)

(138,733

)

(128,363

)

Total shareholders’ equity

207,562

1,709,124

Total liabilities and shareholders’

equity

$

5,319,204

$

6,964,687

(1)Shares, common stock and additional paid-in capital have been

retroactively adjusted for all periods presented to reflect the

one-for-forty (1-for-40) reverse stock split that became effective

on September 20, 2024.

MULTIPLAN CORPORATION

Unaudited Condensed

Consolidated Statements of Loss and Comprehensive Loss

(in thousands, except share and

per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues

$

230,495

$

242,804

$

698,479

$

717,389

Costs of services (exclusive of

depreciation and amortization of intangible assets shown below)

60,825

60,949

182,271

174,806

General and administrative expenses

37,725

36,779

107,133

107,996

Depreciation

22,572

19,586

65,372

56,693

Amortization of intangible assets

85,971

85,971

257,913

256,724

Loss on impairment of goodwill and

intangible assets

361,612

—

1,434,363

—

Total expenses

568,705

203,285

2,047,052

596,219

Operating (loss) income

(338,210

)

39,519

(1,348,573

)

121,170

Interest expense

81,792

84,300

245,119

250,203

Interest income

(1,245

)

(1,505

)

(2,722

)

(7,110

)

Gain on extinguishment of debt

—

(10,129

)

(5,913

)

(46,907

)

(Gain) loss on change in fair value of

Private Placement Warrants and Unvested Founder Shares

(87

)

(2,127

)

(476

)

267

Net loss before taxes

(418,670

)

(31,020

)

(1,584,581

)

(75,283

)

Benefit for income taxes

(27,220

)

(6,875

)

(76,715

)

(14,977

)

Net loss

$

(391,450

)

$

(24,145

)

$

(1,507,866

)

$

(60,306

)

Weighted average shares outstanding –

Basic(1)

16,143,520

16,161,095

16,139,523

16,096,395

Weighted average shares outstanding –

Diluted(1)

16,143,520

16,161,095

16,139,523

16,096,395

Net loss per share – Basic(1)

$

(24.25

)

$

(1.49

)

$

(93.43

)

$

(3.75

)

Net loss per share – Diluted(1)

$

(24.25

)

$

(1.49

)

$

(93.43

)

$

(3.75

)

Net loss

(391,450

)

(24,145

)

(1,507,866

)

(60,306

)

Other comprehensive income:

Change in unrealized gains (losses) on

interest rate swaps, net of tax

(11,341

)

382

(684

)

382

Comprehensive loss

$

(402,791

)

$

(23,763

)

$

(1,508,550

)

$

(59,924

)

(1)Shares and net loss per share have been retroactively

adjusted for all periods presented to reflect the one-for-forty

(1-for-40) reverse stock split that became effective on September

20, 2024.

MULTIPLAN CORPORATION

Unaudited Condensed

Consolidated Statements of Cash Flows

(in thousands)

Nine Months Ended September

30,

2024

2023

Operating activities:

Net loss

$

(1,507,866

)

$

(60,306

)

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

65,372

56,693

Amortization of intangible assets

257,913

256,724

Amortization of the right-of-use asset

3,377

4,329

Loss on impairment of goodwill and

intangible assets

1,434,363

—

Stock-based compensation

19,829

13,357

Deferred income taxes

(142,999

)

(87,278

)

Amortization of debt issuance costs and

discounts

8,788

7,967

Gain on extinguishment of debt

(5,913

)

(46,907

)

Loss on disposal of property and

equipment

155

452

(Gain) loss on change in fair value of

Private Placement Warrants and Unvested Founder Shares

(476

)

267

Changes in assets and liabilities:

Accounts receivable, net

(5,574

)

11,621

Prepaid expenses and other assets

(9,466

)

(759

)

Prepaid taxes

1,364

(5,224

)

Operating lease obligation

(4,884

)

(5,041

)

Accounts payable, accrued interest,

accrued taxes, accrued expenses, legal contingencies and other

27,046

(1,877

)

Net cash provided by operating

activities

141,029

144,018

Investing activities:

Purchases of property and equipment

(87,689

)

(77,509

)

BST Acquisition, net of cash acquired

—

(140,940

)

Net cash used in investing activities

(87,689

)

(218,449

)

Financing activities:

Repurchase of 5.750% Notes

—

(134,975

)

Repayments of Term Loan B

(9,938

)

(9,938

)

Repurchase of Senior Convertible PIK

Notes

(14,886

)

—

Taxes paid on settlement of vested share

awards

(3,355

)

(461

)

Purchase of treasury stock

(10,370

)

(13,140

)

Proceeds from issuance of common stock

under Employee Stock Purchase Plan

883

—

Net cash used in financing activities

(37,666

)

(158,514

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

15,674

(232,945

)

Cash, cash equivalents and restricted cash

at beginning of period

81,494

340,559

Cash, cash equivalents and restricted cash

at end of period

$

97,168

$

107,614

Cash and cash equivalents

$

86,598

$

101,320

Restricted cash

10,570

6,294

Cash, cash equivalents and restricted cash

at end of period

$

97,168

$

107,614

Noncash investing and financing

activities:

Purchases of property and equipment not

yet paid

$

11,928

$

7,319

Supplemental disclosure of cash flow

information:

Cash paid during the period for:

Interest

$

(218,590

)

$

(223,640

)

Income taxes, net of refunds

$

(57,860

)

$

(78,582

)

MULTIPLAN CORPORATION

Calculation of EBITDA and

Adjusted EBITDA

Three Months Ended September

30,

Nine Months Ended September

30,

(in thousands)

2024

2023

2024

2023

Net loss

$

(391,450

)

$

(24,145

)

$

(1,507,866

)

$

(60,306

)

Adjustments:

Interest expense

81,792

84,300

245,119

250,203

Interest income

(1,245

)

(1,505

)

(2,722

)

(7,110

)

Benefit for income taxes

(27,220

)

(6,875

)

(76,715

)

(14,977

)

Depreciation

22,572

19,586

65,372

56,693

Amortization of intangible assets

85,971

85,971

257,913

256,724

Non-income taxes

515

669

1,623

1,672

EBITDA

$

(229,065

)

$

158,001

$

(1,017,276

)

$

482,899

Adjustments:

Other expenses (income), net(1)

1,517

521

2,584

759

Integration expenses

850

891

1,994

2,722

Change in fair value of Private Placement

Warrants and unvested founder shares

(87

)

(2,127

)

(476

)

267

Transaction-related expenses

—

269

—

8,105

Gain on extinguishment of debt

—

(10,129

)

(5,913

)

(46,907

)

Loss on impairment of goodwill and

intangible assets

361,612

—

1,434,363

—

Stock-based compensation

6,818

4,835

19,829

13,357

Adjusted EBITDA

$

141,645

$

152,261

$

435,105

$

461,202

(1) "Other expenses (income), net" represent miscellaneous

non-recurring income, miscellaneous non-recurring expense, gain or

loss on disposal of assets, impairment of other assets, gain or

loss on disposal of leases, tax penalties, and non-integration

related severance costs.

Calculation of Unlevered Free

Cash Flow and Adjusted Cash Conversion Ratio

Three Months Ended September

30,

Nine Months Ended September

30,

(in thousands)

2024

2023

2024

2023

Net cash provided by operating

activities

$

72,842

$

72,118

$

141,029

$

144,018

Purchases of property and equipment

(31,700

)

(22,414

)

(87,689

)

(77,509

)

Free Cash Flow

41,142

49,704

53,340

66,509

Interest paid

60,195

62,156

218,590

223,640

Unlevered Free Cash Flow

$

101,337

$

111,860

$

271,930

$

290,149

Adjusted EBITDA

$

141,645

$

152,261

$

435,105

$

461,202

Adjusted Cash Conversion Ratio

72

%

73

%

62

%

63

%

Net cash used in investing activities

$

(31,700

)

(22,060

)

$

(87,689

)

$

(218,449

)

Net cash used in financing activities

$

(3,143

)

(38,338

)

$

(37,666

)

$

(158,514

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105504314/en/

Investor Relations Jason Wong SVP, Treasury &

Investor Relations and Shawna Gasik AVP, Investor Relations

866-909-7427 investor@multiplan.com

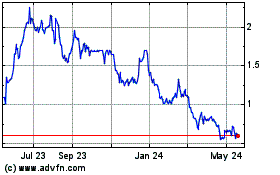

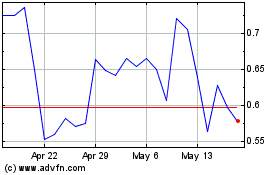

Churchill Capital Corp III (NYSE:MPLN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Churchill Capital Corp III (NYSE:MPLN)

Historical Stock Chart

From Feb 2024 to Feb 2025