Morgan Stanley Infrastructure Partners Sells Höegh Evi Stake

14 December 2024 - 12:50AM

Business Wire

Morgan Stanley Investment Management (“MSIM”), through

investment funds managed by Morgan Stanley Infrastructure Partners

(“MSIP”), its private infrastructure investment platform, today

announced it has entered an agreement to sell its 50% ownership

stake in Larus Holding Limited, the 100% owner of H�egh Evi Ltd.

(“H�egh Evi” or the “Company”) to funds managed by Igneo

Infrastructure Partners. Aequitas Limited (“Aequitas”), indirectly

controlled by Leif O. Høegh and family trusts (“Høegh Family”),

will retain its 50% ownership stake.

H�egh Evi is one of the leading owner-operators of Floating

Storage and Regasification Units ("FSRUs") and Liquid Natural Gas

Carrier ("LNGC") vessels globally. MSIP and the Høegh Family

undertook a strategic realignment of H�egh Evi to enable its

transition to provisioning clean energy infrastructure assets.

H�egh Evi initiated the development of floating solutions for

Carbon Capture and Storage (“CCS”), ammonia and hydrogen segments.

Notably, the Company is on track to convert to the first hybrid

FSRUs by 2028, enabling parallel imports of LNG and hydrogen,

providing customers the flexibility to ensure supply security and

affordability during the transition away from fossil fuels. In

September 2024, the Company rebranded itself from H�egh LNG to

H�egh Evi (Energy Vector Infrastructure) in recognition of its role

in both the energy transition and a multi-energy source

environment.

“Since acquisition, we have worked with H�egh Evi to further

strengthen its position as a leader in the FSRU market, providing

essential long-term LNG regasification capacity and enhancing

critical energy security for countries around the world,” said

Alberto Donzelli, Managing Director and Co-Head of Europe for

MSIP.

In partnership with the Høegh Family, a prominent Norwegian

family that has pioneered the international shipping industry since

1927, MSIP successfully de-listed the Company from the Oslo Stock

Exchange in May 2021 and took private the previously partially

owned subsidiary H�egh LNG Partners LP from the New York Stock

Exchange in September 2022.

“H�egh Evi is another example of how MSIP’s ability to partner

and collaborate with family shareholders provides differentiated

sourcing capabilities that can create substantial value for our

investors,” said Markus Hottenrott, Chief Investment Officer for

MSIP.

About H�egh Evi Ltd. H�egh Evi is the vital link to

secure transition-delivering fast, adaptable, and secure solutions

that respond to countries' evolving energy needs. For 50 years,

H�egh Evi has been a pioneer and global leader in floating energy

infrastructure, with one of the world's largest fleets of FSRUs

(floating storage and regasification units) for importing natural

gas. Today, H�egh Evi is building the infrastructure needed to make

the energy transition possible, with floating terminals for ammonia

and hydrogen import, the world's first floating ammonia-to-hydrogen

cracker, and services for carbon transport and permanent storage.

H�egh Evi is a global company with a highly skilled global team of

900 employees at sea and onshore. To learn more, please visit

www.hoeghevi.com.

About Morgan Stanley Infrastructure Partners Morgan

Stanley Infrastructure Partners (“MSIP”) is a leading global

private infrastructure investment platform with approximately $17

billion in assets under management since inception. Founded in

2006, MSIP has invested in a diverse portfolio of over 40

investments across transport, digital infrastructure, energy

transition and utilities. MSIP targets assets that provide

essential public goods and services with the potential for value

creation through active asset management. For further information

about Morgan Stanley Infrastructure Partners, please visit

www.morganstanley.com/im/infrastructurepartners.

About Morgan Stanley Investment Management Morgan Stanley

Investment Management, together with its investment advisory

affiliates, has more than 1,300 investment professionals around the

world and $1.6 trillion in assets under management or supervision

as of September 30, 2024. Morgan Stanley Investment Management

strives to provide outstanding long-term investment performance,

service, and a comprehensive suite of investment management

solutions to a diverse client base, which includes governments,

institutions, corporations and individuals worldwide. For further

information about Morgan Stanley Investment Management, please

visit www.morganstanley.com/im.

About Morgan Stanley Morgan Stanley (NYSE: MS) is a

leading global financial services firm providing a wide range of

investment banking, securities, wealth management and investment

management services. With offices in 42 countries, the Firm’s

employees serve clients worldwide including corporations,

governments, institutions and individuals. For further information

about Morgan Stanley, please visit www.morganstanley.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241212182023/en/

Morgan Stanley Media Relations: Tom Walton

Tom.Walton@morganstanley.com

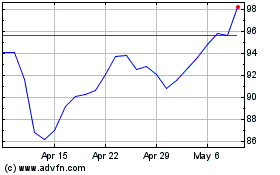

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Nov 2024 to Dec 2024

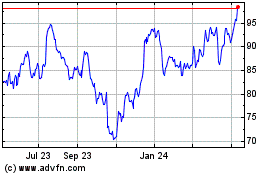

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Dec 2023 to Dec 2024