Fourth Quarter:

- Net sales of $298.8 million decreased 20% compared to prior

year primarily due to repositioning actions in the Performance

Chemicals segment that resulted in the exit of lower-margin end

markets

- Net income of $16.6 million and diluted earnings per share

(EPS) of $0.46, including pre-tax restructuring charges of $23.4

million; adjusted earnings of $34.7 million and diluted adjusted

EPS of $0.95

- Adjusted EBITDA of $80.6 million and adjusted EBITDA margin of

27.0%

- Operating cash flow of $64.5 million and free cash flow of

$39.6 million, which included the second and final $50.0 million

installment of a termination fee for a long-term crude tall oil

(CTO) supply agreement

Full Year:

- Net sales of $1.4 billion decreased 17% compared to prior year

primarily due to repositioning actions in the Performance Chemicals

segment that resulted in the exit of lower-margin end markets

- Net loss of $430.3 million and diluted loss per share of

$11.85, including pre-tax charges of $688.0 million primarily

related to the Performance Chemicals segment; adjusted earnings of

$128.3 million and diluted adjusted EPS of $3.51

- Adjusted EBITDA of $362.7 million and adjusted EBITDA margin of

25.8%

- Operating cash flow of $128.6 million with free cash flow of

$51.0 million

- In January 2025, announced plans to explore strategic

alternatives for Performance Chemicals Industrial Specialties

product line and North Charleston CTO refinery

Guidance:

Company announces full year 2025 guidance of sales between $1.3

billion and $1.4 billion, adjusted EBITDA between $400 million and

$415 million, and free cash flow between $220 and $260 million.

The results and guidance in this release

include non-GAAP financial measures. Refer to the section entitled

“Use of non-GAAP financial measures” within this release. All

comparisons are made versus the same period in 2023 unless

otherwise stated.

Ingevity Corporation (NYSE: NGVT) today reported its financial

results for the fourth quarter and full year 2024.

Fourth quarter (Q4) net sales of $298.8 million were 20% lower

versus the prior year. Sales increases in the Performance Materials

and Advanced Polymer Technologies segments were more than offset by

the strategic repositioning of the Performance Chemicals segment

(“repositioning actions”) which resulted in the exit of

lower-margin end markets. Q4 net income of $16.6 million included

pre-tax restructuring charges of $23.4 million primarily associated

with the repositioning actions. Adjusted EBITDA of $80.6 million

was up 91% reflecting the benefits of repositioning actions that

drove a $20.4 million improvement in Performance Chemicals segment

EBITDA. In addition, Q4 2023 adjusted EBITDA was negatively

impacted by a $19.7 million non-cash inventory charge related to

repositioning actions. Q4 adjusted EBITDA margin was 27.0%. Diluted

EPS in Q4 was $0.46 compared to diluted loss per share of $3.23 in

the prior year quarter. Diluted adjusted EPS in Q4 was $0.95

compared to diluted adjusted loss per share of $0.20 in the prior

year quarter.

Full year (FY) net sales of $1.4 billion were down 17% compared

to last year. Performance Materials reported record sales, but this

increase was more than offset by lower sales primarily in the

Industrial Specialties product line as strategic repositioning

actions resulted in the exit of lower-margin end markets. Road

Technologies product line reported lower sales due to adverse

weather conditions and the Advanced Polymer Technologies segment

sales were lower due to adverse mix and price concessions

implemented in certain markets. The company reported a FY net loss

of $430.3 million, reflecting a pre-tax goodwill impairment of

$349.1 million and $338.9 million of special charges primarily

related to the repositioning actions which included restructuring

charges of $186.2 million, a $100.0 million termination fee for a

long-term CTO supply agreement and $52.7 million of losses on the

resale of excess CTO. FY adjusted EBITDA was $362.7 million, down

4%, with adjusted EBITDA margin of 25.8%, an increase of 350 basis

points. FY diluted loss per share was $11.85 compared to diluted

loss per share of $0.15 in the prior year. FY diluted adjusted EPS

was $3.51 compared to diluted adjusted EPS of $3.53 in the prior

year.

“Ingevity’s management team and Board have taken aggressive

actions to improve performance and our stronger than expected

results are evidence of our solid execution,” said Luis

Fernandez-Moreno, interim president and CEO. “We remain focused on

our key priorities which are execution excellence, reducing

leverage, and portfolio optimization to accelerate the delivery of

shareholder value.”

Fernandez-Moreno continued, “Performance Materials had its best

year yet, meeting the increased demand for more fuel-efficient

vehicles that require the advanced solutions provided by our

activated carbon. The segment achieved record sales and EBITDA due

to increased volumes, improved price and mix and lower costs. Our

focus on manufacturing efficiency was a key component to reduced

costs and improved profitability which greatly contributed to the

company’s solid free cash flow for the year. Advanced Polymer

Technologies increased volumes despite continued weak industrial

demand, but volume growth was more than offset by adverse mix and

selective price concessions implemented to maintain share. 2024 was

a transformational year for Performance Chemicals (PC) as we took

major steps to reposition the segment, which resulted in

significantly improved segment EBITDA margins in the second half.

As part of the continued review of our portfolio of businesses, we

recently announced plans to explore strategic alternatives for the

Industrial Specialties product line and North Charleston CTO

refinery. We believe this action will further strengthen the PC

segment and enable us to focus our attention on higher growth and

higher margin opportunities within our portfolio while improving

the company’s earnings and cash flow.”

Performance Materials

Sales in Performance Materials were up 2% in Q4 at $156.2

million driven by volume growth in North America and China. Segment

EBITDA was $78.3 million in Q4, flat to last year, while segment

EBITDA margin was down 100 basis points to 50.1% as lower energy

spend resulting from operational improvements was offset by lower

plant utilization versus last year. FY sales were up 4% to a record

$609.6 million due to higher volumes, price, and favorable mix,

partially offset by a negative foreign exchange impact. FY segment

EBITDA was also a record at $319.1 million, up 11%, with segment

EBITDA margin of 52.3%, an increase of 340 basis points. The

improvement was primarily driven by investments in operational

improvements that resulted in lower energy spend and improved

yields.

Advanced Polymer Technologies

Sales in the Advanced Polymer Technologies segment were $43.9

million in Q4, up 4% due to higher volumes in all regions,

partially offset by lower prices and foreign exchange impacts.

Segment EBITDA for the quarter was down 23% to $6.1 million and

segment EBITDA margin of 13.9% reflected primarily unfavorable

price and mix, and higher energy costs. FY sales were $188.6

million, down 8% for the year as volume increases were more than

offset by unfavorable mix and price concessions implemented in

certain markets. Segment EBITDA for the year was down 21% to $35.2

million due primarily to pricing concessions and unfavorable

product mix, offsetting the benefit from lower input costs,

reducing the EBITDA margin to 18.7%.

Performance Chemicals

Sales in the Performance Chemicals segment were $98.7 million in

Q4, down 44%, reflecting the exit of certain lower-margin end

markets primarily as a result of repositioning actions in the

Industrial Specialties product line, where sales were lower by

$72.9 million. Road Technologies product line sales decreased 9% to

$48.5 million as mild weather in Q4 2023 extended the paving season

as compared to this year. Segment EBITDA was negative $3.8 million,

an improvement of $20.4 million, as the impact of repositioning

actions such as plant closures and cost savings initiatives

resulted in lower costs. FY sales were down 33% to $608.2 million.

Industrial Specialties product line sales were down 50% to $265.9

million primarily as a result of the repositioning actions. Road

Technologies product line sales decreased 7% to $342.3 million

primarily due to adverse weather conditions. FY segment EBITDA was

down 78% to $14.7 million due to higher CTO costs and lower

volumes, partially offset by cost savings initiatives.

Liquidity/Other

Full year operating cash flow was $128.6 million. Free cash flow

was $51.0 million, reflecting disciplined working capital

management, particularly in the fourth quarter, that helped offset

special charges such as a $100.0 million payment to terminate a

long-term CTO supply contract, $46.1 million in cash losses on the

resale of excess CTO, and $59.3 million of restructuring charges

paid during the year. There were no share repurchases for the

quarter and $353.4 million remains available under the current $500

million Board authorization. Net leverage improved sequentially to

3.5 times from last quarter’s 4.0 times due to higher EBITDA and

utilizing free cash flow to reduce debt. Net leverage was 3.4 times

last year.

Full Year 2025 Guidance

Ingevity announced its 2025 guidance of sales between $1.3

billion and $1.4 billion, adjusted EBITDA between $400 million and

$415 million, and free cash flow of between $220 and $260 million.

The 2025 guidance does not include any potential impact from the

exploration of strategic alternatives for the Performance Chemicals

Industrial Specialties product line and North Charleston CTO

refinery announced previously.

“The actions we took in 2024 position the company to deliver

more profitable growth in 2025 and beyond. We are committed to

enhancing shareholder value through improved EBITDA with margins

approaching 30% and significantly stronger cash flow. With our

focus on deleveraging, we expect to reduce our net leverage ratio

to below 2.8 times by the fourth quarter,” said

Fernandez-Moreno.

Additional Information

The company will host a live webcast on Wednesday, February 19,

at 10:00 a.m. (Eastern) to discuss Ingevity’s fourth-quarter and

full year 2024 fiscal results. The webcast can be accessed here or

on the investors section of Ingevity’s website. You may also listen

to the conference call by dialing 833 470 1428 (inside the U.S.)

and entering access code 068901. Callers outside the U.S. can find

global dial-in numbers here. For those unable to join the live

event, a recording will be available beginning at approximately

2:00 p.m. (Eastern) on February 19, 2025, through February 18,

2026, at this replay link.

Ingevity: Purify, Protect and Enhance

Ingevity provides products and technologies that purify, protect

and enhance the world around us. Through a team of talented and

experienced people, we develop, manufacture and bring to market

solutions that help customers solve complex problems and make the

world more sustainable. We operate in three reporting segments:

Performance Materials, which includes activated carbon; Advanced

Polymer Technologies, which includes caprolactone polymers; and

Performance Chemicals, which includes specialty chemicals and road

technologies. Our products are used in a variety of demanding

applications, including adhesives, agrochemicals, asphalt paving,

certified biodegradable bioplastics, coatings, elastomers, pavement

markings and automotive components. Headquartered in North

Charleston, South Carolina, Ingevity operates from 31 countries

around the world and employs approximately 1,600 people. The

company’s common stock is traded on the New York Stock Exchange

(NYSE:NGVT). For more information, visit ingevity.com.

Use of non-GAAP financial measures: This press release

includes certain non‐GAAP financial measures intended to

supplement, not substitute for, comparable GAAP measures.

Reconciliations of non‐GAAP financial measures to GAAP financial

measures are provided within the Appendix to this press release.

Investors are urged to consider carefully the comparable GAAP

measures and the reconciliations to those measures provided. The

company does not attempt to provide reconciliations of

forward-looking non-GAAP guidance to the comparable GAAP measure

because the impact and timing of the factors underlying the

guidance assumptions are inherently uncertain and difficult to

predict and are unavailable without unreasonable efforts. In

addition, Ingevity believes such reconciliations would imply a

degree of certainty that could be confusing to investors.

Forward-looking statements: This press release contains

“forward looking statements” within the meaning of the Securities

Exchange Act of 1934, as amended, and the Private Securities

Litigation Reform Act of 1995. Such statements generally include

the words “will,” “plans,” “intends,” “targets,” “expects,”

“outlook,” “guidance,” “believes,” “anticipates” or similar

expressions. Forward looking statements may include, without

limitation, anticipated timing, results, charges and costs of any

current or future repositioning of our Performance Chemicals

segment, including the announced review of strategic alternatives

for the Industrial Specialties product line and North Charleston,

South Carolina crude tall oil refinery, the oleo-based product

refining transition, closure of our plants in Crossett, Arkansas

and DeRidder, Louisiana; leadership transitions within our

organization; the potential benefits of any acquisition or

investment transaction, expected financial positions, guidance,

results of operations and cash flows; financing plans; business

strategies and expectations; operating plans; capital and other

expenditures; competitive positions; growth opportunities for

existing products; benefits from new technology and cost reduction

initiatives, plans and objectives; litigation-related strategies

and outcomes; and markets for securities. Actual results could

differ materially from the views expressed. Factors that could

cause actual results to materially differ from those contained in

the forward looking statements, or that could cause other forward

looking statements to prove incorrect, include, without limitation,

charges, costs or actions, including adverse legal or regulatory

actions, resulting from, or in connection with, the current or

future repositioning of our Performance Chemicals segment,

including the announced review of strategic alternatives for the

Industrial Specialties product line and North Charleston, South

Carolina crude tall oil refinery, the oleo-based product refining

transition, closure of our plants in Crossett, Arkansas and

DeRidder, Louisiana; losses due to resale of crude tall oil at less

than we paid for it; leadership transitions within our

organization; adverse effects from general global economic,

geopolitical and financial conditions beyond our control, including

inflation and the Russia Ukraine war and conflict in the middle

east; risks related to our international sales and operations;

adverse conditions in the automotive market; competition from

substitute products, new technologies and new or emerging

competitors; worldwide air quality standards; a decrease in

government infrastructure spending; adverse conditions in cyclical

end markets; the limited supply of or lack of access to sufficient

raw materials, or any material increase in the cost to acquire such

raw materials; issues with or integration of future acquisitions

and other investments; the provision of services by third parties

at several facilities; supply chain disruptions; natural disasters

and extreme weather events; or other unanticipated problems such as

labor difficulties (including work stoppages), equipment failure or

unscheduled maintenance and repair; attracting and retaining key

personnel; dependence on certain large customers; legal actions

associated with our intellectual property rights; protection of our

intellectual property and other proprietary information;

information technology security breaches and other disruptions;

complications with designing or implementing our new enterprise

resource planning system; government policies and regulations,

including, but not limited to, those affecting the environment,

climate change, tax policies, tariffs and the chemicals industry;

losses due to lawsuits arising out of environmental damage or

personal injuries associated with chemical or other manufacturing

processes; and the other factors detailed from time to time in the

reports we file with the Securities and Exchange Commission (the

“SEC”), including those described in Part I, Item 1A. Risk Factors

in our most recent Annual Report on Form 10 K as well as in our

other filings with the SEC. These forward-looking statements speak

only to management’s beliefs as of the date of this press release.

Ingevity assumes no obligation to provide any revisions to, or

update, any projections and forward-looking statements contained in

this press release.

INGEVITY CORPORATION

Condensed Consolidated

Statements of Operations (Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

In millions, except per share

data

2024

2023

2024

2023

Net sales

$

298.8

$

371.7

$

1,406.4

$

1,692.1

Cost of sales

196.9

312.2

951.7

1,220.2

Gross profit

101.9

59.5

454.7

471.9

Selling, general, and administrative

expenses

39.4

43.4

166.7

183.7

Research and technical expenses

7.3

7.2

28.1

31.8

Restructuring and other (income) charges,

net

23.4

120.8

186.2

170.2

Goodwill impairment charge

—

—

349.1

—

Acquisition-related costs

0.3

(0.2

)

0.3

3.6

Other (income) expense, net

1.9

19.6

169.8

5.7

Interest expense, net

20.8

22.7

90.1

87.0

Income (loss) before income taxes

8.8

(154.0

)

(535.6

)

(10.1

)

Provision (benefit) for income taxes

(7.8

)

(37.2

)

(105.3

)

(4.7

)

Net income (loss)

$

16.6

$

(116.8

)

$

(430.3

)

$

(5.4

)

Per share data

Basic earnings (loss) per share

$

0.46

$

(3.23

)

$

(11.85

)

$

(0.15

)

Diluted earnings (loss) per share

$

0.46

$

(3.23

)

$

(11.85

)

$

(0.15

)

Weighted average shares outstanding

Basic

36.3

36.2

36.3

36.5

Diluted

36.6

36.2

36.3

36.5

INGEVITY CORPORATION

Segment Operating Results

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

In millions

2024

2023

2024

2023

Net sales

Performance Materials

$

156.2

$

152.8

$

609.6

$

586.0

Performance Chemicals

98.7

176.5

608.2

902.1

Road Technologies product line

48.5

53.4

342.3

369.8

Industrial Specialties product line

50.2

123.1

265.9

532.3

Advanced Polymer Technologies

43.9

42.4

188.6

204.0

Total net sales

$

298.8

$

371.7

$

1,406.4

$

1,692.1

Segment EBITDA (1)

Performance Materials

$

78.3

$

78.1

$

319.1

$

286.6

Performance Chemicals

(3.8

)

(24.2

)

14.7

65.7

Advanced Polymer Technologies

6.1

7.9

35.2

44.5

Total segment EBITDA (1)

$

80.6

$

61.8

$

369.0

$

396.8

Interest expense, net

(20.8

)

(22.7

)

(90.1

)

(87.0

)

(Provision) benefit for income taxes

7.8

37.2

105.3

4.7

Depreciation and amortization (2)

(25.2

)

(30.7

)

(108.3

)

(122.8

)

Restructuring and other income (charges),

net (3)(4)

(23.4

)

(120.8

)

(186.2

)

(170.2

)

Goodwill impairment charge (3)(5)

—

—

(349.1

)

—

Acquisition and other-related costs

(3)(5)

(0.3

)

0.1

(0.3

)

(4.5

)

Inventory charges (3)(6)

—

(19.7

)

(6.3

)

(19.7

)

Loss on CTO resales (3)(5)

(1.9

)

(22.0

)

(52.7

)

(22.0

)

CTO supply contract termination charges

(3)(5)

—

—

(100.0

)

—

Gain (loss) on sale of strategic

investment (3)(7)

—

—

(11.4

)

19.3

Pension and postretirement settlement and

curtailment (charges) income, net (3)(5)

(0.2

)

—

(0.2

)

—

Net income (loss)

$

16.6

$

(116.8

)

$

(430.3

)

$

(5.4

)

_______________

(1)

Segment EBITDA is the primary measure used

by our chief operating decision maker ("CODM"), the Interim CEO and

President of Ingevity, to evaluate the performance of and allocate

resources among our operating segments. Segment EBITDA is defined

as segment net sales less segment operating expenses (segment

operating expenses consist of costs of sales, selling, general and

administrative expenses, research and technical expenses, other

(income) expense, net, excluding depreciation and amortization). We

have excluded the following items from segment EBITDA: interest

expense associated with corporate debt facilities, interest income,

income taxes, depreciation, amortization, goodwill impairment

charge, restructuring and other income (charges), net, litigation

verdict charges, inventory lower of cost or market charges

associated with restructuring actions, acquisition and

other-related income (costs), gain (loss) on sale of strategic

investments, loss on CTO resales, CTO supply contract termination

charges, and pension and postretirement settlement and curtailment

income (charges), net.

(2)

The table below provides an allocation of

these charges between our three reportable segments to provide

investors, potential investors, securities analysts and others with

the information, should they choose, to apply such charges to each

respective reportable segment for which the charges relate.

Three Months Ended December

31,

Twelve Months Ended December

31,

In millions

2024

2023

2024

2023

Performance Materials

$

(9.7

)

$

(9.6

)

$

(38.7

)

$

(38.3

)

Performance Chemicals

(7.7

)

(13.2

)

(38.8

)

(53.2

)

Advanced Polymer Technologies

(7.8

)

(7.9

)

(30.8

)

(31.3

)

Depreciation and amortization

$

(25.2

)

$

(30.7

)

$

(108.3

)

$

(122.8

)

(3)

For more information on these charges,

refer to the Reconciliation of Adjusted Earnings table on page

7.

(4)

We regularly perform strategic reviews and

assess the return on our operations, which sometimes results in a

plan to restructure the business. These costs are excluded from our

reportable segment results. The table below provides an allocation

of these charges between our three reportable segments to provide

investors, potential investors, securities analysts and others with

the information, should they choose, to apply such (income) charges

to each respective reportable segment for which the charges

relate.

Three Months Ended December

31,

Twelve Months Ended December

31,

In millions

2024

2023

2024

2023

Performance Materials

$

0.2

$

1.6

$

0.9

$

9.0

Performance Chemicals

23.1

104.8

185.1

144.5

Advanced Polymer Technologies

0.1

14.4

0.2

16.7

Restructuring and other (income) charges,

net

$

23.4

$

120.8

$

186.2

$

170.2

(5)

For all periods presented, charges relate

to the Performance Chemicals reportable segment.

(6)

For all periods presented, inventory

charges represent lower of cost or market charges associated with

the Performance Chemicals’ repositioning. These charges were not

allocated in the measurement of our Performance Chemicals

reportable segment profitability used by our CODM. Amounts are

included in Cost of sales on the consolidated statement of

operations.

(7)

The table below provides an allocation of

these charges between our three reportable segments to provide

investors, potential investors, securities analysts and others with

the information, should they choose, to apply such (income) charges

to each respective reportable segment for which the charges

relate.

Three Months Ended December

31,

Twelve Months Ended December

31,

In millions

2024

2023

2024

2023

Performance Materials

$

—

$

—

$

(0.1

)

$

(19.3

)

Performance Chemicals

—

—

9.3

—

Advanced Polymer Technologies

—

—

2.2

—

(Gain) loss on sale of strategic

investment

$

—

$

—

$

11.4

$

(19.3

)

INGEVITY CORPORATION

Condensed Consolidated Balance

Sheets (Unaudited)

December 31,

In millions

2024

2023

Assets

Cash and cash equivalents

$

68.0

$

95.9

Accounts receivable, net

141.0

182.0

Inventories, net

226.8

308.8

Prepaid and other current assets

57.4

71.9

Current assets

493.2

658.6

Property, plant, and equipment, net

658.9

762.2

Goodwill

175.2

527.5

Other intangibles, net

278.8

336.1

Restricted investment

81.6

79.1

Strategic investments

87.3

99.2

Other assets

247.6

160.6

Total Assets

$

2,022.6

$

2,623.3

Liabilities

Accounts payable

$

94.5

$

158.4

Accrued expenses

58.1

72.3

Notes payable and current maturities of

long-term debt

61.3

84.4

Other current liabilities

50.2

47.8

Current liabilities

264.1

362.9

Long-term debt including finance lease

obligations

1,339.7

1,382.8

Deferred income taxes

56.2

70.9

Other liabilities

167.4

175.3

Total Liabilities

1,827.4

1,991.9

Equity

195.2

631.4

Total Liabilities and Equity

$

2,022.6

$

2,623.3

INGEVITY CORPORATION

Condensed Consolidated

Statements of Cash Flows (Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

In millions

2024

2023

2024

2023

Cash provided by (used in) operating

activities:

Net income (loss)

$

16.6

$

(116.8

)

$

(430.3

)

$

(5.4

)

Adjustments to reconcile net income (loss)

to cash provided by operating activities:

Depreciation and amortization

25.2

30.7

108.3

122.8

(Gain) loss on strategic investment

—

—

11.4

(19.3

)

CTO resales

1.9

22.0

52.7

22.0

Goodwill impairment charge

—

—

349.1

—

Restructuring and other (income) charges,

net

23.4

120.8

186.2

170.2

Other non-cash items

(100.8

)

(15.9

)

(89.3

)

99.5

Changes in operating assets and

liabilities, net of effect of acquisitions:

Restructuring and other spending

(15.4

)

(12.8

)

(59.3

)

(44.0

)

CTO Resales

(1.1

)

(10.6

)

(46.1

)

(10.6

)

Changes in other operating assets and

liabilities, net

114.7

27.0

45.9

(130.1

)

Net cash provided by (used in) operating

activities

$

64.5

$

44.4

$

128.6

$

205.1

Cash provided by (used in) investing

activities:

Capital expenditures

$

(24.9

)

$

(29.2

)

$

(77.6

)

$

(109.8

)

Proceeds from sale of strategic

investment

—

—

—

31.5

Purchase of strategic investments

(0.3

)

—

(0.3

)

(2.4

)

Other investing activities, net

(2.8

)

4.5

(1.6

)

3.4

Net cash provided by (used in) investing

activities

$

(28.0

)

$

(24.7

)

$

(79.5

)

$

(77.3

)

Cash provided by (used in) financing

activities:

Proceeds from revolving credit facility

and other borrowings

$

81.1

$

136.8

$

404.5

$

376.3

Payments on revolving credit facility

(178.4

)

(142.8

)

(470.6

)

(382.9

)

Debt issuance costs

—

(0.4

)

—

(0.4

)

Financing lease obligations, net

(0.1

)

(0.1

)

(1.0

)

(0.7

)

Tax payments related to withholdings on

vested equity awards

(0.2

)

—

(3.1

)

(4.8

)

Proceeds and withholdings from share-based

compensation plans, net

—

—

—

4.7

Repurchases of common stock under publicly

announced plan

—

—

—

(92.1

)

Net cash provided by (used in) financing

activities

$

(97.6

)

$

(6.5

)

$

(70.2

)

$

(99.9

)

Increase (decrease) in cash, cash

equivalents, and restricted cash

(61.1

)

13.2

(21.1

)

27.9

Effect of exchange rate changes on

cash

(5.8

)

2.7

(4.2

)

(0.3

)

Change in cash, cash equivalents, and

restricted cash

(66.9

)

15.9

(25.3

)

27.6

Cash, cash equivalents, and restricted

cash at beginning of period

153.5

96.0

111.9

84.3

Cash, cash equivalents, and restricted

cash at end of period (1)

$

86.6

$

111.9

$

86.6

$

111.9

(1) Includes restricted cash of $18.6

million and $16.0 million, and cash and cash equivalents of $68.0

million and $95.9 million, for the years ended December 31, 2024

and 2023, respectively. Restricted cash is included within "Prepaid

and other current assets" and "Restricted investment" within the

condensed consolidated balance sheets.

Supplemental cash flow

information:

Cash paid for interest, net of capitalized

interest

$

24.4

$

24.8

$

85.4

$

82.7

Cash paid for income taxes, net of

refunds

2.9

1.8

26.9

29.7

Purchases of property, plant and equipment

in accounts payable

0.2

(3.3

)

2.4

2.8

Leased assets obtained in exchange for new

finance lease liabilities

—

—

—

0.2

Leased assets obtained in exchange for new

operating lease liabilities

0.5

3.1

6.0

29.1

Ingevity Corporation

Non-GAAP Financial Measures

Ingevity has presented certain financial measures, defined

below, which have not been prepared in accordance with U.S.

generally accepted accounting principles (“GAAP”) and has provided

a reconciliation to the most directly comparable financial measure

calculated in accordance with GAAP on the following pages. These

financial measures are not meant to be considered in isolation nor

as a substitute for the most directly comparable financial measure

calculated in accordance with GAAP. Investors should consider the

limitations associated with these non-GAAP measures, including the

potential lack of comparability of these measures from one company

to another.

We believe these non-GAAP financial measures provide management

as well as investors, potential investors, securities analysts, and

others with useful information to evaluate the performance of the

business, because such measures, when viewed together with our

financial results computed in accordance with GAAP, provide a more

complete understanding of the factors and trends affecting our

historical financial performance, liquidity measures, and projected

future results.

Ingevity uses the following non-GAAP measures:

Adjusted earnings (loss) is defined as

net income (loss) plus restructuring and other (income) charges,

net, goodwill impairment charge, acquisition and other-related

(income) costs, pension and postretirement settlement and

curtailment (income) charges, loss on CTO resales, CTO supply

contract termination charges, (gain) loss on strategic investments,

debt refinancing fees, litigation verdict charges, and the income

tax expense (benefit) on those items, less the provision (benefit)

from certain discrete tax items.

Diluted adjusted earnings (loss) per

share is defined as diluted earnings (loss) per common share

plus restructuring and other (income) charges, net, per share,

goodwill impairment charge per share, acquisition and other-related

(income) costs per share, pension and postretirement settlement and

curtailment (income) charges per share, loss on CTO resales per

share, CTO supply contract termination charges per share, (gain)

loss on strategic investments per share, debt refinancing fees per

share, litigation verdict charge per share, and the income tax

expense (benefit) per share on those items, less the provision

(benefit) from certain discrete tax items per share.

Adjusted EBITDA is defined as net

income (loss) plus interest expense, net, provision (benefit) for

income taxes, depreciation, amortization, restructuring and other

(income) charges, net, goodwill impairment charge, acquisition and

other-related (income) costs, litigation verdict charges, (gain)

loss on strategic investments, loss on CTO resales, CTO supply

contract termination charges, and pension and postretirement

settlement and curtailment (income) charges, net.

Adjusted EBITDA Margin is defined as

Adjusted EBITDA divided by Net sales.

Free Cash Flow is defined as the sum

of net cash provided by (used in) the following items: operating

activities less capital expenditures.

Net Debt is defined as the sum of

notes payable, short-term debt, current maturities of long-term

debt and long-term debt including finance lease obligations less

the sum of cash and cash equivalents, restricted cash associated

with our new market tax credit financing arrangement, and

restricted investment associated with certain finance lease

obligations, excluding the allowance for credit losses on

held-to-maturity debt securities held within the restricted

investment.

Net Debt Ratio is defined as Net Debt

divided by the last twelve months Adjusted EBITDA, inclusive of

acquisition-related pro forma adjustments.

Ingevity's management also uses the above financial measures as

the primary measures of profitability and liquidity of the

business. In addition, Ingevity believes Adjusted EBITDA and

Adjusted EBITDA Margin are useful measures because they exclude the

effects of financing and investment activities as well as

non-operating activities.

GAAP Reconciliation of 2025 Adjusted EBITDA

Guidance

A reconciliation of net income to adjusted EBITDA as projected

for 2025 is not provided. Ingevity does not forecast net income as

it cannot, without unreasonable effort, estimate or predict with

certainty various components of net income. These components, net

of tax, include further restructuring and other income (charges),

net; additional acquisition and other-related (income) costs;

litigation verdict charges; additional pension and postretirement

settlement and curtailment (income) charges; and revisions due to

legislative tax rate changes. Additionally, discrete tax items

could drive variability in our projected effective tax rate. All of

these components could significantly impact such financial

measures. Further, in the future, other items with similar

characteristics to those currently included in adjusted EBITDA,

that have a similar impact on the comparability of periods, and

which are not known at this time, may exist and impact adjusted

EBITDA.

INGEVITY CORPORATION

Reconciliation of Non-GAAP Financial

Measures

Reconciliation of Net Income

(Loss) (GAAP) to Adjusted Earnings (Loss) (Non-GAAP) and

Reconciliation of Diluted

Earnings (Loss) per Common Share (GAAP) to

Diluted Adjusted Earnings per

Share (Non-GAAP)

Three Months Ended December

31,

Twelve Months Ended December

31,

In millions, except per share data

(unaudited)

2024

2023

2024

2023

Net income (loss) (GAAP)

$

16.6

$

(116.8

)

$

(430.3

)

$

(5.4

)

Restructuring and other (income) charges,

net (1)

23.4

120.8

186.2

170.2

Goodwill impairment charge (2)

—

—

349.1

—

Acquisition and other-related costs

(3)

0.3

(0.1

)

0.3

4.5

Loss on CTO resales (4)

1.9

22.0

52.7

22.0

CTO supply contract termination charges

(5)

—

—

100.0

—

(Gain) loss on sale of strategic

investment (6)

—

—

11.4

(19.3

)

Pension and postretirement settlement and

curtailment income (charges), net (7)

0.2

—

0.2

—

Tax effect on items above (8)

(7.7

)

(33.6

)

(165.7

)

(41.8

)

Certain discrete tax provision (benefit)

(9)

—

0.5

24.4

(0.6

)

Adjusted earnings (loss)

(Non-GAAP)

$

34.7

$

(7.2

)

$

128.3

$

129.6

Diluted earnings (loss) per common

share (GAAP)

$

0.46

$

(3.23

)

$

(11.85

)

$

(0.15

)

Restructuring and other (income)

charges

0.64

3.34

5.12

4.64

Goodwill impairment charge

—

—

9.62

—

Acquisition and other-related costs

0.01

—

0.01

0.12

Loss on CTO resales

0.05

0.61

1.45

0.60

CTO supply contract termination

charges

—

—

2.75

—

(Gain) loss on sale of strategic

investment

—

—

0.31

(0.52

)

Pension and postretirement settlement and

curtailment income (charges), net

0.01

—

0.01

—

Tax effect on items above

(0.22

)

(0.93

)

(4.58

)

(1.14

)

Certain discrete tax provision

(benefit)

—

0.01

0.67

(0.02

)

Diluted adjusted earnings (loss) per

share (Non-GAAP)

$

0.95

$

(0.20

)

$

3.51

$

3.53

Weighted average common shares outstanding

- Diluted (10)

36.6

36.2

36.5

36.7

___________

(1)

We regularly perform strategic reviews and

assess the return on our operations, which sometimes results in a

plan to restructure the business. These costs are excluded from our

reportable segment results; details of which are included in the

table below. For the details of these costs between our reportable

segments, see Segment Operating Results on page 2.

Three Months Ended December

31,

Twelve Months Ended December

31,

In millions

2024

2023

2024

2023

Work force reductions and other

$

2.3

$

0.9

$

2.3

$

12.5

Performance Chemicals' repositioning

14.8

113.1

172.7

113.1

Restructuring charges (1)

$

17.1

$

114.0

$

175.0

$

125.6

Alternative feedstock transition

—

3.7

—

22.1

North Charleston plant transition

6.3

2.1

11.2

14.8

Business transformation costs

—

1.0

—

7.7

Other (income) charges, net (1)

$

6.3

$

6.8

$

11.2

$

44.6

Restructuring and other (income) charges,

net (2)

$

23.4

$

120.8

$

186.2

$

170.2

_________________

(1) Amounts are recorded within

Restructuring and other (income) charges, net on the condensed

consolidated statement of operations.

(2) For information on our Workforce

reductions and other, Performance Chemicals' repositioning,

Alternative feedstock transition, North Charleston plant

transition, and the Business transformation costs please refer to

Note 11, Restructuring and Other (Income) Charges, net, in the

Notes to the Condensed Consolidated Financial Statements included

in the Company’s Form 10-Q for the quarter ended September 30,

2024, filed on October 30, 2024. Updates will be provided in the

subsequent filing of the Company's Form 10-K for 2024.

(2)

During the second quarter of 2024, the

company concluded that the carrying amount of the Performance

Chemicals reporting unit exceeded its fair value, resulting in a

non-cash goodwill impairment charge.

(3)

Charges represent (gains) losses incurred

to complete and integrate acquisitions and other strategic

investments. Charges may include the expensing of the inventory

fair value step-up resulting from the application of purchase

accounting for acquisitions and certain legal and professional fees

associated with the completion of acquisitions and strategic

investments. For the details of these costs between our reportable

segments, see Segment Operating Results on page 2.

Three Months Ended December

31,

Twelve Months Ended December

31,

In millions

2024

2023

2024

2023

Legal and professional service fees

$

0.3

$

(0.2

)

$

0.3

$

3.6

Acquisition-related (income) costs

$

0.3

$

(0.2

)

$

0.3

$

3.6

Inventory fair value step-up amortization

(1)

—

0.1

—

0.9

Acquisition and other-related (income)

charges

$

0.3

$

(0.1

)

$

0.3

$

4.5

_________________

(1) Included in Cost of sales on the

condensed consolidated statement of operations.

(4)

Due to the DeRidder Plant closure and the

corresponding reduced CTO refining capacity, we were obligated,

under an existing CTO supply contract, to purchase CTO through 2025

at amounts in excess of required CTO volumes. As of July 1, 2024,

we have terminated the CTO supply contract that resulted in these

excess CTO volumes. As a result of the termination, the purchases

under the CTO supply contract ended effective June 30, 2024. The

CTO resale activity described above ended in 2024 and no excess CTO

volumes were on hand at December 31, 2024.

(5)

As consideration for the termination of

the CTO supply contract, we made a cash payment in the amount of

$100.0 million in 2024. Since this contract termination is directly

attributable to the Performance Chemicals repositioning, that is,

it does not represent normal, recurring expenses necessary to

operate our business, we have excluded the CTO supply contract

termination charges for the purposes of calculating our non-GAAP

financial performance measures. Updates will be provided in the

subsequent filing of the Company's Form 10-K for 2024.

(6)

We exclude gains and losses from sales of

strategic investments from our segment results, as well as our

non-GAAP financial measures, because we do not consider such gains

or losses to be directly associated with the operational

performance of the segment. We believe that the inclusion of such

gains or losses, would impair the factors and trends affecting the

historical financial performance of our reportable segments. We

continue to include undistributed earnings or loss, distributions,

amortization or accretion of basis differences, and

other-than-temporary impairments for equity method investments that

we believe are directly attributable to the operational performance

of such investments, in our reportable segment results.

(7)

Our pension and postretirement settlement

and curtailment charges (income) are related to the acceleration of

prior service costs, as a result of a reduction in the number of

participants within the Union Hourly defined benefit pension plan.

These are excluded from our segment results because we consider

these costs to be outside our operational performance. We continue

to include the service cost, amortization of prior service cost,

interest costs, expected return on plan assets, and amortized

actual gains and losses in our segment EBITDA.

(8)

Income tax impact of non-GAAP adjustments

is the summation of the calculated income tax charge related to

each pre-tax non-GAAP adjustment. The non-GAAP adjustments relate

primarily to adjustments in the United States. As such, the income

tax effect is calculated using the statutory tax rates of 21% for

the United States and approximately 2.5% for state and local taxes,

applied to the non-GAAP adjustments.

(9)

Represents certain discrete tax items such

as excess tax benefits on stock compensation and impacts of

legislative tax rate changes.

(10)

The weighted average number of shares

outstanding used in diluted adjusted earnings per share computation

(Non-GAAP) includes an average of 0.2 million diluted shares for

the twelve months ended December 31, 2024 and 2023, respectively.

This number of shares differs from the weighted average number of

shares outstanding used in diluted loss per share computations

(GAAP) as we had a net loss for each of those periods,

respectively.

Reconciliation of Net Income (Loss) (GAAP)

to Adjusted Earnings (Loss) (Non-GAAP) and Reconciliation of

Diluted Earnings (Loss) per Common Share (GAAP) to Diluted

Adjusted Earnings per Share (Non-GAAP)

We revised our December 31, 2023 non-GAAP Adjusted earnings

(loss) calculation to remove previous adjustments of $19.7 million

related to inventory lower of cost or market charges associated

with the Company's Performance Chemicals repositioning. This change

was made to address a request from the Securities and Exchange

Commission to revise future filings to no longer exclude these

adjustments from non-GAAP performance measures. The following table

presents the three and twelve months ended December 31, 2023 as

previously reported and as revised.

Three Months Ended

December 31, 2023

Twelve Months Ended

December 31, 2023

In millions, except per share data

(unaudited)

As previously

reported

As revised

As previously

reported

As revised

Net income (loss) (GAAP)

$

(116.8

)

$

(116.8

)

$

(5.4

)

$

(5.4

)

Restructuring and other (income) charges,

net (1)

140.5

120.8

189.9

170.2

Acquisition and other-related costs

(1)

(0.1

)

(0.1

)

4.5

4.5

Loss on CTO resales (1)

22.0

22.0

22.0

22.0

Gain on sale of strategic investment

(1)

—

—

(19.3

)

(19.3

)

Tax effect on items above (1)

(38.3

)

(33.6

)

(46.4

)

(41.8

)

Certain discrete tax provision (benefit)

(1)

0.5

0.5

(0.6

)

(0.6

)

Adjusted earnings (loss)

(Non-GAAP)

$

7.8

$

(7.2

)

$

144.7

$

129.6

Diluted earnings (loss) per common

share (GAAP)

$

(3.23

)

$

(3.23

)

$

(0.15

)

$

(0.15

)

Restructuring and other (income)

charges

3.86

3.34

5.17

4.64

Acquisition and other-related costs

—

—

0.12

0.12

Loss on CTO resales

0.61

0.61

0.60

0.60

Gain on sale of strategic investment

—

—

(0.52

)

(0.52

)

Tax effect on items above

(1.04

)

(0.93

)

(1.26

)

(1.14

)

Certain discrete tax provision

(benefit)

0.01

0.01

(0.02

)

(0.02

)

Diluted adjusted earnings (loss) per

share (Non-GAAP)

$

0.21

$

(0.20

)

$

3.94

$

3.53

Weighted average common shares outstanding

- Diluted

36.4

36.2

36.7

36.7

___________

(1)

For more information on these charges,

refer to the Reconciliation of Adjusted Earnings included in the

Company’s Form 8-K for the year ended December 31, 2023, filed on

February 21, 2024.

Reconciliation of Net Income

(Loss) (GAAP) to Adjusted EBITDA (Non-GAAP)

Three Months Ended December

31,

Twelve Months Ended December

31,

In millions, except percentages

(unaudited)

2024

2023

2024

2023

Net income (loss) (GAAP)

$

16.6

$

(116.8

)

$

(430.3

)

$

(5.4

)

Interest expense, net

20.8

22.7

90.1

87.0

Provision (benefit) for income taxes

(7.8

)

(37.2

)

(105.3

)

(4.7

)

Depreciation and amortization

25.2

30.7

108.3

122.8

Restructuring and other (income) charges,

net (1)

23.4

120.8

186.2

170.2

Goodwill impairment charge (1)

—

—

349.1

—

Acquisition and other-related (income)

costs (1)

0.3

(0.1

)

0.3

4.5

Loss on CTO resales (1)

1.9

22.0

52.7

22.0

CTO supply contract termination charges

(1)

—

—

100.0

—

(Gain) loss on sale of strategic

investments (1)

—

—

11.4

(19.3

)

Pension and postretirement settlement and

curtailment charges (income) (1)

0.2

—

0.2

—

Adjusted EBITDA (Non-GAAP)

$

80.6

$

42.1

$

362.7

$

377.1

Net sales

$

298.8

$

371.7

$

1,406.4

$

1,692.1

Net income (loss) margin

5.6

%

(31.4

)%

(30.6

)%

(0.3

)%

Adjusted EBITDA margin

27.0

%

11.3

%

25.8

%

22.3

%

___________

(1)

For more information on these charges,

refer to the Reconciliation of Adjusted Earnings table on page

7.

Reconciliation of Net Income (Loss) (GAAP)

to Adjusted EBITDA (Non-GAAP)

We revised our December 31, 2023 non-GAAP Adjusted EBITDA

calculation to remove previous adjustments of $19.7 million related

to inventory lower of cost or market charges associated with the

Company's Performance Chemicals repositioning. This change was made

to address a request from the Securities and Exchange Commission to

revise future filings to no longer exclude these adjustments from

non-GAAP performance measures. The following table presents the

three and twelve months ended December 31, 2023 as previously

reported and as revised.

Three Months Ended

December 31, 2023

Twelve Months Ended

December 31, 2023

In millions, except percentages

(unaudited)

As previously

reported

As revised

As previously

reported

As revised

Net income (loss) (GAAP)

$

(116.8

)

$

(116.8

)

$

(5.4

)

$

(5.4

)

Provision (benefit) for income taxes

22.7

22.7

87.0

87.0

Interest expense, net

(37.2

)

(37.2

)

(4.7

)

(4.7

)

Depreciation and amortization

30.7

30.7

122.8

122.8

Restructuring and other (income) charges,

net (1)

140.5

120.8

189.9

170.2

Acquisition and other-related (income)

costs (1)

(0.1

)

(0.1

)

4.5

4.5

Loss on CTO resales (1)

22.0

22.0

22.0

22.0

(Gain) loss on strategic investments

(1)

—

—

(19.3

)

(19.3

)

Adjusted EBITDA (Non-GAAP)

$

61.8

$

42.1

$

396.8

$

377.1

Net sales

$

371.7

$

371.7

$

1,692.1

$

1,692.1

Net income (loss) margin

(31.4

)%

(31.4

)%

(0.3

)%

(0.3

)%

Adjusted EBITDA margin

16.6

%

11.3

%

23.5

%

22.3

%

___________

(1)

For more information on these charges,

refer to the Reconciliation of Adjusted Earnings included in the

Company’s Form 8-K for the year ended December 31, 2023, filed on

February 21, 2024.

Calculation of Free Cash Flow

(Non-GAAP)

Three Months Ended December

31,

Twelve Months Ended December

31,

In millions (unaudited)

2024

2023

2024

2023

Net cash provided by (used in) operating

activities

$

64.5

$

44.4

$

128.6

$

205.1

Less: Capital expenditures

24.9

29.2

77.6

109.8

Free Cash Flow (Non-GAAP)

$

39.6

$

15.2

$

51.0

$

95.3

Calculation of Net Debt Ratio

(Non-GAAP)

In millions, except ratios

(unaudited)

December 31, 2024

Notes payable and current maturities of

long-term debt

$

61.3

Long-term debt including finance lease

obligations

1,339.7

Debt issuance costs

4.2

Total Debt

1,405.2

Less:

Cash and cash equivalents (1)

68.2

Restricted investment (2)

81.8

Net Debt

$

1,255.2

Net Debt Ratio (Non-GAAP)

Adjusted EBITDA (Non-GAAP) (3)

Adjusted EBITDA - last twelve months (LTM)

as of December 31, 2024

$

362.7

Net debt ratio (Non-GAAP)

3.5x

_______________

(1)

Includes $0.2 million of Restricted Cash

related to the new market tax credit financing arrangement.

(2)

Our restricted investment is a trust

managed in order to secure repayment of the finance lease

obligation associated with Performance Materials' Wickliffe,

Kentucky, manufacturing site at maturity. The trust, presented as

Restricted investment on our consolidated balance sheets,

originally purchased long-term bonds that mature through 2026. The

principal received at maturity of the bonds, along with interest

income that is reinvested in the trust, are expected to be equal to

or more than the $80.0 million finance lease obligation that is due

in 2027. The restricted investment balance excludes $0.2 million

allowance for credit losses on held-to-maturity debt securities

within the trust.

(3)

Refer to the Reconciliation of Net Income

(GAAP) to Adjusted EBITDA (Non-GAAP) schedule for the

reconciliation to the most comparable GAAP financial measure.

Calculation of Net Debt Ratio

(Non-GAAP)

We revised our December 31, 2023 non-GAAP Net debt ratio

calculation to remove the previous adjustment of $19.7 million from

the three months ended December 31, 2023, from the last twelve

months Adjusted EBITDA related to inventory lower of cost or market

charges associated with the Company's Performance Chemicals'

repositioning. This change was made to address a request from the

Securities and Exchange Commission to revise future filings to no

longer exclude these adjustments from non-GAAP performance

measures. The following table presents the period ended December

31, 2023 as previously reported and as revised.

December 31, 2023

In millions, except ratios

(unaudited)

As previously

reported

As revised

Notes payable and current maturities of

long-term debt

$

84.4

$

84.4

Long-term debt including finance lease

obligations

1,382.8

1,382.8

Debt issuance costs

5.3

5.3

Total Debt

1,472.5

1,472.5

Less:

Cash and cash equivalents (1)

96.1

96.1

Restricted investment (2)

79.3

79.3

Net Debt

$

1,297.1

$

1,297.1

Net Debt Ratio (Non GAAP)

Adjusted EBITDA (3)

Adjusted EBITDA - last twelve months (LTM)

as of December 31, 2023

$

396.8

$

377.1

Net debt ratio (Non GAAP)

3.3x

3.4x

_______________

(1)

Includes $0.2 million of Restricted Cash

related to the New Market Tax Credit arrangement.

(2)

Our restricted investment is a trust

managed in order to secure repayment of the finance lease

obligation associated with Performance Materials' Wickliffe,

Kentucky, manufacturing site at maturity. The trust, presented as

Restricted investment on our condensed consolidated balance sheets,

originally purchased long-term bonds that mature through 2026. The

principal received at maturity of the bonds, along with interest

income that is reinvested in the trust, are expected to be equal to

or more than the $80.0 million finance lease obligation that is due

in 2027. Excludes $0.2 million allowance for credit losses on

held-to-maturity debt securities.

(3)

Refer to the Reconciliation of Net Income

(GAAP) to Adjusted EBITDA (Non-GAAP) schedule for the

reconciliation to the most comparable GAAP financial measure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218303081/en/

Caroline Monahan 843-740-2068 media@ingevity.com

Investors: John E. Nypaver, Jr. 843-740-2002

investors@ingevity.com

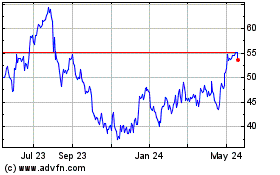

Ingevity (NYSE:NGVT)

Historical Stock Chart

From Jan 2025 to Feb 2025

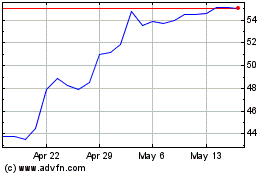

Ingevity (NYSE:NGVT)

Historical Stock Chart

From Feb 2024 to Feb 2025